Global Pos Terminals Market

Market Size in USD Billion

CAGR :

%

USD

110.00 Billion

USD

185.00 Billion

2024

2032

USD

110.00 Billion

USD

185.00 Billion

2024

2032

| 2025 –2032 | |

| USD 110.00 Billion | |

| USD 185.00 Billion | |

|

|

|

|

POS (Point of Sale) Terminals Market Size

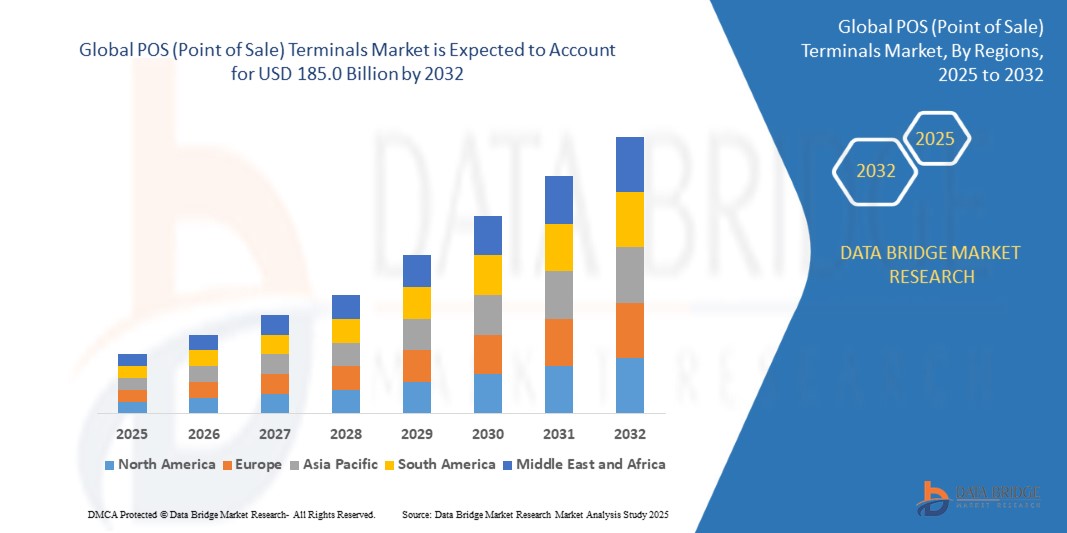

- The Global POS (Point of Sale) Terminals Market size was valued at USD 110.0 Billion in 2024 and is expected to reach USD 185.0 Billion by 2032, at a CAGR of 7.7% during the forecast period

- Market growth is driven by the rising demand for cashless transactions, the proliferation of mobile and cloud-based POS systems, and increasing digital transformation in sectors such as retail, hospitality, healthcare, and entertainment. The integration of advanced technologies including contactless payments, QR code scanning, and AI-enabled sales analytics is streamlining transactions and enhancing customer experiences across industries.

POS (Point of Sale) Terminals Market Analysis

- POS terminals are critical retail and service infrastructure that facilitate payment processing, inventory tracking, billing, and customer engagement. These systems combine hardware (e.g., barcode scanners, receipt printers, tablets) and software for real-time operations.

- The increasing shift toward mobile and cloud-based POS systems is transforming how businesses—especially in retail and hospitality—manage transactions and customer experiences. Mobile POS (mPOS) systems offer flexibility, speed, and improved service personalization.

- The demand for contactless payment technologies, digital wallets, and QR code scanning is driving widespread adoption of smart POS terminals, particularly in regions with high smartphone penetration.

- Businesses are integrating AI and data analytics into POS platforms to gain actionable insights into customer behavior, inventory optimization, and revenue forecasting.

- Cloud deployment models are gaining traction among SMEs due to lower upfront costs, remote access, automatic updates, and ease of integration with third-party applications such as accounting, CRM, and loyalty programs.

Report Scope and POS (Point of Sale) Terminals Market Segmentation

|

Attributes |

Automotive Battery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

POS (Point of Sale) Terminals Market Trends

Omnichannel Capabilities, AI Integration, and mPOS Revolutionizing In-Store Engagement

- A key and rapidly advancing trend in the POS Terminals Market is the shift toward omnichannel retailing, where POS systems are seamlessly integrated with online and offline sales platforms. This ensures a unified customer experience across e-commerce, mobile apps, and physical stores.

- The integration of AI and machine learning within POS software is enabling real-time inventory tracking, predictive analytics, and personalized customer recommendations—boosting sales and operational efficiency.

- Mobile POS (mPOS) terminals are gaining rapid adoption, especially among small and medium-sized businesses. These devices offer flexibility, cost-effectiveness, and improved customer engagement at events, pop-up stores, and in-table restaurant ordering.

