Global Red Algae Market

Market Size in USD Billion

CAGR :

%

USD

31.49 Billion

USD

62.29 Billion

2024

2032

USD

31.49 Billion

USD

62.29 Billion

2024

2032

| 2025 –2032 | |

| USD 31.49 Billion | |

| USD 62.29 Billion | |

|

|

|

|

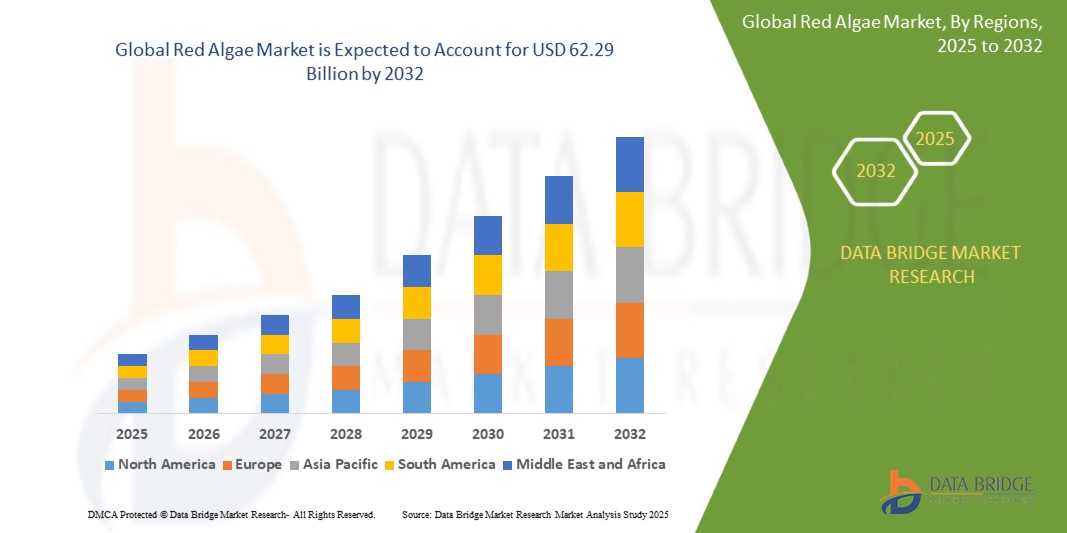

What is the Global Red Algae Market Size and Growth Rate?

- The global red algae market size was valued at USD 31.49 billion in 2024 and is expected to reach USD 62.29 billion by 2032, at a CAGR of 8.90% during the forecast period

- The red algae market is witnessing consistent growth, fueled by rising demand across multiple sectors, including food, pharmaceuticals, and cosmetics. Red algae are highly valued for their abundant polysaccharides, such as agar and carrageenan, which play a crucial role in these industries

- In the food sector, red algae-derived ingredients are widely used as gelling agents, thickeners, and stabilizers. They significantly enhance the texture and quality of a variety of products, including dairy items, processed meats, and vegetarian alternatives, by improving consistency and shelf life

- The growing recognition of these benefits, coupled with increasing consumer preference for natural and sustainable ingredients, continues to drive the expansion of the red algae market

What are the Major Takeaways of Red Algae Market?

- The growing awareness of marine-based ingredients is a key factor driving their adoption across various industries, particularly in food, pharmaceuticals, and cosmetics. Marine-based ingredients, such as those derived from red algae, are gaining recognition for their unique benefits and sustainable nature

- Red algae's rich content of essential nutrients and bioactive compounds, including antioxidants and anti-inflammatory agents, make them valuable in enhancing human health and wellness. This increased awareness is reflected in their incorporation into dietary supplements, functional foods, and skincare product

- North America dominated the red algae market with the largest revenue share of 41.2% in 2024, driven by the rising demand for plant-based, functional, and antioxidant-rich products across the U.S. and Canada

- Asia-Pacific is projected to grow at the fastest CAGR of 14.6% from 2025 to 2032, driven by traditional consumption patterns, marine biodiversity, and rising awareness about red algae's health and nutritional properties

- The Marine Red Algae segment dominated the market with the largest market revenue share of 46.8% in 2024, owing to its abundant availability in coastal waters and high commercial usage in cosmetics, food additives, and pharmaceuticals

Report Scope and Red Algae Market Segmentation

|

Attributes |

Red Algae Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Red Algae Market?

