Global Polypropylene Packaging Film Market

Market Size in USD Billion

CAGR :

%

USD

32.61 Billion

USD

53.73 Billion

2024

2032

USD

32.61 Billion

USD

53.73 Billion

2024

2032

| 2025 –2032 | |

| USD 32.61 Billion | |

| USD 53.73 Billion | |

|

|

|

|

Polypropylene Packaging Films Market Analysis

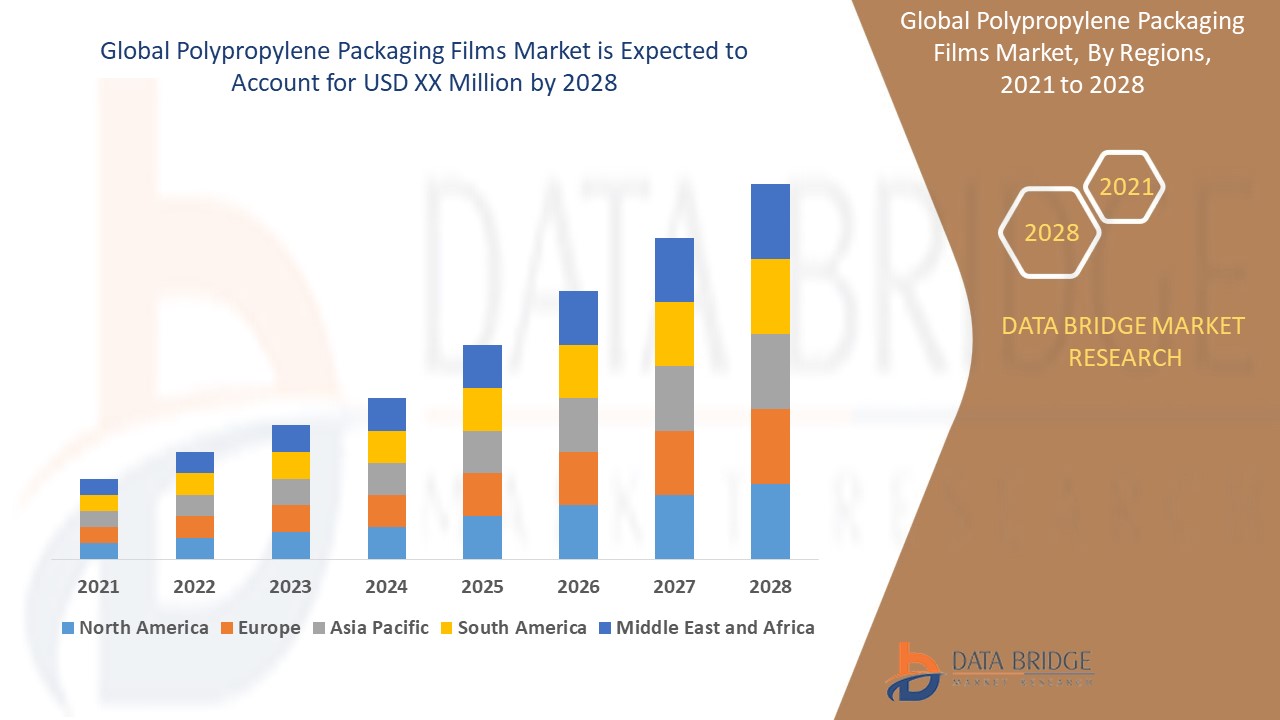

The polypropylene packaging films market is experiencing steady growth, driven by advancements in material science and rising demand for flexible packaging solutions. Polypropylene (PP) films, including biaxially-oriented polypropylene (BOPP) and cast polypropylene (CPP), have gained popularity due to their excellent clarity, strength, and moisture resistance. These films are widely used across industries such as food and beverages, pharmaceuticals, personal care, and electronics, where durability and product safety are paramount. Recent advancements in production techniques have enhanced the barrier properties and recyclability of PP films, addressing sustainability concerns. For instance, high-barrier films with advanced coatings now provide extended shelf life for perishable goods, reducing food waste. In addition, innovative formulations, such as fully recyclable mono-material films, align with global environmental mandates and cater to eco-conscious consumers. The market's growth is fueled by increasing urbanization, rising disposable incomes, and consumer preference for lightweight, easy-to-carry packaging. Asia-Pacific, with its robust manufacturing sector and growing population, is emerging as a dominant region. North America and Europe also exhibit significant demand due to technological innovations and regulatory initiatives promoting sustainable packaging. As the industry continues to evolve, integrating automation in production processes and fostering collaborations between manufacturers and end-users will remain pivotal for market expansion.

Polypropylene Packaging Films Market Size

The polypropylene packaging films market size was valued at USD 32.61 billion in 2024 and is projected to reach USD 53.73 billion by 2032, with a CAGR of 6.44% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Polypropylene Packaging Films Market Trends

“Increasing Shift towards Sustainable and Eco-Friendly Solutions”

A significant trend in the polypropylene packaging films market is the shift towards sustainable and eco-friendly solutions, driven by rising consumer awareness and stricter environmental regulations. Brands are increasingly adopting recyclable and biodegradable polypropylene (PP) films to meet the demand for sustainable packaging. For instance, companies are developing mono-material packaging that enhances recyclability and reduces environmental impact. Innovations in barrier technology have also allowed for the creation of high-performance films that maintain product