Global Radar Transmitter Market

Market Size in USD Billion

CAGR :

%

USD

3.81 Billion

USD

6.17 Billion

2025

2033

USD

3.81 Billion

USD

6.17 Billion

2025

2033

| 2026 –2033 | |

| USD 3.81 Billion | |

| USD 6.17 Billion | |

|

|

|

|

Radar Transmitter Market Size

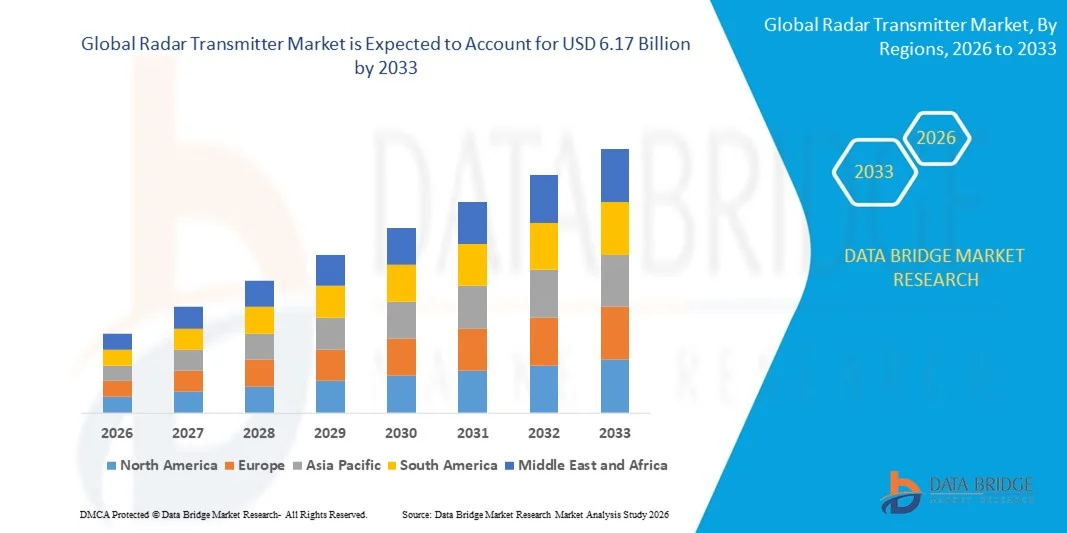

- The global radar transmitter market size was valued at USD 3.81 billion in 2025 and is expected to reach USD 6.17 billion by 2033, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by the rising adoption of radar-based level measurement solutions across industries such as oil and gas, chemicals, water treatment, and power generation

- In addition, increasing investments in industrial automation and process optimization are contributing to strong market expansion

Radar Transmitter Market Analysis

- The market is witnessing steady growth driven by the transition from traditional ultrasonic and mechanical sensors to advanced radar-based transmitters due to their higher accuracy, durability, and compatibility with evolving industrial standards

- Increasing emphasis on operational safety, real-time monitoring, and efficiency across manufacturing and processing industries continues to strengthen market adoption

- North America dominated the radar transmitter market with the largest revenue share in 2025, driven by the strong adoption of industrial automation technologies and the rising need for accurate level and flow measurement across process industries

- Asia-Pacific region is expected to witness the highest growth rate in the global radar transmitter market, driven by rapid industrialization, expanding manufacturing sectors, and growing investments in defense and infrastructure development

- The C and X Band segment held the largest market revenue share in 2025, driven by its widespread use in industrial level and flow measurement applications, owing to its stable performance across varying environmental conditions. These bands are extensively adopted in sectors such as oil and gas, chemicals, and water treatment due to their ability to deliver reliable readings with minimal interference

Report Scope and Radar Transmitter Market Segmentation

|

Attributes |

Radar Transmitter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Emerson Electric Co. (U.S.) |

|

Market Opportunities |

• Growing Demand For Non-Contact Level Measurement • Rising Adoption Of 80 GHz Radar Technology |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Radar Transmitter Market Trends

Rise of High-Frequency Radar Technology Adoption

- The growing shift toward high-frequency radar transmitters, especially 80 GHz systems, is transforming industrial level measurement by offering greater precision, narrower beam angles, and improved performance in complex tank geometries. These systems provide stable results even in vessels with internal obstructions, foam, or vapor presence. Their ability to deliver accurate readings under extreme temperature and pressure conditions is strengthening demand across process industries

