Global Portable Laboratory Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.96 Billion

USD

3.57 Billion

2025

2033

USD

2.96 Billion

USD

3.57 Billion

2025

2033

| 2026 –2033 | |

| USD 2.96 Billion | |

| USD 3.57 Billion | |

|

|

|

|

Portable Laboratory Equipment Market Size

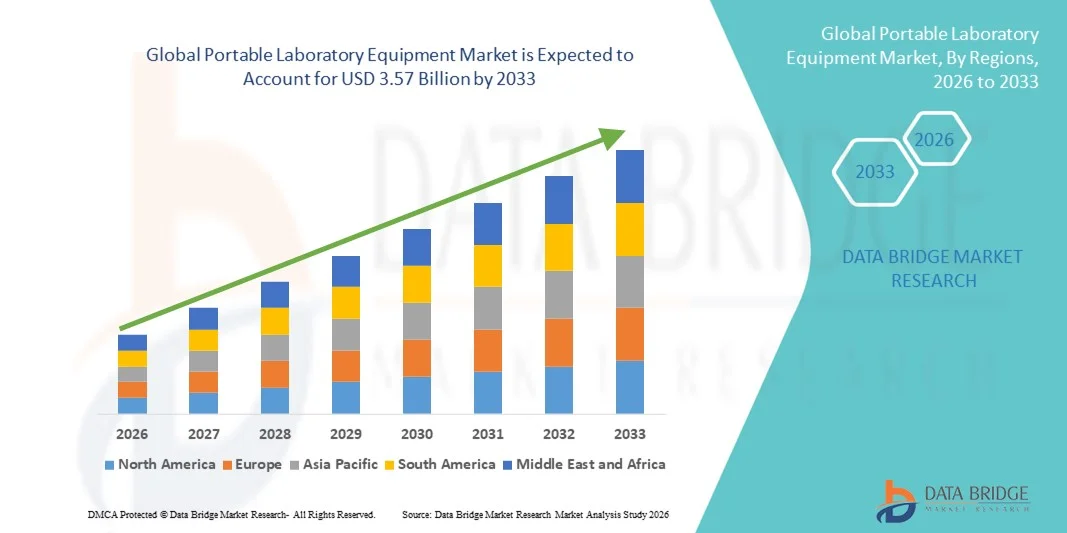

- The global portable laboratory equipment market size was valued at USD 2.96 billion in 2025 and is expected to reach USD 3.57 billion by 2033, at a CAGR of2.40% during the forecast period

- The market growth is largely driven by the increasing need for rapid, on-site diagnostic and analytical solutions across healthcare, environmental testing, pharmaceuticals, and research applications, supported by continuous technological advancements in compact, lightweight, and battery-operated laboratory devices

- Furthermore, rising demand for point-of-care testing, decentralized laboratories, and field-based analysis—combined with the need for faster turnaround times, ease of use, and cost-effective testing solutions—is accelerating the adoption of portable laboratory equipment, thereby significantly boosting the overall growth of the Portable Laboratory Equipment market

Portable Laboratory Equipment Market Analysis

- Portable laboratory equipment—designed to deliver accurate, real-time testing and analysis outside traditional laboratory settings—is becoming increasingly essential across healthcare, environmental monitoring, pharmaceuticals, food safety, and research applications due to its mobility, rapid results, and ease of deployment in decentralized locations

- The growing demand for portable laboratory equipment is primarily driven by the rising adoption of point-of-care diagnostics, increasing need for field-based and emergency testing, and advancements in miniaturization, sensor technologies, and battery-powered systems that enhance usability and performance

- North America dominated the portable laboratory equipment market with the largest revenue share of approximately 38.6% in 2025, supported by strong healthcare infrastructure, high adoption of point-of-care testing, significant R&D investments, and the presence of leading market players, with the U.S. witnessing widespread utilization across hospitals, diagnostic centers, and research institutions

- Asia-Pacific is expected to be the fastest-growing region in the portable laboratory equipment market during the forecast period, driven by expanding healthcare access, increasing government initiatives for rapid diagnostics, rising disease burden, and growing adoption of portable testing solutions in emerging economies such as China and India

