Global Power Sports After Market

Market Size in USD Billion

CAGR :

%

USD

13.53 Billion

USD

20.93 Billion

2025

2033

USD

13.53 Billion

USD

20.93 Billion

2025

2033

| 2026 –2033 | |

| USD 13.53 Billion | |

| USD 20.93 Billion | |

|

|

|

|

Power Sports After Market Size

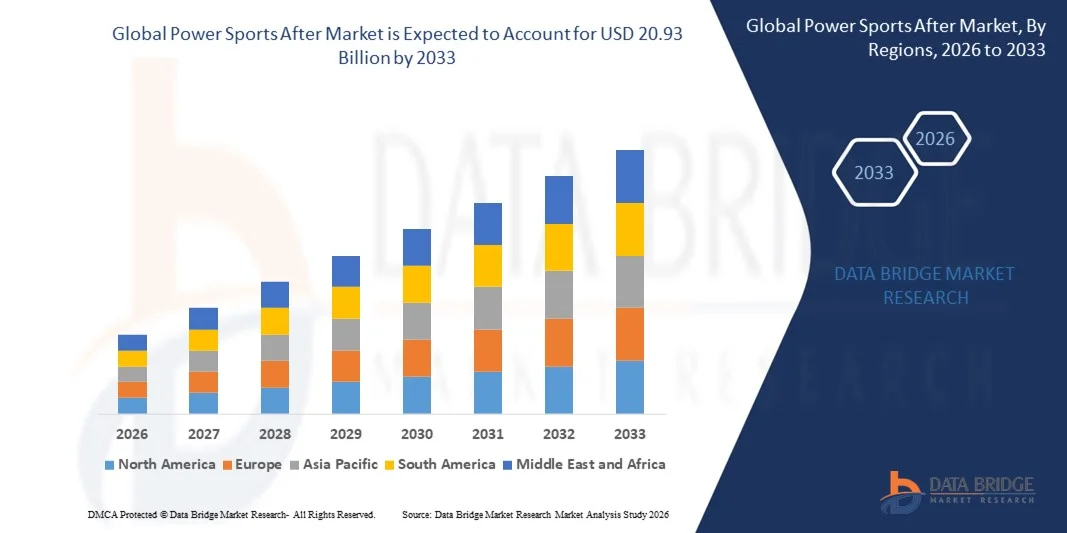

- The global power sports after market size was valued at USD 13.53 billion in 2025 and is expected to reach USD 20.93 billion by 2033, at a CAGR of 5.60% during the forecast period

- The market growth is largely fuelled by the rising ownership of power sports vehicles such as motorcycles, ATVs, UTVs, and personal watercraft, leading to sustained demand for replacement parts and accessories

- Increasing consumer preference for vehicle customization and performance enhancement through aftermarket components such as exhaust systems, suspension kits, and aesthetic upgrades is supporting revenue expansion

Power Sports After Market Analysis

- The market is characterized by steady demand driven by maintenance needs, lifestyle-driven upgrades, and performance optimization across the installed base of power sports vehicles

- Strong brand loyalty, product innovation, and expanding e-commerce and omnichannel distribution networks are enhancing aftermarket accessibility and customer reach

- North America dominated the global power sports aftermarket with the largest revenue share in 2025, driven by high ownership of motorcycles, ATVs, side-by-side vehicles, and personal watercraft, along with a strong culture of recreation and motorsports

- Asia-Pacific region is expected to witness the highest growth rate in the global power sports after market, driven by rapid urbanization, increasing disposable incomes, growing popularity of power sports vehicles, and expanding manufacturing and distribution capabilities across emerging economies

- The Heavyweight Motorcycle segment held the largest market revenue share in 2025 driven by high ownership levels, strong customization culture, and frequent replacement of parts and accessories. Heavyweight motorcycles generate sustained aftermarket demand for components such as exhaust systems, suspension, braking parts, and aesthetic upgrades, supported by enthusiast communities and long vehicle lifecycles

Report Scope and Power Sports After Market Segmentation

|

Attributes |

Power Sports After Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Power Sports After Market Trends

Rising Demand For Customization, Performance Upgrades, And Vehicle Longevity

- The increasing ownership of power sports vehicles such as motorcycles, ATVs, UTVs, snowmobiles, and personal watercraft is significantly shaping the global power sports aftermarket, as consumers actively seek customization, performance enhancement, and extended vehicle lifespan. Aftermarket components are gaining traction due to their ability to improve aesthetics, safety, durability, and riding experience, supporting consistent replacement and upgrade cycles. This trend is strengthening demand across recreational, utility, and motorsports applications, encouraging manufacturers to expand product portfolios

