Global Prenatal Testing And New Born Screening Market

Market Size in USD Billion

CAGR :

%

USD

7.90 Billion

USD

17.03 Billion

2025

2033

USD

7.90 Billion

USD

17.03 Billion

2025

2033

| 2026 –2033 | |

| USD 7.90 Billion | |

| USD 17.03 Billion | |

|

|

|

|

Prenatal Testing and New-born Screening Market Size

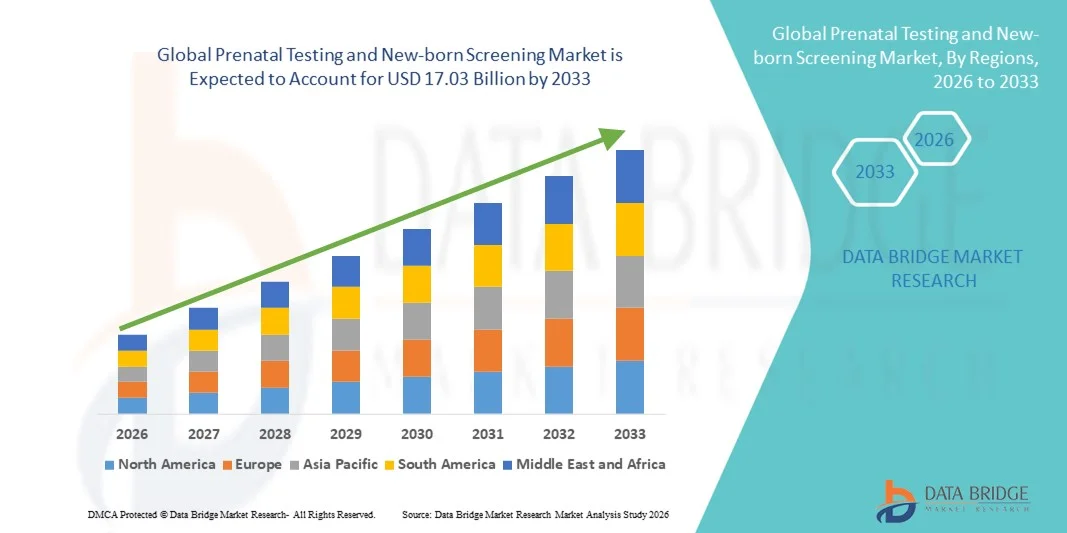

- The global prenatal testing and new-born screening market size was valued at USD 7.90 billion in 2025 and is expected to reach USD 17.03 billion by 2033, at a CAGR of 10.08% during the forecast period

- The market growth is largely fueled by rising prevalence of genetic disorders, increasing maternal age, expanding adoption of advanced testing technologies and growing awareness of early diagnosis benefits among healthcare providers and parents

- Furthermore, supportive government initiatives, mandatory screening programs in many regions, and advancements in genetic counseling and point‑of‑care testing are strengthening demand for integrated prenatal and newborn diagnostic solutions. These converging factors are accelerating the uptake of prenatal testing and newborn screening services, thereby significantly boosting the industry’s growth

Prenatal Testing and New-born Screening Market Analysis

- Prenatal testing and newborn screening, providing early detection of genetic, metabolic, and congenital disorders, are increasingly essential components of modern maternal and infant healthcare due to their ability to guide timely interventions, improve health outcomes, and reduce long-term healthcare costs

- The escalating demand for these tests is primarily fueled by rising prevalence of genetic disorders, increasing maternal age, growing awareness of early diagnosis benefits, and widespread adoption of advanced testing technologies, including non-invasive prenatal testing (NIPT) and comprehensive newborn screening panels

- North America dominated the prenatal testing and newborn screening market with the largest revenue share of 38.5% in 2025, characterized by well-established healthcare infrastructure, supportive government regulations, high healthcare expenditure, and a strong presence of key industry players, with the U.S. experiencing substantial growth due to innovations in genetic counseling, point-of-care diagnostics, and adoption of next-generation sequencing technologies

- Asia-Pacific is expected to be the fastest growing region in the prenatal testing and newborn screening market during the forecast period due to increasing healthcare awareness, expanding healthcare infrastructure, and rising disposable incomes in countries such as China and India

- Non-invasive segment dominated the market with a share of 45.1% in 2025, driven by its high accuracy, minimal risk to the fetus, and growing preference among expectant mothers and healthcare providers for safer, early-stage diagnostic options

