Global Quantum Cryptography Market

Market Size in USD Million

CAGR :

%

USD

219.20 Million

USD

1,689.30 Million

2024

2032

USD

219.20 Million

USD

1,689.30 Million

2024

2032

| 2025 –2032 | |

| USD 219.20 Million | |

| USD 1,689.30 Million | |

|

|

|

|

Quantum Cryptography Market Size

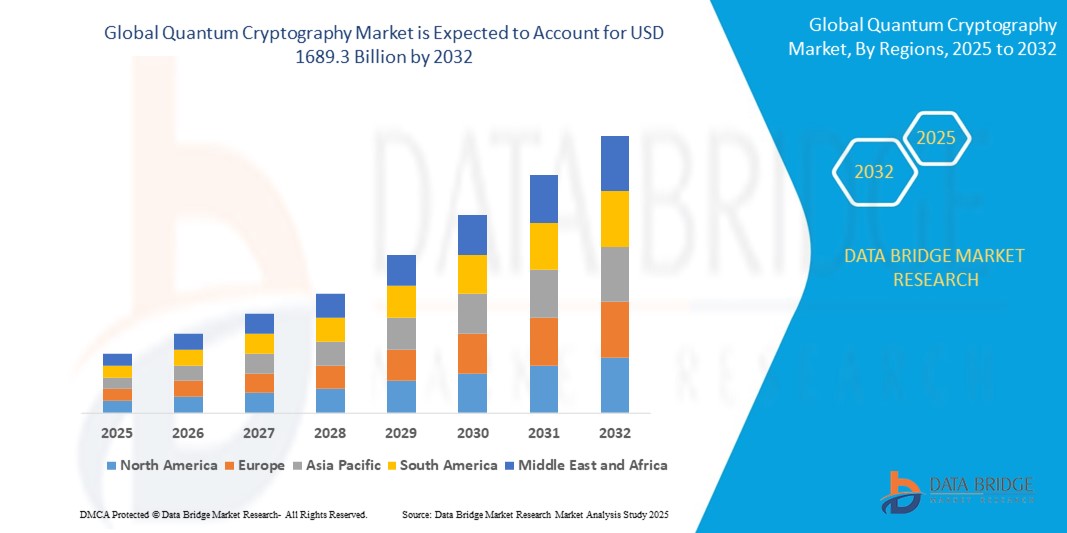

- The Global Quantum Cryptography Market size was valued at USD 219.2 Million in 2024 and is expected to reach USD 1689.3 billion by 2032, at a CAGR of 33.9% during the forecast period

- The Market expansion is driven by Escalating concerns over data integrity and privacy, especially in critical sectors like defence, BFSI, and telecom.

- Strong demand from intelligence agencies and military entities for quantum key distribution (QKD) and ultra-secure communication channels.

Quantum Cryptography Market Analysis

- With increasing cases of cyberattacks and sophisticated data breaches, enterprises and governments are turning to quantum cryptography for enhanced security. Its capability to deliver theoretically unbreakable encryption makes it highly desirable in national defense, financial services, and healthcare.

- Governments globally are investing heavily in quantum communication infrastructure and R&D. National programs in countries like the U.S., China, and EU nations are accelerating market adoption through grants, public-private partnerships, and regulatory support.

- Asia Pacific holds the largest market share, accounting for 38.5% of global revenue in 2025, driven by Integration with Emerging Technologies.

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, fuelled by Quantum-safe communication solutions are being prioritized by military, aerospace, and critical infrastructure sectors. As traditional encryption is expected to be vulnerable to future quantum computers, quantum cryptography is becoming an urgent upgrade path.

- The Software segment is expected to dominate the market with a share of 62.1% in 2025 The integration of quantum cryptography with 5G, IoT, and edge computing opens up scalable and future-proof security models. This convergence can unlock new use cases in smart cities, autonomous vehicles, and secure financial networks.

Report Scope and Quantum Cryptography Market Segmentation

|

Attributes |

Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Quantum Cryptography Market Trends

“Integration with Post-Quantum Cryptography Standards and Government Initiatives”

- A significant trend in the quantum cryptography market is the adoption of post-quantum cryptography (PQC) standards to counteract the potential threats posed by quantum computers to current encryption methods.

- For instance, in August 2024, the National Institute of Standards and Technology (NIST) released the first three finalized PQC standards: FIPS 203, FIPS 204, and FIPS 205. These standards aim to provide quantum-resistant encryption algorithms to secure data against future quantum attacks.

