Global Property Management Software Market

Market Size in USD Million

CAGR :

%

USD

695.55 Million

USD

1,195.09 Million

2024

2032

USD

695.55 Million

USD

1,195.09 Million

2024

2032

| 2025 –2032 | |

| USD 695.55 Million | |

| USD 1,195.09 Million | |

|

|

|

|

Property Management Software Market Size

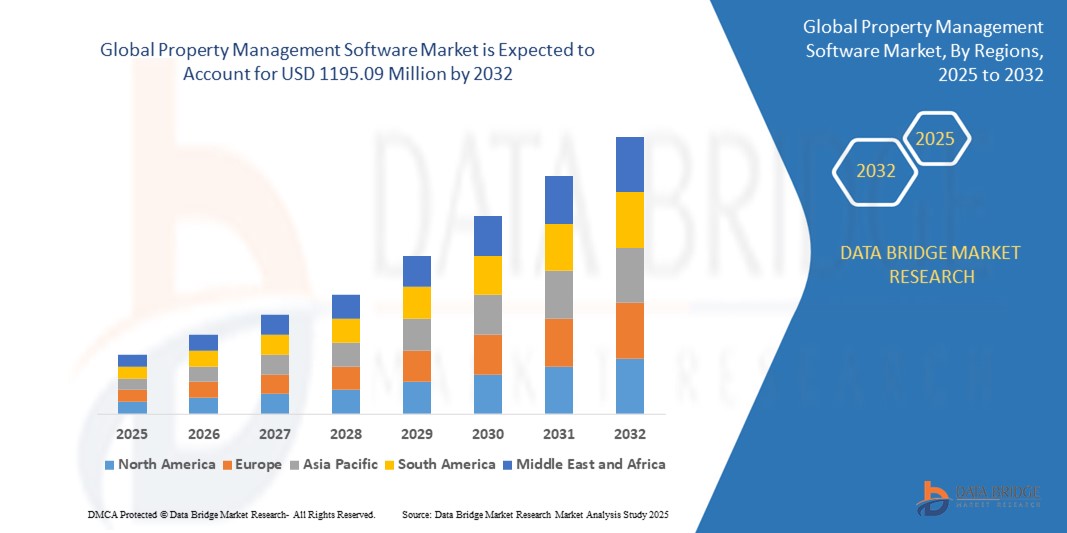

- The global property management software market size was valued at USD 695.55 million in 2024 and is expected to reach USD 1195.09 million by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is primarily driven by the increasing adoption of digital solutions in real estate management, advancements in cloud-based technologies, and the growing need for streamlined operations in property management across residential and commercial sectors

- In addition, rising demand for efficient, scalable, and automated solutions to manage properties, leases, and tenant interactions is positioning property management software as a critical tool for property managers and real estate professionals, further accelerating market expansion

Property Management Software Market Analysis

- Property management software, designed to automate and streamline tasks such as tenant management, lease tracking, maintenance scheduling, and financial reporting, is becoming an essential tool for property managers, housing associations, and real estate investors in both commercial and residential settings

- The surge in demand is fueled by the growing complexity of property portfolios, increasing adoption of cloud-based solutions, and the need for real-time data access and analytics to enhance decision-making

- North America dominated the property management software market with the largest revenue share of 42.5% in 2024, driven by early adoption of technology, high digital infrastructure penetration, and the presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing real estate investments, and rising adoption of digital solutions in emerging markets

- The software segment dominated the largest market revenue share of 62.3% in 2024, driven by its ability to address diverse customer needs such as record keeping, tenant communication, maintenance scheduling, and financial tracking

Report Scope and Property Management Software Market Segmentation

|

Attributes |

Property Management Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Property Management Software Market Trends

“Increasing Integration of AI and IoT Technologies”

- The global property management software market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Internet of Things (IoT) technologies

- These technologies enable advanced data processing and analytics, providing deeper insights into property performance, tenant behavior, and maintenance needs

- AI-powered property management solutions allow for proactive issue resolution, such as predicting maintenance requirements to prevent costly repairs or downtime

- For instances, companies are developing AI-driven platforms that analyze tenant patterns to optimize rental pricing or integrate IoT devices to monitor energy usage and enhance building efficiency

- This trend is enhancing the value proposition of property management software, making it more appealing to property managers, housing associations, and investors

- IoT integration enables real-time monitoring of properties, such as smart home systems for residential units or automated facility management for commercial spaces, improving tenant experiences and operational efficiency

Property Management Software Market Dynamics

Driver

“Rising Demand for Digitalization and Efficient Property Management”

- The increasing demand for digital solutions to streamline property management tasks, such as tenant management, lease administration, and maintenance scheduling, is a major driver for the global property management software market

