Global Portable Gas Detectors Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

2.81 Billion

2024

2032

USD

1.70 Billion

USD

2.81 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 2.81 Billion | |

|

|

|

|

Portable Gas Detectors Market Size

-

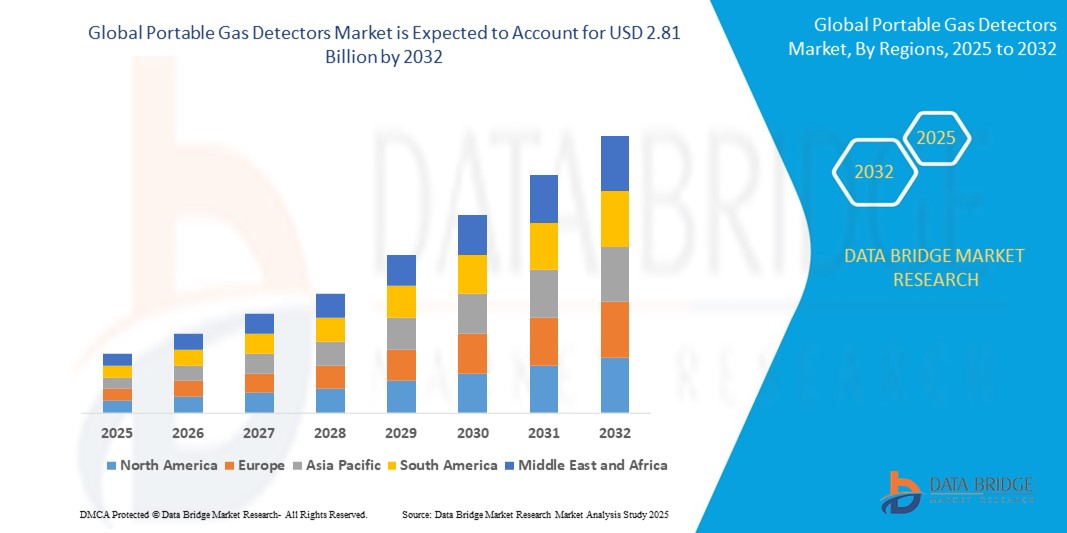

The Global Portable Gas Detectors Market was valued at USD 1.7 billion in 2024 and is projected to reach USD 2.81 billion by 2032, growing at a CAGR of 7.4% during the forecast period.

-

The growth is fueled by increasing emphasis on workplace safety regulations, rising occurrences of hazardous gas leaks, and the expanding adoption of wireless gas monitoring technologies across various high-risk industrial sectors.

Portable Gas Detectors Market Analysis

- Portable gas detectors are compact, handheld devices used to detect the presence of toxic and combustible gases in real-time. They are essential tools in hazardous environments to protect personnel from gas exposure and ensure regulatory compliance.

- Increasing industrialization in emerging markets and growing awareness of occupational health and safety are driving demand across oil & gas, mining, chemical, and manufacturing sectors. Portable detectors are favored for their mobility, multi-gas detection capability, and fast response times.

- The adoption of IoT-enabled gas detectors, with features like Bluetooth connectivity, GPS tracking, and cloud-based alerts, is revolutionizing the way safety personnel monitor confined spaces and remote locations.

- Governments and regulatory bodies across North America, Europe, and Asia-Pacific are enforcing stricter safety mandates under OSHA, ATEX, and IECEx guidelines, further encouraging companies to invest in advanced gas detection systems.

Report Scope and Global Portable Gas Detectors Market Segmentation

|

Attributes |

Global Portable Gas Detectors Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Portable Gas Detectors Market Trends

“Smart, Connected, and Multi-Gas Detection Solutions Lead the Safety Innovation Curve”

- The portable gas detectors market is evolving with the integration of wireless technologies, IoT platforms, and real-time cloud monitoring. Devices are increasingly equipped with Bluetooth, GPS, and 4G/5G capabilities to enable remote access, live alerting, and centralized safety analytics.

- Multi-gas detection is becoming the standard as workplaces face complex hazards involving toxic, flammable, and asphyxiating gases. New detectors offer plug-and-play sensor modules, enabling users to customize gas detection based on job site requirements.

