Global Purified Water Market

Market Size in USD Billion

CAGR :

%

USD

154.62 Billion

USD

255.90 Billion

2024

2032

USD

154.62 Billion

USD

255.90 Billion

2024

2032

| 2025 –2032 | |

| USD 154.62 Billion | |

| USD 255.90 Billion | |

|

|

|

|

Purified Water Market Size

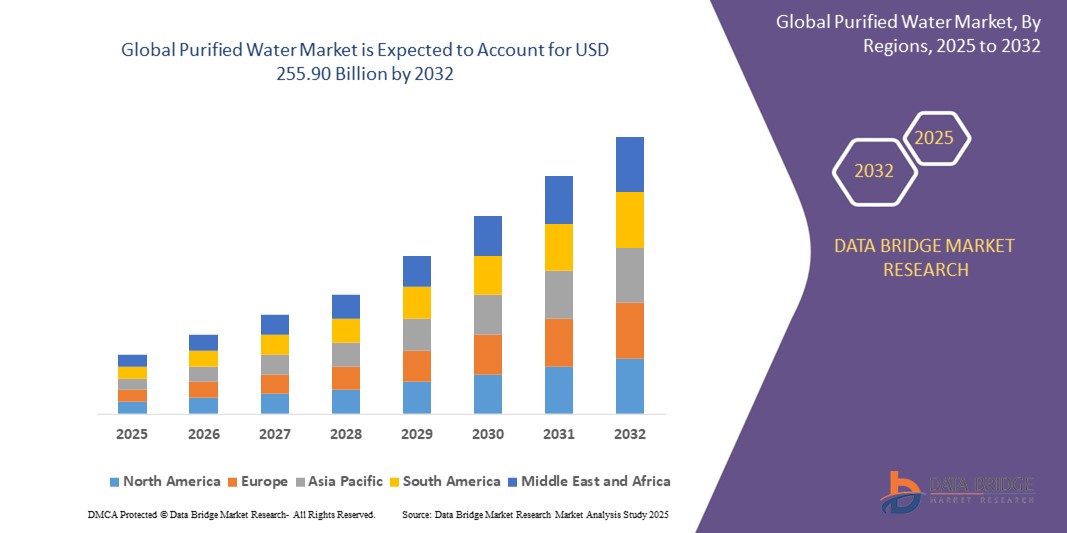

- The global purified water market was valued at USD 154.62 billion in 2024 and is expected to reach USD 255.90 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.50%, primarily driven by the rising demand from pharmaceutical, industrial, and residential sectors

- This growth is driven by factors such as the aging population, increasing prevalence of eye diseases, and advancements in ophthalmic technology

Purified Water Market Analysis

- Purified water is vital in industries like pharmaceuticals, laboratories, food processing, and medical treatments, ensuring the removal of contaminants for precision and health-sensitive operations

- The demand for purified water is fueled by the growth of pharmaceuticals, biotechnology, health awareness, and the need for ultra-pure water in industrial and clinical applications, especially in drug production

- The Asia-Pacific region leads in demand due to rapid industrial growth, strict pharmaceutical and food regulations, and increasing healthcare investments

- For instance, India and China have experienced notable growth in pharmaceutical exports, with companies expanding their production capacities. This has led to increasing installations of purified water generation and distribution systems in both countries, pushing regional market growth

- Globally, purified water systems rank among the most crucial utilities in pharmaceutical cleanrooms, diagnostic laboratories, and industrial facilities, following HVAC and contamination control systems. They play a pivotal role in maintaining process integrity, regulatory compliance, and product quality across critical applications

Report Scope and Purified Water Market Segmentation

|

Attributes |

Purified Water Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Purified Water Market Trends

“Integration of Smart Monitoring and IoT-Enabled Purification Systems”

- One prominent trend in the global purified water market is the increased integration of smart monitoring technologies and Internet of Things (IoT)-enabled purification systems

- These advancements are enhancing the efficiency, transparency, and control of water purification processes, particularly in industrial and pharmaceutical applications where real-time monitoring is crucial

- For instance, smart purification systems now allow continuous tracking of water quality parameters such as Total Organic Carbon (TOC), conductivity, and microbial levels, helping operators respond quickly to any deviations

- IoT integration also enables remote access and predictive maintenance, reducing downtime and ensuring consistent water quality across operations

- This trend is transforming how purified water systems are operated and maintained, increasing their reliability, reducing operational costs, and fueling demand for intelligent, automated solutions in both emerging and developed markets

Purified Water Market Dynamics

Driver

“Rising Demand for High-Purity Water in Pharmaceutical and Biotech Industries”

