Global Polymeric Biomaterial Market

Market Size in USD Billion

CAGR :

%

USD

8.56 Billion

USD

13.29 Billion

2025

2033

USD

8.56 Billion

USD

13.29 Billion

2025

2033

| 2026 –2033 | |

| USD 8.56 Billion | |

| USD 13.29 Billion | |

|

|

|

|

Polymeric Biomaterial Market Size

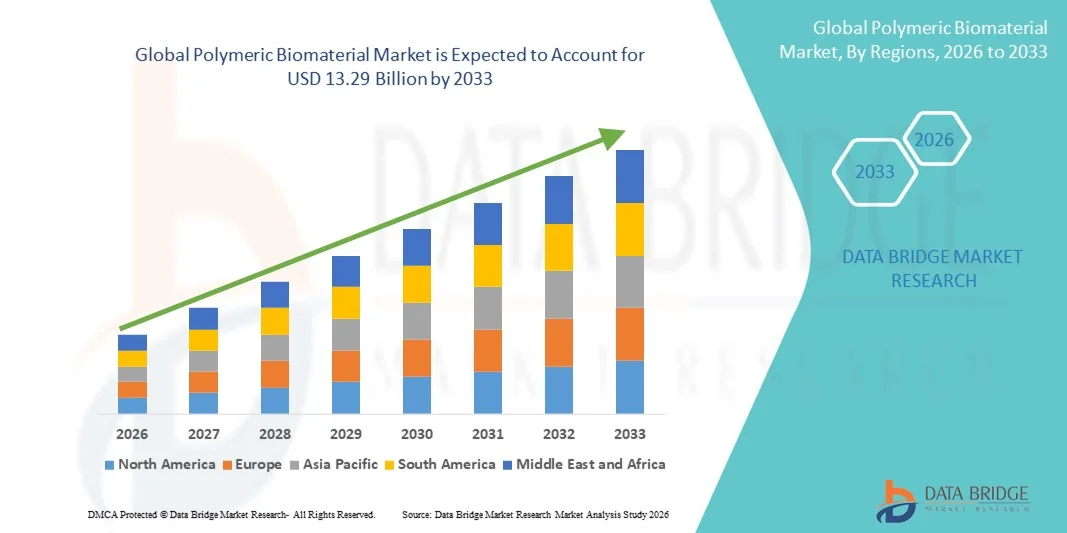

- The global polymeric biomaterial market size was valued at USD 8.56 billion in 2025 and is expected to reach USD 13.29 billion by 2033, at a CAGR of 5.66% during the forecast period

- The market growth is largely fueled by the increasing use of polymeric biomaterials in medical applications such as implants, drug delivery systems, tissue engineering, and wound care, supported by continuous technological advancements in polymer science and biomaterial engineering, leading to wider adoption across healthcare settings

- Furthermore, rising demand for biocompatible, lightweight, cost-effective, and customizable materials in medical devices and regenerative medicine is establishing polymeric biomaterials as a preferred solution. These converging factors are accelerating the uptake of polymeric biomaterial solutions, thereby significantly boosting the industry's growth

Polymeric Biomaterial Market Analysis

- Polymeric biomaterials, widely used in medical devices, implants, tissue engineering, wound care, and drug delivery systems, are becoming increasingly critical to modern healthcare due to their biocompatibility, flexibility, and cost-effectiveness across both clinical and research settings

- The growing demand for minimally invasive procedures, rising prevalence of chronic diseases, and rapid advancements in biodegradable and bioresorbable polymer technologies are key factors accelerating the adoption of polymeric biomaterials worldwide

- North America dominated the polymeric biomaterial market with the largest revenue share of approximately 36.8% in 2025, supported by strong healthcare infrastructure, high R&D spending, early adoption of advanced biomaterials, and the presence of leading medical device and biotechnology companies, with the U.S. contributing the majority of regional revenue

- Asia-Pacific is expected to be the fastest-growing region in the polymeric biomaterial market during the forecast period, registering a CAGR of around 18.9%, driven by expanding healthcare access, increasing surgical volumes, growing medical tourism, and rising investments in biomedical research across countries such as China, India, and South Korea

- The orthopedics segment accounted for the largest market revenue share of nearly 41.5% in 2025, driven by the high demand for polymer-based implants used in joint reconstruction, trauma fixation, and spinal surgeries

Report Scope and Polymeric Biomaterial Market Segmentation

|

Attributes |

Polymeric Biomaterial Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Polymeric Biomaterial Market Trends