freshness while being more eco-conscious. Biaxially-oriented polypropylene (BOPP) films, known for their strength and clarity, are now being produced with coatings that make them recyclable and improve their ability to extend food shelf life. This trend is further supported by initiatives such as the European Union's push for packaging waste reduction and the global push towards a circular economy. As eco-friendly materials become a market standard, companies that prioritize sustainability will be well-positioned for growth in this evolving sector.

Report Scope and Polypropylene Packaging Films Segmentation

|

Attributes |

Polypropylene Packaging Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Polyplex (India), UFlex Limited (India), 3B Films Limited (U.K.), Taghleef Industries (U.A.E.), Schur International Holding a/s (Denmark), Oben Group (Peru), Thai Film Industries Public Company Limited (Thailand), PT. Bhineka Tatamulya Industri (Indonesia), Jindal Poly Films Ltd. (India), Profol GmbH (Germany), PT Panverta Cakrakencana (Indonesia), MITSUI CHEMICALS AMERICA, INC. (U.S.), Polibak (Turkey), Copol International Ltd. (Canada), TriPack Films Limited (Pakistan), and LC Packaging (Netherlands) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polypropylene Packaging Films Market Definition

Polypropylene packaging films are thin, flexible sheets made from polypropylene (PP), a type of thermoplastic polymer. These films are commonly used in packaging applications due to their durability, clarity, and resistance to moisture, chemicals, and heat. BOPP films are known for their high strength, transparency, and excellent printability, making them ideal for food packaging, labels, and wraps.

Polypropylene Packaging Films Market Dynamics

Drivers

- Rising Demand for Flexible Packaging

The rising demand for flexible packaging is a significant driver for the polypropylene packaging films market, as consumers and manufacturers increasingly seek lightweight, cost-effective, and eco-friendly solutions. Polypropylene films are highly versatile, making them ideal for packaging a range of products, including food items such as snacks and frozen goods, as well as personal care products such as shampoos and skincare items. For instance, in the food industry, the flexibility and durability of polypropylene films help maintain product freshness and extend shelf life, which is crucial for retailers and consumers who value convenience and quality. The demand for sustainable packaging has further pushed this trend, as polypropylene is recyclable and offers an eco-friendly alternative compared to non-recyclable materials. This shift towards flexible, adaptable, and environmentally conscious packaging solutions has propelled the growth of the polypropylene packaging films market, making it a major contributor to the packaging industry's evolution.

