Global Polyisobutylene Market

Market Size in USD Billion

CAGR :

%

USD

2.25 Billion

USD

3.42 Billion

2024

2032

USD

2.25 Billion

USD

3.42 Billion

2024

2032

| 2025 –2032 | |

| USD 2.25 Billion | |

| USD 3.42 Billion | |

|

|

|

|

Polyisobutylene Market Size

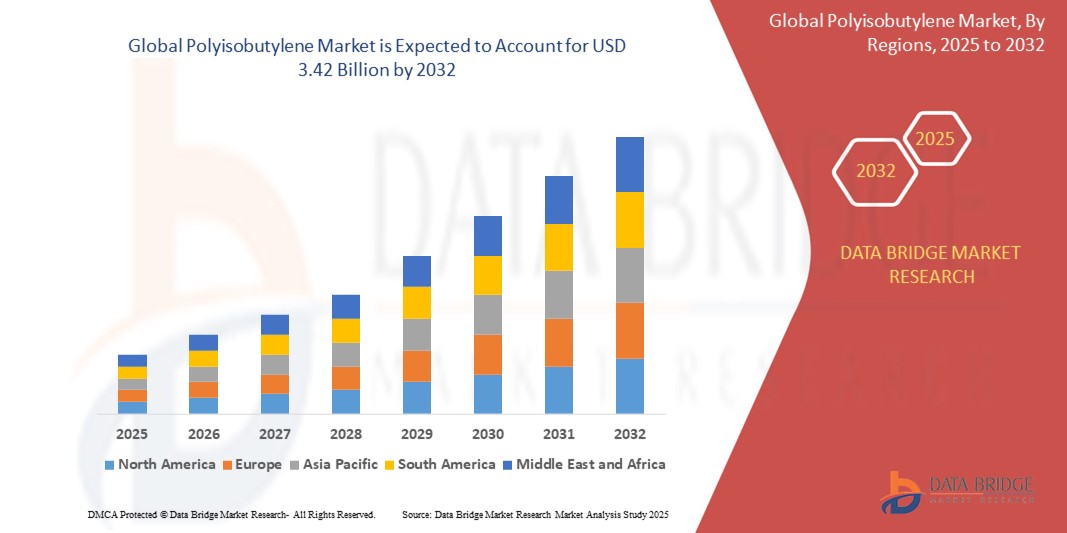

- The global polyisobutylene market was valued at USD 2.25 billion in 2024 and is expected to reach USD 3.42 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.35%, primarily driven by the increasing demand from automotive, construction, and pharmaceutical sectors

- This growth is fueled by factors such as rising production of vehicles, expansion of construction and infrastructure activities, and increased use of polyisobutylene in medical and personal care applications due to its non-toxic and impermeable properties

Polyisobutylene Market Analysis

- Polyisobutylene (PIB) is a versatile polymer used in a wide range of industrial applications, including adhesives, sealants, lubricants, fuel additives, and medical devices. Its impermeability to gases and resistance to chemicals make it a valuable material in automotive, pharmaceutical, and construction sectors

- The market demand for polyisobutylene is largely driven by the growth of the automotive and transportation sectors, where PIB is widely used in fuel and lubricant additives to enhance engine performance and efficiency. Additionally, its use in medical packaging and drug delivery systems has expanded due to its biocompatibility and chemical stability

- The Asia-Pacific region leads the global polyisobutylene market, supported by the rapid industrialization in countries like China and India, coupled with the expanding automotive manufacturing base and increasing infrastructure projects. The region’s robust demand for adhesives and sealants in construction also plays a crucial role in market growth

- For instance, in recent years, Chinese automakers and lubricant producers have ramped up demand for high molecular weight PIB for advanced lubricant formulations. The expansion of production facilities by global players like BASF and Daelim further underscores Asia-Pacific’s central role in driving PIB market growth

- Globally, polyisobutylene is considered one of the most essential elastomers in fuel systems and automotive sealing solutions, ranking alongside styrene-butadiene rubber (SBR) and butyl rubber. It plays a critical role in enhancing durability, flexibility, and performance in various end-use industries

Report Scope and Polyisobutylene Market Segmentation

|

Attributes |

Polyisobutylene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polyisobutylene Market Trends

“Rising Use of Polyisobutylene in Sustainable and High-Performance Applications”

- One prominent trend in the global polyisobutylene market is the increasing use of PIB in sustainable and high-performance applications across various industries, including automotive, packaging, and pharmaceuticals

- Manufacturers are shifting toward eco-friendly and energy-efficient formulations, where polyisobutylene plays a critical role due to its recyclability, low volatility, and superior barrier properties against moisture and gases

