Global Rail Mounted Gantry Crane Market

Market Size in USD Billion

CAGR :

%

USD

2.74 Billion

USD

3.96 Billion

2025

2033

USD

2.74 Billion

USD

3.96 Billion

2025

2033

| 2026 –2033 | |

| USD 2.74 Billion | |

| USD 3.96 Billion | |

|

|

|

|

Rail Mounted Gantry Crane Market Size

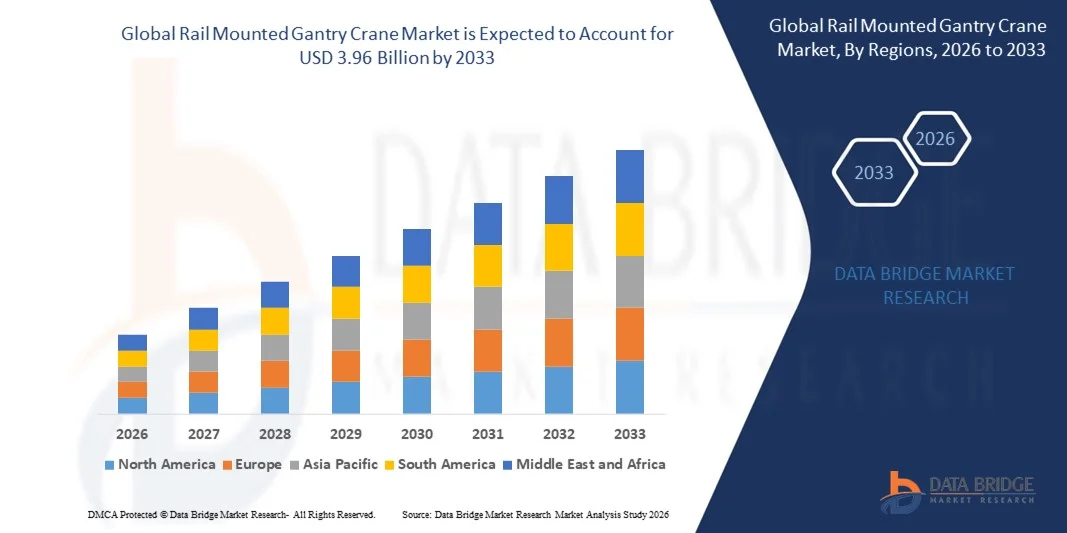

- The global rail mounted gantry crane market size was valued at USD 2.74 billion in 2025 and is expected to reach USD 3.96 billion by 2033, at a CAGR of 4.70% during the forecast period

- The market growth is largely fueled by increasing global trade and expanding port infrastructure, which are driving demand for efficient cargo handling solutions and high-capacity material movement in industrial and container terminals

- Furthermore, rising adoption of automation, digital monitoring systems, and advanced RMG crane technologies is enabling operators to improve throughput, reduce operational bottlenecks, and optimize terminal productivity. These converging factors are accelerating the deployment of rail mounted gantry cranes, thereby significantly boosting the industry’s growth

Rail Mounted Gantry Crane Market Analysis

- Rail mounted gantry cranes are specialized cranes used for lifting and transporting heavy cargo containers and industrial materials within ports, rail yards, and industrial facilities. These systems are designed for high-capacity handling, operational efficiency, and integration with automated terminal management systems to enhance cargo movement and logistics operations

- The escalating demand for RMG cranes is primarily fueled by growing container traffic, port modernization projects, expansion of industrial freight corridors, and increasing emphasis on automation and smart material handling solutions to meet global trade and logistics requirements

- Asia-Pacific dominated the rail mounted gantry crane market with a share of 54.23% in 2025, due to expanding port infrastructure, growing containerized cargo volumes, and increasing investments in automated cargo handling systems

- North America is expected to be the fastest growing region in the rail mounted gantry crane market during the forecast period due to increasing container traffic, industrial automation, and port expansion projects

- 26 tons - 74 tons segment dominated the market with a market share of 49.53% in 2025, due to its widespread adoption across ports, container yards, and industrial facilities requiring medium-to-heavy lifting operations. Operators prefer this capacity range due to its optimal balance between lifting efficiency and operational flexibility, enabling smooth handling of standard shipping containers and bulk materials

