Global Qpcr And Dpcr Market

Market Size in USD Billion

CAGR :

%

USD

10.67 Billion

USD

21.35 Billion

2024

2032

USD

10.67 Billion

USD

21.35 Billion

2024

2032

| 2025 –2032 | |

| USD 10.67 Billion | |

| USD 21.35 Billion | |

|

|

|

|

Q-PCR and D-PCR Devices Market Size

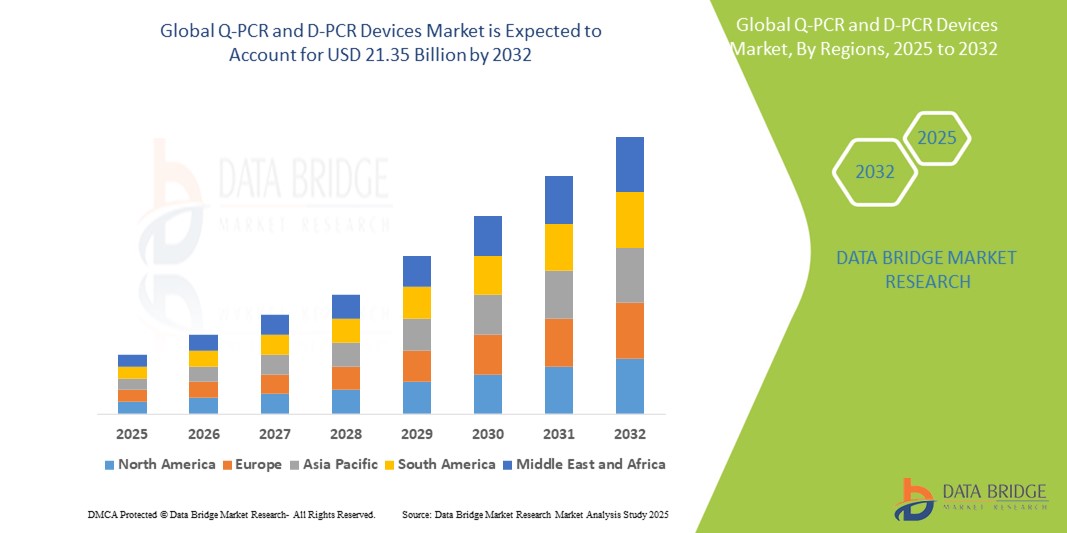

- The global Q-PCR and D-PCR devices market size was valued at USD 10.67 billion in 2024 and is expected to reach USD 21.35 billion by 2032, at a CAGR of 9.05% during the forecast period

- The market growth is largely fueled by the increasing incidence and prevalence of infectious diseases and genetic disorders globally, driving the demand for rapid and accurate diagnostic solutions

- Furthermore, continuous technological advancements in PCR technologies, including enhanced sensitivity, precision, and automation, are expanding their applications across diverse fields

Q-PCR and D-PCR Devices Market Analysis

- Q-PCR (quantitative Polymerase Chain Reaction) and D-PCR (digital Polymerase Chain Reaction) devices are increasingly vital tools in modern molecular diagnostics and research, offering precise and sensitive nucleic acid quantification. These technologies are crucial for various applications due to their high specificity, accuracy, and efficiency in detecting and quantifying genetic material

- The escalating demand for Q-PCR and D-PCR devices is primarily fueled by the rising incidence and prevalence of infectious diseases and genetic disorders, a growing focus on personalized medicine, and continuous technological advancements leading to improved efficiency and automation

- North America dominates the Q-PCR and D-PCR devices market with the largest revenue share of 38.5% in 2024, characterized by substantial investments in genomics research, a well-established healthcare infrastructure, and the strong presence of key industry players

- Asia-Pacific is expected to be the fastest growing region in the Q-PCR and D-PCR devices market with a CAGR of 9.3% during the forecast period due to increasing healthcare investments, rising prevalence of infectious diseases, and growing R&D activities in pharmaceutical and biotechnology companies

- Research segment dominates the Q-PCR and D-PCR devices market with a market share of 59.6% in 2024, driven by its extensive use of these technologies in genomics, gene expression analysis, biomarker discovery, and the increasing demand for precise nucleic acid quantification in various scientific studies and drug development

Report Scope and Q-PCR and D-PCR Devices Market Segmentation

|

Attributes |

Q-PCR and D-PCR Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Q-PCR and D-PCR Devices Market Trends

“Advancements in Automation and AI Integration for Enhanced Precision and Throughput”