- Property management software enhances operational efficiency by offering features such as automated rent collection, online tenant portals, and real-time reporting for both residential and commercial applications

- Government regulations, particularly in regions such as Europe with mandates for energy efficiency and transparency in real estate, are contributing to the widespread adoption of these systems

- The proliferation of cloud computing and the development of high-speed internet infrastructure, such as 5G, are enabling faster data transmission and more sophisticated software applications for property management

- Property developers and managers are increasingly adopting cloud-based software as standard or optional tools to meet tenant expectations and enhance property value across housing associations, corporate occupiers, and property investors

Restraint/Challenge

“High Implementation Costs and Data Privacy Concerns”

- The substantial initial investment required for software, hardware, and integration of property management systems can be a significant barrier, particularly for small property managers or in emerging markets

- Integrating advanced software into existing property management workflows can be complex and costly, requiring specialized expertise

- Data security and privacy concerns pose a major challenge, as property management software collects and transmits sensitive tenant and property data, raising risks of breaches or misuse

- The fragmented regulatory landscape across countries regarding data collection, storage, and compliance with privacy laws, such as GDPR in Europe, complicates operations for global software providers

- These factors can deter adoption, especially in regions with high cost sensitivity or strong awareness of data privacy issues, limiting market expansion for end users such as property managers, housing associations, and investors

Property Management Software market Scope

The market is segmented on the basis of component, deployment, application, and end user.

- By Component

On the basis of component, the global property management software market is segmented into software and services. The software segment dominated the largest market revenue share of 62.3% in 2024, driven by its ability to address diverse customer needs such as record keeping, tenant communication, maintenance scheduling, and financial tracking. The adoption of software-as-a-service (SaaS) models enhances flexibility and scalability, enabling centralized access across multiple devices and locations.

The services segment is expected to witness the fastest growth rate of 10.5% from 2025 to 2032. This growth is fueled by increasing demand for professional services, including implementation, training, and ongoing support, as property managers seek customized solutions to optimize operations and integrate with emerging technologies such as AI and IoT.

- By Deployment

On the basis of deployment, the global property management software market is segmented into cloud and on-premises. The cloud segment dominated the market with a revenue share of 60.6% in 2024, attributed to its cost-effectiveness, scalability, and ease of use. Cloud-based solutions offer seamless data integration, backup facilities, and remote accessibility, making them highly adopted by housing associations, property managers, and corporate occupiers.

The on-premises segment is anticipated to experience steady growth from 2025 to 2032, with a CAGR of 7.8%. This growth is driven by organizations prioritizing stricter security protocols and reduced risks of data breaches, particularly for sensitive property and tenant data.

- By Application

On the basis of application, the global property management software market is segmented into commercial and residential. The residential segment accounted for the largest market revenue share of 59.1% in 2024, driven by increasing urbanization, rising demand for rental housing, and the need to manage multifamily housing, apartments, and single-family units efficiently. The growth in residential construction further fuels demand for property management systems.

The commercial segment is expected to witness the fastest growth rate of 11.2% from 2025 to 2032. This is propelled by the rising number of commercial spaces, such as retail, offices, and hotels, particularly in the Asia-Pacific region, coupled with the need for integrated solutions for lease management, tenant tracking, and financial reporting.

- By End User

On the basis of end user, the global property management software market is segmented into housing associations, property managers/agents, corporate occupiers, property investors, and others. The property managers/agents segment held the largest market revenue share of 37.9% in 2024, owing to their critical role in overseeing daily operations, including tenant screening, rent collection, and maintenance coordination. The complexity of managing diverse property portfolios drives the adoption of advanced software solutions.

The housing associations segment is anticipated to experience robust growth from 2025 to 2032, with a CAGR of 10.8%. This growth is driven by the need for streamlined processes and centralized data management to oversee multiple properties, optimize occupancy rates, and enhance tenant experiences through resident portals.

Property Management Software Market Regional Analysis

- North America dominated the property management software market with the largest revenue share of 42.5% in 2024, driven by early adoption of technology, high digital infrastructure penetration, and the presence of key industry players

- Consumers and businesses prioritize property management software for streamlining operations, enhancing tenant experiences, and optimizing financial and maintenance workflows, particularly in urbanized regions with diverse property portfolios

- Growth is supported by advancements in software technology, including AI-powered analytics, cloud-based platforms, and IoT integration, alongside rising demand in both residential and commercial applications.

U.S. Property Management Software Market Insight

The U.S. property management software market captured the largest revenue share of 87.8% in 2024 within North America, fueled by strong demand from property managers and real estate agents, coupled with growing awareness of automation and digitalization benefits. The trend toward smart property management and increasing regulatory requirements for compliance and transparency further boost market expansion. Major software providers headquartered in the U.S., such as Yardi Systems and AppFolio, complement both enterprise and small-scale solutions, creating a robust market ecosystem.

