Global Potting and Encapsulating Compounds Market Segmentation, By Type (Epoxy, Polyurethane, Silicone, Polyester System, Polyamide, Polyolefin, and Others), Substrate Type (Glass, Metal, Ceramic, and Others), Function (Electrical Insulation, Heat Dissipation, Corrosion Protection, Shock Resistance, Chemical Protection, and Others), Curing Technique (Room Temperature Cured, High Temperature or Thermally Cured, and UV Cured), Distribution Channel (Offline and Online), Application (Electronics and Electrical), End-User (Transportation, Consumer, Electronics, Energy and Power, Telecommunication, Healthcare, and Others) - Industry Trends and Forecast to 2031.

Potting and Encapsulating Compounds Market Analysis

The potting and encapsulating compounds market has seen significant advancements in recent years, driven by innovations in materials and processing technologies. Modern methods include the development of advanced epoxy, silicone, and polyurethane compounds that offer improved thermal conductivity, electrical insulation, and chemical resistance. For instance, the introduction of nanofiller technologies enhances the thermal and mechanical properties of these compounds, making them suitable for more demanding applications.

One key technological advancement is the use of low-viscosity formulations, which allow for better flow and complete encapsulation of complex electronic components. Additionally, the adoption of automated dispensing systems has increased precision and efficiency in application, reducing production costs and improving consistency.

The growth of the potting and encapsulating compounds market is propelled by the rising demand from the electronics, automotive, and aerospace industries. As electronic devices become more compact and sophisticated, the need for reliable protection against environmental factors drives the demand for these advanced materials. This trend is expected to continue, supporting steady market expansion.

Potting and Encapsulating Compounds Market Size

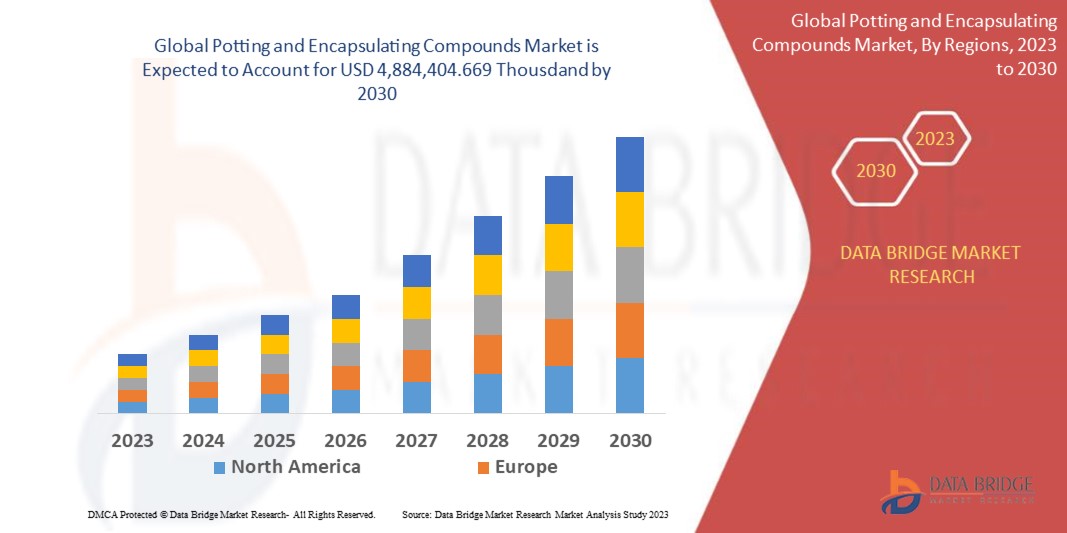

The global potting and encapsulating compounds market size was valued at USD 3.47 billion in 2023 and is projected to reach USD 5.13 billion by 2031, with a CAGR of 5.00% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Potting and Encapsulating Compounds Market Trends

“Rising Demand for Advanced Electronics”

One specific trend propelling the growth of the potting and encapsulating compounds market is the surge in demand for advanced electronics, particularly in the automotive and consumer electronics sectors. As electronic devices become more complex and essential, the need for effective protection against environmental factors, such as moisture and temperature extremes, increases. Potting and encapsulating compounds are crucial for safeguarding these components. For instance, the automotive industry’s shift towards electric vehicles (EVs) and autonomous systems has led to increased use of these compounds to protect sensitive electronic systems. This trend ensures reliability and durability, driving significant market growth.

Report Scope and Potting and Encapsulating Compounds Market Segmentation

|

Attributes

|

Potting and Encapsulating Compounds Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

3M (U.S.), DuPont (U.S.), PARKER HANNIFIN CORP (U.S.), Momentive (U.S.), Henkel AG and Co. KgaA (Germany), Solvay (Belgium), Avantor, Inc. (U.S.), ELANTAS (Germany), Electrolube (U.K.), Epoxies, Etc. (U.S.), Dymax (U.S.), Master Bond Inc. (U.S.), Owens Corning (U.S.), DELO (U.S.), RBC Industries, Inc. (U.S.), Hernon Manufacturing (U.S.), ITW Performance Polymers (U.S.), Creative Materials (U.S.), United Resin, Inc. (U.S.), Epic Resins (U.S.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Potting and Encapsulating Compounds Market Definition

Potting and encapsulating compounds are materials used to protect electronic components and assemblies. Potting involves encasing electronic parts in a solid or gel-based substance to safeguard against environmental factors such as moisture, dust, and vibration. Encapsulation is similar but usually involves a protective coating that conforms to the shape of the component. These compounds enhance durability, thermal management, and electrical insulation, ensuring long-term reliability and performance. They are commonly used in industries such as automotive, aerospace, and consumer electronics to increase the lifespan and robustness of sensitive components.

