Global Project Portfolio Market

Market Size in USD Billion

CAGR :

%

USD

7.69 Billion

USD

19.33 Billion

2024

2032

USD

7.69 Billion

USD

19.33 Billion

2024

2032

| 2025 –2032 | |

| USD 7.69 Billion | |

| USD 19.33 Billion | |

|

|

|

|

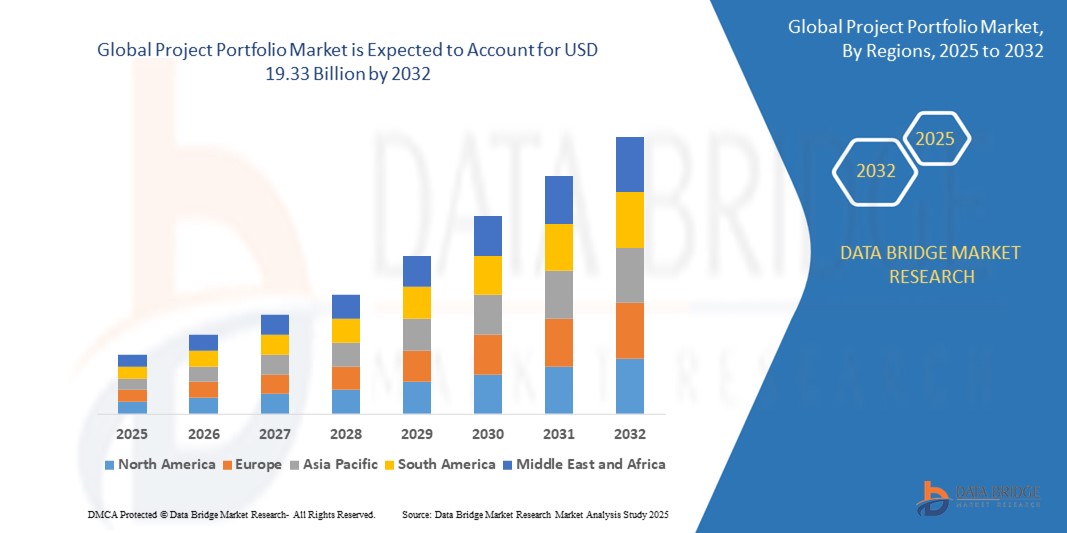

What is the Global Project Portfolio Market Size and Growth Rate?

- The global project portfolio market size was valued at USD 7.69 billion in 2024 and is expected to reach USD 19.33 billion by 2032, at a CAGR of 12.20% during the forecast period

- Project portfolio is experiencing significant growth due to advancements in technology and methodologies. The latest methods include AI-driven analytics and machine learning, which enable more accurate forecasting and risk management

- Cloud-based project portfolio solutions have gained popularity, offering scalability and real-time collaboration, which enhance project visibility and resource allocation

What are the Major Takeaways of Project Portfolio Market?

- Technologies such as blockchain are also emerging, providing transparency and security in project tracking and documentation

- The usage of these technologies is expanding as organizations seek to optimize their project outcomes and streamline operations. Integrated platforms that combine project management with financial and resource management are becoming increasingly prevalent. This integration supports more strategic decision-making and alignment with business goals

- North America dominated the global Project Portfolio market, capturing the largest revenue share of 41.2% in 2024, fueled by the region's mature IT infrastructure, high adoption of cloud solutions, and growing demand for AI-driven project management tools

- Asia-Pacific (APAC) project portfolio market is projected to expand at the fastest CAGR of 18.5% during 2025 to 2032, driven by rapid urbanization, expanding digital infrastructure, and growing investments in large-scale infrastructure and technology projects across China, India, Japan, and Southeast Asia

- The Web segment dominated the project portfolio market with the largest market revenue share of 42.3% in 2024, attributed to its universal accessibility, cross-platform compatibility, and lower development costs

Report Scope and Project Portfolio Market Segmentation

|

Attributes |

Project Portfolio Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Project Portfolio Market?