- Retailers and restaurants are increasingly adopting cloud-based POS solutions for their scalability, real-time data access, simplified updates, and centralized control across multiple locations.

- Innovations in biometric authentication, voice-activated transactions, and NFC-based contactless payments are reshaping how customers interact with POS systems—enhancing speed, security, and convenience at checkout points.

POS (Point of Sale) Terminals Market Dynamics

Driver

Digital Payment Surge and Mobility-Driven Retail Transformation

- The rapid adoption of digital payment systems, including mobile wallets, UPI, QR code payments, and contactless cards, is a primary driver for the POS Terminals Market. Consumers now expect fast, secure, and frictionless checkout experiences across all retail environments.

- The growth of mobile POS (mPOS) systems is empowering small and medium enterprises (SMEs) to digitize their operations with low capital investment. These devices offer portability, real-time reporting, and app-based customization.

- The retail and hospitality sectors are undergoing digital transformation, where POS systems are being integrated with customer relationship management (CRM), loyalty programs, and omnichannel platforms to provide seamless cross-channel engagement.

- Governments and regulatory bodies in countries like India, Singapore, and Australia are actively supporting cashless economies through tax incentives and digital infrastructure development—boosting POS adoption.

- The pandemic further accelerated the shift to touchless and remote payments, prompting businesses to upgrade legacy systems to cloud-based and AI-powered POS solutions for improved resilience, scalability, and consumer safety.

Restraint/Challenge

Data Security and Integration Complexity

- One of the primary challenges limiting the widespread adoption of POS systems—especially cloud-based and mobile POS—is the growing concern around data security and cyber threats. POS systems often handle sensitive financial and customer data, making them frequent targets for fraud and breaches.

- The integration of modern POS terminals with legacy enterprise systems (such as ERP, CRM, and inventory management) can be complex and time-consuming. Many businesses struggle with compatibility, data synchronization, and downtime during deployment.

- Small and medium enterprises (SMEs) often lack the in-house IT expertise to implement and maintain modern POS solutions, leading to dependence on third-party service providers and increased long-term operational costs.

- Compliance with industry standards and data protection regulations (e.g., PCI-DSS, GDPR) adds layers of technical and legal responsibility, particularly for multinational retailers operating across jurisdictions.

- Additionally, system upgrades, hardware replacements, and software licensing fees can strain the budgets of smaller businesses. High upfront and maintenance costs may deter adoption in price-sensitive markets, especially in developing regions.

POS (Point of Sale) Terminals Market Scope

The market is segmented on the product type, component, deployment type, application and end user.

POS (Point of Sale) Terminals Market Scope

The market is segmented on the product type, component, deployment type, application and end user.

• By Product Type

The POS Terminals Market is segmented into Fixed POS Terminals and Mobile POS Terminals (mPOS).Fixed POS Terminals hold the largest market share in 2025, driven by widespread use in large-format retail stores, supermarkets, and restaurants. These terminals offer stable infrastructure, high-speed processing, and integration with complex enterprise systems.Mobile POS Terminals (mPOS) are rapidly gaining popularity among SMEs, pop-up stores, and event vendors due to their portability, lower cost, and app-based flexibility. They enable contactless payments and real-time inventory updates.

• By Component

Component segmentation includes Hardware, Software, and Services. Hardware accounts for the largest share in 2025, encompassing card readers, barcode scanners, printers, displays, and tablets. Continuous upgrades and innovations in touchscreen terminals and biometric readers drive demand. Software is growing steadily, with cloud-based POS and AI-driven analytics gaining traction among retailers seeking operational efficiency and customer personalization. Services, including installation, integration, maintenance, and support, are essential for system uptime and secure operations, particularly in multi-location retail environments.

• By Application

Applications include Retail, Hospitality, Healthcare, Transportation, and Entertainment. Retail dominates the market due to high transaction volumes, inventory complexity, and customer engagement needs. POS systems are crucial for billing, stock tracking, and CRM. Hospitality (restaurants, cafes, hotels) leverages POS for table management, order customization, and payment processing. Healthcare is increasingly adopting POS for patient billing and pharmacy sales. Transportation and Entertainment use POS for ticketing, kiosks, and concession sales, driven by mobility and customer flow.

• By End User

End users are classified into Large Enterprises and SMEs (Small and Medium Enterprises).Large Enterprises lead the market share owing to enterprise-grade system adoption, multi-location integration, and high-volume transaction management. SMEs are showing the fastest growth, enabled by mobile POS, SaaS pricing models, and simplified setup—making digital payments more accessible to small retailers, food vendors, and service providers.

POS (Point of Sale) Terminals Market Regional Analysis

- North America dominates the POS Terminals market with the largest revenue share of 42.7% in 2024. The North American POS terminals market is fueled by rapid adoption of digital payments, high smartphone penetration, and strong demand for contactless transaction options in retail and hospitality sectors.

