Global Randomization And Trial Supply Management Rtsm Market

Market Size in USD Million

CAGR :

%

USD

258.54 Million

USD

790.90 Million

2024

2032

USD

258.54 Million

USD

790.90 Million

2024

2032

| 2025 –2032 | |

| USD 258.54 Million | |

| USD 790.90 Million | |

|

|

|

|

Randomization and Trial Supply Management Market Size

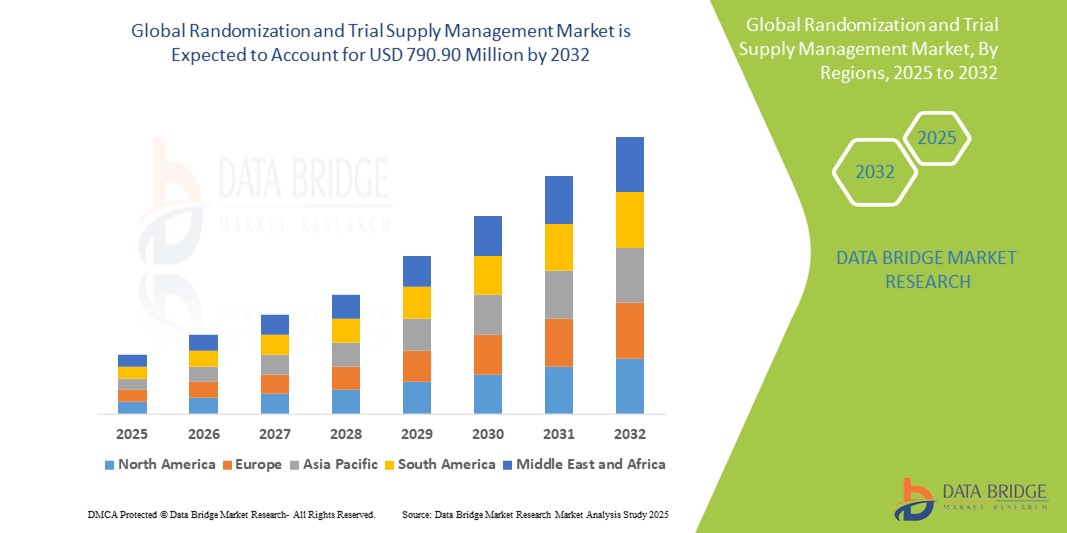

- The global Randomization and Trial Supply Management market was valued at USD 258.54 million in 2024 and is expected to reach USD 790.90 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.00%, primarily driven by the increasing number of clinical trials and rising demand for efficient trial supply chain management solutions

- This growth is driven by factors such as the rising adoption of decentralized and virtual clinical trials, technological advancements in RTSM solutions, and the growing need to streamline complex clinical trial processes

Randomization and Trial Supply Management Market Analysis

- Randomization and trial supply management (RTSM) systems are essential components in modern clinical trials, facilitating subject randomization and ensuring timely, accurate drug supply across trial sites. These systems support trial efficiency, regulatory compliance, and data integrity in complex global studies

- The market demand is significantly driven by the rising number of clinical trials, especially for rare diseases and personalized medicine, as well as the increasing adoption of decentralized and virtual trial models. Automation and real-time tracking capabilities have become critical in reducing delays and errors in trial supply chains

- North America stands out as one of the dominant markets for RTSM solutions, fueled by its large pharmaceutical and biotech sector, strong regulatory framework, and high investment in clinical research infrastructure

- For instance, the U.S. consistently leads in the number of active clinical trials, with both global pharma giants and emerging biotech firms increasingly leveraging advanced RTSM platforms to manage complex multi-site studies efficiently

- Globally, RTSM systems are considered a cornerstone technology in clinical trial operations, second only to electronic data capture (EDC) systems, and play a pivotal role in optimizing timelines, costs, and compliance across diverse therapeutic areas

Report Scope and Randomization and Trial Supply Management Market Segmentation

|

Attributes |

Randomization and Trial Supply Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Randomization and Trial Supply Management Market Trends

“Integration of AI and Cloud-Based RTSM Solutions”

- One prominent trend in the global RTSM market is the increasing integration of artificial intelligence (AI) and cloud-based technologies into RTSM platforms

