Global Pregabalin Market

Market Size in USD Million

CAGR :

%

USD

853.86 Million

USD

1,126.98 Million

2024

2032

USD

853.86 Million

USD

1,126.98 Million

2024

2032

| 2025 –2032 | |

| USD 853.86 Million | |

| USD 1,126.98 Million | |

|

|

|

|

Pregabalin Market Size

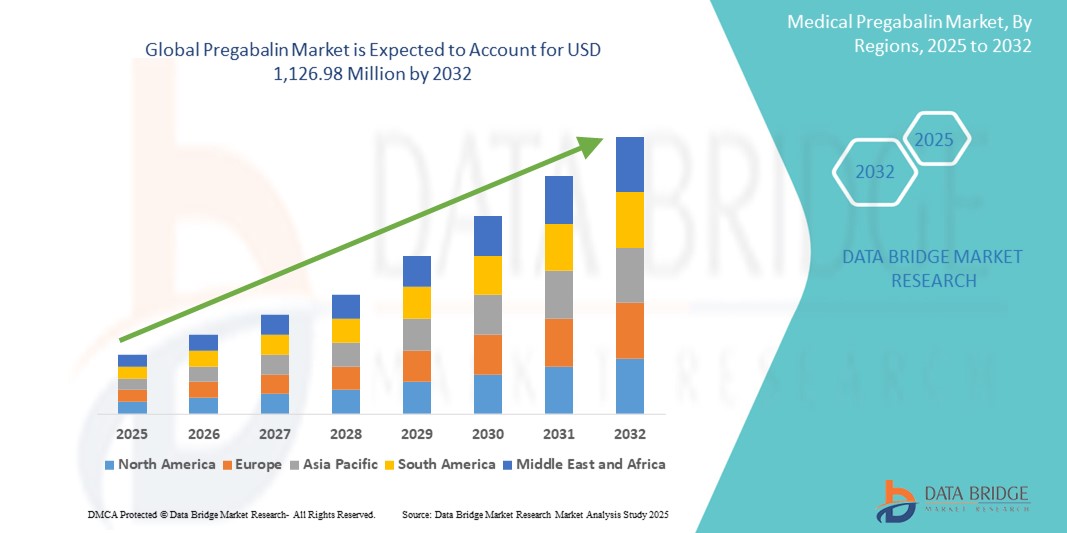

- The global pregabalin market size was valued at USD 853.86 Million in 2024 and is expected to reach USD 1,126.98 Million by 2032, at a CAGR of 3.53% during the forecast period

- The market growth is largely fueled by the rising incidence of neuropathic pain, epilepsy, and generalized anxiety disorder (GAD), coupled with growing awareness and diagnosis rates across both developed and developing regions. This increasing patient pool is directly contributing to the heightened demand for pregabalin as a first-line treatment option

- Furthermore, rising consumer demand for effective, fast-acting, and well-tolerated therapeutic options is establishing Pregabalin as the preferred choice across multiple neurological and pain-related conditions. These converging factors are accelerating the uptake of Pregabalin solutions, thereby significantly boosting the industry's growth

Pregabalin Market Analysis

- Pregabalin, an anticonvulsant and anxiolytic medication, plays a critical role in the treatment of neuropathic pain, epilepsy, fibromyalgia, and generalized anxiety disorder (GAD). It is increasingly vital in modern neurology and pain management protocols due to its fast-acting relief, minimal drug interaction profile, and effectiveness across multiple indications

- The escalating demand for pregabalin is primarily fueled by the growing global burden of chronic pain and neurological disorders, along with increased diagnosis rates and healthcare accessibility in emerging economies. Rising geriatric populations, who are more prone to such conditions, further contribute to market expansion

- North America dominated the pregabalin market with the largest revenue share of 42.8% in 2024, driven by strong prescription volumes in the U.S., a mature healthcare system, and robust insurance coverage. The region benefits from high awareness levels, advanced diagnostic capabilities, and established market players focusing on neuropathic and psychiatric disorders

