Global Resistive Random Access Memory Reram Market

Market Size in USD Million

CAGR :

%

USD

833.52 Million

USD

2,967.15 Million

2024

2032

USD

833.52 Million

USD

2,967.15 Million

2024

2032

| 2025 –2032 | |

| USD 833.52 Million | |

| USD 2,967.15 Million | |

|

|

|

|

What is the Global Resistive Random-Access Memory (ReRAM) Market Size and Growth Rate?

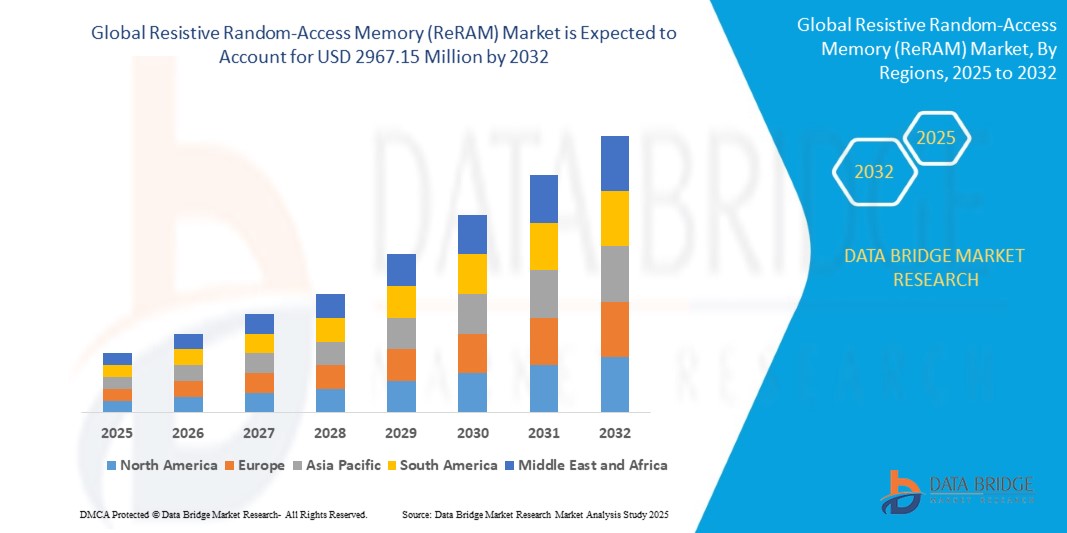

- The global resistive random-access memory (ReRAM) market size was valued at USD 833.52 million in 2024 and is expected to reach USD 2967.15 million by 2032, at a CAGR of 17.20% during the forecast period

- In the resistive random-access memory (ReRAM) market, technological advancements continue to drive innovation, enhancing memory density and performance. These developments offer benefits such as higher data storage capacity, faster access times, and lower power consumption

- As ReRAM gains traction, its versatility and efficiency promise transformative impacts across various applications, from consumer electronics to data centers, fueling market growth and adoption

What are the Major Takeaways of Resistive Random-Access Memory (ReRAM) Market?

- ReRAM's ability to operate at lower voltages greatly reduces power consumption, making it well-suited for battery-powered devices and energy-efficient applications, thus offering significant advantages in terms of energy savings. For instance, in wearable health monitors, where battery life is crucial, ReRAM's low-power operation extends device longevity, ensuring continuous monitoring without frequent recharges. This energy efficiency enhances user experience and reduces the environmental impact by lowering the need for frequent battery replacements

- North America led the global resistive random-access memory (ReRAM) market with a 32.89% revenue share in 2024, owing to its strong technological infrastructure and rising integration of ReRAM in AI, IoT, and advanced computing applications

- Asia-Pacific is the fastest-growing ReRAM market, forecasted to grow at a CAGR of 11.7% from 2025 to 2032, fueled by increasing urbanization, rapid digital transformation, and a booming electronics manufacturing base in China, Japan, South Korea, and India

- The Oxide Based ReRAM segment dominated the market with the largest market revenue share of 59.3% in 2024, driven by its superior scalability, low programming voltage, and compatibility with CMOS processes

Report Scope and Resistive Random-Access Memory (ReRAM) Market Segmentation

|

Attributes |

Resistive Random-Access Memory (ReRAM) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Resistive Random-Access Memory (ReRAM) Market?

