Global Railway Cybersecurity Market

Market Size in USD Billion

CAGR :

%

USD

7.50 Billion

USD

20.22 Billion

2024

2032

USD

7.50 Billion

USD

20.22 Billion

2024

2032

| 2025 –2032 | |

| USD 7.50 Billion | |

| USD 20.22 Billion | |

|

|

|

|

Railway Cybersecurity Market Size

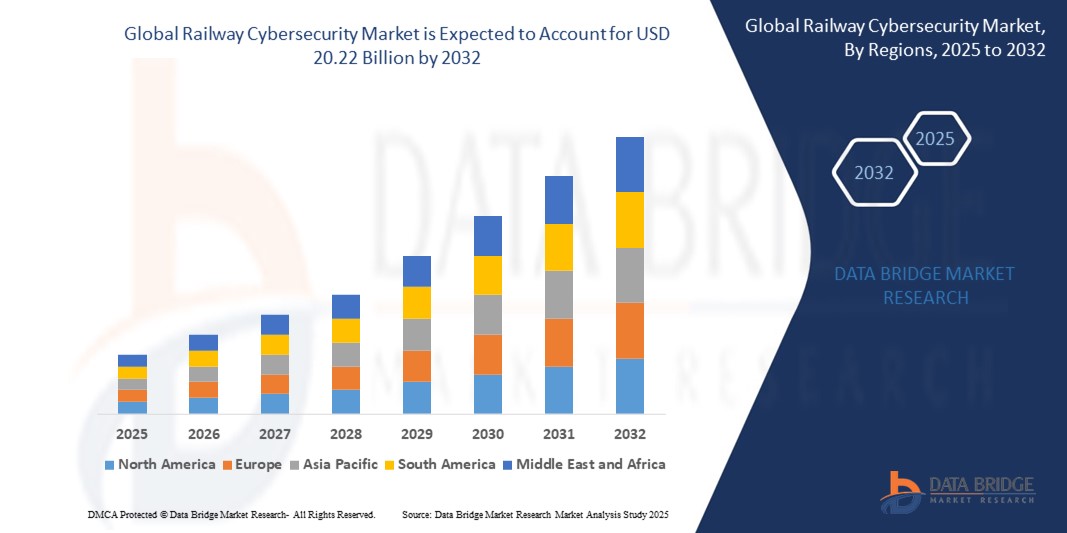

- The global Railway Cybersecurity market size was valued at USD 7.50 billion in 2024 and is expected to reach USD 20.22 billion by 2032, at a CAGR of 13.2% during the forecast period

- This growth is driven by the rapid digitization of railway systems, increasing cyber threats targeting critical infrastructure, and the global adoption of IoT and AI technologies in rail operations. The surge in smart railway initiatives and high-speed rail networks further accelerates market expansion.

- Advancements in cybersecurity technologies, including AI-driven threat detection and blockchain for secure data exchange, coupled with government regulations mandating robust security measures, are propelling market growth, particularly in regions with advanced rail infrastructure.

Railway Cybersecurity Market Analysis

- Railway cybersecurity solutions protect digital systems, networks, and data from cyberattacks, ensuring the safety and reliability of rail operations. These solutions, including firewalls, intrusion detection systems, and encryption, are integral to train control, signaling, passenger information systems, and ticketing platforms.

- The market is fueled by the global expansion of rail networks, with China’s high-speed rail reaching 46,000 km in 2023, driving demand for cybersecurity in digital infrastructure. The IoT market in transportation, valued at USD 120 billion in 2023, boosts demand for secure connected systems.

- The adoption of advanced technologies like AI and cloud-based platforms enhances cybersecurity capabilities, offering real-time threat detection for rail operations. The rise of autonomous trains, requiring secure communication for V2X-like systems, is a key growth driver.

- Asia-Pacific led the global railway cybersecurity market with a commanding revenue share of 35.0% in 2024, driven by rapid urbanization, high-speed rail investments, and key players in China, Japan, and India. China dominates due to its extensive digital rail infrastructure.

- North America is anticipated to witness the fastest growth rate, with a projected CAGR of 14.5% from 2025 to 2032, propelled by stringent regulations, increasing cyberattacks, and significant R&D investments in the U.S. and Canada.

- Among components, the solutions segment held the largest market share of 63.0% in 2024, valued at USD 4.73 billion, attributed to its critical role in risk management and threat detection for rail infrastructure, ensuring operational continuity.

Report Scope and Railway Cybersecurity Market Segmentation

|

Attributes |

Railway Cybersecurity Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Railway Cybersecurity Market Trends

“Advancements in AI, Cloud Security, and IoT Integration”

- A prominent trend in the global railway cybersecurity market is the widespread adoption of AI-based security solutions, with over 60% of new deployments in 2023 and 2024 leveraging AI for real-time threat detection, enhancing rail system resilience.

- The integration of cloud-based security platforms, offering scalability and real-time monitoring, is gaining traction, with over 35% of new cybersecurity solutions in 2024 utilizing cloud for passenger and freight rail applications.