- A significant and accelerating trend in the global Q-PCR and D-PCR devices market is the deepening integration of automation, artificial intelligence (AI), and machine learning (ML). This fusion of technologies is significantly enhancing the precision, efficiency, and throughput of molecular diagnostic and research workflows

- For instance, companies are developing fully integrated dPCR systems, such as the Applied Biosystems QuantStudio Absolute Q Digital PCR System, designed to provide accurate and consistent results within a rapid timeframe by automating various steps. Similarly, advancements in microfluidics are leading to miniaturized and portable devices that offer faster analyses and lower reagent consumption through enhanced automation

- AI and ML integration in Q-PCR and D-PCR workflows enables features such as improved data analysis, pattern recognition, and automation. This helps in reducing human error and providing real-time data interpretation, leading to faster and more reliable results. For example, AI-powered PCR systems can optimize workflows in laboratories, allowing for high-throughput testing and better management of large-scale diagnostics, crucial in areas such as infectious disease surveillance and personalized medicine

- The seamless integration of Q-PCR and D-PCR devices with automated platforms and AI-driven software facilitates streamlined workflows and comprehensive data management. This creates a unified and efficient experience, from sample preparation to result interpretation

- This trend towards more intelligent, automated, and interconnected molecular testing systems is fundamentally reshaping user expectations for diagnostic accuracy and speed. Consequently, companies are investing in R&D to develop advanced systems that incorporate AI and automation to meet the increasing demand for precise and efficient nucleic acid quantification

- The demand for Q-PCR and D-PCR devices offering seamless automation and AI integration is growing rapidly across clinical, research, and forensic sectors, as users increasingly prioritize high-throughput capabilities, reduced hands-on time, and enhanced data reliability

Q-PCR and D-PCR Devices Market Dynamics

Driver

“Rising Prevalence of Infectious Diseases and Genetic Disorders, Coupled with Advancements in Personalized Medicine”

- The increasing global incidence and prevalence of infectious diseases and genetic disorders are significant drivers for the heightened demand for Q-PCR and D-PCR devices

- For instance, the COVID-19 pandemic significantly underscored the critical role of Q-PCR in large-scale diagnostic testing, driving substantial investment and adoption

- As the need for rapid, accurate, and sensitive diagnostic solutions grows, Q-PCR and D-PCR offer unparalleled capabilities for early detection, pathogen identification, and disease monitoring

- Furthermore, the growing emphasis on personalized medicine, which tailorsmedical treatment to an individual's genetic profile, relies heavily on the precise nucleic acid quantification capabilities of Q-PCR and D-PCR

- These technologies enable biomarker discovery, monitoring treatment responses, and identifying genetic predispositions, making them indispensable in the evolving landscape of precision healthcare. The continuous development of more efficient and automated systems, alongside increasing research and development activities in genomics and proteomics, further propels the adoption of Q-PCR and D-PCR in clinical, research, and pharmaceutical settings

Restraint/Challenge

“High Initial Costs and Complex Data Analysis Requirements”

- The high initial investment costs associated with Q-PCR and especially D-PCR instruments, along with their specialized reagents and consumables, pose a significant challenge to broader market adoption

- For instance, advanced dPCR systems can range from tens of thousands to over a hundred thousand USD, making them less accessible for smaller laboratories or those in developing regions with limited budgets

- This financial barrier can deter potential buyers, particularly those who might find existing qPCR systems sufficient for their needs, even if dPCR offers higher precision for specific applications

- Furthermore, the complexity of data analysis and interpretation, especially for D-PCR, requires specialized technical expertise. While Q-PCR data analysis is relatively established, D-PCR generates large datasets that necessitate advanced software and trained personnel for accurate interpretation and quality control

- Overcoming these challenges through the development of more affordable and user-friendly instruments, coupled with simplified data analysis solutions and comprehensive training programs, will be vital for sustained market growth

Q-PCR and D-PCR Devices Market Scope

The market is segmented on the basis of technology, products and services, application, and end user.