“AI-Powered Computing and Neuromorphic Integration Driving Adoption”

- A major emerging trend in the global resistive random-access memory (ReRAM) market is its increasing integration with artificial intelligence (AI) and neuromorphic computing architectures, which aim to mimic the human brain’s neural networks for advanced data processing and decision-making capabilities

- For instance, Weebit Nano has developed ReRAM technology that is optimized for neuromorphic and edge AI applications, offering ultra-low power consumption and fast switching speeds essential for real-time processing in AI workloads

- ReRAM’s ability to function as both a storage and processing unit enables parallel processing and in-memory computation, reducing latency and improving energy efficiency—key requirements in autonomous vehicles, robotics, and next-generation computing systems

- The adoption of AI-enabled devices, especially those relying on edge computing, is driving demand for memory components that support real-time learning and pattern recognition, where ReRAM stands out for its scalability and non-volatility

- Leading semiconductor firms are investing in ReRAM as a viable replacement for traditional flash memory in AI-centric architectures, further signaling its potential in deep learning and intelligent processing tasks

- This shift toward AI-powered memory solutions and neuromorphic chip integration is accelerating ReRAM’s role in redefining memory design for future-ready computing systems

What are the Key Drivers of Resistive Random-Access Memory (ReRAM) Market?

- The growing demand for high-performance, low-power memory solutions in consumer electronics, industrial IoT, automotive, and AI-based applications is a core driver for the ReRAM market

- For instance, in February 2024, Fujitsu announced a collaboration to develop next-gen memory systems incorporating ReRAM for ultra-efficient edge devices, targeting wearables and smart sensors

- As traditional flash memory technologies face limitations in scalability and endurance, ReRAM is emerging as a promising alternative offering faster read/write cycles, high durability, and low energy consumption

- ReRAM’s compatibility with CMOS technology allows easy integration into existing semiconductor fabrication processes, enabling cost-effective development of embedded memory for microcontrollers and SoCs

- The push for miniaturization and energy efficiency in electronics, combined with ReRAM’s radiation resistance and temperature tolerance, makes it an ideal solution for mission-critical applications such as aerospace and medical devices

- These technological advantages are driving adoption across multiple sectors, especially where memory density, endurance, and performance are critical

Which Factor is challenging the Growth of the Resistive Random-Access Memory (ReRAM) Market?

- One of the key challenges facing the ReRAM market is the lack of standardization and limited commercial-scale deployment, which hinders large-scale integration into mainstream devices

- For instance, despite successful pilot programs, companies such as 4DS Memory and Adesto Technologies still face technical bottlenecks in delivering high-volume, cost-effective ReRAM products for mass markets

- The competitive landscape in non-volatile memory technologies especially from established players in NAND flash, MRAM, and PCM creates pressure on ReRAM vendors to demonstrate superior cost-performance ratios

- In addition, material compatibility issues, variability in performance, and endurance limitations in certain use cases continue to present engineering challenges for broader adoption

- The high initial investment required for process development and limited foundry support also restrict smaller firms from scaling up, slowing commercial readiness

- Overcoming these barriers will require greater industry collaboration, strategic partnerships with semiconductor foundries, and continued R&D to ensure performance reliability and manufacturability of ReRAM at competitive cost

How is the Resistive Random-Access Memory (ReRAM) Market Segmented?

The market is segmented on the basis of type, memory, solution, technology, application, and end user.

• By Type

On the basis of type, the resistive random-access memory (ReRAM) market is segmented into Conductive Bridging, Oxide Based ReRAM, and Others. The Oxide Based ReRAM segment dominated the market with the largest market revenue share of 59.3% in 2024, driven by its superior scalability, low programming voltage, and compatibility with CMOS processes. These characteristics make oxide-based ReRAM a preferred choice for integration into high-performance computing and storage systems.