- The increasing use of compact and maintenance-free radar devices is accelerating adoption across sectors such as chemicals, oil and gas, and water treatment, where harsh process conditions demand reliable non-contact measurement. These transmitters reduce the need for frequent recalibration, resulting in lower operational costs for facility operators. Their robust construction also ensures consistent performance even in corrosive or dust-filled environments

- The affordability and ease of integration of modern high-frequency radar units are making them suitable for both brownfield upgrades and new industrial installations, improving operational efficiency and safety. Many plants are replacing outdated ultrasonic and mechanical sensors with advanced radar systems that integrate seamlessly with digital control platforms. This ease of deployment helps minimize downtime and enhances plant-wide measurement accuracy

- For instance, in 2024, several petrochemical plants in Europe reported improved measurement stability after replacing legacy ultrasonic sensors with 80 GHz radar devices, resulting in reduced downtime and more consistent process control. These upgrades also contributed to improved compliance with safety standards and reduced manual intervention during inspections. The enhanced performance encouraged many plants to extend radar adoption across additional tanks and silos

- While high-frequency radar systems are transforming industrial automation, sustained growth will depend on continued innovation, user training, and broader integration with digital monitoring platforms. Manufacturers must focus on developing intuitive interfaces that simplify configuration for operators with varying skill levels. Expansion of IoT-enabled radar solutions will further enhance remote monitoring and predictive maintenance capabilities

Radar Transmitter Market Dynamics

Driver

Increasing Demand for Accurate Level Measurement in Process Industries

- The rising need for precise and reliable level measurement in industries such as oil and gas, pharmaceuticals, and food processing is driving strong adoption of radar transmitters. These devices offer superior accuracy unaffected by temperature, pressure, or vapor variations, leading to higher operational efficiency. Their long-term stability and reduced drift make them ideal for critical applications where precision is essential

- Process operators are increasingly aware of the financial risks linked to inaccurate measurements, including product loss, equipment damage, and regulatory non-compliance. This heightened awareness is encouraging widespread use of radar-based solutions across both large and mid-sized facilities. With growing focus on asset optimization, operators are prioritizing advanced technologies that offer measurable improvements in reliability

- Government initiatives and industry regulations are strengthening the demand for advanced monitoring technologies. Supportive standards related to plant safety and environmental compliance are encouraging companies to upgrade from conventional sensors to radar transmitters. Regulatory push for real-time monitoring and automation is further accelerating market adoption

- For instance, in 2023, regulatory bodies across North America introduced stricter guidelines for storage tank monitoring, boosting demand for non-contact radar systems in refineries and chemical plants. These regulations require continuous level tracking to prevent spills, overfills, and environmental hazards. As a result, operators are investing heavily in radar transmitters to ensure compliance and reduce long-term liabilities

- While rising industry awareness is enhancing adoption, there remains a strong need for modernization of aging infrastructure and integration of radar technologies with digital and automated control systems. Many plants in developing regions still rely on outdated monitoring tools that hinder process efficiency. Upgrading these systems will be key to unlocking the full benefits of radar-based measurement

Restraint/Challenge

High Cost of Advanced Radar Systems and Deployment Barriers

- The high price of advanced radar transmitters, especially FMCW and high-frequency units, makes them less accessible for small-scale facilities and cost-sensitive industries. Capital investment requirements remain a major barrier for widespread deployment. Many operators delay adoption due to budget constraints, even when the long-term savings are clear

- In many developing regions, limited technical expertise and a shortage of trained personnel hinder the adoption of complex radar technologies. Installation challenges and calibration requirements further discourage smaller operators. The lack of hands-on training programs contributes to operational errors and reduced system efficiency

- Market penetration is also affected by supply chain constraints and inconsistent availability of specialized components, particularly in remote industrial areas. These challenges often lead facilities to continue using older, less accurate measurement devices. Dependence on imported components can also cause long lead times, slowing modernization efforts

- For instance, in 2024, several water treatment facilities in Southeast Asia reported delays in radar transmitter upgrades due to long lead times and limited local service support. These delays affected plant performance and forced operators to rely on interim manual measurements. The lack of local technicians amplified maintenance challenges

- While radar technology continues to advance, solving cost, training, and supply chain limitations will be essential for expanding adoption and unlocking long-term market potential. Manufacturers and distributors must collaborate to build strong regional support networks. Affordable entry-level radar models and modular service frameworks can help broaden market reach

Radar Transmitter Market Scope

The market is segmented on the basis of range, type, industrial vertical, and product.