- Asia-Pacific is expected to be the fastest-growing region in the pregabalin market, projected to expand at a CAGR of 8.9% from 2025 to 2032, fueled by rapid urbanization, rising healthcare spending, and increasing patient awareness. Countries such as China and India are witnessing a surge in epilepsy and diabetic neuropathy cases, supporting wider adoption of Pregabalin

- The neuropathic pain segment dominated the pregabalin market with a revenue share of 47.3% in 2024, owing to the high prevalence of diabetes-induced nerve damage, post-herpetic neuralgia, and chemotherapy-induced neuropathy. Pregabalin’s FDA-approved use for multiple neuropathic conditions ensures continued demand across various patient groups

Report Scope and Pregabalin Market Segmentation

|

Attributes |

Pregabalin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pregabalin Market Trends

“Growing Importance of AI in Drug Discovery and Personalized Therapeutics””

- A significant and accelerating trend in the global pregabalin market is the integration of artificial intelligence (AI) in drug discovery, clinical trial optimization, and personalized medicine. This technological advancement is improving the efficiency and precision of developing pregabalin-based therapies, particularly in the treatment of neuropathic pain, epilepsy, and anxiety disorders

- For instance, leading pharmaceutical companies are using AI platforms to analyze patient data, predict treatment responses, and optimize dosage regimens for pregabalin. Such developments are enabling more targeted and effective treatment plans, improving outcomes and reducing side effects

- AI integration is also helping identify novel indications for pregabalin through data mining and pattern recognition in real-world evidence. This not only expands the therapeutic potential of the drug but also enhances post-market surveillance and pharmacovigilance

- The use of predictive analytics powered by AI is streamlining clinical trial design and recruitment for new pregabalin formulations, such as extended-release versions or combination therapies, significantly reducing time-to-market

- This trend towards more intelligent, data-driven drug development is fundamentally transforming the pharmaceutical landscape. As a result, companies such as Pfizer and Teva Pharmaceuticals are investing heavily in AI partnerships to accelerate innovation in the pregabalin segment

Pregabalin Market Dynamics

Driver

“Growing Need Due to Rising Neuropathic Disorders and Personalized Pain Management”

- The increasing prevalence of neuropathic pain disorders, epilepsy, and generalized anxiety, coupled with a shift toward more personalized medicine, is a significant driver for the heightened demand for Pregabalin

- For instance, in April 2024, Pfizer Inc., one of the primary manufacturers of Pregabalin, announced a strategic expansion into emerging markets across Asia and Latin America, aiming to improve access to neuropathic pain medications. Such initiatives by key players are expected to accelerate the growth of the Pregabalin industry during the forecast period

- As healthcare providers and patients become more aware of the long-term consequences of unmanaged nerve pain and epilepsy, Pregabalin’s proven efficacy in providing symptomatic relief makes it a first-line treatment choice in multiple therapeutic guidelines

- Furthermore, the growing acceptance of centralized prescription models, increased mental health awareness, and chronic pain management strategies are making Pregabalin an integral part of multi-modal treatment protocols in hospitals and specialty clinics

- The convenience of once or twice daily dosing, availability in multiple dosage forms (capsules, oral solution), and generally favorable side-effect profile contribute to Pregabalin’s strong adoption in both developed and developing regions. The rising geriatric population and the associated increase in neuropathic conditions further amplify this demand

Restraint/Challenge

“Patent Expiry, Regulatory Pressure, and Risk of Abuse Potential”

- The expiration of key patents for branded pregabalin, such as Lyrica, has led to increased generic competition, putting downward pressure on pricing and margins for original manufacturers

- For instance, since 2019, multiple generic players have launched lower-cost alternatives in Europe and the U.S., which—while increasing access—have also introduced concerns over market saturation and profitability for premium brands

- Another significant challenge is the growing regulatory scrutiny related to the misuse and abuse potential of Pregabalin, especially in combination with opioids or other CNS depressants. Several countries, including the U.K. and some EU members, have moved to reclassify Pregabalin as a controlled substance due to rising misuse cases

- To address these challenges, pharmaceutical companies must focus on physician education, proper labeling, and controlled marketing strategies. In addition, the need for more rigorous post-marketing surveillance is essential to mitigate abuse risks

- Although cost-effective generics support market volume growth, the reduced profitability and stricter regulations create headwinds that need strategic navigation to ensure long-term sustainability in the Pregabalin market

Pregabalin Market Scope

The pregabalin market is segmented into five notable segments based on dosage form, application, drug class, end-users, and distribution channel.