- The analytical equipment segment accounted for the largest market revenue share of 38.1% in 2025, driven by its extensive use in precise testing, diagnostics, and sample analysis

Report Scope and Portable Laboratory Equipment Market Segmentation

|

Attributes |

Portable Laboratory Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Portable Laboratory Equipment Market Trends

Technological Advancements and Miniaturization of Diagnostic Devices

- A significant and accelerating trend in the global portable laboratory equipment market is the rapid advancement in miniaturization, digital integration, and automation of diagnostic and analytical devices

- These innovations are enabling complex laboratory testing to be conducted outside traditional lab settings, improving accessibility in point-of-care, field diagnostics, and emergency response scenarios

- For instance, in March 2023, Abbott Laboratories expanded its i-STAT Alinity portable blood testing system, enabling rapid analysis of blood gases, electrolytes, and metabolites at the patient’s bedside, demonstrating the growing shift toward compact and mobile diagnostic platforms

- Manufacturers are increasingly incorporating advanced sensors, microfluidics, and battery-efficient designs to enhance accuracy, portability, and ease of use, making these devices suitable for remote and resource-limited environments

- The integration of digital connectivity and data management capabilities allows portable laboratory equipment to seamlessly transmit test results to centralized databases, electronic health records, and cloud platforms, supporting faster clinical decision-making

- This trend toward lightweight, multifunctional, and user-friendly laboratory devices is transforming diagnostic workflows across healthcare, environmental monitoring, food safety testing, and pharmaceutical research

- The growing demand for rapid testing, decentralized diagnostics, and on-site analytical capabilities is further accelerating innovation and adoption across both developed and emerging markets

Portable Laboratory Equipment Market Dynamics

Driver

Rising Demand for Point-of-Care Testing and Decentralized Diagnostics

- The increasing need for rapid, accurate, and on-site diagnostic testing across healthcare, biotechnology, and environmental applications is a major driver fueling the growth of the portable laboratory equipment market

- For instance, in July 2024, Thermo Fisher Scientific introduced an upgraded portable PCR and molecular testing solution, aimed at enabling faster infectious disease detection in clinics, field laboratories, and emergency healthcare settings

- As healthcare systems shift toward decentralized care models, portable laboratory equipment enables quicker diagnosis, reduced turnaround times, and improved patient outcomes by eliminating dependence on centralized laboratories

- Growing prevalence of chronic diseases, infectious outbreaks, and emergency medical situations is increasing the demand for portable diagnostic solutions that can be deployed rapidly in hospitals, ambulances, and remote locations

- In addition, rising adoption of portable testing systems in pharmaceutical research, clinical trials, and environmental monitoring is expanding the application scope of portable laboratory equipment

- Supportive government initiatives and investments aimed at strengthening diagnostic infrastructure, particularly in rural and underserved regions, are further driving market growth

Restraint/Challenge

High Equipment Costs and Accuracy Concerns Compared to Conventional Laboratories

- The relatively high initial cost of advanced portable laboratory equipment, combined with concerns regarding accuracy and consistency compared to centralized laboratory systems, poses a significant challenge to widespread adoption

- For instance, in 2022, several healthcare providers reported limitations in adopting portable molecular diagnostic devices due to higher per-test costs and calibration requirements, highlighting budget constraints faced by smaller clinics and diagnostic centers

- Ensuring consistent performance, proper calibration, and regulatory compliance remains a challenge, particularly in resource-limited settings where skilled personnel and maintenance support may be lacking

- Portable systems may also face limitations in handling high test volumes or complex assays, restricting their use in large-scale diagnostic laboratories

- Data security, device durability, and battery life are additional concerns that manufacturers must address to ensure reliable long-term operation

- Overcoming these challenges through cost optimization, improved device accuracy, enhanced training programs, and continued technological advancements will be essential for sustained growth of the portable laboratory equipment market

Portable Laboratory Equipment Market Scope

The market is segmented on the basis of type, product, application, and end user.

