Global Rental Leasing On Demand Transportation Market

Market Size in USD Million

CAGR :

%

USD

296.80 Million

USD

750.77 Million

2025

2033

USD

296.80 Million

USD

750.77 Million

2025

2033

| 2026 –2033 | |

| USD 296.80 Million | |

| USD 750.77 Million | |

|

|

|

|

What is the Global Rental Leasing On-Demand Transportation Market Size and Growth Rate?

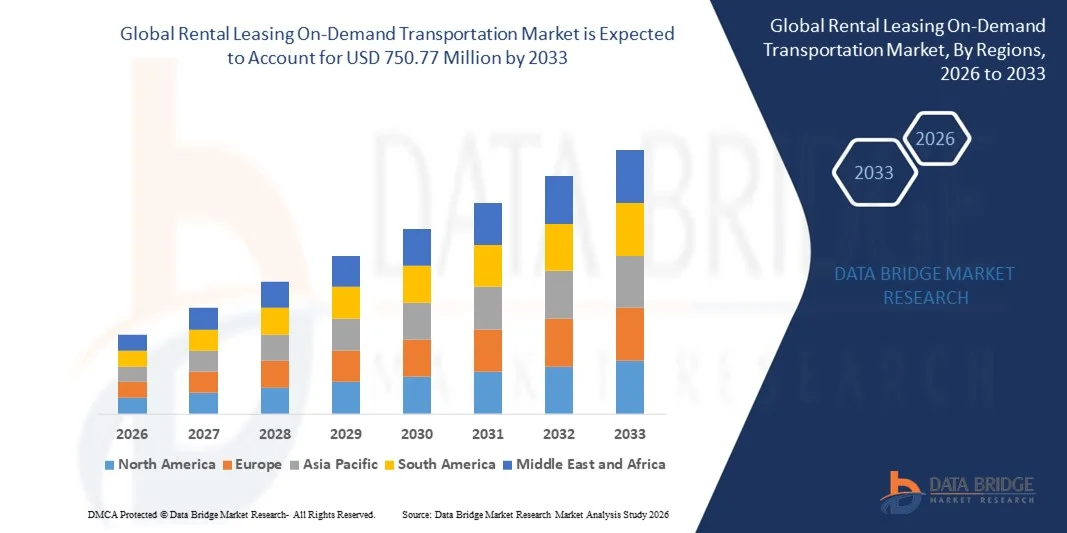

- The global rental leasing on-demand transportation market size was valued at USD 296.80 million in 2025 and is expected to reach USD 750.77 million by 2033, at a CAGR of43.40% during the forecast period

- The increase in the fuel costs across the globe acts as one of the major factors driving the growth of rental leasing on-demand transportation market. The high cost of automobiles changing the consumer preference towards on-demand services that allows users to pre-book, modify and cancel their bookings at lower costs through applications and the rise in the problems related to traffic accelerate the rental leasing on-demand transportation market growth

What are the Major Takeaways of Rental Leasing On-Demand Transportation Market?

- The growing penetration of smartphone and connected vehicles and increase in the usage of car sharing services by millennials globally further influence the rental leasing on-demand transportation market

- In addition, the flexibility of traveling and enhanced traveling experience with none maintenance cost, reduced parking spaces, the advent of car sharing applications, rapid urbanization and digitization and surge in disposable income of people positively affect the rental leasing on-demand transportation market

- Asia-Pacific dominated the rental leasing on-demand transportation market with the largest revenue share of 39.14% in 2025, driven by rapid urbanization, rising smartphone penetration, expanding shared mobility ecosystems, and increasing adoption of app-based transportation services across major economies

- North America is projected to register the fastest CAGR of 7.12% from 2026 to 2033, driven by increasing adoption of subscription-based mobility, corporate fleet leasing, and premium on-demand transportation services across the U.S. and Canada

- The Passenger Cars segment dominated the market with a 41.6% share in 2025, driven by high demand for ride-hailing, short-term rentals, airport transfers, and daily commuting services in urban and semi-urban areas

Report Scope and Rental Leasing On-Demand Transportation Market Segmentation

|

Attributes |

Rental Leasing On-Demand Transportation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Rental Leasing On-Demand Transportation Market?

Increasing Shift Toward App-Based, Flexible, and Asset-Light Mobility Solutions

- The rental leasing on-demand transportation market is witnessing strong adoption of app-based, short-term, and subscription-driven mobility services designed to meet urban commuting, corporate travel, and last-mile transportation needs

- Service providers are introducing AI-enabled fleet management, dynamic pricing models, and real-time vehicle tracking to improve asset utilization and customer experience

- Growing demand for cost-efficient, flexible, and maintenance-free transportation solutions is driving adoption across individual users, enterprises, logistics operators, and tourism sectors

- For instance, companies such as Uber, Lyft, Bolt, and Gett have expanded on-demand rental, ride-hailing, and leasing offerings with improved app interfaces, multi-vehicle options, and integrated payment systems

- Increasing focus on reducing vehicle ownership costs, improving urban mobility efficiency, and supporting shared transportation ecosystems is accelerating the shift toward on-demand rental and leasing models

- As cities become more congested and digitally connected, Rental Leasing On-Demand Transportations will remain critical for scalable, sustainable, and technology-driven mobility solutions

What are the Key Drivers of Rental Leasing On-Demand Transportation Market?

