Global Popping Boba Juice Balls Market

Market Size in USD Billion

CAGR :

%

USD

1.57 Billion

USD

2.15 Billion

2024

2032

USD

1.57 Billion

USD

2.15 Billion

2024

2032

| 2025 –2032 | |

| USD 1.57 Billion | |

| USD 2.15 Billion | |

|

|

|

|

What is the Global Popping Boba/Juice Balls Market Size and Growth Rate?

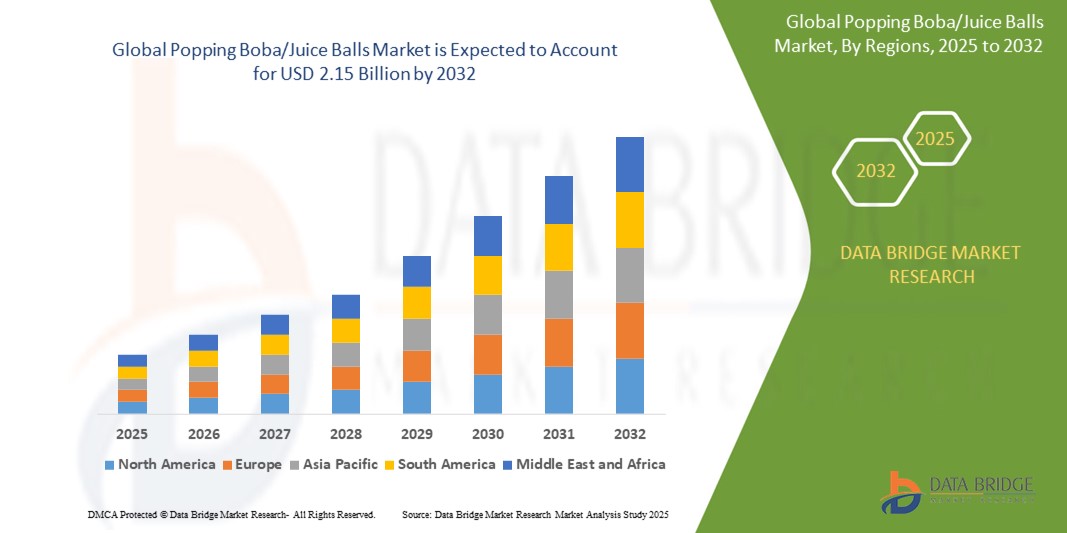

- The global popping boba/juice balls market size was valued at USD 1.57 billion in 2024 and is expected to reach USD 2.15 billion by 2032, at a CAGR of 4.10% during the forecast period

- The global popping boba/juice balls market is a thriving segment within the beverage industry, characterized by the popularity of the colorful, flavor-filled balls that burst upon consumption. Widely utilized in beverages such as bubble tea, smoothies, and frozen yogurt, these innovative additions enhance both visual appeal and taste

- The market is driven by consumer demand for unique and interactive food experiences, prompting beverage establishments and manufacturers to incorporate popping boba to cater to evolving preferences

What are the Major Takeaways of Popping Boba/Juice Balls Market?

- Manufacturers' relentless pursuit of innovation in flavor offerings captures the attention of a broad customer base seeking novel taste experiences. The availability of exotic and unconventional flavors stimulates consumer curiosity and fosters brand loyalty

- As the market responds to the evolving preferences of consumers for diverse and exciting options, the prominence of varied flavors emerges as a key factor driving sustained growth in the popping boba/juice balls sector

- North America dominated the popping boba/juice balls market with the largest revenue share of 33.36% in 2024, primarily driven by increasing demand for functional beverages, customizable drink options, and low-sugar formulations

- Asia-Pacific is projected to grow at the fastest CAGR of 16.26% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and an expanding middle-class population seeking affordable, customizable drink option

- The Bubble Tea segment dominated the market with the largest revenue share of 44.3% in 2024, primarily due to the global popularity of bubble tea as a trendy and customizable beverage option

Report Scope and Popping Boba/Juice Balls Market Segmentation

|

Attributes |

Popping Boba/Juice Balls Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Popping Boba/Juice Balls Market?

