Global Portable Medical Electronic Devices Market

Market Size in USD Billion

CAGR :

%

USD

103.51 Billion

USD

389.08 Billion

2024

2032

USD

103.51 Billion

USD

389.08 Billion

2024

2032

| 2025 –2032 | |

| USD 103.51 Billion | |

| USD 389.08 Billion | |

|

|

|

|

Portable Medical Electronic Devices Market Size

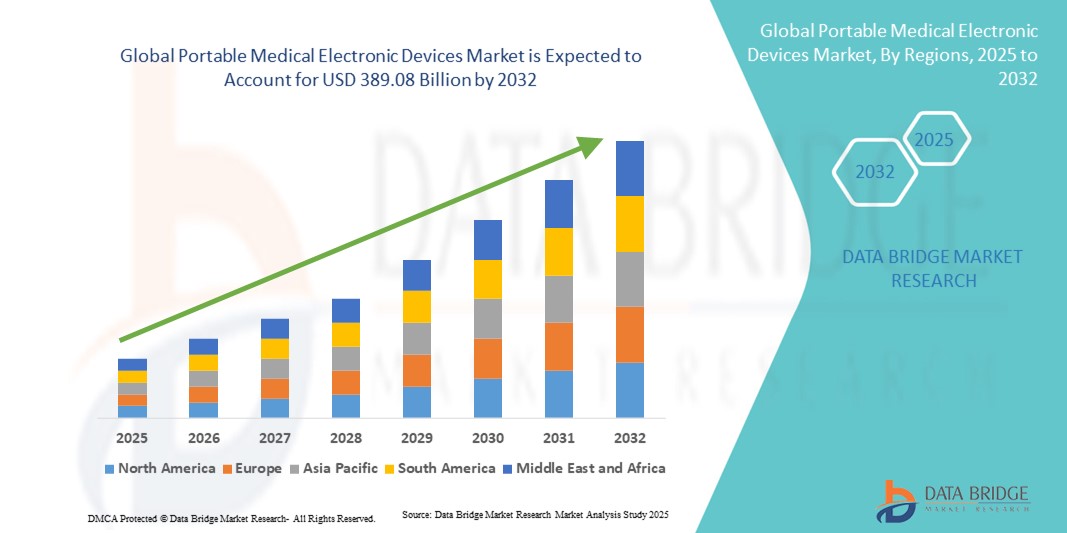

- The global portable medical electronic devices market size was valued at USD 103.51 billion in 2024 and is expected to reach USD 389.08 billion by 2032, at a CAGR of 18.00% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases, rising geriatric population, and growing demand for home-based healthcare solutions, coupled with technological advancements in wearable and portable diagnostic devices

- In addition, heightened awareness regarding health monitoring, coupled with the convenience and efficiency offered by portable medical electronics, is encouraging adoption across both residential and clinical settings. These factors are collectively propelling the market expansion, positioning portable medical electronic devices as essential tools in modern healthcare delivery

Portable Medical Electronic Devices Market Analysis

- Portable medical electronic devices, including handheld diagnostic tools, mobile imaging systems, blood pressure monitors, pulse oximeters, and respiratory products, are becoming essential components of modern healthcare delivery in both clinical and homecare settings due to their real-time monitoring capabilities, ease of use, and integration with telehealth and mobile health platforms

- The rising demand for portable medical electronic devices is primarily driven by the increasing prevalence of chronic diseases, growing geriatric population, and the shift toward home-based and personalized healthcare solutions, coupled with continuous technological advancements in miniaturized sensors and wireless connectivity

- North America dominated the portable medical electronic devices market with the largest revenue share of 39% in 2024, characterized by advanced healthcare infrastructure, high adoption of telemedicine, and a strong presence of key medical device manufacturers, with the U.S. witnessing substantial growth in portable diagnostic and monitoring devices driven by innovations from both established healthcare companies and startups focusing on AI-enabled diagnostics and remote patient monitoring

- Asia-Pacific is expected to be the fastest-growing region in the portable medical electronic devices market during the forecast period due to rising healthcare awareness, increasing healthcare expenditure, and growing investments in remote patient monitoring and mobile health technologies

- Respiratory products dominated the portable medical electronic devices market with a market share of 28.9% in 2024, driven by the increasing prevalence of respiratory disorders, rising demand for portable oxygen concentrators, and the growing adoption of home-based respiratory care solutions