“AI-Driven Predictive Analytics Enhancing Project Visibility and Decision-Making”

- A significant and rapidly evolving trend in the global Project Portfolio market is the integration of Artificial Intelligence (AI) and predictive analytics, revolutionizing how organizations manage, prioritize, and execute complex projects. AI is transforming portfolio planning by providing real-time insights, risk forecasts, and resource optimization, enhancing overall efficiency and strategic alignment

- For instance, industry leaders such as Microsoft and Planview are embedding AI-powered tools within their project portfolio platforms, enabling predictive project health assessments, automated risk identification, and smarter resource allocations, allowing organizations to proactively address issues before they escalate

- AI-driven project portfolio platforms are also facilitating enhanced scenario planning, allowing enterprises to simulate project outcomes, assess budget impacts, and align project portfolios with dynamic business objectives. This leads to more data-informed decisions, increased agility, and improved project success rates

- Furthermore, the integration of AI with collaborative tools and mobile applications is streamlining project communications, empowering teams to access real-time updates, track milestones, and adjust strategies on the go, fostering greater accountability and transparency

- This shift toward intelligent, automated, and data-driven project management is reshaping expectations, driving demand for AI-enabled project portfolio platforms that can support large-scale digital transformations

- As organizations increasingly seek to improve project delivery, reduce costs, and align initiatives with strategic goals, AI-powered predictive analytics is becoming a cornerstone of modern project portfolio management, fueling global market growth

What are the Key Drivers of Project Portfolio Market?

- The growing complexity of projects, combined with the need for real-time visibility, resource optimization, and strategic alignment, is a major factor driving the growth of the project portfolio market

- For instance, in January 2024, Oracle expanded its cloud-based project portfolio suite with enhanced AI-driven analytics and scenario planning capabilities, aimed at helping businesses make more informed project investment decisions and optimize resource utilization

- The rise of remote work, digital collaboration platforms, and distributed project teams is increasing the demand for centralized, cloud-based project portfolio solutions that offer seamless access to project data, performance dashboards, and predictive insights from anywhere

- Additionally, organizations across industries are prioritizing digital transformation initiatives, requiring scalable, integrated project portfolio platforms to manage growing project portfolios, track KPIs, and ensure alignment with evolving business strategies

- The growing emphasis on data-driven decision-making, risk mitigation, and regulatory compliance further underscores the need for advanced project portfolio tools that offer enhanced reporting, audit trails, and real-time performance tracking

- The convenience of AI-powered automation, resource forecasting, and cross-functional collaboration is positioning project portfolio platforms as essential tools for modern enterprises seeking to improve project outcomes and maximize returns on investment

Which Factor is challenging the Growth of the Project Portfolio Market?

- Data integration complexities, system interoperability issues, and the high cost of deploying advanced project portfolio solutions are key challenges hindering market expansion, particularly for small and medium-sized enterprises (SMEs)

- For instance, organizations with fragmented IT environments often struggle to seamlessly integrate project portfolio platforms with existing ERP, CRM, or legacy project management systems, limiting their ability to achieve a unified project view

- Concerns over data privacy, cybersecurity risks, and compliance with evolving regulations also present barriers, especially as project portfolio platforms increasingly leverage cloud-based infrastructures and handle sensitive project and financial data

- The skills gap in AI, data analytics, and advanced project management further constrains the effective adoption of sophisticated project portfolio solutions, particularly in regions with limited access to specialized talent

- Moreover, the initial investment required for high-end project portfolio platforms, including software licensing, training, and system integration, can be prohibitive for resource-constrained organizations, slowing down broader market penetration

- Addressing these challenges through simplified integrations, affordable cloud-based offerings, enhanced cybersecurity frameworks, and targeted training initiatives will be crucial to ensure sustained growth and adoption of project portfolio management solutions globally

How is the Project Portfolio Market Segmented?

The market is segmented on the basis of type, service type, deployment, end- users, and types of software.

• By Type

On the basis of type, the project portfolio market is segmented into Web, Android Native, iOS Native, and Other. The Web segment dominated the Project Portfolio market with the largest market revenue share of 42.3% in 2024, attributed to its universal accessibility, cross-platform compatibility, and lower development costs. Organizations increasingly prefer web-based Project Portfolio platforms for centralized project management, real-time collaboration, and remote accessibility across devices without the need for multiple native applications.

The Android Native segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the widespread global adoption of Android smartphones and the growing demand for mobile-first project management solutions. Android-native apps offer superior performance, offline capabilities, and enhanced user experiences, driving their popularity among enterprises with mobile-centric workforces.