- Growing Food and Beverage Industry

The growth in the food and beverage industry has significantly driven the adoption of polypropylene packaging films, as these materials offer safe, hygienic, and durable solutions essential for packaging perishable items. With the expanding global food sector, there is a growing need for packaging that can extend shelf life and preserve product quality, which is where polypropylene films excel. For instance, in the packaged food industry, polypropylene films are used for items such as ready-to-eat meals, snacks, and frozen foods, ensuring that these products remain fresh and maintain their intended taste and texture. This type of packaging meets consumer expectations for convenience, allowing for easy handling and extended storage without compromising safety. In addition, the durability of polypropylene films helps prevent contamination and preserves the integrity of products during transportation and storage. As consumer demand for high-quality and long-lasting food products continues to rise, the adoption of polypropylene packaging films is expected to grow, solidifying its role as a key market driver in the food and beverage sector.

Opportunities

- Rising Technological Advancements in Film Production

Technological advancements in film production, such as biaxial orientation and co-extrusion techniques, have significantly enhanced the properties of polypropylene packaging films, making them more robust, transparent, and heat-resistant. These innovations have broadened the application range of polypropylene films, attracting industries looking for high-performance, reliable packaging solutions. For instance, the food packaging sector benefits from these improvements as they allow for the creation of films that can withstand higher temperatures without deforming, ensuring that products such as microwaveable meals and hot beverage containers maintain their integrity during use. In addition, the increased transparency of modern polypropylene films provides better visibility for consumers, which is particularly valuable in packaging fresh produce, deli items, and ready-to-eat meals. These advancements have also fueled the use of polypropylene films in non-food sectors, including pharmaceuticals and personal care products, where secure and durable packaging is crucial. As these technologies continue to evolve, they present significant market opportunities by catering to industries demanding superior packaging solutions.

- Increasing Urbanization and Changing Lifestyles

Urbanization and changing lifestyles have driven a surge in the need for packaging solutions that cater to fast-paced, on-the-go living. The rise of busy city environments has led to higher demand for convenient, ready-to-eat, and single-serve products that fit consumers’ schedules. Polypropylene films, known for their lightweight, durability, and flexibility, are ideally suited for this purpose. For instance, single-serve snack packs, instant noodle containers, and portable beverage bottles all benefit from polypropylene’s resistance to moisture, heat, and chemicals, ensuring product freshness and convenience for consumers. This adaptability has led to increased adoption of polypropylene films in foodservice, retail, and quick-service restaurant packaging. The trend toward urbanization, paired with consumers' desire for convenience and practicality, creates significant market opportunities for manufacturers that produce innovative, high-quality polypropylene packaging solutions that align with modern lifestyles.

Restraints/Challenges

- Environmental Concerns and Recycling Issues

Environmental concerns and recycling issues are major challenges in the polypropylene (PP) packaging films market, impacting both consumer perception and regulatory compliance. Polypropylene, while versatile and cost-effective, is not biodegradable, contributing to the growing problem of plastic pollution. For instance, discarded PP packaging can take hundreds of years to break down, accumulating in landfills and contributing to environmental hazards. In addition, recycling polypropylene is complex; it requires specialized facilities and processes that are not as widespread as those for other plastics such as polyethylene terephthalate (PET). The limited recycling infrastructure means that a significant amount of PP packaging ends up in the waste stream rather than being recycled into new products, exacerbating environmental pollution. This challenge has led to increased pressure on the PP industry to adopt more sustainable practices, such as incorporating recycled content or developing biodegradable alternatives. Companies that do not address these issues may face regulatory penalties or damage to their reputation, affecting market growth and consumer trust.

