Global Propylene Oxide Market

Market Size in USD Billion

CAGR :

%

USD

25.96 Billion

USD

41.23 Billion

2024

2032

USD

25.96 Billion

USD

41.23 Billion

2024

2032

| 2025 –2032 | |

| USD 25.96 Billion | |

| USD 41.23 Billion | |

|

|

|

|

Propylene Oxide Market Size

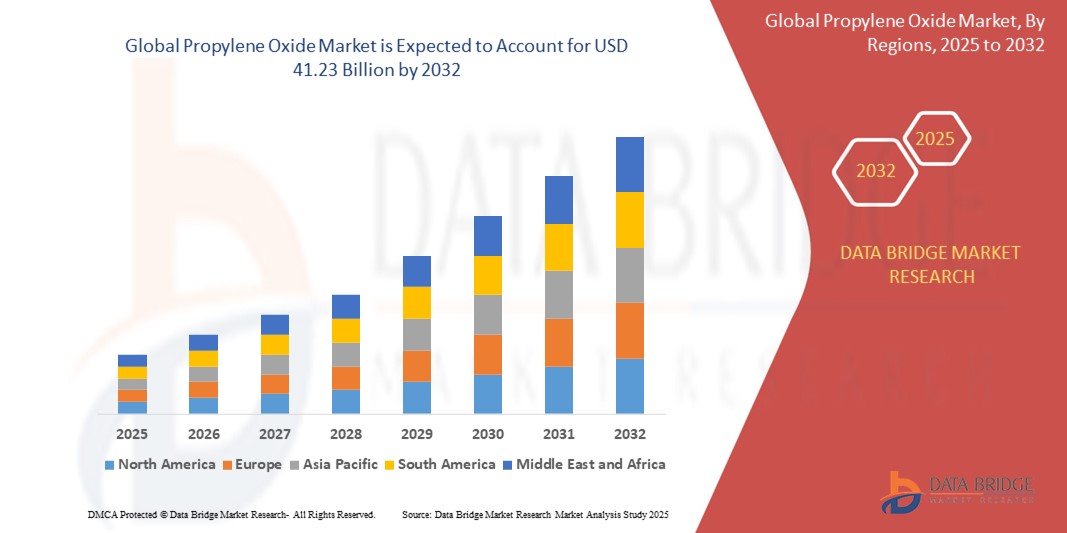

- The global propylene oxide market was valued at USD 25.96 billion in 2024 and is expected to reach USD 41.23 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.95%, primarily driven by the rising demand from end-use industries

- This growth is driven by factors such as increasing polyurethane production, rising demand for propylene glycol in automotive and construction sectors, and expansion of manufacturing facilities across Asia-Pacific

Propylene Oxide Market Analysis

- Propylene oxide is a versatile industrial chemical used primarily in the production of polyether polyols (for polyurethane foams), propylene glycol, and glycol ethers. These downstream products find application in sectors such as automotive, construction, furniture, textiles, and pharmaceuticals

- The demand for propylene oxide is significantly driven by the rising consumption of polyurethane foams, particularly in insulation, automotive seating, and bedding applications. Rapid urbanization and infrastructure development in emerging economies are fueling demand, especially in Asia-Pacific

- The Asia-Pacific region stands out as the dominant market for propylene oxide, owing to rapid industrialization, growing automotive production, and large-scale construction activities

- For instance, several Chinese and Indian manufacturers have expanded their production capacity to meet both domestic and international demand, supported by favorable government policies and low-cost production advantages

- Globally, propylene oxide ranks among the most widely used intermediate chemicals, playing a crucial role in the value chains of rigid and flexible polyurethane foams, coatings, and automotive components, thus making it indispensable for various industrial and consumer applications

Report Scope and Propylene Oxide Market Segmentation

|

Attributes |

Propylene Oxide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Propylene Oxide Market Trends

“Shift Toward Sustainable and Bio-Based Production Methods”

- One prominent trend in the global propylene oxide market is the increasing shift toward sustainable and bio-based production technologies

- Traditional production processes, such as chlorohydrin and hydroperoxide methods, are energy-intensive and generate hazardous byproducts. As environmental regulations tighten, manufacturers are turning to greener alternatives

- For instance, companies like BASF and Dow have invested in hydrogen peroxide to propylene oxide (HPPO) technology, which significantly reduces wastewater and avoids the use of chlorine-based raw materials

- These innovative production routes enhance environmental compliance, reduce operational costs, and appeal to environmentally conscious consumers and industries