- The UK's National Cyber Security Centre (NCSC) has advised organizations to transition to post-quantum cryptography by 2035, emphasizing the need for proactive measures to safeguard against quantum-enabled cyber threats.

- Companies like Toshiba Europe have demonstrated practical implementations of quantum key distribution (QKD) over existing telecom networks, achieving secure quantum-encrypted communication over 254 km without the need for specialized infrastructure.

- These developments indicate a growing focus on integrating quantum-resistant technologies into existing systems to enhance cybersecurity resilience.

Quantum Cryptography Market Dynamics

Driver

“Escalating Cybersecurity Threats and Data Breaches”

- The increasing frequency and sophistication of cyberattacks have heightened the demand for advanced security solutions like quantum cryptography.

- For instance, in May 2024, Terra Quantum AG, a Switzerland-based quantum technology company, launched TQ42 Cryptography, an open-source post-quantum cryptography library designed for secure data transmission, storage, and authentication. This technology supports integration of quantum-resistant security into applications across mobile, web, IoT, and cloud platforms.

- Quantum cryptography offers enhanced security features, such as the ability to detect eavesdropping attempts, making it a compelling option for organizations seeking robust data protection.

- The financial sector, in particular, has shown increased interest, with over 50% of banks exploring quantum-safe cryptographic solutions to safeguard sensitive information.

Restraint/Challenge

“High Implementation Costs and Integration Complexities”

- The deployment of quantum cryptographic systems involves substantial costs, including specialized hardware like photon detectors and the establishment of secure key distribution networks.

- For instance, in 2025, Toshiba manufactures quantum-secured communication systems leveraging QKD technology, with major deployments in the financial and government sectors. Toshiba holds a 12-16% market share in 2025.

- These high initial investments can be prohibitive, especially for small and medium-sized enterprises.

- Additionally, integrating quantum cryptography into existing IT infrastructures presents technical challenges, such as compatibility issues and the need for significant system overhauls.

Quantum Cryptography Market Scope

The market is segmented based on Component, Algorithm Type, Enterprise Size, Encryption Type, Deployment Protocol, and Application.

- By Component

On the basis of Component, the Quantum Cryptography Market is segmented into Hardware, Software, Services. The Software segment dominates the market, commanding an impressive market share of 62.1% in 2025, driven by the increasing frequency and sophistication of cyberattacks have heightened the demand for advanced security solutions like quantum cryptography. Quantum cryptography offers enhanced security features, such as the ability to detect eavesdropping attempts, making it a compelling option for organizations seeking robust data protection.

The Services segment, encompassing software and services, is projected to grow at a robust CAGR of 14.2% from 2025 to 2032, fueled by Escalating Cybersecurity Threats and Data Breaches.

- By Algorithm Type

On the basis of Algorithm Type, the market is segmented into Symmetric Key, Asymmetric Key. The Symmetric Key segment holds the largest market share 51.2 in 2025, driven by Increasing reliance on cloud services creates demand for quantum-resistant data protection mechanisms.

The Asymmetric Key segment is anticipated to witness the fastest CAGR of 15.1% from 2025 to 2032, propelled by Growing concerns over data breaches and cyberattacks are increasing demand for quantum-safe security solutions.

- By Enterprise Size

On the basis of application, the market is segmented into Small and Medium Enterprise (SMEs). The Small and Medium Enterprise (SMEs) segment holds the largest market share in 2025, driven by the risk that quantum computers will break current encryption methods is driving early adoption of quantum cryptography.

The Large Enterprise segment is anticipated to witness the fastest CAGR of 15.1% from 2025 to 2032, propelled by National security applications are a major driver, with public sector funding for quantum-secure communications growing steadily.

- By Encryption Type

On the basis of Encryption Type, the market is segmented into Network Encryption, Database Encryption, Application Security, Cloud Encryption. The Network Encryption segment holds the largest market share in 2025, driven by the enterprise shift to cloud environments is creating demand for enhanced encryption through QKD.

- By Deployment Protocol

On the basis of Deployment Protocol, the market is segmented into TSL/SSL Protocol, BB84 Protocol. The TSL/SSL Protocol segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the Progress in quantum optics and photonics is making QKD systems more practical and cost-efficient.

- By Application

On the basis of Application, the market is segmented into Simulation, Optimization, Sampling. The Simulation segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the the proliferation of connected devices opens new markets for secure quantum communication.

- By Vertical

On the basis of Vertical, the market is segmented into Government, Healthcare, Automotive, Manufacturing, Banking, Financial Services and Insurance (BFSI), IT and Telecom, Defence, Education, Others. The Government segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the Banks and fintech companies are exploring quantum cryptography to protect high-value transactions and sensitive data.

