Global Rapid Microbiology Testing Market

Market Size in USD Billion

CAGR :

%

USD

5.40 Billion

USD

11.09 Billion

2024

2032

USD

5.40 Billion

USD

11.09 Billion

2024

2032

| 2025 –2032 | |

| USD 5.40 Billion | |

| USD 11.09 Billion | |

|

|

|

|

Rapid Microbiology Testing Market Size

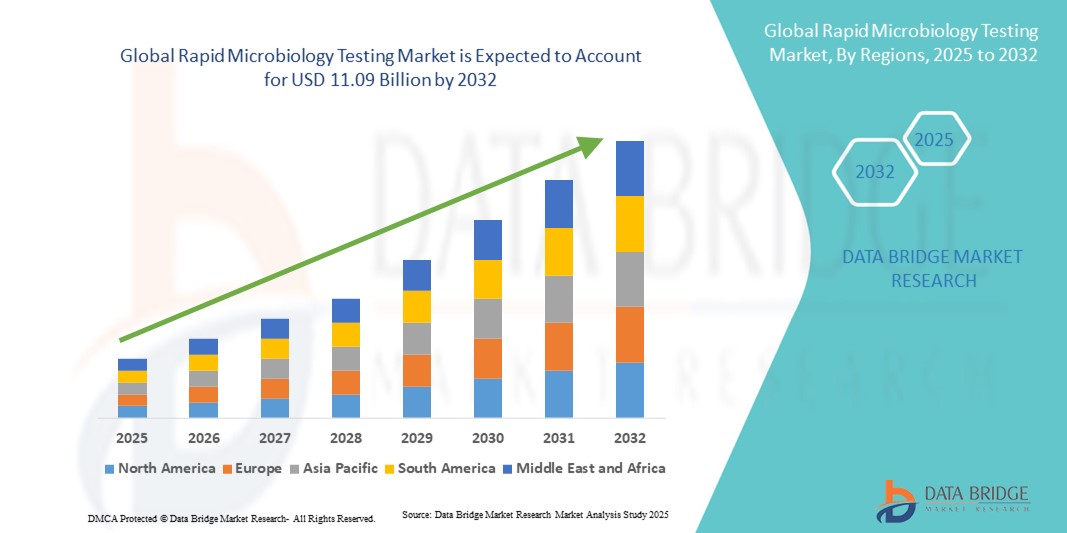

- The global rapid microbiology testing market size was valued at USD 5.40 billion in 2024 and is expected to reach USD 11.09 billion by 2032, at a CAGR of 9.40% during the forecast period

- The market growth is primarily driven by the increasing demand for rapid and accurate microbiological testing across pharmaceutical, clinical, and food & beverage industries. Rapid Microbiology Testing (RMT) enables faster detection of microbial contamination, supporting compliance with stringent quality and safety standards while reducing production downtime

- Technological advancements in automated testing platforms, biosensors, and molecular diagnostics have significantly enhanced the precision and throughput of RMT solutions. These innovations are allowing laboratories and production facilities to accelerate decision-making and maintain high-quality standards efficiently

Rapid Microbiology Testing Market Analysis

- Rapid microbiology testing refers to advanced diagnostic methods designed to detect and quantify microorganisms in pharmaceutical, food, and clinical samples with high speed and accuracy, playing a crucial role in quality control and ensuring product safety across industries

- The escalating demand for rapid microbiology testing is primarily fueled by the growing need for faster and more reliable microbial detection methods, increasing regulatory compliance requirements, and rising awareness of contamination risks in pharmaceutical and food production

- North America dominated the rapid microbiology testing market with the largest revenue share of 39.5% in 2024, characterized by advanced healthcare and pharmaceutical infrastructure, stringent quality regulations, and the strong presence of key market players. The U.S. leads the regional market due to widespread adoption of rapid microbiology testing solutions in pharmaceutical manufacturing, clinical laboratories, and food safety applications, supported by favorable regulatory frameworks and ongoing investment in laboratory modernization