• By Dosage Form

On the basis of dosage form, the pregabalin market is segmented into oral capsule, oral solution, oral tablet, and extended release. The oral capsule segment dominated the largest market revenue share of 46.8% in 2024, owing to its wide prescription base, ease of administration, and high patient adherence. Capsules are also favored for their stability and extended shelf life.

The extended-release segment is anticipated to witness the fastest growth rate of 7.9% from 2025 to 2032, driven by increasing demand for once-daily formulations that enhance patient compliance, particularly among individuals managing chronic neuropathic pain and generalized anxiety disorder.

• By Application

On the basis of application, the pregabalin market is segmented into epilepsy, neuropathic pain, anxiety disorder, and others. The neuropathic pain segment accounted for the largest market revenue share of 47.3% in 2024, driven by the growing global burden of diabetes, cancer, and spinal cord injuries—all of which contribute to neuropathic pain. Pregabalin's strong clinical efficacy in pain modulation makes it the preferred choice.

The anxiety disorder segment is expected to witness the fastest CAGR of 8.4% from 2025 to 2032, attributed to rising awareness around mental health and an increasing number of prescriptions in off-label usage for generalized anxiety treatment, especially in Europe and Asia-Pacific.

• By Drug Class

On the basis of drug class, the pregabalin market is segmented into fibromyalgia agents, anticonvulsants, and others. The anticonvulsants segment dominated the market with a revenue share of 49.6% in 2024, as Pregabalin is widely prescribed as a second-generation antiepileptic drug.

The fibromyalgia agents segment is projected to register the fastest CAGR of 7.2% during the forecast period, fueled by growing diagnoses and awareness about fibromyalgia, especially in North America and Western Europe, where pregabalin remains one of the few FDA-approved medications for the condition.

• By End-User

On the basis of end-users, the pregabalin market is segmented into hospitals, specialty clinics, homecare, and others. The hospitals segment held the largest market share of 41.3% in 2024, driven by the high volume of inpatient prescriptions and widespread usage in acute care settings.

The homecare segment is expected to grow at the fastest CAGR of 9.1% between 2025 and 2032, supported by an aging population, rising preference for home-based treatments, and increased accessibility of remote medical guidance.

• By Distribution Channel

On the basis of distribution channel, the pregabalin market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The retail pharmacy segment captured the largest revenue share of 47.9% in 2024, reflecting strong patient access and convenience in obtaining repeat prescriptions for chronic conditions.

The online pharmacy segment is forecasted to experience the fastest CAGR of 10.6% from 2025 to 2032, owing to the rapid digitization of healthcare, improved e-commerce infrastructure, and growing patient preference for discreet, home-delivered medication services.

Pregabalin Market Regional Analysis

- North America dominated the pregabalin market with the largest revenue share of 42.8% in 2024, driven by high prevalence of neuropathic pain and anxiety disorders, growing awareness about fibromyalgia, and widespread access to healthcare services and prescription drugs

- The region benefits from favorable reimbursement policies, a well-established pharmaceutical supply chain, and robust clinical research infrastructure that support the expansion of Pregabalin prescriptions across multiple indications

- In addition, the increasing geriatric population, coupled with a high diagnosis rate for chronic neurological conditions, continues to propel market demand

U.S. Pregabalin Market Insight

The U.S. pregabalin market captured the largest revenue share of 85% in 2024 within North America, attributed to the country’s strong healthcare infrastructure, high rate of chronic pain diagnosis, and a rising number of off-label Pregabalin prescriptions for anxiety disorders and sleep disturbances. The availability of both branded and generic versions enhances accessibility, while a growing trend toward outpatient and homecare services sustains continued market demand.