• By Service

On the basis of service, the project portfolio market is segmented into Managed Service and Professional Service. The Managed Service segment captured the largest market revenue share in 2024, driven by organizations' increasing reliance on third-party providers to oversee end-to-end project portfolio management, system maintenance, and ongoing technical support. Managed services help reduce internal IT burden, ensure system uptime, and optimize performance, making them highly attractive for businesses of all sizes.

The Professional Service segment is projected to experience the fastest CAGR from 2025 to 2032, supported by rising demand for consulting, system integration, training, and customization services. Organizations implementing complex Project Portfolio solutions require professional expertise to maximize value, accelerate deployment, and align platforms with specific business needs.

• By Deployment

On the basis of deployment, the project portfolio market is segmented into On-Premises and Cloud. The Cloud segment dominated the market with the largest revenue share of 57.9% in 2024, propelled by growing enterprise preference for scalable, cost-efficient, and easily accessible project management solutions. Cloud-based platforms enable remote access, seamless updates, and improved collaboration, making them a cornerstone for modern, distributed project teams.

The On-Premises segment is anticipated to register steady growth, particularly among highly regulated industries with strict data security requirements. Organizations with existing infrastructure investments also continue to favor on-premises deployments for greater control over data and system operations.

• By End-User

On the basis of end-user, the project portfolio market is segmented into Banking, Insurance, Asset Management, Energy and Utilities, Educational Institutions, Healthcare, Telecom, Information Technology, Oil and Gas, Retail, and Life Sciences. The Information Technology (IT) segment dominated the market with the largest revenue share of 29.8% in 2024, driven by the sector's continuous innovation cycles, complex project portfolios, and demand for agile, scalable management platforms. IT firms increasingly leverage Project Portfolio solutions to align projects with strategic objectives and optimize resource utilization.

The Healthcare segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing need for digitized project management in areas such as telehealth, medical research, and healthcare infrastructure development. The sector's focus on operational efficiency, compliance, and patient-centric initiatives is accelerating the adoption of Project Portfolio solutions.

• By Types of Software

On the basis of types of software, the project portfolio market is segmented into Enterprise Risk Management Software, Financial Risk Management Software, Integrated Risk Management Software, Application Risk Management Software, Market Risk Management Software, Credit Risk Management Software, Information Technology Risk Management Software, Quantitative Risk Management Software, and Project Risk Management Software. The Project Risk Management Software segment dominated the market with the largest revenue share of 36.1% in 2024, driven by rising demand for proactive risk identification, mitigation, and real-time monitoring within project environments. Organizations are prioritizing risk management tools to improve project outcomes, reduce costs, and enhance stakeholder confidence.

The Integrated Risk Management Software segment is projected to register the fastest CAGR during the forecast period, as businesses seek holistic, enterprise-wide visibility across various risk categories. Integrated platforms enable better decision-making by consolidating financial, operational, and compliance risks into a single, actionable framework.

Which Region Holds the Largest Share of the Project Portfolio Market?

- North America dominated the global project portfolio market, capturing the largest revenue share of 41.2% in 2024, fueled by the region's mature IT infrastructure, high adoption of cloud solutions, and growing demand for AI-driven project management tools

- Organizations across North America are prioritizing real-time visibility, resource optimization, and data-driven decision-making, driving widespread integration of project portfolio platforms across industries such as IT, healthcare, and financial services

- This market leadership is further supported by a robust ecosystem of PP software providers, significant investment in digital transformation, and the region's early adoption of predictive analytics and automation in project portfolio management processes

U.S. Project Portfolio Market Insight

The U.S. project portfolio market accounted for the largest share within North America in 2024, driven by the growing need for scalable project management solutions across industries such as technology, construction, and government sectors. The widespread implementation of AI, cloud-based platforms, and real-time analytics is enhancing project success rates and aligning projects with strategic objectives. The demand for remote collaboration tools and mobile project management applications continues to accelerate market expansion across enterprises of all sizes.

Europe Project Portfolio Market Insight

The Europe project portfolio market is projected to experience steady growth during the forecast period, supported by stringent regulatory requirements, increased emphasis on risk management, and growing digital literacy across businesses. European enterprises are adopting project portfolio platforms to enhance project governance, ensure compliance, and optimize resource utilization. The region's strong focus on sustainability, smart city initiatives, and infrastructure development further boosts the demand for centralized, data-driven project management solutions.

