Polypropylene Compounds Market Analysis and Size

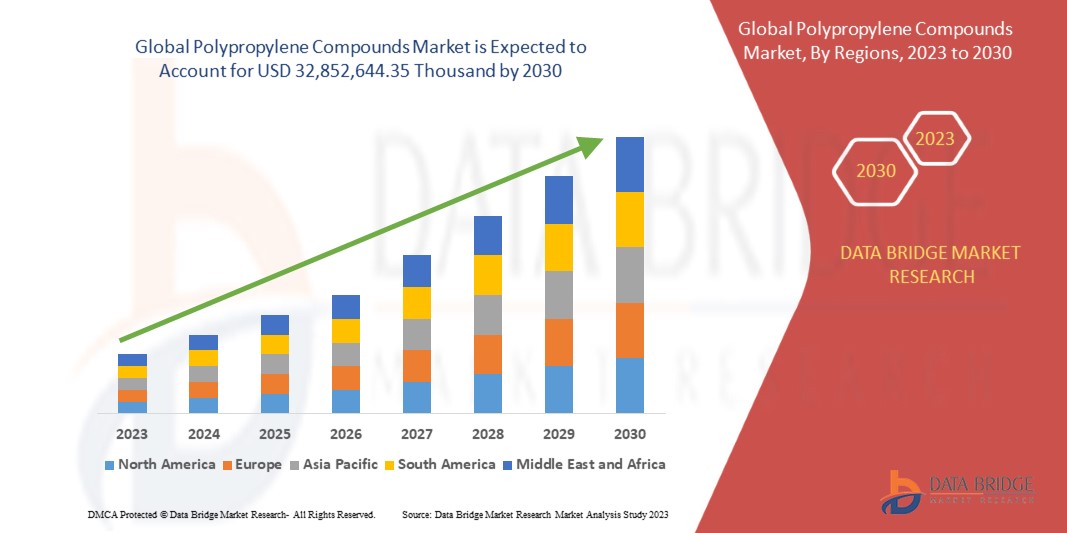

The global polypropylene compounds market is expected to grow significantly in the forecast period of 2023 to 2030. Data bridge market research analyses that the market is growing with a CAGR of 4.6% in the forecast period of 2023 to 2030 and is expected to reach USD 32,852,644.35 thousand by 2030. The major factor driving the growth of the global polypropylene market is the growing demand from end-use industries.

The increasing demand for polypropylene compounds in various end-use industries is a key driver for the market's growth. Polypropylene compounds are highly versatile materials that offer a combination of desirable properties, including high strength, low weight, chemical resistance, and cost-effectiveness. These properties make them suitable for a wide range of applications across different sectors, driving their adoption in industries such as automotive, packaging, construction, and electronics.

The global polypropylene compounds market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Product (Mineral Filled Polypropylene, Compound TPOs/TPVs, Additive Concentrates, Glass Reinforced, and Others), Polymer Type (Homopolymers and Copolymers), Application (Fiber, Film & Sheet, Raffia, and Others), End Use (Automotive, Packaging, Building and Construction, Electrical and Electronics, Consumer Goods, Medical, Textile, and Others |

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, Sweden, Denmark, Norway, Finland, Rest of Europe, China, India, Japan, South Korea, Australia, New Zealand, Malaysia, Singapore, Thailand, Taiwan, Indonesia, Philippines, Hong Kong, Rest of Asia- Pacific, Brazil, Argentina, Rest of South America, South Africa, United Arab Emirate, Saudi Arabia, Kuwait, Egypt, Israel, Oman Qatar, Bahrain Rest of Middle East and Africa |

|

Market Players Covered |

Mitsui Chemicals, Inc., Exxon Mobil Corporation, SABIC, Borealis AG, Braskem, China Petrochemical Corporation (SINOPEC), Celanese Corporation, BASF SE, Formosa Plastics Group, LyondellBasell Industries Holdings B.V., Avient Corporation, Reliance Industries Limited, Sasol, SCG Chemicals Public Company Limited, Trinseo, TotalEnergies, GS GLOBAL CORP, LG Chem, Repsol, and INEOS, among others |

Market Definition

Polypropylene compounds (PP) are thermoplastic resins made from a combination of one or more basic polyolefins and additional components such as impact modifiers, fillers, and strengtheners (for instance mineral fillers and glass fiber), colors, and additives. These polypropylene compounds have several advantages and are utilized in a wide range of industries, including automotive, packaging, textiles, consumer products, and others. PP compound is a thermoplastic that is robust, stiff, and crystalline. Propene monomer is used to make it.

