Global Risk Analytics Market, By Component (Software, Solution and Services), Deployment Mode (Cloud and On-Premises), Organization Size (Large Enterprises and SMEs), Risk Type (Portfolio Risk, Strategic Risk, Operational Risk, Financial Risk and Others), Vertical (Banking and Financial Services, Insurance, Manufacturing, Transportation and Logistics, Retail and Consumer Goods, IT and Telecom, Government and Defense, Healthcare and Life Sciences, Energy and Utilities and Others), and Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa) Industry Trends and Forecast to 2028.

Market Analysis and Insights : Global Risk Analytics Market

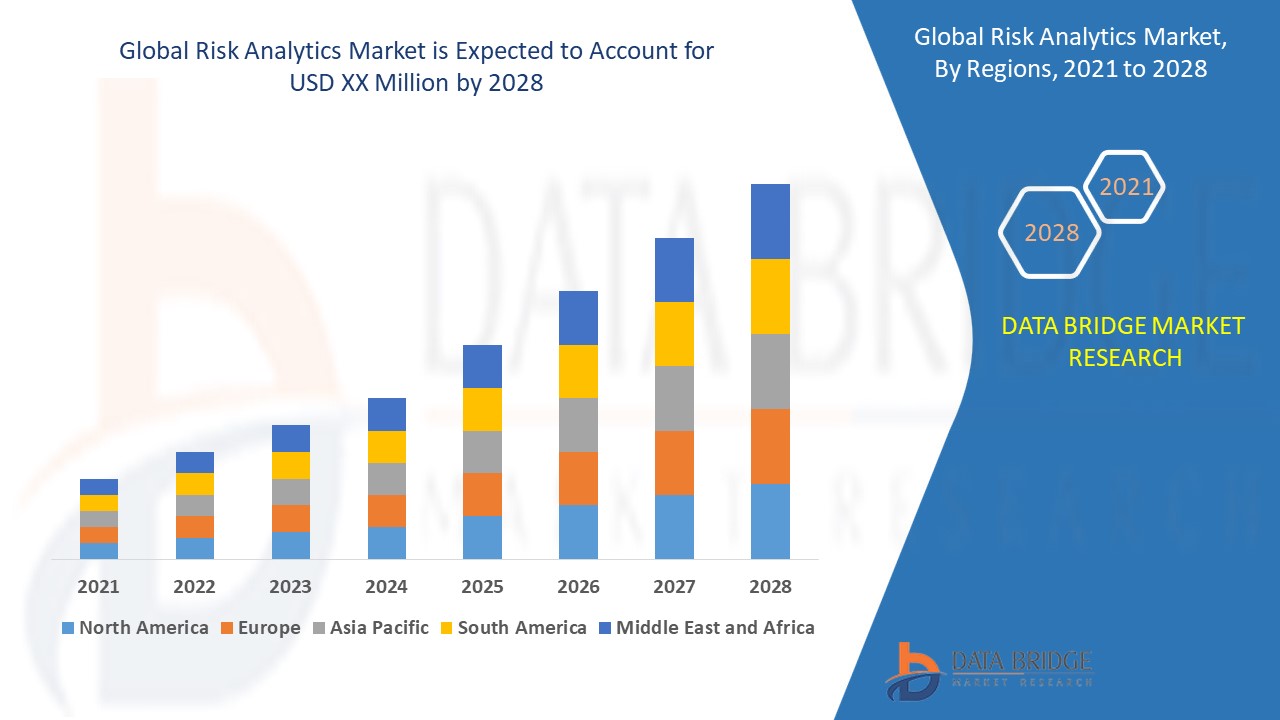

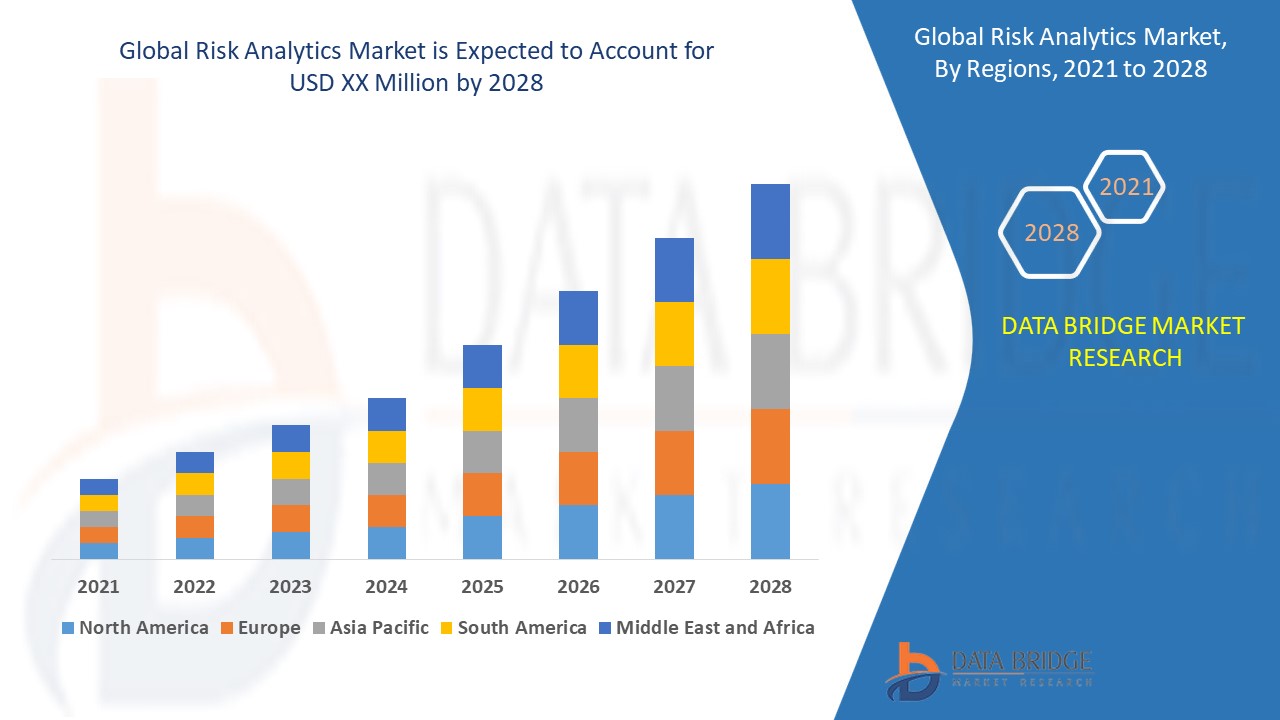

The risk analytics market is expected to witness market growth at a rate of 16.05% in the forecast period of 2021 to 2028. Data Bridge Market Research report on risk analytics market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rise in the data and security breaches is escalating the growth of risk analytics market.

Risk analytics is known as the kind of software that is utilized by organization to effectively and efficiently manage various types of risks. The software is recognised for its various capabilities like managing, identifying several types of risk and for taking measures to prevent potential crisis.

Major factors that are expected to boost the growth of risk analytics market in the forecast period are the compliance with strict industry regulations. Furthermore, the rise in the difficulties across business processes is further anticipated to propel the growth of the risk analytics market. Moreover, the growing of the digitalization and BPA is further estimated to cushion the growth of the risk analytics market. On the other hand, the complicated nature of regulatory compliance is further projected to impede the growth of the risk analytics market in the timeline period.

In addition, the rise in the acceptance of AI and blockchain technology in the industry and growing of the innovations in the FinTech industry will further provide potential opportunities for the growth of the risk analytics market in the coming years. However, incorporation of data from data silos which might further challenge the growth of the risk analytics market in the near future.

This risk analytics market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the optical satellite communication market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Global Risk Analytics Market Scope and Market Size

The risk analytics market is segmented on the basis of components, deployment mode, organization size, risk type and vertical. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

