Global Quick Response Qr Code Payment Technologies Market

Market Size in USD Billion

CAGR :

%

USD

15.35 Billion

USD

179.81 Billion

2024

2032

USD

15.35 Billion

USD

179.81 Billion

2024

2032

| 2025 –2032 | |

| USD 15.35 Billion | |

| USD 179.81 Billion | |

|

|

|

|

Quick Response (QR) Code Payment Technologies Market Size

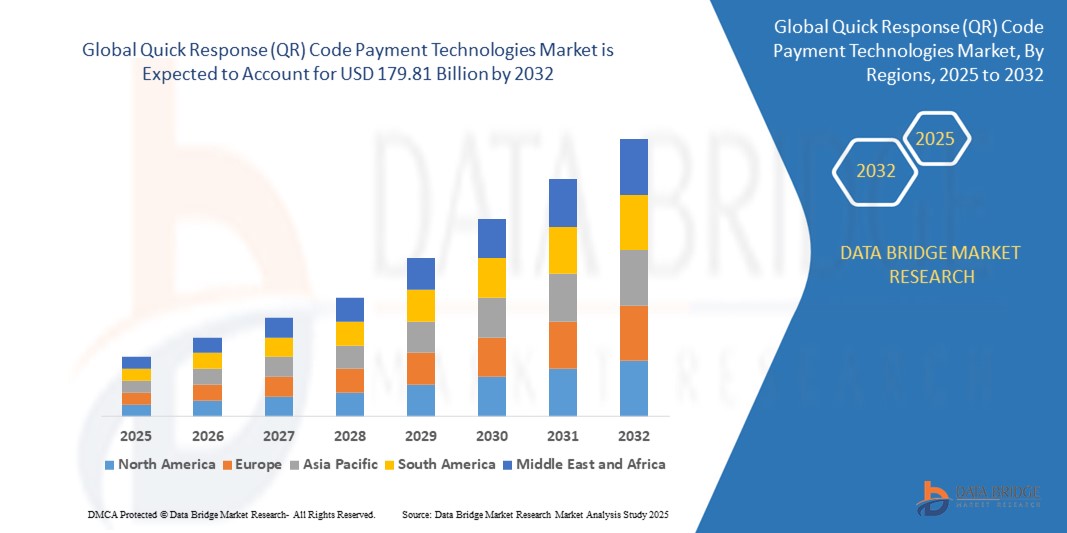

- The global quick response (QR) code payment technologies market size was valued at USD 15.35 billion in 2024 and is expected to reach USD 179.81 billion by 2032, at a CAGR of 36.01% during the forecast period

- The market growth is largely fueled by the widespread adoption of smartphones and the accelerating shift toward cashless transactions, leading to increased digitalization across retail, banking, and public service sectors

- Furthermore, rising consumer demand for fast, secure, and contactless payment methods is positioning QR code technology as a preferred solution for both in-store and remote transactions. These converging factors are driving the integration of QR payment options into mobile wallets, banking apps, and merchant platforms, thereby significantly boosting the industry's growth

Quick Response (QR) Code Payment Technologies Market Analysis

- QR code payment technologies enable users to make digital transactions by scanning a code through a mobile device, offering a low-cost, efficient, and contactless alternative to traditional payment methods. These systems are widely used in P2P transfers, retail payments, e-commerce, and public services, enhancing convenience and accessibility

- The surging demand for QR-based payments is primarily driven by increasing smartphone penetration, expansion of mobile internet access, and growing support from fintech platforms and governments. The simplicity of QR integration and its compatibility with both smartphones and POS systems are further accelerating market adoption across global economies

- North America dominated the quick response (QR) code payment technologies market with a share of 39.5% in 2024, due to the high penetration of smartphones, digital wallets, and mobile banking across the region

- Asia-Pacific is expected to be the fastest growing region in the quick response (QR) code payment technologies market during the forecast period due to rapid smartphone adoption, government-backed digital economy initiatives, and widespread merchant acceptance

