Global Power Tools Market

Market Size in USD Billion

CAGR :

%

USD

40.50 Billion

USD

63.10 Billion

2024

2032

USD

40.50 Billion

USD

63.10 Billion

2024

2032

| 2025 –2032 | |

| USD 40.50 Billion | |

| USD 63.10 Billion | |

|

|

|

|

Power Tools Market Size

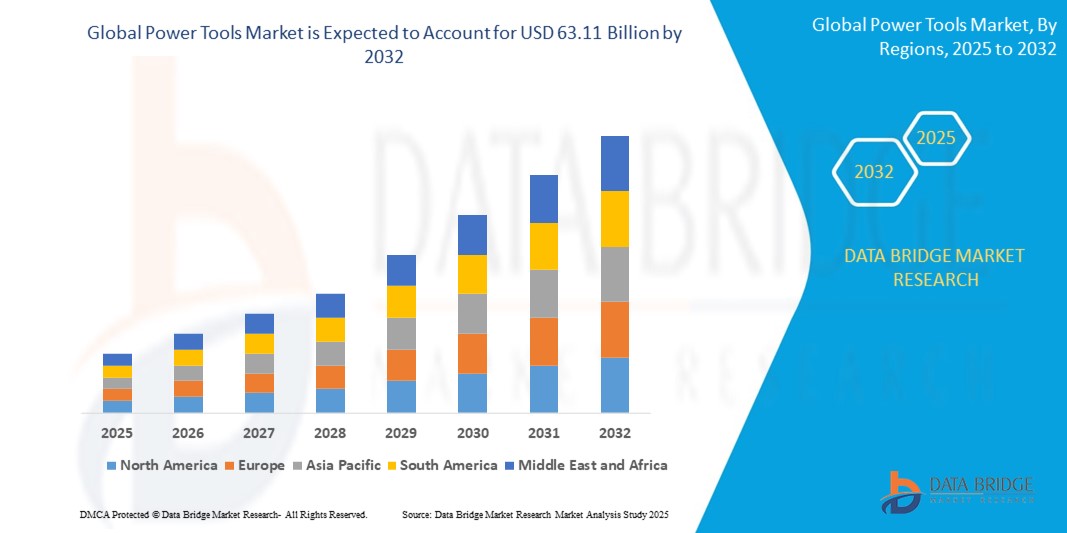

- The global power tools market size was valued at USD 40.50 billion in 2024 and is expected to reach USD 63.11 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by rising construction and infrastructure development activities across emerging and developed economies, increasing the demand for efficient, high-performance power tools in residential, commercial, and industrial applications

- Furthermore, growing consumer preference for cordless and battery-powered tools, coupled with advancements in brushless motor technology and lithium-ion batteries, is accelerating the adoption of modern power tools, thereby significantly boosting the industry's growth

Power Tools Market Analysis

- Power tools, enabling mechanical operations such as drilling, cutting, fastening, and grinding, are increasingly vital in construction, manufacturing, automotive, and DIY applications due to their high efficiency, precision, and ability to reduce manual effort across residential, commercial, and industrial settings

- The escalating demand for power tools is primarily fueled by rapid urbanization, expanding infrastructure projects, and growing adoption of cordless and battery-powered tools supported by advancements in motor and battery technologies

- Asia-Pacific dominated the power tools market with a share of 36.1% in 2024, due to robust industrialization, rapid infrastructure development, and expanding automotive and construction sectors across emerging economies

- North America is expected to be the fastest growing region in the power tools market during the forecast period due to rising construction activity, increasing residential renovations, and growing adoption of battery-powered tools in professional trades

- Electric segment dominated the market with a market share of 66.5% in 2024, due to its widespread use across both consumer and professional applications. The dominance of electric power tools is supported by innovations in cordless technology, lithium-ion battery systems, and energy-efficient motors, which provide consistent power output and portability. Their ease of use, reduced maintenance, and compatibility with smart charging systems make them the preferred choice for various end users

Report Scope and Power Tools Market Segmentation

|

Attributes |

Power Tools Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Power Tools Market Trends

“Rising Demand for Power Tools in the Automotive Sector”

- A significant and accelerating trend in the global power tools market is the rising demand from the automotive sector, where precision, efficiency, and speed are crucial in manufacturing and assembly processes

- For instance, pneumatic and cordless electric tools are extensively used for tasks such as fastening, drilling, and grinding during vehicle assembly and repair. Companies such as Bosch and Stanley Black & Decker offer advanced torque-controlled tools specifically for automotive applications

