Global Rack Stacker Market

Market Size in USD Million

CAGR :

%

USD

605.05 Million

USD

714.49 Million

2025

2033

USD

605.05 Million

USD

714.49 Million

2025

2033

| 2026 –2033 | |

| USD 605.05 Million | |

| USD 714.49 Million | |

|

|

|

|

Rack Stacker Market Size

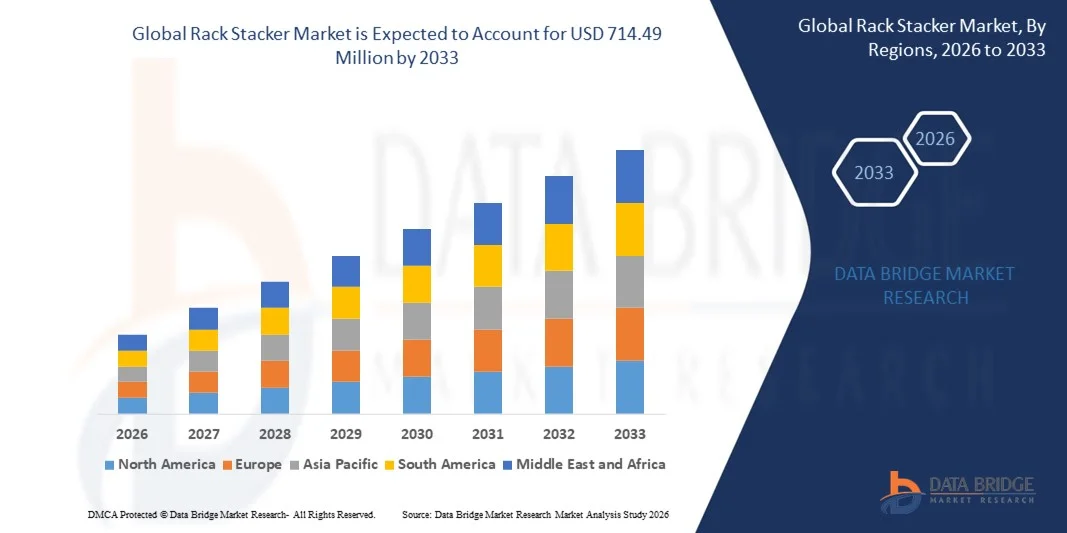

- The global rack stacker market size was valued at USD 605.05 million in 2025 and is expected to reach USD 714.49 million by 2033, at a CAGR of 2.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for automated material handling solutions, rising e-commerce activities, and the need for efficient warehouse and storage management

- Growing adoption of smart warehouses and Industry 4.0 technologies is further enhancing operational efficiency and reducing labor dependency, supporting market expansion

Rack Stacker Market Analysis

- The rack stacker market is witnessing steady growth due to the rising focus on warehouse automation and operational efficiency

- Demand is supported by technological advancements in stacker design, enhanced safety features, and integration with warehouse management systems

- North America dominated the global rack stacker market with the largest revenue share of 38.75% in 2025, driven by the growing demand for automated material handling solutions and modern warehousing infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global rack stacker market, driven by rising e-commerce penetration, growing manufacturing and logistics activities, and government initiatives promoting smart warehousing and industrial automation

- The Electric segment held the largest market revenue share in 2025 driven by higher efficiency, lower operating costs, and growing adoption in modern automated warehouses. Electric rack stackers offer enhanced lifting speed, battery-powered mobility, and reduced labor requirements, making them a preferred choice for high-volume distribution and industrial operations

Report Scope and Rack Stacker Market Segmentation

|

Attributes |

Rack Stacker Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Rack Stacker Market Trends

Technological Advancements and Automation Integration

- The increasing integration of automation and smart technologies is significantly shaping the global rack stacker market, as businesses seek solutions that enhance efficiency, accuracy, and throughput in warehouse and material handling operations. Rack stackers with features such as IoT connectivity, automated guidance systems, and real-time data analytics are gaining traction across logistics, retail, and manufacturing industries. This trend encourages manufacturers to innovate with advanced solutions that support intelligent warehousing and Industry 4.0 initiatives

- Growing emphasis on workforce safety and operational ergonomics has accelerated the adoption of high‑performance rack stackers equipped with advanced safety mechanisms and operator assistance systems. Warehouse managers and supply chain operators are actively investing in equipment that minimizes human error, reduces accident risks, and supports continuous operations, prompting suppliers to enhance safety protocols and compliance certifications

- Sustainability and energy efficiency trends are influencing purchasing decisions, with companies prioritizing electric and battery‑powered rack stackers over traditional fuel‑based models. These eco‑friendly alternatives help reduce carbon footprints, lower operating costs, and align with corporate environmental goals. Manufacturers are also using marketing strategies to highlight these benefits to reinforce brand positioning and appeal to environmentally conscious customers