- By Technology

On the basis of technology, the Q-PCR and D-PCR devices market is segmented into quantitative PCR and digital PCR. The quantitative PCR (qPCR) segment held a dominant share of the market in 2024, driven by its widespread adoption in various applications due to its established reliability, cost-effectiveness, and broad utility in real-time nucleic acid quantification. qPCR's robustness and versatility make it a primary choice for routine molecular diagnostics and research

The digital PCR (dPCR) segment is anticipated to exhibit the fastest growth during the forecast period, owing to its superior sensitivity and precision for absolute quantification, particularly in applications requiring detection of low-abundance targets, rare mutations, and copy number variations. Its growing recognition in areas such as liquid biopsy and gene therapy drives its rapid expansion

- By Product and Services

On the basis of products and services, the Q-PCR and D-PCR devices market is segmented into reagents & consumables, instruments, and software. The reagents & consumables segment dominated the market with the largest market share in 2024, as these components are essential for every PCR experiment and are consumed regularly. The continuous demand for high-quality and specialized kits for various applications fuels this segment's growth

The software segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing need for advanced data analysis, automation, and workflow management in PCR applications. As data complexity grows, sophisticated software solutions become critical for efficient and accurate interpretation.

- By Application

On the basis of application, the Q-PCR and D-PCR devices market is segmented into clinical applications, research, forensic, and others. The research segment dominated the Q-PCR and D-PCR devices market with a market share of 59.6% in 2024, driven by the extensive use of these technologies in genomics, gene expression analysis, biomarker discovery, and the increasing demand for precise nucleic acid quantification in various scientific studies and drug development. Academic and pharmaceutical R&D drive consistent demand

The clinical applications segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the rising prevalence of infectious diseases and genetic disorders, and the growing adoption of personalized medicine. The need for rapid and accurate diagnostics in hospitals and diagnostic centers is a key drive

- By End User

On the basis of end user, the Q-PCR and D-PCR devices market is segmented into hospitals, diagnostic centers, research laboratories, academic institutes, pharmaceutical and biotechnology companies, clinical research organizations, and forensic laboratories. The pharmaceutical and biotechnology companies segment accounted for the largest market revenue share in 2024, driven by extensive R&D activities in drug discovery, development, and quality control, where precise nucleic acid analysis is crucial

The hospitals and diagnostic centers segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing demand for advanced molecular diagnostics for disease detection, monitoring, and personalized treatment decisions. The integration of these technologies into routine clinical practice is rapidly expanding

Q-PCR and D-PCR Devices Market Regional Analysis

- North America dominates the Q-PCR and D-PCR devices market with the largest revenue share of 38.5% in 2024, driven by substantial investments in genomics research, a well-established healthcare infrastructure, and the strong presence of key industry players

- Consumers and researchers in the region highly value the precision, sensitivity, and high-throughput capabilities offered by Q-PCR and D-PCR for applications in clinical diagnostics, infectious disease surveillance, and advanced research

- This widespread adoption is further supported by high R&D expenditure by pharmaceutical and biotechnology companies, increasing government funding for life sciences, and a growing demand for rapid and accurate molecular diagnostic tools, establishing Q-PCR and D-PCR devices as favored solutions across various sectors

U.S. Q-PCR and D-PCR Devices Market Insight

The U.S. Q-PCR and D-PCR devices market captured market revenue share of 85.2% in 2024, fueled by substantial investments in genomics research, a robust healthcare infrastructure, and the high adoption of advanced molecular diagnostic techniques. Researchers and clinicians increasingly prioritize these technologies for precise genetic analysis, infectious disease testing, and cancer diagnostics. The growing emphasis on personalized medicine, coupled with continuous technological advancements from leading companies, further propels the market's expansion in the U.S.

Europe Q-PCR and D-PCR Devices Market Insight

The Europe Q-PCR and D-PCR devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing incidence of genetic and infectious diseases and growing funding for advanced research. European countries are seeing increased adoption due to strong regulatory frameworks supporting medical diagnostics and a rising focus on precision medicine. The region benefits from significant government and private funding for research, further accelerating the integration of Q-PCR and D-PCR into clinical and academic settings

U.K. Q-PCR and D-PCR Devices Market Insight

The U.K. Q-PCR and D-PCR devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating demand for rapid and accurate diagnostic tools, particularly in response to public health emergencies and the increasing prevalence of genetic disorders. The U.K. government's commitment to enhancing diagnostic capabilities, along with significant investments in biotechnology and life sciences, encourages the adoption of these technologies in both clinical and research laboratories

Germany Q-PCR and D-PCR Devices Market Insight

The Germany Q-PCR and D-PCR devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of molecular diagnostics, a strong emphasis on research and development, and a well-developed healthcare system. Germany's focus on innovation and its robust pharmaceutical and biotechnology sectors promotes the adoption of advanced PCR solutions, particularly for applications in personalized medicine and infectious disease control

Asia-Pacific Q-PCR and D-PCR Devices Market Insight

The Asia-Pacific Q-PCR and D-PCR devices market is poised to grow at the fastest CAGR of 9.3%, during the forecast period, driven by increasing healthcare investments, rising prevalence of infectious diseases, and growing R&D activities in pharmaceutical and biotechnology companies across countries such as China, Japan, and India. The region's expanding patient base and improving healthcare infrastructure, coupled with a focus on advanced diagnostics, are key factors propelling market growth.

