Global Remote Patient Monitoring Software Market

Market Size in USD Billion

CAGR :

%

USD

12.05 Billion

USD

312.50 Billion

2024

2032

USD

12.05 Billion

USD

312.50 Billion

2024

2032

| 2025 –2032 | |

| USD 12.05 Billion | |

| USD 312.50 Billion | |

|

|

|

|

Remote Patient Monitoring Software Market Size

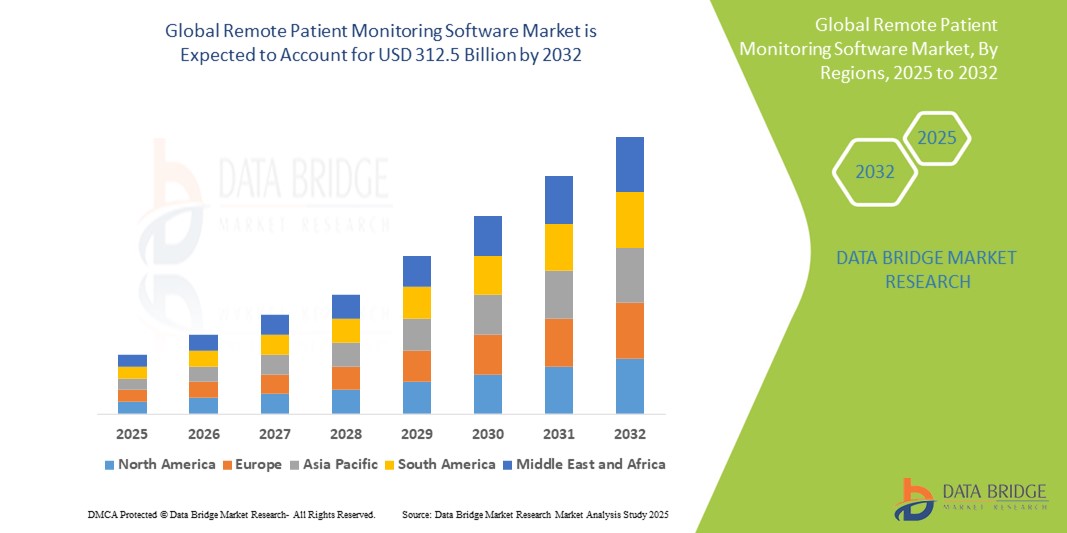

- The global remote patient monitoring software market was valued at USD 12.05 billion in 2024 and is expected to reach USD 312.5 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 34.94%, primarily driven by the rising prevalence of chronic diseases and increasing demand for home-based healthcare solutions

- This growth is driven by factors such as the increasing adoption of telehealth, advancements in wearable technologies, and the need to reduce healthcare costs through early intervention and continuous monitoring

Remote Patient Monitoring Software Market Analysis

- Remote patient monitoring (RPM) software enables the continuous collection and transmission of patient health data from outside traditional clinical settings, supporting timely interventions and personalized care plans. It is widely used for chronic disease management, post-acute care, and elderly health monitoring

- The demand for RPM software is significantly driven by the rising incidence of chronic conditions such as diabetes, hypertension, and cardiovascular diseases, coupled with the growing preference for home-based care and telehealth services

- North America stands out as one of the dominant regions for remote patient monitoring software, fueled by its robust digital health infrastructure, favorable reimbursement policies, and a high rate of technology adoption

- For instance, the U.S. Centers for Medicare & Medicaid Services (CMS) has expanded coverage for RPM services, accelerating adoption across hospitals, clinics, and home healthcare providers

- Globally, remote patient monitoring software is emerging as one of the top digital health tools, following electronic health records (EHR), and plays a pivotal role in transforming traditional care models into more proactive, data-driven healthcare systems

Report Scope and Remote Patient Monitoring Software Market Segmentation

|

Attributes |

Remote Patient Monitoring Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Remote Patient Monitoring Software Market Trends

“Increasing Use of AI and Cloud-Based Platforms”

- One prominent trend in the global remote patient monitoring software market is the increasing integration of artificial intelligence (AI) and cloud-based platforms into monitoring systems

- These advanced features enhance real-time data analysis and decision-making by enabling predictive analytics, personalized alerts, and efficient management of large volumes of patient health data