- Asia-Pacific is expected to be the fastest growing region in the rapid microbiology testing market during the forecast period, driven by increasing urbanization, rising disposable incomes, expansion of pharmaceutical and food processing industries, and growing government initiatives to enhance laboratory and diagnostic capabilities in countries such as China, India, and Japan

- The instruments segment dominated the rapid microbiology testing market with a revenue share of 45.6% in 2024, driven by the rising adoption of automated and high-throughput microbiology testing systems across clinical, pharmaceutical, and food testing laboratories. Instruments such as automated microbial detection analyzers, incubators, colony counters, and biosafety cabinets provide laboratories with enhanced accuracy, faster turnaround times, and the ability to process large sample volumes efficiently

Report Scope and Rapid Microbiology Testing Market Segmentation

|

Attributes |

Rapid Microbiology Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rapid Microbiology Testing Market Trends

Advancements in Automation and High-Throughput Testing

- A significant and accelerating trend in the global rapid microbiology testing market is the growing adoption of automated and high-throughput testing systems, which allow laboratories and manufacturing facilities to achieve faster, more reliable microbial detection while reducing manual labor and human error

- For instance, several next-generation rapid testing platforms now enable simultaneous analysis of multiple sample types, streamlining workflows and improving turnaround times in pharmaceutical and food safety laboratories

- Automation in rapid microbiology testing enhances reproducibility, minimizes contamination risks, and supports compliance with stringent regulatory requirements, making it an essential feature for quality assurance programs

- The integration of robotics, automated sample preparation, and advanced imaging or sensor technologies is facilitating centralized monitoring and control, allowing laboratory personnel to manage multiple assays efficiently from a single platform

- This trend toward more sophisticated, precise, and scalable rapid microbiology testing systems is fundamentally reshaping expectations for laboratory productivity and safety standards

- Consequently, companies such as Thermo Fisher Scientific, bioMérieux, and Merck are developing advanced automated rapid microbiology platforms that provide faster results, higher accuracy, and improved operational efficiency for pharmaceutical, clinical, and food safety applications

- The demand for automated and high-throughput rapid microbiology testing systems is growing rapidly across both industrial and clinical sectors, as stakeholders increasingly prioritize faster results, compliance with safety regulations, and enhanced laboratory productivity

Rapid Microbiology Testing Market Dynamics

Driver

Growing Need Due to Rising Demand for Faster and Accurate Testing

- The increasing demand for rapid and reliable microbiological testing across pharmaceutical, clinical, and food safety sectors is a significant driver for the growth of the Rapid Microbiology Testing market

- For instance, in April 2024, bioMérieux announced the launch of its new automated rapid microbial detection system designed to deliver faster and more accurate results in quality control laboratories. Such strategic initiatives by key companies are expected to boost market growth during the forecast period

- As organizations face stricter regulatory requirements and heightened pressure for timely product release, rapid microbiology testing offers advanced features such as high-throughput analysis, reduced turnaround times, and real-time monitoring, providing a critical advantage over traditional culture-based methods

- Furthermore, the adoption of integrated testing platforms enables seamless workflow management, improved reproducibility, and enhanced laboratory efficiency, which are increasingly valued across industrial and clinical applications

- The growing focus on patient safety, product quality, and compliance with regulatory standards is propelling the adoption of rapid microbiology testing systems in both large-scale industrial and clinical laboratory settings. The trend toward automation and the availability of user-friendly platforms further contributes to market expansion

Restraint/Challenge

High Initial Costs, Technical Expertise, and Operational Challenges

- The relatively high initial investment required for advanced rapid microbiology testing systems can be a barrier to adoption, particularly for small-scale laboratories and facilities in developing regions

- Some systems also require trained personnel for operation, maintenance, and data interpretation, which can increase operational costs and slow adoption rates

- Addressing these challenges through cost-effective system designs, simplified interfaces, and training programs for laboratory staff is crucial for broader market penetration

- In addition, ongoing maintenance, calibration, and consumable costs may deter budget-conscious organizations from transitioning from traditional methods to rapid microbiology testing solutions

- The lack of standardized global protocols for rapid microbiology testing may result in regulatory hurdles, limiting adoption in certain regions

