Global Relational Database Market

Market Size in USD Billion

CAGR :

%

USD

69.24 Billion

USD

155.03 Billion

2024

2032

USD

69.24 Billion

USD

155.03 Billion

2024

2032

| 2025 –2032 | |

| USD 69.24 Billion | |

| USD 155.03 Billion | |

|

|

|

|

Relational Database Market Size

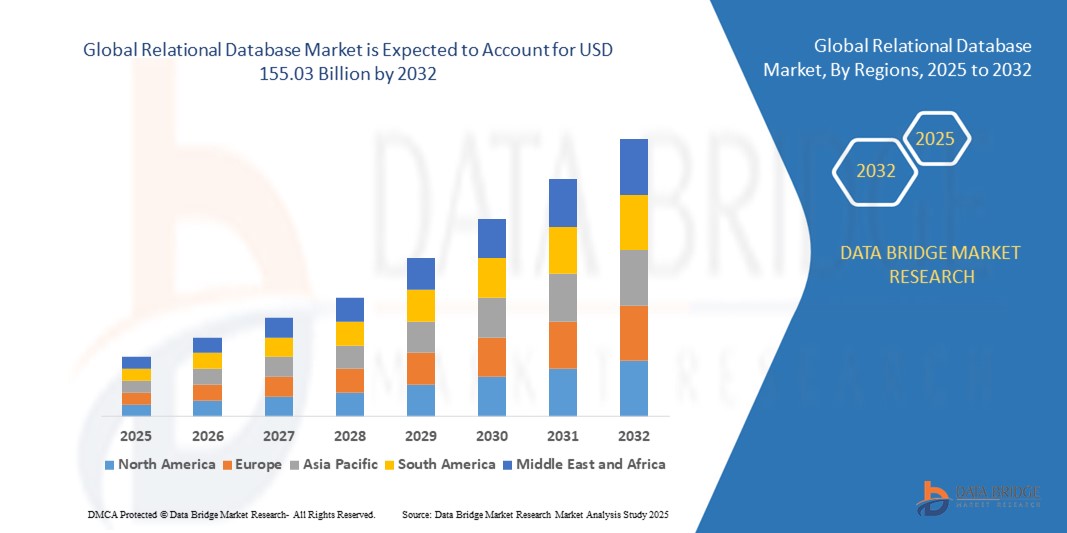

- The global relational database market size was valued at USD 69.24 billion in 2024 and is expected to reach USD 155.03 billion by 2032, at a CAGR of 10.60% during the forecast period

- The market growth is largely fuelled by the increasing adoption of cloud-based database solutions, the rising demand for real-time data processing, and the growing integration of AI and analytics into enterprise systems

- The surge in big data applications across industries such as BFSI, retail, healthcare, and IT is further accelerating the adoption of relational databases

Relational Database Market Analysis

- The relational database market is witnessing strong momentum as enterprises prioritize structured data management for decision-making, compliance, and customer experience optimization

- The shift toward hybrid and multi-cloud environments is driving demand for flexible, scalable, and interoperable database solutions, with vendors increasingly offering managed services to reduce operational complexities

- North America dominated the relational database market with the largest revenue share of 39.5% in 2024, driven by the rising demand for structured data management across enterprises and the strong presence of leading database vendors

- Asia-Pacific region is expected to witness the highest growth rate in the global relational database market, driven by rising internet penetration, increasing enterprise investments in digital platforms, and the surge in demand for real-time analytics across emerging economies

- The Disk-Based segment held the largest market revenue share in 2024, driven by its widespread use in managing large-scale, structured data across enterprises. Disk-based systems remain the preferred choice for businesses requiring durability, reliability, and cost-effectiveness for traditional workloads

Report Scope and Relational Database Market Segmentation

|

Attributes |

Relational Database Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Adoption Of Cloud-Based Database Solutions |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Relational Database Market Trends

Adoption Of Cloud-Native And Hybrid Database Solutions

• The rapid shift toward cloud-native relational databases is transforming the market by enabling scalability, flexibility, and reduced infrastructure costs. Organizations are increasingly deploying hybrid models that integrate on-premise and cloud systems for seamless data access and management. This trend is reshaping enterprise IT strategies with a focus on agility and cost optimization

• Growing demand for real-time analytics and data-driven decision-making is accelerating the adoption of relational databases integrated with AI and machine learning. These systems allow businesses to process and analyze large volumes of structured data more efficiently, enhancing operational intelligence and customer engagement

• The rise of multi-cloud strategies is further boosting the deployment of relational databases that support interoperability across platforms. Enterprises benefit from vendor flexibility, improved data security, and reduced downtime risks, making relational databases a core element of digital transformation initiatives

• For instance, in 2023, several financial institutions in North America adopted cloud-native relational database platforms to strengthen fraud detection systems, improve compliance management, and deliver real-time transaction monitoring, significantly improving efficiency and customer trust

• While cloud adoption is driving scalability and innovation, its long-term success depends on addressing issues related to data privacy, regulatory compliance, and migration complexity. Vendors must focus on offering secure, cost-effective, and user-friendly solutions tailored for diverse industries