Report Scope and Portable Medical Electronic Devices Market Segmentation

|

Attributes |

Portable Medical Electronic Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Portable Medical Electronic Devices Market Trends

Integration with AI, IoT, and Mobile Health Platforms

- A significant trend in the global portable medical electronic devices market is the increasing integration of artificial intelligence (AI), Internet of Things (IoT), and mobile health (mHealth) platforms. This convergence enables real-time health monitoring, predictive diagnostics, and seamless remote patient management

- For instance, advanced portable ECG monitors now sync with mobile apps to provide instant analysis and AI-driven alerts for arrhythmias, while wearable glucose monitors integrate with IoT-enabled platforms for continuous diabetes management

- AI integration allows devices to learn patient health patterns, predict potential anomalies, and provide actionable insights to healthcare providers. Similarly, mobile connectivity enables patients and clinicians to track health metrics remotely, improving adherence and outcomes

- The seamless interoperability with telemedicine platforms and electronic health records facilitates centralized monitoring of multiple health parameters from a single interface, enabling healthcare professionals to make informed decisions efficiently

- This trend toward smarter, connected, and predictive portable medical devices is reshaping patient care expectations, with companies such as iHealth and Omron developing AI-enabled monitors that offer automated alerts, data analytics, and integration with mobile and cloud-based platforms

- The demand for portable medical electronic devices with AI and IoT integration is rising across both clinical and homecare settings, as patients and providers increasingly prioritize convenience, real-time monitoring, and comprehensive digital health solutions

Portable Medical Electronic Devices Market Dynamics

Driver

Rising Prevalence of Chronic Diseases and Home Healthcare Adoption

- The growing incidence of chronic diseases, coupled with the increasing adoption of home healthcare solutions, is a key driver for portable medical electronic devices

- For instance, in March 2024, Omron Healthcare launched an AI-enabled home blood pressure monitor integrated with telehealth platforms to enhance remote patient monitoring. Such innovations are expected to fuel market growth during the forecast period

- Portable medical devices allow continuous monitoring of vital signs, remote data sharing with healthcare providers, and early detection of health issues, making them indispensable in managing chronic conditions such as diabetes, cardiovascular, and respiratory diseases

- The rising popularity of home-based care, telemedicine, and patient-centric monitoring solutions further propels market adoption, with both hospitals and homecare users seeking portable devices for convenience and efficiency

- Features such as smartphone connectivity, cloud-based data storage, and automated health alerts enhance usability, reduce hospital visits, and empower patients to manage their health proactively

Restraint/Challenge

Regulatory Compliance, Data Privacy, and High Device Costs

- The regulatory challenges and strict compliance requirements for medical devices pose significant hurdles in market expansion. Portable medical devices must meet rigorous safety and accuracy standards set by authorities such as the FDA and CE, which can delay product launches

- Data privacy and cybersecurity concerns regarding the storage and transmission of sensitive patient information via connected devices also affect adoption, as breaches can undermine patient trust

- For instance, in February 2024, a security vulnerability was reported in certain Wi-Fi-enabled glucose monitors that could allow unauthorized access to patient data, highlighting the risks of connected medical devices. Companies such as iHealth and Withings emphasize encrypted data transfer and secure cloud storage to mitigate these concerns

- In addition, high costs of advanced portable medical devices, especially AI-enabled or multi-parameter monitors, can be a barrier for price-sensitive consumers and emerging markets. While some basic devices have become more affordable, premium features often come with significant additional cost

- Overcoming these challenges through regulatory guidance, robust cybersecurity measures, patient education, and development of cost-effective devices will be essential for sustained growth in the portable medical electronic devices market

Portable Medical Electronic Devices Market Scope

The market is segmented on the basis of equipment and end users.

- By Equipment

On the basis of equipment, the portable medical electronic devices market is segmented into respiratory products, heart monitors, pulse oximeters, blood pressure monitors, medical imaging, and others. The respiratory products segment dominated the market with the largest revenue share of 28.9% in 2024, driven by the rising prevalence of respiratory disorders such as COPD and asthma. Devices such as portable oxygen concentrators, nebulizers, and spirometers are widely adopted in hospitals, nursing homes, and homecare settings. Lightweight, battery-operated, and IoT-enabled devices provide mobility, ease of use, and continuous patient monitoring. Awareness about respiratory health, increasing environmental pollution, and the need for home-based respiratory care further support the dominance of this segment. Hospitals and homecare providers both prefer advanced respiratory products for patient convenience and clinical efficiency. Continuous innovation in product design and connectivity enhances adoption, making respiratory products the largest equipment segment.