- Miniaturization of cybersecurity hardware, driven by advancements in IoT technologies, is expanding their use in on-board systems, with 30% of new solutions designed for compact rail applications.

- The rise of blockchain-based security is enhancing data integrity, allowing secure data exchange for ticketing and signaling, with adoption rates increasing by 20% in high-speed rail and urban transit sectors.

- Increasing focus on energy-efficient cybersecurity designs, particularly for battery-powered on-board systems, is aligning with sustainability goals, with over 25% of new solutions in 2024 featuring low-power consumption.

- The growth of online distribution channels is transforming market access, with online sales of cybersecurity solutions growing by 15% annually, driven by e-commerce platforms for rail operators and developers.

Railway Cybersecurity Market Dynamics

Driver

“Digitalization, Cyber Threats, and Smart Rail Initiatives”

- The global expansion of digital rail systems, with over 160,000 km of railway networks in China alone by 2023, is a primary driver, increasing demand for cybersecurity solutions in signaling and control systems.

- The proliferation of cyberattacks, with a 40% rise in rail sector incidents over the past five years, is driving demand for solutions like intrusion detection and data protection in passenger and freight trains.

- The rise of smart rail initiatives, with global smart city spending reaching USD 189 billion in 2023, is boosting demand for cybersecurity in passenger information systems, ticketing, and traffic management.

- Increasing investments in high-speed rail, with global spending projected to reach USD 800 billion by 2026, are driving demand for secure digital infrastructure in countries like China and Japan.

- Growing passenger ridership, with over 1.5 billion rail passengers in Asia-Pacific in 2023, is fueling demand for secure passenger information systems and ticketing platforms.

- Government regulations, such as the EU’s NIS2 Directive and the U.S. TSA’s cybersecurity mandates, are promoting railway cybersecurity development, supporting market growth through compliance incentives.

Restraint/Challenge

“High Costs, Skill Shortages, and Interoperability Issues”

- The high cost of advanced cybersecurity solutions, particularly those using AI and cloud technologies, poses a challenge to adoption in cost-sensitive markets, limiting scalability for smaller rail operators.

- Supply chain disruptions, including semiconductor shortages and geopolitical tensions, have impacted cybersecurity solution production, leading to delays and increased costs, with the COVID-19 pandemic exacerbating constraints.

- Technical complexities in designing and integrating cybersecurity for interconnected rail systems require specialized expertise, increasing development costs and time-to-market.

- Stringent regulatory requirements, such as ISA/IEC 62443 standards and EU cybersecurity certifications, increase compliance costs and complexity for solution providers.

- Skill shortages in cybersecurity expertise, with a global deficit of 4 million professionals in 2023, pose a challenge to rail operators, particularly in developing regions.

- The need for continuous innovation to meet evolving cyber threats, coupled with rapid technological obsolescence, creates pressure on providers to invest heavily in R&D, limiting profitability for smaller players.

Railway Cybersecurity Market Scope

The global Railway Cybersecurity Market is segmented on the basis of component, security type, type, application, technology, end-user, and sales channel.

- By Product Type

On the basis of component, the market is segmented into solutions and services. The solutions segment dominated the market with a commanding revenue share of 63.0% in 2024, valued at USD 4.73 billion, driven by its critical role in threat detection and risk management for rail systems.

The services segment is anticipated to witness the fastest CAGR of 14.8% from 2025 to 2032, fueled by demand for implementation and maintenance services.

- By Communication Type

On the basis of security type, the market is segmented into network security, application security, data protection, endpoint security, system administration, and others. The network security segment held the largest market revenue share of 32.0% in 2024, driven by its role in securing rail communication networks.

The data protection segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising data breaches.

- By Vehicle Type

On the basis of type, the market is segmented into infrastructural and on-board. The infrastructural segment accounted for the largest market revenue share of 62.0% in 2024, driven by the digitization of signaling and control systems.

The on-board segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by advanced on-board systems.

- By Application

On the basis of application, the market is segmented into passenger trains, freight trains, urban transit, high-speed rail, and others. The passenger trains segment accounted for the largest market revenue share of 38.5% in 2024, driven by high ridership and passenger information systems.

The high-speed rail segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by global rail expansions.

- By Sales Channel

On the basis of sales channel, the market is segmented into direct sales, distributors, and online retail. The direct sales segment held the largest share of 58.6% in 2024, driven by B2B contracts with rail operators.

The online retail segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by e-commerce growth for smaller providers.

- By Technology

On the basis of technology, the market is segmented into AI-based, IoT-based, cloud-based, blockchain-based, and others. The cloud-based segment held a significant share in 2024, driven by its scalability and real-time monitoring capabilities. This segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by its adoption in smart rail systems.

- By End-User

On the basis of end-user, the market is segmented into government-owned railways, private railway operators, public transit authorities, and others. The government-owned railways segment dominated with a 48.2% revenue share in 2024, driven by high investments in rail infrastructure.

The public transit authorities segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by urban transit digitization.