“Personalized Flavors and Health-Oriented Formulations”

- A prominent trend in the global popping boba/juice balls market is the growing consumer preference for custom flavor profiles and health-focused ingredients. Brands are responding with offerings that support dietary needs such as low-calorie, sugar-free, or nutrient-enriched variants

- For instance, Popping Boba brands such as Frozip and Bossen have launched customizable assortments that let customers choose flavor, size, and even juice content, appealing to cafes and home users alike seeking personalized beverage or dessert add-ons

- Functional benefits such as added vitamin C, collagen, or probiotics—are becoming common in new product lines to attract health-conscious consumers. Natural coloring agents and non-GMO ingredients are also trending

- In addition, smart vending systems and self-serve kiosks in cafes now allow real-time customization of Popping Boba toppings based on consumer preferences, increasing both foot traffic and brand loyalty

- Companies such as Bursting Boba® and Tea Zone are actively innovating to align with this trend, offering organic, vegan, and allergen-free variants

- This trend is creating cross-category applications across bubble tea, frozen yogurt, cocktails, and even health-centric beverages, driving both volume and premiumization in the market

What are the Key Drivers of Popping Boba/Juice Balls Market?

- Rising popularity of bubble tea and Asian desserts globally is significantly driving the demand for Popping Boba. These juice-filled balls are now widely used as a topping in beverages, frozen desserts, and creative culinary recipes

- For instance, in February 2024, Chatime and Gong Cha expanded their menu offerings to include new Popping Boba flavors, helping drive broader consumer exposure to the product

- The increased presence of bubble tea chains across North America and Europe has contributed to mainstream consumer acceptance and expanded market reach for Boba-based toppings

- Millennials and Gen Z consumers are drawn to visually appealing and interactive food experiences, fueling the growth of Popping Boba due to its texture, bursting sensation, and colorful aesthetic

- E-commerce platforms have made Popping Boba more accessible for home consumers, DIY drink kits, and small businesses, contributing to market expansion beyond traditional foodservice channels

Which Factor is challenging the Growth of the Popping Boba/Juice Balls Market?

- A significant challenge is the health perception of popping boba as high in sugar, artificial flavoring, and additives, which deters health-conscious consumers from frequent use

- For instance, a 2023 market study by Mintel highlighted that over 40% of Western consumers perceive Boba toppings as unhealthy, limiting adoption in fitness or wellness-driven markets

- The lack of clean-label options and non-transparent ingredient sourcing further exacerbates consumer hesitation, especially among those preferring natural and organic foods

- In addition, short shelf-life and storage challenges (due to the perishable juice content in the balls) create hurdles for retailers and distributors in maintaining inventory freshness

- Competition from nutrient-rich smoothie balls, chia-based toppings, and low-calorie dessert inclusions also threatens market share, especially in health-first food categories

- To overcome these challenges, market players need to invest in cleaner formulations, sustainable packaging, and better consumer education to communicate benefits and usage versatility

How is the Popping Boba/Juice Balls Market Segmented?

The market is segmented on the basis of application and ingredients.

• By Application

On the basis of application, the popping boba/juice balls market is segmented into Bubble Tea, Milkshakes, Smoothies, Frozen Yogurts, Cake Topping, Ice Cream Topping, and Others. The Bubble Tea segment dominated the market with the largest revenue share of 44.3% in 2024, primarily due to the global popularity of bubble tea as a trendy and customizable beverage option. Popping Boba is a key ingredient in bubble tea, offering visual appeal and a unique sensory experience, which boosts repeat purchases across cafes and food outlets. The expansion of bubble tea chains such as Chatime, Gong Cha, and CoCo Fresh Tea & Juice continues to drive strong demand for Popping Boba in this segment.

The Frozen Yogurts segment is expected to witness the fastest CAGR from 2025 to 2032, supported by its growing adoption as a dessert topping that enhances flavor and texture. Rising demand for premium frozen desserts and increasing consumer interest in innovative toppings are fueling segment growth, particularly in North America and East Asia.

• By Ingredients

On the basis of ingredients, the popping boba/juice balls market is segmented into Water, Sugar, Fruit Juice, Calcium Lactate, Seaweed Extract, Malic Acid, Potassium Sorbate, Colouring, and Fruit Flavourings. The Water segment led the market with the highest revenue share of 28.6% in 2024, as it forms the primary base component of Popping Boba. Water is essential in forming the juice-filled core and outer membrane of the boba through the spherification process, making it a key raw material across all product types.

