Global Raman Spectroscopy Market

Market Size in USD Million

CAGR :

%

USD

394.32 Million

USD

724.47 Million

2024

2032

USD

394.32 Million

USD

724.47 Million

2024

2032

| 2025 –2032 | |

| USD 394.32 Million | |

| USD 724.47 Million | |

|

|

|

|

Raman Spectroscopy Market Analysis

Raman spectroscopy is rapidly evolving with significant technological advancements aimed at improving sensitivity, speed, and versatility. One of the latest methods includes the development of surface-enhanced Raman spectroscopy (SERS), which amplifies weak Raman signals, allowing for the detection of trace amounts of substances. This technique is gaining traction in various industries, including pharmaceuticals, for drug analysis, and in environmental monitoring for pollutant detection.

Another major advancement is the integration of Raman spectroscopy with artificial intelligence (AI) and machine learning (ML) algorithms. These technologies enhance data analysis capabilities, making the process faster and more accurate, particularly in complex samples. In addition, portable Raman devices are becoming more common, allowing for on-site analysis in industries such as agriculture, food safety, and chemical manufacturing.

The growth of the Raman spectroscopy market is also being fueled by increasing demand for non-destructive testing methods, particularly in the pharmaceutical, food and beverage, and material science industries. The versatility of Raman spectroscopy in both research and industrial applications continues to drive its adoption, positioning it as a key tool for quality control, product development, and environmental monitoring.

Raman Spectroscopy Market Size

The global raman spectroscopy market size was valued at USD 394.32 million in 2024 and is projected to reach USD 724.47 million by 2032, with a CAGR of 7.9% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Raman Spectroscopy Market Trends

“Increasing Use in Pharmaceutical and Healthcare Applications”

A key trend driving growth in the Raman spectroscopy market is its expanding use in pharmaceutical and healthcare applications. Raman spectroscopy allows for rapid, non-destructive analysis of drug formulations, aiding in quality control and ensuring the authenticity of pharmaceuticals. For instance, it is employed in drug identification and the detection of contaminants in pharmaceutical production. In healthcare, Raman spectroscopy is being explored for early-stage disease detection, such as identifying cancer cells or analyzing tissue samples without invasive procedures. The technology's ability to provide precise, detailed molecular information is revolutionizing diagnostics, leading to greater adoption in medical research and clinical applications, driving market growth.

Report Scope and Raman Spectroscopy Market Segmentation

|

Attributes |

Raman Spectroscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Horiba Scientific (Japan/France), Bruker Corporation (U.S.), Thermo Fisher Scientific (U.S.), Renishaw plc (United Kingdom), Agilent Technologies (U.S.), PerkinElmer, Inc. (U.S.), Shimadzu Corporation (Japan), JASCO Corporation (Japan), B&W Tek (U.S.), Kaiser Optical Systems (U.S.), Metrohm AG (Switzerland), WITec GmbH (Germany), Snowy Range Instruments (U.S.), BaySpec, Inc. (U.S.), Ocean Insight (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Raman Spectroscopy Market Definition

Raman spectroscopy is a non-destructive analytical technique used to study molecular vibrations, providing detailed information about molecular structures and chemical compositions. It works by scattering light from a monochromatic source (usually a laser) and analyzing the shift in the light's frequency as it interacts with the sample. The frequency shift, known as the Raman shift, corresponds to specific vibrational modes of the molecules in the sample. Raman spectroscopy is widely used in chemistry, material science, biology, and pharmaceuticals for qualitative and quantitative analysis, identifying substances, and detecting molecular changes in complex systems.

Raman Spectroscopy Market Dynamics

Drivers

- Demand for Non-Destructive Testing

Raman spectroscopy’s non-destructive nature is a major driver in its adoption, particularly in quality control and forensic analysis. In manufacturing, it ensures product integrity by allowing for the analysis of materials without damaging them, making it ideal for inspecting high-value items such as electronics and aerospace components. For instance, in June 2022, Renishaw plc introduced the inLux SEM Raman interface, a groundbreaking technology for enhancing Raman spectroscopy capabilities within a scanning electron microscope (SEM). This interface enables the collection of Raman spectra while imaging in the SEM, offering advanced 2D and 3D imaging features. It opens new possibilities for detailed material analysis, combining the benefits of both SEM and Raman technologies.

- Growth in Food and Agriculture Sectors

The food and agriculture sectors are increasingly adopting Raman spectroscopy for quality control, authenticity testing, and contaminant detection, driving market growth. In food production, Raman spectroscopy helps analyze ingredients, verify product quality, and ensure safety without altering samples. For instance, it is used in detecting adulteration in spices or confirming the authenticity of organic produce. Moreover, the technology is employed to check pesticide residues and contaminants in food, ensuring consumer safety. With growing concerns over food fraud and quality assurance, Raman spectroscopy is gaining traction for rapid, non-destructive testing, making it a vital tool for food manufacturers and regulatory bodies, thus significantly boosting the market.

