Global Printing Inks Market

Market Size in USD Billion

CAGR :

%

USD

20.96 Billion

USD

29.80 Billion

2024

2032

USD

20.96 Billion

USD

29.80 Billion

2024

2032

| 2025 –2032 | |

| USD 20.96 Billion | |

| USD 29.80 Billion | |

|

|

|

|

Printing Inks Market Size

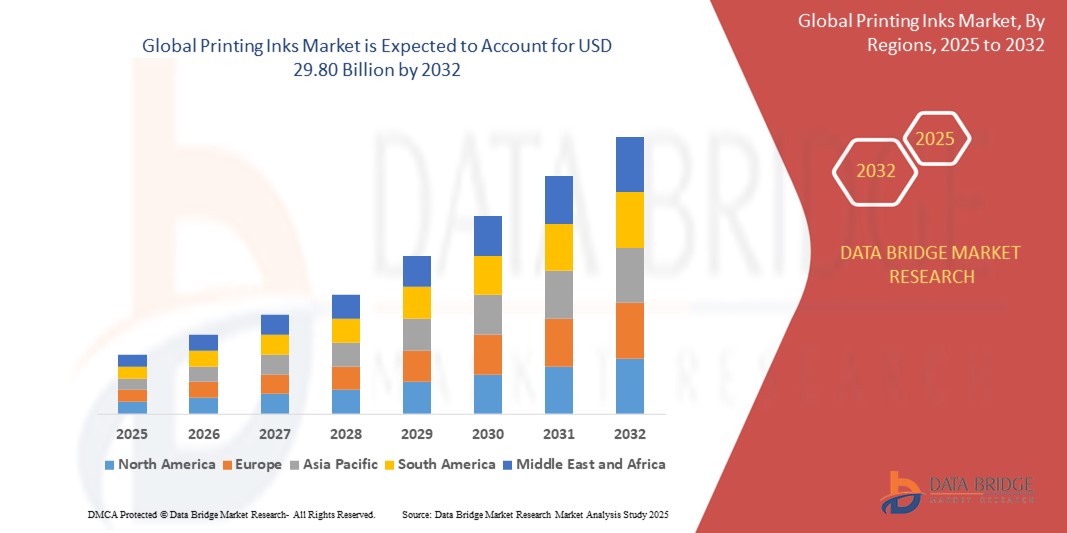

- The global printing inks market size was valued at USD 20.96 billion in 2024 and is expected to reach USD 29.80 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by increasing demand for high-quality, sustainable, and eco-friendly printing inks across packaging, commercial printing, and publishing sectors, driven by evolving consumer preferences and regulatory pressures

- Furthermore, technological advancements in ink formulations, such as water-based, UV-curable, and digital inks, along with the rise of e-commerce and customized printing solutions, are accelerating adoption and expanding applications, thereby significantly boosting the industry’s growth

Printing Inks Market Analysis

- Printing inks, used to impart color and protective properties on various substrates, are essential components in packaging, commercial printing, and publishing industries due to their role in enhancing product appeal, brand identity, and information display

- The growing demand for printing inks is primarily driven by increasing packaging needs across food, beverage, and consumer goods sectors, rising adoption of sustainable and eco-friendly ink technologies, and advancements in digital and UV-curable inks enabling high-quality, customizable printing solutions

- Asia-Pacific dominated the printing inks market with a share of 36.11% in 2024 due to rapid industrialization, growth in packaging and publishing sectors, and increasing demand for high-quality printed materials across emerging economies

- North America is expected to be the fastest growing region in the printing inks market during the forecast period due to increased demand for eco-friendly and high-performance inks in packaging, commercial printing, and publishing

- Packaging and labels segment dominated the market with a market share of 45.5% in 2024 due to the growth in e-commerce, food and beverage packaging, and the demand for vibrant, durable prints

Report Scope and Printing Inks Market Segmentation

|

Attributes |

Printing Inks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Printing Inks Market Trends

“Increasing Demand for Eco-Friendly And Sustainable Inks”

- A significant and accelerating trend in the global printing inks market is the growing demand for eco-friendly and sustainable ink formulations, driven by increasing environmental regulations and consumer preference for green products