Report Scope and Rail Mounted Gantry Crane Market Segmentation

|

Attributes |

Rail Mounted Gantry Crane Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Rail Mounted Gantry Crane Market Trends

Rising Adoption of Automated and High-Capacity RMG Cranes

- A key trend in the rail mounted gantry crane market is the increasing adoption of automated and high-capacity cranes at major ports to enhance container handling efficiency and operational throughput. Automation technologies are enabling ports to reduce manual labor, improve safety, and achieve faster turnaround times for containerized cargo

- For instance, Kalmar and Liebherr supply automated RMG cranes equipped with remote monitoring and energy-efficient drive systems that are widely deployed in container terminals across Asia and Europe. These solutions support continuous operation under high-volume traffic and improve overall terminal productivity

- The deployment of RMG cranes is expanding in response to rising global container traffic, where high-capacity cranes support multi-container lifts and optimize yard operations. This trend is positioning RMG systems as essential infrastructure for modern container terminals seeking operational efficiency

- Ports are increasingly integrating digital control systems and IoT-enabled monitoring in RMG cranes to enhance predictive maintenance, reduce downtime, and streamline crane management. These technological advancements are driving the adoption of smart port solutions and more reliable cargo handling operations

- The demand for RMG cranes is also rising in regions upgrading port infrastructure to accommodate larger vessels and meet international shipping standards. Cranes capable of handling wider and heavier container loads are becoming critical for maintaining competitive port operations

- The market is witnessing growth in hybrid RMG models that combine electric and diesel power systems to achieve energy savings and environmental compliance. Such innovations are encouraging terminal operators to invest in sustainable and high-performance crane technologies

Rail Mounted Gantry Crane Market Dynamics

Driver

Expanding Global Port Infrastructure and Growing Container Traffic

- The growth of global trade and increasing container volumes are driving the demand for RMG cranes, as ports seek to expand their infrastructure and improve handling efficiency. These cranes are critical for managing larger container fleets and ensuring timely cargo movement

- For instance, DP World has invested in high-capacity automated RMG cranes at its Jebel Ali and London Gateway terminals to handle growing container throughput efficiently. Such deployments enhance port productivity and optimize yard utilization

- The expansion of deep-water ports to accommodate ultra-large container vessels is further fueling demand for advanced RMG cranes capable of higher lifts and longer spans. These upgrades support larger terminal operations and enable faster vessel turnaround

- Emerging economies are increasing port development projects to support rising trade, generating significant opportunities for RMG crane suppliers. Infrastructure modernization in countries such as India and Vietnam is boosting crane procurement

- The need for integrated terminal operations and digitalization is reinforcing investments in RMG systems with smart control capabilities. Ports are adopting solutions that optimize crane scheduling, reduce congestion, and enhance cargo handling accuracy

Restraint/Challenge

High Capital Investment and Maintenance Costs

- The rail mounted gantry crane market faces challenges due to the significant capital required for procurement, installation, and commissioning of high-capacity automated systems. These investments can strain budgets for mid-sized ports and terminal operators

- For instance, Liebherr and Konecranes RMG cranes involve substantial upfront costs, making it critical for operators to evaluate ROI based on operational efficiency gains. Such high-cost investments may limit adoption among smaller ports with restricted budgets

- Maintenance of RMG cranes involves specialized services, periodic inspections, and replacement of critical components to ensure operational safety and reliability. These requirements increase operational expenditures and influence total cost of ownership

- The complexity of automated systems requires skilled technicians for operation and maintenance, creating additional training and staffing costs. Ensuring system uptime while managing maintenance schedules adds further financial pressure on operators

- Economic fluctuations and variability in global trade can impact investment planning for RMG infrastructure, affecting procurement cycles and expansion strategies. These constraints collectively challenge market growth and encourage manufacturers to offer flexible financing and service solutions

Rail Mounted Gantry Crane Market Scope

The market is segmented on the basis of capacity and application.

