Global Pulp And Paper Market

Market Size in USD Billion

CAGR :

%

USD

423.78 Billion

USD

458.89 Billion

2024

2032

USD

423.78 Billion

USD

458.89 Billion

2024

2032

| 2025 –2032 | |

| USD 423.78 Billion | |

| USD 458.89 Billion | |

|

|

|

|

Pulp and Paper Market Size

Pulp and Paper Market Size

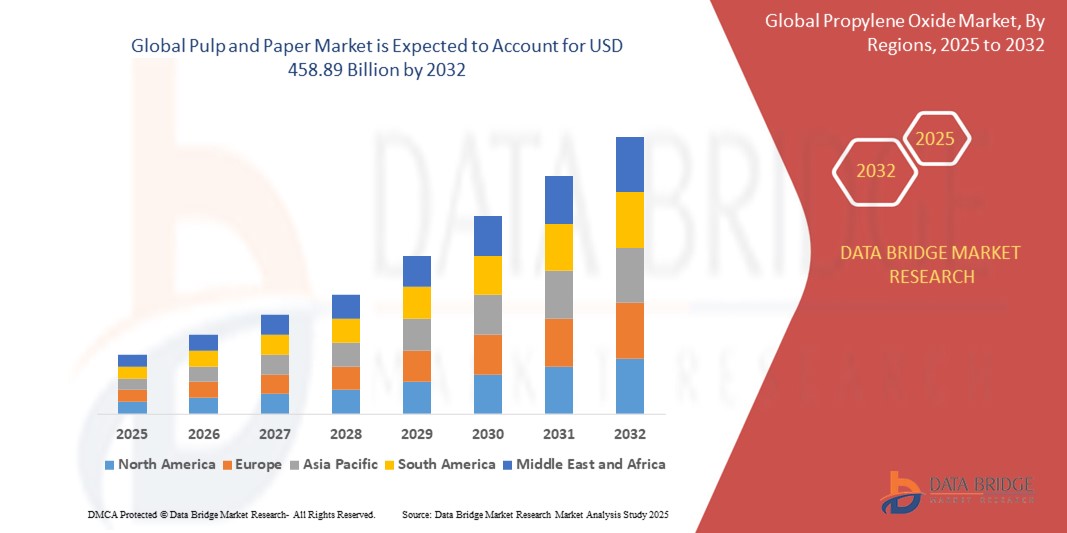

- The global pulp and paper market was valued at USD 423.78 billion in 2024 and is expected to reach USD 458.89 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 1.00%, primarily driven by sustainable packaging innovations

- This growth is driven by factors such as the rising demand for and recyclable packaging materials, increasing regulations on plastic usage, and technological advancements in paper production and pulp processing

Pulp and Paper Market Analysis

- Pulp and paper products are essential raw materials used across a wide array of industries, including packaging, hygiene, printing, and publishing. These materials are also increasingly used in sustainable packaging solutions as the world shifts away from single-use plastics

- The demand for pulp and paper is significantly driven by the growth in e-commerce, which fuels the need for corrugated packaging and carton board, and by sustainability trends that encourage biodegradable and recyclable alternatives

- The Asia-Pacific region stands out as the dominant region for pulp and paper production and consumption, led by countries such as China, India, and Indonesia. Rapid industrialization, a growing middle class, and rising consumer goods demand contribute to strong market growth in this region

- For instance, In 2024, Nine Dragons Paper (Holdings) Limited, one of China’s largest paper manufacturers, expanded its production capacity with new plants in Southeast Asia to meet regional and global demand for packaging materials

- Globally, the pulp and paper industry is undergoing a transformation driven by circular economy principles, with leading companies adopting cleaner production techniques, utilizing agro-residues, and investing in sustainable forestry practices to reduce environmental impact

Report Scope and Pulp and Paper Market Segmentation

|

Attributes |

Pulp and Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pulp and Paper Market Trends

“Shift Toward Sustainable and Eco-Friendly Packaging Solutions”

- One prominent trend in the global pulp and paper market is the accelerating shift toward sustainable and eco-friendly packaging solutions driven by environmental concerns and regulatory pressure to reduce plastic waste