Europe Pregabalin Market Insight

The Europe pregabalin market is projected to expand at a substantial CAGR throughout the forecast period, fueled by increasing prevalence of epilepsy and neuropathic pain, and growing awareness about mental health disorders. Countries such as Germany, the U.K., and France are leading in terms of prescription volume due to supportive regulatory frameworks and the presence of major generic manufacturers. Additionally, the demand for cost-effective generics is supporting consistent market growth.

U.K. Pregabalin Market Insight

The U.K. pregabalin market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a high incidence of fibromyalgia and diabetic neuropathy. The country’s National Health Service (NHS) guidelines encourage the use of generic pregabalin, ensuring wide patient coverage. Additionally, mental health initiatives and rising general practitioner (GP) consultations for anxiety and sleep disorders are contributing to increased Pregabalin prescriptions.

Germany Pregabalin Market Insight

The Germany pregabalin market is expected to expand at a considerable CAGR, supported by strong insurance coverage for chronic conditions and a growing population of elderly patients susceptible to epilepsy and neuralgia. Germany’s focus on clinical efficacy and strict pharmaceutical regulations favor proven therapies such as Pregabalin. The shift toward outpatient neurological care also provides opportunities for increased Pregabalin use.

Asia-Pacific Pregabalin Market Insight

The Asia-Pacific pregabalin market is poised to grow at the fastest CAGR of 8.9% during 2025–2032, driven by rapidly increasing diabetic population, improved access to healthcare, and rising awareness of neuropathic disorders. In countries such as China, India, and Japan, generic drug production has scaled rapidly, making pregabalin more affordable and widely available. Additionally, increasing mental health diagnoses and growing insurance penetration are further fueling market growth.

Japan Pregabalin Market Insight

The Japan pregabalin market is gaining momentum due to a significant elderly population, high technological advancement in healthcare delivery, and increasing prevalence of chronic pain and epilepsy. Physicians in Japan prefer pregabalin for its effectiveness in treating peripheral neuropathy and post-herpetic neuralgia. Moreover, the government’s support for mental health awareness is contributing to a rise in prescriptions related to generalized anxiety disorder.

China Pregabalin Market Insight

The China pregabalin market accounted for the largest revenue share in Asia-Pacific in 2024, due to the country’s expanding middle class, growing prevalence of diabetes and cancer, and rapid healthcare infrastructure development. Local pharmaceutical companies have increased the production of affordable generic pregabalin, expanding its accessibility across both urban and rural regions.In addition, strong government focus on chronic disease management and pharmaceutical innovation further boosts market potential.

Pregabalin Market Share

The pregabalin industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Zydus Cadila (India)

- Lupin (India)

- Amneal Pharmaceuticals LLC. (U.S.)

- Cipla Inc. (U.S.)

- Torrent Pharmaceuticals Ltd. (India)

- Aurobindo Pharma Limited (India)

- Glenmark Pharmaceuticals Limited (India)

- Medley Pharmaceuticals Ltd. (India)

- Genesisbiotec (India)

- Biomax Biotechnics (India)

- Olon S.p.A. (Italy)

- HIKAL Ltd. (India)

Latest Developments in Global Pregabalin Market

- In February 2024, Pfizer Inc., the original developer of Lyrica (brand name for Pregabalin), announced expanded availability of its generic Pregabalin in several emerging markets including Latin America and Southeast Asia. This move is aimed at improving access to essential neuropathic pain and epilepsy treatments in lower-income countries, thereby reinforcing Pfizer’s leadership in the global CNS therapeutics segment

- In January 2024, Teva Pharmaceutical Industries Ltd. launched a new extended-release formulation of Pregabalin in the U.S. market. Designed for once-daily dosing, this formulation aims to improve patient adherence in managing chronic neuropathic pain and fibromyalgia, particularly among elderly patients

- In October 2023, Dr. Reddy’s Laboratories received FDA approval for its Pregabalin extended-release tablets, 165 mg and 330 mg, marking a significant step in the company’s strategy to diversify its complex generics portfolio in the U.S. market

- In August 2023, Sun Pharmaceutical Industries Ltd. initiated clinical trials in India for a combination therapy of Pregabalin and Duloxetine, targeting treatment-resistant neuropathic pain. The trial aims to evaluate the synergistic effect of dual therapy on diabetic neuropathy and fibromyalgia