U.K. Project Portfolio Market Insight

The U.K. project portfolio market is expected to grow at a notable CAGR, underpinned by the country's thriving digital economy, rapid adoption of cloud technologies, and rising demand for agile project management solutions. Businesses across finance, technology, and public sectors are leveraging project portfolio platforms to manage complex projects, improve resource allocation, and drive strategic alignment. The U.K.'s leadership in digital transformation, supported by favorable government policies and a vibrant tech ecosystem, continues to propel project portfolio adoption.

Germany Project Portfolio Market Insight

The Germany project portfolio market is witnessing consistent growth, driven by its strong manufacturing sector, emphasis on Industry 4.0 initiatives, and increasing need for efficient project execution and risk management. German organizations are adopting project portfolio platforms to manage large-scale digital transformation projects, optimize costs, and enhance project performance. The market benefits from Germany's reputation for engineering excellence, innovation, and the integration of AI and analytics within project portfolio management tools.

Which Region is the Fastest Growing Region in the Project Portfolio Market?

Asia-Pacific (APAC) project portfolio market is projected to expand at the fastest CAGR of 18.5% during 2025 to 2032, driven by rapid urbanization, expanding digital infrastructure, and growing investments in large-scale infrastructure and technology projects across China, India, Japan, and Southeast Asia. Enterprises in APAC are increasingly turning to cloud-based and AI-powered project portfolio platforms to manage complex projects, enhance resource efficiency, and drive strategic alignment. Government-backed initiatives promoting digital transformation, smart cities, and economic development are accelerating project portfolio adoption across industries.

Japan Project Portfolio Market Insight

The Japan project portfolio market is experiencing steady growth, fueled by the country's technological advancement, increasing project complexity, and the need for enhanced resource management. Japanese organizations are adopting AI-driven project portfolio solutions for better project visibility, risk mitigation, and performance optimization. The integration of mobile project management tools and advanced analytics supports Japan's push for efficiency, particularly across manufacturing, healthcare, and IT sectors.

China Project Portfolio Market Insight

The China project portfolio market accounted for the largest revenue share within Asia Pacific in 2024, supported by rapid infrastructure development, digital transformation initiatives, and growing adoption of cloud-based project management platforms. Chinese enterprises, particularly in construction, technology, and manufacturing sectors, are investing in project portfolio tools to enhance project governance, align with national development goals, and manage large, complex projects. The government's focus on smart city development and innovation further propels project portfolio market growth across the country.

Which are the Top Companies in Project Portfolio Market?

The project portfolio industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- Planview, Inc. (U.S.)

- Broadcom (U.S.)

- Microsoft (U.S.)

- Sciforma (U.S.)

- Workfront, Inc. (U.S.)

- HEXAGON (Sweden)

- ServiceNow (U.S.)

- Upland Software, Inc. (U.S.)

- Basecamp LLC. (U.S.)

- Asana (U.S.)

- Bestoutcome (U.K.)

- Micro Focus (U.K.)

- Hewlett-Packard Development LP (U.S.)

- ONE2TEAM (France)

- WorkOtter (U.S.)

- Atlassian (Australia)

- Citrix Systems, Inc. (U.S.)

- Celoxis Technologies Pvt. Ltd. (India)

What are the Recent Developments in Global Project Portfolio Market?

- In December 2023, Planisware achieved "Great Place to Work" certification across its offices in France, Germany, the U.S., Japan, the U.K., and Tunisia. This recognition highlights Planisware's commitment to a supportive corporate culture and a stimulating work environment, fostering employee satisfaction and collaboration in all its global locations

- In March 2023, UiPath and Planview partnered to integrate Planview Tasktop Hub with the UiPath Business Automation Platform. This collaboration aims to enhance automation by streamlining repetitive tasks, speeding up product delivery, and minimizing manual errors, thus improving operational efficiency and productivity

- In May 2022, Kimble Applications merged with Mavenlink to create Kantata, a new entity in project portfolio management software. Kantata offers a comprehensive suite for managing finances, resources, team collaboration, projects, business intelligence (BI), and integrations, enhancing capabilities for organizations in managing complex projects and workflows

- In December 2020, Adobe acquired Workfront for USD 1.5 billion, integrating the work management platform into its suite. This acquisition provides Adobe clients with a range of Workfront features, including Business, Team, Pro, and Enterprise Plans, to enhance work management across various organizational needs and improve overall productivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.