- For instance, water-based inks and UV-curable inks are gaining widespread adoption due to their low volatile organic compound (VOC) emissions and reduced environmental impact compared to traditional solvent-based inks

- Innovations in biodegradable and bio-based resin technologies are enabling manufacturers to produce inks that minimize ecological footprints while maintaining high performance and print quality. For example, some leading ink producers now offer vegetable oil-based inks suitable for food packaging that comply with stringent safety standards

- The shift towards sustainable inks is also supported by brand owners and packaging companies seeking to meet corporate social responsibility (CSR) goals and appeal to environmentally conscious consumers

- This trend is driving investments in research and development focused on renewable raw materials, recycling-friendly ink formulations, and energy-efficient printing processes, encouraging a circular economy approach within the printing industry

- As sustainability becomes a critical purchasing criterion, the demand for eco-friendly inks is rapidly rising across packaging, commercial printing, and publishing sectors, making it a pivotal growth driver for the printing inks market globally

Printing Inks Market Dynamics

Driver

“Advancements in Digital Printing”

- The increasing demand for faster, cost-effective, and high-quality printing solutions is a significant driver for the growing adoption of digital printing technologies in the printing inks market

- For instance, in 2024, HP Inc. introduced enhanced digital inkjet printers with improved color accuracy and faster drying inks, enabling more efficient production of packaging and commercial print materials. Such innovations by leading companies are expected to drive market growth during the forecast period

- As businesses seek greater flexibility and customization capabilities, digital printing inks offer advantages such as short-run production, variable data printing, and on-demand printing, which traditional printing methods cannot easily provide

- Furthermore, advancements in digital ink formulations, including UV-curable and latex-based inks, improve print durability, substrate compatibility, and environmental performance, making digital printing a preferred choice across various applications

- The rise in personalized packaging, labels, and marketing materials, combined with the growing e-commerce sector, is fueling demand for digital printing solutions that leverage advanced ink technologies. The trend towards automation and integration of digital workflows further supports market expansion

Restraint/Challenge

“Rising Environmental Regulations”

- Rising environmental regulations concerning the use of volatile organic compounds (VOCs), hazardous chemicals, and non-biodegradable substances in ink formulations pose a significant challenge to the growth of the printing inks market. As governments across regions tighten compliance standards, manufacturers face mounting pressure to reformulate products to meet environmental and safety requirements

- For instance, the European Union’s REACH regulations and the U.S. Environmental Protection Agency’s VOC emission standards have prompted stricter scrutiny of solvent-based inks, leading to increased costs for compliance, reformulation, and certification

- Adapting to these regulatory shifts requires substantial investment in R&D to develop low-emission, water-based, and biodegradable inks without compromising performance. Companies such as Sun Chemical and Flint Group have been working toward greener solutions, but the transition remains complex and resource-intensive, particularly for small and mid-sized enterprises

- In addition, the varying regulatory landscapes across countries complicate global production and distribution, forcing ink manufacturers to manage diverse compliance protocols. This fragmentation can lead to operational inefficiencies and limit the availability of certain ink types in specific regions

- While sustainable inks present long-term benefits, the immediate cost implications, technical challenges in reformulation, and the need for regulatory approvals hinder rapid market transition, posing a persistent challenge to ink producers in a highly competitive environment

Printing Inks Market Scope

The market is segmented on the basis of printing process, resin, product, and application.

- By Printing Process

On the basis of printing process, the printing inks market is segmented into gravure inks, flexographic inks, lithographic inks, digital inks, and others. The gravure inks segment dominated the largest market revenue share in 2024, driven by their widespread use in high-volume packaging applications. Their ability to produce high-quality, detailed images on flexible packaging materials has cemented their position in food and beverage, cosmetics, and consumer goods industries.

The digital inks segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rise in short-run printing demands and customization trends. Digital inks offer rapid setup times, variable data capabilities, and are increasingly used for label printing and textile applications, particularly in on-demand environments.

- By Resin

On the basis of resin, the printing inks market is segmented into modified rosin, modified cellulose, acrylic, polyurethane, and others. The polyurethane segment held the largest market revenue share of 16.5% in 2024 due to its superior adhesion, flexibility, and resistance properties. Polyurethane-based inks are increasingly adopted for high-performance applications such as flexible packaging and industrial labelling.