The Conductive Bridging segment is anticipated to witness the fastest growth rate of 22.1% from 2025 to 2032, owing to its promising potential in ultra-low-power applications and neuromorphic computing. The ability to modulate conductance states with high precision enhances its appeal in AI-driven memory architectures.

• By Memory

On the basis of memory type, the market is categorized into Embedded and Standalone. The Embedded ReRAM segment held the largest market revenue share in 2024, accounting for 63.7%, primarily due to rising integration in microcontrollers and IoT chips for industrial, automotive, and wearable devices. Its non-volatility, low latency, and ease of integration with logic processes contribute to this dominance.

The Standalone segment is projected to grow at the highest CAGR from 2025 to 2032, driven by increasing demand for high-density memory solutions in enterprise storage and data centers, where separate memory units are required for massive data handling.

• By Solution

On the basis of solution, the market is segmented into NVMe SSD and NVDIMM. The NVMe SSD segment dominated the market in 2024, capturing a revenue share of 52.4%, due to the increasing deployment of high-speed, energy-efficient SSDs in consumer electronics, enterprise storage, and AI-driven workloads.

The NVDIMM segment is expected to witness the fastest CAGR during the forecast period, benefiting from the demand for persistent memory in server environments, enabling faster data recovery and system resiliency in critical infrastructure.

• By Technology

On the basis of technology, the market is segmented into 180 nm, 40 nm, and Others. The 40 nm segment held the largest market share in 2024, contributing 47.6%, supported by its balance between performance, power efficiency, and cost-effectiveness. It is widely used for embedded memory in MCUs and IoT devices.

The 180 nm segment is expected to grow at the highest rate through 2032, due to its adoption in industrial and legacy systems where high voltage and robustness are critical requirements.

• By Application

On the basis of application, the market is segmented into Neuromorphic Computing, Security, Data Storage and Logical. The Data Storage and Logical segment dominated the market with a market share of 49.2% in 2024, fueled by ReRAM’s fast switching speeds, high endurance, and ability to retain data without power—making it suitable for data-intensive applications.

The Neuromorphic Computing segment is projected to witness the highest growth rate, owing to ReRAM’s ability to mimic synaptic behavior in AI systems, enhancing edge AI and real-time learning capabilities.

• By End User

On the basis of end user, the market is segmented into Computer, IoT, Consumer Electronics, Medical, IT and Telecom, Aerospace and Defence, and Others. The Consumer Electronics segment held the largest market revenue share of 34.8% in 2024, driven by rising demand for smart wearables, smartphones, and other connected devices where high-speed, non-volatile memory is critical.

The IoT segment is expected to experience the fastest CAGR from 2025 to 2032, owing to the proliferation of smart sensors and edge devices that require compact, energy-efficient, and reliable memory components such as ReRAM.

Which Region Holds the Largest Share of the Resistive Random-Access Memory (ReRAM) Market?

- North America led the global resistive random-access memory (ReRAM) market with a 32.89% revenue share in 2024, owing to its strong technological infrastructure and rising integration of ReRAM in AI, IoT, and advanced computing applications

- The U.S. and Canada are key contributors, with robust R&D investments, well-established semiconductor ecosystems, and growing demand for energy-efficient, non-volatile memory in data centers and consumer electronics

- Adoption is further driven by collaborations between chip manufacturers and cloud service providers aiming to enhance processing speed and storage efficiency

U.S. Resistive Random-Access Memory (ReRAM) Market Insight

The U.S. dominated the North American ReRAM market revenue share in 2024, supported by rising usage in neuromorphic computing, AI accelerators, and defense applications. Top players such as Intel and Micron are scaling production capacities, while government-backed innovation initiatives boost development. Demand is notably strong in automotive, aerospace, and healthcare industries for low-power memory applications.

Europe Resistive Random-Access Memory (ReRAM) Market Insight

Europe is witnessing steady growth in ReRAM adoption, driven by green computing trends, strict data privacy regulations, and innovation in edge computing and wearable electronics. Countries such as Germany, France, and the U.K. are investing in advanced memory research, focusing on energy efficiency and secure storage for smart devices and industrial automation.