- The increasing demand for high-purity water in the pharmaceutical and biotechnology industries is a significant driver of the global purified water market

- As these industries continue to grow, there is a greater need for ultra-pure water in processes such as drug formulation, laboratory testing, equipment cleaning, and injectable medication production, all of which require strict quality standards

- Water used in these applications must meet stringent pharmacopeial requirements such as USP, EP, and JP standards, necessitating reliable and advanced purification systems

- The expansion of vaccine manufacturing, biologics, and cell and gene therapies has further intensified the demand for systems capable of consistently producing pharmaceutical-grade water

For instance,

- In March 2023, Merck KGaA announced the expansion of its pharmaceutical manufacturing facility in Corsier-sur-Vevey, Switzerland. The facility includes advanced purified water generation systems to support biologics production, emphasizing the crucial role of high-purity water in drug development and manufacturing

- In May 2022, Thermo Fisher Scientific expanded its biologics production site in St. Louis, USA, incorporating advanced water purification technologies to support the increased demand for injectable medications and vaccine production

- These real-world expansions reflect the growing importance of reliable purified water systems in achieving product safety, regulatory compliance, and manufacturing efficiency

- As the pharmaceutical and biotech sectors continue to evolve and scale globally, the demand for purified water systems is projected to rise substantially, acting as a key growth driver for the market

Opportunity

“Enhancing Water Purification with AI and Automation Integration”

- The integration of artificial intelligence (AI) and automation technologies in water purification systems presents a major opportunity for the global purified water market

- AI-powered purification systems can optimize water treatment processes, monitor water quality in real-time, and detect anomalies or inefficiencies before they become critical, ensuring greater system efficiency and reliability

- These systems can automate routine tasks such as filter replacement alerts, pressure monitoring, and contaminant tracking, which reduces human intervention and minimizes the risk of operational errors

For instance,

- In December 2023, Xylem Inc., a global leader in water technology, introduced AI-driven analytics for water treatment plants that use real-time data to optimize membrane filtration and reduce energy consumption. This advancement has shown potential for improving purified water production efficiency in industrial settings

- In September 2023, SUEZ announced the deployment of its digital platform “Aquadvanced” in multiple pharmaceutical and electronics manufacturing plants, utilizing AI for predictive maintenance and quality assurance in water purification systems

- These innovations not only support cost-effective and scalable water purification solutions, but also align with global sustainability goals by optimizing resource consumption and minimizing waste

- As demand grows for high-quality water across pharmaceutical, food, electronics, and healthcare sectors, the integration of AI and automation will become increasingly critical in achieving precision, compliance, and operational excellence, offering vast opportunities for market expansion

Restraint/Challenge

“High Installation and Maintenance Costs Hindering Market Expansion”

- The high initial installation and ongoing maintenance costs of advanced purified water systems pose a significant challenge for the market, particularly impacting small- to mid-sized enterprises (SMEs) and facilities in developing regions

- These systems, especially those used in pharmaceutical, food, and semiconductor industries, often require complex infrastructure, stringent validation protocols, and specialized components, which can drive total system costs into the hundreds of thousands of dollars

- This financial burden can discourage smaller laboratories, healthcare facilities, and manufacturers from adopting or upgrading to advanced purification technologies, leading to dependence on less efficient or outdated systems

For instance,

- In October 2024, according to a report by Veolia Water Technologies, the high cost of multi-stage purification systems (e.g., reverse osmosis combined with UV and ultrafiltration) remains a key barrier in emerging markets. Many facilities struggle to meet capital expenditure requirements, delaying modernization efforts

- In August 2023, a white paper by Sartorius AG noted that ongoing maintenance costs—such as filter replacements, system calibration, and technician training—can significantly increase total cost of ownership, often becoming unaffordable for resource-limited facilities

- As a result, the economic challenge associated with acquiring and maintaining high-end purification infrastructure contributes to disparities in access to pharmaceutical-grade water, especially in low-resource settings, ultimately restraining broader market penetration

Purified Water Market Scope

The market is segmented on the basis of category, product, quality, origin of product, raw material, pack size, distribution channel, and end user packaging.

|

Segmentation |

Sub-Segmentation |

|

By Category |

|

|

By Product |

|

|

By Quality |

|

|

By Origin of Product

|

|

|

By Raw Material |

|

|

By Pack Size |

|

|

By Distribution Channel

|

|

|

By End User Packaging |

|

Purified Water Market Regional Analysis

“North America is the Dominant Region in the Purified Water Market”