- For instance, in 2025, logistics firms in the U.S. and Germany expanded their fleets by incorporating automated and electric rack stackers in distribution centers to improve throughput and reduce energy consumption. These deployments were part of broader efforts to modernize supply chain infrastructure, with distribution across industrial, retail, and e‑commerce facilities. The solutions were promoted as high‑efficiency and low‑emission choices, strengthening operational resilience and customer satisfaction

- While demand for advanced rack stackers is rising, sustained market growth depends on continuous R&D, cost‑effective production, and seamless integration with existing warehouse management systems. Manufacturers are also focusing on improving scalability, serviceability, and modular designs that balance performance, flexibility, and total cost of ownership for diverse end users

Rack Stacker Market Dynamics

Driver

Expansion of E‑Commerce and Modern Warehousing

- Rapid growth in e‑commerce and omni‑channel retail is a major driver for the global rack stacker market as companies expand warehouse space and optimize inventory handling to meet rising consumer demand. Rack stackers help improve storage density, reduce handling time, and support high‑velocity operations, enabling businesses to achieve faster order fulfillment and better space utilization

- Increasing investments in modern warehousing and distribution infrastructure across regions are influencing market growth. Demand for efficient material handling solutions that can support automated systems, dynamic slotting, and high stacking heights is driving adoption of advanced rack stackers. This trend is further reinforced by rising demand for just‑in‑time inventory management and lean logistics practices

- Material handling equipment manufacturers and suppliers are actively promoting rack stacker solutions through product innovation, extended service networks, and flexible financing options. These efforts are supported by collaborations with warehouse integrators and logistics providers to tailor solutions for specific operational requirements, reducing downtime and improving return on investment

- For instance, in 2024, retail and logistics companies in China and the U.S. reported increased implementation of high‑capacity rack stackers in fulfillment centers. This expansion followed higher demand for rapid order processing and space optimization, driving repeat investments in material handling technologies. Both regions also emphasized system interoperability and lifecycle support to strengthen supply chain efficiency

- Although expanding e‑commerce and warehousing modernization support growth, wider adoption depends on addressing cost concerns, aftermarket support, and skilled operator availability. Investment in training programs, robust maintenance services, and flexible deployment models will be essential for meeting diverse customer needs and maintaining competitive advantage

Restraint/Challenge

High Initial Investment and Infrastructure Constraints

- The relatively high initial investment required for advanced rack stacker systems remains a key challenge, limiting adoption among small and medium‑sized enterprises. The cost of acquiring automated or high‑capacity equipment can be prohibitive, especially for companies with budget constraints or limited access to financing

- Infrastructure limitations in older warehouses and facilities also restrict market growth, as retrofit projects for accommodating taller racks, wider aisles, or automated guidance systems can incur significant expenses. Limited floor space and structural constraints may reduce the feasibility of deploying advanced stacker solutions in certain environments

- Operator skill gaps and training requirements further impact market expansion, as effective utilization of sophisticated rack stackers depends on skilled personnel. Companies must invest in training programs and certification initiatives to ensure safety, efficiency, and compliance with operational standards

- For instance, in 2025, distribution centers in Brazil and South Africa reported slower adoption of high‑end rack stackers due to budgetary constraints and infrastructure inadequacies. Challenges such as limited aisle space, older racking systems, and insufficient training programs contributed to cautious investment strategies. These factors also prompted some operators to rely on manual or semi‑automated solutions, affecting overall market penetration

- Overcoming these challenges will require cost‑optimization strategies, modular product designs, and targeted educational efforts. Collaboration with financing partners, industry associations, and training providers can help unlock long‑term growth potential of the global rack stacker market. Furthermore, developing adaptable solutions that align with varied infrastructure and skill levels will be essential for broader adoption

Rack Stacker Market Scope

The market is segmented on the basis of type and end user.

- By Type

On the basis of type, the global rack stacker market is segmented into Electric, Manual/Hydraulic, and Semi-Electric. The Electric segment held the largest market revenue share in 2025 driven by higher efficiency, lower operating costs, and growing adoption in modern automated warehouses. Electric rack stackers offer enhanced lifting speed, battery-powered mobility, and reduced labor requirements, making them a preferred choice for high-volume distribution and industrial operations.

The Semi-Electric segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its combination of manual maneuverability and powered lifting, which offers cost-effective performance for small to medium-sized warehouses. Semi-Electric rack stackers are particularly popular for their ease of use, flexible deployment, and suitability in environments with limited space or moderate lifting requirements.

- By End User

On the basis of end user, the market is segmented into Retail and Wholesale, Logistics, Automobile, Food and Beverages, and Others. The Logistics segment held the largest market revenue share in 2025 due to increasing demand for efficient material handling solutions in e-commerce fulfillment centers, third-party logistics facilities, and large distribution hubs. Rack stackers help improve storage density, reduce handling time, and enhance operational efficiency, supporting high-throughput logistics operations.

