Global Recreational Cannabis Market, By Product Type (Oils Tinctures, Transdermal Patches, Isolates Tablets, Flower, Concentrates, Edibles, Topicals, Tinctures, Others), Distribution Channel (Online, Offline), Species (Cannabis Indica, Cannabis Sativa, Hybrid) Compound (THC-Dominant, CBD-Dominant, Balanced THC, CBD), Application (Chronic Pain, Mental Disorders, Cancer, Others), Administration (Oral, Topical, Inhalation, Rectal, Sublingual), End Use (Pharmaceuticals, Food, Beverages, Tobacco, Personal Care, Research and Development Centres) – Industry Trends and Forecast to 2031.

Recreational Cannabis Market Analysis and Size

The tourism and hospitality sector benefits from the recreational cannabis market through the development of cannabis tourism destinations and specialized services. In regions where cannabis is legal for recreational use, such as certain states in the U.S. and countries such as Canada, cannabis-friendly accommodations, tours of cultivation facilities, and cannabis-themed events attract visitors interested in exploring the culture and industry surrounding cannabis. Hospitality businesses may offer curated experiences that include cannabis-infused dining, wellness activities, or guided tours of dispensaries and local landmarks. This niche market segment presents opportunities for hotels, restaurants, tour operators, and event planners to cater to cannabis enthusiasts and capitalize on the growing trend of cannabis tourism within the cannabis industry.

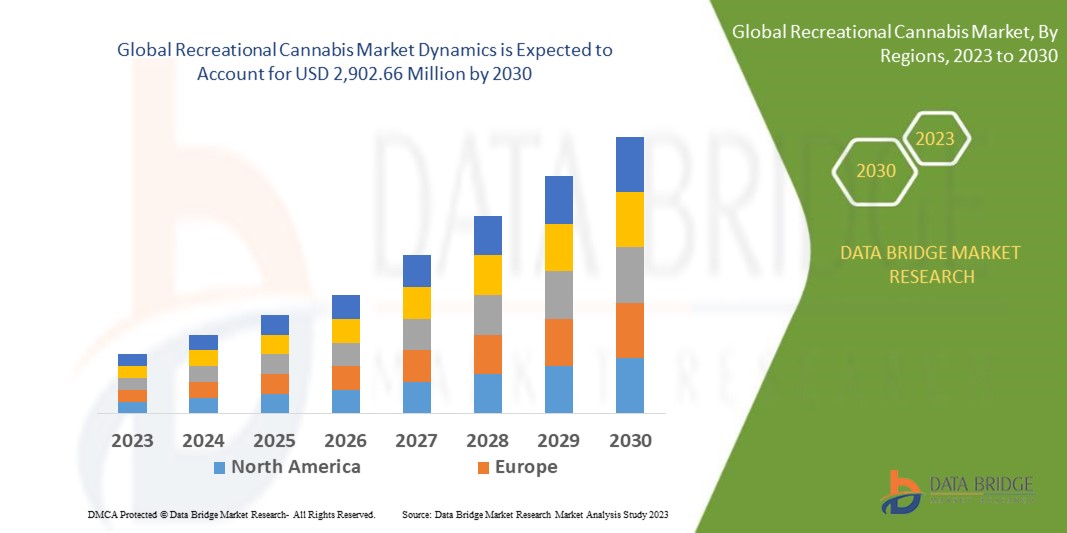

Global recreational cannabis market size was valued at USD 1.89 billion in 2023 and is projected to reach USD 3.09 billion by 2031, with a CAGR of 6.3% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

|

Forecast Period

|

2024-2031

|

|

|

Base Year

|

2023

|

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

|

Segments Covered

|

Product Type (Oils Tinctures, Transdermal Patches, Isolates Tablets, Flower, Concentrates, Edibles, Topicals, Tinctures, Others), Distribution Channel (Online, Offline), Species (Cannabis Indica, Cannabis Sativa, Hybrid) Compound (THC-Dominant, CBD-Dominant, Balanced THC, CBD), Application (Chronic Pain, Mental Disorders, Cancer, Others), Administration (Oral, Topical, Inhalation, Rectal, Sublingual), End Use (Pharmaceuticals, Food, Beverages, Tobacco, Personal Care, Research and Development Centres)