- These Innovations enhance the efficiency, scalability, and real-time adaptability of clinical trial operations by enabling predictive analytics, automated decision-making, and remote access across geographically dispersed sites

- For instance, AI-driven algorithms can optimize drug supply forecasting and patient randomization, reducing waste and improving enrollment balance, while cloud-based systems support decentralized trials by offering centralized access to data and system functionalities

- Cloud integration also improves collaboration among sponsors, CROs, and clinical sites, streamlining regulatory compliance and data management

- This trend is transforming the clinical trial landscape, driving demand for intelligent, agile RTSM solutions that can support increasingly complex trial designs and global operations

Randomization and Trial Supply Management Market Dynamics

Driver

“Rising Number of Clinical Trials and Increasing Complexity in Trial Designs”

- The growing volume of clinical trials worldwide, particularly in areas such as oncology, rare diseases, and personalized medicine, is significantly driving the demand for sophisticated RTSM systems

- With clinical studies becoming more complex—featuring adaptive trial designs, multiple arms, and global site distribution—the need for automated, real-time randomization and trial supply solutions is critical to maintain trial integrity and efficiency

- These systems ensure proper patient randomization, minimize bias, and manage drug inventory across multiple sites, reducing waste and improving trial timelines

- The shift toward decentralized and hybrid trial models further underscores the importance of flexible and scalable RTSM platforms that can support remote operations and seamless data integration

For instance,

- In a May 2023 report by Xtalks, it was highlighted that the number of registered clinical trials continues to grow steadily year over year. This trend underscores the rising complexity and scale of global clinical research, driving the need for advanced RTSM platforms to manage trial logistics, ensure timely drug distribution, and support seamless randomization across multiple study sites

- In a 2023 report by ClinicalTrials.gov indicated a steady annual increase in registered clinical trials, highlighting the expanding scope of global research and the demand for digital infrastructure to manage trial logistics efficiently

- In addition, regulators emphasizing data accuracy and compliance, RTSM solutions have become essential tools for maintaining audit trails and ensuring transparency

- As the pharmaceutical and biotech industries invest heavily in R&D, the need for robust RTSM systems continues to grow, positioning them as vital components in the future of clinical trial management

Opportunity

“Enhancing Trial Efficiency with Artificial Intelligence Integration”

- AI-powered RTSM platforms are transforming clinical trial management by automating randomization processes, optimizing drug supply logistics, and predicting enrollment patterns, ultimately improving trial efficiency and reducing operational costs

- AI algorithms can analyze vast datasets in real-time, identifying patterns and anomalies, forecasting drug usage, and helping trial managers make data-driven decisions to minimize delays and wastage

- In addition, AI integration allows for better patient stratification and protocol adherence, especially in adaptive and complex trial designs, which are increasingly common in oncology, neurology, and rare disease studies

For instance,

- In February 2024, a study published in Nature Digital Medicine highlighted how AI-driven RTSM platforms reduced drug wastage by 30% and improved patient enrollment timelines by accurately forecasting supply needs across multi-site trials, particularly in oncology research

- In October 2023, according to a report by Deloitte Insights, major pharmaceutical companies adopted AI-enhanced RTSM systems to support their decentralized trial initiatives, enabling real-time monitoring and adjustment of supply chains, thereby reducing trial delays and improving overall data integrity

- The integration of AI in RTSM systems not only streamlines operations but also contributes to better compliance, faster trial execution, and improved patient experiences—making it a key growth driver in the evolving clinical research landscape

Restraint/Challenge

“High Implementation Costs and Integration Complexities”

- The high initial investment required for implementing advanced RTSM systems, along with the complexity of integrating them with existing clinical trial infrastructure (such as EDC, CTMS, and regulatory platforms), poses a significant challenge, particularly for small to mid-sized pharmaceutical companies and CROs

- These systems often require extensive customization, staff training, and ongoing maintenance, which can strain resources and delay implementation timelines—especially in organizations with limited IT capabilities or tight budgets

For instance,

- In September 2023, a report by GlobalData indicated that nearly 40% of small CROs and emerging biotechs cited cost and integration issues as primary barriers to adopting full-scale RTSM platforms, affecting their ability to participate in complex, global clinical trials