Europe Property Management Software Market Insight

The Europe property management software market is expected to witness significant growth, supported by a strong focus on digital transformation and regulatory emphasis on energy efficiency and tenant satisfaction. Consumers and businesses seek software that enhances operational efficiency while ensuring compliance with local regulations. Growth is prominent in both residential and commercial applications, with countries such as Germany and the U.K. showing notable uptake due to increasing real estate investments and smart city initiatives.

U.K. Property Management Software Market Insight

The U.K. market for property management software is expected to witness rapid growth, driven by demand for improved tenant management and operational efficiency in urban and suburban settings. Increased interest in cloud-based solutions and rising awareness of predictive analytics benefits encourage adoption. Evolving regulations, such as those related to energy performance and tenant rights, influence consumer choices, balancing functionality with compliance.

Germany Property Management Software Market Insight

Germany is expected to witness significant growth in the property management software market, attributed to its advanced real estate sector and high consumer focus on operational efficiency and sustainability. German property managers prefer technologically advanced software that automates lease management, tenant tracking, and financial reporting while contributing to energy-efficient building operations. The integration of these solutions in both premium and mid-tier properties supports sustained market growth.

Asia-Pacific Property Management Software Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid urbanization, expanding real estate markets, and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of operational efficiency, tenant satisfaction, and regulatory compliance is boosting demand. Government initiatives promoting smart cities and digitalization further encourage the adoption of advanced property management software.

Japan Property Management Software Market Insight

Japan’s property management software market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced software that enhances property management efficiency and tenant comfort. The presence of major real estate developers and the integration of cloud-based solutions in both OEM and aftermarket applications accelerate market penetration. Rising interest in smart building technologies also contributes to growth.

China Property Management Software Market Insight

China holds the largest share of the Asia-Pacific property management software market, propelled by rapid urbanization, rising property ownership, and increasing demand for efficient management solutions. The country’s growing middle class and focus on smart city development support the adoption of advanced software. Strong domestic software development capabilities and competitive pricing enhance market accessibility.

Property Management Software Market Share

The property management software industry is primarily led by well-established companies, including:

- Adobe (U.S.)

- Oracle (U.S.)

- HubSpot, Inc. (U.S.)

- SAS Institute Inc. (U.S.)

- HP Development Company, L.P. (U.S.)

- SimplyCast (Canada)

- Act-On Software, Inc. (U.S.)

- Infor (U.S.)

- Yesware, Inc. (U.S.)

- Marigold Engage by Sailthru (U.S.)

- Vivial Inc. (U.S.)

- Keap (U.S.)

- IBM (U.S.)

- SAP SE (Germany)

- Microsoft (U.S.)

What are the Recent Developments in Global Property Management Software Market?

- In April 2024, CoStar Group announced its acquisition of Matterport, a leading developer of 3D capture solutions for digital twins and virtual property tours. This strategic move reinforces CoStar’s position in real estate analytics, expanding its capabilities in AI-driven immersive visualization for property marketing and management. Matterport’s technology enables high-precision spatial data capture, enhancing real estate listings, commercial spaces, and architectural planning. The acquisition is expected to accelerate innovation in digital twin technology, benefiting buyers, sellers, and investors

- In September 2023, AppFolio unveiled Realm-X, a generative AI-powered conversational interface designed to streamline property management workflows. This innovation enhances leasing, maintenance, and accounting processes, allowing managers to automate tasks, ask queries, and execute operations seamlessly. Alongside Realm-X, AppFolio introduced new payment solutions, including personalized rent payment options and instant vendor payments, reinforcing its commitment to efficiency and user experience. These advancements reflect the growing role of AI in real estate technology, optimizing business operations and resident interactions

- In July 2023, Entrata, Inc. acquired Rent Dynamics, a company specializing in resident rent reporting and financial resources. This strategic move expanded Entrata’s service offerings, providing residents with enhanced financial tools to improve credit-building and rent payment management. The acquisition strengthens Entrata’s position in the property management sector, integrating Rent Dynamics’ RentPlus products to support economic inclusion and financial health for residents

- In April 2023, Inhabit introduced ResidentIQ, a comprehensive property management software tailored for residential property managers. This platform consolidates secured operations, payments, insurance, resident engagement, and screening, streamlining various aspects of property management. ResidentIQ enhances efficiency by integrating best-in-class solutions within a flexible ecosystem, allowing managers to customize their tech stack while maintaining their existing core property management system (PMS).

- In January 2023, Union, a property management software provider, introduced a centralized leasing software and support solution. This development aims to facilitate organized remote management of multifamily communities, reflecting the ongoing need for flexible and efficient solutions in a dynamic real estate market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.