Enhanced Performance Through Advanced Polymeric Biomaterial Design

- A significant and accelerating trend in the global Polymeric Biomaterial market is the advancement in polymer design to enhance biocompatibility, mechanical strength, and controlled degradation properties for medical applications. These innovations are improving clinical outcomes across orthopedics, cardiovascular devices, wound care, and tissue engineering

- For instance, bioresorbable polymers such as polylactic acid (PLA) and polyglycolic acid (PGA) are increasingly used in sutures, orthopedic fixation devices, and drug delivery systems, where they gradually degrade in the body and eliminate the need for secondary surgical removal

- Advanced polymer engineering enables improved cell adhesion, flexibility, and durability, supporting their use in long-term implants and regenerative medicine applications. Modified polymer surfaces and composite formulations are also enhancing integration with biological tissues

- The growing incorporation of polymeric biomaterials into tissue scaffolds and implantable devices allows for better mimicry of natural extracellular matrices, supporting cell growth and tissue regeneration

- This trend toward high-performance and application-specific polymeric biomaterials is reshaping expectations for medical implants. Consequently, companies such as Evonik and Corbion are developing next-generation medical-grade polymers with enhanced biofunctionality and controlled resorption profiles

- The demand for advanced polymeric biomaterials continues to grow across hospitals, research institutions, and medical device manufacturers as the focus on minimally invasive and regenerative therapies intensifies

Polymeric Biomaterial Market Dynamics

Driver

Growing Demand Driven by Rising Chronic Diseases and Medical Implant Usage

- The increasing prevalence of chronic diseases, orthopedic disorders, cardiovascular conditions, and trauma injuries is a major driver of the Polymeric Biomaterial market. These conditions often require implantable medical devices, prosthetics, and regenerative solutions where polymeric biomaterials play a critical role

- For instance, in March 2024, Evonik Industries expanded its production capacity for medical-grade bioresorbable polymers to support rising demand from orthopedic and drug delivery applications, highlighting strong market momentum for polymer-based biomaterials

- Polymeric biomaterials offer advantages such as flexibility, lightweight properties, corrosion resistance, and ease of fabrication compared to traditional materials, making them highly suitable for diverse medical applications

- In addition, the aging global population is increasing demand for joint replacements, cardiovascular implants, and wound care products, further accelerating market growth

- The expanding use of polymeric biomaterials in drug delivery systems and tissue engineering is reinforcing their importance in modern healthcare

Restraint/Challenge

Concerns Regarding Regulatory Complexity and High Development Costs

- Stringent regulatory requirements for medical biomaterials pose a significant challenge to market growth, as polymeric biomaterials must undergo extensive testing to ensure safety, biocompatibility, and long-term performance

- For instance, delays in regulatory approvals for bioresorbable polymer-based implants in the U.S. and Europe have increased development timelines and costs for manufacturers, limiting faster commercialization

- Compliance with varying regulatory standards across regions adds further complexity, particularly for small and mid-sized companies

- In addition, the high cost associated with R&D, clinical trials, and specialized manufacturing processes can restrict adoption, especially in cost-sensitive healthcare systems

- While technological advancements are improving material performance, balancing innovation with affordability remains a key challenge for sustained market expansion

Polymeric Biomaterial Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Polymeric Biomaterial market is segmented into nylon, silicon, polyester, polyethylene, polymethylmethacrylate (PMMA), polyvinyl chloride (PVC), and others. The silicon segment dominated the largest market revenue share of approximately 36.8% in 2025, driven by its superior biocompatibility, flexibility, chemical stability, and long-term performance in medical applications. Silicone polymers are extensively used in implants, catheters, prosthetics, and cardiovascular devices due to their non-reactive nature and excellent patient tolerance. The dominance of this segment is further supported by its widespread use in ophthalmology and plastic surgery procedures, where durability and softness are critical. Rising volumes of minimally invasive surgeries and increasing demand for implantable medical devices are reinforcing silicon’s strong market position. In addition, continuous product innovations and regulatory approvals for medical-grade silicone materials have expanded their adoption across hospitals and specialty clinics. The availability of silicon in various formulations tailored for specific medical uses further strengthens its dominance in the polymeric biomaterial market.