- For instance, AI-powered RPM platforms can detect anomalies in vital signs—such as irregular heart rates or fluctuating glucose levels—and alert healthcare providers promptly, supporting early intervention and reducing hospital readmissions

- Cloud-based integration also allows for seamless data sharing across healthcare systems, facilitating collaborative care, remote consultations, and centralized patient records

- This trend is transforming remote patient monitoring into a more proactive, scalable, and intelligent system, driving its adoption across hospitals, clinics, and home care settings globally

Remote Patient Monitoring Software Market Dynamics

Driver

“Rising Burden of Chronic Diseases and Aging Population”

- The growing prevalence of chronic diseases such as diabetes, hypertension, heart failure, and chronic obstructive pulmonary disease (COPD) is a major driver of the global remote patient monitoring (RPM) software market

- As the global population continues to age, there is an increased need for continuous monitoring of vital health parameters outside traditional clinical settings, especially for elderly individuals who require frequent check-ups and long-term care

- Chronic conditions often demand consistent data collection and proactive intervention, which RPM software facilitates through real-time monitoring and timely communication between patients and healthcare providers

- In addition, the shift toward value-based care and home healthcare services supports the adoption of RPM solutions that improve patient outcomes while reducing hospital readmissions and healthcare costs

- The integration of advanced analytics and mobile health technologies further enhances the effectiveness of RPM systems in managing patient health remotely

For instance,

- In September 2022, the World Health Organization (WHO) reported that chronic diseases such as cardiovascular diseases account for 17.9 million deaths each year, highlighting the growing need for continuous care solutions such as remote monitoring

- According to the United Nations' 2022 report, the global population aged 65 and older is expected to more than double by 2050, reaching over 1.5 billion. This demographic shift underscores the rising demand for RPM solutions to manage age-related health conditions efficiently

- As the burden of chronic diseases continues to rise alongside an aging global population, the demand for remote patient monitoring software will expand, playing a vital role in delivering cost-effective, patient-centered care

Opportunity

“Transforming Healthcare with Artificial Intelligence and Predictive Analytics”

- The integration of artificial intelligence (AI) and predictive analytics into remote patient monitoring (RPM) software presents a significant opportunity to revolutionize patient care by enabling early detection, timely intervention, and personalized treatment plans

- AI algorithms can analyze real-time patient data—such as heart rate, blood pressure, and glucose levels—to detect anomalies, predict health deterioration, and generate alerts for healthcare providers, thus enhancing patient safety and clinical efficiency

- In addition, predictive analytics supports risk stratification, helping identify patients who are more likely to experience complications, allowing for targeted interventions and optimized care delivery

For instance,

- In February 2024, an article published by the Journal of Medical Internet Research highlighted how AI-enhanced RPM platforms improved the early detection of heart failure exacerbations by 38%, significantly reducing hospital readmission rates

- In October 2023, according to a report by the National Library of Medicine, machine learning models integrated into RPM tools demonstrated over 90% accuracy in predicting adverse diabetic events, showcasing the potential of AI to support chronic disease management

- The fusion of AI with RPM software not only streamlines remote care but also empowers providers with actionable insights, ultimately improving health outcomes, reducing healthcare costs, and advancing the delivery of personalized, preventive care on a global scale

Restraint/Challenge

“High Implementation and Integration Costs Limiting Adoption”

- The high cost of implementing and integrating remote patient monitoring (RPM) software into existing healthcare systems presents a significant barrier to widespread adoption, particularly in low- and middle-income regions

- Expenses related to hardware procurement (e.g., wearable devices), software licenses, data management infrastructure, cybersecurity, and staff training can be substantial, making it challenging for smaller healthcare providers and rural facilities to adopt these technologies

- In addition, interoperability issues between RPM software and electronic health record (EHR) systems further increase the complexity and cost of integration

For instance,

- In August 2024, a report published by the Healthcare Information and Management Systems Society (HIMSS) noted that nearly 40% of small healthcare providers in developing countries cite high infrastructure costs and limited digital readiness as major barriers to adopting RPM solution

- In October 2023, the Journal of Telemedicine and Telecare highlighted that even in developed regions, healthcare systems face hurdles in harmonizing RPM platforms with legacy systems, requiring costly custom integrations and ongoing technical support

- Consequently, these cost and compatibility challenges may slow the market's growth by limiting access to RPM technology among budget-constrained providers, ultimately impacting the delivery of continuous, remote care