The acrylic segment is anticipated to register the fastest growth from 2025 to 2032, driven by its excellent pigment wetting properties, fast drying times, and versatility across different substrates. These resins are preferred in water-based and UV-curable inks for applications ranging from packaging to publication printing.

- By Product

On the basis of product, the printing inks market is segmented into solvent based, water based, oil based, and UV-cured based. The solvent-based segment led the market revenue share in 2024, supported by their strong adherence on non-porous surfaces and fast drying properties, making them suitable for outdoor and industrial packaging uses.

The UV-cured based segment is expected to experience the fastest CAGR from 2025 to 2032, propelled by increasing environmental regulations and demand for low-VOC, energy-efficient alternatives. These inks cure instantly under UV light, offering higher print quality and less environmental impact.

- By Application

On the basis of application, the printing inks market is segmented into packaging and labels, corrugated cardboards, commercial printing/publishing, and others. The packaging and labels segment accounted for the largest market share of 45.5% in 2024, driven by the growth in e-commerce, food and beverage packaging, and the demand for vibrant, durable prints.

The commercial printing/publishing segment is projected to witness the fastest growth from 2025 to 2032, supported by increased usage in magazines, brochures, catalogs, and book printing. This segment benefits from evolving marketing strategies and demand for high-resolution printed content.

Printing Inks Market Regional Analysis

- Asia-Pacific dominated the printing inks market with the largest revenue share of 36.11% in 2024, driven by rapid industrialization, growth in packaging and publishing sectors, and increasing demand for high-quality printed materials across emerging economies

- The region’s expanding e-commerce, rising disposable incomes, and urbanization are major contributors to market growth

- In addition, government initiatives promoting sustainable printing solutions and advancements in ink formulations, such as eco-friendly and UV-curable inks, are accelerating adoption in both domestic and export-oriented industries

Japan Printing Inks Market Insight

The Japan market is expanding due to rising demand for advanced printing technologies in commercial publishing and packaging. Japanese consumers and industries prioritize high-performance inks with superior color quality and environmental safety. Local manufacturers are investing in innovations such as digital inks and UV-curable formulations to meet stringent regulations and growing preferences for sustainable products.

China Printing Inks Market Insight

The China printing inks market held the largest share in Asia-Pacific in 2024, supported by its position as a global manufacturing hub and booming packaging industry. Government policies encouraging green manufacturing and reduced VOC emissions are driving demand for water-based and UV-cured inks. Increasing consumption of packaged goods and rapid urbanization further fuel market expansion, with domestic players focusing on eco-friendly ink technologies for both local and export markets.

Europe Printing Inks Market Insight

The Europe printing inks market is projected to grow steadily over the forecast period, propelled by strong regulatory frameworks supporting environmental sustainability and increased consumer awareness of eco-friendly printing solutions. The region leads in the adoption of low-VOC inks and recyclable packaging materials, promoting demand in packaging and commercial printing sectors. Growth in organic and premium product packaging is also contributing to increased use of specialized inks across Western and Northern Europe.

U.K. Printing Inks Market Insight

The U.K. market is expected to grow moderately during the forecast period, driven by rising demand for sustainable and recyclable printing inks in packaging and labels. Government regulations targeting reduction of harmful emissions and plastic waste encourage brands to shift toward water-based and UV-curable inks. The expanding food and beverage packaging industry and growth in premium printed products support the market’s steady development.

Germany Printing Inks Market Insight

The Germany printing inks market is poised for considerable growth, backed by a strong environmental focus and technological innovation in ink formulations. Germany’s robust recycling infrastructure and consumer demand for sustainable packaging promote the use of eco-friendly inks such as modified cellulose and acrylic-based inks. High industrial printing output and investments in clean technologies further boost the market outlook.

North America Printing Inks Market Insight

North America printing inks market is projected to grow at the fastest CAGR from 2025 to 2032, driven by increased demand for eco-friendly and high-performance inks in packaging, commercial printing, and publishing. Rising consumer preference for sustainable products and stricter environmental regulations are accelerating the adoption of water-based and UV-cured inks. Advances in printing technology, coupled with strong retail and e-commerce growth, are further propelling market expansion.