The polyethylene segment is expected to witness the fastest growth, registering a CAGR of 23.1% from 2026 to 2033, owing to its extensive use in orthopedic and joint replacement applications. Polyethylene biomaterials offer excellent wear resistance, mechanical strength, and cost-effectiveness, making them ideal for hip and knee implants. Growing incidences of osteoarthritis, aging populations, and increasing orthopedic surgical volumes are significantly driving demand for polyethylene-based biomaterials. Advancements such as highly cross-linked polyethylene have improved implant longevity, accelerating adoption among surgeons and healthcare providers. Furthermore, rising healthcare expenditure in emerging economies and expanding access to orthopedic care are fueling rapid growth. The scalability of polyethylene manufacturing and its compatibility with advanced implant designs are also contributing to its high-growth trajectory globally.

- By Application

On the basis of application, the Polymeric Biomaterial market is segmented into cardiovascular, ophthalmology, dental, plastic surgery, wound healing and tissue engineering, and orthopedics. The orthopedics segment accounted for the largest market revenue share of nearly 41.5% in 2025, driven by the high demand for polymer-based implants used in joint reconstruction, trauma fixation, and spinal surgeries. Polymeric biomaterials are widely preferred in orthopedics due to their lightweight nature, durability, and ability to reduce wear-related complications. The increasing prevalence of musculoskeletal disorders, sports injuries, and age-related bone degeneration is significantly contributing to the dominance of this segment. Technological advancements in polymer processing and implant customization are further enhancing clinical outcomes. In addition, favorable reimbursement policies and rising surgical volumes in developed regions are supporting sustained demand.

The wound healing and tissue engineering segment is projected to grow at the fastest CAGR of 24.6% from 2026 to 2033, driven by advancements in regenerative medicine and biomaterial-based scaffolds. Polymeric biomaterials play a critical role in tissue regeneration by supporting cell adhesion, proliferation, and controlled drug delivery. The growing burden of chronic wounds, diabetic ulcers, and burn injuries is accelerating the adoption of advanced polymer-based wound care solutions. Increasing research investments in tissue engineering and stem cell therapies are further boosting growth. Moreover, the shift toward biodegradable and bioresorbable polymeric materials is creating new opportunities in regenerative applications. Expansion of clinical trials and commercialization of next-generation tissue-engineered products are expected to sustain rapid market expansion.

Polymeric Biomaterial Market Regional Analysis

- North America dominated the polymeric biomaterial market with the largest revenue share of approximately 36.8% in 2025, supported by a well-established healthcare infrastructure, strong reimbursement systems, and high adoption of advanced biomaterials across clinical applications

- The region benefits from significant investments in biomedical research and development, along with the presence of leading medical device manufacturers and biotechnology companies. High procedure volumes in orthopedics, cardiovascular surgeries, and wound care are major contributors to market dominance

- Early adoption of innovative polymeric materials in implants, tissue engineering, and regenerative medicine further strengthens the regional market position. In addition, favorable regulatory frameworks and continuous product approvals facilitate faster commercialization of advanced polymer-based medical solutions across hospitals and specialty clinics

U.S. Polymeric Biomaterial Market Insight

The U.S. polymeric biomaterial market accounted for the majority share of the North American polymeric biomaterial market in 2025, contributing in regional revenue, driven by robust healthcare spending and a strong focus on innovation. The country leads in the development and adoption of polymeric biomaterials for orthopedic implants, cardiovascular devices, and tissue engineering applications. High prevalence of chronic diseases, an aging population, and rising surgical volumes are key demand drivers. The presence of major biomaterial manufacturers, research institutions, and clinical trial activity further accelerates market growth. In addition, continuous advancements in biodegradable and bioresorbable polymers are expanding application areas across multiple medical specialties.

Europe Polymeric Biomaterial Market Insight

The Europe polymeric biomaterial market is projected to expand at a steady CAGR during the forecast period, driven by increasing adoption of advanced medical materials and strong regulatory emphasis on patient safety and product quality. Countries across the region are witnessing growing demand for polymer-based implants and medical devices, supported by rising orthopedic and cardiovascular procedure volumes. Europe’s strong focus on innovation, sustainability, and biocompatible materials is encouraging the development of next-generation polymeric biomaterials. Public healthcare systems and increasing investments in regenerative medicine research further support market expansion across the region.

U.K. Polymeric Biomaterial Market Insight

The U.K. polymeric biomaterial market is expected to grow at a notable CAGR over the forecast period, driven by rising demand for advanced biomaterials in orthopedics, wound care, and tissue engineering. Increasing incidence of musculoskeletal disorders and chronic wounds is accelerating adoption of polymer-based medical solutions. The country’s strong academic research base and collaborations between universities and medical device companies support innovation in biomaterial development. In addition, growing focus on minimally invasive procedures and improved patient outcomes is contributing to sustained market growth.