- Integration challenges with existing laboratory information management systems (LIMS) can complicate workflow and data management

- Environmental concerns regarding the disposal of chemical reagents and biohazardous waste from rapid microbiology testing systems may also restrict their widespread adoption

- While technological advancements are gradually reducing operational complexity, perceived high costs, training requirements, and integration challenges can still hinder adoption, particularly among smaller laboratories or in regions with limited resources

- Overcoming these challenges through affordable solutions, technical support, regulatory alignment, and user-friendly platforms will be vital for sustained growth and expansion of the Rapid Microbiology Testing market

Rapid Microbiology Testing Market Scope

The market is segmented on the basis of product, application, method, and end-user.

- By Product

On the basis of product, the rapid microbiology testing market is segmented into instruments, reagents and kits, and consumables. The instruments segment dominated the market with a revenue share of 45.6% in 2024, driven by the rising adoption of automated and high-throughput microbiology testing systems across clinical, pharmaceutical, and food testing laboratories. Instruments such as automated microbial detection analyzers, incubators, colony counters, and biosafety cabinets provide laboratories with enhanced accuracy, faster turnaround times, and the ability to process large sample volumes efficiently. The demand is further fueled by regulatory compliance requirements, increasing focus on infection control, and the need for reproducible, high-quality results. Institutions also prefer instruments that integrate seamlessly with laboratory information management systems (LIMS) and support multiple testing methods, further strengthening their market dominance.

The reagents and kits segment is anticipated to witness the fastest CAGR of 22.3% from 2025 to 2032, driven by the growing need for standardized, ready-to-use solutions that simplify microbiology workflows. These kits support diverse applications, including nucleic acid-based testing, growth-based detection, and cellular component analysis. Reagents and kits provide high sensitivity, specificity, and reproducibility, enabling laboratories to quickly detect pathogens in clinical, pharmaceutical, and food samples. The convenience of pre-formulated reagents, reduced preparation time, and compatibility with automated systems make this segment increasingly attractive. Rising demand in emerging markets, coupled with the introduction of specialized kits for rapid pathogen detection, is expected to propel growth significantly over the forecast period.

- By Application

On the basis of application, the rapid microbiology testing market is segmented into clinical disease diagnosis, food and beverage testing, pharmaceutical and biological drug testing, environmental testing, cosmetics and personal care products testing, research applications, and others. The clinical disease diagnosis segment dominated the market with a 41.8% share in 2024, owing to the rising prevalence of infectious diseases, hospital-acquired infections, and the growing emphasis on rapid pathogen detection. Rapid microbiology testing enables healthcare providers to deliver timely treatment decisions, reduce patient risks, and monitor antimicrobial resistance effectively. Hospitals and diagnostic laboratories are increasingly investing in automated and high-throughput testing systems to improve operational efficiency, reduce human error, and enhance reproducibility. The segment’s growth is also supported by increasing government initiatives, healthcare infrastructure expansion, and rising awareness of advanced diagnostic technologies among clinicians and patients.

The food and beverage testing segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, driven by stricter food safety regulations, growing consumer awareness regarding contamination, and the need for rapid testing in supply chains. Manufacturers are adopting advanced instruments, automated systems, and ready-to-use kits to identify microbial contaminants quickly and ensure compliance with international standards. Outsourcing testing to specialized laboratories is also on the rise, allowing companies to access faster, cost-effective solutions for quality control. The increasing complexity of global supply chains, expansion of processed and packaged foods, and the demand for rapid, accurate testing methods contribute significantly to the growth of this application segment.

- By Method

On the basis of method, the rapid microbiology testing market is segmented into growth-based, cellular component-based, nucleic acid-based, viability-based rapid microbiology diagnostic testing, and other rapid microbiology testing methods. The nucleic acid-based rapid microbiology testing segment dominated the market with a 44.2% share in 2024, driven by its high sensitivity, specificity, and ability to deliver rapid pathogen detection in clinical, pharmaceutical, and food testing laboratories. This method enables accurate identification of bacteria, viruses, and other microorganisms at the genetic level, reducing turnaround times and improving diagnostic outcomes. The adoption is further accelerated by automation, integration with real-time PCR systems, and growing demand for rapid diagnostic tools in hospitals, research centers, and pharmaceutical companies. Regulatory support for advanced molecular diagnostics and increasing awareness about antimicrobial resistance are additional growth factors.

