Global Regtech Market

Market Size in USD Billion

CAGR :

%

USD

26.71 Billion

USD

793.71 Billion

2024

2032

USD

26.71 Billion

USD

793.71 Billion

2024

2032

| 2025 –2032 | |

| USD 26.71 Billion | |

| USD 793.71 Billion | |

|

|

|

Global RegTech Market Analysis

The global regtech market is experiencing rapid growth, driven by the increasing need for regulatory compliance, risk management, and fraud prevention across financial and non-financial sectors. Regulatory technology (regtech) leverages AI, blockchain, big data, and cloud computing to streamline compliance processes, reduce costs, and enhance operational efficiency. The market is expanding due to stringent regulatory frameworks, rising financial crimes, and digital transformation in banking and capital markets. Recent developments include AI-driven compliance solutions, real-time transaction monitoring, and automation of regulatory reporting. Major players are investing in advanced analytics and cybersecurity solutions to meet evolving compliance demands. In addition, the adoption of cloud-based regtech solutions is accelerating due to remote work trends and increased cybersecurity threats. As governments and organizations focus on enhancing transparency and mitigating risks, the regtech market is set for continued expansion, offering scalable and innovative compliance solutions to businesses worldwide.

Global RegTech Market Size

The global regtech market size was valued at USD 26.71 billion in 2024 and is projected to reach USD 793.71 billion by 2032, with a CAGR of 52.80% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Global RegTech Market Trends

“Increased Adoption of AI and Machine Learning”

A key trend in the global RegTech market is the increasing integration of artificial intelligence (AI) and machine learning (ML) into compliance processes. These technologies are revolutionizing the way businesses approach regulatory compliance by automating critical tasks such as real-time monitoring, risk assessment, and fraud detection. AI and ML enable RegTech solutions to analyze vast amounts of data quickly and accurately, identifying patterns or irregularities that might indicate potential compliance issues or fraudulent activities. As a result, organizations can enhance efficiency, reduce human error, and maintain continuous compliance with evolving regulatory requirements. This trend is reshaping how businesses manage regulatory challenges, offering more intelligent, cost-effective, and scalable solutions for a rapidly changing regulatory environment.

Report Scope and Global RegTech Market Segmentation

|

Attributes |

Global RegTech Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

ACTICO GmbH (Germany), Broadridge Financial Solutions, Inc. (U.S.), Deloitte (U.K.), London Stock Exchange Group (U.K.), IBM (U.S.), Jumio (U.S.), MetricStream (U.S.), NICE Actimize (U.S.), PwC (U.K.), REGIS-TR (Luxembourg), Infrasoft Technologies (India), Thomson Reuters (Canada), VERMEG Ltd Legal (France), Trulioo (Canada), Fenergo (Ireland), ComplyAdvantage (U.K.), IDology, Inc. (U.S.), Ascent Technologies, Inc. (U.S.), Avenga (Germany), Star Space Applications (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global RegTech Market Definition

Global regtech (regulatory technology) refers to the use of technology, particularly artificial intelligence (AI), machine learning (ML), blockchain, big data, and cloud computing, to help businesses comply with regulatory requirements in a more efficient, automated, and cost-effective manner. Regtech solutions assist in areas such as risk management, compliance monitoring, fraud detection, anti-money laundering (AML), and regulatory reporting. By leveraging advanced technologies, regtech aims to streamline complex and often resource-intensive compliance processes, reduce the risk of human error, and provide real-time data analysis to ensure ongoing regulatory adherence. The global regtech market has seen significant growth as organizations seek to meet increasingly stringent regulations and manage the evolving landscape of financial crimes, cybersecurity threats, and data protection laws.

Global RegTech Market Dynamics

Drivers

- Increasing Regulatory Complexity

As governments worldwide continue to implement stricter regulations across various industries, businesses are increasingly turning to regtech solutions to manage compliance more effectively. These solutions enable organizations to automate compliance tasks, track regulatory changes in real-time, and ensure adherence to complex requirements. By leveraging advanced technologies such as AI, machine learning, and data analytics, regtech helps businesses minimize the risk of non-compliance and avoid costly penalties. The growing need for efficient regulatory management is a key driver of the global regtech market, as businesses seek to streamline operations, reduce human error, and maintain consistent compliance in an evolving regulatory landscape.

- Adoption of Cloud-Based Solutions

The shift to cloud computing is significantly driving the growth of the global regtech market. Cloud-based solutions offer businesses the flexibility to scale their compliance tools according to their needs, without the high upfront costs associated with traditional on-premises software. This is particularly beneficial for small and medium-sized enterprises (SMEs), which may not have the resources to invest in expensive infrastructure. With cloud technology, businesses can access affordable, efficient, and real-time regtech solutions that streamline compliance processes, reduce operational complexity, and enhance regulatory reporting, making it a key driver for the market's expansion.