U.K. Resistive Random-Access Memory (ReRAM) Market Insight

The U.K. market is projected to grow at a notable CAGR, attributed to rising tech startups, growing use of IoT in healthcare, and demand for low-latency memory in autonomous vehicles. Government investments in chip design and semiconductor fabrication are expected to boost local ReRAM adoption across commercial and academic sectors.

Germany Resistive Random-Access Memory (ReRAM) Market Insight

Germany's ReRAM market is expanding rapidly, supported by a strong automotive sector and Industry 4.0 initiatives. As ReRAM offers superior endurance and faster read/write cycles, it is being widely integrated into robotics, industrial automation, and energy-efficient computing systems. Partnerships between universities and tech firms are advancing ReRAM research in the country.

Which Region is the Fastest Growing Region in the Resistive Random-Access Memory (ReRAM) Market?

Asia-Pacific is the fastest-growing ReRAM market, forecasted to grow at a CAGR of 11.7% from 2025 to 2032, fueled by increasing urbanization, rapid digital transformation, and a booming electronics manufacturing base in China, Japan, South Korea, and India. Government incentives and growing demand for smart devices further accelerate the adoption.

Japan Resistive Random-Access Memory (ReRAM) Market Insight

Japan is experiencing strong momentum in the ReRAM market due to its emphasis on miniaturization and high-performance electronics. Integration with IoT, robotics, and consumer electronics is driving uptake, particularly from companies such as Panasonic and Sony. Japan’s aging population also supports demand for efficient, compact memory solutions in healthcare and home automation.

China Resistive Random-Access Memory (ReRAM) Market Insight

China accounted for the largest APAC market share in 2024, driven by a large electronics consumer base, rapid 5G rollout, and smart city initiatives. Domestic manufacturers such as SMIC and Hope Microelectronics are investing heavily in R&D, while government policies support semiconductor independence, boosting ReRAM development in smartphones, AI processors, and automotive systems.

Which are the Top Companies in Resistive Random-Access Memory (ReRAM) Market?

The resistive random-access memory (ReRAM) industry is primarily led by well-established companies, including:

- Fujitsu (Japan)

- Panasonic Corporation (Japan)

- Weebit (Israel)

- SMIC (China)

- Micron Technology Inc. (U.S.)

- Taiwan Semiconductor Manufacturing Company Limited (TSMC) (Taiwan)

- 4DS Memory Limited (Australia)

- Renesas Electronics Corporation (Japan)

- Other World Computing, Inc. (U.S.)

- Sony Corporation (Japan)

- VentureBeat (U.S.)

- Rambus (U.S.)

- Intel Corporation (U.S.)

- Avalanche Technology (U.S.)

- SK HYNIX INC. (South Korea)

- HOPE Microelectronics CO., Ltd. (China)

- Adesto Technologies Corporation (U.S.)

What are the Recent Developments in Global Resistive Random-Access Memory (ReRAM) Market?

- In May 2022, Everspin launched its EMxxLX xSPI MRAM, a high-speed, non-volatile memory solution specifically designed for industrial IoT and embedded applications. Offering storage capacities between 8MB and 64MB and delivering read/write speeds of up to 400MB/s, this innovation serves as a robust alternative to traditional SPI NOR and NAND flash memory. This move reinforces Everspin's commitment to addressing evolving storage demands in industrial and connected environments

- In January 2022, Samsung Electronics unveiled the world’s first in-memory computing platform based on MRAM technology, in collaboration with its Foundry Business, Semiconductor R&D Center, and the Samsung Advanced Institute of Technology (SAIT). This breakthrough aims to unify storage and processing in AI chip designs, enhancing system performance and energy efficiency. The advancement underscores Samsung’s leadership in next-generation memory and semiconductor integration for AI-driven computing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Resistive Random Access Memory Reram Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Resistive Random Access Memory Reram Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Resistive Random Access Memory Reram Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.