The Fruit Juice segment is projected to record the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for natural and fruit-based ingredients. The inclusion of real fruit juice enhances nutritional value and clean-label appeal, aligning with trends in health-conscious consumption and supporting brand differentiation.

Which Region Holds the Largest Share of the Popping Boba/Juice Balls Market?

- North America dominated the popping boba/juice balls market with the largest revenue share of 33.36% in 2024, primarily driven by increasing demand for functional beverages, customizable drink options, and low-sugar formulations

- Consumers in the region, particularly health-conscious millennials and Gen Z, favor DIY drinks and wellness-enhancing ingredients such as collagen or vitamins, driving product adoption in both homes and foodservice channels

- Strong retail infrastructure, broad e-commerce penetration, and active marketing by major beverage players such as PepsiCo and Coca-Cola continue to reinforce the region's dominance

U.S. Popping Boba/Juice Balls Market Insight

The U.S. held the highest share within North America in 2024 due to the nation's strong affinity for customizable, sugar-free beverages. Increasing focus on at-home beverage mixing, backed by smart dispensers and concentrate pods, is accelerating market expansion. Major brands are enhancing availability through subscription models and warehouse retailers, catering to evolving consumer needs for both health and convenience.

Europe Popping Boba/Juice Balls Market Insight

European market is expected to witness notable CAGR growth during the forecast period, fueled by growing consumer preference for plant-based, organic, and sugar-tax-compliant drinks. Regulatory support for healthier formulations and recyclable packaging is encouraging innovation across beverage formats. Retailers and HoReCa sectors are responding with a wider variety of clean-label concentrate offerings.

U.K. Popping Boba/Juice Balls Market Insight

The U.K. market is projected to grow significantly owing to increasing public health campaigns around obesity and diabetes. Rising demand for low-calorie, vitamin-enriched, fruit-based drinks is creating fertile ground for concentrate expansion. Consumers are adopting smart beverage systems and compact concentrate solutions that offer both personalization and convenience in home settings.

Germany Popping Boba/Juice Balls Market Insight

Germany’s market is growing steadily due to rising interest in eco-conscious and health-centric beverage solutions. Consumers in the country are gravitating toward organic-certified and natural ingredient-based concentrates. German brands are increasingly focused on minimal processing, sustainability, and innovative flavor profiles, strengthening their appeal among premium buyers.

Which Region is the Fastest Growing in the Popping Boba/Juice Balls Market?

Asia-Pacific is projected to grow at the fastest CAGR of 16.26% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and an expanding middle-class population seeking affordable, customizable drink options. The region is witnessing a boom in convenience stores, cafés, and e-commerce, making Popping Boba/Juice Balls easily accessible. Increased health awareness and the popularity of bubble tea culture are major growth accelerators.

Japan Popping Boba/Juice Balls Market Insight

Japanese market is expanding due to high demand for compact, functional beverages suited to busy lifestyles. Consumers are embracing personalized nutrition through beverage mixes tailored to aging populations, with added benefits such as collagen, probiotics, or vitamins, supported by innovations in smart kitchen appliances and QR-enabled dispensers.

China Popping Boba/Juice Balls Market Insight

China accounted for the largest share in Asia-Pacific in 2024, fueled by a vast population, fast-growing health trends, and the rise of fruit-based and sugar-free beverages. Local players are innovating with herbal infusions and regional flavors, while global brands are expanding premium offerings to capture the attention of urban, health-aware consumers, especially Gen Z.

Which are the Top Companies in Popping Boba/Juice Balls Market?

The popping boba/juice balls industry is primarily led by well-established companies, including:

- Tachiz Group (Taiwan)

- PT. Formosa Ingredient Factory Tbk. (Indonesia)

- Nam Viet F&B (Vietnam)

- Italian Beverage Company (U.K.)

- Brilsta (Singapore)

- Sunnysyrup Food Co., Ltd. (Taiwan)

- Possmei (Taiwan)

- Golden Choice Marketing Sdn Bhd (Malaysia)

- Bossen (U.S.)

- Boba Box Limited (U.K.)