- Proximity payment segment dominated the market with a market share of 61.9% in 2024, due to the growing adoption of smartphones with built-in QR scanning capabilities and the increased acceptance of contactless payment solutions among retailers and consumers. The widespread integration of QR payment options into point-of-sale (POS) systems and digital wallets has enabled consumers to make quick, secure transactions without physical contact, aligning with post-pandemic hygiene preferences and digital convenience

Report Scope and Quick Response (QR) Code Payment Technologies Market Segmentation

|

Attributes |

Quick Response (QR) Code Payment Technologies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Quick Response (QR) Code Payment Technologies Market Trends

“Growing Contactless Payments Adoption”

- A significant and accelerating trend in the QR code payment technologies market is the widespread adoption of contactless payments, fueled by consumer demand for convenience, hygiene, and speed in transactions, especially after the COVID-19 pandemic

- For instance, major companies such as PayPal, Block, Inc. (Square), Revolut Ltd, and Mastercard are aggressively expanding their QR code payment solutions, enabling merchants and consumers to transact seamlessly without physical contact

- The technology’s simplicity requiring only a smartphone and a scannable code has driven adoption across diverse sectors, including retail, hospitality, transportation, and healthcare, with large retailers such as Starbucks, Walmart, and Target integrating QR code payments at checkout to streamline the customer experience

- In Asia, QR code payments have become the dominant method for both formal and informal transactions, supported by mobile wallets and national payment frameworks that ensure interoperability and financial inclusion

- The market is also witnessing innovation in cross-border payments, multi-currency support, and integration with loyalty programs, as providers compete to attract merchants and consumers in a rapidly growing digital economy

- Growing consumer preference for fast, secure, and contactless payment options positions QR code payment technologies as a pivotal component of the future digital payment ecosystem, driving continued innovation and adoption worldwide

Quick Response (QR) Code Payment Technologies Market Dynamics

Driver

“Increased Smartphone Penetration”

- The rapid increase in smartphone penetration is a major driver for the QR code payment technologies market, as it enables a broader population to access and use digital payment solutions

- For instance, companies such as PayPal, Stripe, and SumUp are leveraging the growing base of smartphone users to expand their QR code payment offerings, making it easier for both small businesses and large enterprises to accept digital payments without costly hardware investments

- The proliferation of digital wallets and mobile banking apps that support QR code payments is further fueling market growth, as consumers increasingly rely on their mobile devices for shopping, banking, and peer-to-peer transfers

- The ease of use and accessibility of QR code payments appeal to younger, tech-savvy consumers, while also bridging the financial inclusion gap in developing economies where traditional banking infrastructure may be limited

- As smartphone adoption continues to rise globally, QR code payment technologies are expected to become even more prevalent in everyday transactions

Restraint/Challenge

“Security Concerns among Users”

- Security concerns remain a significant challenge in the QR code payment technologies market, as users and merchants worry about potential fraud, phishing attacks, and data breaches

- For instance, the risk of malicious QR codes redirecting users to fraudulent websites or capturing sensitive payment information has prompted companies such as Mastercard and PayPal to invest in enhanced security features, such as encrypted transactions, real-time fraud monitoring, and user authentication protocols

- Regulatory bodies and industry groups are working to establish standardized security frameworks and best practices to build user trust and ensure safe adoption of QR code payment systems

- Despite these efforts, ongoing education and awareness campaigns are needed to help users identify legitimate QR codes and avoid common scams, especially as adoption expands into new regions and demographics

- Addressing these security challenges will be crucial for sustaining the rapid growth and mainstream acceptance of QR code payment technologies worldwide

Quick Response (QR) Code Payment Technologies Market Scope

The market is segmented on the basis of type, purchase type, and end user.

- By Type

On the basis of type, the QR code payment technologies market is segmented into proximity payment and remote payment. The proximity payment segment dominated the largest market revenue share of 61.9% in 2024, largely driven by the growing adoption of smartphones with built-in QR scanning capabilities and the increased acceptance of contactless payment solutions among retailers and consumers. The widespread integration of QR payment options into point-of-sale (POS) systems and digital wallets has enabled consumers to make quick, secure transactions without physical contact, aligning with post-pandemic hygiene preferences and digital convenience.