- Growing participation in recreational riding, adventure touring, and organized motorsports events has accelerated demand for high-performance aftermarket parts such as exhaust systems, suspension components, braking systems, and protective accessories. Enthusiasts are increasingly investing in premium aftermarket products to enhance speed, handling, and comfort, reinforcing sustained revenue growth. In addition, rising disposable income and lifestyle-driven spending are supporting higher aftermarket penetration

- Digitalization and the expansion of e-commerce platforms are influencing purchasing behavior, with consumers increasingly relying on online channels for product comparison, availability, and direct-to-consumer purchases. Manufacturers and distributors are emphasizing online catalogs, customization tools, and fast delivery options to improve customer engagement and accessibility. This shift is also enabling smaller aftermarket brands to gain visibility and compete effectively

- For instance, in 2024, Polaris in the U.S. and Yamaha Motor in Japan expanded their aftermarket accessory and parts offerings through official online platforms and dealer networks. These initiatives were introduced to address rising demand for customization and replacement parts, with products marketed for durability, performance enhancement, and ease of installation. The launches contributed to higher customer retention and aftermarket revenue growth

- While demand for aftermarket components remains strong, long-term market expansion depends on continuous product innovation, compatibility with evolving vehicle technologies, and cost-effective manufacturing. Companies are also focusing on improving supply chain efficiency, inventory management, and dealer partnerships to ensure timely availability and consistent product quality

Power Sports After Market Dynamics

Driver

Growing Preference For Vehicle Customization And Performance Enhancement

- Rising consumer interest in personalization and performance optimization is a major driver for the global power sports aftermarket. Vehicle owners are increasingly upgrading factory-installed components with aftermarket alternatives to improve aesthetics, comfort, and functional performance. This trend is particularly strong among enthusiast and motorsports communities, supporting repeat purchases and brand loyalty

- Expanding usage of power sports vehicles for recreation, utility, and competitive racing is influencing market growth. Aftermarket parts play a critical role in maintenance, repair, and performance tuning, enabling vehicles to withstand intensive usage and harsh operating conditions. Increasing average vehicle age further drives demand for replacement components

- Manufacturers and distributors are actively promoting aftermarket products through dealer networks, sponsorships, motorsports events, and digital marketing campaigns. These efforts are supported by growing consumer awareness of performance benefits, safety enhancements, and long-term cost savings associated with aftermarket upgrades. Partnerships between OEMs and aftermarket suppliers are also improving product compatibility and innovation

- For instance, in 2023, Harley-Davidson in the U.S. and BRP in Canada reported increased aftermarket sales driven by customization programs and performance upgrade kits. These initiatives were launched in response to strong consumer demand for personalized riding experiences and enhanced vehicle capabilities, supporting higher margins and repeat customer engagement

- Although customization and performance trends support growth, sustained expansion depends on continuous innovation, compliance with safety and emission standards, and alignment with evolving vehicle technologies. Investment in R&D, advanced materials, and modular product design will be critical for maintaining competitiveness

Restraint/Challenge

High Cost Of Premium Aftermarket Components And Compatibility Concerns

- The relatively high cost of premium aftermarket components compared to standard replacement parts remains a key challenge, limiting adoption among price-sensitive consumers. Advanced materials, precision engineering, and performance-focused designs contribute to higher pricing, which can restrict demand in cost-conscious segments. Economic uncertainty can further impact discretionary spending on non-essential upgrades

- Compatibility issues across different vehicle models and generations pose additional challenges for manufacturers and consumers. Ensuring proper fitment and performance requires extensive testing and product variation, increasing development costs and complexity. Limited technical knowledge among end users can also result in installation challenges and reduced confidence in aftermarket purchases

- Supply chain disruptions and fluctuating raw material prices can affect production timelines and cost stability. Dependence on specialized components and global sourcing increases vulnerability to logistical delays. Companies must invest in inventory optimization, supplier diversification, and efficient distribution networks to mitigate these risks

- For instance, in 2024, aftermarket distributors supplying performance parts for brands such as KTM and Can-Am reported slower sales in certain product categories due to high pricing and fitment concerns. Installation complexity and limited availability of skilled technicians were additional barriers affecting consumer adoption and repeat purchases

- Addressing these challenges will require cost optimization, standardized component design, and improved consumer education. Strengthening dealer training programs, offering installation support, and expanding warranty coverage can help build trust and unlock long-term growth opportunities in the global power sports aftermarket

Power Sports After Market Scope

The market is segmented on the basis of vehicle, model, application, and sales channel.