- By Type

On the basis of type, the Global Portable Laboratory Equipment market is segmented into autoclaves, incubators, centrifuges, spectrometers, sonicators, scopes, and others. The centrifuges segment dominated the largest market revenue share of 34.6% in 2025, driven by its critical importance in sample separation across clinical diagnostics, pharmaceutical research, and academic laboratories. Portable centrifuges are extensively used for blood testing, molecular biology, and microbiology applications, making them indispensable in both fixed and mobile laboratory settings. Their compact size, low maintenance requirements, and ability to deliver rapid and accurate results enhance their adoption. Growing demand for decentralized and point-of-care testing has further strengthened this segment. Technological advancements such as battery-operated and low-noise centrifuges support wider deployment. Increasing use in emergency diagnostics and field research also contributes to dominance. These combined factors have solidified the centrifuges segment’s leadership position in the market.

The spectrometers segment is expected to witness the fastest CAGR of 11.9% from 2026 to 2033, driven by rising demand for real-time chemical and biological analysis in portable environments. Portable spectrometers are increasingly utilized in pharmaceutical research, environmental monitoring, and food safety testing. Their ability to deliver high-precision analytical results in field conditions significantly enhances operational efficiency. Advancements in miniaturization and sensor technology have improved performance and portability. Growing investments in mobile laboratories and on-site analytical testing are further accelerating adoption. Increased focus on rapid diagnostics and analytical accuracy continues to fuel strong growth momentum in this segment.

- By Product

On the basis of product, the Global Portable Laboratory Equipment market is segmented into analytical equipment, general equipment, support equipment, and specialty equipment. The analytical equipment segment accounted for the largest market revenue share of 38.1% in 2025, driven by its extensive use in precise testing, diagnostics, and sample analysis. Portable analytical instruments are widely deployed in clinical laboratories, pharmaceutical R&D, and biotechnology research due to their accuracy and reliability. Increasing demand for point-of-care diagnostics and rapid disease detection strongly supports this segment. Continuous advancements in portable analyzers and diagnostic platforms have enhanced usability without compromising performance. Rising healthcare expenditures and growing adoption of decentralized testing further contribute to dominance. These factors collectively position analytical equipment as the leading product segment.

The specialty equipment segment is expected to witness the fastest CAGR of 12.6% from 2026 to 2033, driven by increasing demand for application-specific portable laboratory solutions. Specialty equipment is gaining traction in molecular diagnostics, forensic testing, and advanced biological research. Rising investments in precision medicine and specialized diagnostic techniques support growth. Technological innovations enabling compact yet high-performance systems further enhance adoption. Growing collaboration between research institutes and equipment manufacturers also fuels expansion. These factors are expected to sustain strong growth in the specialty equipment segment.

- By Application

On the basis of application, the Global Portable Laboratory Equipment market is segmented into genetic testing, endocrinology, haematology, microbiology, biochemistry, and others. The microbiology segment dominated the largest market revenue share of 29.4% in 2025, driven by the widespread use of portable equipment for infectious disease diagnosis and pathogen detection. Portable microbiology tools enable rapid testing in hospitals, field clinics, and outbreak response units. Rising incidence of infectious diseases and growing emphasis on early diagnosis significantly boost demand. Government initiatives for disease surveillance and epidemic preparedness further strengthen this segment. Continuous advancements in portable microbiological testing technologies improve speed and accuracy. These factors collectively contribute to the strong market position of the microbiology segment.

The genetic testing segment is expected to witness the fastest CAGR of 13.2% from 2026 to 2033, driven by growing adoption of molecular diagnostics and personalized medicine. Portable genetic testing equipment enables on-site DNA and RNA analysis, reducing dependency on centralized laboratories. Increasing awareness of genetic disorders and demand for early detection support growth. Advancements in portable PCR and sequencing technologies further enhance accessibility. Expanding applications in oncology, prenatal screening, and infectious disease genetics continue to accelerate adoption. These trends are expected to drive robust growth in this segment.

- By End User

On the basis of end user, the Global Portable Laboratory Equipment market is segmented into pharmaceutical and biotechnology companies, clinical and diagnostic laboratories, academic institutes, and others. The clinical and diagnostic laboratories segment held the largest market revenue share of 41.7% in 2025, driven by high demand for portable equipment in point-of-care and decentralized diagnostic testing. These laboratories benefit from reduced turnaround times and improved operational efficiency. Rising patient volumes and increasing need for rapid diagnostics further support dominance. Portable equipment enables effective testing in emergency care, rural healthcare, and mobile diagnostic units. Growing investments in diagnostic infrastructure and technological advancements also contribute. These factors collectively strengthen the segment’s leadership position.