- In May 2023, Zydus Lifesciences introduced a novel fixed-dose combination (FDC) of Pregabalin and Nortriptyline in India. This FDC is designed to offer comprehensive pain relief in patients suffering from peripheral neuropathic conditions, enhancing Zydus' neurology product portfolio

- In March 2023, Lupin Limited launched Pregabalin oral solution in the European market following the EMA's approval. The new formulation is intended for patients with swallowing difficulties, particularly in the geriatric and pediatric population

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PREGABALIN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PREGABALIN MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PREGABALIN MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.1.1 PATENT LANDSCAPE

6.1.2 USPTO NUMBER

6.1.3 PATENT EXPIRY

6.1.4 EPIO NUMBER

6.1.5 PATENT STRENGTH AND QUALITY

6.1.6 PATENT CLAIMS

6.1.7 PATENT CITATIONS

6.1.8 PATENT LITIGATION AND LICENSING

6.1.9 FILE OF PATENT

6.1.10 PATENT RECEIVED CONTRIES

6.1.11 TECHNOLOGY BACKGROUND

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH SPECIALIST

6.8 OTHER KOL SNAPSHOTS

7 EPIDEMIOLOGY

7.1 INCIDENCE OF ALL BY GENDER

7.2 TREATMENT RATE

7.3 MORTALITY RATE

7.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

7.5 PATIENT TREATMENT SUCCESS RATES

8 MERGERS AND ACQUISITION

8.1 LICENSING

8.2 COMMERCIALIZATION AGREEMENTS

9 REGULATORY FRAMEWORK

9.1 REGULATORY APPROVAL PROCESS

9.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

9.3 REGULATORY APPROVAL PATHWAYS

9.4 LICENSING AND REGISTRATION

9.5 POST-MARKETING SURVEILLANCE

9.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

10 PIPELINE ANALYSIS

10.1 CLINICAL TRIALS AND PHASE ANALYSIS

10.2 DRUG THERAPY PIPELINE

10.3 PHASE III CANDIDATES

10.4 PHASE II CANDIDATES

10.5 PHASE I CANDIDATES

10.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR XX

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

11 MARKETED DRUG ANALYSIS

11.1 DRUG

11.1.1 BRAND NAME

11.1.2 GENERICS NAME

11.2 THERAPEUTIC INDICTION

11.3 PHARMACOLOGICAL CLASS OF THE DRUG

11.4 DRUG PRIMARY INDICATION

11.5 MARKET STATUS

11.6 MEDICATION TYPE

11.7 DRUG DOSAGES FORM

11.8 DOSAGES AVAILABILITY

11.9 DRUG ROUTE OF ADMINISTRATION

11.1 DOSING FREQUENCY

11.11 DRUG INSIGHT

11.12 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

11.12.1 FORECAST MARKET OUTLOOK

11.12.2 CROSS COMPETITION

11.12.3 THERAPEUTIC PORTFOLIO

11.12.4 CURRENT DEVELOPMENT SCENARIO

12 MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13 R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14 MARKET OVERVIEW