The heart monitors segment is expected to witness the fastest growth from 2025 to 2032, propelled by the rising incidence of cardiovascular diseases and increasing awareness of preventive care. Wearable ECG monitors, Holter monitors, and portable cardiac telemetry devices allow real-time monitoring both in hospitals and at home. AI-enabled anomaly detection, mobile app integration, and cloud-based data sharing improve diagnostic accuracy and patient outcomes. Continuous cardiac monitoring facilitates early detection of arrhythmias and alerts healthcare providers promptly, which is critical for patient safety. Patients and healthcare professionals prefer these devices for their convenience, portability, and ability to support remote healthcare. The growing trend of connected healthcare and telemedicine adoption further accelerates the demand for portable heart monitors, making it the fastest-growing equipment segment.

- By End Users

On the basis of end users, the portable medical electronic devices market is segmented into hospitals, nursing homes, physician offices, homecare patients, and others. The hospitals segment dominated the market with the largest revenue share in 2024, driven by the growing adoption of portable medical devices such as pulse oximeters, portable ECG monitors, and handheld imaging systems for point-of-care diagnostics and emergency care. Hospitals prioritize devices with interoperability features for integration with electronic health records (EHRs) and telemedicine platforms. These devices allow clinicians to monitor multiple patients simultaneously, optimize workflow efficiency, and reduce hospital stay durations. Real-time data monitoring and automated alerts enhance patient safety and improve clinical outcomes. Moreover, hospitals increasingly invest in multi-parameter and AI-enabled devices to improve critical care decision-making. The combination of convenience, reliability, and integration capabilities makes hospitals the dominant end-user segment in the market.

The homecare patients segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the rising prevalence of chronic diseases, an aging population, and the increasing preference for home-based healthcare solutions. Portable devices such as wearable heart monitors, blood pressure monitors, and pulse oximeters enable patients to monitor vital signs independently and transmit data remotely to healthcare providers. This reduces the need for frequent hospital visits while empowering patients to manage their health proactively. Integration with mobile health apps and cloud platforms enhances usability and patient engagement. Convenience, affordability, and personalized care are key drivers for this segment. Growing awareness of preventive healthcare and the adoption of telemedicine services further accelerate market adoption in homecare settings.

Portable Medical Electronic Devices Market Regional Analysis

- North America dominated the portable medical electronic devices market with the largest revenue share of 39% in 2024, characterized by advanced healthcare infrastructure, high adoption of telemedicine, and a strong presence of key medical device manufacturers

- Patients and healthcare providers in the region highly value the convenience, real-time monitoring capabilities, and seamless integration of portable medical devices with mobile health apps, electronic health records (EHRs), and remote patient monitoring platforms

- This widespread adoption is further supported by high healthcare spending, a technologically inclined population, and favorable reimbursement policies for home-based medical devices, establishing portable medical electronic devices as essential tools in both clinical and homecare settings

U.S. Portable Medical Electronic Devices Market Insight

The U.S. portable medical electronic devices market captured the largest revenue share of 82% in 2024 within North America, fueled by rising chronic disease prevalence, an aging population, and growing adoption of home healthcare and telemedicine solutions. Patients and healthcare providers increasingly prioritize real-time monitoring, convenience, and remote data sharing through wearable and portable devices. The popularity of mobile health applications, AI-enabled monitoring, and integration with electronic health records further drives adoption. In addition, favorable reimbursement policies and high healthcare spending are key factors supporting market growth in the U.S.

Europe Portable Medical Electronic Devices Market Insight

The Europe portable medical electronic devices market is projected to expand at a substantial CAGR during the forecast period, driven by increasing healthcare infrastructure, rising demand for home-based care, and technological advancements in portable medical devices. Government initiatives supporting digital health and telemedicine are fostering adoption. Consumers in the region value convenience, real-time monitoring, and integration with mobile health apps. Hospitals, clinics, and homecare providers are incorporating portable devices into patient management programs, further supporting market expansion.

U.K. Portable Medical Electronic Devices Market Insight

The U.K. portable medical electronic devices market is anticipated to grow at a noteworthy CAGR, driven by rising awareness of chronic disease management, home healthcare adoption, and the demand for real-time monitoring solutions. Portable devices offer patients convenience, remote data sharing with healthcare providers, and integration with telemedicine platforms. The country’s robust healthcare infrastructure and strong adoption of digital health tools are expected to continue stimulating market growth.

