Global Processor IP Market, By Type (CPU SIP, Wired SIP, GPU SIP, Memory SIP, DSP SIP, Library SIP, Infrastructure SIP, Digital SIP, Analog SIP, Wireless SIP, Others), Form (Soft Form, Hard Form), IP Source (Licensing, Royalty), Channel (Direct Sources, Internet Catalogue), End User (Automotive, Telecom, Consumer Electronics, Industrial, Defense, Commercial, Medical, Others) - Industry Trends and Forecast to 2031.

Processor IP Market Analysis and Size

Processor IP (Intellectual Property) refers to pre-designed and reusable processor cores, including CPUs and GPUs, licensed for integration into custom System-on-Chip (SoC) designs. These cores are often customizable to meet specific performance, power, and area requirements of various applications. Processor IP enables semiconductor companies to accelerate chip development by leveraging proven and optimized designs, reducing time-to-market and development costs. Licensing processor IP allows companies to focus on differentiating features while relying on established processor architectures for core functionality. It facilitates the creation of diverse embedded systems, from mobile devices to automotive applications, by providing scalable and efficient computing solutions. In essence, processor IP serves as a foundational component for building complex integrated circuits, driving innovation across various industries.

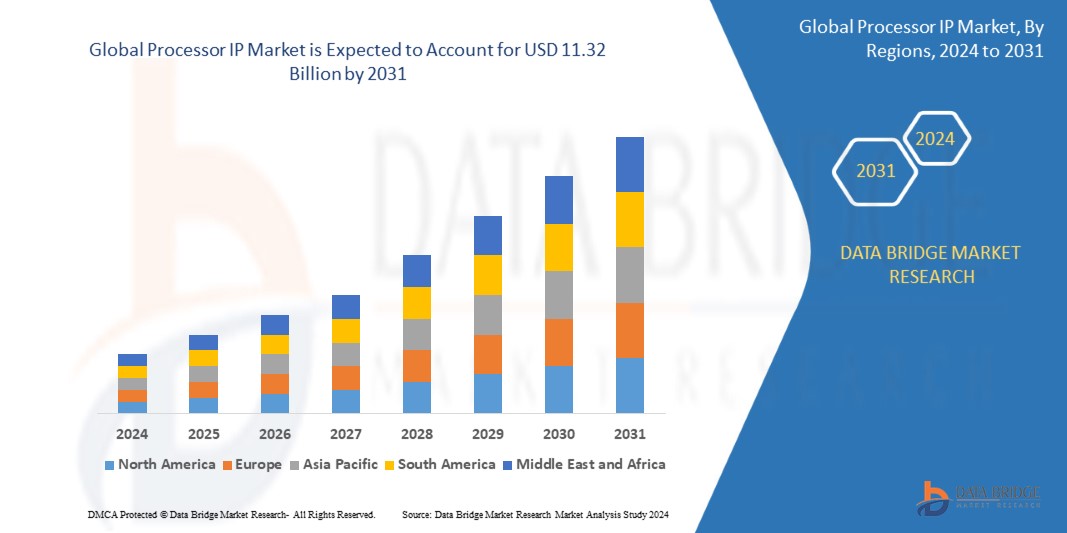

Global processor IP market was valued at USD 6.97 billion in 2023 and is expected to reach USD 11.32 billion by 2031, registering a CAGR of 6.25% during the forecast period of 2024-2031. “Type” segments accounts the highest market share with diverse offerings catering to specific application needs. RISC-V architecture, characterized by its open-source nature, is gaining traction, empowering customization and innovation. ARM continues to lead with its versatile designs, serving a wide spectrum of devices from smartphones to servers. Specialized processors, such as those for AI or IoT, are witnessing rapid growth, addressing niche demands with optimized performance. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (CPU SIP, Wired SIP, GPU SIP, Memory SIP, DSP SIP, Library SIP, Infrastructure SIP, Digital SIP, Analog SIP, Wireless SIP, Others), Form (Soft Form, Hard Form), IP Source (Licensing, Royalty), Channel (Direct Sources, Internet Catalogue), End User (Automotive, Telecom, Consumer Electronics, Industrial, Defense, Commercial, Medical, Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of the Middle East and Africa

|

|

Market Players Covered

|

Avery Design Systems (U.S.), Intel Corporation (U.S.), Arm Limited (U.K.), Cadence Design Systems, Inc. (U.S.), CAST (U.S.), Ceva, Inc. (U.S.), eSilicon Corporation (U.S.), Imagination Technologies (U.K.), Kilopass Technology Inc. (U.S.), Open-Silicon, Inc. (U.S.), Rambus.com (U.S.), Stäubli International AG (Switzerland), Synopsys, Inc. (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Global processor IP market encompasses the licensing and sale of intellectual property related to microprocessor designs and architectures. It includes a range of offerings from companies such as ARM, RISC-V, and MIPS, catering to diverse applications such as mobile devices, automotive systems, and IoT devices. Key players compete in delivering efficient, scalable, and customizable processor designs to meet the demands of various industries. This market is characterized by rapid innovation, technological advancements, and strategic partnerships to address evolving performance and power efficiency requirements.