|

|

|

Countries Covered

|

U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

|

|

|

Market Players Covered

|

AURORA CANNABIS INC (Canada), Cannabis Science Inc.(U.S.), Medical Marijuana, Inc.(U.S.), STENOCARE A/S (Denmark), CannabisNL (U.S.), Controlled Environments Limited (Canada), The Cronos Group (Canada), Maricann Inc (Canada), Tikun Olam (Israel), ,Canopy Growth Corporation (Canada), TerrAscend (Canada), VIVO Cannabis Inc.(Canada), Harvest Health & Recreation, Inc (U.S.), Curaleaf Holdings Inc. (U.S.), HEXO Corp. (Canada), INDIVA. (Canada), Cresco Labs (U.S.), Organigrams Holding Inc. (Canada), Trulieve (U.S.)

|

|

|

Market Opportunities

|

|

|

Market Definition

Recreational cannabis refers to the non-medical use of cannabis products for leisure, relaxation, or enjoyment purposes. Unlike medical cannabis, which is prescribed to treat specific health conditions, recreational cannabis is used by individuals for its psychoactive effects, such as euphoria or relaxation, without a medical need or prescription. It is often consumed through smoking, vaping, edibles, or other methods to achieve a desired recreational experience.

Recreational Cannabis Market Dynamics

Drivers

- Expanding Legalization due to Increased Demand for Recreational Cannabis

When governments legalize recreational cannabis, it opens up new markets, attracting investment and driving consumer demand. Regulation establishes frameworks for licensing, product safety, and distribution, ensuring consumer protection and quality control. Evolving regulations can impact market dynamics, influencing pricing, competition, and product innovation. The clarity and consistency of legalization and regulation profoundly shape the growth trajectory and viability of the recreational cannabis market.

For instance, in September 2023, Republicans' softened stance on federal marijuana reform signaled a potential shift in regulatory attitudes, likely boosting investor confidence and spurring market growth in the recreational cannabis industry. This development could lead to expanded legalization efforts, opening up new markets and driving consumer demand for cannabis products.

- Rising Health and Wellness Consciousness Drives Increased Consumer Demand for Recreational Cannabis

Cannabis products perceived to offer health benefits, such as those containing CBD, are in high demand. This trend is fueled by growing awareness of cannabis' potential therapeutic properties for managing stress, anxiety, pain, and sleep issues. As people prioritize holistic well-being, they turn to cannabis for relaxation and self-care. Companies capitalize on this trend by developing innovative cannabis formulations and marketing them as lifestyle-enhancing products, driving market growth and expanding consumer demographics.

Opportunities

- Increasing Product Innovation Diversifies Product Selection

Innovations such as high-potency concentrates, diverse edibles, and convenient vaping devices attract new users and cater to evolving preferences. Advancements in cultivation techniques and genetics contribute to the development of novel strains with unique flavors and effects, enhancing product variety and consumer appeal. As companies invest in research and development, product innovation drives market growth and fosters competition and differentiation in the increasingly crowded cannabis landscape.

- Evolving Branding Strategies Influencing Consumer Perceptions

Effective marketing, including targeted advertising, influencer partnerships, and experiential marketing, help companies reach and engage with their target audience. Strong branding efforts create a distinct identity for cannabis products, fostering trust and credibility among consumers. Brands that effectively communicate product quality, safety, and compliance stand out, influencing purchase decisions and driving market growth. Innovative packaging and product design contribute to brand recognition and consumer appeal, further propelling the expansion of the recreational cannabis market.

Restraints/Challenges

- Increased Costs of Recreational Cannabis Quality due to Supply Chain Challenges

High costs squeeze profit margins, especially for smaller businesses, limiting their ability to invest in innovation and scale operations. Moreover, the necessity for extensive quality control measures and testing further adds to operational expenses. Access to traditional banking services remains limited due to federal regulations, leading to additional costs associated with cash-based transactions and difficulties in securing loans. Overall, these increased costs hinder market competitiveness, impede growth, and deter potential investors.