Relational Database Market Dynamics

Driver

Growing Digital Transformation And Rising Demand For Real-Time Data Processing

• The accelerated pace of digital transformation across industries is fueling the demand for relational databases to manage mission-critical applications. From e-commerce to healthcare, enterprises are prioritizing systems that ensure accuracy, reliability, and consistency in handling structured data. Relational databases play a vital role in supporting business continuity and regulatory compliance in an increasingly data-centric world

• Real-time data processing capabilities are becoming essential as businesses seek to enhance customer experiences, improve supply chain visibility, and strengthen decision-making. This has increased the reliance on relational databases for applications such as online payments, inventory management, and risk monitoring. The ability to provide immediate insights is driving large-scale adoption in sectors where time-sensitive data is critical

• Governments and regulatory authorities are also emphasizing transparent data management practices, further strengthening adoption across highly regulated sectors such as BFSI and healthcare. This is supported by large-scale IT modernization initiatives worldwide, which encourage enterprises to adopt secure, compliant, and scalable relational database systems. Such initiatives are boosting vendor opportunities globally

• For instance, in 2022, multiple retail giants in Europe implemented real-time relational database systems to improve inventory tracking and demand forecasting, reducing stockouts and improving operational efficiency. This adoption enabled them to streamline logistics, increase customer satisfaction, and achieve higher profitability through better demand planning

• While real-time analytics and digitalization are driving adoption, the industry must continue innovating around automation, AI integration, and cloud-native designs to fully leverage growth opportunities. Companies that fail to modernize may struggle with rising competition, limited scalability, and operational inefficiencies in a highly dynamic market

Restraint/Challenge

High Cost Of Deployment And Rising Complexity In Multi-Cloud Environments

• The significant costs associated with licensing, implementation, and maintenance of enterprise-grade relational databases pose a major barrier for small and medium-sized enterprises. Advanced systems often require skilled IT staff and robust infrastructure, limiting accessibility for smaller organizations. This financial burden slows adoption in developing economies and among budget-conscious enterprises

• As businesses adopt multi-cloud strategies, managing data across diverse platforms is creating new levels of complexity. Ensuring seamless integration, consistent performance, and compliance with varying regulations across regions is proving to be challenging for enterprises. These hurdles often lead to operational inefficiencies and increased risks of downtime or data breaches

• Limited technical expertise in emerging economies further restricts widespread deployment, as many firms lack the resources to maintain and optimize large-scale relational database systems. This leads to delays in digital adoption and inefficient data utilization. In many cases, enterprises remain dependent on outdated legacy systems that lack flexibility and scalability

• For instance, in 2023, enterprises in Southeast Asia reported increased operational costs and integration difficulties when attempting to migrate legacy databases to hybrid or multi-cloud platforms, underscoring the barriers to adoption. Many organizations faced prolonged transition times and data security concerns, further stalling modernization efforts

• While innovation continues to reduce cost and complexity, addressing affordability, automation, and simplified integration will be key to unlocking broader market penetration and sustaining long-term growth. Vendors that can provide scalable, cost-effective, and user-friendly solutions will be better positioned to capture opportunities in both developed and emerging economies

Relational Database Market Scope

The market is segmented on the basis of type, deployment, and end user.

- By Type

On the basis of type, the relational database market is segmented into In-Memory, Disk-Based, and Others. The Disk-Based segment held the largest market revenue share in 2024, driven by its widespread use in managing large-scale, structured data across enterprises. Disk-based systems remain the preferred choice for businesses requiring durability, reliability, and cost-effectiveness for traditional workloads.

The In-Memory segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its ability to deliver real-time analytics, faster query performance, and improved scalability for mission-critical applications. In-memory databases are increasingly popular among organizations seeking to enhance decision-making speed and support data-intensive processes

- By Deployment

On the basis of deployment, the relational database market is segmented into Cloud-Based and On-Premises. The On-Premises segment held the largest market revenue share in 2024 due to strong adoption in highly regulated sectors such as BFSI and healthcare, where data security, compliance, and control are critical. Enterprises continue to rely on on-premises solutions for mission-critical applications requiring stability and stringent governance.

The Cloud-Based segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising digital transformation initiatives, scalability, and reduced infrastructure costs. Cloud-based relational databases offer seamless integration, flexibility, and support for multi-cloud strategies, making them a preferred choice for modern enterprises.

- By End User

On the basis of end user, the relational database market is segmented into BFSI, IT and Telecom, Retail and E-commerce, Manufacturing, Healthcare, and Others. The BFSI segment held the largest market revenue share in 2024, driven by the high demand for secure, reliable, and regulatory-compliant data management systems for transactions, fraud detection, and customer analytics.

The IT and Telecom segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the exponential growth in data traffic, customer engagement platforms, and real-time analytics. Increasing reliance on digital services, 5G adoption, and cloud-native technologies are accelerating the demand for relational database systems in this sector.