Global Polypropylene Compounds Market Dynamics

Drivers

- Growing Demand from End-Use Industries

The increasing demand for polypropylene compounds in various end-use industries is a key driver for the market's growth. Polypropylene compounds are highly versatile materials that offer a combination of desirable properties, including high strength, low weight, chemical resistance, and cost-effectiveness.

In the automotive industry, manufacturers are increasingly incorporating polypropylene compounds in the production of various components due to their lightweight nature. The automotive sector is focusing on sustainability and fuel efficiency, leading to a growing demand for lightweight materials that can help reduce vehicle weight and improve fuel economy. Polypropylene compounds, with their ability to meet performance requirements while being lighter than traditional materials, are well-suited for this purpose.

- Advancements In Material Technology

Technological advancements in material formulation and processing techniques have been instrumental in the development of high-performance polypropylene compounds. These innovations have allowed manufacturers to tailor the properties of polypropylene compounds to meet specific industry needs and requirements.

Research and development efforts in the field of polypropylene compounds have resulted in the creation of new and improved formulations. These advanced compounds cater to niche markets and high-value applications, expanding the market's potential and attracting new customers. For example, the demand for polypropylene compounds with enhanced mechanical strength and chemical resistance is rising in industries such as automotive and electronics.

- Rising As Substitutes for Traditional Materials

Polypropylene compounds are increasingly being used as substitutes for traditional materials such as metals, glass, and other plastics in various applications. The shift towards lightweight materials in industries such as automotive, aerospace, and consumer goods is driven by the need to improve fuel efficiency, reduce emissions, and enhance overall performance.

In the automotive industry, the replacement of metal parts with polypropylene compounds has become more common due to their lower weight and comparable strength. Lighter components contribute to reduced fuel consumption and lower emissions, aligning with the industry's efforts toward sustainability.

In conclusion, the versatile properties of polypropylene compounds, along with continuous technological advancements, make them increasingly attractive to various industries seeking lightweight, durable, and cost-effective solutions. As demand continues to rise and innovation drives the development of high-performance variants, polypropylene compounds are expected to play an even more significant role in shaping the future of materials used in diverse applications and promoting sustainability in various sectors. The rising usage of polypropylene compounds as a substitute is expected to drive market growth

OPPORTUNITIES

- Rising Demand for Eco-Friendly and Sustainable Materials

The increasing demand for eco-friendly and sustainable materials has become a prominent driver for innovation and product development across industries. As environmental concerns grow, consumers, businesses, and governments are showing a greater preference for products with reduced environmental impact. In response to this demand, the development and commercialization of sustainable and bio-based polypropylene compounds present significant opportunities for the market.

Bio-based polypropylene compounds are derived from renewable resources, such as plant-based feedstocks. Unlike conventional polypropylene, which relies on fossil fuel-derived propylene, bio-based polypropylene is manufactured using renewable biomass sources. By replacing a portion of petroleum-based feedstocks with renewable alternatives, bio-based polypropylene can significantly reduce the carbon footprint and dependency on finite fossil resources.

- Expanding Industrial Sectors

The expansion of industrial sectors in developing economies presents exciting growth opportunities for the global polypropylene compounds market. As these economies experience rapid urbanization and industrialization, the demand for advanced materials, including polypropylene compounds, is on the rise.

In developing countries, the construction industry is a major consumer of polypropylene compounds due to the ongoing infrastructure development and urban expansion. The demand for high-quality pipes, fittings, and insulation materials has grown significantly, providing ample opportunities for market players to cater to these emerging markets.