- Rising demand for affordable, flexible, and convenient transportation alternatives is supporting growth across urban and semi-urban regions

- For instance, during 2024–2025, leading providers such as Uber, Bolt, ANI Technologies, and Avis Budget Group expanded fleet sizes, subscription offerings, and regional coverage to meet growing demand

- Increasing smartphone penetration, digital payment adoption, and availability of high-speed mobile internet are boosting usage of app-based transportation platforms across the U.S., Europe, and Asia-Pacific

- Advancements in GPS tracking, AI-driven route optimization, and cloud-based fleet analytics are improving operational efficiency and service reliability

- Rising adoption of electric vehicles, shared mobility concepts, and sustainability-focused transport policies is strengthening demand for rental and leasing models

- Supported by continuous investments in smart mobility infrastructure and digital platforms, the Rental Leasing On-Demand Transportation market is expected to experience sustained long-term growth

Which Factor is Challenging the Growth of the Rental Leasing On-Demand Transportation Market?

- High operational costs related to vehicle procurement, maintenance, insurance, and regulatory compliance limit profitability for service providers

- For instance, during 2024–2025, fuel price volatility, rising EV battery costs, and changing transportation regulations increased operating expenses for several global mobility companies

- Complex regulatory frameworks, licensing requirements, and data-privacy laws across regions create entry barriers and slow market expansion

- Limited infrastructure for electric vehicle charging and fleet digitization in developing markets restricts large-scale deployment

- Intense competition among global and regional players is creating pricing pressure and reducing margin sustainability

- To overcome these challenges, companies are focusing on fleet electrification, strategic partnerships, optimized pricing models, and advanced analytics to enhance scalability and profitability in the rental leasing on-demand transportation market

How is the Rental Leasing On-Demand Transportation Market Segmented?

The market is segmented on the basis of vehicle type, autonomy level, power source, business model and application.

- By Vehicle Type

On the basis of vehicle type, the rental leasing on-demand transportation market is segmented into Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Buses and Coaches, and Micro-Mobility. The Passenger Cars segment dominated the market with a 41.6% share in 2025, driven by high demand for ride-hailing, short-term rentals, airport transfers, and daily commuting services in urban and semi-urban areas. Passenger cars offer flexibility, cost efficiency, and widespread availability, making them the preferred choice for individual and corporate users. Increasing smartphone-based bookings and subscription car leasing further support segment dominance.

The Micro-Mobility segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption of e-scooters, e-bikes, and shared mobility solutions for last-mile connectivity. Urban congestion, sustainability goals, and favorable city-level regulations are accelerating demand for compact, low-emission rental mobility options.

- By Autonomy Level

On the basis of autonomy level, the market is segmented into Manual, Semi-Autonomous, and Autonomous transportation services. The Manual segment accounted for the largest market share of 52.3% in 2025, as most rental and leasing fleets continue to rely on human-driven vehicles due to regulatory constraints, infrastructure limitations, and cost considerations. Manual vehicles remain dominant across developing regions and conventional ride-hailing services, offering reliability and lower operational complexity.

The Autonomous segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by pilot deployments of self-driving taxis, autonomous shuttles, and logistics vehicles. Advancements in AI, LiDAR, sensor fusion, and vehicle-to-everything (V2X) communication, along with growing investments from mobility and technology companies, are expected to accelerate commercialization of autonomous rental and on-demand transportation solutions.

- By Power Source

Based on power source, the rental leasing on-demand transportation market is segmented into Fuel Powered, Hybrid Electric Vehicles (HEV), Plug-in Hybrid Electric Vehicles (PHEV), and Battery Electric Vehicles (BEV). The Fuel Powered segment dominated the market with a 45.8% share in 2025, due to extensive existing vehicle fleets, lower upfront costs, and limited EV charging infrastructure in many regions. Fuel-powered vehicles continue to serve long-distance travel and high-utilization routes effectively.

The BEV segment is anticipated to witness the fastest growth from 2026 to 2033, supported by stricter emission regulations, declining battery costs, and increasing government incentives for electric mobility. Fleet electrification initiatives by ride-hailing and rental companies, coupled with expanding charging networks, are significantly boosting BEV adoption in on-demand transportation services.

- By Business Model

On the basis of business model, the market is segmented into Peer-to-Peer (P2P), Business-to-Business (B2B), and Business-to-Consumer (B2C) models. The B2C segment dominated the market with a 48.9% share in 2025, driven by widespread use of ride-hailing apps, self-drive rentals, and subscription-based mobility services by individual consumers. High convenience, transparent pricing, and real-time availability support strong adoption.