Remote Patient Monitoring Software Market Scope

The market is segmented on the basis of types, application and end-use

|

Segmentation |

Sub-Segmentation |

|

By Types |

|

|

By Application |

|

|

By End Use |

|

Remote Patient Monitoring Software Market Regional Analysis

“North America is the Dominant Region in the Remote Patient Monitoring Software Market”

- North America leads the global remote patient monitoring (RPM) software market, driven by its advanced digital healthcare infrastructure, favorable reimbursement frameworks, and strong presence of established health tech companies

- U.S. holds a significant share, fueled by growing demand for home-based care, a high prevalence of chronic diseases, and supportive regulatory policies from agencies such as the Centers for Medicare & Medicaid Services (CMS)

- The continuous innovation, government incentives for telehealth adoption, and increasing investment in AI-driven health technologies further reinforce the region’s dominance

- In addition, the rising elderly population and growing emphasis on reducing hospital readmissions and healthcare costs are propelling the adoption of RPM solutions across hospitals, clinics, and home care providers

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the fastest growth in the RPM software market, driven by expanding healthcare digitization, increasing chronic disease burden, and growing government initiatives to modernize healthcare delivery

- Countries such as China, India, and Japan are emerging as high-growth markets due to their large aging populations and rising demand for accessible, cost-effective healthcare monitoring solutions

- Japan stands out with its technologically advanced healthcare system and early adoption of telehealth and remote care platforms, especially in managing elderly and rural populations

- In China and India, the rapid urbanization, increasing internet and smartphone penetration, and initiatives to enhance digital health infrastructure are accelerating RPM adoption. The growing involvement of private health tech firms and international collaborations are further contributing to market expansion across the region

Remote Patient Monitoring Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- NIHON KOHDEN CORPORATION (Japan)

- Capsule Technologies, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Medtronic (Ireland)

- Abbott (U.S.)

- Intelesens Ltd (Ireland)

- Biotronik (Germany)

- Aerotel Medical Systems (1998) Ltd. (Israel)

- General Electric Company (U.S.)

- Boston Scientific Corporation (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- AMD Global Telemedicine (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Teladoc Health, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Caretaker Medical (U.S)

- OMRON Healthcare, Inc. (Japan)

- BioIntelliSense Inc. (U.S.)

- ResMed (U.S.)

- GE HealthCare (U.S.)

- Qardio, Inc. (U.S.)

- VivaLNK, Inc. (U.S.)

Latest Developments in Global Remote Patient Monitoring Software Market

- In March 2024, Medasense Biometrics Ltd. partnered with a leading healthcare provider to trial an AI-based platform aimed at remotely monitoring congestive heart failure patients, seeking to improve care and outcomes

- In February 2024, Nuance Communications and IBM introduced a new interoperable data standard for AI-driven RPM systems, enhancing data sharing and care coordination to optimize patient outcomes

- In September 2024, Avery Telehealth, a top telehealth platform with RPM devices, and Kajeet, a pioneer in IoT connection solutions, formed a strategic agreement to expedite the rollout of digital health solutions, improve Avery Telehealth's service portfolio, and increase their market share in the rapidly expanding digital health sector

- In July 2023, BPGBio, Inc., and VELL Health collaborated to create a holistic health application for Type 2 diabetes patients in Guyana. This advanced AI-based platform aims to deliver comprehensive care

- In May 2023, Philips launched an AI-powered CT system designed to optimize routine radiology and high-volume screening. The system features advanced image reconstruction and workflow improvements, delivering fast, consistent, and high-quality imaging results