Germany Polymeric Biomaterial Market Insight

Germany is anticipated to witness considerable growth in the polymeric biomaterial market during the forecast period, supported by its advanced healthcare infrastructure and strong manufacturing capabilities. The country has a high demand for polymeric biomaterials in orthopedic, cardiovascular, and dental applications. Emphasis on precision engineering, quality standards, and clinical efficiency drives adoption of high-performance polymer materials. Germany’s leadership in medical device innovation and growing investments in regenerative medicine research further enhance market expansion.

Asia-Pacific Polymeric Biomaterial Market Insight

The Asia-Pacific polymeric biomaterial market is expected to grow at the fastest CAGR of around 18.9% during the forecast period, driven by expanding healthcare access and increasing surgical volumes across emerging economies. Rapid urbanization, rising healthcare expenditure, and growing medical tourism are key factors fueling demand. Countries such as China, India, and South Korea are witnessing strong growth in orthopedic, cardiovascular, and tissue engineering applications. Government initiatives to improve healthcare infrastructure and rising investments in biomedical research are accelerating adoption of advanced polymeric biomaterials across the region.

Japan Polymeric Biomaterial Market Insight

Japan’s polymeric biomaterial market is gaining steady momentum due to its aging population and high demand for advanced medical treatments. The country has strong adoption of polymer-based implants and medical devices, particularly in orthopedics and cardiovascular care. Technological innovation, precision manufacturing, and focus on biocompatible materials support market growth. In addition, Japan’s leadership in regenerative medicine and tissue engineering research is driving demand for advanced polymeric biomaterials in clinical and research applications.

China Polymeric Biomaterial Market Insight

China accounted for the largest revenue share in the Asia-Pacific polymeric biomaterial market in 2025, driven by rapid expansion of its healthcare sector and increasing adoption of advanced medical technologies. Rising prevalence of chronic diseases, growing surgical volumes, and expanding access to hospital care are major demand drivers. Strong domestic manufacturing capabilities and increasing government support for biomedical innovation further propel market growth. In addition, China’s growing investments in regenerative medicine and tissue engineering are expected to sustain long-term expansion of the polymeric biomaterial market.

Polymeric Biomaterial Market Share

The Polymeric Biomaterial industry is primarily led by well-established companies, including:

• Evonik Industries AG (Germany)

• BASF SE (Germany)

• Corbion N.V. (Netherlands)

• DSM–Firmenich (Netherlands)

• Celanese Corporation (U.S.)

• DuPont de Nemours, Inc. (U.S.)

• Covestro AG (Germany)

• Lubrizol Corporation (U.S.)

• Arkema S.A. (France)

• Solvay S.A. (Belgium)

• Victrex plc (U.K.)

• Zeus Industrial Products, Inc. (U.S.)

• 3M Company (U.S.)

• Wacker Chemie AG (Germany)

• Ashland Global Holdings Inc. (U.S.)

• Mitsubishi Chemical Group (Japan)

• Toray Industries, Inc. (Japan)

• RTP Company (U.S.)

• Kuraray Co., Ltd. (Japan)

Latest Developments in Global Polymeric Biomaterial Market

- In June 2023, International Flavors & Fragrances Inc. introduced its Enzymatic Biomaterials (DEB) technology platform, a sustainable biopolymer production technology designed to create high-performance biopolymers with enhanced functionality for medical and industrial applications, enabling customization of polymer properties through enzymatic processing and signaling a major step in eco-friendly polymer innovation

- In October 2023, Evonik Industries AG launched its VESTAKEEP iC4620 3DF high-performance polymer filament and its carbon fiber-reinforced counterpart (VESTAKEEP iC4612 3DF), engineered for 3D printing of patient-specific medical implants with superior strength and biocompatibility, supporting more robust additive manufacturing of polymeric biomaterials for clinical use

- In March 2025, BASF SE introduced HySorb B 6610 ZeroPCF, the first polyacrylate-based superabsorbent polymer with a zero product carbon footprint, expanding its medical-grade polymer portfolio for advanced hygiene and wound-care applications while helping customers meet sustainability targets

- In May 2025, Victrex PLC and Maxx Orthopedics secured U.S. FDA IDE approval and performed the first clinical cases for the Freedom Total Knee System using Invibio’s PEEK-OPTIMA femoral component, marking a major clinical milestone for high-performance, metal-free polymeric implants in total knee arthroplasty

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.