Global Radiology Services Market

Market Size in USD Billion

CAGR :

%

USD

2.34 Billion

USD

10.63 Billion

2024

2032

USD

2.34 Billion

USD

10.63 Billion

2024

2032

| 2025 –2032 | |

| USD 2.34 Billion | |

| USD 10.63 Billion | |

|

|

|

|

Radiology Services Market Size

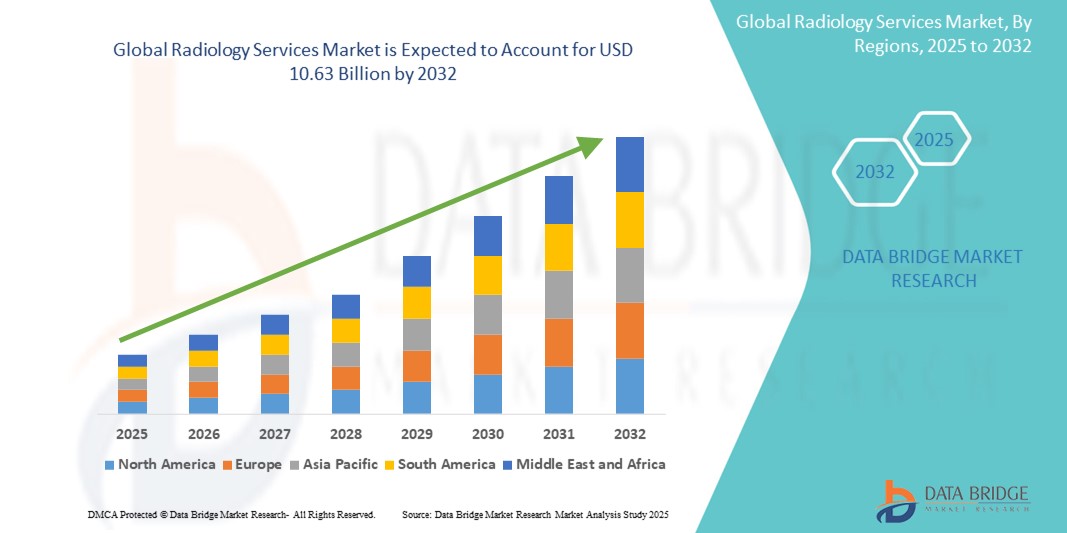

- The global radiology services market size was valued at USD 2.34 billion in 2024 and is expected to reach USD 10.63 billion by 2032, at a CAGR of 20.80% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases, increasing demand for early and accurate diagnosis, advancements in imaging technologies, and the growing adoption of teleradiology services worldwide.

Radiology Services Market Analysis

- The current radiology services market is steadily advancing due to the rising integration of digital imaging workflows that enhance the speed, precision, and accessibility of diagnostic interpretations across healthcare systems

- Market analysis highlights a consistent shift toward centralized imaging platforms where, for instance, cloud-based radiology tools allow seamless collaboration among specialists, ensuring faster turnaround times and improved patient outcomes

- North America dominates the Radiology Services market with the largest revenue share of 38.14% in 2024, due to a strong healthcare infrastructure that supports rapid adoption of advanced diagnostic imaging technologies

- Asia-Pacific is expected to be the fastest growing region in the Radiology Services market during the forecast period due to rapidly expanding healthcare infrastructure, rising medical tourism, and an increasing burden of chronic diseases

- The deadbolt segment dominates the largest market revenue share of 43.2% in 2025, driven by its widespread application in disease detection, treatment monitoring, and pre-surgical planning. Healthcare providers consistently rely on diagnostic imaging techniques such as magnetic resonance imaging and computed tomography for their precision, non-invasiveness, and real-time insights into internal body structures

Report Scope and Radiology Services Market Segmentation

|

Attributes |

Radiology Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Radiology Services Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- The radiology services market is steadily shifting toward cloud-based imaging systems that streamline data access and sharing across healthcare networks

- These platforms support remote diagnostics, enabling radiologists to evaluate imaging results from various locations without delay

- Cloud integration allows for seamless updates, easy scalability, and reduced reliance on physical infrastructure in imaging centers