The pharmaceutical and biotechnology companies segment is expected to witness the fastest CAGR of 12.1% from 2026 to 2033, driven by increasing research and drug development activities. Portable laboratory equipment supports flexible research workflows and accelerates experimental processes. Rising focus on biologics, vaccines, and molecular research fuels demand. The need for rapid testing during clinical trials further boosts adoption. Continuous innovation in portable analytical systems enhances research efficiency. Increasing global pharmaceutical investments are expected to sustain strong growth in this segment.

Portable Laboratory Equipment Market Regional Analysis

- North America dominated the portable laboratory equipment market with the largest revenue share of approximately 38.6% in 2025, supported by a strong and well-established healthcare infrastructure, high adoption of point-of-care (POC) testing, significant investments in biomedical R&D, and the strong presence of leading market players

- The region benefits from advanced diagnostic capabilities, rapid technological innovation, and early adoption of portable testing solutions across hospitals, diagnostic laboratories, ambulatory care centers, and research institutions.

- The widespread utilization of portable laboratory equipment in North America is further driven by the growing demand for rapid diagnostics, decentralized testing, and emergency care applications, particularly in the U.S. High healthcare spending, favorable reimbursement policies, and increased focus on early disease detection and monitoring are reinforcing market growth across both clinical and non-clinical settings

U.S. Portable Laboratory Equipment Market Insight

The U.S. portable laboratory equipment market accounted for the largest revenue share within North America in 2025, driven by extensive adoption of point-of-care diagnostics, strong government and private funding for medical research, and the widespread presence of advanced healthcare facilities. Hospitals and diagnostic centers increasingly rely on portable laboratory devices for rapid testing, infectious disease detection, and emergency diagnostics. In addition, the growing emphasis on home healthcare, remote patient monitoring, and outbreak preparedness continues to accelerate demand for compact, accurate, and easy-to-use laboratory equipment across the country.

Europe Portable Laboratory Equipment Market Insight

The Europe portable laboratory equipment market is expected to expand at a steady CAGR during the forecast period, primarily driven by increasing demand for rapid diagnostics, stringent regulatory standards for healthcare quality, and rising emphasis on early disease detection. The region is witnessing growing adoption of portable testing solutions across hospitals, clinics, and research laboratories, supported by strong public healthcare systems. Moreover, technological advancements and the increasing focus on decentralized healthcare delivery are encouraging the integration of portable laboratory equipment in both urban and rural healthcare settings.

U.K. Portable Laboratory Equipment Market Insight

The U.K. portable laboratory equipment market is projected to grow at a notable CAGR over the forecast period, supported by rising demand for point-of-care testing, expanding diagnostic services, and increasing healthcare digitization. The country’s focus on improving patient outcomes through faster diagnosis and reduced laboratory turnaround times is driving adoption. In addition, government-backed healthcare initiatives and the growing use of portable diagnostic tools in emergency care and community health programs are contributing to sustained market growth.

Germany Portable Laboratory Equipment Market Insight

The Germany portable laboratory equipment market is anticipated to witness considerable growth during the forecast period, driven by strong investments in medical technology, advanced healthcare infrastructure, and a high focus on precision diagnostics. Germany’s emphasis on innovation, quality standards, and clinical accuracy supports the adoption of portable laboratory devices in hospitals, diagnostic labs, and research institutions. The increasing use of portable equipment for chronic disease monitoring and infectious disease screening further strengthens market expansion.

Asia-Pacific Portable Laboratory Equipment Market Insight

- Asia-Pacific portable laboratory equipment market is expected to be the fastest-growing region in the portable laboratory equipment market during the forecast period, driven by expanding healthcare access, rising disease burden, increasing government initiatives for rapid diagnostics, and growing awareness of early disease detection

- The region is witnessing strong demand for portable laboratory solutions across primary healthcare centers, rural clinics, and emergency care facilities.