Opportunities

- Expansion in Emerging Markets

As emerging economies such as India, China, and Brazil continue to strengthen regulatory frameworks, the demand for regtech solutions is rapidly increasing. These regions are experiencing significant economic growth, and businesses are facing greater pressure to comply with evolving regulations. This presents a substantial opportunity for regtech companies to introduce cost-effective compliance tools tailored to the specific needs of these markets. With a growing focus on streamlining compliance processes and reducing operational risks, companies in these emerging economies are actively seeking scalable, affordable, and efficient solutions, creating a promising growth opportunity for the global regtech market.

- Focus on Cybersecurity

As cyber threats continue to escalate, the need for robust regtech solutions that offer enhanced security and data protection is becoming more critical. Organizations are under increasing pressure to comply with stringent data protection regulations, such as GDPR, while safeguarding sensitive information from cyber-attacks and breaches. This rising demand presents a significant market opportunity for regtech companies to develop advanced tools focused on data security, compliance management, and fraud prevention. By offering innovative solutions that mitigate risks and ensure adherence to data protection laws, regtech companies can capitalize on the growing need for secure, compliant operations in today’s digital environment.

Restraints/Challenges

- Data Privacy and Security Concerns

As regtech solutions handle vast amounts of sensitive data, concerns about data privacy and security are becoming more pronounced. Businesses must ensure that they comply with stringent data protection regulations such as GDPR and other regional laws to safeguard customer and corporate data. The potential risks of data breaches, cyber-attacks, and unauthorized access may deter organizations from fully adopting regtech tools, especially if they are unsure about the security features of these solutions. Ensuring robust data protection protocols and gaining trust in the security of regtech solutions is a significant challenge for the market, as businesses prioritize safeguarding sensitive information.

- High Initial Investment

While regtech solutions provide long-term cost savings by automating compliance processes, the initial investment in advanced technologies such as AI, machine learning, and blockchain can be prohibitively expensive. For smaller businesses, particularly those with limited budgets, the upfront costs associated with implementing regtech solutions can be a significant barrier. The integration of cutting-edge technologies often requires substantial financial resources, as well as skilled personnel to manage and maintain the systems. This financial challenge can restrict the adoption of regtech tools among small and medium-sized enterprises (SMEs), limiting the overall growth of the market and hindering access to the benefits of automation and efficiency.

Global RegTech Market Scope

The market is segmented on the basis of component, deployment model, organization size, application, and end users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solution