- By Range

On the basis of range, the radar transmitter market is segmented into C and X Band, K Band, W Band, and Others. The C and X Band segment held the largest market revenue share in 2025, driven by its widespread use in industrial level and flow measurement applications, owing to its stable performance across varying environmental conditions. These bands are extensively adopted in sectors such as oil and gas, chemicals, and water treatment due to their ability to deliver reliable readings with minimal interference.

The W Band segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising demand for high-frequency, high-precision radar solutions with superior resolution and narrow beam capabilities. Its strong adoption in modern automated plants, especially where precise measurements are required in complex tanks or high-pressure systems, is driving segment expansion.

- By Type

On the basis of type, the radar transmitter market is segmented into Contact Type and Non-Contact Type. The Non-Contact Type segment held the largest market revenue share in 2025, supported by its increasing adoption in hazardous and hard-to-reach industrial environments where direct contact with materials is not feasible. These transmitters offer minimal maintenance, long service life, and stable performance even in corrosive or high-temperature conditions.

The Contact Type segment is projected to grow steadily from 2026 to 2033, driven by its use in applications that require direct immersion measurement for improved accuracy in certain liquid processes. Its cost-effectiveness and suitability for specific industrial setups with simpler operational requirements are contributing to its continued demand.

- By Industrial Vertical

On the basis of industrial vertical, the radar transmitter market is segmented into Military and Defence, Oil and Gas, Chemical, Mining, Water Waste Treatment, Telecommunication, Food and Beverages, and Others. The Oil and Gas segment held the largest market revenue share in 2025 owing to the high need for precise level and flow monitoring in storage tanks, pipelines, and processing units. Stringent safety regulations and the growing adoption of automation technologies further support segment dominance.

The Water Waste Treatment segment is expected to witness rapid growth from 2026 to 2033, driven by rising global investments in water infrastructure modernization and the increasing use of radar systems for continuous and accurate water level monitoring. The growing emphasis on sustainable water management and reduced operational downtime is also accelerating adoption.

- By Product

On the basis of product, the radar transmitter market is segmented into short, medium, and long range. The Medium range segment accounted for the largest market revenue share in 2025 due to its versatility and broad applicability across industrial tanks, reactors, and processing vessels. Its ability to provide stable readings in environments with steam, dust, or foam makes it a preferred choice for many manufacturing facilities.

The Long range segment is expected to grow at the fastest rate from 2026 to 2033, supported by the increasing deployment of radar transmitters in large storage silos, deep tanks, and outdoor monitoring applications. Demand is further fuelled by advancements in high-frequency radar technology that enhance accuracy over extended distances.

Radar Transmitter Market Regional Analysis

- North America dominated the radar transmitter market with the largest revenue share in 2025, driven by the strong adoption of industrial automation technologies and the rising need for accurate level and flow measurement across process industries

- Industries in the region place strong emphasis on efficiency, real-time monitoring, and reliability, which drives the preference for radar transmitters over traditional measurement technologies. Sectors such as oil and gas, chemicals, and water treatment increasingly utilize radar systems for their precision, non-contact operation, and stable performance in harsh environments

- This widespread adoption is further supported by strong regulatory frameworks, high capital spending, and the rapid integration of digital monitoring platforms, establishing radar transmitters as a preferred solution for industrial measurement and automation applications across North America

U.S. Radar Transmitter Market Insight

The U.S. radar transmitter market captured the largest revenue share in 2025 within North America, driven by large-scale investments in industrial automation and the growing need for accurate measurement systems across refineries, chemical plants, and water infrastructure. Facilities across the U.S. are rapidly upgrading from conventional sensors to radar-based technologies to enhance accuracy, reliability, and compliance with strict safety regulations. The strong shift toward IIoT-enabled radar transmitters and integration with advanced digital platforms such as cloud-based monitoring systems is further accelerating market growth. Moreover, the presence of major technology providers and a strong focus on modernization of aging industrial assets contribute significantly to the expansion of the radar transmitter market in the U.S.