Report Scope and Prenatal Testing and New-born Screening Market Segmentation

|

Attributes |

Prenatal Testing and New-born Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Prenatal Testing and New-born Screening Market Trends

Advancements in Non-Invasive and AI-Driven Genetic Testing

- A significant and accelerating trend in the global prenatal testing and newborn screening market is the increasing adoption of non-invasive prenatal testing (NIPT) and AI-driven genomic analysis, enabling safer, faster, and more accurate detection of genetic disorders

- For instance, the Harmony Prenatal Test utilizes cell-free DNA combined with AI algorithms to screen for chromosomal abnormalities early in pregnancy, providing highly reliable results without risk to the fetus

- AI integration in prenatal diagnostics allows predictive modeling of genetic risks, automated anomaly detection, and personalized reporting for healthcare providers. For instance, some GeneDx models analyze genomic data to suggest early interventions based on detected risk factors

- Integration of prenatal testing platforms with hospital information systems and digital health records facilitates centralized monitoring and follow-up, enabling healthcare providers to track maternal and newborn health in a unified digital environment

- The adoption of multi-gene and expanded newborn screening panels is growing, allowing detection of rare metabolic and genetic disorders, thereby supporting early intervention strategies and improving long-term child health outcomes

- This trend toward safer, data-driven, and integrated prenatal and newborn diagnostics is reshaping patient and provider expectations. Consequently, companies such as Natera are developing AI-enabled solutions capable of comprehensive genome analysis and seamless digital integration with clinical workflows

- The demand for advanced, minimally invasive, and AI-powered prenatal and newborn screening solutions is growing rapidly across both developed and emerging markets, as stakeholders prioritize accuracy, safety, and early intervention in maternal and infant healthcare

Prenatal Testing and New-born Screening Market Dynamics

Driver

Rising Genetic Disorder Prevalence and Growing Awareness

- The increasing incidence of genetic and congenital disorders, coupled with rising awareness among expectant parents and healthcare providers, is a significant driver for the heightened demand for prenatal and newborn screening

- For instance, in March 2025, Natera announced expanded adoption of its NIPT solution across several U.S. hospitals, aimed at early detection of chromosomal abnormalities and improved maternal-fetal outcomes

- As parents and clinicians become more conscious of potential health risks, prenatal and newborn screening offers timely interventions, counseling, and clinical decision support, providing a compelling alternative to traditional postnatal diagnosis

- Furthermore, the growing penetration of advanced diagnostic technologies and the expansion of maternal health programs are making prenatal testing an integral part of standard prenatal care, offering seamless integration with electronic health records

- The convenience of early, non-invasive testing, predictive risk assessments, and comprehensive newborn screening panels are key factors propelling adoption. The trend toward accessible testing and digital health integration further contributes to market growth

- Rising investment in research and development by diagnostic companies to expand test accuracy, reduce turnaround times, and integrate AI analytics is driving innovation and market expansion

- Collaborations between public health agencies and private companies to implement nationwide newborn screening programs are increasing testing coverage, particularly in emerging economies, further fueling market demand

Restraint/Challenge

Regulatory Hurdles and High Testing Costs

- Strict regulatory requirements and varying healthcare policies across regions pose a significant challenge to broader market adoption, as prenatal and newborn tests require compliance with rigorous safety and efficacy standards

- For instance, delays in regulatory approvals for new NIPT panels have limited their availability in certain countries, slowing overall market penetration

- Addressing these compliance challenges while ensuring accurate and safe diagnostic results is crucial for building provider and patient trust. Companies such as Illumina emphasize validation studies and certification processes to reassure stakeholders. In addition, high costs of advanced prenatal and genomic tests can be a barrier for price-sensitive populations, particularly in developing regions

- While insurance coverage and government funding are gradually improving, the perceived premium for cutting-edge genetic testing can still hinder adoption for patients who do not see immediate benefits

- Limited awareness and education among healthcare providers and patients about the availability and utility of prenatal and newborn screening in certain regions further restrains market growth

- Infrastructure limitations, such as lack of advanced diagnostic labs or trained genetic counselors in rural or underdeveloped areas, can delay timely testing and reduce accessibility of comprehensive screening services

- Overcoming these challenges through regulatory harmonization, reimbursement support, cost-effective testing solutions, and healthcare provider education will be vital for sustained market growth

Prenatal Testing and New-born Screening Market Scope

The market is segmented on the basis of type, test, product, technology, and end user.

