Global Poultry Feed Micronutrients Market, By Type (Iron, Manganese, Zinc, Boron, Copper, and Others), Form (Solid, Liquid) – Industry Trends and Forecast to 2029.

Poultry Feed Micronutrients Market Analysis and Size

Livestock production has increased in several countries around the world to meet the needs of changing population diet patterns, particularly in developing markets. The livestock sector in the global market is becoming increasingly industrial, despite the fact that a large number of farmers in countries such as India and China remain small and marginal.

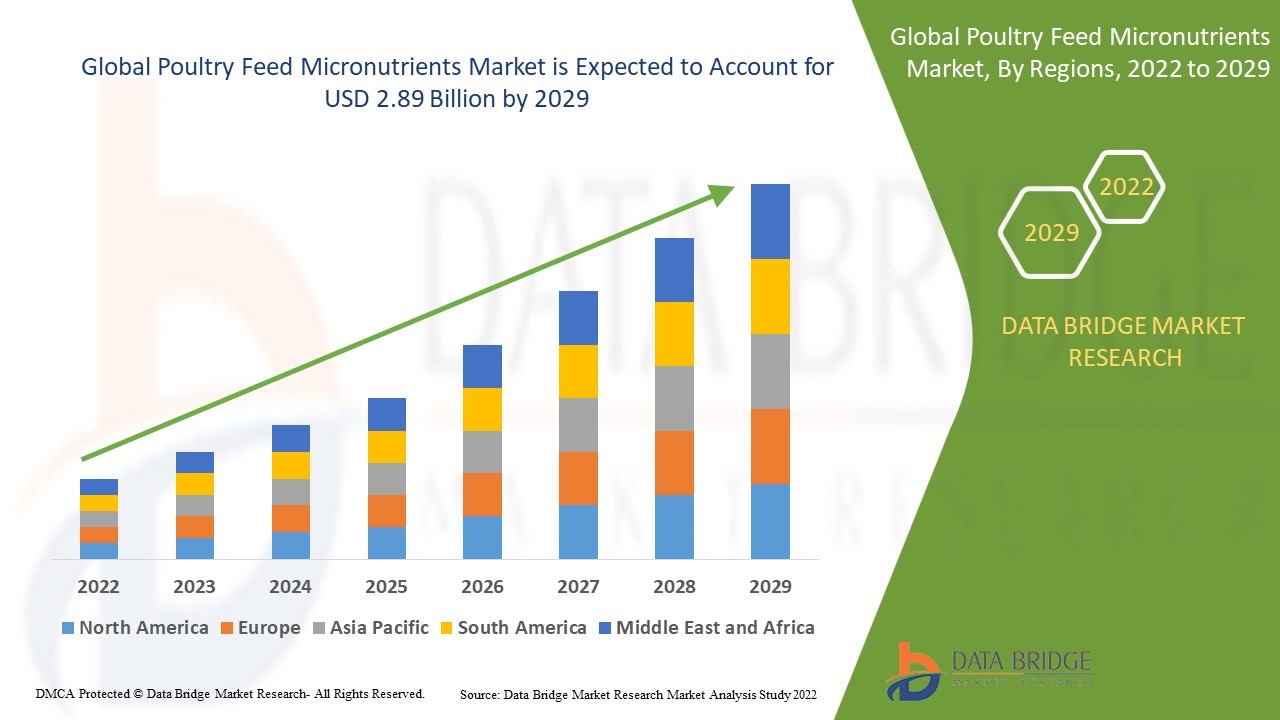

Data Bridge Market Research analyses that the poultry feed micronutrients market which was growing at a value of 1.71 billion in 2021 and is expected to reach the value of USD 2.89 billion by 2029, at a CAGR of 6.80% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Poultry Feed Micronutrients Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Iron, Manganese, Zinc, Boron, Copper, and Others), Form (Solid, Liquid)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

Dow (U.S.), BASF SE (Germany), Chr. Hansen Holding A/S (Denmark), DSM (Netherlands), DuPont (U.S.), Evonik Industries AG (Germany), NOVUS INTERNATIONAL (U.S.), Alltech (Nicholasville), Associated British Foods plc (U.K.), Charoen Pokphand Foods PCL (Thailand), Cargill, Incorporated (U.S.), Nutreco (Netherlands), ForFarmers. (Netherlands), De Heus Poultry Nutrition (Netherlands), Land O'Lakes (U.S.), Kent Nutrition Group (U.S.), J. D. HEISKELL & CO. (U.S.), Perdue Farms (U.S.), SunOpta (Canada), Scratch and Peck Feeds (U.S.), De Heus Poultry Nutrition (Netherlands), MEGAMIX (Russia), Agrofeed (Hungary)

|

|

Opportunities

|

|

Market Definition

Micronutrients in animal feed are nutrients that the body requires in trace amounts for proper development. These nutrients are critical because many bodily functions are dependent on their availability. They are used as an animal feed additive and to improve feed quality in order to improve livestock health. Furthermore, these micronutrients support complex functions during production and the operation of enzyme systems.