- For instance, in the automotive industry, low molecular weight PIB is being used in the formulation of fuel-efficient and low-emission lubricants, which align with global emission standards and sustainability goals. High molecular weight PIB is also gaining traction in tire inner liners and sealants to reduce air loss and improve fuel economy

- In packaging, particularly in pharmaceutical and food sectors, PIB is used to enhance the shelf life of products by providing superior sealing and protection. Its role in drug delivery systems and transdermal patches is expanding due to its biocompatibility and chemical inertness

- This trend reflects a broader market shift toward multi-functional, durable, and sustainable materials, positioning polyisobutylene as a vital ingredient in next-generation formulations and green manufacturing initiatives

Polyisobutylene Market Dynamics

Driver

“Growing Demand from Automotive and Transportation Industries”

- The expanding automotive and transportation sectors are significantly contributing to the rising demand for polyisobutylene (PIB), particularly in applications related to fuel additives, lubricants, and tire inner liners

- As global mobility increases and vehicle ownership rises—especially in emerging economies—the need for high-performance, durable, and efficient automotive components continues to grow. PIB is widely used to enhance engine performance, reduce emissions, and increase the longevity of engine oils

- In fuel systems, PIB-based additives improve fuel stability, reduce sludge formation, and help maintain cleaner engine internals. In tires, high molecular weight PIB is used in inner liners to prevent air leakage, contributing to better fuel efficiency and improved safety

- Ongoing innovations in automotive engineering and environmental regulations also highlight the demand for advanced materials like PIB, which provide superior sealing, adhesion, and barrier properties compared to conventional polymers

- As vehicle manufacturers seek materials that can support both performance and sustainability, PIB is increasingly favored in formulations that comply with low-emission standards and extended service intervals

For instance,

- In June 2023, BASF announced an expansion of its polyisobutylene production capacity at its Ludwigshafen site in Germany to meet rising demand from the automotive lubricant and fuel additive industries. The move reflects increased usage of PIB-based dispersants and detergents across global markets

- In April 2022, Daelim Industrial Co., Ltd. launched new high-reactive PIB products aimed at next-generation fuel additive formulations, especially targeting markets in Southeast Asia and Europe, where environmental standards are becoming more stringent

- As the automotive industry continues to emphasize efficiency, emissions reduction, and material performance, the demand for polyisobutylene as a functional, high-value polymer is expected to rise steadily in the coming years

Opportunity

“Expanding Applications of PIB in Medical and Pharmaceutical Innovations”

- The increasing exploration of polyisobutylene (PIB) in the medical and pharmaceutical industries presents a significant growth opportunity for the global market. Due to its biocompatibility, chemical stability, and impermeability to moisture and gases, PIB is increasingly being used in advanced drug delivery systems, wound care products, and pharmaceutical packaging

- In particular, PIB-based transdermal drug delivery systems enable controlled and sustained release of medications through the skin, enhancing treatment efficacy and patient compliance. Its adhesive and barrier properties make it ideal for skin patches and other topical treatments

- In addition, PIB is gaining traction as a key component in pharmaceutical stoppers, seals, and syringes, where it helps preserve drug stability by preventing contamination and maintaining a sterile environment

For instance,

- In October 2024, ExxonMobil announced the development of a new medical-grade polyisobutylene formulation specifically designed for controlled-release drug applications and skin-contact adhesives, highlighting the polymer’s growing medical relevance

- In June 2023, a research paper published in Materials Today: Proceedings explored the use of PIB-based polymers in wound dressings with antimicrobial capabilities, aimed at improving healing rates while maintaining patient comfort

- By capitalizing on this trend, manufacturers can tap into high-margin, regulation-driven markets, boosting both revenue potential and product diversification within the PIB space

Restraint/Challenge

“Volatility in Raw Material Prices and Supply Chain Disruptions”

- The fluctuating prices of raw materials used in the production of polyisobutylene (PIB), such as isobutylene and other petrochemical derivatives, present a major challenge for market stability and profitability—especially for smaller manufacturers and price-sensitive end-use sectors

- Since PIB is derived from petroleum-based feedstocks, its production cost is heavily influenced by crude oil price volatility, geopolitical tensions, and disruptions in global petrochemical supply chains. This can lead to inconsistent pricing, impacting procurement and planning for downstream industries like automotive, construction, and packaging

- In addition, supply chain disruptions, including shortages of base chemicals or logistical delays, can hinder consistent availability of PIB products, delaying project timelines and increasing production costs for end-users

For instance,

- In March 2022, the Russia-Ukraine conflict resulted in major disruptions across European petrochemical supply chains, with export restrictions and freight delays affecting the availability of raw materials critical to PIB production