- By Type

On the basis of type, the prenatal testing and newborn screening market is segmented into newborn screening and prenatal testing. The prenatal testing segment dominated the market with the largest revenue share of 54.3% in 2025, driven by increasing awareness among expectant mothers, rising maternal age, and higher prevalence of genetic and chromosomal disorders. Prenatal testing allows early detection of potential complications, guiding timely interventions and counseling for healthcare providers and parents. The availability of advanced non-invasive technologies, coupled with hospital integration and insurance coverage in developed countries, further supports the dominance of this segment. Prenatal testing also benefits from growing adoption of genetic counseling services, which enhances trust and reliance on these diagnostic tools. Government initiatives and guidelines promoting prenatal care in key regions also contribute to the strong market share of prenatal testing.

The newborn screening segment is expected to witness the fastest CAGR of 13.5% from 2026 to 2033, fueled by increasing implementation of mandatory screening programs in emerging economies. Newborn screening helps identify rare metabolic and genetic disorders shortly after birth, allowing for early intervention that significantly improves child health outcomes. The segment is benefiting from technological advancements such as expanded panel testing, tandem mass spectrometry, and improved point-of-care diagnostic tools. Growing awareness among parents and pediatricians regarding the long-term benefits of early diagnosis is driving adoption. Increasing government support for national newborn screening programs and rising healthcare expenditure in Asia-Pacific and Latin America also contribute to its rapid growth.

- By Test

On the basis of test, the market is segmented into non-invasive and invasive tests. The non-invasive test segment dominated the market with a revenue share of 45.1% in 2025 due to its safety, accuracy, and minimal risk to both mother and fetus. Non-invasive prenatal testing (NIPT) is widely preferred by healthcare providers and expectant mothers, as it uses cell-free fetal DNA from maternal blood to detect chromosomal abnormalities. The segment’s dominance is further supported by technological advancements, higher adoption in developed countries, and the growing availability of comprehensive genetic panels. Non-invasive tests also reduce the need for follow-up invasive procedures and are increasingly integrated into routine prenatal care workflows. Rising awareness campaigns and positive patient experiences are driving sustained demand for non-invasive tests globally.

The invasive test segment is expected to witness the fastest growth rate of 12.8% from 2026 to 2033, driven by its diagnostic precision for high-risk pregnancies and confirmatory testing following abnormal non-invasive results. Procedures such as amniocentesis and chorionic villus sampling (CVS) are preferred in complex cases requiring definitive genetic analysis. The segment benefits from increased adoption in regions with high-risk pregnancy rates and greater awareness of congenital disorders. Technological improvements reducing procedural risk, coupled with physician recommendations for at-risk populations, are further supporting growth. Emerging markets are adopting invasive testing more rapidly due to enhanced hospital infrastructure and skilled personnel availability.

- By Product

On the basis of product, the market is segmented into ultrasonography, tandem quadrupole detector, reagent and assay kits, hearing screen instruments, and incubator shaker. The reagent and assay kits segment dominated the market with a 49.7% revenue share in 2025, owing to their essential role in both prenatal and newborn testing workflows. Reagents and kits are critical for detecting genetic, metabolic, and infectious disorders and are widely used across hospitals, diagnostic labs, and maternity clinics. The segment benefits from continuous innovation, expansion of test panels, and rising demand for high-throughput testing. Bulk procurement by healthcare facilities, regulatory approvals, and increasing availability of point-of-care assay kits further support its dominance. In addition, the adoption of automation in testing laboratories increases efficiency and drives reliance on assay kits.

The ultrasonography segment is expected to witness the fastest CAGR of 14.1% from 2026 to 2033, driven by rising demand for early fetal monitoring and anomaly detection. Modern ultrasound systems integrated with AI and high-resolution imaging are being increasingly used in prenatal care, facilitating accurate diagnosis and routine monitoring. Expanding hospital infrastructure in emerging economies and increasing awareness of non-invasive fetal health monitoring are key growth drivers. The segment also benefits from technological innovations, ease of use, and integration with electronic medical records for continuous maternal-fetal tracking.

- By Technology

On the basis of technology, the market is segmented into screening technology, diagnostic technology, mass spectrometry, enzyme immunoassays, electrophoresis, and DNA assays. The diagnostic technology segment dominated the market with a revenue share of 57.4% in 2025, driven by its accuracy, reliability, and wide applicability in both prenatal and newborn screening. Diagnostic technologies such as molecular testing, chromosomal microarrays, and next-generation sequencing (NGS) are extensively adopted in hospitals and specialty clinics. The segment benefits from regulatory approvals, integration into standard prenatal and newborn care protocols, and increasing demand for early detection of rare disorders. Rising investments in research and development, expansion of testing panels, and increasing insurance coverage further support its dominance. Diagnostic technology also ensures clinical confidence, reducing false positives and enabling informed decision-making.