- Rising Quality Concerns Limits the Adoption of Recreational Cannabis

Ensuring consistent product quality, potency, and purity is crucial but challenging due to varying regulatory standards and testing procedures across different regions. Lack of standardized testing protocols and enforcement mechanisms can lead to discrepancies in product quality and mislabeling, eroding consumer confidence. Concerns about contaminants such as pesticides, heavy metals, and microbial pathogens further exacerbate quality issues, potentially leading to health risks and legal liabilities for businesses.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In May 2023, Toast and Nirvana Group forged a partnership aimed at bringing innovative products to patients and consumers in Oklahoma and New Mexico, leveraging Toast's expertise in cannabis products and Nirvana Group's market presence to offer new solutions to meet the evolving needs of consumers in the region

- In April 2023, Hello Juice and Smoothie partnered with Beleaf Co. to launch CBD-infused juice shots, combining the health-conscious trend of juice consumption with the wellness benefits of CBD, offering a unique product in the local U.S. market

- In May 2022, Canopy Growth expanded its product line with the introduction of orange and grape flavors for its cannabis-infused carbonated drinks, catering to the growing demand for diverse cannabis-infused beverages in the market

Recreational Cannabis Market Scope

The market is segmented on the basis of product type, distribution channel, species, compound, application, administration, and end use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Oils

- Tinctures

- Transdermal patches

- Isolates

- Tablets

- Flower

- Concentrates

- Edibles

- Topical

- Others

- Vape

- Capsules

- Suppositories

- Creams and roll-ons

Distribution channel

- Online

- Offline

- Retail store

- Pharmacies

- Others

Species

- Cannabis indica

- Cannabis sativa

- Hybrid

Compound

- THC-Dominant

- CBD-Dominant

- Balanced THC and CBD

Application

- Chronic Pain

- Mental Disorders

- Cancer

- Others

Administration

- Oral

- Topical

- Inhalation

- Rectal

- Sublingual

End Use

- Pharmaceuticals

- Food

- Beverages

- Tobacco

- Personal care

- Research and Development Centre

Recreational Cannabis Market Regional Analysis/Insights

The market is analysed and market size insights and trends are product type, distribution channel, species, compound, application, administration, and end use, as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates in the market, largely attributed to the U.S. progressive stance on cannabis legalization for medical and recreational purposes. This trend has catalyzed a surge in supply and demand across the region, solidifying its leading position in the global market. With more states joining the legalization wave, North America continues to bolster its status as the primary hub for cannabis production and consumption, driving innovation and growth in the industry.

Asia-Pacific is expected to experience significant growth in the cannabis market, primarily due to the legalization of cannabis in certain economies within the region. Among these, China is poised to emerge as a dominant player, fueled by extensive cannabis cultivation and substantial investments in the industry. This growth is driven by evolving attitudes towards cannabis, increasing recognition of its potential medical and economic benefits, and the expanding global trend towards legalization. China's robust infrastructure and agricultural capabilities position it favorably to capitalize on the burgeoning cannabis market in the Asia-Pacific region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Recreational Cannabis Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- AURORA CANNABIS INC (Canada)

- Cannabis Science Inc. (U.S.)

- Medical Marijuana, Inc. (U.S.)

- STENOCARE A/S (Denmark)

- CannabisNL (U.S.)

- Controlled Environments Limited (Canada)

- The Cronos Group (Canada)

- Maricann Inc (Canada)

- Tikun Olam (Israel)

- Canopy Growth Corporation (Canada)

- TerrAscend (Canada)

- VIVO Cannabis Inc.(Canada)

- Harvest Health & Recreation, Inc (U.S.)

- Curaleaf Holdings Inc. (U.S.)

- HEXO Corp. (Canada)

- INDIVA. (Canada)

- Cresco Labs (U.S.)

- Organigrams Holding Inc. (Canada)

- Trulieve (U.S.)

SKU-