- The integration of smart technologies in power tools allows real-time performance monitoring and torque accuracy, enhancing productivity and reducing human error on production lines. For instance, Atlas Copco’s smart tools provide data feedback and predictive maintenance alerts, improving operational efficiency

- Automation and electrification trends in the automotive industry are driving the adoption of more sophisticated, programmable power tools. These tools support greater consistency in repetitive tasks and meet stringent safety and quality standards

- This growing reliance on precision tools in vehicle production and aftersales services is reshaping tool specifications and prompting manufacturers to invest in tool innovation tailored to automotive needs

- The demand for efficient, durable, and ergonomically designed power tools in automotive assembly lines and service stations is increasing globally, especially as electric vehicle manufacturing expands and requires more specialized tool solutions

Power Tools Market Dynamics

Driver

“Growing Technological Advancements”

- The increasing incorporation of brushless motors, lithium-ion batteries, and IoT-enabled features is a key driver fueling growth in the power tools market

- For instance, manufacturers are introducing tools with enhanced torque control, wireless connectivity, and real-time diagnostics, improving efficiency and safety in industrial and professional environments

- Innovations such as battery platform standardization (e.g., Bosch’s AMPShare and DeWalt’s FLEXVOLT) are enabling users to power multiple tools with a single battery system, boosting convenience and productivity

- These advancements are also extending battery life, reducing downtime, and enabling cordless tools to match the performance of corded counterparts, thereby accelerating their adoption across applications. Smart power tools integrated with Bluetooth and cloud-based monitoring systems are enabling predictive maintenance, reducing tool failure and operational interruptions

- These technological improvements are enhancing tool capabilities and are also aligning with the growing need for automation and digital integration in construction, manufacturing, and DIY sectors

Power Tools Market Scope

The market is segmented on the basis of type, mode of operation, application, material, end user, and sales channel.

• By Type

On the basis of type, the power tools market is segmented into sawing and cutting, drilling and fastening, demolition, routing, portable nibblers, air-powered, material removal, electric cords and plugs, accessories, and others. The drilling and fastening segment dominated the largest market revenue share in 2024, driven by its extensive application across construction, woodworking, and metalworking industries. These tools are integral to both assembly and repair operations due to their versatility, high precision, and availability in cordless, compact forms that enhance mobility and ease of use. The increasing adoption of battery-powered drill drivers with brushless motors and smart features such as torque adjustment and overload protection continues to fuel their demand in residential and industrial settings.

The sawing and cutting segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to rising construction and infrastructure activities, where efficient cutting tools are essential for precise and high-speed material processing. Technological advancements in blade design and motor efficiency, along with growing use in do-it-yourself (DIY) and remodeling projects, are accelerating the uptake of advanced electric saws and cutting equipment.

• By Mode of Operation

On the basis of mode of operation, the market is segmented into electric, liquid fuel, hydraulic, pneumatic, and powder-actuated tools. The electric segment held the largest market revenue share of 66.5% in 2024, attributed to its widespread use across both consumer and professional applications. The dominance of electric power tools is supported by innovations in cordless technology, lithium-ion battery systems, and energy-efficient motors, which provide consistent power output and portability. Their ease of use, reduced maintenance, and compatibility with smart charging systems make them the preferred choice for various end users.

The pneumatic segment is projected to register the fastest CAGR from 2025 to 2032, primarily due to its high power-to-weight ratio, cost-effectiveness for repetitive tasks, and suitability for heavy-duty industrial environments. Pneumatic tools are increasingly used in manufacturing and automotive sectors where precision, speed, and continuous use are crucial.

• By Application

On the basis of application, the market is segmented into concrete and construction, woodworking, metalworking, welding, and others. The concrete and construction segment accounted for the largest market share in 2024, driven by the surge in residential, commercial, and infrastructure development activities. Power tools such as hammers, drills, and saws play a critical role in cutting, fastening, and shaping building materials with efficiency and accuracy. The growing trend of smart cities and sustainable construction is further pushing demand for advanced, energy-efficient power tools.

The woodworking segment is anticipated to witness the fastest growth during the forecast period, propelled by increasing demand for custom furniture, modular interiors, and home improvement projects. Compact and ergonomically designed tools with precision control features are enhancing productivity for both artisans and home users.