- December 2024, according to an article published by Clinical Trials Arena, the integration of RTSM with legacy systems across multi-regional trial networks continues to pose a challenge, often requiring custom APIs and significant IT support, thereby increasing overall operational costs and hindering seamless data exchange

- Consequently, these barriers can slow down adoption, reduce operational efficiency, and limit the scalability of clinical trial operations—ultimately restraining the growth potential of the global RTSM market, especially in developing and resource-limited regions

Randomization and Trial Supply Management Market Scope

The market is segmented on the basis of delivery mode, clinical trial phase, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Delivery Mode |

|

|

By Clinical Trial Phase |

|

|

By End User |

|

Randomization and Trial Supply Management Market Regional Analysis

“North America is the Dominant Region in the Randomization and Trial Supply Management Market”

- North America leads the RTSM market, driven by a robust clinical research ecosystem, advanced healthcare infrastructure, and widespread adoption of digital technologies in trial management

- U.S. holds a significant share due to the high volume of clinical trials conducted across diverse therapeutic areas, presence of major pharmaceutical and biotech companies, and strong regulatory support for innovation in trial processes

- The Favorable reimbursement frameworks, government funding for research, and early adoption of decentralized trial models further propel market growth

- In addition, strategic collaborations between technology providers and clinical research organizations (CROs) have accelerated the deployment of AI- and cloud-based RTSM systems across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is anticipated to witness the fastest growth in the RTSM market, supported by expanding clinical trial activity, increasing R&D investments, and growing interest from global pharmaceutical companies in conducting cost-effective trials in the region

- Countries such as China, India, South Korea, and Japan are emerging as clinical trial hubs due to large patient populations, regulatory reforms, and improvements in trial infrastructure

- Japan remains a leader in technological integration, with its pharma industry quickly adopting advanced RTSM platforms to support precision medicine and adaptive trial designs

- Rising demand for efficient trial logistics, especially in multi-site and multi-country studies, is driving the need for flexible, scalable RTSM systems throughout the region

Randomization and Trial Supply Management Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medidata (U.S.)

- IQVIA Inc. (U.S.)

- Parexel International (MA) Corporation (U.S.)

- Cytel Inc. (U.S.)

- Veeva Systems (U.S.)

- Oracle (U.S.)

- Cognizant (U.S.)

- Veradigm LLC (U.S.)

- eClinicalWorks (U.S.)

- Optum, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- athenahealth, Inc. (U.S.)

- SAP SE (Germany)

- Infor (U.S.)

- Epic Systems Corporation (U.S.)

- ELINEXT (U.S.)

- JAG Product Inc. (U.S.)

- Meta (U.S.)

- 4G Clinical (U.S.)

- Korio Inc. (U.S.)

Latest Developments in Global Randomization and Trial Supply Management Market

- In February 2025, Endpoint Clinical, a global leader in RTSM solutions, announced a significant brand evolution to reflect its customer-centric approach and 15 years of innovation in the RTSM space. This rebranding follows its acquisition by Arsenal Capital Partners in June 2024 and underscores Endpoint's commitment to delivering rapid study builds and tech-enabled services

- In October 2024, Telemedicine Technologies was honored with the BSMA Clinical Trials Supply Chain Award for its innovative CleanWeb-RTSM module. This recognition highlights the company's efforts in transforming clinical trial management through integrated, cloud-based platforms that enhance supply chain efficiency and stakeholder collaboration

- In May 2024, Oracle introduced new features to its Clinical One RTSM cloud-based solution, aimed at assisting sponsors and CROs in managing complex, global clinical trials. Enhancements include automated randomization list creation, customizable reconciliation forms, and improved regional compliance tools

- In March 2024, Sitero unveiled the latest version of its Mentor RTSM, offering enhanced self-service capabilities and advanced reporting features. Designed to empower clinical research teams, the platform aims to streamline trial management with greater efficiency and real-time insights

- October 2016, 4G Clinical launched Prancer, its 4th generation RTSM software for clinical trials. Prancer utilizes natural language processing to automate system builds and features advanced clinical supply forecasting capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.