The viability-based rapid microbiology diagnostic testing segment is expected to witness the fastest CAGR of 21.9% from 2025 to 2032, owing to its capability to assess the metabolic activity or viability of microorganisms quickly. This method is particularly valuable in monitoring sterility, quality control in pharmaceutical production, and food safety testing. Laboratories prefer viability-based techniques due to their speed, minimal sample preparation requirements, and compatibility with high-throughput systems. The method also helps identify live pathogens even in complex matrices, making it increasingly popular across clinical, industrial, and research applications, especially in regions with stringent quality and safety standards.

- By End-User

On the basis of end-user, the rapid microbiology testing market is segmented into laboratories and hospitals, food and beverage companies, pharmaceutical and biotechnology companies, contract research organizations (CROs), and other end-users. The laboratories and hospitals segment dominated the market with a 46.5% share in 2024, driven by the increasing adoption of rapid testing solutions to diagnose infectious diseases, monitor antimicrobial resistance, and ensure patient safety. Hospitals and clinical laboratories are increasingly investing in automated systems and integrated workflows to enhance accuracy, reduce testing time, and meet the rising demand for high-quality diagnostics. The segment also benefits from government healthcare initiatives, growing diagnostic infrastructure, and rising awareness among clinicians and patients about rapid microbiology testing benefits.

The pharmaceutical and biotechnology companies segment is expected to witness the fastest CAGR of 22.7% from 2025 to 2032, fueled by the rising demand for microbiological testing in drug development, quality control, and biopharmaceutical production. Rapid microbiology testing enables timely detection of microbial contamination, supporting regulatory compliance and ensuring product safety. Biotech firms and pharmaceutical manufacturers are increasingly adopting automated, high-throughput, and nucleic acid-based testing methods to accelerate R&D timelines, reduce operational costs, and maintain stringent quality standards. The segment’s growth is further driven by the expanding biologics and vaccine markets globally.

Rapid Microbiology Testing Market Regional Analysis

- North America dominated the rapid microbiology testing market with the largest revenue share of 39.5% in 2024, characterized by advanced healthcare and pharmaceutical infrastructure, stringent quality regulations, and the strong presence of key market players

- The widespread of regional market due to adoption of rapid microbiology testing solutions in pharmaceutical manufacturing, clinical laboratories, and food safety applications, supported by favorable regulatory frameworks and ongoing investment in laboratory modernization

- The region benefits from early adoption of innovative testing methods, high awareness regarding contamination control, and continuous R&D initiatives by leading companies, which further strengthens North America’s dominance in the global market

U.S. Rapid Microbiology Testing Market Insight

The U.S. rapid microbiology testing market captured the largest revenue share in 2024 within North America. This growth is fueled by increasing demand for faster, more reliable microbial testing across pharmaceutical, clinical, and food safety applications. Key drivers include the adoption of automated testing platforms, regulatory emphasis on rapid batch release, and growing integration of advanced diagnostics into laboratory workflows. Expansion of clinical and industrial laboratories, combined with strong investment in modern microbiology solutions, is expected to further propel market growth.

Europe Rapid Microbiology Testing Market Insight

The Europe rapid microbiology testing market is projected to expand at a substantial CAGR throughout the forecast period, driven by strict regulatory requirements for pharmaceutical and food industries, increasing adoption of automated laboratory solutions, and growing focus on contamination control. Countries such as Germany, France, and Italy are witnessing significant investments in laboratory modernization, which is accelerating the uptake of rapid microbiology testing solutions. Europe’s well-established healthcare and pharmaceutical infrastructure also supports market expansion.