• By Material

On the basis of material, the power tools market is segmented into concrete, wood/metal, brick/block, glass, and others. The wood/metal segment led the market in 2024, owing to the broad range of tools specifically designed to handle diverse densities and structures of both materials. These tools support key industries including furniture making, automotive, shipbuilding, and structural fabrication. Their compatibility with different attachments and cutting heads enhances user flexibility and process efficiency.

The glass segment is expected to register the fastest CAGR from 2025 to 2032, driven by the increasing installation of glass fixtures and facades in modern architecture and automotive design. Specialized glass cutting and polishing tools, equipped with precision cooling systems and safety features, are seeing greater adoption among professionals aiming for high-quality finishes.

• By End User

On the basis of end user, the market is segmented into industrial/professional and residential. The industrial/professional segment held the largest market share in 2024, supported by large-scale adoption in construction, manufacturing, and maintenance operations. These users demand high-performance, durable tools capable of operating under continuous, high-load conditions, making them critical assets in productivity-driven environments.

The residential segment is poised to grow at the fastest pace through 2032, spurred by the rise in DIY culture, home renovation trends, and increasing affordability of compact, user-friendly power tools. E-commerce platforms and tutorial content are also encouraging homeowners to invest in basic toolkits for routine repairs and creative projects.

• By Sales Channel

On the basis of sales channel, the market is divided into indirect sales and direct sales. The indirect sales segment dominated the market in 2024, benefiting from the widespread presence of retail outlets, dealer networks, and third-party distributors that offer a broad selection of brands and product types. After-sales services and bundled promotions further enhance customer retention and market penetration.

The direct sales segment is projected to grow at the highest rate from 2025 to 2032, driven by the rising preference of large enterprises to procure equipment directly from manufacturers for better pricing, customized tool solutions, and direct technical support. The digital transformation of B2B platforms and brand-specific online stores is also simplifying the purchasing process for end users seeking authenticity and personalized service.

Power Tools Market Regional Analysis

- Asia-Pacific dominated the power tools market with the largest revenue share of 36.1% in 2024, driven by robust industrialization, rapid infrastructure development, and expanding automotive and construction sectors across emerging economies

- The region’s rising demand for cordless and energy-efficient tools, along with a growing DIY culture and increasing disposable income, is contributing significantly to market growth

- Furthermore, government initiatives to boost domestic manufacturing, technological advancements in power tools, and the presence of numerous local and international manufacturers are propelling regional expansion

Japan Power Tools Market Insight

The Japan power tools market is growing steadily due to high demand for compact, precise, and high-performance tools suited to the country's advanced manufacturing and electronics sectors. Japanese consumers and industries emphasize quality and innovation, encouraging the adoption of cordless and brushless power tools. Continuous R&D investments and smart factory initiatives are reinforcing domestic demand.

China Power Tools Market Insight

China held the largest share of the Asia-Pacific power tools market in 2024, driven by its position as a global manufacturing hub and major exporter of construction and industrial tools. Booming real estate and infrastructure projects, along with rising domestic consumption in DIY and professional segments, are fueling growth. Local companies are also investing in lithium-ion and smart tool technologies to stay competitive.

Europe Power Tools Market Insight

The Europe power tools market is expected to expand at a considerable CAGR during the forecast period, supported by strong demand in industrial automation, renewable energy, and home renovation sectors. The region’s focus on sustainable, battery-operated tools and adherence to energy efficiency standards is prompting widespread adoption. Growth is especially notable in Northern and Western Europe due to robust construction activity and high per capita income.

U.K. Power Tools Market Insight

The U.K. market is poised for steady growth, bolstered by surging interest in DIY activities, home improvement projects, and eco-friendly construction practices. The shift toward cordless and ergonomic tools, supported by rising e-commerce penetration, is enhancing accessibility and driving consumer adoption. Government efforts to promote energy-efficient equipment are also shaping product development and sales.

Germany Power Tools Market Insight

Germany’s power tools market is expanding significantly, underpinned by the country’s leadership in advanced manufacturing, automotive production, and engineering excellence. Demand for high-precision and durable tools is being met by both domestic brands and global players. The growing focus on Industry 4.0 and smart tools integration is supporting innovation, while stringent quality standards ensure consistent growth.