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET, BY TYPE

17.1 OVERVIEW

17.2 DEVICES

17.2.1 CARDIAC MONITORING DEVICES

17.2.1.1. ELECTROCARDIOGRAPHY (ECG) DEVICES

17.2.1.1.1. ECG DEVICES

17.2.1.1.1.1 ELECTROCARDIOGRAPHY (ECG) DEVICES, BY TYPE

17.2.1.1.1.1.1. PORTABLE

17.2.1.1.1.1.2. AMPLIFIERS

17.2.1.1.1.1.3. ELECTRODES

17.2.1.1.1.1.4. OUTPUT DEVICES

17.2.1.1.1.2 ELECTROCARDIOGRAPHY (ECG) DEVICES, BY PRODUCT TYPE

17.2.1.1.1.2.1. RESTING ECG

A. ECG

B. HOLTER MONITOR

17.2.1.1.1.2.2. WIRED HOLTER MONITORS

17.2.1.1.1.2.3. WIRELESS HOLTER MONITORS

17.2.1.1.1.3 ELECTROCARDIOGRAPHY (ECG) DEVICES, BY LEAD TYPE

17.2.1.1.1.3.1. SINGLE-LEAD ECG DEVICES

17.2.1.1.1.3.2. 3–6 LEAD ECG DEVICES

17.2.1.1.1.3.3. 12-LEAD ECG S DEVICES

17.2.1.1.1.3.4. OTHERS

17.2.1.1.1.4 BY TECHNOLOGY

17.2.1.1.1.4.1. DIGITAL

17.2.1.1.1.4.2. ANALOG

17.2.1.1.1.5 BY MODALITY

17.2.1.1.1.5.1. PORTABLE

17.2.1.1.1.5.2. FIXED

17.2.1.1.1.5.3. WEARABLE

17.2.1.1.2. ELECTROCARDIOGRAPHY (ECG) VACUUM SYSTEMS

17.2.1.2. EVENT MONITORS

17.2.1.2.1. EVENT MONITORS, BY PRODUCT TYPE

17.2.1.2.1.1 PRE-SYMPTOM (MEMORY LOOP)

17.2.1.2.1.2 POST-SYMPTOM

17.2.1.2.2. EVENT MONITORS, BY TECHNOLOGY

17.2.1.2.2.1 AUTODETECT MONITORS

17.2.1.2.2.2 MANUAL EVENT MONITOR

17.2.1.3. IMPLANTABLE LOOP RECORDER (ILR)

17.2.1.4. CARDIAC OUTPUT MONITORING DEVICES

17.2.1.4.1. MINIMALLY INVASIVE SYSTEMS

17.2.1.4.2. NON-INVASIVE SYSTEMS

17.2.2 BLOOD PRESSURE MONITORING DEVICES

17.2.2.1. BY PRODUCT TYPE

17.2.2.1.1. SELF-MONITORING BLOOD GLUCOSE (SMBG) SYSTEMS

17.2.2.1.2. CONTINUOUS GLUCOSE MONITORING (CGM) SYSTEMS

17.2.2.2. BY MODALITY

17.2.2.2.1. WEARABLE

17.2.2.2.2. NON-WEARABLE

17.2.2.3. BY TYPE

17.2.2.3.1. NON-INVASIVE

17.2.2.3.2. INVASIVE

17.2.2.4. BY PATEINT TYPE

17.2.2.4.1. TYPE 1 DIABETES

17.2.2.4.2. TYPE 2 DIABETES

17.2.2.4.3. OTHERS

17.2.3 RESPIRATORY MONITORING DEVICES

17.2.3.1. SPIROMETERS

17.2.3.2. PEAK FLOW METERS

17.2.3.3. SLEEP TEST DEVICES

17.2.3.4. GAS ANALYZERS

17.2.3.5. PULSE OXIMETER

17.2.3.6. CAPNOGRAPHS

17.2.3.7. OTHERS

17.2.4 NEUROLOGIOCAL MONITORING DEVICES

17.2.4.1. ELECTROENCEPHALOGRAPH (EEG)

17.2.4.2. TRANSCRANIAL DOPPLER (TCD)

17.2.4.3. MAGNETOENCEPHALOGRAPH (MEG)

17.2.4.4. CEREBRAL OXIMETERS & INTRACRANIAL

17.2.4.5. PRESSURE MONITORS (ICP)

17.2.4.6. OTHERS

17.2.5 MULTI-PARAMETER MONITORING DEVICES

17.2.5.1. HIGH-ACUITY MONITORS

17.2.5.2. MID-ACUITY MONITORS

17.2.5.3. LOW-ACUITY MONITORS

17.2.6 OTHERS

17.3 SOFTWARE

17.3.1 BY DEPLOYMENT