14.1 DRIVERS

14.2 RESTRAINTS

14.3 OPPORTUNITIES

14.4 CHALLENGES

15 GLOBAL PREGABALIN MARKET, BY DRUG TYPE

15.1 OVERVIEW

15.2 GENERICS

15.3 BRANDED

15.3.1 LYRICA

15.3.2 LYRICA CR

15.3.3 OTHERS

15.3.3.1. MARKET VALUE (USD MN)

15.3.3.2. MARKET VOLUME (SU)

15.3.3.3. AVERAGE SELLING PRICE (USD)

16 GLOBAL PREGABALIN MARKET, BY DRUG CLASS

16.1 OVERVIEW

16.2 EXTENDED RELEASE

16.3 REGULAR RELEASE

17 GLOBAL PREGABALIN MARKET, BY DOSAGE FORM

17.1 OVERVIEW

17.2 ORAL CAPSULE

17.2.1 100 MG

17.2.2 150 MG

17.2.3 200 MG

17.2.4 225 MG

17.2.5 25 MG

17.2.6 300 MG

17.2.7 50 MG

17.2.8 75 MG

17.2.9 OTHERS

17.3 ORAL TABLET

17.3.1 165 MG

17.3.2 330 MG

17.3.3 82.5 MG

17.3.4 OTHERS

17.4 ORAL SOLUTION

17.5 OTHERS

18 GLOBAL PREGABALIN MARKET, BY INDICATION

18.1 OVERVIEW

18.2 NEUROPATHY

18.2.1 DIABETIC PERIPHERAL NEUROPATHY

18.2.2 PERIPHERAL NEUROPATHY

18.2.3 SMALL FIBER NEUROPATHY

18.2.4 PERIPHERAL NEUROPATHIC PAIN

18.2.5 CENTRAL NEUROPATHIC PAIN

18.2.6 OTHERS

18.3 EPILEPSIES

18.4 FIBROMYALGIA

18.5 POST HERPETIC NEURALGIA

18.6 GENERALISED ANXIETY DISORDER

18.7 COUGH & CHRONIC REFRACTORY CONDITIONS

18.8 CHRONIC PRUITUS

18.9 OTHERS

19 GLOBAL PREGABALIN MARKET, BY AGE GROUP

19.1 OVERVIEW

19.2 ADULT

19.3 GERIATRIC

20 GLOBAL PREGABALIN MARKET, BY END USER

20.1 OVERVIEW

20.2 HOSPITALS

20.2.1 PUBLIC

20.2.2 PRIVATE

20.3 SPECIALTY CLINICS

20.4 ACADEMIC & RESEARCH INSTITUTIONS

20.5 HOME HEALTHCARE

20.6 OTHERS

21 GLOBAL PREGABALIN MARKET, BY DISTRIBUTION CHANNEL

21.1 OVERVIEW

21.2 DIRECT TENDER

21.3 RETAIL SALES

21.3.1 HOSPITAL PHARMACY

21.3.2 ONLINE PHARMACY

21.3.3 MEDICINE STORES

21.4 OTHERS

22 GLOBAL PREGABALIN MARKET, BY GEOGRAPHY

GLOBAL PREGABALIN MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1 NORTH AMERICA

22.1.1 U.S.

22.1.2 CANADA

22.1.3 MEXICO

22.2 EUROPE

22.2.1 GERMANY

22.2.2 FRANCE

22.2.3 U.K.

22.2.4 HUNGARY

22.2.5 LITHUANIA

22.2.6 AUSTRIA

22.2.7 IRELAND

22.2.8 NORWAY

22.2.9 POLAND

22.2.10 ITALY

22.2.11 SPAIN

22.2.12 RUSSIA

22.2.13 TURKEY

22.2.14 NETHERLANDS

22.2.15 SWITZERLAND

22.2.16 REST OF EUROPE

22.3 ASIA-PACIFIC

22.3.1 JAPAN

22.3.2 CHINA

22.3.3 SOUTH KOREA

22.3.4 INDIA

22.3.5 AUSTRALIA

22.3.6 SINGAPORE

22.3.7 THAILAND

22.3.8 MALAYSIA

22.3.9 INDONESIA

22.3.10 PHILIPPINES

22.3.11 VIETNAM

22.3.12 REST OF ASIA-PACIFIC

22.4 SOUTH AMERICA

22.4.1 BRAZIL

22.4.2 ARGENTINA

22.4.3 PERU

22.4.4 REST OF SOUTH AMERICA

22.5 MIDDLE EAST AND AFRICA

22.5.1 SOUTH AFRICA

22.5.2 GLOBAL

22.5.3 UAE

22.5.4 EGYPT

22.5.5 KUWAIT

22.5.6 ISRAEL

22.5.7 REST OF MIDDLE EAST AND AFRICA

22.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

23 GLOBAL PREGABALIN MARKET, SWOT AND DBMR ANALYSIS

24 GLOBAL PREGABALIN MARKET, COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.3 COMPANY SHARE ANALYSIS: EUROPE

24.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

24.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

24.6 MERGERS & ACQUISITIONS

24.7 NEW PRODUCT DEVELOPMENT & APPROVALS

24.8 EXPANSIONS

24.9 REGULATORY CHANGES

24.1 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL PREGABALIN MARKET, COMPANY PROFILE