U.S. Printing Inks Market Insight

The U.S. printing inks market captured the largest revenue share in North America in 2024, supported by the high demand for packaging inks in food, beverage, and pharmaceutical sectors. The growing focus on sustainability and reducing hazardous emissions is leading to widespread adoption of solvent-free and UV-cured inks. In addition, the thriving e-commerce industry and increased demand for customized packaging are driving innovations and uptake of advanced printing ink solutions.

Printing Inks Market Share

The printing inks industry is primarily led by well-established companies, including:

- DIC CORPORATION (Japan)

- Flint Group India Pvt Ltd (India)

- TOYO INK SC HOLDINGS CO., LTD. (Japan)

- Sakata Inx (India) Private Limited (India)

- Siegwerk Druckfarben AG & Co. KGaA (Germany)

- HuberGroup India (India)

- T&K TOKA Corporation (Japan)

- Altana (Germany)

- TOKYO PRINTING INK MFG CO., LTD. (Japan)

- Wikoff Color Corporation (U.S.)

- Royal Dutch Printing Ink Factories Van Son (Netherlands)

- Dainichiseika Color & Chemicals Mfg.Co.,Ltd. (Japan)

- Zeller+Gmelin Corporation (Germany)

- Sun Chemical (U.S.)

- Alden & Ott Printing Inks Co (U.S.)

- Gardiner Colours Limited (U.K.)

- Kohinoor Printing Ink Co. (India)

- MALLARD INK CO AND OFFSET BLANKET CO, INC. (U.S.)

- INX International Ink Co. (U.S.)

- INKNOVATORS (U.S.)

- Avreon Chemicals India Private Limited (India)

Latest Developments in Global Printing Inks Market

- In August 2023, Global print consumables manufacturer Flint Group has solidified its reputation as the sustainable ink supplier of choice after announcing that all its Sheetfed process ink series are now mineral oil free. The full range of Flint Group’s K+E process series is now exclusively made from more sustainable formulations, under plans to increase the use of environmentally friendly raw materials and make packaging easier to recycle

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PRINTING INKS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PRINTING INKS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL PRINTING INKS MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 GLOBAL PRINTING INKS MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION) (KILO TONS)