In agriculture, polypropylene compounds are being employed in innovative ways. They are used in applications such as greenhouse films, crop protection materials, and irrigation systems. As the agricultural sector seeks more efficient and sustainable solutions to address food security challenges, the demand for advanced materials such as polypropylene compounds are expected to grow, which is expected to create opportunities for market growth.

Restraints/Challenges

- Volatility In Raw Material Prices

The cost of polypropylene compounds is heavily influenced by the prices of raw materials, particularly the propylene monomer. Propylene is a key feedstock for polypropylene production, and its availability and pricing can significantly impact the overall production cost of polypropylene compounds.

Fluctuations in raw material prices can result from various factors, including changes in global supply and demand dynamics, geopolitical tensions, natural disasters affecting production facilities, and currency fluctuations. Such price volatility poses challenges to manufacturers and end-users, as it affects cost structures, inventory management, and profit margins.

In conclusion, Price fluctuations, and raw material availability, can impact the availability of replacements. Price changes or disruptions in the supply of substitute products might impact polypropylene demand and hinder its market expansion.

- Competitive Material Market

Polypropylene compounds face competition from a wide range of engineering plastics and advanced materials that offer similar or even enhanced properties. As industries seek materials with specific performance characteristics, manufacturers of polypropylene compounds must continuously innovate and improve their products to remain competitive in the market.

One of the main competitors to polypropylene compounds is polyethylene (PE), another popular thermoplastic polymer. While polypropylene compounds offer better mechanical strength, polyethylene is known for its superior impact resistance and flexibility. Depending on the application, end-users may opt for polyethylene instead of polypropylene compounds.

Furthermore, manufacturers can leverage the versatility of polypropylene compounds to develop custom formulations that cater to niche applications. By collaborating closely with customers and understanding their specific needs, manufacturers can create tailor-made solutions, strengthening their competitive position in the market, which is expected to pose a challenge to market growth.

Recent Development

- In May 2023, LyondellBasell announced that Alujain National Industrial Company (Alujain) has chosen LyondellBasell polypropylene process technology for a new Spherizone process technology line. National Petrochemical Industrial Co. (NatPet), which operates a Spheripol process technology line, is owned by Alujain. This technological leadership is a critical facilitator of growth.

- In June 2023, Borealis agreed to acquire Rialti, one of Europe's top manufacturers of mechanically recovered polypropylene (PP) compounds for injection molding and extrusion. The project will expand Borealis' circular range by adding 50,000 tons of recycled compounding capacity and satisfying rising customer demand for environmentally friendly solutions.

Global Polypropylene Compounds Market Scope

The global polypropylene compounds market is categorized based on product, polymer type, application, and end use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Mineral Filled Polypropylene

- Compound TPOS/TPVS

- Additive Concentrates

- Glass Reinforced

- Others

On the basis of product, the market is segmented into mineral filled polypropylene, compound tpos/tpvs, additive concentrates glass reinforced, and others.

Polymer Type

- Homopolymers

- Copolymers

On the basis of polymer type, the market is segmented into homopolymers and copolymers.

Application

- Fiber

- Film & Sheet

- Raffia

- Others

On the basis of application, the market is segmented into fiber, film & sheet, raffia, and others.

End Use

- Automotive

- Packaging

- Building and Construction

- Electrical and Electronics

- Consumer Goods

- Medical

- Textile

- Others

On the basis of end-user, the market is segmented into automotive, packaging, building and construction, electrical and electronics, consumer goods, medical, textile, and others.