- Manufacturers are increasingly investing in biodegradable, compostable, and recyclable paper-based alternatives to cater to consumer demand for green products and to align with global sustainability goals

- For instance, In 2024, Mondi Group launched a fully recyclable paper-based packaging line for dry food and e-commerce applications, replacing plastic film while maintaining durability and barrier properties

- The trend includes innovations such as coated paper with water-based barriers, recyclable corrugated board for perishables, and flexible paper packaging for fast-moving consumer goods (FMCG)

- This shift is not only reducing environmental impact but also creating new growth opportunities for paper producers adapting to a circular economy model, reshaping the landscape of the packaging industry globally

Pulp and Paper Market Dynamics

Driver

“Technological Advancements in Pulping and Paper Manufacturing”

- Continuous innovations in pulping and paper processing technologies are significantly enhancing production efficiency, reducing energy consumption, and improving the quality of paper products

- Automation and digitalization, including the integration of AI, IoT, and data analytics, are being widely adopted by pulp and paper manufacturers to optimize operational performance and reduce downtime

- Advanced bleaching techniques and chemical recovery systems are allowing producers to minimize environmental impact while maintaining high-quality output

- Modern papermaking machinery and smart control systems are enabling companies to improve speed, precision, and customization, thereby expanding the application range of paper products

- These technological developments are also helping companies meet strict environmental compliance standards by reducing emissions, effluents, and water usage

For instance,

- In July 2023, Valmet launched a new generation of intelligent paper machines with integrated AI-based monitoring and predictive maintenance systems to enhance production output and reduce operational costs

- In January 2024, Andritz announced a collaboration with Metsä Fibre to supply cutting-edge pulp production technology for the new Kemi bioproduct mill in Finland, designed to produce high-yield pulp with minimal environmental footprint

- The rising adoption of such innovations is not only strengthening production capabilities but also enabling the pulp and paper industry to meet evolving sustainability and performance demands, thus driving market growth

Opportunity

“Advancing Ophthalmology Through AI Integration”

- The global shift toward environmental sustainability is opening significant opportunities for innovative pulp processing technologies and advanced fiber materials that reduce energy consumption, water usage, and chemical dependency in the manufacturing process

- Companies are exploring the use of non-wood fibers such as agricultural residues (e.g., wheat straw, bagasse, hemp) and recycled paper to create high-quality pulp while lowering the environmental footprint

- Breakthroughs in enzyme-based pulping, closed-loop bleaching systems, and waterless paper production are revolutionizing traditional paper manufacturing, enabling cleaner production processes

For instance,

- In November 2023, Stora Enso partnered with Pulpex Limited to develop a new type of fiber-based bottle using wood pulp, offering a biodegradable alternative to plastic containers in personal care and beverage packaging

- In January 2024, UPM Biofore announced its investment in a next-generation biorefinery in Germany, aimed at producing wood-based biochemicals and improving the sustainability of fiber-based product manufacturing

- These innovations not only support carbon reduction goals but also unlock new revenue streams in premium personal care packaging , and food service sectors, where demand for renewable materials is growing rapidly

- The expansion of circular economy initiatives and the growing popularity of carbon-neutral production lines are further encouraging investment in advanced pulp and paper technologies, making it a key opportunity area for market players

Restraint/Challenge

“Environmental Concerns and Deforestation-Related Regulations”

- While the pulp and paper industry is shifting toward sustainability, concerns related to deforestation, biodiversity loss, and high water and energy usage remain major challenges, particularly in regions dependent on traditional wood-based raw materials

- The industry’s environmental footprint, including greenhouse gas emissions, wastewater discharge, and land use changes, has drawn criticism from environmental groups and led to increased regulatory scrutiny

- Stricter global and regional regulations on sustainable forestry practices and environmental compliance are placing pressure on manufacturers to adopt greener operations, which often come with high upfront costs

For instance,

- In September 2023, Greenpeace International raised concerns over large-scale deforestation linked to pulp production in parts of Southeast Asia, prompting global brands to review their supply chains and sourcing policies

- In December 2024, the European Union introduced legislation aimed at banning products linked to deforestation, including certain pulp and paper goods, increasing compliance requirements and potential trade barriers for exporters