Opportunities

- Advancements in Technology

Continuous technological advancements in Raman spectroscopy, such as improved sensitivity, higher resolution, and portable designs, have created significant opportunities in the market. These innovations have made Raman spectroscopy more accessible and versatile across diverse industries. For instance, in February 2023, Agilent Technologies Inc. launched a significant software upgrade for its Vaya handheld Raman spectrometer. This upgrade enhances raw material identification by expanding the device's capabilities, allowing it to analyze both opaque and transparent containers. This development improves the efficiency and accuracy of quality control processes in various industries, particularly for pharmaceutical and biopharmaceutical applications.

- Increased Use in Material Science

The increased use of Raman spectroscopy in material science presents significant market opportunities. The technique is crucial for characterizing materials such as polymers, semiconductors, and carbon-based materials, offering insights into their molecular structure, composition, and properties. For instance, in June 2021, HORIBA Ltd. launched its CiCi-Raman engine, designed for OEM industrial clients requiring high-volume analysis. This spectrometer features an aberration-corrected concave holographic grating, a deep-cooled Syncerity CCD camera, a VIS-NIR detector, and a round-to-slit fiber converter, delivering high-efficiency Raman probe collection. The CiCi-Raman-785 is specifically tailored for industrial applications, providing precise and reliable performance in high-demand environments.

Restraints/Challenges

- High Initial Cost

The high initial cost of Raman spectroscopy systems poses a significant barrier to market growth. Advanced models, equipped with sophisticated technology and features, come with steep price tags, which can be prohibitive for small and medium-sized enterprises (SMEs) and research institutions. These organizations often operate under tight budgets, limiting their ability to invest in such high-end equipment. This financial constraint restricts the widespread adoption of Raman spectroscopy across various industries. As a result, many potential users may opt for less expensive, alternative analytical techniques, which can impede the overall growth and development of the Raman spectroscopy market, particularly in regions with limited funding resources.

- Sensitivity to Sample Quality

Raman spectroscopy's dependence on sample quality poses a significant challenge, as even slight variations in homogeneity or surface roughness can lead to inaccurate or unreliable results. For instance, samples that are not uniformly prepared can result in scattered data or false readings, which compromises the integrity of analysis. The technique’s sensitivity to surface irregularities further complicates its application, especially in heterogeneous samples. This issue restricts Raman spectroscopy's reliability in critical fields such as material science and biology, where precise and reproducible measurements are essential. As a result, the market for Raman spectroscopy faces limitations, particularly in industries requiring high-precision analysis across diverse sample types.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Raman Spectroscopy Market Scope

The market is segmented on the basis of type, application sampling technique, and instruments. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Bench Top Type

- Portable Type

Applications

- Pharmaceutics

- Research and Development in Academia

- Industrial Sector

- Life Sciences

- Material Sciences

- Carbon Materials

- Semiconductors

- Others

Sampling Technique

- Surface-Enhanced Raman Scattering

- Tip-Enhanced Raman Scattering

- Other Raman Scattering Techniques

Instruments

- Probe-based Raman

- Fourier-transform Infrared Raman

- Micro-Raman

- Others

Raman Spectroscopy Market Regional Analysis

The market is analyzed and market size insights and trends are provided by type, application sampling technique, and instruments as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