- These challenges can deter investment and long-term contract commitments, particularly from cost-conscious industries and regions. As a result, uncertainty in raw material sourcing and pricing limits the ability of producers to maintain consistent product quality and supply, ultimately restraining the global growth potential of the polyisobutylene

Polyisobutylene Market Scope

The market is segmented on the basis of molecular weight, product, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Molecular Weight |

|

|

By Product |

|

|

By Application |

|

|

By End-user |

|

Polyisobutylene Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Polyisobutylene Market”

- Asia-Pacific leads the global polyisobutylene (PIB) market, fueled by rapid industrialization, a strong automotive manufacturing base, and increasing demand for adhesives, sealants, and lubricants across key economies like China, India, and South Korea

- China holds a substantial market share, driven by high production volumes in the automotive and construction sectors, as well as a growing focus on performance-enhancing fuel and lubricant additives. The availability of cost-effective raw materials and favorable government initiatives to boost domestic manufacturing also contribute to the region’s dominance

- The region benefits from ongoing investments in petrochemical infrastructure, with several global and local manufacturers expanding their production capacities to meet rising demand. In addition, strong export capabilities allow Asia-Pacific producers to supply PIB to emerging and mature markets worldwide

- Moreover, the increasing application of PIB in pharmaceutical and personal care products across countries like India and Japan adds to regional growth, as healthcare and hygiene awareness continues to rise

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global polyisobutylene market, driven by rapid industrialization, growing automotive production, and expanding demand in the construction and packaging sectors

- Countries such as China, India, and South Korea are emerging as key markets due to increasing consumption of polyisobutylene in manufacturing adhesives, sealants, and lubricants. The region’s focus on infrastructure development and vehicle manufacturing fuels this demand

- China, with its vast automotive and industrial base, remains a major consumer of polyisobutylene. The country’s strong emphasis on domestic manufacturing and export-oriented production continues to stimulate demand for polyisobutylene-based materials

- India is witnessing growing demand due to rising investments in the automotive and construction industries, along with government initiatives promoting local manufacturing. This, coupled with increasing urbanization, boosts the need for products utilizing polyisobutylene

- South Korea and other Southeast Asian countries are experiencing increased usage of polyisobutylene in specialty applications such as pharmaceutical packaging, electrical insulation, and fuel additives. The region's focus on technological advancement and diversification in chemical applications supports long-term market growth

Polyisobutylene Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- China Petroleum & Chemical Corporation (China)

- Royal Dutch Shell Plc (U.K.)

- Eni S.p.A. (Italy)

- Evonik Industries AG (Germany)

- Ineos Group AG (U.K.)

- LANXESS (Germany)

- LG Chem (South Korea)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Nizhnekamskneftekhim (Russia)

- Repsol (Spain)

- SABIC (Saudi Arabia)

- Dow (U.S.)

- TPC Group (U.S.)

- Formosa Plastics Corporation, U.S.A. (U.S.)

- ZEON Corporation (Japan)

- Shanghai Petrochemical (China)

- Borealis AG (Austria)

- Versalis S.p.A. (Italy)

- Kothari Petrochemicals (India)

Latest Developments in Global Polyisobutylene Market

- In July 2023, Omsky Kauchuk, a subsidiary of the Titan Group, began constructing a 10-kiloton polyisobutylene (PIB) production plant and a technical butane processing facility in Omsk. This initiative is designed to reduce Russia's dependence on imports and utilize domestic technologies to enhance production efficiency

- In August 2023, BASF revealed a 25% increase in production capacity for its medium molecular weight polyisobutenes, branded as OPPANOL B, at its Ludwigshafen facility in Germany. This expansion was driven by the growing global demand for high-quality medium molecular weight polyisobutylene, which is utilized in applications like window sealants, surface protective films, and battery binder materials

- In September 2023, TPC Group completed the initial phase of its di-isobutylene (DIB) capacity upgrade. This milestone enables the company to address the increasing global demand for DIB, driven by the adoption of low global warming potential refrigerants

- In March 2023, Pidilite Industries announced its plan to manufacture Jowat’s hot melt adhesives in India. These adhesives will be produced at Pidilite's state-of-the-art facility in Vapi, Gujarat, and will be marketed under the Pidilite brand

- In July 2023, Kraton Corporation introduced a new range of polyisobutylene (PIB)-based adhesives and sealants tailored for the automotive and construction sectors. These innovative products are engineered to deliver exceptional performance and durability, aligning with the latest industry standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyisobutylene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyisobutylene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyisobutylene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.