Global Restaurant Pos Terminals Market

Market Size in USD Billion

CAGR :

%

USD

22.92 Billion

USD

31.10 Billion

2024

2032

USD

22.92 Billion

USD

31.10 Billion

2024

2032

| 2025 –2032 | |

| USD 22.92 Billion | |

| USD 31.10 Billion | |

|

|

|

|

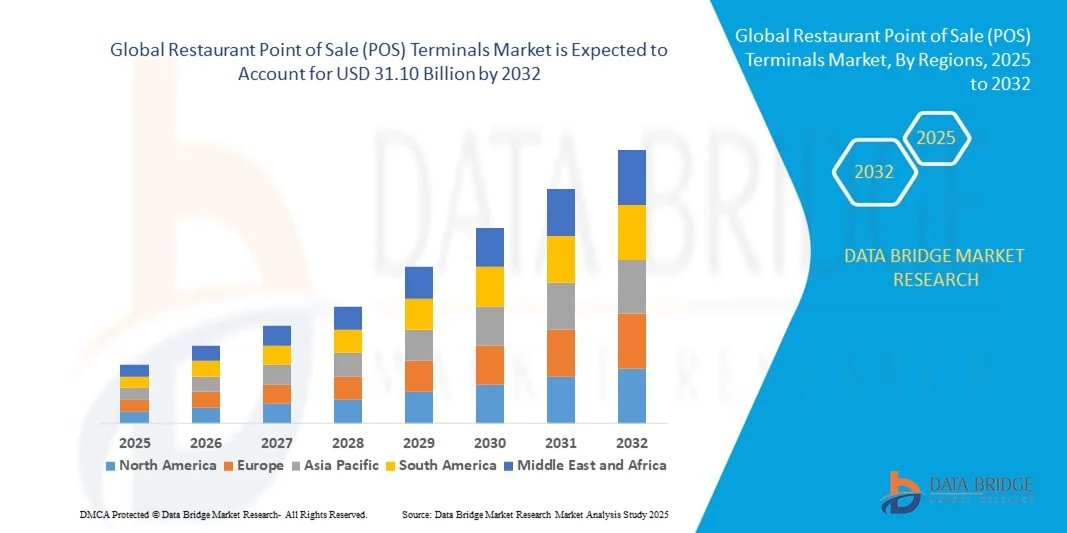

What is the Global Restaurant Point of Sale (POS) Terminals Market Size and Growth Rate?

- The global restaurant point of sale (POS) terminals market size was valued at USD 22.92 billion in 2024 and is expected to reach USD 31.10 billion by 2032, at a CAGR of 6.00% during the forecast period

- Surge in the establishment of food outlets with the purpose of serving various food items to the customers will influence the growth of restaurant point of sale (POS) terminals market. Furthermore, growing adoption of mobile technologies, increasing technological changes that are making food outlets to adopt modern solutions simplifying customer engagement operations are the factors that will enhance the market growth rate

- Also, repetitive duties such as manual inventory control and scheduling management can be minimized by using POS terminals, which improve business operations and drive market demand

What are the Major Takeaways of Restaurant Point of Sale (POS) Terminals Market?

- Low deployment cost and user friendly interface of POS terminal will further create beneficial opportunities for the growth of the market

- However, growing concern about security data and privacy are the factors that will act as restraints for the growth of restaurant point of sale (POS) terminals market. Network connectivity issues faced by developing economies will challenge the growth of the market

- Asia-Pacific dominated the restaurant point of sale (POS) terminals market with the largest revenue share of 41.23% in 2024, driven by the rising adoption of digital payment solutions, government initiatives promoting cashless economies, and the rapid expansion of quick-service restaurants and cloud kitchens

- North America is projected to grow at the fastest CAGR of 12.4% during 2025–2032, fueled by the increasing adoption of cloud-based POS solutions and the rising trend of contactless and mobile payments in restaurants

- The hardware segment dominated the market with a revenue share of 52.8% in 2024, driven by the demand for touchscreen monitors, barcode scanners, receipt printers, and card readers

Report Scope and Restaurant Point of Sale (POS) Terminals Market Segmentation

|

Attributes |

Restaurant Point of Sale (POS) Terminals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Restaurant Point of Sale (POS) Terminals Market?