Germany Portable Medical Electronic Devices Market Insight

The Germany portable medical electronic devices market is expected to expand at a considerable CAGR, fueled by increasing awareness of preventive healthcare, demand for technologically advanced devices, and strong healthcare infrastructure. Hospitals, clinics, and homecare services are rapidly adopting portable medical devices such as wearable heart monitors and portable imaging systems. Integration with electronic health records and mobile apps enhances patient monitoring and data-driven care. Germany’s focus on innovation and quality standards supports the adoption of advanced portable devices across residential and clinical settings.

Asia-Pacific Portable Medical Electronic Devices Market Insight

The Asia-Pacific portable medical electronic devices market is poised to grow at the fastest CAGR of 23% during the forecast period, driven by increasing healthcare awareness, rising chronic disease prevalence, and expanding homecare services in countries such as China, Japan, and India. Government initiatives promoting digital health, telemedicine, and affordable medical devices are driving adoption. Technological advancements, combined with a growing middle-class population, are further accelerating the uptake of portable medical devices in both clinical and homecare settings.

Japan Portable Medical Electronic Devices Market Insight

The Japan portable medical electronic devices market is gaining momentum due to rapid urbanization, an aging population, and high healthcare technology adoption. Patients and providers increasingly rely on wearable and portable devices for real-time health monitoring and chronic disease management. Integration with mobile health applications and IoT-enabled healthcare platforms supports efficient care delivery. The demand for user-friendly and secure devices in both homecare and clinical environments is driving growth.

India Portable Medical Electronic Devices Market Insight

The India portable medical electronic devices market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the expanding middle class, rising healthcare awareness, and increasing adoption of homecare services. Portable devices such as blood pressure monitors, pulse oximeters, and portable ECG systems are gaining popularity in residential and clinical settings. Government initiatives supporting telemedicine and digital health, along with affordable device options and growing domestic manufacturing, are key factors propelling the market in India.

Portable Medical Electronic Devices Market Share

The Portable Medical Electronic Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Koninklijke Philips N.V., (Netherlands)

- GE HealthCare (U.S.)

- Abbott (U.S.)

- Siemens Healthineers AG (Germany)

- FUJIFILM Corporation (Japan)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Honeywell International Inc. (U.S.)

- SAMSUNG (South Korea)

- LG Electronics. (South Korea)

- Guangdong Transtek Medical Electronics Co.,Ltd (China)

- Microlife Corporation (Switzerland)

- iHealth Labs Inc. (U.S.)

- Withings (France)

- Masimo (U.S.)

- Nonin (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- Mindray Bio-Medical Electronics Co., Ltd. (China)

What are the Recent Developments in Global Portable Medical Electronic Devices Market?

- In August 2025, Samsung India, in collaboration with its subsidiary NeuroLogica, introduced a new range of mobile CT (Computed Tomography) products in India. This next-generation portfolio includes the CereTom Elite, OmniTom Elite, OmniTom Elite PCD, and BodyTom 32/64. These mobile, AI-powered CT systems are designed to provide advanced diagnostic imaging across various medical environments such as ICUs, operating rooms, and emergency departments

- In August 2025, San Francisco-based biotech company Openwater introduced a multi-purpose platform approach to medical device development, combining infrared light and low-intensity focused ultrasound technologies. This platform is designed to accelerate time to market for medical devices by providing a flexible and scalable infrastructure for various medical applications

- In June 2025, Australian company Lubdub Technologies is advancing at-home cardiac care by developing three innovative portable diagnostic tools: a wearable ECG patch, a saliva biosensor measuring five key cardiac biomarkers, and a wearable ultrasound device for real-time heart imaging. These devices aim to facilitate early detection of cardiac issues, reducing the need for hospital visits and enabling timely intervention, particularly in underserved remote communities

- In January 2025, 42 Technology (42T) launched an innovative, video-capable medical device at CES 2025 designed to improve the speed and safety of patient intubation during surgery and emergency care. The device aims to enhance procedural efficiency and patient safety by providing real-time video assistance to clinicians

- In March 2022, Mobvoi Inc., in partnership with CardieX, launched the TicWatch GTH Pro, a smartwatch designed for heart health monitoring. This device, equipped with advanced sensors, offers detailed insights into both general and arterial health, capturing data from both the wrist and finger for improved accuracy and user experience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.