- Rapid urbanization, rising healthcare expenditure, and technological advancements in countries such as China, India, and Japan are accelerating adoption. In addition, government-led programs promoting affordable diagnostics and improvements in healthcare infrastructure are significantly boosting market penetration across emerging economies

Japan Portable Laboratory Equipment Market Insight

The Japan portable laboratory equipment market is gaining steady momentum due to the country’s advanced healthcare system, aging population, and strong focus on early diagnosis and disease management. Portable laboratory devices are increasingly used for routine testing, chronic disease monitoring, and emergency diagnostics. Japan’s emphasis on precision medicine, combined with high adoption of technologically advanced medical devices, continues to drive demand across hospitals and diagnostic centers.

China Portable Laboratory Equipment Market Insight

The China portable laboratory equipment market accounted for the largest revenue share in the Asia-Pacific region in 2025, supported by rapid healthcare infrastructure development, a growing patient population, and strong government initiatives promoting diagnostic accessibility. The rising prevalence of infectious and chronic diseases, along with increasing adoption of point-of-care testing in urban and rural settings, is fueling market growth. Furthermore, the presence of domestic manufacturers offering cost-effective portable laboratory solutions is enhancing affordability and accelerating widespread adoption across the country.

Portable Laboratory Equipment Market Share

The Portable Laboratory Equipment industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Danaher Corporation (U.S.)

- Agilent Technologies (U.S.)

- Bruker Corporation (U.S.)

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Eppendorf AG (Germany)

- PerkinElmer (U.S.)

- Bio-Rad Laboratories (U.S.)

- Shimadzu Corporation (Japan)

- Horiba Ltd. (Japan)

- Oxford Instruments (U.K.)

- Cole-Parmer Instrument Company (U.S.)

- Benchmark Scientific (U.S.)

- Becton, Dickinson and Company (U.S.)

- Hitachi High-Tech Corporation (Japan)

- IKA Werke (Germany)

- VWR International (U.S.)

- Labnet International (U.S.)

- KNF Neuberger (Germany)

Latest Developments in Global Portable Laboratory Equipment Market

- In September 2023, Bio-Rad Laboratories, Inc. launched the PTC Tempo 48/48 and Tempo 384 thermal cyclers designed to enhance PCR workflows such as sequencing, cloning, and genotyping; the 48/48 model features dual blocks allowing two protocols to run simultaneously, while the 384 model includes automated lid integration and thermal control to support high-throughput portable PCR applications. This launch reflects continued innovation in compact, flexible amplification tools suitable for decentralized molecular testing

- In September 2023, Yourgene Health introduced “MagBench,” an automated DNA extraction instrument aimed at improving non-invasive prenatal testing (NIPT) workflows, featuring rapid processing and customizable throughput; the platform was launched across Asia-Pacific and Middle East markets to support local demand for portable and semi-portable laboratory processing solutions. This development highlights the shift toward automated, field-capable equipment in genetic and clinical labs

- In April 2024, Eppendorf AG launched a new state-of-the-art centrifuge equipped with a novel rotor technology that significantly reduces noise and vibration during operation, enhancing usability and safety in benchtop and smaller lab environments where portability and space-efficiency are priorities. This introduction aligns with broader trends toward more ergonomic and compact lab devices

- In May 2024, Bruker unveiled a cutting-edge mass spectrometer designed to meet performance needs for complex biomolecular analyses, featuring enhanced sensitivity and resolution; although a benchtop instrument, its improved compact design supports broader adoption in decentralized labs, academic research, and field studies that rely on portable analytical capacity

- In June 2024, Thermo Fisher Scientific introduced advanced AI-enabled incubators with integrated real-time monitoring of temperature and humidity, enabling remote control and connectivity that improves reproducibility and efficiency in both centralized and decentralized labs, including setups that rely on portable incubator systems

- In December 2024, Nova Biomedical launched the Nova i50 portable analyzer, offering a multi-parameter point-of-care testing solution designed for clinics and urgent care settings; this release expands the suite of mobile diagnostic devices capable of on-site analytical testing outside traditional lab infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.