Enhanced Convenience Through AI and Voice Integration

- A major trend shaping the global Restaurant POS Terminals market is the integration of artificial intelligence (AI) and voice-enabled assistants such as Amazon Alexa, Google Assistant, and Apple Siri. These technologies are transforming the way restaurants manage operations and enhance customer service

- For instance, POS terminals integrated with voice commands enable restaurant staff to place or modify orders hands-free, streamlining workflows and improving efficiency. AI-powered analytics further provide predictive insights into sales, customer preferences, and inventory needs

- The adoption of AI-driven solutions also enhances fraud detection, customer personalization, and faster transaction processing. Companies such as Oracle MICROS and Lightspeed are advancing AI-based POS solutions with features such as predictive ordering and dynamic menu recommendations

- As restaurants increasingly seek automation, efficiency, and customer engagement, the integration of AI and voice technology in POS terminals is expected to become a defining industry standard

What are the Key Drivers of Restaurant Point of Sale (POS) Terminals Market?

- Rising demand for contactless and digital payments has accelerated POS adoption, as restaurants seek secure, fast, and hygienic payment processing solutions

- For instance, in March 2024, Toast, Inc. announced advanced POS software updates enabling real-time payment data analytics and improved online ordering integrations, strengthening its market position

- The increasing need for streamlined operations, including order management, billing, inventory tracking, and customer engagement, is driving demand for advanced POS systems

- The surge in cloud-based POS deployments enables restaurants to manage multiple outlets, gain centralized data access, and improve decision-making efficiency

- In addition, the rising popularity of QR-code ordering, mobile wallets, and loyalty program integrations is boosting the adoption of modern POS terminals across quick-service and fine-dining restaurants worldwide

Which Factor is Challenging the Growth of the Restaurant Point of Sale (POS) Terminals Market?

- Cybersecurity threats pose a critical challenge as POS terminals handle sensitive customer data, including payment details. Vulnerabilities can lead to data breaches and financial losses, impacting consumer trust

- For instance, high-profile data breaches involving restaurant POS systems have heightened concerns over payment security, making many businesses cautious about adopting digital systems

- Ensuring robust end-to-end encryption, tokenization, and secure payment gateways is vital to overcoming this challenge. Vendors such as VeriFone and Ingenico emphasize their security-first designs to assure restaurant operators

- Another barrier is the high upfront cost of modern POS systems, especially for small and independent restaurants in developing markets. While subscription-based and mobile POS options are reducing costs, many businesses still perceive advanced POS terminals as expensive investments

- Addressing these challenges through affordable, scalable, and highly secure POS solutions will be essential to drive sustainable growth in the restaurant POS terminals market

How is the Restaurant Point of Sale (POS) Terminals Market Segmented?

The market is segmented on the basis of component, product, deployment type, and application.

- By Component

On the basis of component, the restaurant point of sale (POS) terminals market is segmented into hardware, software, and services. The hardware segment dominated the market with a revenue share of 52.8% in 2024, driven by the demand for touchscreen monitors, barcode scanners, receipt printers, and card readers. Restaurants, especially full-service outlets, rely heavily on durable and efficient hardware systems to ensure seamless billing and order management. Hardware also forms the backbone of integration with payment gateways and inventory management solutions.

However, the software segment is projected to witness the fastest CAGR of 20.9% from 2025 to 2032, fueled by increasing adoption of cloud-based POS solutions, real-time data analytics, and AI-driven personalization features. Software upgrades allow restaurants to streamline operations, manage loyalty programs, and enhance customer engagement, making it a key growth enabler for both small outlets and large restaurant chains.

- By Product

On the basis of product, the market is segmented into fixed POS terminals and mobile POS terminals. The fixed POS terminal segment accounted for the largest revenue share of 61.4% in 2024, owing to its widespread use in full-service restaurants and chain outlets. Fixed systems are favored for their reliability, advanced reporting features, and ability to handle high transaction volumes. They also support multi-functional integration across kitchen display systems, order management, and centralized billing.