25.1 PFIZER INC.

25.1.1 COMPANY OVERVIEW

25.1.2 REVENUE ANALYSIS

25.1.3 GEOGRAPHIC PRESENCE

25.1.4 PRODUCT PORTFOLIO

25.1.5 RECENT DEVELOPMENTS

25.2 VIATRIS INC.

25.2.1 COMPANY OVERVIEW

25.2.2 REVENUE ANALYSIS

25.2.3 GEOGRAPHIC PRESENCE

25.2.4 PRODUCT PORTFOLIO

25.2.5 RECENT DEVELOPMENTS

25.3 ADVACARE PHARMA

25.3.1 COMPANY OVERVIEW

25.3.2 REVENUE ANALYSIS

25.3.3 GEOGRAPHIC PRESENCE

25.3.4 PRODUCT PORTFOLIO

25.3.5 RECENT DEVELOPMENTS

25.4 ALEMBIC PHARMACEUTICALS

25.4.1 COMPANY OVERVIEW

25.4.2 REVENUE ANALYSIS

25.4.3 GEOGRAPHIC PRESENCE

25.4.4 PRODUCT PORTFOLIO

25.4.5 RECENT DEVELOPMENTS

25.5 ALKEM LABORATORIES LTD

25.5.1 COMPANY OVERVIEW

25.5.2 REVENUE ANALYSIS

25.5.3 GEOGRAPHIC PRESENCE

25.5.4 PRODUCT PORTFOLIO

25.5.5 RECENT DEVELOPMENTS

25.6 LUPIN

25.6.1 COMPANY OVERVIEW

25.6.2 REVENUE ANALYSIS

25.6.3 GEOGRAPHIC PRESENCE

25.6.4 PRODUCT PORTFOLIO

25.6.5 RECENT DEVELOPMENTS

25.7 AMNEAL PHARMACEUTIALS LLC.

25.7.1 COMPANY OVERVIEW

25.7.2 REVENUE ANALYSIS

25.7.3 GEOGRAPHIC PRESENCE

25.7.4 PRODUCT PORTFOLIO

25.7.5 RECENT DEVELOPMENTS

25.8 APOTEX INC.

25.8.1 COMPANY OVERVIEW

25.8.2 REVENUE ANALYSIS

25.8.3 GEOGRAPHIC PRESENCE

25.8.4 PRODUCT PORTFOLIO

25.8.5 RECENT DEVELOPMENTS

25.9 CELLTRIONPHARMA INC.

25.9.1 COMPANY OVERVIEW

25.9.2 REVENUE ANALYSIS

25.9.3 GEOGRAPHIC PRESENCE

25.9.4 PRODUCT PORTFOLIO

25.9.5 RECENT DEVELOPMENTS

25.1 DR REDDY LABORATORIES LTD.

25.10.1 COMPANY OVERVIEW

25.10.2 REVENUE ANALYSIS

25.10.3 GEOGRAPHIC PRESENCE

25.10.4 PRODUCT PORTFOLIO

25.10.5 RECENT DEVELOPMENTS

25.11 ESKAYEF PHARMACEUTICALS LIMITED

25.11.1 COMPANY OVERVIEW

25.11.2 REVENUE ANALYSIS

25.11.3 GEOGRAPHIC PRESENCE

25.11.4 PRODUCT PORTFOLIO

25.11.5 RECENT DEVELOPMENTS

25.12 CAMBER PHARMACEUTICALS INC.

25.12.1 COMPANY OVERVIEW

25.12.2 REVENUE ANALYSIS

25.12.3 GEOGRAPHIC PRESENCE

25.12.4 PRODUCT PORTFOLIO

25.12.5 RECENT DEVELOPMENTS

25.13 VIVANTA GENERICS (MSN GROUP)

25.13.1 COMPANY OVERVIEW

25.13.2 REVENUE ANALYSIS

25.13.3 GEOGRAPHIC PRESENCE

25.13.4 PRODUCT PORTFOLIO

25.13.5 RECENT DEVELOPMENTS

25.14 CIPLA

25.14.1 COMPANY OVERVIEW