Global Processor IP Market Dynamics

Drivers

- Increasing Demand for High-Performance Computing (HPC)

The increasing need for powerful processors to support HPC applications such as AI, big data analytics, and scientific simulations is driving the demand for advanced Processor IP. These applications require efficient and scalable processing solutions, spurring innovation and growth in the market.

- Rise of Edge Computing

The proliferation of IoT devices and the demand for real-time data processing at the edge are driving the global processor IP market. Edge computing requires processors that can deliver high performance within power and space constraints, leading to the adoption of customizable and power-efficient processor IP solutions.

- 5G Deployment

The rollout of 5G networks is fueling demand for processor IP capable of handling the increased data throughput and low-latency requirements of 5G applications. Processors embedded in network infrastructure equipment, smartphones, and IoT devices need to support the processing demands of 5G technology, driving growth in the market.

Opportunity

- Automotive Electronics Advancements

The automotive industry's evolution towards electric and autonomous vehicles is spurring demand for advanced processor IP tailored for automotive applications. These processors need to meet the stringent safety, reliability, and performance requirements of automotive electronics, driving innovation and investment in the market.

- Emergence of AI Acceleration

The integration of artificial intelligence (AI) capabilities into various devices and applications is driving the demand for processor IP optimized for AI workloads. Processors with specialized AI acceleration features, such as neural network accelerators, are increasingly sought after to deliver efficient and high-performance AI processing, catalyzing growth in the market.

Restraint/Challenge

- Intellectual Complex Licensing Agreements

Complexities in licensing agreements, including terms related to royalties, usage restrictions, and compliance requirements, can create barriers to entry for potential customers and lead to delays or disputes in IP adoption.

- Technological Obsolescence

Rapid advancements in processor technology may render existing IP designs obsolete relatively quickly, requiring continual investment in research and development to maintain competitiveness, which can strain resources and slow market growth.

This global processor IP market, report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global processor IP market, contact data bridge market research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Recent Devlopments

- In June 2020, Qualcomm Incorporated launched its new product "Snapdragon 690 System-on-chip," to support its Snapdragon 6-series processors. The Snapdragon 690 is specifically designed for 5G connectivity and supports both standalone (SA) and non-standalone (NSA) modes

- In February 2019, Intel Corporation declared that "Telefonaktiebolaget LM Ericsson" is focusing on deploying its 10nm system-on-chip (SoC) product, specifically for 5G and edge computing

Global Processor IP Market Scope

The global processor IP market is segmented on the basis of type, form, IP source, channel and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- CPU SIP

- Wired SIP

- GPU SIP

- Memory SIP

- DSP SIP

- Library SIP

- Infrastructure SIP

- Digital SIP

- Analog SIP

- Wireless SIP

- Others

Form

- Soft Form

- Hard Form

IP Source

- Licensing

- Royalty

Channel

- Direct Sources

- Internet Catalogue

End User

- Automotive

- Telecom

- Consumer Electronics

- Industrial

- Defense

- Commercial

- Medical

- Others

Global Processor IP Market Region Analysis/Insights

The global processor IP market is segmented on the basis of type, form, IP source, channel and end user as referenced above.

The countries covered in the global processor IP market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific in the Asia-Pacific, Saudi Arabia, U.A.E., Israel, Egypt, South Africa, Rest of Middle East and Africa as a part of Middle East and Africa, Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific region leads the global processor IP market as the fastest-growing and dominating region due to its robust semiconductor manufacturing ecosystem. With key players and foundries located in countries such as China, Taiwan, South Korea, and Japan, the region enjoys a strong foundation for IP development and deployment. Moreover, increasing demand for consumer electronics and automotive electronics in the region further drives the growth of semiconductor IP adoption. In addition, favorable government policies and investments in R&D contribute to the rapid expansion of the global processor IP market in Asia-Pacific.

The country section of the global processor IP market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Processor IP Market Share Analysis

The global processor IP market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the global processor IP market.

Some of the major players operating in the global processor IP market are:

- Avery Design Systems (U.S.)

- Intel Corporation (U.S.)

- Arm Limited (U.K.)

- Cadence Design Systems, Inc. (U.S.)

- CAST (U.S.), Ceva, Inc. (U.S.)

- eSilicon Corporation (U.S.)

- Imagination Technologies (U.K.)

- Kilopass Technology Inc. (U.S.)

- Open-Silicon, Inc. (U.S.)

- Rambus.com (U.S.)

- Stäubli International AG (Switzerland)

- Synopsys, Inc. (U.S.)

SKU-