- Consequently, companies that fail to adapt to these evolving environmental and legal standards may face reputational risks, trade restrictions, or loss of market share, particularly in sustainability-focused regions like Europe and North America

- This regulatory and environmental pressure presents a key restraint for the pulp and paper market, especially for players lacking the capital or technology to modernize their operations

Pulp and Paper Market Scope

The market is segmented on the basis of application and product type.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

By Product Type |

|

Pulp and Paper Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Pulp and Paper Market”

- Asia-Pacific dominates the pulp and paper market, driven by rapid industrialization, a growing middle class, and the region’s high demand for paper-based products across packaging, printing, and hygiene sectors

- China holds a significant share of the market, supported by its large pulp and paper production capacity, robust manufacturing sector, and increasing demand for sustainable packaging solutions

- The Indian market is also seeing strong growth due to expanding e-commerce activities, growing urbanization, and increasing awareness of environmental sustainability. Additionally, rising disposable incomes and changing consumption patterns are driving demand for paper-based products

- Investments in new paper mills, improved manufacturing technologies, and the push towards recycling are strengthening the market in the Asia-Pacific region

- In addition, the rising adoption of eco-friendly packaging, including recyclable corrugated boxes and biodegradable packaging materials, is further propelling growth, particularly in markets like Japan, South Korea, and Southeast Asia

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global pulp and paper market, driven by rapid urbanization, increasing demand for sustainable packaging, and a growing middle class with rising consumption of paper-based products

- Countries such as China, India, and Indonesia are emerging as key markets due to their expanding e-commerce sectors, rising disposable incomes, and increased awareness of eco-friendly packaging options

- China, as the world’s largest producer and consumer of paper, continues to dominate the market, with significant investments in advanced paper manufacturing technologies and recycling initiatives to meet the demand for sustainable and cost-effective packaging solutions

- India, with its burgeoning population and rapidly expanding manufacturing sector, is also seeing a surge in demand for paper products, particularly in packaging and hygiene sectors. Increased governmental focus on waste management and sustainability initiatives is further boosting the pulp and paper market in the region

- Southeast Asia and Japan are expected to see significant growth, driven by investments in sustainable forestry practices, increased demand for recyclable paper packaging, and the rise of the circular economy. The region’s established infrastructure and adoption of green practices are supporting its strong market trajectory

Pulp and Paper Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Amcor plc (Australia)

- Cascades Inc. (Canada)

- Packaging Corporation of America (U.S.)

- DS Smith (U.K.)

- Fedrigoni S.P.A. (Italy)

- Atlantic Packaging (Canada)

- International Paper (U.S.)

- Smurfit Kappa (Ireland)

- Svenska Cellulosa Aktiebolaget SCA (Sweden)

- Mondi (U.K.)

- Nippon Paper Industries Co., Ltd. (Japan)

- Stora Enso (Finland/Sweden)

- METSÄ GROUP (Finland)

- Georgia-Pacific (U.S.)

- Oji Holdings Corporation (Japan)

- Mayr-Melnhof Karton AG (Austria)

- UPM (Finland)

- Rengo Co., Ltd. (Japan)

- WestRock Company (U.S.)

- Sonoco Products Company (U.S.)

Latest Developments in Global Pulp and Paper Market

- In August 2023, Atlas Holdings finalized its acquisition of the pulp, newsprint, and directory paper mill operations in Thunder Bay, Ontario, previously owned by Resolute FP Canada Inc. This acquisition marks a significant milestone for Atlas, as the Thunder Bay mill joins its portfolio of leading pulp and paper companies. The facility, now operating under Thunder Bay Pulp and Paper Inc., continues its legacy as a trusted employer and reliable industry player in the region

- In January 2022, Stora Enso announced a USD 40.67 million investment to enhance its fluff pulp production facility in Skutskär, Sweden. This initiative aims to improve cost efficiency and significantly reduce the site's carbon footprint, aligning with the company's sustainability goals. The upgraded facility will produce fluff pulp for healthcare applications, including baby care, adult incontinence, and feminine care products. This investment underscores Stora Enso's commitment to providing renewable and eco-friendly solutions