17.3.1.1. ON PREMISES

17.3.1.2. CLOUD BASED

17.3.1.3. HYBRID

17.3.2 BY MODE

17.3.2.1. STANDALONE

17.3.2.2. INTEGRATED

17.3.3 BY OPERATING SYSTEM

17.3.3.1. IOS

17.3.3.2. WINDOWS

17.3.3.3. LINUX

18 GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET, BY APPLICATION

18.1 OVERVIEW

18.2 CARDIOLOGY

18.2.1 DEVICES

18.2.2 SOFTWARE

18.3 NEUROLOGY

18.3.1 DEVICES

18.3.2 SOFTWARE

18.4 OBSTETRICS AND GYNECOLOGY

18.4.1 DEVICES

18.4.2 SOFTWARE

18.5 NEONATOLOGY/PEDIATRICS

18.5.1 DEVICES

18.5.2 SOFTWARE

18.6 PSYCHIATRIC

18.6.1 DEVICES

18.6.2 SOFTWARE

18.7 DERMATOLOGY

18.7.1 DEVICES

18.7.2 SOFTWARE

18.8 OTHERS

19 GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET, BY END USER

19.1 OVERVIEW

19.2 PROVIDERS

19.2.1 HOSPITALS

19.2.1.1. ACUTE CARE HOSPITALS

19.2.1.2. LONG-TERM CARE HOSPITALS

19.2.1.3. PSYCHIATRIC HOSPITALS

19.2.1.4. OTHERS

19.2.2 SPECIALTY CLINICS

19.2.3 HOME HEALTHCARE

19.2.4 NURSING FACILITIES

19.2.5 REHABILITATION CENTERS

19.2.6 PSYCHIATRIC FACILITIES

19.2.7 OTHERS

19.3 PAYERS

19.3.1 PRIVATE

19.3.2 PUBLIC

19.4 PATIENTS

19.5 OTHERS

20 GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 DIRECT TENDERS

20.3 RETAIL SALES

20.3.1 OFFLINE

20.3.2 ONLINE

20.4 OTHERS

21 GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET, BY GEOGRAPHY

21.1 GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

21.1.1 NORTH AMERICA

21.1.1.1. U.S.

21.1.1.2. CANADA

21.1.1.3. MEXICO

21.1.2 EUROPE

21.1.2.1. GERMANY

21.1.2.2. FRANCE

21.1.2.3. U.K.

21.1.2.4. ITALY

21.1.2.5. SPAIN

21.1.2.6. RUSSIA

21.1.2.7. TURKEY

21.1.2.8. BELGIUM

21.1.2.9. NETHERLANDS

21.1.2.10. SWITZERLAND

21.1.2.11. REST OF EUROPE

21.1.3 ASIA-PACIFIC

21.1.3.1. JAPAN

21.1.3.2. CHINA

21.1.3.3. SOUTH KOREA

21.1.3.4. INDIA

21.1.3.5. AUSTRALIA

21.1.3.6. SINGAPORE

21.1.3.7. THAILAND

21.1.3.8. MALAYSIA

21.1.3.9. INDONESIA

21.1.3.10. PHILIPPINES

21.1.3.11. REST OF ASIA-PACIFIC

21.1.4 SOUTH AMERICA

21.1.4.1. BRAZIL

21.1.4.2. ARGENTINA

21.1.4.3. REST OF SOUTH AMERICA

21.1.5 MIDDLE EAST AND AFRICA

21.1.5.1. SOUTH AFRICA

21.1.5.2. SAUDI ARABIA

21.1.5.3. UAE

21.1.5.4. EGYPT

21.1.5.5. ISRAEL

21.1.5.6. REST OF MIDDLE EAST AND AFRICA

21.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

22 GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.5 MERGERS & ACQUISITIONS

22.6 NEW PRODUCT DEVELOPMENT & APPROVALS

22.7 EXPANSIONS

22.8 REGULATORY CHANGES

22.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET, SWOT AND DBMR ANALYSIS