- By Vehicle

On the basis of vehicle, the global power sports aftermarket is segmented into All-Terrain Vehicles, Side-by-Side, Snowmobiles, Watercraft, and Heavyweight Motorcycle. The Heavyweight Motorcycle segment held the largest market revenue share in 2025 driven by high ownership levels, strong customization culture, and frequent replacement of parts and accessories. Heavyweight motorcycles generate sustained aftermarket demand for components such as exhaust systems, suspension, braking parts, and aesthetic upgrades, supported by enthusiast communities and long vehicle lifecycles.

The Side-by-Side segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising adoption in recreational, agricultural, and utility applications. Increasing usage intensity and harsh operating conditions are boosting demand for maintenance, repair, and performance-enhancing aftermarket components, supporting rapid segment expansion.

- By Model

On the basis of model, the market is segmented into Sit-Down and Stand-Up. The Sit-Down segment dominated the market revenue share in 2025 due to its widespread use across motorcycles, snowmobiles, and personal watercraft. Sit-down models require regular maintenance and upgrades for comfort, safety, and performance, resulting in consistent aftermarket spending.

The Stand-Up segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising participation in recreational water sports and motorsports activities. Enthusiast demand for lightweight, high-performance components and frequent wear-and-tear replacement is contributing to aftermarket growth in this segment.

- By Application

On the basis of application, the global power sports aftermarket is segmented into Off-Road, On-Road, and Snow. The Off-Road segment accounted for the largest market share in 2025 driven by extensive use of ATVs and side-by-side vehicles in recreational and utility environments. Exposure to rugged terrain accelerates component wear, driving higher demand for replacement parts and durability-focused aftermarket solutions.

The On-Road segment is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing motorcycle ownership and customization trends. Rising demand for performance upgrades, safety components, and aesthetic enhancements is strengthening aftermarket consumption in on-road applications.

- By Sales Channel

On the basis of sales channel, the market is segmented into Offline and Online. The Offline segment held the dominant market share in 2025 due to strong dealer networks, authorized service centers, and consumer preference for professional installation and technical support. Offline channels also benefit from brand trust and bundled service offerings.

The Online segment is expected to witness the fastest growth rate from 2026 to 2033, driven by expanding e-commerce platforms, wider product availability, and competitive pricing. Increasing consumer confidence in online purchases, along with detailed product information and doorstep delivery, is accelerating the shift toward digital aftermarket sales channels.

Power Sports After Market Regional Analysis

- North America dominated the global power sports aftermarket with the largest revenue share in 2025, driven by high ownership of motorcycles, ATVs, side-by-side vehicles, and personal watercraft, along with a strong culture of recreation and motorsports

- Consumers in the region place high value on performance upgrades, customization, and regular maintenance, leading to sustained demand for aftermarket parts and accessories such as exhaust systems, suspension components, and protective gear

- This strong adoption is further supported by high disposable incomes, extensive dealer and service networks, and widespread participation in off-road and on-road recreational activities, positioning aftermarket products as essential for both recreational and utility use

U.S. Power Sports After Market Insight

The U.S. power sports aftermarket captured the largest revenue share in 2025 within North America, fueled by strong motorcycle ownership, widespread use of ATVs and side-by-side vehicles, and a mature customization ecosystem. Consumers increasingly invest in aftermarket upgrades to enhance performance, safety, and aesthetics. The popularity of adventure touring, motorsports events, and off-road recreation, combined with a well-developed e-commerce and dealer infrastructure, continues to propel aftermarket sales across the country.

Europe Power Sports After Market Insight

The Europe power sports aftermarket is expected to witness steady growth from 2026 to 2033, driven by rising interest in recreational riding, adventure tourism, and motorsports activities. Increasing focus on vehicle maintenance, safety compliance, and performance optimization is supporting aftermarket demand. European consumers also show growing preference for premium, durable, and environmentally compliant aftermarket components, contributing to consistent market expansion across both recreational and utility applications.