The B2B segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for corporate mobility solutions, logistics leasing, employee transportation, and fleet outsourcing. Enterprises are adopting long-term leasing and on-demand transport services to reduce capital expenditure and improve operational efficiency.

- By Application

On the basis of application, the rental leasing on-demand transportation market is segmented into Passenger Transportation and Goods Transportation. The Passenger Transportation segment held the largest share of 57.4% in 2025, supported by rising urbanization, tourism growth, daily commuting needs, and expanding ride-hailing platforms. Flexible pricing models and app-based booking systems continue to strengthen passenger-focused services.

The Goods Transportation segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rapid expansion of e-commerce, last-mile delivery demand, and urban logistics services. Increasing use of on-demand vans, electric delivery vehicles, and flexible leasing solutions is accelerating adoption across retail, food delivery, and logistics sectors.

Which Region Holds the Largest Share of the Rental Leasing On-Demand Transportation Market?

- Asia-Pacific dominated the rental leasing on-demand transportation market with the largest revenue share of 39.14% in 2025, driven by rapid urbanization, rising smartphone penetration, expanding shared mobility ecosystems, and increasing adoption of app-based transportation services across major economies

- Widespread deployment of ride-hailing, vehicle subscription, and on-demand rental platforms across densely populated cities in China, India, Japan, and Southeast Asia is accelerating market growth

- Strong government support for smart mobility, expansion of electric vehicle fleets, and high consumer acceptance of shared transportation models positions Asia-Pacific as the most innovation-driven and volume-intensive region for Rental Leasing On-Demand Transportations

China Rental Leasing On-Demand Transportation Market Insight

China is the largest contributor within Asia-Pacific, supported by massive urban populations, strong digital infrastructure, and widespread adoption of ride-hailing and vehicle leasing platforms. Increasing integration of AI-driven dispatch systems, EV fleets, and real-time mobility analytics is enhancing service efficiency. Government policies promoting shared mobility and electric transportation, along with the presence of major platform operators, continue to strengthen China’s leadership in the Rental Leasing On-Demand Transportation market.

India Rental Leasing On-Demand Transportation Market Insight

India is witnessing strong growth due to rising demand for affordable urban mobility, rapid expansion of ride-hailing services, and increasing use of subscription-based vehicle leasing. Growing smartphone usage, digital payments, and government initiatives supporting shared and electric mobility are accelerating adoption. Expansion of two-wheeler rentals, micro-mobility services, and last-mile transportation solutions further supports market penetration across metro and tier-2 cities.

Japan Rental Leasing On-Demand Transportation Market Insight

Japan shows steady market expansion supported by high urban density, strong public–private collaboration, and advanced digital mobility platforms. Increasing adoption of on-demand car rentals, corporate leasing, and technology-enabled fleet management systems is driving growth. Focus on service quality, reliability, and integration with public transport reinforces Japan’s role as a mature yet innovation-focused Asia-Pacific market.

North America Rental Leasing On-Demand Transportation Market

North America is projected to register the fastest CAGR of 7.12% from 2026 to 2033, driven by increasing adoption of subscription-based mobility, corporate fleet leasing, and premium on-demand transportation services across the U.S. and Canada. Rapid electrification of rental and ride-hailing fleets, integration of AI-based routing, and growing demand for flexible mobility solutions are accelerating regional market expansion. Strong investment in autonomous mobility pilots, EV infrastructure, and digital transportation platforms positions North America as the fastest-growing region in the Rental Leasing On-Demand Transportation market

U.S. Rental Leasing On-Demand Transportation Market Insight

The U.S. is the primary growth engine in North America, supported by high adoption of ride-hailing, long-term vehicle subscriptions, and corporate mobility solutions. Expansion of EV fleets, growing use of data-driven fleet optimization, and strong presence of leading mobility platforms are driving demand. Regulatory support for shared and electric transportation, along with high consumer preference for flexible mobility, continues to fuel market growth.

Canada Rental Leasing On-Demand Transportation Market Insight

Canada contributes steadily to regional expansion, driven by increasing urban mobility needs, growth of on-demand rental services, and rising focus on sustainable transportation. Adoption of EV-based rental fleets, smart fleet management platforms, and integrated mobility services is strengthening market penetration. Government incentives for clean mobility and improving digital infrastructure further support long-term growth.

Which are the Top Companies in Rental Leasing On-Demand Transportation Market?

The rental leasing on-demand transportation industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Bayerische Motoren Werke AG (Germany)

- Daimler AG (Germany)

- Ford Motor Company (U.S.)

- General Motors (U.S.)

- Gett (Israel)

- Bosch Limited (Germany)

- Uber Technologies Inc. (U.S.)

- TOYOTA MOTOR CORPORATION (Japan)

- Beijing Xiaoju Technology Co., Ltd. (China)

- Avis Budget Group (U.S.)

- Bolt Technology OÜ (Estonia)

- ANI Technologies Pvt. Ltd. (India)

- Lyft, Inc. (U.S.)

- Maxi Mobility S.L. (Spain)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.