Poultry Feed Micronutrients Market Dynamics

Drivers

- Growing focus on the usage of feed additives to provide essential nutrients to the animals

Increased emphasis on poultry health will drive market growth. Increased poultry farming is likely to result in increased demand for poultry feed micronutrients. Humans' increasing demand for animal based products will drive up market demand. Proponents of natural growth are expected to be active in the market as their momentum grows. Rising consumer awareness of the benefits of using feed additives to reduce disease has fuelled the market's demand.

- Growing incidences of bird flus and virus is augmenting product demand

The increasing number of bird deaths caused by avian influenza is cause for concern. Furthermore, bird deaths in rivers and dams contaminate water resources and can set serious illnesses in motion. More than 25,000 birds died in several Indian states in the first months of 2021. Similarly, H5N1 is on the loose in Israel in 2022. Over 1 million chickens and turkeys have been infected by the virus, which has also killed over 7,500 cranes. Given the massive increase in bird flu incidences worldwide, the possibility of possible mutations in virus structure that can affect humans has also increased, which can be a major factor in the growth of the respective market.

Opportunity

Favourable government regulations and standards, particularly those enacted by the CFIA, REACH, and FDA to combat micronutrient malnutrition and reduce the consumption of synthetic additives, will accelerate business growth over the forecast period. Furthermore, the growing trend for clean label products, which require a stringent approval process by these regulatory bodies, will expand the product portfolio.

Restraints

High raw material prices, as well as an increasing number of restrictions and regulatory bans, will act as market restraints for the growth of poultry feed micronutrients during the forecast period. Less product awareness will act as a restraint further challenging the growth of the poultry feed micronutrients market during the forecast period.

This poultry feed micronutrients market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the poultry feed micronutrients market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Poultry Feed Micronutrients Market

Agriculture and food production have been identified as critical sectors Global during the COVID-19 situation. As a result, farmers have continued to ensure that farm poultry receive high-quality nutrition in order to feed an increasing number of global consumers. However, the disruption of the supply chain has become the most significant factor affecting the poultry feed micronutrients market. China is a major producer and exporter of poultry feed micronutrients, and it stockpiled significant amounts of product during the emergence of the COVID-19 situation while businesses were closed for the Lunar New Year, which was enough for 2-3 months’ supply. Furthermore, logistics issues have hampered the supply of containers and vessels, as well as the transport of certain micro-ingredients.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- Cargill and BASF partnered in the poultry nutrition business in October 2021, adding research and development capabilities and new markets to the partners' existing feed enzymes distribution agreements. This collaboration aided in the development, production, marketing, and sale of customer-focused enzyme products and solutions for poultrys, including swine.

- De Heus acquired Coppens Diervoeding, a feed manufacturing company based in the Netherlands that specialises in the pig farming sector, in July 2021. This acquisition enabled the company to double its production capacity and strengthen its regional presence by 400k.

- ADM opened a new livestock feed plant in Ha Nam province, Vietnam, in November 2019. The new facility adds to ADM's growing list of investments in Vietnam, becoming the company's fifth plant dedicated to poultry nutrition in the country.

Global Poultry Feed Micronutrients Market Scope

The poultry feed micronutrients market is segmented on the basis of type and form. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Iron

- Manganese

- Zinc

- Boron

- Copper

- Others

Form

- Solid

- Liquid

Poultry Feed Micronutrients Market Regional Analysis/Insights

The poultry feed micronutrients market is analysed and market size insights and trends are provided by country, type and form as referenced above.

The countries covered in the poultry feed micronutrients market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia is the most important market for pork consumption and production, accounting for roughly half of Global output. The Global region is the largest market for poultry feed micronutrients products due to the high consumption of pork meat. South East Asia is the world's largest pork producer and exporter. Pork meat has been consumed in the region since ancient times and is the most popular meat due to its high fat content and flavour. China is the largest pork producer's market, followed by Vietnam, Thailand, South Korea, Japan, and the Philippines. Japan, South Korea, and Taiwan are saturated pork consumption markets, while Vietnam and the Philippines are emerging markets.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Poultry Feed Micronutrients Market Share Analysis

The poultry feed micronutrients market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to poultry feed micronutrients market.

Some of the major players operating in the poultry feed micronutrients market are:

- Dow (U.S.)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Alltech (Nicholasville)

- Associated British Foods plc (U.K.)

- Charoen Pokphand Foods PCL (Thailand)

- Cargill, Incorporated (U.S.)

- Nutreco (Netherlands)

- ForFarmers. (Netherlands)

- De Heus Poultry Nutrition (Netherlands)

- Land O'Lakes (U.S.)

- Kent Nutrition Group (U.S.)

- J. D. HEISKELL & CO. (U.S.)

- Perdue Farms (U.S.)

- SunOpta (Canada)

- Scratch and Peck Feeds (U.S.)

- De Heus Poultry Nutrition (Netherlands)

- MEGAMIX (Russia)

- Agrofeed (Hungary)

SKU-