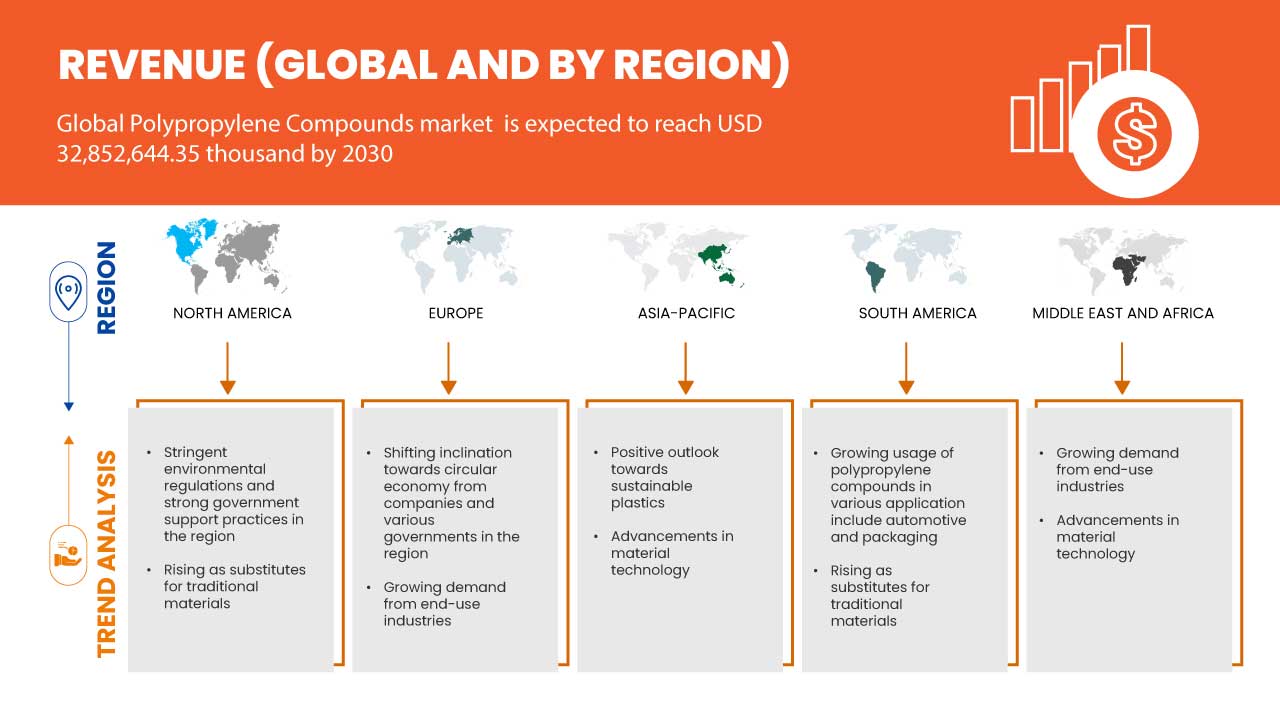

Global Polypropylene Compounds Market Regional Analysis/Insights

The global polypropylene compounds market is segmented on the basis of product, polymer type, application, and end use.

The countries in the global polypropylene compounds market are U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, Sweden, Denmark, Norway, Finland, Rest of Europe, China, India, Japan, South Korea, Australia, New Zealand, Malaysia, Singapore, Thailand, Taiwan, Indonesia, Philippines, Hong Kong, Rest of Asia- Pacific, Brazil, Argentina, Rest of South America, South Africa, United Arab Emirate, Saudi Arabia, Kuwait, Egypt, Israel, Oman Qatar, Bahrain Rest of Middle East and Africa.

China is dominating in Asia-Pacific polypropylene compounds market in terms of market share and market revenue due to growing demand from end-use industries in this region. Growing demand from end-use Industries also contributes to market growth.

Germany is dominating countries in Europe polypropylene compounds market due to rising demand in automotive, packaging, and electronics sectors. U.S is dominating in North America due to expanding industrial sectors.The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Polypropylene Compounds Market Share Analysis

The global polypropylene compounds Market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, products trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the global polypropylene compounds market.

Some of the prominent participants operating in the global polypropylene compounds market are Mitsui Chemicals, Inc., Exxon Mobil Corporation, SABIC, Borealis AG, Braskem, China Petrochemical Corporation (SINOPEC), Celanese Corporation, BASF SE, Formosa Plastics Group, LyondellBasell Industries Holdings B.V., Avient Corporation, Reliance Industries Limited, Sasol, SCG Chemicals Public Company Limited, Trinseo, TotalEnergies, GS GLOBAL CORP, LG Chem, Repsol, and INEOS, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 IMPORT-EXPORT SCENARIO