25.14.2 REVENUE ANALYSIS

25.14.3 GEOGRAPHIC PRESENCE

25.14.4 PRODUCT PORTFOLIO

25.14.5 RECENT DEVELOPMENTS

25.15 MARKSANS PHARMALTD.

25.15.1 COMPANY OVERVIEW

25.15.2 REVENUE ANALYSIS

25.15.3 GEOGRAPHIC PRESENCE

25.15.4 PRODUCT PORTFOLIO

25.15.5 RECENT DEVELOPMENTS

25.16 SCIEGEN PHARMACEUTICALS, INC.

25.16.1 COMPANY OVERVIEW

25.16.2 REVENUE ANALYSIS

25.16.3 GEOGRAPHIC PRESENCE

25.16.4 PRODUCT PORTFOLIO

25.16.5 RECENT DEVELOPMENTS

25.17 LAURUS LABS LIMITED

25.17.1 COMPANY OVERVIEW

25.17.2 REVENUE ANALYSIS

25.17.3 GEOGRAPHIC PRESENCE

25.17.4 PRODUCT PORTFOLIO

25.17.5 RECENT DEVELOPMENTS

25.18 STRIDES PHARMA SCIENCE LIMITED

25.18.1 COMPANY OVERVIEW

25.18.2 REVENUE ANALYSIS

25.18.3 GEOGRAPHIC PRESENCE

25.18.4 PRODUCT PORTFOLIO

25.18.5 RECENT DEVELOPMENTS

25.19 SUN PHARMACEUTICALS INDUSTRIES LTD.

25.19.1 COMPANY OVERVIEW

25.19.2 REVENUE ANALYSIS

25.19.3 GEOGRAPHIC PRESENCE

25.19.4 PRODUCT PORTFOLIO

25.19.5 RECENT DEVELOPMENTS

25.2 TEVA PHARMACEUTICALS USA, INC.

25.20.1 COMPANY OVERVIEW

25.20.2 REVENUE ANALYSIS

25.20.3 GEOGRAPHIC PRESENCE

25.20.4 PRODUCT PORTFOLIO

25.20.5 RECENT DEVELOPMENTS

25.21 ADALVO LIMITED

25.21.1 COMPANY OVERVIEW

25.21.2 REVENUE ANALYSIS

25.21.3 GEOGRAPHIC PRESENCE

25.21.4 PRODUCT PORTFOLIO

25.21.5 RECENT DEVELOPMENTS

25.22 SHANGHAI PHARMA HOLDINGS CO., LTD.

25.22.1 COMPANY OVERVIEW

25.22.2 REVENUE ANALYSIS

25.22.3 GEOGRAPHIC PRESENCE

25.22.4 PRODUCT PORTFOLIO

25.22.5 RECENT DEVELOPMENTS

25.23 AUROBINDO PHARMA USA

25.23.1 COMPANY OVERVIEW

25.23.2 REVENUE ANALYSIS

25.23.3 GEOGRAPHIC PRESENCE

25.23.4 PRODUCT PORTFOLIO

25.23.5 RECENT DEVELOPMENTS

25.24 HETERO HEALTHCARE LIMITED

25.24.1 COMPANY OVERVIEW

25.24.2 REVENUE ANALYSIS

25.24.3 GEOGRAPHIC PRESENCE

25.24.4 PRODUCT PORTFOLIO

25.24.5 RECENT DEVELOPMENTS

25.25 ACCORD HEALTHCARE B.V.( INTAS PHARMACEUTICALS)

25.25.1 COMPANY OVERVIEW

25.25.2 REVENUE ANALYSIS

25.25.3 GEOGRAPHIC PRESENCE

25.25.4 PRODUCT PORTFOLIO

25.25.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

26 RELATED REPORTS

27 CONCLUSION

28 QUESTIONNAIRE

29 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.