- In August 2021, Smurfit Kappa Group finalized an agreement to acquire the containerboard business from Burgo Group. This acquisition includes the Verzuolo Mill, a state-of-the-art facility with a capacity of 600-kilo tons of recycled containerboard. Strategically located in Northern Italy, the mill enhances Smurfit Kappa's production optimization and strengthens its ability to serve consumers in Southern Europe and related markets. This move aligns with the company's commitment to sustainability and operational excellence

- In June 2021, Mondi Group announced a significant investment to upgrade its paper mill in Kuopio, Finland. This initiative aims to boost the plant's capacity by 55 kilotons annually, addressing growing market demands. The investment focuses on modernizing key areas, including the fiber line, wood yard, paper machines, and evaporation plants. These enhancements are expected to improve operational efficiency and environmental performance, aligning with Mondi's commitment to sustainability

- In June 2021, Stora Enso revealed plans to invest millions of dollars in its Anjala-Ingerois and Nymölla pulp processing facilities. This strategic initiative aims to enhance market competitiveness and boost softwood pulp production capacity to 245 kilotons annually. The investment focuses on modernizing operations and improving environmental performance, aligning with Stora Enso's commitment to sustainability and innovation. These upgrades are expected to strengthen the company's position in the global pulp and paper industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PULP AND PAPER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PULP AND PAPER MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL PULP AND PAPER MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6. PRICING INDEX ANALYSIS

7. PRODUCTION CAPACITY OVERVIEW

8. SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9. CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10. GLOBAL PULP AND PAPER MARKET, BY FIBRE SOURCE, 2022-2031, (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 RECOVERED FIBRE

10.3 VIRGIN FIBRE

10.4 OTHER FIBRE

11. GLOBAL PULP AND PAPER MARKET, BY TYPE OF PULP, 2022-2031, (USD MILLION)

11.1 OVERVIEW

11.2 VIRGIN CHEMICAL

11.3 VIRGIN MECHANICAL

11.4 RECYCLED

12. GLOBAL PULP AND PAPER MARKET, BY PROCESSING CHEMICALS, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 SIZING AGENTS