- North America is expected to dominate the global purified water market, fueled by strong demand across pharmaceutical, biotechnology, and healthcare industries, alongside a well-established regulatory framework for water quality standards

- The U.S. holds a significant market share due to its robust presence of pharmaceutical manufacturing facilities, widespread adoption of advanced water purification technologies, and stringent compliance with FDA and USP water quality guidelines

- The region’s leadership is further supported by high investments in R&D, frequent upgrades to purification infrastructure, and growing demand for ultrapure water in diagnostics, drug production, and life sciences research

- In addition, the presence of major market players such as Merck Millipore, Thermo Fisher Scientific, and GE HealthCare enhances the market’s maturity in the region, with rapid deployment of innovations like IoT-enabled and AI-integrated purification systems

- With stringent water quality standards, high regulatory compliance, and continuous infrastructure investments, North America is expected to retain its dominant position in the global purified water market over the forecast period

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global purified water market, driven by rapid industrialization, increasing pharmaceutical and biotech production, and rising demand for high-purity water across multiple sectors

- Countries such as China, India, and Japan are emerging as major growth centers due to the expansion of healthcare and pharmaceutical infrastructure, coupled with government initiatives to improve water quality and safety standards

- Japan, known for its advanced manufacturing and technological capabilities, remains a key market for purified water systems. The country has a strong presence of pharmaceutical companies and enforces strict water quality regulations aligned with global pharmacopeial standards

- In India and China, the surge in pharmaceutical exports, biopharmaceutical research, and generics manufacturing is leading to increased investments in high-efficiency water purification systems

- The growing presence of global water technology providers and the rising number of local manufacturers investing in water treatment innovations are contributing to better accessibility and affordability of purified water solutions in the region

- As Asia-Pacific continues to urbanize and industrialize, supported by favorable government policies and rising awareness about water quality in manufacturing, it is poised to become the fastest-growing regional market for purified water systems

Purified Water Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Nestlé (Switzerland)

- PepsiCo, Inc. (U.S.)

- The Coca-Cola Company (U.S.)

- Primo Water Corporation (U.S.)

- DANONE (France)

- FIJI Water Company LLC (U.S.)

- GEROLSTEINER BRUNNEN GMBH & CO. KG (U.S.)

- VOSS WATER (Norway)

- RHODIUS Mineralquellen und Getränke GmbH & Co. KG (Germany)

- CG Roxane, LLC (U.S.)

- Vichy Catalan Corporation (Spain)

- Himalayan Mountain Valley Spring Water (India)

- A.G. Barr (U.K.)

- Bisleri International Pvt. Ltd. (India)

- SANPELLEGRINO (Italy)

- LaCroix Beverages, Inc. (U.S.)

- SUNTORY HOLDINGS LIMITED (Japan)

- Ferrarelle (Italy)

- Keurig Dr Pepper Inc. (U.S.)

Latest Developments in Global Purified Water Market

- In March 2024, Suez SA partnered with a prominent Middle East healthcare group to implement advanced hospital-grade purified water systems. This collaboration addresses the increasing demand for high-quality water solutions in the healthcare sector, ensuring enhanced patient care and operational efficiency. The initiative reflects Suez's commitment to innovation and sustainability in water management, catering to the evolving needs of the healthcare industry

- In February 2024, Pentair plc introduced an innovative range of smart water filtration and purification products tailored for the residential sector. This launch addresses the growing consumer demand for clean and safe drinking water at home, offering advanced technology and user-friendly solutions. The new product line reflects Pentair's commitment to enhancing water quality and meeting the evolving needs of urban households. By focusing on convenience and efficiency, Pentair continues to strengthen its position as a leader in water treatment solutions

- In January 2024, A. O. Smith Corporation introduced a compact RO purification unit designed specifically for urban households in India. This innovative product caters to high-density residential markets, addressing the need for efficient and space-saving water purification solutions. The unit combines advanced technology with user-friendly features, ensuring clean and safe drinking water for families in urban settings. This launch highlights A. O. Smith's commitment to providing reliable and sustainable water purification systems

- In December 2023, Toray Industries announced the expansion of its membrane production facility in Vietnam. This strategic move aims to address the growing demand for industrial and pharmaceutical purified water across the Asia-Pacific region. By enhancing production capacity, Toray reinforces its commitment to providing innovative and sustainable water treatment solutions. This expansion aligns with the company's vision to support industries with high-quality membrane technologies while meeting the region's increasing water purification needs