4.4 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATION

4.7 PRICING ANALYSIS

4.8 RAW MATERIAL COVERAGE

4.8.1 PROPYLENE

4.8.2 ADDITIVES

4.8.3 FILLERS

4.8.4 LUBRICANTS

4.8.5 FLAME RETARDANTS

4.8.6 ANTISTATIC AGENTS

4.9 SUPPLY CHAIN OF THE GLOBAL POLYPROPYLENE COMPOUNDS MARKET

4.9.1 OVERVIEW:

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS:

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FROM END-USE INDUSTRIES

6.1.2 ADVANCEMENTS IN MATERIAL TECHNOLOGY

6.1.3 RISING AS SUBSTITUTES FOR TRADITIONAL MATERIALS

6.2 RESTRAINTS

6.2.1 VOLATILITY IN RAW MATERIAL PRICES

6.2.2 ENVIRONMENTAL CONCERNS AND REGULATIONS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR ECO-FRIENDLY AND SUSTAINABLE MATERIALS

6.3.2 EXPANDING INDUSTRIAL SECTORS

6.4 CHALLENGES

6.4.1 COMPETITIVE MATERIAL MARKET

6.4.2 RECYCLING CHALLENGES

7 GLOBAL POLYPROPYLENE COMPOUNDS MARKET BY GEOGRAPHY

7.1 OVERVIEW

7.2 NORTH AMERICA

7.3 EUROPE

7.4 ASIA-PACIFIC

7.5 SOUTH AMERICA

7.6 MIDDLE EAST & AFRICA

8 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: GLOBAL

8.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

8.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

8.4 COMPANY SHARE ANALYSIS: EUROPE

8.5 PRODUCT LAUNCH

8.6 INVESTMENT

8.7 AWARD

8.8 EXPANSION

8.9 NEW FACILITY

8.1 COLLABORATION

8.11 ACQUISITION

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COPANY SHARE ANALYSIS

10.1.4 PRODUCT PORTFOLIO

10.1.5 RECENT DEVELOPMENT

10.2 SABIC

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COPANY SHARE ANALYSIS

10.2.4 PRODUCT PORTFOLIO

10.2.5 RECENT DEVELOPMENT

10.3 BOREALIS AG

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENT

10.4 TOTALENERGIES

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 COPANY SHARE ANALYSIS

10.4.4 PRODUCT PORTFOLIO

10.4.5 RECENT DEVELOPMENT

10.5 EXXON MOBIL CORPORATION

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COPANY SHARE ANALYSIS

10.5.4 PRODUCT PORTFOLIO

10.5.5 RECENT DEVELOPMENT

10.6 AVIENT CORPORATION

10.6.1 COMPANY SNAPSHOT

10.6.2 REVENUE ANALYSIS

10.6.3 PRODUCT PORTFOLIO

10.6.4 RECENT DEVELOPMENT

10.7 BASF SE

10.7.1 COMPANY SNAPSHOT

10.7.2 REVENUE ANALYSIS

10.7.3 PRODUCT PORTFOLIO

10.7.4 RECENT DEVELOPMENT

10.8 BRASKEM

10.8.1 COMPANY SNAPSHOT

10.8.2 REVENUE ANALYSIS

10.8.3 PRODUCT PORTFOLIO

10.8.4 RECENT DEVELOPMENT

10.9 CELANESE CORPORATION

10.9.1 COMPANY SNAPSHOT

10.9.2 REVENUE ANALYSIS

10.9.3 PRODUCT PORTFOLIO

10.9.4 RECENT DEVELOPMENT

10.1 CHINA PETROCHEMICAL CORPORATION (SINOPEC)

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 PRODUCT PORTFOLIO

10.10.4 RECENT DEVELOPMENT

10.11 FORMOSA PLASTICS GROUP

10.11.1 COMPANY SNAPSHOT

10.11.2 REVENUE ANALYSIS

10.11.3 PRODUCT PORTFOLIO

10.11.4 RECENT DEVELOPMENT

10.12 GS GLOBAL CORP

10.12.1 COMPANY SNAPSHOT

10.12.2 REVENUE ANALYSIS

10.12.3 PRODUCT PORTFOLIO

10.12.4 RECENT DEVELOPMENT

10.13 INEOS

10.13.1 COMPANY SNAPSHOT

10.13.2 REVENUE ANALYSIS

10.13.3 PRODUCT PORTFOLIO

10.13.4 RECENT DEVELOPMENT

10.14 LG CHEM

10.14.1 COMPANY SNAPSHOT

10.14.2 REVENUE ANALYSIS

10.14.3 PRODUCT PORTFOLIO

10.14.4 RECENT DEVELOPMENT

10.15 MITSUI CHEMICALS, INC.

10.15.1 COMPANY SNAPSHOT

10.15.2 REVENUE ANALYSIS

10.15.3 PRODUCT PORTFOLIO

10.15.4 RECENT DEVELOPMENTS

10.16 RELIANCE INDUSTRIES LIMITED

10.16.1 COMPANY SNAPSHOT

10.16.2 REVENUE ANALYSIS

10.16.3 PRODUCT PORTFOLIO

10.16.4 RECENT DEVELOPMENT

10.17 REPSOL

10.17.1 COMPANY SNAPSHOT

10.17.2 REVENUE ANALYSIS