- This trend is reshaping the competitive landscape, with major players adopting eco-efficient technologies to maintain market relevance and meet global sustainability goals

Propylene Oxide Market Dynamics

Driver

“Growing Demand from Polyurethane Foam and Propylene Glycol Applications”

- The increasing demand for polyurethane foam and propylene glycol is a major driver propelling the global propylene oxide market forward

- Polyurethane foams, derived from polyether polyols made using propylene oxide, are extensively used in sectors such as automotive, furniture, construction, packaging, and electronics insulation

- Propylene glycol, another key derivative, finds widespread use in pharmaceuticals, personal care, food processing, and de-icing solutions, making propylene oxide indispensable in multiple industries

- The expansion of end-use industries, coupled with population growth, urbanization, and rising disposable incomes in emerging markets, is significantly increasing demand for propylene oxide-based products

- Furthermore, the global shift toward energy-efficient infrastructure and lightweight automotive components continues to drive polyurethane consumption

For instance,

- In February 2023, Dow Inc. announced the expansion of its propylene oxide and polyether polyol capacity in Texas, USA, to meet the growing demand for polyurethane foams used in construction and mobility sectors

- In July 2022, LyondellBasell Industries reported strong growth in propylene oxide derivatives due to increased usage in insulation and automotive manufacturing, underscoring a key growth trend in the market

- As a result, the rising consumption of polyurethanes and glycols across diverse sectors is acting as a strong growth driver for the global propylene oxide market

Opportunity

“Technological Innovations in Propylene Oxide Production”

- Continuous technological advancements in propylene oxide production processes are creating opportunities for enhanced efficiency, lower costs, and reduced environmental impacts. Innovations like the development of more energy-efficient catalysts, advanced reaction technologies, and optimized production processes are enabling manufacturers to produce propylene oxide more sustainably and economically

- The integration of automation and digitalization technologies, such as AI and IoT, in manufacturing processes is improving production monitoring, reducing waste, and enhancing safety. These technologies allow for better control of production parameters, leading to consistent quality and cost savings

For instance,

- In January 2024, BASF announced the successful implementation of a new, energy-efficient catalytic process for propylene oxide production at one of its European facilities. The new technology is expected to reduce energy consumption by up to 20%, offering both economic and environmental benefits

- In August 2022, Honeywell UOP introduced a new advanced technology for the production of propylene oxide that combines the benefits of both the HPPO process and new catalyst innovations. The system is designed to minimize energy consumption and raw material waste, significantly improving the overall efficiency and sustainability of production

- The development and adoption of these cutting-edge production technologies not only provide a competitive advantage but also enable manufacturers to meet increasingly stringent environmental regulations. By reducing energy use, minimizing waste, and lowering costs, these innovations present significant opportunities for companies to boost their profitability while staying ahead of market demands for sustainability

Restraint/Challenge

“High Production and Raw Material Costs Hindering Market Growth”

- The high production and raw material costs associated with propylene oxide (PO) manufacturing pose a significant challenge for the market, particularly affecting the competitiveness of manufacturers in both developed and emerging regions

- Propylene oxide, a critical chemical used in the production of polyurethanes, antifreeze, and other industrial products, is often derived from petroleum-based products or natural gas. Fluctuating oil prices and the cost of raw materials can cause substantial volatility in production costs, making it difficult for companies to maintain consistent pricing strategies

- These significant financial barriers can affect smaller manufacturers or those in regions with less access to affordable raw materials, limiting their ability to scale operations or invest in more advanced production technologies. As a result, companies may struggle to meet the growing demand for propylene oxide, leading to supply shortages or delays in production

For instance,

- In December 2023, according to a report published by the International Energy Agency (IEA), one of the primary concerns regarding the production of propylene oxide is the impact of volatile raw material prices. The rising cost of petroleum products used in propylene oxide production has placed additional pressure on manufacturers, making it challenging for them to maintain profitability while adhering to the competitive pricing required in global market

- Consequently, these limitations can result in market stagnation, hindering the growth of the propylene oxide industry, particularly in regions that are highly dependent on imported raw materials, and affecting the affordability of propylene oxide-derived products in end-use industries. This could ultimately impact the overall growth and expansion of the global propylene oxide market

Propylene Oxide Market Scope

The market is segmented on the basis of production process, application, and end-use industry.

|

Segmentation |

Sub-Segmentation |

|

By Production Process |

|

|

By Application |

|

|

By End-Use Industry |

|

Propylene Oxide Market Regional Analysis

“Asia Pacific is the Fastest Growing Region in the Propylene Oxide Market”