On the basis of components, the risk analytics market has been segmented into software, solution, services. Software is further sub segmented into extract, transform and load (ETL) tools, risk calculation engines, scorecard and visualization tools, dashboard analytics and risk reporting tools, governance, risk and compliance (GRC) software and others. Solution is further sub segmented into regulatory compliance, governance, risk and compliance, market risk management, trading risk, credit risk management, liquidity risk management and others. Others is further sub segmented into insurance risk management and actuarial modelling. Services is further sub segmented into professional services and managed services. Professional services is further sub segmented into systems integration and risk assessment. Managed services is further sub segmented into maintenance and servicing.

- On the basis of deployment mode, the risk analytics market has been segmented into cloud and on-premises.

- On the basis of organization size, the risk analytics market has been segmented into large enterprises and SMEs.

- On the basis of risk type, the risk analytics market has been segmented into portfolio risk, strategic risk, operational risk, financial risk and others.

- On the basis of vertical, the risk analytics market has been segmented into banking and financial services, insurance, manufacturing, transportation and logistics, retail and consumer goods, it and telecom, government and defense, healthcare and life sciences, energy and utilities and others.

Risk Analytics Market Country Level Analysis

The risk analytics market is analyzed and market size, volume information is provided by country, components, deployment mode, organization size, risk type and vertical as referenced above.

The countries covered in the risk analytics market report are the U.S., Canada, and Mexico in North America, Brazil, Argentina, and the rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of the Middle East and Africa (MEA).

North America dominates the risk analytics market due to the rise in the developments in IT sector and the occurrence of large enterprises. Furthermore, the increase in the competitiveness in the industry and the variation in the currency will further boost the growth of the risk analytics market in the region during the forecast period. Asia-Pacific is projected to observe significant amount of growth in the risk analytics market due to the advancing countries. Moreover, the occurrence of major key players is further anticipated to propel the growth of the risk analytics market in the region in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Risk Analytics Market Share Analysis

The risk analytics market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the risk analytics market.

The major players covered in the risk analytics market report are IBM, Oracle, SAP SE, SAS Institute Inc., FIS, Moody's Analytics, Inc., Verisk Analytics, Inc., AXIOMSL, Inc., GURUCUL; PROVENIR, BRIDGEi2i Analytics Solutions, DataFactZ; RECORDED FUTURE, INC., Digital Fineprint, Finastra, Accenture, Tata Consultancy Services Limited, Genpact and ACL Services Ltd. dba Galvanize among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

SKU-