North America Power Tools Market Insight

North America is projected to register the fastest CAGR from 2025 to 2032, driven by rising construction activity, increasing residential renovations, and growing adoption of battery-powered tools in professional trades. High labor costs are encouraging productivity-enhancing tools, while consumer demand for convenient, easy-to-use products is fostering DIY tool sales. The push for cordless and brushless technologies, coupled with strong retail and aftersales networks, is reinforcing regional market momentum.

U.S. Power Tools Market Insight

The U.S. captured the largest revenue share in North America in 2024, supported by widespread adoption of power tools across construction, woodworking, and metalworking sectors. The expanding trend of smart homes and growing popularity of DIY projects among homeowners are driving retail sales. Leading manufacturers are focusing on innovation in battery platforms and tool connectivity to meet the demands of both professionals and hobbyists.

Power Tools Market Share

The power tools industry is primarily led by well-established companies, including:

- Stanley Black & Decker, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Techtronic Industries Co. Ltd. (China)

- makita (Japan)

- Hilti Corporation (Liechtenstein)

- Atlas Copco AB (Sweden)

- Ingersoll Rand (U.S.)

- Snap-on Incorporated (U.S.)

- Apex Tool Group (U.S.)

- Koki Holding Co., Ltd. (Japan)

- Honeywell International Inc. (U.S.)

- 3M (U.S.)

- Emerson Electric Co. (U.S.)

- Festool GmbH (Germany)

- KYOCERA Corporation (Japan)

- Husqvarna Group (Sweden)

Latest Developments in Global Power Tools Market

- In March 2023, the company introduced the GBH 18V-22 Professional, a compact and lightweight product designed for enhanced safety and protection. It is specifically optimized for overhead installation tasks and integrates efficiently with a rotary hammer

- In 2021, Stanley Black & Decker, Inc. collaborated with Eastman to enhance sustainability in the power tools market. BLACK+DECKER introduced reviva, the first sustainable power tools brand using Eastman's Tritan Renew copolyester, aiming to reduce environmental impact

- In 2021, DEWALT, under Stanley Black & Decker, launched the DEWALT POWERSTACK 20V MAX Compact Battery, a technological advancement promising enhanced performance for their cordless power tools, marking a new era in efficiency and usability

- In 2021, Robert Bosch Power Tools GmbH expanded its wood cutting and woodworking solutions range with the release of 18V and 12V cordless sanders, prioritizing convenience and ergonomic balance to cater to user needs effectively

- In 2021, Robert Bosch Power Tools GmbH launched new additions to its line of random orbit sanders, including the GEX33-6N 6 In., GEX33-5N 5 In., and GEX34-6N 6 In., designed specifically for professional use, emphasizing precision and durability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL POWER TOOLS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL POWER TOOLS MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMAPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL POWER TOOLS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 VALUE CHAIN ANALYSIS

5.2 COMPANY COMPARITIVE ANALYSIS

5.3 PRICING ANALYSIS

5.4 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.5 PENETRATION AND GROWTH POSPECT MAPPING

5.6 COMPETITOR KEY PRICING STRATEGIES

5.7 TECHNOLOGY ANALYSIS

5.7.1 KEY TECHNOLOGIES

5.7.2 COMPLEMENTARY TECHNOLOGIES

5.7.3 ADJACENT TECHNOLOGIES

FIGURE 1 TECHNOLOGY MATRIX

Company Product/Service offered

5.8 COMPANY COMPETITIVE ANALYSIS

5.8.1 STRATEGIC DEVELOPMENT

5.8.2 TECHNOLOGY IMPLEMENTATION PROCESS

5.8.2.1. CHALLENGES

5.8.2.2. INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.8.3 TECHNOLOGY SPEND OF COMPANY

5.8.4 CUSTOMER BASE

5.8.5 SERVICE POSITIONING

5.8.6 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

5.8.7 APPLICATION REACH

5.8.8 SERVICE PLATFORM MATRIX

FIGURE 2 COMPANY COMPARATIVE ANALYSIS

Parameters Company A

Market Share

Growth (%)

Target Audience

Price Structure

Market Strategies

Customer Feedback

Service Positioning

Customer Feedback/Rating

Strategic Development

Acquisitions & its value (USD Million)