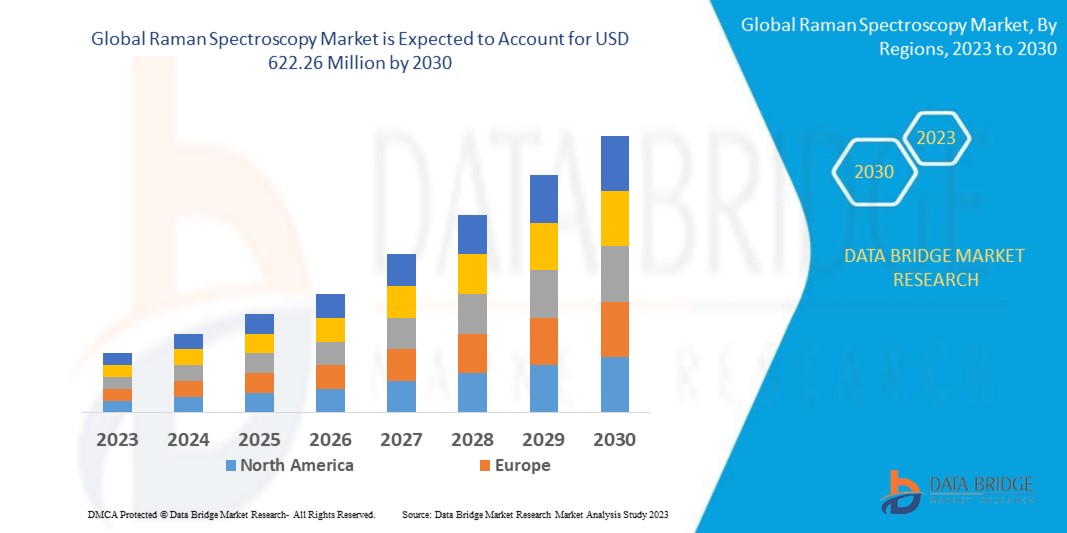

North America is expected to dominate the Raman spectroscopy market and grow with the highest CAGR due to its strong scientific and research community. The region is home to numerous academic institutions, government laboratories, and private research organizations, which actively contribute to advancements in Raman spectroscopy technology. In addition, increasing demand for non-destructive testing in various industries, including pharmaceuticals, healthcare, and materials science, further drives market growth. The presence of major industry players and significant investments in research and development also play a crucial role in maintaining North America's leading position in the global market.

Asia-Pacific is expected to witness significant growth in the Raman spectroscopy market during the forecast period. This growth is driven by the increasing demand from key sectors such as pharmaceuticals, biotechnology, and environmental analysis. Countries such as China, India, and Japan are actively adopting Raman spectroscopy for diverse applications, including drug development, quality control, and materials science. In addition, the rise in research and development activities and the expansion of industrial sectors further enhance the demand for these advanced analytical instruments, positioning Asia-Pacific as a key region for market expansion.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Raman Spectroscopy Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Raman Spectroscopy Market Leaders Operating in the Market Are:

- Horiba Scientific (Japan/France)

- Bruker Corporation (U.S.)

- Thermo Fisher Scientific (U.S.)

- Renishaw plc (United Kingdom)

- Agilent Technologies (U.S.)

- PerkinElmer, Inc. (U.S.)

- Shimadzu Corporation (Japan)

- JASCO Corporation (Japan)

- B&W Tek (U.S.)

- Kaiser Optical Systems (U.S.)

- Metrohm AG (Switzerland)

- WITec GmbH (Germany)

- Snowy Range Instruments (U.S.)

- BaySpec, Inc. (U.S.)

- Ocean Insight (U.S.)

Latest Developments in Raman Spectroscopy Market

- In October 2023, HORIBA Scientific acquired Process Instruments Inc., a prominent manufacturer of Raman spectroscopy technology. This acquisition strengthens HORIBA’s portfolio in analytical instrumentation, enhancing its capability in Raman spectroscopy solutions. Process Instruments’ expertise will enable HORIBA to expand its offerings and serve industries such as pharmaceuticals, chemical analysis, and materials science with advanced Raman technologies

- In February 2023, Agilent Technologies Inc. launched a significant software upgrade for its Vaya handheld Raman spectrometer. This upgrade enhances raw material identification by expanding the device's capabilities, allowing it to analyze both opaque and transparent containers. This development improves the efficiency and accuracy of quality control processes in various industries, particularly for pharmaceutical and biopharmaceutical applications

- In June 2022, Renishaw plc introduced the inLux SEM Raman interface, a groundbreaking technology for enhancing Raman spectroscopy capabilities within a scanning electron microscope (SEM). This interface enables the collection of Raman spectra while imaging in the SEM, offering advanced 2D and 3D imaging features. It opens new possibilities for detailed material analysis, combining the benefits of both SEM and Raman technologies

- In 2021, Thermo Fisher Scientific, Inc. allocated nearly USD 1.4 billion for research and development in 2021. This investment highlights the company’s commitment to advancing scientific instrumentation. In addition, Agilent Technologies Inc. introduced the Agilent Vaya Raman raw material identity verification system, a handheld tool that accelerates quality control testing, particularly in the pharmaceutical and biopharmaceutical sectors, enabling more efficient raw material verification and ensuring product quality

- In June 2021, HORIBA Ltd. launched its CiCi-Raman engine, designed for OEM industrial clients requiring high-volume analysis. This spectrometer features an aberration-corrected concave holographic grating, a deep-cooled Syncerity CCD camera, a VIS-NIR detector, and a round-to-slit fiber converter, delivering high-efficiency Raman probe collection. The CiCi-Raman-785 is specifically tailored for industrial applications, providing precise and reliable performance in high-demand environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Raman Spectroscopy Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Raman Spectroscopy Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Raman Spectroscopy Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.