On the other hand, the mobile POS terminal segment is expected to record the fastest CAGR of 23.2% during 2025–2032, driven by rising demand in quick-service restaurants (QSRs), bars, and food trucks. Mobile POS systems enable tableside ordering, quicker checkouts, and flexible billing, significantly improving customer experience. Their portability, cost-effectiveness, and compatibility with smartphones and tablets make them especially appealing to small and medium-sized businesses seeking efficiency.

- By Deployment Type

By deployment type, the market is categorized into on-cloud and on-premise. The on-premise segment dominated the market with a revenue share of 55.6% in 2024, as many traditional restaurants prefer locally managed systems with complete control over data security and customization. On-premise systems are particularly popular among large restaurants and franchises that need offline capabilities and enhanced integration with in-house servers.

However, the on-cloud segment is projected to grow at the fastest CAGR of 21.8% from 2025 to 2032, fueled by the increasing shift towards SaaS-based subscription models. Cloud POS solutions enable real-time updates, remote access, and lower upfront costs, making them highly attractive for small and mid-sized restaurants. In addition, features such as AI-driven analytics, CRM integration, and centralized inventory tracking across multiple outlets are accelerating adoption, positioning cloud deployment as the future growth driver in the restaurant POS landscape.

- By Application

On the basis of application, the restaurant POS terminals market is segmented into full-service restaurants (FSR), quick-service restaurants (QSR), bars and pubs, cafés and bistros, and others. The full-service restaurants (FSR) segment dominated the market with the largest revenue share of 40.3% in 2024, driven by high-volume transactions, advanced order customization needs, and integration with kitchen and reservation systems. FSR operators value robust POS systems for handling complex menus, multi-course orders, and loyalty management.

Meanwhile, the QSR segment is expected to witness the fastest CAGR of 22.5% from 2025 to 2032, fueled by the global expansion of fast-food chains and increasing consumer demand for quick, contactless service. QSRs increasingly adopt mobile POS and self-service kiosks to minimize wait times and enhance efficiency. Growing preference for digital payments and AI-driven upselling in QSRs further strengthens the adoption of POS systems in this segment.

Which Region Holds the Largest Share of the Restaurant Point of Sale (POS) Terminals Market?

- Asia-Pacific dominated the restaurant point of sale (POS) terminals market with the largest revenue share of 41.23% in 2024, driven by the rising adoption of digital payment solutions, government initiatives promoting cashless economies, and the rapid expansion of quick-service restaurants and cloud kitchens

- Consumers across the region are increasingly drawn to the convenience, speed, and security offered by POS systems, coupled with the rising popularity of contactless and mobile-based transactions

- The strong presence of domestic players, combined with the booming foodservice industry in China, India, and Japan, has made Asia-Pacific the global leader in the Restaurant POS Terminals market

China Restaurant Point of Sale (POS) Terminals Market Insight

The China restaurant POS terminals market accounted for the largest share within Asia-Pacific in 2024, fueled by rapid urbanization, the growth of organized foodservice chains, and government support for digital infrastructure. The surge in mobile wallet adoption, particularly Alipay and WeChat Pay, has accelerated the need for advanced POS systems. Furthermore, China’s large middle-class population and booming quick-service restaurant sector continue to strengthen demand.

Japan Restaurant Point of Sale (POS) Terminals Market Insight

The Japan restaurant POS terminals market is expanding steadily due to the country’s technological sophistication and strong preference for contactless solutions. The growth of self-service kiosks and the integration of POS systems with IoT-enabled devices in restaurants are key factors fueling adoption. In addition, Japan’s aging population and emphasis on convenience drive restaurant operators to invest in automated, efficient POS solutions to improve customer experiences.

India Restaurant Point of Sale (POS) Terminals Market Insight

The India restaurant POS terminals market is witnessing rapid growth, supported by the rise of food delivery platforms, the increasing penetration of quick-service chains, and government-led initiatives such as Digital India. With the surge in smartphone usage and UPI-based transactions, restaurants are adopting modern POS systems to streamline payments, enhance order accuracy, and manage customer engagement effectively. The trend is further reinforced by a growing young consumer base with strong digital payment preferences.

Which Region is the Fastest Growing Region in the Restaurant Point of Sale (POS) Terminals Market?