U.K. Rapid Microbiology Testing Market Insight

The U.K. rapid microbiology testing market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by government initiatives to enhance laboratory testing capabilities and stringent quality compliance requirements in pharmaceutical manufacturing and food safety. Increasing demand for faster microbial detection methods in clinical diagnostics and biotechnology research further boosts market growth. Strong adoption of automated testing platforms and high investment in laboratory modernization are key factors driving the U.K. market.

Germany Rapid Microbiology Testing Market Insight

The Germany rapid microbiology testing market is expected to expand at a considerable CAGR during the forecast period, supported by growing pharmaceutical manufacturing activities, rigorous food safety regulations, and the increasing adoption of automated laboratory testing systems. Germany’s emphasis on precision diagnostics, contamination control, and innovation in biotechnology contributes to the rising demand for rapid microbiology testing solutions across clinical, pharmaceutical, and industrial applications.

Asia-Pacific Rapid Microbiology Testing Market Insight

The Asia-Pacific rapid microbiology testing market is poised to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, rising disposable incomes, and expanding pharmaceutical and food processing industries in countries such as China, India, and Japan. Government initiatives aimed at enhancing laboratory infrastructure, improving food safety, and supporting diagnostic testing are further accelerating market adoption. The growing awareness regarding contamination control and quality compliance across industries also supports the market’s rapid expansion in the region.

Japan Rapid Microbiology Testing Market Insight

The Japan rapid microbiology testing market is gaining momentum due to high technological adoption, an advanced healthcare system, and growing pharmaceutical and food industries. The country emphasizes quick, reliable microbial testing to ensure product safety and regulatory compliance. Increasing investments in automated testing systems and laboratory modernization initiatives further contribute to the market’s growth.

China Rapid Microbiology Testing Market Insight

The China rapid microbiology testing market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding healthcare and pharmaceutical infrastructure, and increasing demand for accurate, rapid microbial detection in clinical, food, and industrial applications. Government-led initiatives to improve laboratory and diagnostic capabilities, combined with growing awareness regarding quality control and contamination prevention, are key factors propelling market growth in China.

Rapid Microbiology Testing Market Share

The rapid microbiology testing industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- BD (U.S.)

- BIOMERIEUX (France)

- Bruker (U.S.)

- Charles River Laboratories (U.S.)

- Danaher Corporation (U.S.)

- Don Whitley Scientific Limited (U.S.)

- Merck KGaA (Germany)

- Neogen Corporation (U.S.)

- Quidel Corporation (U.S.)

- Rapid Micro Biosystems, Inc. (U.S.)

- Sartorius Group (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- TSI (U.S.)

- Vivione Biosciences Inc. (U.S.)

- ERBA Diagnostics (U.S.)

- Vedalab (India)

- Rtalabs (London, U.K.)

- Shimadzu Corporation (Japan)

- Pall Corporation (U.S.)

- Mocon, Inc. (U.S.)

Latest Developments in Global Rapid Microbiology Testing Market

- In August 2025, researchers at the Indian Institute of Technology (IIT) Madras developed a low-cost, chip-based device capable of detecting antibiotic resistance within three hours. This device utilizes electrochemical impedance spectroscopy to measure bacterial growth in the presence of antibiotics, offering a rapid and affordable alternative to traditional methods that typically take two to three days. This innovation is particularly beneficial for regions with limited healthcare infrastructure, enabling timely and targeted treatment of bacterial infections

- In March 2025, scientists in the U.K. introduced a rapid DNA sequencing system aimed at combating antibiotic-resistant superbugs. This system allows for the identification of bacterial infections within 48 hours, significantly faster than traditional methods that can take up to seven days. By providing quicker and more accurate diagnoses, this technology helps reduce the unnecessary use of broad-spectrum antibiotics, thereby mitigating the spread of resistance

- In July 2024, researchers at Seoul National University Hospital in South Korea developed a culture-free method for blood-based pathogen detection. This ultra-rapid antimicrobial susceptibility testing approach bypasses the traditional blood culture stage, reducing the time required for diagnosis by up to 48 hours. The method employs artificial intelligence to analyze bacterial growth patterns, facilitating faster and more accurate identification of sepsis-causing pathogens

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.