12.2.1 WET-END/INTERNAL

12.2.1.1. ALKYL SUCCINIC ANHYDRIDE (ASA)

12.2.1.2. ALKYL KETENE DIMER (AKD)

12.2.1.3. ROSIN

12.2.2 SURFACE

12.2.2.1. STYRENE MALEIC ANHYDRIDE (SMA)

12.2.2.2. STYRENE ACRYLIC EMULSION (SAE)

12.2.2.3. ETHYLENE ACRYLIC ACID (EAA)

12.2.2.4. MODIFIED STARCHES

12.2.2.5. POLYURETHANE (PU)

12.2.2.6. OTHERS

12.3 BINDERS

12.4 COLORING

12.4.1 ACID DYES

12.4.2 BASIC DYES

12.4.3 DIRECT DYES

12.4.4 DISPERSE DYES

12.4.5 NATURAL DYES

12.5 STRENGTHENING AGENTS

12.5.1 POLYACRYLAMIDE (PAM)

12.5.2 STARCH

12.5.3 CHITOSAN

12.5.4 OTHER POLYMERS

12.6 BIOCIDES

12.6.1 GLUTARALDEHYDE

12.6.2 METHYLENE BISTHIOCYANATE (MBT)

12.6.3 BROMO-2-NITROPROPANE-1,3-DIOL/BRONOPOL

12.6.4 DAZOMET

12.6.5 OTHERS

12.7 BLEACHING AGENTS

12.7.1 SODIUM DITHIONITE

12.7.2 CHLORINE DIOXIDE

12.7.3 HYDROGEN PEROXIDE

12.7.4 OTHERS

12.8 DEPOSIT CONTROL

12.9 OPTICAL BRIGHTENING AGENTS (OBA)

12.9.1 DISULFONATED OPTICAL BRIGHTENING AGENTS

12.9.2 TETRASULFONATED

12.9.3 HEXASULFONATED

12.10 ANTIFOAM AGENTS/DEFOAMERS

12.10.1 ALCOHOLS

12.10.2 INSOLUBLE OILS

12.10.3 STEARATES

12.10.4 POLYDIMETHYLSILOXANES

12.10.5 GLYCOLS

12.10.6 OTHERS

12.11 FILLERS

12.12 OTHERS

13. GLOBAL PULP AND PAPER MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 PAPERBOARD

13.2.1 CONTAINER BOARD

13.2.2 CARTON BOARD

13.2.3 CORRUGATED BOARD

13.2.4 OTHERS

13.3 WRAPPING PAPER

13.4 PACKAGING PAPER

13.5 PRINTING PAPER

13.6 WRITING PAPER

13.7 SPECIALTY PAPER

13.8 SANITARY & HOUSEHOLD TISSUE

13.9 NEWSPRINT

13.10 OTHERS

14. GLOBAL PULP AND PAPER MARKET, BY END-USE INDUSTRY, 2022-2031, (USD MILLION)

14.1 OVERVIEW

14.2 CONSUMER GOODS

14.3 PACKAGING

14.4 HEALTHCARE

14.5 AUTOMOTIVE

14.6 BUILDING AND CONSTRUCTION

14.7 CHEMICAL

14.8 INDUSTRIAL

14.9 FOOD AND BEVERAGE

14.10 OTHERS

15. GLOBAL PULP AND PAPER MARKET, BY GEOGRAPHY, 2022-2031, (USD MILLION) (KILO TONS)

15.1 GLOBAL PULP AND PAPER MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 GERMANY

15.3.2 U.K.

15.3.3 ITALY

15.3.4 FRANCE

15.3.5 SPAIN

15.3.6 RUSSIA

15.3.7 SWITZERLAND

15.3.8 TURKEY

15.3.9 BELGIUM

15.3.10 NETHERLANDS

15.3.11 LUXEMBURG

15.3.12 REST OF EUROPE

15.4 ASIA-PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 SINGAPORE

15.4.6 THAILAND

15.4.7 INDONESIA

15.4.8 MALAYSIA

15.4.9 PHILIPPINES

15.4.10 AUSTRALIA & NEW ZEALAND

15.4.11 REST OF ASIA-PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 ARGENTINA

15.5.3 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 EGYPT

15.6.3 SAUDI ARABIA

15.6.4 UNITED ARAB EMIRATES

15.6.5 ISRAEL

15.6.6 REST OF MIDDLE EAST AND AFRICA

16. GLOBAL PULP AND PAPER MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS AND ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17. SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

18. GLOBAL PULP AND PAPER MARKET- COMPANY PROFILES

18.1 INTERNATIONAL PAPER

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT UPDATES

18.2 KCWW

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT UPDATES

18.3 WESTROCK COMPANY

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT UPDATES

18.4 SMURFIT KAPPA

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT UPDATES

18.5 MONDI

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT UPDATES

18.6 OJI HOLDINGS CORPORATION

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT UPDATES

18.7 UPM

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT UPDATES

18.8 STORA ENSO

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT UPDATES

18.9 SVENSKA CELLULOSA AKTIEBOLAGET SCA

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATES

18.10 SAPPI

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT UPDATES

18.11 DS SMITH

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT UPDATES

18.12 NIPPON PAPER INDUSTRIES CO., LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT UPDATES

18.13 DOMTAR CORPORATION

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT UPDATES

18.14 NINE DRAGONS PAPER (HOLDINGS) LIMITED

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT UPDATES

18.15 RENGO CO., LTD.

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT UPDATES

18.16 MARUBENI PULP & PAPER CO.,LTD.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT UPDATES

18.17 SONOCO PRODUCTS COMPANY

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT UPDATES

18.18 PACKAGING CORPORATION OF AMERICA

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT UPDATES

18.19 SHANDONG CHENMING PAPER HOLDINGS LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT UPDATES

18.20 GEORGIA-PACIFIC CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19. RELATED REPORTS

20. QUESTIONNAIRE

21. CONCLUSION

22. ABOUT DATA BRIDGE MARKET RESEARCH

Global Pulp And Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pulp And Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pulp And Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.