Europe Radar Transmitter Market Insight

The Europe radar transmitter market is expected to witness the fastest growth rate from 2026 to 2033, supported by stringent environmental and safety regulations across industrial facilities. The region’s increasing focus on energy efficiency, precision monitoring, and sustainable operations is driving strong adoption of radar transmitters. Growing industrial automation initiatives, particularly in chemicals, food and beverages, and water treatment sectors, are contributing to expanding demand. Radar transmitters are being increasingly incorporated into both newly built facilities and modernized infrastructure, reflecting Europe’s commitment to advanced measurement technologies.

U.K. Radar Transmitter Market Insight

The U.K. radar transmitter market is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising investments in automation, modernization of process industries, and a growing emphasis on improving plant safety and efficiency. Increasing concerns related to operational risks and regulatory compliance are encouraging industries to adopt accurate, non-contact radar measurement solutions. The strong penetration of digital technologies and expanding industrial innovation ecosystem in the U.K. are anticipated to further propel demand for radar transmitters across key sectors such as chemicals, water treatment, and oil and gas.

Germany Radar Transmitter Market Insight

The Germany radar transmitter market is expected to witness the fastest growth rate from 2026 to 2033, driven by the country’s strong focus on advanced engineering, industrial automation, and sustainable operations. German industries are rapidly adopting high-accuracy radar systems to optimize process efficiency and ensure compliance with strict environmental and safety standards. The integration of radar transmitters into modern industrial automation frameworks, along with the country’s emphasis on Industry 4.0 adoption, is significantly accelerating market growth in both manufacturing and process industries.

Asia-Pacific Radar Transmitter Market Insight

The Asia-Pacific radar transmitter market is expected to witness the fastest growth rate from 2026 to 2033, supported by rapid industrialization, rising investments in manufacturing and processing facilities, and increasing demand for automation across countries such as China, Japan, and India. The shift toward smart factories, combined with government initiatives aimed at improving industrial efficiency and safety, is driving widespread adoption of radar measurement technologies. As APAC continues to strengthen its position as a global manufacturing hub, the affordability and availability of radar transmitters are expanding, enabling broader market penetration across industries.

Japan Radar Transmitter Market Insight

The Japan radar transmitter market is expected to witness the fastest growth rate from 2026 to 2033, driven by the country’s advanced technological ecosystem and strong emphasis on precision, automation, and efficiency. Japanese industries prioritize high-performance measurement solutions that support smart manufacturing and seamless integration with IoT-enabled systems. The increasing adoption of radar transmitters in sectors such as chemicals, food and beverages, and water treatment reflects Japan’s focus on accuracy, safety, and operational optimization. In addition, the country’s aging industrial workforce is driving demand for automated and reliable measurement technologies.

China Radar Transmitter Market Insight

The China radar transmitter market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid industrial expansion, strong government support for automation, and increasing investments in smart manufacturing. China is one of the largest markets for industrial instrumentation, and radar transmitters are becoming widely adopted across sectors such as oil and gas, chemicals, mining, and water treatment. The country’s strong domestic manufacturing capabilities, combined with the growing availability of cost-effective radar solutions, are contributing significantly to market growth. In addition, China’s large-scale industrial modernization initiatives and continuous push toward digital transformation are further strengthening demand for advanced radar transmitter technologies.

Radar Transmitter Market Share

The Radar Transmitter industry is primarily led by well-established companies, including:

• Emerson Electric Co. (U.S.)

• Lockheed Martin Corporation (U.S.)

• BAE Systems (U.K.)

• Rheinmetall AG (Germany)

• General Dynamics Corporation (U.S.)

• Saab AB (Sweden)

• Collins Aerospace (U.S.)

• ABB (Switzerland)

• Endress+Hauser Group Services AG (Switzerland)

• Siemens (Germany)

• VEGA Grieshaber KG (Germany)

• KROHNE Messtechnik GmbH (Germany)

• Honeywell International Inc. (U.S.)

• Yokogawa Electric Corporation (Japan)

• AMETEK Inc. (U.S.)

• Magnetrol (U.S.)

• Dwyer Instruments Inc. (U.S.)

• WIKA Alexander Wiegand SE & Co. KG (Germany)

• SOR Inc. (U.S.)

• Spectris plc (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Radar Transmitter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Radar Transmitter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Radar Transmitter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.