9.1 OVERVIEW

9.2 SOLVENT-BASED INKS

9.3 WATER-BASED INKS

9.3.1 ACRYLIC BASED

9.3.2 MALEIC BASED

9.3.3 SHELLAC BASED

9.3.4 OTHERS

9.4 UV-CURED INKS

9.5 OIL-BASED INKS

9.6 HOT MELT INKS

9.7 POWDER INKS

9.8 ENERGY-CURABLE INKS

9.9 UV-LED CURABLE INKS

9.1 OTHERS

10 GLOBAL PRINTING INKS MARKET, BY PROCESS, 2022-2031, (USD MILLION)

10.1 OVERVIEW

10.2 FLEXOGRAPHIC

10.3 GRAVURE

10.4 SCREEN PRINTING

10.5 LITHOGRAPHIC

10.6 DIGITAL

10.7 SCREEN PRINTING

10.8 OFFSET

10.9 LETTERPRESS

10.1 PAD PRINTING

10.11 METAL DECORATIVE

10.12 OTHERS

11 GLOBAL PRINTING INKS MARKET, BY RESIN TYPE, 2022-2031, (USD MILLION)

11.1 OVERVIEW

11.2 ACRYLIC RESINS

11.3 POLYURETHANE RESINS

11.4 POLYAMIDE RESINS

11.5 MODIFIED ROSIN RESINS

11.6 CELLULOSE DERIVATIVES RESINS

11.7 EPOXY RESINS

11.8 POLYESTER RESINS

11.9 ALKYD RESINS

11.1 VINYL RESINS

11.11 POLYKETONE RESINS

11.12 NITROCELLULOSE RESINS

11.13 OTHERS

12 GLOBAL PRINTING INKS MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 PACKAGING

12.2.1 PACKAGING, BY APPLICATION

12.2.1.1. LABELS

12.2.1.2. PAPERS

12.2.1.3. FLEXIBLE PACKAGING

12.2.1.4. FOLDING CARTONS

12.2.1.5. CARDBOARDS

12.2.1.6. TAGS

12.2.1.7. OTHERS

12.2.2 PACKAGING, BY PRODUCT TYPE

12.2.2.1. SOLVENT-BASED INKS

12.2.2.2. WATER-BASED INKS

12.2.2.3. UV-CURED INKS

12.2.2.4. OIL-BASED INKS

12.2.2.5. HOT MELT INKS

12.2.2.6. POWDER INKS

12.2.2.7. ENERGY-CURABLE INKS

12.2.2.8. UV-LED CURABLE INKS

12.2.2.9. OTHERS

12.3 PUBLICATION

12.3.1 PUBLICATION, BY APPLICATION

12.3.1.1. BOOKS

12.3.1.2. NEWSPAPERS

12.3.1.3. MAGAZINES

12.3.1.4. OTHERS

12.3.2 PUBLICATION, BY PRODUCT TYPE

12.3.2.1. SOLVENT-BASED INKS

12.3.2.2. WATER-BASED INKS

12.3.2.3. UV-CURED INKS

12.3.2.4. OIL-BASED INKS

12.3.2.5. HOT MELT INKS

12.3.2.6. POWDER INKS

12.3.2.7. ENERGY-CURABLE INKS

12.3.2.8. UV-LED CURABLE INKS

12.3.2.9. OTHERS

12.4 COMMERCIAL PRINTING

12.4.1 COMMERCIAL PRINTING, BY PRODUCT TYPE

12.4.1.1. SOLVENT-BASED INKS

12.4.1.2. WATER-BASED INKS

12.4.1.3. UV-CURED INKS

12.4.1.4. OIL-BASED INKS

12.4.1.5. HOT MELT INKS

12.4.1.6. POWDER INKS

12.4.1.7. ENERGY-CURABLE INKS

12.4.1.8. UV-LED CURABLE INKS

12.4.1.9. OTHERS

12.5 TEXTILES

12.5.1 TEXTILES, BY PRODUCT TYPE

12.5.1.1. SOLVENT-BASED INKS

12.5.1.2. WATER-BASED INKS

12.5.1.3. UV-CURED INKS

12.5.1.4. OIL-BASED INKS

12.5.1.5. HOT MELT INKS

12.5.1.6. POWDER INKS

12.5.1.7. ENERGY-CURABLE INKS

12.5.1.8. UV-LED CURABLE INKS

12.5.1.9. OTHERS

12.6 ART

12.6.1 ART, BY PRODUCT TYPE

12.6.1.1. SOLVENT-BASED INKS

12.6.1.2. WATER-BASED INKS

12.6.1.3. UV-CURED INKS

12.6.1.4. OIL-BASED INKS

12.6.1.5. HOT MELT INKS

12.6.1.6. POWDER INKS

12.6.1.7. ENERGY-CURABLE INKS

12.6.1.8. UV-LED CURABLE INKS

12.6.1.9. OTHERS

12.7 FLYRES AND BROCHURES

12.7.1 FLYRES AND BROCHURES, BY PRODUCT TYPE

12.7.1.1. SOLVENT-BASED INKS

12.7.1.2. WATER-BASED INKS

12.7.1.3. UV-CURED INKS

12.7.1.4. OIL-BASED INKS

12.7.1.5. HOT MELT INKS

12.7.1.6. POWDER INKS

12.7.1.7. ENERGY-CURABLE INKS

12.7.1.8. UV-LED CURABLE INKS

12.7.1.9. OTHERS

12.8 DECORATIVE PRINTING

12.8.1 DECORATIVE PRINTING, BY PRODUCT TYPE

12.8.1.1. SOLVENT-BASED INKS

12.8.1.2. WATER-BASED INKS

12.8.1.3. UV-CURED INKS

12.8.1.4. OIL-BASED INKS

12.8.1.5. HOT MELT INKS

12.8.1.6. POWDER INKS

12.8.1.7. ENERGY-CURABLE INKS

12.8.1.8. UV-LED CURABLE INKS

12.8.1.9. OTHERS

12.9 CERAMICS OR ELECTRONICS

12.9.1 CERAMICS OR ELECTRONICS, BY PRODUCT TYPE

12.9.1.1. SOLVENT-BASED INKS

12.9.1.2. WATER-BASED INKS

12.9.1.3. UV-CURED INKS

12.9.1.4. OIL-BASED INKS

12.9.1.5. HOT MELT INKS

12.9.1.6. POWDER INKS

12.9.1.7. ENERGY-CURABLE INKS

12.9.1.8. UV-LED CURABLE INKS

12.9.1.9. OTHERS

12.1 OTHERS

13 GLOBAL PRINTING INKS MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (KILO TONS)

GLOBAL PRINTING INKS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 U.K.