Application Reach

FIGURE 3 COMPANY SERVICE PLATFORM MATRIX

5.9 FUNDING DETAILS—INVESTOR DETAILS , REASON OF INVESTMENT FROM INVESTOR

5.1 USED CASES & ITS ANALYSIS

FIGURE 4 USED CASE ANALYSIS

Company Product/Service offered

6 GLOBAL POWER TOOLS MARKET, BY TYPE

6.1 OVERVIEW

6.2 DRILLING AND FASTENING TOOLS

6.2.1 BY TYPE

6.2.1.1. DRILLS

6.2.1.2. SCREWDRIVERS AND NUTRUNNERS

6.2.1.3. IMPACT WRENCHES

6.2.1.4. IMPACT DRIVERS

6.2.2 BY MATERIAL

6.2.2.1. WOODS

6.2.2.2. STONE

6.2.2.3. METAL

6.2.2.4. CONCRETE

6.2.2.5. MULTI PURPOSE

6.3 SCREWING (SCREWDRIVER BITS)

6.4 SAWING

6.4.1 JIG SAWS

6.4.2 CIRCULAR SAWS

6.4.3 RECIPROCATING SAWS

6.4.4 HOLE SAWS

6.4.5 MULTI-CUTTER SAWS

6.4.6 CHOP SAWS

6.4.7 BAND SAWS

6.4.8 SHEARS AND NIBBLERS

6.5 CUTTING

6.5.1 BONDED CUTTING

6.5.2 DIAMOND CUTTING

6.6 MATERIAL REMOVAL TOOLS

6.6.1 GRINDERS

6.6.1.1. DIE AND STRAIGHT GRINDER

6.6.1.2. ANGLE GRINDER

6.6.1.3. PENCIL GRINDER

6.6.1.4. BENCH GRINDER

6.6.1.5. ROTARY FILES

6.6.2 SANDERS

6.6.2.1. WOOD SANDING

6.6.2.2. METAL SANDING

6.6.2.3. COMPOSITE SANDING

6.6.3 POLISHERS/BUFFERS

6.7 CHISELS

6.8 AIR POWERED TOOLS

6.8.1 AIR HOSES

6.8.2 AIR HAMMERS

6.8.3 AIR SCALERS

6.8.4 OTHERS

6.9 ROUTING TOOLS

6.9.1 ROUTERS/PLANERS

6.9.2 JOINERS

6.1 NAILERS

6.11 DEMOLITION TOOLS

6.11.1 DEMOLITION HAMMERS

6.11.2 HAMMER DRILL

6.11.3 ROTARY HAMMER

6.11.4 BREAKER

6.11.5 OTHERS

6.12 ACCESSORIES

6.13 PORTABLE NIBBLERS

6.14 PLUMBING DRILLS

6.15 PLUMBING SAWS

6.16 PLUMBING GRINDERS

6.17 OTHERS

7 GLOBAL POWER TOOLS MARKET, BY MODE OF OPERATION

7.1 OVERVIEW

7.2 PNEUMATIC

7.3 HYDRAULIC

7.4 LIQUID FUEL TOOL

7.5 ELECTRIC

7.5.1 CORDLESS TOOL

7.5.2 CORDED TOOL

7.6 POWER-ACTUATED TOOLS

8 GLOBAL POWER TOOLS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 WOODWORKING

8.3 CONCRETE AND CONSTRUCTION

8.4 METALWORKING

8.5 WELDING

8.6 OTHERS

9 GLOBAL POWER TOOLS MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 WOOD/METAL

9.3 BRICK/BLOCK

9.4 CONCRETE

9.5 GLASS

9.6 OTHERS

10 GLOBAL POWER TOOLS MARKET, BY END USER

10.1 OVERVIEW

10.2 RESIDENTIAL

10.2.1 RESIDENTIAL, BY TYPE

10.2.1.1. SINGLE FAMILY HOME

10.2.1.2. DUPLEXES

10.2.1.3. APARTMENTS

10.2.1.4. OTHERS

10.2.2 BY TYPE

10.2.2.1. DRILLING AND FASTENING TOOLS

10.2.2.2. SCREWING (SCREWDRIVER BITS)

10.2.2.3. SAWING

10.2.2.4. CUTTING

10.2.2.5. MATERIAL REMOVAL TOOLS

10.2.2.6. CHISELS

10.2.2.7. AIR POWERED TOOLS

10.2.2.8. ROUTING TOOLS

10.2.2.9. NAILERS

10.2.2.10. DEMOLITION TOOLS

10.2.2.11. ACCESSORIES

10.2.2.12. PORTABLE NIBBLERS

10.2.2.13. OTHERS

10.2.3 BY MODE OF OPERATION

10.2.3.1. PNEUMATIC

10.2.3.2. HYDRAULIC

10.2.3.3. LIQUID FUEL TOOL

10.2.3.4. ELECTRIC

10.2.3.5. POWER-ACTUATED TOOLS

10.3 INDUSTRIAL/PROFESSIONAL

10.3.1 INDUSTRIAL/PROFESSIONAL, BY TYPE

10.3.1.1. CONSTRUCTION

10.3.1.2. ENERGY

10.3.1.3. AUTOMOTIVE

10.3.1.4. AEROSPACE

10.3.1.5. SHIPBUILDING

10.3.1.6. MANUFACTURING

10.3.1.7. WOOD WORKING AND ART

10.3.1.8. CHEMICAL

10.3.1.9. OTHERS

10.3.2 BY TYPE

10.3.2.1. DRILLING AND FASTENING TOOLS

10.3.2.2. SCREWING (SCREWDRIVER BITS)

10.3.2.3. SAWING

10.3.2.4. CUTTING

10.3.2.5. MATERIAL REMOVAL TOOLS

10.3.2.6. CHISELS

10.3.2.7. AIR POWERED TOOLS

10.3.2.8. ROUTING TOOLS

10.3.2.9. NAILERS

10.3.2.10. DEMOLITION TOOLS

10.3.2.11. ACCESSORIES

10.3.2.12. PORTABLE NIBBLERS

10.3.2.13. OTHERS

10.3.3 BY MODE OF OPERATION

10.3.3.1. PNEUMATIC