- Regulatory Pressures and Compliance

Regulatory pressures and compliance are significant challenges in the polypropylene (PP) packaging films market, driven by the increasing push for more sustainable and environmentally friendly practices. Many countries are implementing stringent regulations to curb plastic waste, including bans on single-use plastics and mandates for recyclable packaging. For instance, the European Union's Single-Use Plastics Directive has targeted certain plastic products, pushing for a shift towards alternatives and more sustainable materials. Such regulations force manufacturers to adapt their production processes, invest in research and development for recyclable or biodegradable solutions, and meet higher environmental standards. Compliance with these rules can be costly, requiring modifications in manufacturing processes and changes to supply chains. For smaller producers, these expenses can be especially burdensome, potentially limiting their ability to compete with larger companies that have the resources to meet these standards. This regulatory landscape challenges the entire PP packaging industry to innovate and maintain profitability while meeting evolving environmental requirements.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Polypropylene Packaging Films Market Scope

The market is segmented on the basis of product type, file format, thickness, application, and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Biaxially-Oriented Polypropylene (BOPP)

- Cast Polypropylene (CPP)

Film Format

- Clear Films

- Coated Films

- Matte Films

- White Films

- Metallized Films

Thickness

- Up to 18 micron

- 18 to 50 micron

- 51 to 80 micron

- Above 80 micron

Application

- Bags and Pouches

- Lamination

- Tapes

- Labels

- Wraps

- Others

End Use

- Food and Beverages

- Personal Care and Cosmetics

- Electric and Electronics

- Industrial

- Pharmaceuticals and Medical

- Tobacco

- Others

Polypropylene Packaging Films Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, file format, thickness, application, and end use as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa

Asia-Pacific has the highest growth rate during the forecast period. This growth can be attributed to the abundant availability of raw materials, rapid urbanization, and the region's expanding population. In addition, the growing demand for ready-to-eat and portable food products, coupled with rising personal disposable income, serves as a key driver for market expansion. These factors collectively create a favorable environment for sustained growth in the Asia-Pacific market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Polypropylene Packaging Films Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Polypropylene Packaging Films Market Leaders Operating in the Market Are:

- Polyplex (India)

- UFlex Limited (India)

- 3B Films Limited (U.K.)

- Taghleef Industries (U.A.E.)

- Schur International Holding a/s (Denmark)

- Oben Group (Peru)

- Thai Film Industries Public Company Limited (Thailand)

- PT. Bhineka Tatamulya Industri (Indonesia)

- Jindal Poly Films Ltd. (India)

- Profol GmbH (Germany)

- PT Panverta Cakrakencana (Indonesia)

- MITSUI CHEMICALS AMERICA, INC. (U.S.)

- Polibak (Turkey)

- Copol International Ltd. (Canada)

- TriPack Films Limited (Pakistan)

- LC Packaging (Netherlands)

Latest Developments in Polypropylene Packaging Films Market

- In May 2024, Plastchim-T completed the acquisition of Manucor SpA, significantly expanding its BOPP production capacity to 200,000 tons annually and enhancing its expertise in flexible packaging. This acquisition also strengthens transportation and delivery networks across Europe

- In April 2024, Inteplast BOPP Films partnered with VerdaFresh to create a high-barrier flexible film designed to extend food shelf life and reduce packaging waste. This collaboration merges Inteplast's advanced moisture barrier films with VerdaFresh's cutting-edge coating technology to ensure superior oxygen protection and sustainability

- In March 2024, Inteplast Group, a leading plastics manufacturer, obtained ISCC PLUS certification for its three BOPP film facilities in Gray Court, South Carolina, Lolita, Texas, and Morristown, Tennessee. This achievement positions Inteplast as one of the first North American producers of BOPP films with ISCC PLUS verification

- In December 2023, Cosmo Films introduced metalized electrical-grade BOPP films for capacitor applications. These films, produced in a clean-room environment with thicknesses from 2.5 to 12 microns, cater to AC and DC capacitors used in electronics, industrial systems, power electronics, and the automotive sector

- In March 2022, Innovia launched Propacast KF, a new cast polypropylene film designed for lamination in HFFS, VFFS, and lidding applications. This film is fully recyclable and offers a wide heat-seal range

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polypropylene Packaging Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polypropylene Packaging Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polypropylene Packaging Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.