- For instance, many hospitals now use centralized cloud dashboards that sync real-time patient imaging data with specialist devices for faster consultations

- In conclusion, this ongoing trend is not only modernizing radiology workflows but also reinforcing faster decision-making and better coordination in patient treatment pathways

Radiology Services Market Dynamics

Driver

“Growing Need for Early Disease Detection Through Imaging”

- The rising demand for early and accurate diagnosis is driving the growth of radiology services as imaging plays a crucial role in detecting chronic conditions such as cancer and cardiovascular diseases at treatable stages

- Medical imaging technologies such as magnetic resonance imaging and computed tomography are increasingly used to monitor disease progression and assist in therapy planning for real-time treatment adjustments

- For instance, hospitals now conduct routine low-dose computed tomography scans for early lung cancer detection among high-risk patients as part of standard screening programs

- The shift toward preventive healthcare and faster diagnostics has led many diagnostic centers to adopt high-resolution imaging systems with 3D capabilities that enhance diagnostic precision

- In conclusion, as healthcare facilities invest in digital infrastructure and imaging upgrades, the demand for skilled radiologists grows and radiology services become a foundational element in improving patient survival and reducing overall care costs

Restraint/Challenge

“High Operational Costs and Infrastructure Demands”

- A key challenge in the radiology services market is the high cost of acquiring and maintaining advanced imaging systems such as magnetic resonance imaging and computed tomography which require regular calibration and software upgrades

- Mid-sized and small diagnostic centers struggle with these expenses as they also need to invest in skilled professionals including radiologists, imaging technicians, and IT staff to manage operations

- For instance, private diagnostic clinics often delay upgrades to newer imaging technologies due to the cumulative financial burden of equipment, digital storage systems, and compliance with medical regulations

- Energy consumption is another concern as large imaging machines demand significant power and unplanned downtimes during maintenance can lead to revenue loss in busy facilities

- In conclusion, the inability of many developing healthcare providers to adopt or scale radiology services due to limited resources and reimbursement structures continues to slow overall market penetration despite growing demand for diagnostic imaging

Radiology Services Market Scope

The market is segmented on the basis of type, procedure, patient age, radiation type, application, and end users.

- By Type

On the basis of type, the radiology services market is segmented into product and services. The deadbolt segment dominates the largest market revenue share of 43.2% in 2025, driven by its widespread application in disease detection, treatment monitoring, and pre-surgical planning. Healthcare providers consistently rely on diagnostic imaging techniques such as magnetic resonance imaging and computed tomography for their precision, non-invasiveness, and real-time insights into internal body structures. The segment also benefits from continuous technological advancements and growing incorporation into regular preventive care protocols.

The teleradiology segment is anticipated to witness the fastest growth rate of 23.4% from 2025 to 2032, fueled by increasing demand for remote diagnostic services and the global shortage of specialized radiologists. Teleradiology enables timely interpretation of imaging scans across geographically dispersed locations, enhancing access to radiology expertise, especially in underserved and rural areas.

- By Procedure

On the basis of procedure, the radiology services market is segmented into conventional and digital. The wi-fi held the largest market revenue share in 2025 of, driven by the increasing shift toward fully digital imaging systems that provide high-resolution outputs and instant data sharing capabilities. Digital radiology streamlines workflows by enabling faster image acquisition, easier storage, and seamless integration with electronic health records, making it the preferred choice for modern healthcare facilities focused on efficiency and accuracy.

The conventional segment is expected to witness the fastest compound annual growth rate from 2025 to 2032, driven by its continued relevance in resource-limited settings where digital infrastructure is still developing. Conventional radiology remains in use due to its lower initial cost and familiarity among practitioners in smaller clinics and rural healthcare centers.

- By Patient Age

On the basis of patient age, the radiology services market is segmented into adults and pediatric. The smartphone-based unlocking held the largest market revenue share in 2025, driven by the higher prevalence of chronic diseases such as cardiovascular disorders, cancer, and orthopedic conditions among the adult population. Adults frequently undergo diagnostic and interventional imaging procedures for routine screenings, post-operative monitoring, and long-term disease management, making them the primary users of radiology services in clinical settings.