Potting and Encapsulating Compounds Market Dynamics

Drivers

- Rising Aerospace and Defense Spending

Aerospace and defense sectors increasingly demand potting and encapsulating compounds to protect sensitive electronics from extreme temperatures, vibrations, and moisture. For instance, NASA uses advanced encapsulating materials in spacecraft to ensure reliability and performance in space. This rising expenditure on high-performance components drives market growth, as durable, high-quality materials are essential for the demanding conditions encountered in aerospace and defense applications.

- Technological Innovations in Potting Materials

Innovations in potting materials, such as high-performance epoxy resins and advanced silicone-based compounds, significantly enhance protection and durability. For instance, new epoxy resins offer superior thermal stability and chemical resistance, ideal for high-stress environments such as aerospace and automotive applications. These advancements improve the reliability and lifespan of electronic components, driving increased adoption and growth in the potting and encapsulating compounds market.

Opportunities

- Rising Demand for Improved Product Lifespan

The emphasis on prolonging the lifespan of electronic and electrical products drives demand for advanced potting and encapsulating solutions. For instance, in the automotive sector, long-lasting electronic components in vehicles necessitate protective coatings to withstand extreme conditions. This focus on durability and reliability opens opportunities for manufacturers to innovate and provide enhanced potting materials, thus fueling market growth.

- Enhanced Focus on Electronics Miniaturization

As electronic devices become more compact, there is a rising need for advanced potting and encapsulating materials that offer protection in increasingly confined spaces. This trend drives market innovation and demand, as manufacturers seek solutions to safeguard delicate components without compromising on performance. For instance, advancements in silicone-based encapsulants enable protection of miniature electronic assemblies in smartphones and wearables, creating substantial market opportunities.

Restraints/Challenges

- High Raw Material Costs

High raw material costs, including resins and hardeners, are a significant challenge for the potting and encapsulating compounds market. Fluctuations in these prices can substantially impact the overall cost of the compounds, making them less affordable, particularly for manufacturers with tight margins. This price volatility can constrain market growth by increasing production expenses and limiting the financial feasibility of using these compounds in various applications.

- Complex Manufacturing Processes

The production of potting and encapsulating compounds involves complex processes requiring precise control and specialized equipment. This complexity results in higher manufacturing costs and longer production times. Additionally, maintaining consistent quality and performance adds to operational challenges. These factors contribute to increased expenses and inefficiencies, which can hinder market growth by limiting the affordability and scalability of these compounds.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Potting and Encapsulating Compounds Market Scope

The market is segmented on the basis of type, substrate type, function, curing technique, distribution channel, application, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Epoxy

- Polyurethane

- Silicone

- Polyester System

- Polyamide

- Polyolefin

- Others

Substrate Type

- Glass

- Metal

- Ceramic

- Others

Function

- Electrical Insulation

- Heat Dissipation

- Corrosion Protection

- Shock Resistance

- Chemical Protection

- Others

Curing Technique

- Room Temperature Cured

- High Temperature or Thermally Cured

- UV Cured

Distribution Channel

- Offline

- Online

Application

- Electronics

- Electrical

End-User

- Transportation

- Consumer

- Electronics

- Energy and Power

- Telecommunication

- Healthcare

- Others

Potting and Encapsulating Compounds Market Regional Analysis

The market is analysed and market size insights and trends are provided by type, substrate type, function, curing technique, distribution channel, application, and end-user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to dominate the potting and encapsulating compounds market owing to the growing demand for consumer electronics products in this region. Moreover, easy manufacture and installation of potting and encapsulating compounds with superior quality raw materials will further boost the market's growth in this region.

North America is expected to be the fastest developing region in the potting and encapsulating compounds market because of the increasing demand for potting and encapsulating compounds used in high-power devices in this region. Furthermore, the growing demand for eco-friendly potting and encapsulating compounds from the transportation industry will further boost the market growth in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Potting and Encapsulating Compounds Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Potting and Encapsulating Compounds Market Leaders Operating in the Market Are:

- 3M (U.S.)

- DuPont (U.S.)

- PARKER HANNIFIN CORP (U.S.)

- Momentive (U.S.)

- Henkel AG and Co. KgaA (Germany)

- Solvay (Belgium)

- Avantor, Inc. (U.S.)

- ELANTAS (Germany)

- Electrolube (U.K.)

- Epoxies, Etc. (U.S.)

- Dymax (U.S.)

- Master Bond Inc. (U.S.)

- Owens Corning (U.S.)

- DELO (U.S.)

- RBC Industries, Inc. (U.S.)

- Hernon Manufacturing (U.S.)

- ITW Performance Polymers (U.S.)

- Creative Materials (U.S.)

- United Resin, Inc. (U.S.)

- Epic Resins (U.S.)

Latest Developments in Potting and Encapsulating Compounds Market

- In April 2021, Master Bond Inc. introduced a new product named MasterSil 153AO, an adding cured two-part silicone with a self-priming property. This product has an electrically insulating and thermally conductive structure. This product was launched to add variety to their product portfolio

- In October 2020, Epoxies Etc. formulated a new epoxy product, 20-3305. This new epoxy product was developed to meet high-voltage electronic needs and protect the electronic assemblies from stress and heat cycling. This product was launched to add variety in their product portfolio regarding thermal shock resistance

- In April 2020, Electrolube revealed the achievement of its ER2221 resin, which safeguards the electric vehicle batteries in India's most popular two-wheeler cars. This product launch was employed to help their Indian customers to improve thermal management issues

SKU-