- Another trend is the rise of compact, wearable detectors designed for personal protection, especially for workers in confined spaces or hazardous zones. These lightweight devices provide immediate audible and visual alarms and often include panic alert features and man-down detection for lone worker safety.

- As industries move toward predictive maintenance and proactive safety, portable gas detectors are being integrated with AI-based incident forecasting tools, improving risk prevention and regulatory reporting. Environmentally hardened detectors, capable of operating in high-humidity, corrosive, or dusty conditions, are also gaining popularity.

Portable Gas Detectors Market Dynamics

Driver

“Stringent Occupational Safety Standards and Growing Use in Hazardous Work Environments”

- Rising incidents of toxic gas exposure and industrial accidents have led governments and regulatory bodies worldwide (OSHA, NIOSH, ATEX, IECEx) to enforce strict safety protocols requiring portable gas monitoring for worker protection.

- Confined space operations, such as tank cleaning, sewer maintenance, and underground excavation, demand reliable and mobile gas detection systems capable of identifying oxygen deficiency, H2S, CO, and explosive gases in real time.

- In sectors like oil & gas, chemical manufacturing and mining, portable gas detectors are a frontline safety tool, reducing downtime, increasing operational transparency, and meeting mandatory compliance benchmarks.

- Companies are adopting real-time alert systems, data logging, and wireless telemetry features in gas detectors to streamline reporting, auditing, and post-incident analysis.

Restraint/Challenge

“High Cost of Advanced Detectors and Calibration Complexity in Harsh Environments”

- High-quality multi-gas detectors with wireless capabilities, extended battery life, and robust sensor suites can be expensive, limiting adoption among small enterprises and in price-sensitive developing markets.

- Sensors require regular calibration and bump testing, and harsh environments (dust, moisture, corrosive gases) can lead to sensor drift or failure, reducing accuracy and increasing maintenance burdens.

- In industries with low technical literacy, workers may struggle with proper usage, calibration procedures, and alarm response protocols, reducing overall effectiveness and creating liability risks.

- Compatibility issues between newer wireless detectors and legacy infrastructure may hinder full integration with centralized safety systems or industrial IoT platforms.

Automotive Battery Market Scope

The market is segmented on the battery type, vehicle type, engine type, functions and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Sensor Type |

|

|

By Technology |

|

|

By End Use |

|

Portable Gas Detectors Market Scope

The market is segmented by type, sensor type, technology, and end-use industry, reflecting the diversity in application environments and evolving user requirements.

- By Type

Includes single-gas detectors and multi-gas detectors.

Multi-gas detectors dominate the market due to their ability to detect multiple hazardous gases simultaneously, enhancing worker safety in complex environments such as oil rigs, mines, and chemical processing plants. Single-gas detectors are still widely used for targeted detection (e.g., H2S, CO) in localized applications.

- By Sensor Type

Segmented into electrochemical, catalytic, infrared, photoionization detectors (PID), and others.

Electrochemical sensors lead in 2025 due to their accuracy and reliability in toxic gas detection (e.g., CO, H2S). Infrared sensors are gaining traction in detecting hydrocarbons and CO2 in explosive zones, especially in confined spaces and offshore platforms.

- By Technology

Divided into wireless and non-wireless technologies. Wireless portable gas detectors are expected to grow at the fastest CAGR, driven by real-time remote monitoring, integration with safety dashboards, and compliance with Industry 4.0 and smart facility protocols. Non-wireless detectors remain common in traditional setups due to cost-effectiveness.

- By End Use

Covers oil & gas, chemicals, mining, fire services, construction, water treatment, manufacturing, and others. Oil & gas holds the largest market share due to the high risk of gas leaks and explosions in upstream and downstream operations. Mining and chemical industries follow closely due to the prevalence of confined space operations and toxic emissions. Fire services and construction sectors are adopting portable detectors for enhanced crew protection during rescue or site excavation operations.

Portable Gas Detectors Market Regional Analysis

- North America dominates the global portable gas detectors market in 2025, driven by stringent OSHA regulations, high adoption in oil & gas, and widespread use in emergency response. The U.S. and Canada are investing in real-time gas monitoring technologies and lone worker safety tools across industrial and municipal sectors.