24 GLOBAL REMOTE PATIENT MONITORING SOFTWARE AND DEVICE MARKET, COMPANY PROFILE

24.1 GLOBAL COMPANIES

24.1.1 MEDTRONIC

24.1.1.1. COMPANY OVERVIEW

24.1.1.2. REVENUE ANALYSIS

24.1.1.3. GEOGRAPHIC PRESENCE

24.1.1.4. PRODUCT PORTFOLIO

24.1.1.5. RECENT DEVELOPMENTS

24.1.2 100PLUS

24.1.2.1. COMPANY OVERVIEW

24.1.2.2. REVENUE ANALYSIS

24.1.2.3. GEOGRAPHIC PRESENCE

24.1.2.4. PRODUCT PORTFOLIO

24.1.2.5. RECENT DEVELOPMENTS

24.1.3 ADVANCED DATA SYSTEMS

24.1.3.1. COMPANY OVERVIEW

24.1.3.2. REVENUE ANALYSIS

24.1.3.3. GEOGRAPHIC PRESENCE

24.1.3.4. PRODUCT PORTFOLIO

24.1.3.5. RECENT DEVELOPMENTS

24.1.4 OSP

24.1.4.1. COMPANY OVERVIEW

24.1.4.2. REVENUE ANALYSIS

24.1.4.3. GEOGRAPHIC PRESENCE

24.1.4.4. PRODUCT PORTFOLIO

24.1.4.5. RECENT DEVELOPMENTS

24.1.5 MEDM

24.1.5.1. COMPANY OVERVIEW

24.1.5.2. REVENUE ANALYSIS

24.1.5.3. GEOGRAPHIC PRESENCE

24.1.5.4. PRODUCT PORTFOLIO

24.1.5.5. RECENT DEVELOPMENTS

24.1.6 VIVIFY HEALTH, INC. (OPTUM)

24.1.6.1. COMPANY OVERVIEW

24.1.6.2. REVENUE ANALYSIS

24.1.6.3. GEOGRAPHIC PRESENCE

24.1.6.4. PRODUCT PORTFOLIO

24.1.6.5. RECENT DEVELOPMENTS

24.1.7 CARECLIX INC.

24.1.7.1. COMPANY OVERVIEW

24.1.7.2. REVENUE ANALYSIS

24.1.7.3. GEOGRAPHIC PRESENCE

24.1.7.4. PRODUCT PORTFOLIO

24.1.7.5. RECENT DEVELOPMENTS

24.1.8 PREVOUNCE

24.1.8.1. COMPANY OVERVIEW

24.1.8.2. REVENUE ANALYSIS

24.1.8.3. GEOGRAPHIC PRESENCE

24.1.8.4. PRODUCT PORTFOLIO

24.1.8.5. RECENT DEVELOPMENTS

24.1.9 NIHON KOHDEN CORPORATION

24.1.9.1. COMPANY OVERVIEW

24.1.9.2. REVENUE ANALYSIS

24.1.9.3. GEOGRAPHIC PRESENCE

24.1.9.4. PRODUCT PORTFOLIO

24.1.9.5. RECENT DEVELOPMENTS

24.1.10 KONINKLIJKE PHILIPS N.V.

24.1.10.1. COMPANY OVERVIEW

24.1.10.2. REVENUE ANALYSIS

24.1.10.3. GEOGRAPHIC PRESENCE

24.1.10.4. PRODUCT PORTFOLIO

24.1.10.5. RECENT DEVELOPMENTS

24.1.11 HONEYWELL INTERNATIONAL INC.

24.1.11.1. COMPANY OVERVIEW

24.1.11.2. REVENUE ANALYSIS

24.1.11.3. GEOGRAPHIC PRESENCE

24.1.11.4. PRODUCT PORTFOLIO

24.1.11.5. RECENT DEVELOPMENTS

24.1.12 VITEL NET

24.1.12.1. COMPANY OVERVIEW

24.1.12.2. REVENUE ANALYSIS

24.1.12.3. GEOGRAPHIC PRESENCE

24.1.12.4. PRODUCT PORTFOLIO

24.1.12.5. RECENT DEVELOPMENTS

24.1.13 HUMWORLD INC.,

24.1.13.1. COMPANY OVERVIEW

24.1.13.2. REVENUE ANALYSIS

24.1.13.3. GEOGRAPHIC PRESENCE

24.1.13.4. PRODUCT PORTFOLIO

24.1.13.5. RECENT DEVELOPMENTS

24.1.14 BIOTRONIK SE & CO. KG

24.1.14.1. COMPANY OVERVIEW

24.1.14.2. REVENUE ANALYSIS

24.1.14.3. GEOGRAPHIC PRESENCE

24.1.14.4. PRODUCT PORTFOLIO