- The Asia Pacific region is witnessing rapid growth in the propylene oxide market, driven by the booming manufacturing sector, increasing demand for propylene oxide-derived products, and the region’s expanding industrial base

- China and India hold significant shares due to their large-scale chemical production industries, along with growing automotive, construction, and packaging industries, all of which heavily rely on propylene oxide-based products such as polyurethanes and antifreeze

- The region is also benefiting from substantial government investments in infrastructure and industrial development, which is further accelerating the demand for propylene oxide across various sectors

- Additionally, the rising demand for consumer goods, automotive components, and construction materials is expected to drive continued market growth in the region, as these industries require a steady supply of propylene oxide for production

“Middle East and Africa are Projected to Register the Highest Growth Rate”

- The Middle East and Africa (MEA) region is expected to witness the highest growth rate in the global propylene oxide market, driven by rapid industrialization, increased demand for consumer goods, and expansion in the petrochemical sector

- Countries such as Saudi Arabia, the UAE, and South Africa are emerging as key markets for propylene oxide, fueled by the region's growing manufacturing base and substantial investments in infrastructure development

- Saudi Arabia, with its robust petrochemical industry and strong government backing, remains a critical player in propylene oxide production and consumption. The country continues to invest in diversifying its economy and industrial capabilities, making propylene oxide a key chemical for expansion in several sectors, including automotive, construction, and packaging

- The U.A.E. and South Africa, with their expanding industrial capabilities and growing demand for sustainable products, are also driving the adoption of propylene oxide. These countries are witnessing an increase in the number of manufacturing plants using propylene oxide-based products, contributing to the market’s strong growth

Propylene Oxide Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DuPont (U.S.)

- Dow (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Shell group of companies (U.K.)

- Huntsman International LLC. (U.S.)

- BASF SE (Germany)

- Sumitomo Chemical Co., Ltd. (Japan)

- Tokuyama Corporation (Japan)

- PCC Rokita Spólka Akcyjna (Poland)

- PJSC "Nizhnekamskneftekhim" (Russia)

- Manali Petrochemicals Limited. (India)

- Balchem Inc. (U.S.)

- INEOS (U.K.)

- SABIC (Saudi Arabia)

- Hanwha Group (South Korea)

- SK chemicals (South Korea)

- AGC Chemicals Americas (Japan)

- CSPC Pharmaceutical Group Limited (China)

- Air Products Inc. (U.S.)

- Repsol (Spain)

Latest Developments in Global Propylene Oxide Market

- In March 2024, Dow Chemical Company, headquartered in the United States, introduced two groundbreaking propylene glycol (PG) solutions in North America, emphasizing sustainability. These solutions utilize circular and bio-circular feedstocks, offering externally verified sustainability benefits through a mass balance approach. Designed for diverse applications, they cater to industries such as personal care, cosmetics, pharmaceuticals, food ingredients, and agriculture. This launch marks a significant step in Dow's commitment to advancing sustainable production and products

- In February 2024, BASF revealed a strategic plan to increase its polyurethane production capacity, addressing the surging demand for energy-efficient insulation materials in the construction and automotive sectors. This move strengthens the polyurethanes segment's pivotal role within the propylene oxide market, emphasizing BASF's commitment to innovation and sustainability

- In January 2024, Reliance Industries unveiled plans for a significant expansion of its petrochemical operations in India. This initiative includes the establishment of advanced propylene oxide production facilities to cater to the increasing demand from both domestic and international markets. The expansion underscores Reliance's commitment to strengthening its position in the global petrochemical industry while addressing the evolving needs of various sectors

- In October 2023, Sumitomo Chemical Co., Ltd., a leading Japanese company, began constructing a prototype facility to develop innovative technology for producing propylene directly from ethanol. This project, supported by the NEDO Green Innovation Fund, aims to establish a compact and cost-effective process compared to traditional methods. The facility, located at the Sodegaura site in Chiba, Japan, is expected to be completed by the first half of 2025. This initiative aligns with Sumitomo Chemical's commitment to sustainability and creating a carbon-neutral society

- In January 2021, LyondellBasell Industries Holdings B.V. strengthened its partnership with Sinopec by forming a 50/50 joint venture. This collaboration, named Ningbo ZRCC LyondellBasell New Material Company Limited, focuses on constructing a new facility to produce propylene oxide (PO) and styrene monomer (SM). The joint venture aims to meet the increasing demand in China's rapidly expanding market. This initiative highlights the companies' commitment to leveraging advanced technology and operational expertise to support the region's economic growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Propylene Oxide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Propylene Oxide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Propylene Oxide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.