“Premiumization and Health-Focused Offerings”

- A prominent trend in the global red algae market is the rise of premium, wellness-centric product lines, fueled by consumers prioritizing functional nutrition, sustainability, and natural ingredients. Red algae, rich in minerals, antioxidants, and anti-inflammatory compounds, is being positioned as a superfood for immunity, skin health, and cardiovascular support

- Companies are launching organic-certified, vegan-friendly, and fortified red algae powders, capsules, and gummies aimed at the nutraceutical and functional food sectors. For instance, Simris (Sweden) has introduced red algae-based omega-3 supplements targeting vegan and environmentally conscious consumers

- Clean-label transparency, minimal processing, and eco-conscious packaging are also gaining traction as brands aim to appeal to both health-focused and climate-aware demographics

- Red algae is increasingly used in premium personal care, skincare, and functional beverage segments, with demand expanding through e-commerce, specialty wellness stores, and direct-to-consumer platforms

- As consumers lean toward multifunctional, science-backed superfoods, red algae’s diverse applications are helping it evolve from niche to mainstream across global wellness industries

What are the Key Drivers of Red Algae Market?

- Increasing demand for natural, plant-based ingredients in the food, cosmetics, and pharmaceutical sectors is a primary driver, with red algae valued for its nutritional content (including calcium, magnesium, polysaccharides, and proteins)

- The expanding nutraceutical and functional food industries, especially in North America and Europe, are pushing red algae into the spotlight for its role in bone health, digestion, immunity, and detoxification

- In 2023, Algatech Ltd. (Israel) launched a new red algae extract under its AstaPure brand, targeting joint health and inflammation control, catering to aging populations and active consumers

- The growth of veganism and clean-label trends is accelerating the adoption of red algae as a natural alternative to animal-derived ingredients such as gelatin and omega-3 oils

- Rising awareness around sustainable marine-based solutions and climate-resilient crops has strengthened red algae’s appeal in food security and environmental sustainability conversations

Which Factor is challenging the Growth of the Red Algae Market?

- Limited harvesting regions, strict regulatory approvals, and seasonal yield variability are key challenges, making the global red algae supply chain vulnerable to climate events, overfishing, and political instability in harvesting zones

- For instance, red algae farming in Japan and South Korea has seen disruption due to marine heatwaves and shifting ocean salinity, impacting both volume and quality

- Another challenge is insufficient consumer awareness in western countries, where red algae’s taste, nutritional benefits, and uses are still misunderstood compared to other superfoods such as spirulina or chlorella

- The high production costs associated with wild harvesting, processing, and maintaining purity standards often make red algae products premium-priced, limiting mass-market accessibility

- To overcome these hurdles, companies are investing in controlled aquaculture, biotechnology-based extraction methods, and consumer education campaigns highlighting the science and sustainability behind red algae. Strategic collaborations with cosmetics, food, and wellness giants can help accelerate adoption across sectors

How is the Red Algae Market Segmented?

The market is segmented on the basis of type, application, and form.

• By Type

On the basis of type, the red algae market is segmented into Freshwater Red Algae, Marine Red Algae, and Calcified Red Algae. The Marine red algae segment dominated the market with the largest market revenue share of 46.8% in 2024, owing to its abundant availability in coastal waters and high commercial usage in cosmetics, food additives, and pharmaceuticals. Marine variants are particularly valued for their richness in polysaccharides, minerals, and bioactive compounds, making them highly sought-after for industrial extraction and functional food applications.

The Calcified Red Algae segment is projected to witness the fastest CAGR of 19.4% from 2025 to 2032, driven by rising use in calcium supplements, bone health formulations, and natural fortification across nutraceutical and functional beverage sectors.

• By Application

On the basis of application, the red algae market is segmented into Food and Beverages, Medical and Pharmaceutical, Industrial Applications, and Cosmetics and Personal Care Industry. The Food and Beverages segment held the largest market revenue share in 2024 at 38.6%, propelled by the increasing use of red algae in texturizing agents (such as carrageenan), vegan supplements, and plant-based additives. The trend toward functional and clean-label foods is further boosting the integration of red algae in everyday products.

The Cosmetics and Personal Care Industry segment is expected to register the fastest CAGR during the forecast period, fueled by the rising demand for natural anti-aging, moisturizing, and anti-inflammatory ingredients. Red algae’s ability to support skin regeneration and protection against UV-induced stress is driving innovation across skincare and haircare formulations.

• By Form

On the basis of form, the red algae market is segmented into Powdered Form, Liquid Form, Natural Dried Form, and In Gel Form. The Powdered Form segment accounted for the largest market share of 40.2% in 2024, as it offers extended shelf life, easy formulation, and high concentration of active compounds, making it popular in nutraceuticals, supplements, and cosmetic preparations. Powder form is also widely used in the functional food industry due to its solubility and ease of mixing.

The In Gel Form segment is forecasted to grow at the fastest CAGR of 21.5%, as it gains traction in cosmetic masks, topical creams, and personal care due to its excellent texture, moisture retention, and skin adhesion properties.

Which Region Holds the Largest Share of the Red Algae Market?