- Hangzhou Boduo Industrial Trade Co., Ltd. (China)

- TING JEAN FOODS INDUSTRY INC (Taiwan)

- Hesheng Food Resources Co., Ltd. (China)

- Hainan Boyi Biotechnology Development Co., Ltd. (China)

- CHEN EN FOOD PRODUCT ENTERPRISE CO., LTD. (Taiwan)

- Shanghai Lecocq Industry Co., Ltd. (China)

What are the Recent Developments in Global Popping Boba/Juice Balls Market?

- In May 2024, Starbucks unveiled its plan to roll out a distinctive version of boba at its outlets for the upcoming summer, signaling the start of a broader initiative focused on texture-driven beverage innovations to elevate customer experiences

- In April 2024, Twrl Milk Tea, a U.S.-based plant-based beverage brand, introduced its new single-serve, dye-free popping boba toppings in honey, lychee, and strawberry flavors, expanding its product lineup to meet the rising demand for plant-based offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL POPPING BOBA/JUICE BALLS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL POPPING BOBA/JUICE BALLS MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL POPPING BOBA/JUICE BALLS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.6 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 BRAND OUTLOOK

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW

10 GLOBAL POPPING BOBA/JUICE BALLS MARKET, BY BOBA BALL FLAVORS, 2022-2031, (USD MILLION)

10.1 OVERVIEW

10.2 MANGO

10.3 LYCHEE

10.4 STRAWBEERY

10.5 PASSION FRUIT

10.6 GREEN TEA

10.7 MELON

10.8 POMEGRANATE

10.9 BLUEBERRY

10.1 KIWI

10.11 CHERRY

10.12 GRAPE

10.13 RASPBERRY

10.14 CHOCOLATE

10.15 COFFEE

10.16 CANTALOUPE

10.17 OTHERS

11 GLOBAL POPPING BOBA/JUICE BALLS MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

11.1 OVERVIEW

11.2 BUBBLE TEA

11.2.1 BUBBLE TEA, BY FLAVORS

11.2.1.1. MANGO

11.2.1.2. LYCHEE

11.2.1.3. STRAWBEERY

11.2.1.4. PASSION FRUIT

11.2.1.5. GREEN TEA

11.2.1.6. MELO

11.2.1.7. POMEGRANATE

11.2.1.8. BLUEBERRY

11.2.1.9. KIWI

11.2.1.10. CHERRY

11.2.1.11. GRAPE

11.2.1.12. RASPBERRY

11.2.1.13. CHOCOLATE

11.2.1.14. COFFEE

11.2.1.15. CANTALOUPE

11.2.1.16. OTHERS

11.3 MILKSHAKES

11.3.1 MILKSHAKES, BY FLAVORS

11.3.1.1. MANGO

11.3.1.2. LYCHEE

11.3.1.3. STRAWBEERY

11.3.1.4. PASSION FRUIT

11.3.1.5. GREEN TEA

11.3.1.6. MELO

11.3.1.7. POMEGRANATE

11.3.1.8. BLUEBERRY

11.3.1.9. KIWI

11.3.1.10. CHERRY

11.3.1.11. GRAPE

11.3.1.12. RASPBERRY

11.3.1.13. CHOCOLATE

11.3.1.14. COFFEE

11.3.1.15. CANTALOUPE

11.4 SMOOTHIES

11.4.1 SMOOTHIES, BY FLAVORS

11.4.1.1. MANGO

11.4.1.2. LYCHEE

11.4.1.3. STRAWBEERY

11.4.1.4. PASSION FRUIT

11.4.1.5. GREEN TEA

11.4.1.6. MELO

11.4.1.7. POMEGRANATE

11.4.1.8. BLUEBERRY

11.4.1.9. KIWI

11.4.1.10. CHERRY

11.4.1.11. GRAPE

11.4.1.12. RASPBERRY

11.4.1.13. CHOCOLATE

11.4.1.14. COFFEE

11.4.1.15. CANTALOUPE

11.5 FROZEN YOGURTS

11.5.1 FROZEN YOGURTS, BY FLAVORS

11.5.1.1. MANGO

11.5.1.2. LYCHEE

11.5.1.3. STRAWBEERY

11.5.1.4. PASSION FRUIT

11.5.1.5. GREEN TEA

11.5.1.6. MELO

11.5.1.7. POMEGRANATE

11.5.1.8. BLUEBERRY

11.5.1.9. KIWI

11.5.1.10. CHERRY

11.5.1.11. GRAPE

11.5.1.12. RASPBERRY

11.5.1.13. CHOCOLATE

11.5.1.14. COFFEE

11.5.1.15. CANTALOUPE

11.6 CAKE TOPPING

11.6.1 CAKE TOPPING, BY FLAVORS

11.6.1.1. MANGO

11.6.1.2. LYCHEE

11.6.1.3. STRAWBEERY

11.6.1.4. PASSION FRUIT

11.6.1.5. GREEN TEA

11.6.1.6. MELO