The Food and Beverages segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for temperature-controlled storage, hygienic handling, and faster turnover in warehouses and processing units. Rack stackers in this segment are increasingly used for stacking pallets, moving packaged goods, and optimizing warehouse space while maintaining food safety and quality standards.

Rack Stacker Market Regional Analysis

- North America dominated the global rack stacker market with the largest revenue share of 38.75% in 2025, driven by the growing demand for automated material handling solutions and modern warehousing infrastructure

- Businesses in the region highly value the efficiency, safety features, and integration capabilities offered by advanced rack stackers in distribution centers, fulfillment hubs, and manufacturing facilities

- This widespread adoption is further supported by high investment in e-commerce, well-developed logistics networks, and the increasing focus on warehouse automation, establishing rack stackers as a preferred solution across retail, logistics, and industrial sectors

U.S. Rack Stacker Market Insight

The U.S. rack stacker market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of e-commerce, distribution centers, and third-party logistics operations. Companies are increasingly prioritizing automation to enhance storage density, reduce labor costs, and improve operational throughput. The growing demand for electric and semi-electric stackers, combined with integration of warehouse management systems (WMS), is further driving market growth. In addition, investments in smart warehouses and automated material handling systems are contributing to the U.S. market’s expansion.

Europe Rack Stacker Market Insight

The Europe rack stacker market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by modernization of warehouses, rising industrial automation, and stringent safety regulations. Growing adoption of energy-efficient, electric-powered stackers and the need for optimized storage solutions are fueling market expansion. European companies are also focusing on reducing operational costs and improving workforce safety, supporting the deployment of advanced rack stackers across manufacturing, retail, and logistics facilities.

U.K. Rack Stacker Market Insight

The U.K. rack stacker market is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing trend of warehouse automation and the demand for efficient material handling solutions. Rising e-commerce activities, expansion of retail and wholesale distribution networks, and the need to optimize storage space are encouraging businesses to adopt rack stackers. In addition, government initiatives supporting smart logistics infrastructure further stimulate market growth.

Germany Rack Stacker Market Insight

The Germany rack stacker market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising industrial automation, technological innovation, and demand for energy-efficient equipment. Germany’s well-developed logistics infrastructure and focus on sustainable material handling solutions promote the adoption of electric and semi-electric rack stackers. Integration with warehouse management systems and advanced safety features are increasingly sought by manufacturers and distribution centers across the country.

Asia-Pacific Rack Stacker Market Insight

The Asia-Pacific rack stacker market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, increasing e-commerce penetration, and rising investments in modern warehousing facilities in countries such as China, Japan, and India. The region’s growing focus on warehouse efficiency and labor optimization is driving adoption of automated and electric stackers. Moreover, government support for smart logistics and rising domestic manufacturing of material handling equipment are expanding accessibility and affordability of rack stackers in APAC.

Japan Rack Stacker Market Insight

The Japan rack stacker market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s emphasis on advanced technology adoption, high labor costs, and the need for efficient warehouse operations. Japanese companies are increasingly investing in electric and semi-electric stackers to improve storage utilization, reduce operational time, and enhance safety. Integration with automated storage and retrieval systems (ASRS) and IoT-enabled warehouse solutions is further propelling market growth.

China Rack Stacker Market Insight

The China rack stacker market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding manufacturing base, rapid urbanization, and increasing adoption of automated warehouses. China is one of the largest hubs for e-commerce and industrial logistics, driving strong demand for high-capacity and electric stackers. Government initiatives promoting smart logistics, combined with competitive domestic manufacturers, are key factors propelling the market in China

Rack Stacker Market Share

The Rack Stacker industry is primarily led by well-established companies, including:

- CLARK (U.S.)

- Crown Equipment Corporation (U.S.)

- Doosan Corporation (South Korea)

- Godrej (India)

- Hangcha (China)

- Hyster-Yale Materials Handling, Inc. (U.S.)

- Jungheinrich AG (Germany)

- KION GROUP AG (Germany)

- MITSUBISHI LOGISNEXT CO.,LTD. (Japan)

- TOYOTA INDUSTRIES CORPORATION (Japan)

- BEUMER GROUP (Germany)

- Columbus McKinnon Corporation (U.S.)

- Daifuku Co., Ltd. (Japan)

- Dearborn Mid-West Company (U.S.)

- Fives Group (France)

- FlexLink (Sweden)

- Honeywell Intelligrated (U.S.)

- JBT (U.S.)

- Liebherr-International AG (Switzerland)

- Mecalux, S.A. (Spain)

- Murata Machinery, Ltd. (Japan)

- Siemens (Germany)

- Schaefer Systems International Pvt Ltd (India)

- System Logistics S.p.A. (Italy)

- viastore SYSTEMS (Germany)

- Grenzebach Group (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.