North America is projected to grow at the fastest CAGR of 12.4% during 2025–2032, fueled by the increasing adoption of cloud-based POS solutions and the rising trend of contactless and mobile payments in restaurants. The U.S. and Canada are leading the region, with a strong ecosystem of technology providers and a high concentration of quick-service and full-service restaurants adopting POS terminals for efficiency. The growing focus on AI-driven analytics, customer personalization, and mobile wallet integration is positioning North America as the fastest-growing region globally in the Restaurant POS Terminals market.

U.S. Restaurant POS Terminals Market Insight

The U.S. restaurant POS terminals market is expanding rapidly, driven by the increasing adoption of cloud-based, mobile, and AI-integrated solutions across quick-service and full-service restaurants. Rising consumer preference for contactless payments and mobile ordering has accelerated POS deployment in both urban and suburban regions. In addition, restaurants are leveraging advanced POS systems for inventory management, analytics, and customer engagement, enhancing operational efficiency and profitability. The U.S. market also benefits from a robust technology ecosystem and strong investment in digital infrastructure, making it a key growth hub in North America’s fast-growing Restaurant POS Terminals sector.

Canada Restaurant POS Terminals Market Insight

The Canada restaurant POS terminals market is witnessing significant growth, fueled by the adoption of cloud-based, touchless, and integrated payment solutions in restaurants nationwide. Increasing demand for efficient order processing, contactless payments, and real-time data analytics is driving POS deployment in both metropolitan and regional areas. Canadian restaurants are increasingly integrating POS systems with loyalty programs, mobile apps, and inventory management tools, enhancing customer experience and operational efficiency. Supportive government initiatives promoting digital payments and technology adoption further boost market expansion, positioning Canada as a key contributor to North America’s fast-growing Restaurant POS Terminals market

Which are the Top Companies in Restaurant Point of Sale (POS) Terminals Market?

The restaurant point of sale (POS) terminals industry is primarily led by well-established companies, including:

- Brookfield Equinox, LLC (U.S.)

- Clover Network, Inc. (U.S.)

- Diebold Nixdorf, Incorporated (U.S.)

- Shift4 Payments, LLC (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Ingenico (France)

- Lightspeed Management Company, L.L.C. (Canada)

- SAMSUNG (South Korea)

- VeriFone, Inc. (U.S.)

- Micros Retail Systems, Inc. (U.S.)

- NCR Corporation (U.S.)

- NEC Corporation (Japan)

- Panasonic Corporation (Japan)

- PAX (China)

- Toshiba Tec Corporation (Japan)

- Squirrel Systems (U.S.)

What are the Recent Developments in Global Restaurant Point of Sale (POS) Terminals Market?

- In May 2025, Global Payments proposed the acquisition of Worldpay, potentially creating the largest merchant acquirer with an estimated USD 3.5 trillion in annual payments volume, though the deal faces regulatory scrutiny and market skepticism, as reflected by a 22% drop in Global Payments' share price following the announcement, signaling a transformative yet closely watched development in the POS terminal market

- In April 2025, ZCS (Zhongcheng Smart) was recognized as the Top Merchant by Transaction Volume for processing over 150 million transactions in 2024, highlighting the company's expanding influence in the global POS terminal market and its capability to serve clients across more than 80 countries, underlining industry leadership

- In January 2024, ParTech, Inc., a restaurant POS provider, launched the PAR Wave, an all-in-one touch panel designed for hardware components in the hospitality industry, combining performance, security, functionality, and a new design to meet evolving restaurant industry demands, marking a key innovation for modern POS solutions

- In August 2023, Snack POS, a restaurant point-of-sale system provider, partnered with PAX, a secure electronic payment terminal solutions provider, to launch EMV-enabled terminals for Europay, MasterCard, and Visa transactions, ensuring secure payments and convenience for both restaurants and customers, reflecting the ongoing push for safer POS ecosystems

- In May 2023, Toast, Inc., a restaurant POS provider, partnered with Deliverect, a provider of solutions that streamline online orders from food delivery platforms into restaurant POS systems, enabling restaurants to manage online orders with enhanced flexibility and ease through the Toast Partner Ecosystem, strengthening operational efficiency and digital integration

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Restaurant Pos Terminals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Restaurant Pos Terminals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Restaurant Pos Terminals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.