- In November 2023, Merck KGaA revealed plans to expand its high-purity water production facilities in Darmstadt, Germany. This initiative aims to meet the rising demand from pharmaceutical and biotechnology clients, highlighting the critical role of purified water in drug manufacturing. The expansion aligns with Merck's commitment to innovation and sustainability, ensuring the delivery of high-quality water solutions for the healthcare and life sciences sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PURIFIED WATER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PURIFIED WATER MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL PURIFIED WATER MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 RAW MATERIAL PRODUCTION COVERAGE

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

6. SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7. CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8. GLOBAL PURIFIED WATER MARKET, BY TYPE, 2022-2031, (USD MILLION)

8.1 OVERVIEW

8.2 FLAVOURED WATER

8.2.1 STILL FLAVOURED BOTTLED WATER

8.2.2 SPARKLING FLAVOURED BOTTLED WATER

8.3 STILL WATER

8.3.1 STILL NATURAL MINERAL BOTTLED WATER

8.3.2 STILL SPRING BOTTLED WATER

8.3.3 STILL PURIFIED BOTTLED WATER

8.4 CARBONATED WATER

8.4.1 CARBONATED NATURAL MINERAL BOTTLED WATER

8.4.2 CARBONATED SPRING BOTTLED WATER

8.4.3 CARBONATED PURIFIED BOTTLED WATER

9. GLOBAL PURIFIED WATER MARKET, BY TECHNOLOGY, 2022-2031, (USD MILLION)

9.1 OVERVIEW

9.2 UV BASED

9.3 RO BASED

9.4 GRAVITY BASED

10. GLOBAL PURIFIED WATER MARKET, BY PRODUCT, 2022-2031, (USD MILLION)

10.1 OVERVIEW

10.2 SPRING

10.3 PURIFIED

10.4 MINERAL

10.5 SPARKLING

10.6 DISTILLED

10.7 OTHERS

11. GLOBAL PURIFIED WATER MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

11.1 OVERVIEW

11.2 PHARMACEUTICAL

11.3 FOOD AND BEVERAGES

11.4 BIOTECH

11.5 OTHERS

12. GLOBAL PURIFIED WATER MARKET, BY GEOGRAPHY, 2021-2030, (USD MILLION)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 ITALY

12.2.4 FRANCE

12.2.5 SPAIN

12.2.6 SWITZERLAND

12.2.7 NETHERLANDS

12.2.8 BELGIUM

12.2.9 RUSSIA

12.2.10 TURKEY

12.2.11 NORWAY

12.2.12 FINLAND

12.2.13 SWEDEN

12.2.14 DENMARK

12.2.15 POLAND

12.2.16 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 AUSTRALIA

12.3.6 SINGAPORE

12.3.7 THAILAND

12.3.8 INDONESIA

12.3.9 MALAYSIA

12.3.10 PHILIPPINES

12.3.11 TAIWAN

12.3.12 VIETNAM

12.3.13 NEW ZEALAND

12.3.14 REST OF ASIA-PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 UAE

12.5.3 SAUDI ARABIA

12.5.4 KUWAIT

12.5.5 EGYPT

12.5.6 ISRAEL

12.5.7 OMAN

12.5.8 BAHRAIN

12.5.9 REST OF MIDDLE EAST AND AFRICA

13. GLOBAL PURIFIED WATER MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS & PARTNERSHIP

13.8 REGULATORY CHANGES

14. SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

15. GLOBAL PURIFIED WATER MARKET - COMPANY PROFILES

15.1 FINEWATERS MEDIA,LLC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 PUREZZA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 SOURCE GLOBAL, PBC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 BWT HOLDING GMBH

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 WATERGEN

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 AQUABIMBA

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 ATACAMA BI

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 ASPU WATERS

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 AQUA CHILE EDEN

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.10 PEPSICO INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 THE COCA-COLA COMPANY

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 CRYSTAL GEYSER WATER COMPANY

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 HINT INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 NESTLE S.A.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 THE KRAFT HEINZ COMPANY

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

15.16 DANONE S.A.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 KEURIG DR PEPPER, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT UPDATES

15.18 POLAR BEVERAGES

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT UPDATES

15.19 TALKING RAIN BEVERAGE CO.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.20 TRIMINO PROTEIN INFUSED WATER

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT UPDATES

15.21 NYSW BEVERAGE BRANDS, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT UPDATES

15.22 DISRUPTIVE BEVERAGES INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT UPDATES

15.23 VICHY CATALAN CORPORATION

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT UPDATES

15.24 SUNNY DELIGHT BEVERAGES CO.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT UPDATES

15.25 SPINDRIFT BEVERAGE CO.

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16. RELATED REPORTS

17. QUESTIONNAIRE

18. CONCLUSION

19. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.