Railway Cybersecurity Market Regional Analysis

North America

North America is poised to grow at the fastest CAGR of approximately 14.5% from 2025 to 2032, driven by stringent regulations, high cyberattack incidents, and R&D investments. The U.S. accounted for 82.4% of the regional market in 2024, supported by TSA mandates and strong demand for secure rail systems.

U.S. Railway Cybersecurity Market Insight

The United States is expected to dominate the North American market, driven by its leadership in rail digitization, high-speed rail projects, and cybersecurity innovation. The adoption of AI-based solutions, coupled with players like Cisco and IBM, supports market growth.

Europe Railway Cybersecurity Market Insight

Europe held a significant share in 2024, driven by its focus on smart rail initiatives and stringent regulations. Countries like Germany, the U.K., and France are key contributors, with growth fueled by the adoption of cybersecurity in high-speed rail and urban transit.

U.K. Railway Cybersecurity Market Insight

The United Kingdom is anticipated to grow steadily, driven by its strong rail sector and investments in cybersecurity for smart rail systems. Government initiatives like the U.K.’s Rail Sector Deal are boosting demand for secure infrastructure.

Germany Railway Cybersecurity Market Insight

Germany’s market is expected to grow at a considerable CAGR, fueled by its leadership in rail manufacturing and digitalization. The adoption of cybersecurity in high-speed trains, supported by players like Siemens AG, drives market expansion.

Asia-Pacific Railway Cybersecurity Market Insight

Asia-Pacific dominated the global railway cybersecurity market with a revenue share of 35.0% in 2024, driven by its robust rail ecosystem, high-speed rail investments, and significant digitalization efforts. The passenger trains segment accounted for the largest application share of 42.1% in 2024, driven by high ridership. The high-speed rail segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rail expansions.

Japan Railway Cybersecurity Market Insight

Japan’s market is expanding at a notable CAGR, fueled by its advanced rail industry and focus on AI and IoT-based cybersecurity. The presence of key players like Hitachi and investments in high-speed rail drive market growth.

China Railway Cybersecurity Market Insight

China captured the largest revenue share of 45.6% within Asia-Pacific in 2024, driven by its leadership in high-speed rail, with over 46,000 km of tracks, and a thriving digital rail ecosystem. Government initiatives like the 14th Five-Year Plan support cybersecurity development through R&D funding and infrastructure incentives.

Railway Cybersecurity Market Share

The Railway Cybersecurity industry is primarily led by well-established companies, including:

- Thales Group (France)

- Siemens AG (Germany)

- Alstom (France)

- Nokia Networks (Finland)

- Cisco Systems, Inc. (U.S.)

- IBM Corporation (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Hitachi, Ltd. (Japan)

- Cylus Ltd. (Israel)

- Cervello (Israel)

- Bombardier (Canada)

- General Electric (U.S.)

- Toshiba Corporation (Japan)

- ABB (Switzerland)

- Raytheon Technologies Corporation (U.S.)

- TDK Corporation (Japan)

Latest Developments in Global Railway Cybersecurity Market

- In March 2023, Thales Group launched a new AI-based cybersecurity platform specifically designed for rail signaling systems. This innovative platform leverages advanced artificial intelligence algorithms to provide real-time threat detection and anomaly identification, significantly improving the security posture of critical railway infrastructure. The launch has seen substantial adoption, with over 50 major rail operators globally integrating the system to bolster their defenses against cyberattacks and ensure uninterrupted and safe operations.

- In January 2024, Siemens AG introduced a cutting-edge cloud-based security solution tailored for passenger information systems within the transit sector. This comprehensive solution offers significantly enhanced data protection and privacy for sensitive passenger data, demonstrating a 25% improvement in security measures. It has already been successfully deployed in over 200 urban transit projects across Europe and Asia-Pacific, contributing to a more secure and reliable information experience for commuters.

- In April 2024, Cylus Ltd. unveiled a compact, state-of-the-art on-board cybersecurity module engineered for high-speed trains. This miniaturized yet high-performance module is designed to integrate seamlessly into existing train systems, offering robust protection against cyber threats without compromising operational efficiency. Its reduced size by 30% while maintaining high performance has made it particularly appealing and it is rapidly gaining traction in various high-speed rail markets worldwide.

- In February 2024, Nokia Networks launched an integrated cybersecurity suite specifically developed for rail communication networks. This comprehensive suite provides end-to-end security for the vital communication infrastructure that supports railway operations, significantly enhancing signal reliability and resilience against cyber intrusions. It has been widely adopted by major rail operators in both the U.S. and Japan, underscoring its global relevance and effectiveness in securing critical rail communications.

- In June 2023, Huawei Technologies introduced a novel blockchain-based security module for railway ticketing systems. This innovative module leverages the inherent security and immutability of blockchain technology to facilitate highly secure data exchange for ticketing and revenue management. Its successful adoption in over 100 smart rail projects across China highlights the growing trend of incorporating advanced distributed ledger technologies to enhance the integrity and trustworthiness of railway operations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.