10.17.3 PRODUCT PORTFOLIO

10.17.4 RECENT DEVELOPMENT

10.18 SASOL

10.18.1 COMPANY SNAPSHOT

10.18.2 REVENUE ANALYSIS

10.18.3 PRODUCT PORTFOLIO

10.18.4 RECENT DEVELOPMENT

10.19 SCG CHEMICALS PUBLIC COMPANY LIMITED

10.19.1 COMPANY SNAPSHOT

10.19.2 REVENUE ANALYSIS

10.19.3 PRODUCT PORTFOLIO

10.19.4 RECENT DEVELOPMENT

10.2 TRINSEO

10.20.1 COMPANY SNAPSHOT

10.20.2 REVENUE ANALYSIS

10.20.3 PRODUCT PORTFOLIO

10.20.4 RECENT DEVELOPMENT

11 QUESTIONNAIRE

12 RELATED REPORTS

List of Figure

FIGURE 1 GLOBAL POLYPROPYLENE COMPOUNDS MARKET

FIGURE 2 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: THE PRODUCT LIFELINE CURVE

FIGURE 7 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL POLYPROPYLENE COMPOUNDS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 GROWING DEMAND FROM END-USE INDUSTRIES IS EXPECTED TO DRIVE THE GLOBAL POLYPROPYLENE COMPOUNDS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE MINERAL FILLED POLYPROPYLENE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL POLYPROPYLENE COMPOUNDS MARKET IN 2023 AND 2030

FIGURE 17 MIDDLE EAST AND AFRICA IS THE FASTEST-GROWING MARKET FOR POLYPROPYLENE COMPOUNDS MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL POLYPROPYLENE COMPOUNDS MARKET

FIGURE 21 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 22 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: BY REGION (2022)

FIGURE 23 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: BY REGION (2023 & 2030)

FIGURE 24 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: BY REGION (2022 & 2030)

FIGURE 25 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 26 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 31 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 32 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022)

FIGURE 33 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 36 ASIA-PACIFIC POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 37 ASIA-PACIFIC POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022)

FIGURE 38 ASIA-PACIFIC POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 39 ASIA-PACIFIC POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 40 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 41 SOUTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 42 SOUTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022)

FIGURE 43 SOUTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 44 SOUTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 45 SOUTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 46 MIDDLE EAST AND AFRICA POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 47 MIDDLE EAST AND AFRICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022)

FIGURE 48 MIDDLE EAST AND AFRICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 49 MIDDLE EASE AND AFRICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 50 MIDDLE EAST AND AFRICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 - 2030)

FIGURE 51 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: COMPANY SHARE 2022 (%)

FIGURE 52 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: COMPANY SHARE 2022 (%)

FIGURE 53 ASIA-PACIFIC POLYPROPYLENE COMPOUNDS MARKET: COMPANY SHARE 2022 (%)

FIGURE 54 EUROPE POLYPROPYLENE COMPOUNDS MARKET: COMPANY SHARE 2022 (%)

Global Polypropylene Compounds Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polypropylene Compounds Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polypropylene Compounds Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.