The pediatric segment is expected to witness the fastest compound annual growth rate from 2025 to 2032, favored by the rising focus on early diagnosis and specialized imaging techniques tailored for children. Pediatric radiology emphasizes low-dose imaging and child-friendly procedures to minimize radiation exposure and discomfort.

- By Radiation Type

On the basis of radiation type, the radiology services market is segmented into diagnostics and interventional radiology. The residential segment accounted for the largest market revenue share in 2024, driven by the widespread use of imaging techniques such as computed tomography, magnetic resonance imaging, and ultrasound for routine screening, disease detection, and treatment planning. The growing need for non-invasive diagnostic methods across healthcare settings contributes to the segment’s strong demand and integration into standard clinical workflows.

The interventional radiology segment is expected to witness the fastest compound annual growth rate from 2025 to 2032, driven by the increasing preference for minimally invasive procedures that reduce recovery time and lower healthcare costs. Interventional radiology techniques, such as image-guided biopsies, angioplasty, and catheter-based therapies, are gaining traction in both outpatient and inpatient care.

- By Application

On the basis of application, the radiology services market is segmented into cardiovascular, oncology, gynecology, neurology, urology, dental, pelvic and abdominal, musculoskeletal, and others. The residential segment accounted for the largest market revenue share in 2024, driven by the growing use of diagnostic imaging for early cancer detection, staging, and treatment response evaluation. Imaging modalities such as computed tomography and magnetic resonance imaging play a vital role in cancer care pathways, enabling timely intervention and personalized treatment strategies.

The neurology segment is expected to witness the fastest compound annual growth rate from 2025 to 2032, driven by the rising incidence of neurological disorders such as stroke, epilepsy, and neurodegenerative diseases. Neurological imaging, particularly magnetic resonance imaging and positron emission tomography, is increasingly used for real-time brain mapping and monitoring disease progression.

- By End Users

On the basis of end users, the radiology services market is segmented into hospitals, ambulatory centers, diagnostic centers, clinics, and others. The hospital segment accounted for the largest market revenue share of 52.07% in 2024, driven by high patient volumes, advanced infrastructure, and the availability of in-house imaging departments capable of handling a broad range of radiological procedures. Hospitals rely heavily on radiology for comprehensive diagnostics, surgical planning, and emergency care, making them central hubs for imaging services.

The diagnostic centers segment is expected to witness the fastest compound annual growth rate from 2025 to 2032, driven by the rising preference for cost-effective and accessible imaging services outside traditional hospital settings. These centers often specialize in high-demand imaging modalities and offer faster turnaround times for reports.

Radiology Services Market Regional Analysis

- North America dominates the radiology services market with the largest revenue share of 38.14% in 2024, due to a strong healthcare infrastructure that supports rapid adoption of advanced diagnostic imaging technologies

- The presence of major radiology service providers and technology innovators ensures continuous upgrades and integration of imaging systems across hospitals and diagnostic centers

- High awareness among patients and clinicians regarding the benefits of early diagnosis encourages routine use of imaging services across outpatient and inpatient settings supporting the continuous demand for radiology services.

U.S. Radiology Services Market Insight

The U.S. radiology services market captured the largest revenue share of 39.14% within north America in 2025, fueled by the widespread adoption of advanced diagnostic technologies and a strong presence of well-established healthcare infrastructure. high healthcare spending, growing awareness of preventive care, and robust insurance coverage contribute significantly to the demand for radiology services. the integration of artificial intelligence in imaging and the expansion of teleradiology networks further enhance service delivery and patient outcomes across the country.

Europe Radiology Services Market Insight

The European radiology services market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increased healthcare funding, digital transformation in hospitals, and efforts to streamline diagnostic workflows. Rising demand for early disease detection and aging populations across many European countries are fueling the use of both diagnostic and interventional radiology. The region is seeing significant investments in pacs systems and remote diagnostics, helping improve accessibility and efficiency in radiology departments.

U.K. Radiology Services Market Insight

The U.K. radiology services market is anticipated to grow at a noteworthy cagr during the forecast period, driven by the national health service’s (nhs) modernization plans and the rising focus on early diagnosis. Increasing referrals for imaging tests, along with growing use of computed tomography and magnetic resonance imaging in routine assessments, are supporting market growth. Government initiatives to address diagnostic backlogs and invest in digital imaging capacity are also influencing expansion.