The screening technology segment is expected to witness the fastest growth rate of 13.9% from 2026 to 2033, fueled by the implementation of point-of-care screening tools, portable devices, and automated platforms. Mass screening of newborns using advanced enzymatic assays and digital solutions is becoming increasingly adopted in emerging regions. Growth is supported by government programs mandating early-life screening, coupled with technological advancements enhancing speed, sensitivity, and ease of use. The trend toward comprehensive population-level screening and early disease management is accelerating market uptake for screening technologies.

- By End User

On the basis of end user, the market is segmented into hospitals, diagnostic centres, and maternity & specialty clinics. The hospitals segment dominated the market with a revenue share of 61.2% in 2025, due to their advanced infrastructure, availability of trained personnel, and the ability to offer comprehensive prenatal and newborn diagnostic services under one roof. Hospitals also benefit from higher patient volumes, integrated laboratories, and access to advanced technologies such as NIPT and mass spectrometry, ensuring wide adoption of both prenatal and newborn testing services. Supportive insurance coverage and partnerships with assay kit and equipment manufacturers further strengthen hospital dominance. Government programs and hospital-led awareness campaigns also increase patient trust and testing frequency.

The diagnostic centres segment is expected to witness the fastest CAGR of 15.2% from 2026 to 2033, driven by their accessibility, specialization, and increasing preference for outpatient testing services. Diagnostic centres offer convenient, affordable, and rapid testing, particularly in urban and semi-urban regions, catering to time-sensitive prenatal and newborn screening needs. Their flexibility to adopt new technologies quickly, coupled with targeted marketing and collaborations with maternity clinics, is driving rapid growth. Rising awareness among parents about the importance of early screening and convenience of private testing centres is further accelerating adoption in this segment.

Prenatal Testing and New-born Screening Market Regional Analysis

- North America dominated the prenatal testing and newborn screening market with the largest revenue share of 38.5% in 2025, characterized by well-established healthcare infrastructure, supportive government regulations, high healthcare expenditure, and a strong presence of key industry players

- Consumers and healthcare providers in the region highly value the early detection capabilities, accuracy, and safety of both prenatal and newborn screening solutions, as well as the integration of genetic testing with hospital information systems and maternal health programs

- This widespread adoption is further supported by favorable government initiatives, insurance coverage for advanced prenatal tests, high healthcare expenditure, and the presence of key industry players, establishing prenatal and newborn screening as an essential component of maternal and infant healthcare in North America

U.S. Prenatal Testing and New-born Screening Market Insight

The U.S. prenatal testing and newborn screening market captured the largest revenue share of 82% in 2025 within North America, fueled by the widespread adoption of advanced diagnostic technologies and well-established maternal and infant healthcare infrastructure. Expectant parents and healthcare providers increasingly prioritize early detection of genetic, chromosomal, and metabolic disorders to guide timely interventions. The growing preference for non-invasive prenatal testing (NIPT), point-of-care newborn screening, and integration with hospital information systems further propels the market. Moreover, government programs, insurance coverage, and awareness campaigns are significantly contributing to the expansion of prenatal and newborn screening services.

Europe Prenatal Testing and New‑born Screening Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations, rising awareness of congenital and genetic disorders, and the increasing need for early detection in both urban and rural populations. Growing investment in healthcare infrastructure, coupled with the adoption of advanced diagnostic tools such as tandem mass spectrometry and DNA assays, is fostering market growth. European consumers and healthcare providers are increasingly drawn to safe, accurate, and comprehensive prenatal and newborn screening solutions. The region is witnessing significant growth across hospitals, diagnostic centres, and maternity clinics, with screening services being integrated into both routine prenatal care and neonatal programs.

U.K. Prenatal Testing and New‑born Screening Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness among parents and healthcare providers about early detection of genetic and metabolic disorders. Increasing government support for national newborn screening programs and guidelines for prenatal care are encouraging hospitals and clinics to adopt advanced testing solutions. The U.K.’s well-established healthcare system, alongside a high adoption rate of digital health records and maternal health initiatives, is expected to continue stimulating market growth. Concerns regarding congenital disorders and a focus on preventive healthcare are further driving demand for both prenatal and newborn screening services.