Relational Database Market Regional Analysis

• North America dominated the relational database market with the largest revenue share of 39.5% in 2024, driven by the rising demand for structured data management across enterprises and the strong presence of leading database vendors.

• Businesses in the region prioritize data accuracy, scalability, and regulatory compliance, making relational databases a critical part of IT infrastructure in sectors such as BFSI, healthcare, and e-commerce.

• The widespread adoption is further supported by high IT investments, cloud migration initiatives, and the integration of AI-driven analytics, positioning relational databases as a cornerstone for digital transformation.

U.S. Relational Database Market Insight

The U.S. relational database market captured the largest revenue share in 2024 within North America, fueled by rapid digitalization, the surge of cloud-native applications, and the need for real-time data processing. Enterprises are increasingly leveraging relational databases to support mission-critical operations across finance, healthcare, and retail. The growing adoption of SaaS-based database platforms, along with investments in hybrid and multi-cloud architectures, is further accelerating market growth. In addition, the dominance of U.S.-based technology giants strengthens innovation and global leadership in the sector.

Europe Relational Database Market Insight

The Europe relational database market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict data protection regulations such as GDPR and the rising demand for secure, transparent data management. Enterprises across industries are adopting relational databases to enhance compliance, manage complex datasets, and improve customer engagement. Growing digital transformation initiatives in banking, healthcare, and manufacturing are also contributing to adoption. Furthermore, Europe’s emphasis on sustainability and green IT is prompting enterprises to opt for energy-efficient database solutions integrated with cloud platforms.

U.K. Relational Database Market Insight

The U.K. relational database market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s expanding financial services sector and growing reliance on cloud-based platforms. Heightened concerns over data security and the rapid adoption of digital banking and e-commerce are fueling demand for relational databases. In addition, investments in smart infrastructure and IoT ecosystems are generating vast amounts of structured data, encouraging enterprises to deploy advanced relational database solutions.

Germany Relational Database Market Insight

The Germany relational database market is expected to witness the fastest growth rate from 2025 to 2032, fueled by Industry 4.0 adoption and the country’s strong manufacturing and automotive base. German enterprises are focusing on digital innovation, cybersecurity, and compliance with data sovereignty regulations, which is driving database adoption. With increasing investments in AI, IoT, and analytics, relational databases are becoming a vital part of enterprise operations, particularly in industrial automation and healthcare systems.

Asia-Pacific Relational Database Market Insight

The Asia-Pacific relational database market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, digital transformation, and cloud adoption in countries such as China, India, and Japan. The region’s expanding IT and telecom sector, coupled with growing e-commerce penetration, is accelerating demand. Government initiatives promoting digital ecosystems and smart city projects are also fueling the adoption of relational database systems across industries. The availability of cost-efficient cloud solutions from regional providers further boosts market expansion.

Japan Relational Database Market Insight

The Japan relational database market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on digital modernization, cybersecurity, and efficient data governance. Japan’s enterprises are leveraging relational databases to manage structured data in financial services, government, and healthcare sectors. The integration of relational databases with AI-driven analytics and IoT applications is further supporting adoption. In addition, the aging population and demand for smart healthcare systems are contributing to the country’s increased reliance on advanced database solutions.

China Relational Database Market Insight

The China relational database market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the rapid growth of its digital economy, expansion of e-commerce platforms, and widespread enterprise digitalization. Chinese companies are heavily investing in both domestic and global database solutions to enhance scalability, security, and real-time analytics. The push for smart city initiatives and cloud infrastructure development is accelerating adoption across industries such as manufacturing, retail, and government. Strong domestic vendors and competitive pricing further support market dominance in the region.

Relational Database Market Share

The Relational Database industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- Microsoft (U.S.)

- SAP SE (Germany)

- Teradata Corporation (U.S.)

- IBM (U.S.)

- PostgreSQL (U.S.)

- Amazon.com Inc (U.S.)

- MariaDB (Finland)

- Informix Corporation (U.S.)

- Sequel Pro (U.S.)

- SingleStore (U.S.)

- TmaxSoft (South Korea)

- Connx Solutions (U.S.)

- MongoDB (U.S.)

- Couchbase (U.S.)

- Aerospike (U.S.)

Latest Developments in Global Relational Database Market

- In October 2023, Microsoft announced the launch of its new Azure SQL Database free offering, made available for public preview. This development provides users with access to a 32 GB general-purpose, serverless Azure SQL database along with 100,000 vCore seconds of compute free every month. The initiative is aimed at lowering entry barriers for businesses and developers, encouraging wider adoption of Microsoft’s cloud ecosystem. By enabling cost-effective experimentation and development, it strengthens Microsoft’s competitive positioning in the relational database market while promoting scalability and cloud-driven innovation

- In October 2022, Oracle introduced Oracle Database 23c Beta, marking a major advancement in its database technology portfolio. The release is designed to support diverse data types, workloads, and development models, offering innovative features across Oracle’s database services. This move enhances flexibility for enterprises, enabling them to streamline data management while improving performance and scalability. By addressing evolving business requirements, the launch reinforces Oracle’s leadership in enterprise-grade databases and drives broader market adoption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.