- By Capacity

On the basis of capacity, the Rail Mounted Gantry Crane market is segmented into up to 25 tons, 26–74 tons, 75–100 tons, and above 101 tons. The 26–74 tons segment dominated the largest market revenue share of 49.53% in 2025, driven by its widespread adoption across ports, container yards, and industrial facilities requiring medium-to-heavy lifting operations. Operators prefer this capacity range due to its optimal balance between lifting efficiency and operational flexibility, enabling smooth handling of standard shipping containers and bulk materials. The segment also benefits from the availability of advanced automation and remote control features, which enhance productivity and safety in high-traffic cargo zones. Its compatibility with existing infrastructure and cost-effectiveness compared to ultra-heavy cranes further reinforces its leadership in the market.

The above 101 tons segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing investments in large-scale port modernization and industrial expansion projects. For instance, DP World has adopted ultra-heavy RMG cranes to handle mega-containers and bulk cargo efficiently, boosting operational throughput. The growing demand for higher lifting capacities in congested port environments and the integration of automation for precision handling drive the adoption of cranes in this category. Their ability to handle oversized and heavy loads with minimal operational delays makes them an attractive choice for major logistics hubs.

- By Application

On the basis of application, the Rail Mounted Gantry Crane market is segmented into wharf, railway, and industrial. The wharf segment dominated the largest market revenue share in 2025, driven by the critical role of RMG cranes in container handling and cargo operations at seaports. Ports require robust, high-capacity cranes to manage increasing container volumes efficiently while ensuring safe and timely loading and unloading. Advanced automation, remote control features, and integration with terminal operating systems enhance operational efficiency, making RMG cranes the preferred choice for wharf operations. The segment is further supported by ongoing port expansion projects and global trade growth, which sustain high demand for these cranes.

The railway segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the modernization of rail freight corridors and increasing containerized cargo movement via rail networks. For instance, Indian Railways has deployed RMG cranes at major freight terminals to accelerate container handling and reduce turnaround times. The segment benefits from cranes designed for frequent loading and unloading along rail lines, offering high reliability and operational precision. Growing investment in rail infrastructure, combined with the need for faster cargo transit and reduced bottlenecks, fuels the adoption of RMG cranes in railway applications.

Rail Mounted Gantry Crane Market Regional Analysis

- Asia-Pacific dominated the rail mounted gantry crane market with the largest revenue share of 54.23% in 2025, driven by expanding port infrastructure, growing containerized cargo volumes, and increasing investments in automated cargo handling systems

- The region’s cost-effective manufacturing capabilities, rising investments in industrial modernization, and growing trade activities are accelerating market expansion

- The availability of skilled labor, supportive government policies, and rapid urbanization across developing economies are contributing to increased adoption of RMG cranes in port, railway, and industrial applications

China Rail Mounted Gantry Crane Market Insight

China held the largest share in the Asia-Pacific RMG crane market in 2025, owing to its status as a global hub for port operations, container handling, and industrial logistics. The country’s strong infrastructure development, favorable government policies supporting port modernization, and extensive export-import activities are major growth drivers. Demand is also bolstered by ongoing automation initiatives and investments in high-capacity cranes for efficient cargo movement across major ports and industrial zones.

India Rail Mounted Gantry Crane Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding freight corridors, port modernization projects, and increasing industrial cargo movement. Government initiatives such as Sagarmala and Make in India are strengthening infrastructure development and boosting crane adoption. In addition, rising investments in automated handling systems, expanding logistics networks, and increased trade volumes are contributing to robust market growth.

Europe Rail Mounted Gantry Crane Market Insight

The Europe RMG crane market is expanding steadily, supported by modernization of ports, stringent safety regulations, and high demand for container handling efficiency. The region emphasizes sustainable and automated cargo operations, particularly in industrial and port applications. Investments in advanced crane technologies, high-precision operations, and integration with digital terminal management systems are further enhancing market growth.

Germany Rail Mounted Gantry Crane Market Insight

Germany’s RMG crane market is driven by its leadership in industrial automation, well-established port infrastructure, and advanced engineering capabilities. The country has strong R&D networks and collaboration between industrial operators and equipment manufacturers, fostering innovation in high-capacity and automated cranes. Demand is particularly strong for industrial and port applications requiring precision handling and operational efficiency.

U.K. Rail Mounted Gantry Crane Market Insight

The U.K. market is supported by a mature port and logistics industry, ongoing modernization of container terminals, and adoption of automated cargo handling systems. With rising focus on safety, operational efficiency, and integration of digital monitoring systems, the U.K. continues to play a significant role in Europe’s high-value crane market. Investments in refurbishment of existing ports and expanding industrial logistics infrastructure further reinforce market growth.