Quantum Cryptography Market Regional Analysis

- North America dominates the Global Quantum Cryptography Market, capturing a substantial revenue share of 41.5% in 2025, driven by Joint R&D projects are speeding up innovation and bringing products to market faster.

- Emerging cybersecurity regulations are pushing organizations to consider quantum-resilient solutions.

U.S. Quantum Cryptography Market Insight

The United States accounts for an impressive 81% of the North American market share in 2025, fueled by the increasing concerns over data privacy and cybersecurity threats, particularly with the impending advent of quantum computing, which could render traditional encryption obsolete. Governments and defense agencies are investing heavily in quantum-secure communication technologies to safeguard national security infrastructure.

Europe Quantum Cryptography Market Insight

The European Quantum Cryptography Market is projected to grow at a significant CAGR throughout the forecast period, driven by growing demand for secure cloud computing and data center services is fueling adoption in the private sector. Technological advancements and research funding are enabling scalable and cost-effective quantum key distribution (QKD) systems, expanding market accessibility.

U.K. Quantum Cryptography Market Insight

The United Kingdom’s Quantum Cryptography Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rise of 5G networks and IoT ecosystems presents opportunities for secure data transmission using quantum cryptographic solutions. Financial institutions are exploring quantum cryptography to protect sensitive transactions and customer data.

Germany Quantum Cryptography Market Insight

Germany’s Quantum Cryptography Market is expected to expand at a considerable CAGR, fueled by Strategic partnerships between tech firms and academic institutions are accelerating innovation and commercialization. Furthermore, increasing regulatory support for advanced cybersecurity standards and compliance requirements across industries acts as a strong catalyst.

Asia-Pacific Quantum Cryptography Market Insight

The Asia-Pacific region is poised to register the fastest CAGR of 16.8% in 2025, driven by the Academic-industry collaborations, standardization efforts, and regulatory support are creating a conducive environment for long-term market development.

Japan Quantum Cryptography Market Insight

The Japan’s Quantum Cryptography Market is gaining significant momentum, driven by its Rising Cybersecurity Threats: Increasing incidences of data breaches and cyberattacks are pushing organizations to adopt unbreakable encryption technologies like quantum cryptography.

China Quantum Cryptography Market Insight

The China commands the largest market share in the Asia-Pacific region in 2025, attributed to its massive construction sector, government-supported smart city initiatives, and the presence of leading domestic manufacturers such as NVC Lighting and Opple Lighting. The country’s expanding middle class, rapid urbanization, and high rates of technological adoption are driving the widespread adoption of LED lighting in residential, commercial, and institutional applications.

Quantum Cryptography Market Share

The indoor led lighting industry is primarily led by well-established companies, including:

- ID Quantique

- QuintessenceLabs.

- Crypta Labs

- Anhui Qasky Quantum Technology Co. Ltd.

- QUBITEKK

- ISARA Corporation

- PQ Solutions Limited.

- QuantumCTek Co., Ltd.

- MagiQ Technologies

- NuCrypt

- Quantum Xchange.

- Aurea Technology

- qutools GmbH

- Qunu Labs Pvt.LTD

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- IBM Corporation

- Hewlett-Packard Development Company, L.P.

- NEC Corporation

- TOSHIBA CORPORATION

Latest Developments in Global Quantum Cryptography Market

- In April 2025, KETS Quantum Security, a Bristol-based startup, delivered a prototype quantum cybersecurity system to BT for testing. This silicon chip-based technology uses light to transmit quantum-encrypted keys, enabling secure communications and detection of any interception attempts.

- In March 2025, Cloudflare announced the integration of post-quantum cryptography into its Zero Trust Network Access solution. This enhancement aims to secure data as organizations route communications from web browsers to corporate applications, with plans to extend support to all IP protocols by mid-2025.

- In December 2023, Bengaluru-based QNu Labs secured $6.5 million in a Pre-Series A1 funding round. The investment supports the development of their quantum technology solutions, including quantum key distribution and quantum random number generators.

- In November 2022, QuintessenceLabs launched its qOptica QKD technology, which provides enhanced security against cyber-attacks. It uses continuous-variable quantum key distribution (CV-QKD) to distribute keys securely over an optical link.

- In March 2024, China Telecom Quantum Information Technology Group Co. acquired a 23.1% stake in QuantumCTek for $265 million. This strategic move aims to bolster China Telecom's presence in the quantum communication sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Quantum Cryptography Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Quantum Cryptography Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Quantum Cryptography Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.