- Additionally, the region benefits from advanced fintech infrastructure and significant investment in cloud-based and mobile POS systems. Government initiatives supporting cashless economies, along with major players like Square, Toast, and Clover based in the U.S., continue to drive innovation and market expansion.

- The Europe POS Terminals Market is expected to grow steadily throughout the forecast period, fueled by increasing digitization in commerce, adoption of GDPR-compliant transaction systems, and demand for contactless and QR code payment methods. Countries like Germany, the UK, and France are investing in smart retail technologies to enhance efficiency and customer engagement.

- Asia-Pacific is projected to grow at the fastest CAGR through 2032. High smartphone usage, a booming retail sector, and widespread government-led digital payment initiatives (such as UPI in India and e-CNY in China) are key growth drivers. Rising demand for low-cost mPOS among SMEs further accelerates adoption across the region.

- The MEA market is expected to witness steady growth through 2032, driven by increasing financial inclusion initiatives, rising smartphone penetration, and the expansion of e-commerce. Countries like the UAE and Saudi Arabia are rapidly adopting mPOS solutions due to government digitalization programs and growing demand for mobile-based payments in retail and hospitality.

- South America is projected to show moderate growth through 2032, fueled by the increasing shift toward cashless transactions and growing adoption of digital wallets. Brazil leads the regional market with a robust fintech ecosystem and rising demand from small merchants for affordable, mobile-first payment solutions.

U.S. POS (Point of Sale) Terminals Market Insight

The U.S. POS Terminals Market captured the largest revenue share in North America in 2025. The market benefits from robust financial technology infrastructure, regulatory support for cashless payments, and strong demand across SMEs and enterprise retailers. Continuous innovation in mobile POS, self-checkout systems, and app-driven payments makes the U.S. a global innovation hub in the sector.

Germany POS (Point of Sale) Terminals Market Insight

Germany leads the European market due to its advanced retail infrastructure and growing preference for integrated POS systems in chain stores, restaurants, and logistics hubs. The push for Industry 4.0 and retail automation is accelerating the adoption of real-time inventory and analytics-enabled POS platforms.

China POS (Point of Sale) Terminals Market Insight

China dominates the Asia-Pacific region in 2025 due to its massive base of mobile-first consumers, advanced fintech infrastructure, and strong government backing of digital economy initiatives. Popularity of platforms like Alipay and WeChat Pay has propelled POS integration in retail, food service, and transport sectors nationwide.

United Arab Emirates (UAE) POS (Point of Sale) Terminals Market Insight

The UAE POS Terminals Market is witnessing strong growth in 2025, fueled by the government's push toward a cashless economy, smart city initiatives like “Smart Dubai,” and rising consumer preference for digital payments. The retail, hospitality, and healthcare sectors are rapidly adopting mobile POS and contactless systems, making the UAE a leading market for payment innovation in the Gulf region.

Brazil POS (Point of Sale) Terminals Market Insight

Brazil leads the South American POS Terminals Market in 2025 due to its expanding fintech ecosystem, high smartphone penetration, and government-led efforts toward financial inclusion. The country has seen significant growth in mobile POS adoption among small and medium businesses (SMEs), driven by low-cost solutions and flexible payment technologies offered by domestic players.

POS (Point of Sale) Terminals Market Share

The POS (Point of Sale) Terminals Market Share is primarily led by well-established companies, including:

- Acumera, Inc. (US)

- AURES Group (France)

- HP Development Company, L.P. (US)

- Ingenico (France)

- NCR Voyix (US)

- Oracle Corporation (US)

- POSaBIT Inc. (US)

- Presto Phoenix Inc. (US)

- Revel Systems (US)

- Square (US)

- Toast, Inc. (Boston, Massachusetts, US)

- Toshiba Global Commerce Solutions (US)

- TouchBistro (Canada)

- Verifone (US)

- Xenial, Inc. (US)

Latest Developments in Global POS (Point of Sale) Terminals Market

- In February 2025, Square (Block, Inc.) launched a next-generation all-in-one POS terminal featuring biometric authentication, enhanced NFC support, and AI-powered sales analytics, aimed at SMEs and retail chains seeking mobile-first solutions.

- In January 2025, Verifone announced a partnership with Visa to integrate cloud-based payment processing into its POS hardware, enabling faster, more secure transactions across global markets.

- In November 2024, Lightspeed introduced an omnichannel POS platform with real-time inventory syncing across physical stores and e-commerce channels. It features integrated loyalty programs and customer data insights for mid-size retailers.

- In September 2024, HP Inc. unveiled a modular POS terminal for hospitality and retail sectors, featuring 5G connectivity, RFID support, and compatibility with both Android and Windows-based POS apps.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.