North America Rail Mounted Gantry Crane Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing container traffic, industrial automation, and port expansion projects. Investments in high-capacity, automated RMG cranes to improve operational efficiency and cargo handling speed are boosting adoption. In addition, modernization of rail freight corridors and growing demand for industrial material handling are supporting market expansion.

U.S. Rail Mounted Gantry Crane Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its extensive port operations, advanced industrial infrastructure, and strong investment in automation. The country’s focus on high-efficiency cargo handling, safety, and integration of digital terminal management systems is encouraging adoption of RMG cranes. Presence of key crane manufacturers and a well-developed logistics network further solidify the U.S.'s leading position in the region.

Rail Mounted Gantry Crane Market Share

The rail mounted gantry crane industry is primarily led by well-established companies, including:

- Konecranes (Finland)

- Anupam Industries Limited (India)

- SANY Group (China)

- TNT Crane & Rigging (U.S.)

- Liebherr Group (Germany)

- Mi-Jack Products (U.S.)

- Doosan Heavy Industries & Construction (South Korea)

- Terex Corporation (U.S.)

- Macchine Operatrici Portuali SRL (Italy)

- Aimix Group Co., Ltd. (China)

- Dongqi Group (China)

- Zhengzhou Ellsen Heavy Machinery (China)

- SAFEX INDUSTRIES LIMITED (India)

- Henan Dafang Heavy Machine Co., Ltd (China)

- CARGOTEC (Finland)

- DGCRANE (China)

- GANTREX (France)

- GH CRANES & COMPONENTS (Spain)

- Hartmann & König Stromzuführungs AG (Germany)

- IHI Transport Machinery Co., Ltd (Japan)

- Künz GmbH (Austria)

- STONIMAGE (China)

- Weihua Group (China)

Latest Developments in Global Rail Mounted Gantry Crane Market

- In September 2025, Transnet Port Terminals signed a ten-year partnership with Liebherr covering multiple crane types and a 20-year asset-management program to enhance reliability across South African ports. This strategic initiative is expected to significantly reduce equipment downtime, optimize maintenance schedules, and improve overall terminal productivity. By ensuring long-term operational stability, the partnership is likely to drive sustained demand for advanced RMG cranes and reinforce confidence in large-scale infrastructure investments within the African port sector

- In June 2025, Huisman announced its first order for rail mounted yard gantry cranes, emphasizing lifecycle serviceability in new ASC and RMG designs. The focus on long-term serviceability and modular design addresses growing market requirements for cranes that offer minimal maintenance and extended operational lifespan. This development indicates rising adoption of technologically advanced and cost-efficient RMG cranes in container terminals, positioning them as essential assets for operators aiming to maximize throughput while controlling lifecycle costs

- In April 2025, RIKON completed the installation of a rail mounted gantry crane at Uzbekistan’s First Dry Port Terminal, highlighting increasing demand for efficient cargo handling solutions in Central Asian intermodal hubs. The deployment demonstrates the growing significance of RMG cranes in enhancing logistics connectivity in emerging markets and facilitating faster movement of goods through dry ports. It also reflects an expanding trend toward mechanized and automated cargo handling to meet regional trade growth and improve operational turnaround times

- In February 2025, Rijeka Gateway received its final two ship-to-shore cranes from ZPMC, completing yard equipment deliveries ahead of terminal launch. The timely completion of these deliveries ensures seamless operational readiness and exemplifies the importance of synchronized equipment deployment in modern port terminals. By enabling faster container handling and optimized yard operations, this milestone indirectly strengthens the RMG crane market by demonstrating integrated port solutions that enhance terminal efficiency and throughput

- In January 2025, DP World’s London Gateway terminal expanded its RMG crane fleet with automated high-capacity units to manage growing container volumes and accommodate larger ships. The investment reflects a global trend toward automation and high-efficiency material handling, highlighting the crucial role of RMG cranes in supporting advanced terminal operations. The expansion is expected to drive adoption of automated and smart RMG cranes worldwide, as operators seek to increase throughput, reduce operational bottlenecks, and meet rising demands in international trade

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.