Japan Q-PCR and D-PCR Devices Market Insight

The Japan Q-PCR and D-PCR devices market is gaining momentum due to the country's high-tech culture, significant investments in life sciences research, and a strong emphasis on precision medicine. The Japanese market prioritizes advanced diagnostic capabilities, and the adoption of Q-PCR and D-PCR is driven by the increasing number of genetic studies and the need for highly sensitive detection methods. Technological advancements and collaborations between academia and industry further fuel market expansion

India Q-PCR and D-PCR Devices Market Insight

The India Q-PCR and D-PCR devices market accounted for a substantial market revenue share in Asia Pacific in 2024, attributed to the country's rising burden of infectious diseases, increasing healthcare expenditure, and a growing focus on diagnostic capabilities. The demand for rapid and accurate molecular tests, particularly in response to public health needs and the expansion of diagnostic laboratories, is a key factor propelling the market in India. Government initiatives to strengthen healthcare infrastructure also contribute significantly to market growth

Q-PCR and D-PCR Devices Market Share

The Q-PCR and D-PCR devices industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- QIAGEN (Germany)

- Takara Bio Inc. (Japan)

- Agilent Technologies, Inc. (U.S.)

- BIOMÉRIEUX (France)

- Danaher Corporation (U.S.)

- Abbott (U.S.)

- Merck KGaA (Germany)

- BD (U.S.)

- Promega Corporation (U.S.)

- Eppendorf SE (Germany)

- Analytik Jena GmbH+Co. KG (Germany)

- Meridian Bioscience, Inc. (U.S.)

- Enzo Biochem Inc. (U.S.)

- Cole-Parmer Instrument Company, LLC. (U.S.)

- BIONEER CORPORATION (South Korea)

- ELITechGroup (France)

- Quantabio (U.S.)

Latest Developments in Global Q-PCR and D-PCR Devices Market

- In May 2025, QIAGEN Expands Digital PCR Oncology Research Portfolio through Partnership with ID Solutions. QIAGEN announced a commercial partnership and co-marketing agreement with ID Solutions, a French provider of high-quality digital PCR (dPCR) assays. This collaboration aims to expand QIAGEN's dPCR oncology research portfolio by offering optimized assays for multi-mutation detection on QIAGEN's QIAcuity platforms, reinforcing its commitment to comprehensive dPCR solutions

- In May 2025, QIAGEN Launches Digital PCR Lentivirus Solutions for Cell and Gene Therapy Quality Control. QIAGEN announced the expansion of its cell and gene therapy (CGT) portfolio with an enhanced digital PCR (dPCR) workflow that now includes solutions for lentivirus-based applications, commonly used in the production of advanced treatments such as CAR-T cell therapy. These solutions support high-precision quality control workflows

- In July 2024, Bio-Rad Launches New ddPCR Methylation Detection Assays. Bio-Rad launched more than 50 new ddPCR Methylation Detection Assays, available on its Digital Assays portal. These assays are designed to provide more precise and reliable detection of methylation markers crucial for early diagnosis and monitoring of various cancers, further expanding Bio-Rad's Droplet Digital PCR platform into life science research and clinical diagnostics

- In May 2024, Thermo Fisher Scientific Organizes 2024 Digital PCR Workshop Series. Thermo Fisher Scientific is conducting a series of digital PCR workshops in 2024 to provide an overview of dPCR technology, key benefits of the QuantStudio Absolute Q dPCR System, and hands-on experience. This initiative aims to educate users on dPCR applications in various fields such as gene expression, copy number variation, and cancer research

- In May 2024, Roche Diagnostics to Introduce New Molecular Lab Solutions. Roche is set to introduce new molecular lab solutions in 2024, including upgrades for its cobas 6800/8800 systems with increased testing flexibility, throughput, and automation. These developments highlight Roche's commitment to advancing its molecular diagnostics portfolio and leveraging new technologies for efficient testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.