- Services

Deployment Model

- Cloud

- On-Premises

Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

Application

- Risk and Compliance Management

- Identity Management

- Regulatory Reporting

- Anti-Money Laundering and Fraud Management

- Regulatory Intelligence

End Users

- Banking and Capital Markets

- Insurance

- Non-Finance

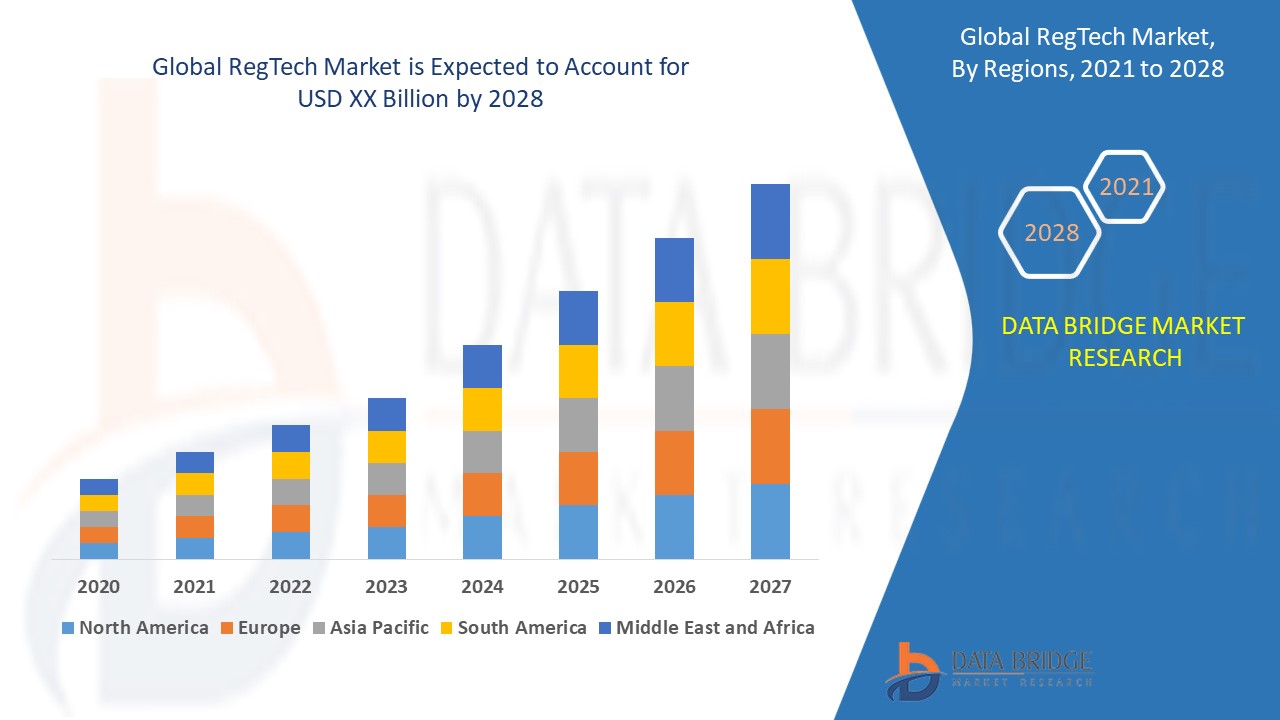

Global RegTech Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, component, deployment model, organization size, application, and end users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is the dominating region in the regtech market, driven by the early adoption and widespread deployment of regtech solutions. The region benefits from stringent regulatory requirements and increasing technological advancements that fuel demand for compliance tools. In addition, the growing focus on digital transformation and operational efficiency further accelerates the adoption of regtech solutions in North America.

The Asia Pacific is the fastest growing region in regtech market, driven by rapid digitization, strong government support for adopting advanced technology solutions, and the increasing need for efficient regtech tools for risk management and regulatory intelligence. In addition, businesses are becoming more reliant on data-driven decision-making, further fueling demand. However, challenges related to complex regulations, particularly in the financial sector, and concerns over data privacy are expected to shape the market's trajectory moving forward.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global RegTech Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Global RegTech Market Leaders Operating in the Market Are:

- ACTICO GmbH (Germany)

- Broadridge Financial Solutions, Inc. (U.S.)

- Deloitte (U.K.)

- London Stock Exchange Group (U.K.)

- IBM (U.S.)

- Jumio (U.S.)

- MetricStream (U.S.)

- NICE Actimize (U.S.)

- PwC (U.K.)

- REGIS-TR (Luxembourg)

- Infrasoft Technologies (India)

- Thomson Reuters (Canada)

- VERMEG Ltd Legal (France)

- Trulioo (Canada)

- Fenergo (Ireland)

- ComplyAdvantage (U.K.)

- IDology ,Inc. (U.S.)

- Ascent Technologies, Inc. (U.S.)

- Avenga (Germany)

- Star Space Applications (U.K.)

Latest Developments in Global RegTech Market

- In May 2024, CUBE, a leading player in the regtech industry, including Automated Regulatory Intelligence (ARI), announced its acquisition of Thomson Reuters’ regtech business. This strategic move significantly expanded CUBE's customer base and bolstered its talent pool, enhancing its ability to provide innovative regulatory solutions. The acquisition strengthens CUBE's position in the market, enabling it to better serve clients with advanced, AI-driven compliance tools

- In June 2023, Dassault Systèmes strengthened the financial services sector of its OUTSCALE cloud brand by acquiring and integrating Innova RegTech solutions. This acquisition enhances OUTSCALE’s ability to provide sovereign and sustainable experiences as a service, reaffirming its position as a reliable partner for financial institutions. With the integration of Innova’s compliance solutions, Dassault Systèmes aims to offer cutting-edge tools for managing regulatory challenges. This move further solidifies OUTSCALE’s commitment to empowering financial organizations with innovative, secure, and efficient compliance technologies

- In April 2023, Hummingbird RegTech launched a new app designed to assist professionals in the compliance sector with combating financial crime. The app incorporates a custom tech stack and provides specialized tools that streamline daily compliance tasks, ensuring professionals stay aligned with evolving regulations. This innovative solution aims to enhance operational efficiency and risk mitigation in financial compliance. By equipping professionals with advanced technology, Hummingbird RegTech is driving progress in the fight against financial crime

- In March 2023, Ascent Technologies, Inc. introduced its new Compliance Confidence Scorecard, a tool designed to assist businesses with navigating regulatory changes. The Scorecard offers real-time regulatory updates, detailed analysis, and monitoring of compliance requirements, helping businesses stay ahead of the regulatory curve. By providing a structured approach to compliance management, the Scorecard enables companies to align their solutions and services with the latest regulations, ensuring they maintain compliance while minimizing risks

- In June 2023, Dassault Systèmes integrated the Innova RegTech solution into its platform, enhancing its capabilities to automate compliance controls for financial institutions. This integration allows Dassault Systèmes to partner with major financial organizations such as BNP Paribas Securities Services and other industry leaders. By automating and streamlining compliance processes, the new system offers enhanced operational efficiency and regulatory alignment, making Dassault Systèmes a key player in transforming the financial compliance landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.