13.2.3 ITALY

13.2.4 FRANCE

13.2.5 SPAIN

13.2.6 SWITZERLAND

13.2.7 RUSSIA

13.2.8 TURKEY

13.2.9 BELGIUM

13.2.10 NETHERLANDS

13.2.11 SWITZERLAND

13.2.12 DENMARK

13.2.13 NORWAY

13.2.14 FINLAND

13.2.15 SWEDEN

13.2.16 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 SINGAPORE

13.3.6 THAILAND

13.3.7 INDONESIA

13.3.8 MALAYSIA

13.3.9 PHILIPPINES

13.3.10 AUSTRALIA

13.3.11 NEW ZEALAND

13.3.12 HONG KONG

13.3.13 TAIWAN

13.3.14 REST OF ASIA-PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 UNITED ARAB EMIRATES

13.5.5 ISRAEL

13.5.6 BAHRAIN

13.5.7 KUWAIT

13.5.8 OMAN

13.5.9 QATAR

13.5.10 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL PRINTING INKS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL PRINTING INKS MARKET – SWOT ANALYSIS

16 GLOBAL PRINTING INKS MARKET – COMPANY PROFILES

16.1 DIC CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 REVENUE ANALYSIS

16.1.4 RECENT UPDATES

16.2 SAKATA INX (INDIA) PRIVATE LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 REVENUE ANALYSIS

16.2.4 RECENT UPDATES

16.3 FLINT GROUP

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 REVENUE ANALYSIS

16.3.4 RECENT UPDATES

16.4 FUJIFILM INK SPECIALITY GROUP (FISG)

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 REVENUE ANALYSIS

16.4.4 RECENT UPDATES

16.5 SUN CHEMICAL

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 REVENUE ANALYSIS

16.5.4 RECENT UPDATES

16.6 TOYO INK SC HOLDINGS CO., LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 REVENUE ANALYSIS

16.6.4 RECENT UPDATES

16.7 DONECK EUROFLEX S.A.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 REVENUE ANALYSIS

16.7.4 RECENT UPDATES

16.8 T&K TOKA CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 REVENUE ANALYSIS

16.8.4 RECENT UPDATES

16.9 TOKYO PRINTING INK MFG CO., LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 REVENUE ANALYSIS

16.9.4 RECENT UPDATES

16.1 YIP’S CHEMICAL HOLDINGS LIMITED

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 REVENUE ANALYSIS

16.10.4 RECENT UPDATES

16.11 SICPA HOLDING SA

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 REVENUE ANALYSIS

16.11.4 RECENT UPDATES

16.12 SIEGWERK DRUCKFARBEN AG & CO. KGAA

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 REVENUE ANALYSIS

16.12.4 RECENT UPDATES

16.13 KAO COLLINS CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 REVENUE ANALYSIS

16.13.4 RECENT UPDATES

16.14 HUBER GROUP

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 REVENUE ANALYSIS

16.14.4 RECENT UPDATES

16.15 WIKOFF COLOR CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 REVENUE ANALYSIS

16.15.4 RECENT UPDATES

16.16 SEBEK INKS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 REVENUE ANALYSIS

16.16.4 RECENT UPDATES

16.17 DOLPHIN INKS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 REVENUE ANALYSIS

16.17.4 RECENT UPDATES

16.18 BCM INKS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 REVENUE ANALYSIS

16.18.4 RECENT UPDATES

16.19 ALTANA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 REVENUE ANALYSIS

16.19.4 RECENT UPDATES

16.2 DAIHAN INK

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 REVENUE ANALYSIS

16.20.4 RECENT UPDATES

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Printing Inks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Printing Inks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Printing Inks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.