U.K. Power Sports After Market Insight

The U.K. power sports aftermarket is expected to witness steady growth from 2026 to 2033, supported by increasing motorcycle ownership and rising interest in touring and leisure riding. Demand for replacement parts, safety equipment, and customization accessories is being encouraged by an aging vehicle fleet and strong enthusiast communities. In addition, the expansion of online sales channels and specialized retailers is improving access to aftermarket products across the country.

Germany Power Sports After Market Insight

The Germany power sports aftermarket is expected to witness stable growth from 2026 to 2033, driven by the country’s strong engineering culture and emphasis on vehicle performance and safety. German consumers prioritize high-quality, technologically advanced aftermarket components that meet stringent regulatory and durability standards. The integration of performance-enhancing and efficiency-focused parts is particularly prominent in both on-road and off-road power sports segments.

Asia-Pacific Power Sports After Market Insight

The Asia-Pacific power sports aftermarket is expected to witness the fastest growth rate from 2026 to 2033, driven by rising disposable incomes, increasing urbanization, and growing popularity of recreational riding in countries such as China, Japan, and India. Expanding middle-class populations and improving access to power sports vehicles are boosting demand for maintenance, repair, and customization products. The region’s growing manufacturing capabilities are also improving affordability and availability of aftermarket components.

Japan Power Sports After Market Insight

The Japan power sports aftermarket is expected to witness steady growth from 2026 to 2033 due to the country’s strong motorsports culture, technological expertise, and demand for precision-engineered components. Japanese consumers emphasize reliability, safety, and performance, driving consistent demand for high-quality aftermarket parts. The growing popularity of recreational riding and organized motorsports events further supports aftermarket consumption in both on-road and off-road applications.

China Power Sports After Market Insight

The China power sports aftermarket accounted for a significant market revenue share in Asia Pacific in 2025, supported by rapid urbanization, increasing disposable incomes, and expanding interest in recreational and utility power sports vehicles. The growing adoption of motorcycles, ATVs, and side-by-side vehicles, along with the presence of strong domestic manufacturers, is driving aftermarket demand. Government initiatives supporting outdoor recreation and the availability of cost-competitive aftermarket products are further strengthening market growth in China.

Power Sports After Market Share

The Power Sports After industry is primarily led by well-established companies, including:

• BRP (Canada)

• Honda Motor Co., Ltd. (Japan)

• AISIN SEIKI Co., Ltd. (Japan)

• Deere & Company (U.S.)

• Harley-Davidson (U.S.)

• Yamaha Motor Co., Ltd. (Japan)

• Kawasaki Motors Corp., U.S.A. (U.S.)

• Kubota Corporation (Japan)

• KYMCO (Taiwan)

• LeMans Corporation (U.S.)

• Motorsport Aftermarket Group (U.S.)

• Polaris Inc. (U.S.)

• Suzuki Motor Corporation (Japan)

• Textron Inc. (U.S.)

• Western Power Sports, Inc. (U.S.)

Latest Developments in Global Power Sports After Market

- In July 2024, Polaris Inc. entered into a strategic partnership with Fox Factory to integrate next-generation adaptive suspension systems into its high-performance off-road vehicles, aimed at improving ride comfort, handling, and vehicle stability across varied terrains. This development enhances product differentiation and strengthens Polaris’ position in the premium aftermarket segment

- In July 2024, Yamaha Motor Co., Ltd. expanded its powersports accessories portfolio by launching AI-enabled navigation systems designed to deliver real-time trail data, group ride tracking, and safety alerts. This innovation improves rider connectivity and safety, supporting increased demand for smart and technology-driven aftermarket solutions

- In June 2024, BRP (Bombardier Recreational Products) introduced an upgraded Sea-Doo aftermarket kit featuring eco-friendly propulsion components focused on improving fuel efficiency and reducing emissions. This launch aligns with global sustainability trends and reinforces the growing role of environmentally responsible aftermarket products

- In June 2024, Kawasaki Motors rolled out a comprehensive aftermarket performance package for its Mule UTV series, incorporating advanced clutch systems, reinforced tires, and high-output LED lighting. The package enhances durability and operational efficiency, driving stronger adoption in both industrial and recreational applications

- In May 2024, Honda powersports unveiled a modular storage and gear-mount system for ATVs and side-by-sides, offering customizable cargo solutions with quick-release functionality. This development improves vehicle utility and convenience, encouraging higher aftermarket spending among outdoor and adventure-oriented users

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.