10.3.3.2. HYDRAULIC

10.3.3.3. LIQUID FUEL TOOL

10.3.3.4. ELECTRIC

10.3.3.5. POWER-ACTUATED TOOLS

11 GLOBAL POWER TOOLS MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 ONLINE

11.2.1 COMPANY WEBSITE

11.2.2 E-COMMERCE WEBSITES

11.3 OFFLINE

11.3.1 WHOLESELLER

11.3.2 DISTRIBUTORS

11.3.3 OTHERS

12 GLOBAL POWER TOOLS MARKET, BY GEOGRAPHY

GLOBAL POWER TOOLS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 FRANCE

12.2.3 U.K.

12.2.4 ITALY

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 TURKEY

12.2.8 BELGIUM

12.2.9 NETHERLANDS

12.2.10 NORWAY

12.2.11 FINLAND

12.2.12 SWITZERLAND

12.2.13 DENMARK

12.2.14 SWEDEN

12.2.15 POLAND

12.2.16 REST OF EUROPE

12.3 ASIA PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 AUSTRALIA

12.3.6 NEW ZEALAND

12.3.7 SINGAPORE

12.3.8 THAILAND

12.3.9 MALAYSIA

12.3.10 INDONESIA

12.3.11 PHILIPPINES

12.3.12 TAIWAN

12.3.13 VIETNAM

12.3.14 REST OF ASIA PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 U.A.E

12.5.5 OMAN

12.5.6 BAHRAIN

12.5.7 ISRAEL

12.5.8 KUWAIT

12.5.9 QATAR

12.5.10 REST OF MIDDLE EAST AND AFRICA

12.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL POWER TOOLS MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL POWER TOOLS MARKET, SWOT & DBMR ANALYSIS

15 GLOBAL POWER TOOLS MARKET, COMPANY PROFILE

15.1 ROBERT BOSCH TOOL CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 AEGON POWER

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 GOLD COAST INTERNATIONAL (M) SDN BHD

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 STANLEY BLACK & DECKER, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 TECHTRONIC INDUSTRIES CO. LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 MAKITA CORPORATION

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 HILTI CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 3M

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 ATLAS COPCO AB

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 KYOCERA CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 APEX TOOL GROUP, LLC

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 C. & E. FEIN GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 DELTA POWER EQUIPMENT CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 EMERSON ELECTRIC CO.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 FERM INTERNATIONL B.V

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 HUSQVARNA AB

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 INGERSOLL RAND

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 INTERSKOL

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 KOKI HOLDINGS CO., LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 PANASONIC CORPORATION OF NORTH AMERICA (A SUBSIDIARY OF PANASONIC CORPORATION)

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 SNAP-ON INCORPORATED

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 PORTER-CABLE

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 KLEIN TOOLS, INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENT

15.24 WORX

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 CARBORUNDUM UNIVERSAL LTD (A PART OF MURUGAPPA GROUP)

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Power Tools Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Power Tools Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Power Tools Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.