24.1.14.5. RECENT DEVELOPMENTS

24.1.15 SYNZI

24.1.15.1. COMPANY OVERVIEW

24.1.15.2. REVENUE ANALYSIS

24.1.15.3. GEOGRAPHIC PRESENCE

24.1.15.4. PRODUCT PORTFOLIO

24.1.15.5. RECENT DEVELOPMENTS

24.1.16 AEROTEL MEDICAL SYSTEMS

24.1.16.1. COMPANY OVERVIEW

24.1.16.2. REVENUE ANALYSIS

24.1.16.3. GEOGRAPHIC PRESENCE

24.1.16.4. PRODUCT PORTFOLIO

24.1.16.5. RECENT DEVELOPMENTS

24.1.17 ALAYACARE

24.1.17.1. COMPANY OVERVIEW

24.1.17.2. REVENUE ANALYSIS

24.1.17.3. GEOGRAPHIC PRESENCE

24.1.17.4. PRODUCT PORTFOLIO

24.1.17.5. RECENT DEVELOPMENTS

24.1.18 SHENZHEN CREATIVE INDUSTRY CO., LTD.

24.1.18.1. COMPANY OVERVIEW

24.1.18.2. REVENUE ANALYSIS

24.1.18.3. GEOGRAPHIC PRESENCE

24.1.18.4. PRODUCT PORTFOLIO

24.1.18.5. RECENT DEVELOPMENTS

24.1.19 IUGO HEALTH (A SUBSIDIARY OF RELIQ HEALTH TECHNOLOGIES)

24.1.19.1. COMPANY OVERVIEW

24.1.19.2. REVENUE ANALYSIS

24.1.19.3. GEOGRAPHIC PRESENCE

24.1.19.4. PRODUCT PORTFOLIO

24.1.19.5. RECENT DEVELOPMENTS

24.1.20 HEALTHSNAP, INC.

24.1.20.1. COMPANY OVERVIEW

24.1.20.2. REVENUE ANALYSIS

24.1.20.3. GEOGRAPHIC PRESENCE

24.1.20.4. PRODUCT PORTFOLIO

24.1.20.5. RECENT DEVELOPMENTS

24.1.21 AETONIX SYSTEM

24.1.21.1. COMPANY OVERVIEW

24.1.21.2. REVENUE ANALYSIS

24.1.21.3. GEOGRAPHIC PRESENCE

24.1.21.4. PRODUCT PORTFOLIO

24.1.21.5. RECENT DEVELOPMENTS

24.1.22 SYNSORMED

24.1.22.1. COMPANY OVERVIEW

24.1.22.2. REVENUE ANALYSIS

24.1.22.3. GEOGRAPHIC PRESENCE

24.1.22.4. PRODUCT PORTFOLIO

24.1.22.5. RECENT DEVELOPMENTS

24.2 INDIAN COMPANIES

24.2.1 REAPMIND INNOVATION LABS PVT LTD.

24.2.1.1. COMPANY SNAPSHOT

24.2.1.2. REVENUE ANALYSIS

24.2.1.3. GEOGRAPHIC PRESENCE

24.2.1.4. PRODUCT PORTFOLIO

24.2.1.5. RECENT DEVELOPMENTS

24.2.2 ORACLE

24.2.2.1. COMPANY SNAPSHOT

24.2.2.2. REVENUE ANALYSIS

24.2.2.3. GEOGRAPHIC PRESENCE

24.2.2.4. PRODUCT PORTFOLIO

24.2.2.5. RECENT DEVELOPMENTS

24.2.3 TURTLE SHELL TECHNOLOGIES PVT LTD

24.2.3.1. COMPANY SNAPSHOT

24.2.3.2. REVENUE ANALYSIS

24.2.3.3. GEOGRAPHIC PRESENCE

24.2.3.4. PRODUCT PORTFOLIO

24.2.3.5. RECENT DEVELOPMENTS

24.2.4 GE HEALTHCARE

24.2.4.1. COMPANY SNAPSHOT

24.2.4.2. REVENUE ANALYSIS

24.2.4.3. GEOGRAPHIC PRESENCE

24.2.4.4. PRODUCT PORTFOLIO

24.2.4.5. RECENT DEVELOPMENTS

24.2.5 MEDIOTEK HEALTH SYSTEMS

24.2.5.1. COMPANY SNAPSHOT

24.2.5.2. REVENUE ANALYSIS

24.2.5.3. GEOGRAPHIC PRESENCE

24.2.5.4. PRODUCT PORTFOLIO

24.2.5.5. RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

25 CONCLUSION

26 QUESTIONNAIRE

27 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.