11.6.1.7. POMEGRANATE

11.6.1.8. BLUEBERRY

11.6.1.9. KIWI

11.6.1.10. CHERRY

11.6.1.11. GRAPE

11.6.1.12. RASPBERRY

11.6.1.13. CHOCOLATE

11.6.1.14. COFFEE

11.6.1.15. CANTALOUPE

11.7 ICE CREAM TOPPING

11.7.1 ICE CREAM TOPPING, BY FLAVORS

11.7.1.1. MANGO

11.7.1.2. LYCHEE

11.7.1.3. STRAWBEERY

11.7.1.4. PASSION FRUIT

11.7.1.5. GREEN TEA

11.7.1.6. MELO

11.7.1.7. POMEGRANATE

11.7.1.8. BLUEBERRY

11.7.1.9. KIWI

11.7.1.10. CHERRY

11.7.1.11. GRAPE

11.7.1.12. RASPBERRY

11.7.1.13. CHOCOLATE

11.7.1.14. COFFEE

11.7.1.15. CANTALOUPE

11.8 OTHERS

12 GLOBAL POPPING BOBA/JUICE BALLS MARKET, BY KEY INGREDIENT, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 SEAWEED EXTRACT

12.3 TAPIOCA STARCH

12.4 OTHERS

13 GLOBAL POPPING BOBA/JUICE BALLS MARKET, BY DISTRIBUTION CHANNEL , 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

13.3.1 ONLINE

13.3.2 OFFLINE

14 GLOBAL POPPING BOBA/JUICE BALLS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS & PARTNERSHIP

14.8 REGULATORY CHANGES

15 GLOBAL POPPING BOBA/JUICE BALLS MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 U.K.

15.2.3 ITALY

15.2.4 FRANCE

15.2.5 SPAIN

15.2.6 SWITZERLAND

15.2.7 NETHERLANDS

15.2.8 BELGIUM

15.2.9 RUSSIA

15.2.10 TURKEY

15.2.11 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 AUSTRALIA

15.3.6 SINGAPORE

15.3.7 THAILAND

15.3.8 INDONESIA

15.3.9 MALAYSIA

15.3.10 PHILIPPINES

15.3.11 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 UAE

15.5.3 SAUDI ARABIA

15.5.4 KUWAIT

15.5.5 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL POPPING BOBA/JUICE BALLS MARKET, SWOT & DBMR ANALYSIS

17 GLOBAL POPPING BOBA/JUICE BALLS MARKET, COMPANY PROFILES

17.1 KRISHNA FOOD INDIA COMPANY LTD

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 CRAVINGZ FOOD PRIVATE LIMITED

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 BOBA BOX LIMITED

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATES

17.4 LEADWAY INTERNATIONAL INC.

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 HANGZHOU BODUO INDUSTRIAL TRADE CO., LTD

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 TING JEAN FOODS INDUSTRY CO., LTD.

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT UPDATES

17.7 HESHENG FOOD RESOURCES CO.,LTD,

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT UPDATES

17.8 SUNNYSYRUP FOOD CO, LTD.

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT UPDATES

17.9 HAINAN BOYI BIOTECHNOLOGY DEVELOPMENT CO., LTD.

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT UPDATES

17.1 CHEN EN FOOD PRODUCT ENTERPRISE CO., LTD.

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT UPDATES

17.11 SHANGHAILECOCQINDUSTRYCO.,LTD.,

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT UPDATES

17.12 XI’AN GAOYUAN BIO-CHEM CO., LTD.

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

17.13 POSSMEI INTERNATIONAL CO., LTD.

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT UPDATES

17.14 NORDIC BOBA

17.14.1 COMPANY OVERVIEW

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 CONCLUSION

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Popping Boba Juice Balls Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Popping Boba Juice Balls Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Popping Boba Juice Balls Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.