- Europe is a major market, supported by strong enforcement of ATEX/IECEx standards in manufacturing, petrochemicals, and energy. Countries like Germany, France, and the U.K. are deploying advanced portable detectors in confined spaces and expanding usage in wastewater, transportation, and construction.

- Asia-Pacific is expected to register the fastest CAGR through 2032, led by growing industrial activity and government-backed worker safety initiatives in India, China, Southeast Asia, and Australia. Urbanization and infrastructure growth are creating demand across construction, utilities, and mining.

- Middle East and Africa (MEA) is experiencing steady growth due to the expansion of oil & gas, refining, and utility sectors in UAE, Saudi Arabia, Nigeria, and South Africa. Governments and international agencies are introducing safety programs to promote gas detection tools in hazardous industries.

- South America, particularly Brazil and Chile, is seeing rising adoption as mining and petrochemical industries modernize their safety equipment and invest in personal protective technologies, including portable gas detection for confined space and exploration field use.

United States Portable Gas Detectors Market Insights

The U.S. leads in both innovation and adoption of portable gas detectors due to strong workplace safety laws under OSHA, NFPA, and MSHA. Use is widespread in oil & gas, mining, and emergency services, with growing demand for IoT-integrated and multi-gas detection systems for lone worker and confined space operations.

Germany Portable Gas Detectors Market Insights

Germany’s robust manufacturing, chemical, and industrial sectors drive strong demand for portable gas detectors, particularly in explosion-proof zones. The country enforces ATEX certification and is advancing in wireless gas detection and wearable safety solutions.

India Portable Gas Detectors Market Insights

India is emerging as a high-growth market, driven by rapid industrialization, construction activity, and worker safety campaigns. Local industries are investing in affordable portable gas detectors to meet increasing regulatory enforcement and reduce incidents of gas exposure in factories, refineries, and infrastructure sites.

United Arab Emirates Portable Gas Detectors Market Insights

UAE is expanding its oil & gas and industrial base under Vision 2031, with growing use of portable gas detectors in refining, offshore, and utility sectors. Emphasis is on wireless detection, remote monitoring, and training for safe confined space entry.

Brazil

Brazil’s mining, wastewater, and construction industries are deploying portable gas detectors to meet safety codes and reduce accidents. Demand is rising for multi-gas, ruggedized, and real-time telemetry-enabled detectors in both public and private sectors.

Portable Gas Detectors Market Share

The Portable Gas Detectors industry is primarily led by well-established companies, including:

- Honeywell International Inc.

- MSA Safety Incorporated

- Drägerwerk AG & Co. KGaA

- Industrial Scientific Corporation

- RAE Systems (a Honeywell company)

- GfG Europe Ltd.

- Crowcon Detection Instruments Ltd.

- Blackline Safety Corp.

- Trolex Ltd.

- Sensor Electronics Corporation

- Hanwei Electronics Group Corporation

- New Cosmos Electric Co., Ltd.

Latest Developments in Global Portable Gas Detectors Market

- In April 2025, MSA Safety launched the ALTAIR® io360, an advanced multi-gas wireless detector designed for perimeter and area monitoring in oil & gas sites, featuring cloud integration, real-time alerts, and push-button calibration.

- In March 2025, Dräger introduced a new generation of X-am 2800 portable gas detectors with Bluetooth capability, compatible with Dräger Gas Detection Connect, enabling centralized management of field-deployed devices.

- In February 2025, Honeywell announced updates to its BW™ Solo detectors, including expanded sensor options, improved data logging, and mobile connectivity for remote device diagnostics and compliance reporting.

- In January 2025, Industrial Scientific unveiled its Ventis Pro5 upgrade with satellite communication compatibility, enabling lone workers in remote locations to stay connected even outside cellular range.

- In December 2024, Blackline Safety partnered with a Canadian utility provider to deploy G7c wireless gas detectors across critical infrastructure, allowing for continuous monitoring of gas exposure, real-time incident response, and automated reporting.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Portable Gas Detectors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Portable Gas Detectors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Portable Gas Detectors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.