Germany Radiology Services Market Insight

The German radiology services market is expected to expand at a considerable cagr during the forecast period, supported by strong technological innovation, digital infrastructure, and a high standard of medical care. Germany’s focus on value-based healthcare and real-time diagnostic accuracy has led to growing demand for automated imaging platforms and data analytics integration. Continued emphasis on reducing hospital stays and improving outpatient care quality is driving adoption of efficient radiology solutions.

Asia-Pacific Radiology Services Market Insight

The Asia-Pacific radiology services market is poised to grow at the fastest in 2025, driven by rapidly expanding healthcare infrastructure, rising medical tourism, and an increasing burden of chronic diseases. Countries such as China, India, and Japan are heavily investing in diagnostic capabilities and digital health transformation. In addition, government initiatives supporting universal health coverage and early screening programs are propelling the demand for radiology services in both urban and semi-urban areas.

Japan Radiology Services Market Insight

The Japan radiology services market is gaining momentum due to its advanced healthcare system, rapid aging population, and a strong emphasis on precision diagnostics. high demand for non-invasive imaging tools, along with the growing integration of artificial intelligence and robotics in radiology, is accelerating market growth. Japan’s commitment to early disease detection and health monitoring through annual check-ups ensures continued utilization of advanced imaging modalities.

China Radiology Services Market Insight

The China radiology services market accounted for the largest market revenue share in Asia pacific in 2025, attributed to massive healthcare reforms, a rising middle-class population, and extensive investments in hospital infrastructure. as the country continues to digitize its healthcare system, the adoption of advanced imaging technologies such as magnetic resonance imaging and computed tomography is expanding. local manufacturing capabilities and favorable government support further enhance the availability and affordability of radiology services across both metropolitan and rural areas.

Radiology Services Market Share

The Radiology Services industry is primarily led by well-established companies, including:

- Hitachi, Ltd. (Japan)

- Siemens (Germany)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- GENERAL ELECTRIC (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Aspect Imaging Ltd. (Israel)

- Bruker (U.S.)

- AURORA HEALTHCARE US CORP (U.S.)

- FONAR Corp. (U.S.)

- ESAOTE SPA (Italy)

- Neusoft Corporation (China)

- TOSHIBA CORPORATION (Japan)

- Sanrad Medical Systems Private Limited (India)

- FUJIFILM Holdings Corporation (Japan)

- ONEX Corporation (Canada)

- Hologic, Inc., (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd., (China)

- Quality Electrodynamics, LLC (U.S.)

- Shenzhen Anke High-tech Co., Ltd., (China)

- Magritek (Germany)

Latest Developments in Global Radiology Services Market

- On November, 2023, GE HealthCare launched a new AI suite at RSNA 2023, the annual radiology and medical imaging conference held in Chicago. The newly introduced product, named the MyBreastAI suite, aims to streamline radiologists’ workflows and enhance early detection of breast cancer in patients

- In June 2023, SimonMed Imaging, one of the largest outpatient medical imaging providers and radiology practices in the United States, announced the introduction of simonONE, offering affordable, rapid, non-invasive whole body MRI screening directly to patients

- In November 2023, MCRA, a prominent privately held independent Clinical Research Organization (CRO) and advisory firm specializing in medical devices, diagnostics, and biologics, announced the inauguration of its AI & Imaging Center. This center, the first of its kind, offered an integrated solution overseen by former FDA imaging specialists, encompassing the entire lifecycle of medical device products

- In August 2021, Amazon Web Services, a subsidiary of Amazon that provides on-demand cloud computing platforms and APIs, has partnered with GE Healthcare. The two businesses will work together to give hospitals and healthcare vendors AI and cloud-based imaging solutions and clinical and operational data

- In Jun-2021, Royal Philips partnered with Akumin, a major outpatient diagnostic imaging services provider. The new Philips Radiology Operations Command Center would be implemented across Akumin's outpatient imaging centres as part of this partnership, and clinical standards for Akumin's MR and CT imaging modalities would be jointly developed

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.