- North America dominated the red algae market with the largest revenue share of 41.2% in 2024, driven by the rising demand for plant-based, functional, and antioxidant-rich products across the U.S. and Canada

- The region’s health-conscious population, expanding nutraceutical sector, and preference for clean-label food products have made red algae a staple ingredient in dietary supplements, beverages, and functional foods

- Strong distribution networks, advanced food processing infrastructure, and increasing investments in algae-based innovations support North America’s leadership position. The region also benefits from extensive scientific research and regulatory approvals for red algae-derived ingredients such as carrageenan and algal protein

U.S. Red Algae Market Insight

The U.S. market captured the largest share in North America in 2024, fueled by growing demand in personal care, pharmaceuticals, and dietary supplements. The country's robust algae farming sector and emphasis on sustainable sourcing are driving commercial use across multiple industries. Consumers are increasingly favoring red algae-based skincare, gut health supplements, and plant-based beverages, aided by e-commerce expansion and wellness trends.

Canada Red Algae Market Insight

Canada is witnessing steady growth, supported by its expanding vegan population and green innovation programs. Canadian companies are investing in red algae cultivation for bioactives used in cosmetics and health foods. The government's support for marine biotechnology, along with rising retail availability of red algae-infused health products, is enhancing market penetration across urban and coastal areas.

Which Region is the Fastest Growing Region in the Red Algae Market?

Asia-Pacific is projected to grow at the fastest CAGR of 14.6% from 2025 to 2032, driven by traditional consumption patterns, marine biodiversity, and rising awareness about red algae's health and nutritional properties. Countries such as China, Japan, South Korea, and India are leading the growth due to red algae's historic use in food, medicine, and cosmetics. Government initiatives supporting seaweed farming, export potential, and increasing demand for natural skincare and anti-aging ingredients are further propelling the regional market.

China Red Algae Market Insight

China holds the largest share in Asia-Pacific in 2024, supported by its position as a top cultivator and exporter of marine algae. The country’s traditional medicine sector heavily relies on red algae for immune-boosting and detoxifying applications. In addition, expanding food processing capabilities and investment in seaweed innovation are enhancing China’s domestic and export-oriented production.

Japan Red Algae Market Insight

Japan’s red algae market is growing steadily, driven by its ageing population, demand for nutraceuticals, and popularity of marine-based skincare. With strong R&D capabilities and clean beauty trends, Japanese firms are innovating with red algae extracts in serums, supplements, and therapeutic beverages. The market also benefits from domestic algae farming and consumer trust in natural remedies.

Which are the Top Companies in Red Algae Market?

The red algae industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Simris (Sweden)

- Cyanotech Corporation (U.S.)

- Algatech LTD (Israel)

- BLOM (U.S.)

- Tatcha, LLC (U.S.)

- BASF SE (Germany)

- Roquette Frères (France)

- Corbion NV (Netherlands)

- Euglena Co., Ltd. (Japan)

- Cellana Inc. (U.S.)

What are the Recent Developments in Global Red Algae Market?

- In September 2024, two U.S.-based companies, Algae Cooking Club and Spotlight Foods, introduced cutting-edge cooking oils derived from microalgae, representing a major leap in sustainable culinary innovation. The oils are created through a fermentation process where microalgae consume plant-based sugars from sugarcane in large bioreactors, transforming them into edible oil within days. This eco-efficient approach significantly reduces resource consumption compared to conventional vegetable oils. This advancement marks a pivotal step toward greener, high-performance food alternatives

- In August 2024, French biotech startup Edonia secured USD 2.19 million in funding led by Asterion Ventures to commercialize its novel microalgae-based meat substitutes. These products leverage nutrient-rich algae strains such as spirulina and chlorella, offering both sustainability and high protein content. The funding will support scaling production and expanding market reach across Europe. This milestone reinforces the growing appeal of algae as a core ingredient in future-ready meat alternatives

- In September 2023, Corbion N.V. introduced AlgaPrime DHA P3, a new algae-derived omega-3 solution specifically designed to enhance the sustainability and nutrition of pet food. The innovation meets rising consumer demands for eco-friendly and health-focused animal nutrition solutions, particularly in premium pet care segments. This launch underlines the rising influence of algae-based bioactives in the global pet nutrition market

- In November 2022, OSEA International debuted a reformulated version of its Red Algae Clarifying Mask, previously known as the Red Algae Mask. The enhanced formula now features a blend of three nutrient-rich red seaweeds combined with bentonite clay, aimed at deeply cleansing and refining skin without compromising its natural moisture balance. This product evolution reflects the increasing consumer demand for clean, algae-powered skincare solutions

- In January 2022, marine biotech company Yemoja, Ltd. unveiled Ounje, a red microalgae-based formulation tailored for plant-based burgers and steaks to replicate the red juiciness of real meat without using synthetic dyes. The ingredient is cultivated in photobioreactors and can function as a plant-based heme alternative using Porphyridium algae strains. This innovation strengthens algae’s role in redefining realism and sustainability in alternative meat products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Red Algae Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Red Algae Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Red Algae Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.