The remote payment segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the surge in e-commerce activities, food delivery services, and online bill payment platforms. Remote QR code payment offers users the flexibility to scan codes via messaging apps, emails, or websites, enhancing convenience for businesses operating outside traditional storefronts. Its increasing integration in peer-to-peer (P2P) payment systems and remote merchant invoicing is further driving adoption across diverse digital environments.

- By Purchase Type

On the basis of purchase type, the market is segmented into airtime transfers and top-ups, money transfers and payments, merchandise and coupons, and travel and ticketing. The money transfers and payments segment held the largest revenue share in 2024 due to its foundational role in enabling P2P transactions, bill payments, and business transactions through QR interfaces. The simplicity of scanning a QR code to transfer funds instantly, coupled with lower transaction costs compared to traditional banking channels, is boosting adoption, particularly in developing economies with a large unbanked population.

The travel and ticketing segment is expected to grow at the fastest CAGR from 2025 to 2032, supported by rising digitalization in public transportation, ride-hailing services, and airline check-in processes. QR codes are increasingly being used for mobile boarding passes, event tickets, and travel bookings, enabling streamlined operations and reducing the need for physical documentation. The shift towards contactless travel solutions and the integration of QR payments in travel-related mobile apps are further accelerating this segment’s growth.

- By End User

On the basis of end user, the market is segmented into hospitality and tourism sector, BFSI, media and entertainment, retail sector, education, and IT and telecom. The retail sector dominated the largest market share in 2024, driven by the rapid shift toward cashless transactions, especially among small and medium-sized merchants leveraging QR-based payment systems for affordability and ease of use. Retailers benefit from quicker checkout processes, improved customer experience, and reduced reliance on physical hardware such as card readers.

The hospitality and tourism sector is projected to witness the fastest growth from 2025 to 2032, propelled by the increasing demand for seamless and hygienic payment methods in hotels, restaurants, and travel-related services. QR code payments enable contactless room service, in-app ordering, and mobile check-outs, catering to digitally-savvy travelers and enhancing operational efficiency. The adoption of QR technology in this sector also supports multilingual and cross-border payments, aligning with global tourism recovery trends.

Quick Response (QR) Code Payment Technologies Market Regional Analysis

- North America dominated the quick response (QR) code payment technologies market with the largest revenue share of 39.5% in 2024, driven by the high penetration of smartphones, digital wallets, and mobile banking across the region

- Consumers in the region increasingly prefer QR-based payments for their speed, ease of use, and contactless nature, especially in sectors such as retail, food services, and e-commerce

- The widespread use of mobile payment platforms, strong financial infrastructure, and tech-savvy population are fostering rapid adoption, positioning QR code solutions as a mainstream payment method in North America

U.S. QR Code Payment Technologies Market Insight

The U.S. market accounted for largest share within North America's revenue share in 2024, supported by the rising shift towards digital transactions and the integration of QR codes into retail POS systems, banking apps, and peer-to-peer payment platforms. The widespread adoption of platforms such as PayPal, Venmo, and Apple Pay with embedded QR functionality, along with the growing merchant acceptance, is significantly driving market expansion. In addition, increased use of QR codes in event ticketing, restaurant menus, and loyalty programs continues to strengthen their presence in daily consumer interactions.

Europe QR Code Payment Technologies Market Insight

The Europe market is projected to witness robust growth during the forecast period, attributed to heightened demand for secure, cashless payment methods and regulatory support for digital transformation. European retailers, public transit systems, and financial institutions are increasingly deploying QR code payment systems to improve operational efficiency and consumer convenience. The adoption is further supported by growing smartphone usage, rising e-commerce transactions, and an emphasis on data privacy and security.

U.K. QR Code Payment Technologies Market Insight

The U.K. market is expected to grow at a notable CAGR throughout the forecast period, driven by the surge in contactless commerce and mobile-first banking. QR code payments are gaining ground in sectors such as retail, hospitality, and transportation, where ease of access and transaction speed are critical. Fintech innovation, a competitive digital payments landscape, and the shift in consumer preferences toward mobile wallets and self-service checkouts are advancing market penetration.