Germany Prenatal Testing and New‑born Screening Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of genetic conditions, emphasis on preventive healthcare, and strong healthcare infrastructure. Germany’s well-developed laboratories, coupled with technological innovations in diagnostic assays, mass spectrometry, and non-invasive prenatal tests, promote widespread adoption of screening services. Hospitals and specialty clinics are increasingly integrating prenatal and newborn testing into routine maternal and infant care. Moreover, Germany’s focus on safety, quality, and accuracy in healthcare diagnostics aligns with local consumer and provider expectations, driving market expansion.

Asia-Pacific Prenatal Testing and New‑born Screening Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 15% during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and growing awareness of the benefits of early genetic and newborn screening in countries such as China, India, and Japan. Expanding healthcare infrastructure, government initiatives promoting maternal and child health, and rising availability of advanced diagnostic technologies are driving adoption. Furthermore, Asia-Pacific is emerging as a hub for manufacturing and local distribution of screening kits and diagnostic devices, making prenatal and newborn screening solutions more affordable and accessible to a wider population.

Japan Prenatal Testing and New‑born Screening Market Insight

The Japan market is gaining momentum due to the country’s aging population, high-tech healthcare environment, and emphasis on preventive maternal and infant care. The adoption of prenatal testing and newborn screening is driven by advanced hospital infrastructure, widespread use of non-invasive testing, and integration with digital health platforms. Japanese consumers place significant importance on early detection, convenience, and accuracy, which is fostering growth across both residential maternity services and specialty clinics. Moreover, government initiatives supporting early-life screening programs are accelerating adoption in both urban and rural healthcare settings.

India Prenatal Testing and New‑born Screening Market Insight

The India market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding middle-class population, and rising awareness of prenatal and newborn health. Hospitals, diagnostic centres, and maternity clinics are increasingly offering advanced screening services, including NIPT, expanded newborn panels, and mass spectrometry-based tests. The government’s push for maternal and child health programs, growing accessibility of diagnostic technologies, and affordability of locally manufactured kits are key factors propelling market growth. Furthermore, increasing healthcare literacy and awareness campaigns among expectant mothers are encouraging early adoption of these screening solutions across urban and semi-urban areas.

Prenatal Testing and New-born Screening Market Share

The Prenatal Testing and New-born Screening industry is primarily led by well-established companies, including:

- Natera, Inc. (U.S.)

- PerkinElmer, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Labcorp (U.S.)

- Invitae Corporation (U.S.)

- Centogene N.V. (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Quest Diagnostics Incorporated (U.S.)

- Baebies, Inc. (U.S.)

- Progenity, Inc. (U.S.)

- Ravgen Inc. (U.S.)

- Eurofins Scientific SE (France)

- QIAGEN (Netherlands)

- Veracyte, Inc. (U.S.)

- NIPD Genetics (Ireland)

- BGI Group (China)

- Yourgene Health (U.K.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- OZ Systems, Inc. (U.S.)

What are the Recent Developments in Global Prenatal Testing and New-born Screening Market?

- In December 2025, U.S. Health Secretary Robert F. Kennedy Jr. approved the addition of Duchenne Muscular Dystrophy (DMD) and Metachromatic Leukodystrophy (MLD) to the Recommended Uniform Screening Panel (RUSP) for newborn screening, enabling early detection and access to effective treatments during optimal intervention windows. Early screening is expected to reduce diagnostic delays and improve long‑term outcomes for affected children

- In April 2025, the World Health Organization (WHO) launched the “Healthy beginnings, hopeful futures” campaign for World Health Day, emphasizing the importance of genetic screening including non‑invasive prenatal tests to improve maternal health and newborn survival, while addressing inequities in access across regions

- In February 2025, the CEO of GeneDx publicly advocated for genetic testing for every newborn in the U.S., stressing that comprehensive genome sequencing at birth could detect hundreds of conditions early, enabling intervention and potentially preventing symptoms, although challenges such as insurance coverage remain

- In February 2025, Yourgene Health (Novacyt Group) announced the launch of IONA Care+ in the UK—a non‑invasive prenatal testing service built on its IONA Nx NIPT workflow to deliver faster and more accurate prenatal screening results, minimizing the need for invasive diagnostic procedures

- In January 2025, Myriad Genetics launched the educational website “Know More Sooner”, aimed at increasing public awareness about prenatal genetic testing, clarifying misconceptions, and helping expectant parents make informed decisions about early genetic screening options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.