Germany QR Code Payment Technologies Market Insight

Germany’s market is expanding steadily, fueled by rising awareness of digital financial tools and increasing usage of QR codes in B2C and B2B payment ecosystems. German consumers are gradually adopting QR-based payments in stores, invoices, and government services. Regulatory efforts to support financial digitization and a focus on secure payment authentication are boosting trust in QR payment systems, especially within retail, healthcare, and public sector applications.

Asia-Pacific QR Code Payment Technologies Market Insight

Asia-Pacific is expected to register the fastest CAGR from 2025 to 2032, driven by rapid smartphone adoption, government-backed digital economy initiatives, and widespread merchant acceptance. Consumers in countries such as China, India, and Southeast Asia are shifting towards mobile-first transactions, with QR codes playing a central role in both urban and rural settings. The region's thriving fintech environment and cost-effectiveness of QR solutions are accelerating adoption across multiple sectors.

Japan QR Code Payment Technologies Market Insight

Japan’s QR code payment market is growing steadily, with increased usage in retail, hospitality, and transit systems. Although traditionally reliant on cash and IC cards, the market is shifting as major companies and government campaigns promote QR adoption. Integration with loyalty programs and secure authentication features is enhancing user appeal. Japan’s focus on efficient, high-tech service delivery aligns well with the expansion of QR payment technologies.

China QR Code Payment Technologies Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, driven by the mass adoption of mobile wallets such as Alipay and WeChat Pay, which use QR codes as a primary transaction interface. QR payments are deeply embedded in the consumer economy—from street vendors to high-end retailers. Strong fintech infrastructure, near-universal smartphone penetration, and widespread QR code literacy among both consumers and merchants underpin China’s leadership in this space.

Quick Response (QR) Code Payment Technologies Market Share

The quick response (QR) code payment technologies industry is primarily led by well-established companies, including:

- Mastercard (U.S.)

- Econet Wireless Zimbabwe (Zimbabwe)

- Visa (U.S.)

- American Express Company (U.S.)

- Boku Inc. (U.S.)

- Airtel India (India)

- Stripe (U.S.)

- PayPal (U.S.)

- Microsoft (U.S.)

- Vodacom (South Africa)

- PayU (Netherlands)

- Comviva (India)

- Novatti Group Pty Ltd (Australia)

- Paysafe Holdings UK Limited (U.K.)

- Bank of America Corporation (U.S.)

- Wirecard (Germany)

- Paytm (India)

- Apple Inc. (U.S.)

Latest Developments in Global Quick Response (QR) Code Payment Technologies Market

- In June 2024, Dinara, a well-known social media influencer from Moscow, captured widespread attention on the internet with her quirky quest for an Indian husband. At an Indian shopping center, she posed with a male mannequin, holding a humorous sign that read, "Looking for an Indian husband (unmarried)." To facilitate connections, she included a QR code on the placard that linked directly to her Instagram profile

- In May 2024, PhonePe, the Bengaluru-based financial technology giant, forged a partnership with LankaPay to introduce PhonePeUPI payments in Sri Lanka. This innovative payment solution aims to enhance the digital transaction experience for users and stimulate Indian tourism in the island nation. By streamlining payment processes, it promises to contribute positively to Sri Lanka’s local economy, attracting more visitors and fostering cross-border commerce

- In February 2024, SuperUs, an Indian technology innovator, unveiled a groundbreaking Dynamic QR Code device that is set to transform the digital payment landscape in India. This device seamlessly integrates with cash and checkout terminals, enhancing transaction efficiency and customer experience. Businesses will benefit from its easy implementation and improved payment processes, potentially increasing customer satisfaction and driving growth in the rapidly evolving financial technology sector

- In December 2022, Matera, a Brazilian company specializing in QR code technology and instant payment solutions, expanded its operations into the United States by opening new headquarters in San Francisco. This strategic move is fueled by the remarkable success of Pix, an instant payment system embraced by 70% of Brazilians. Matera aims to enhance its international presence while adapting to the fast-evolving payments landscape, meeting the demands of global consumers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.