Global Polishing Powder Market

Market Size in USD Billion

CAGR :

%

USD

2.84 Billion

USD

4.13 Billion

2024

2032

USD

2.84 Billion

USD

4.13 Billion

2024

2032

| 2025 –2032 | |

| USD 2.84 Billion | |

| USD 4.13 Billion | |

|

|

|

|

Polishing Powder Market Size

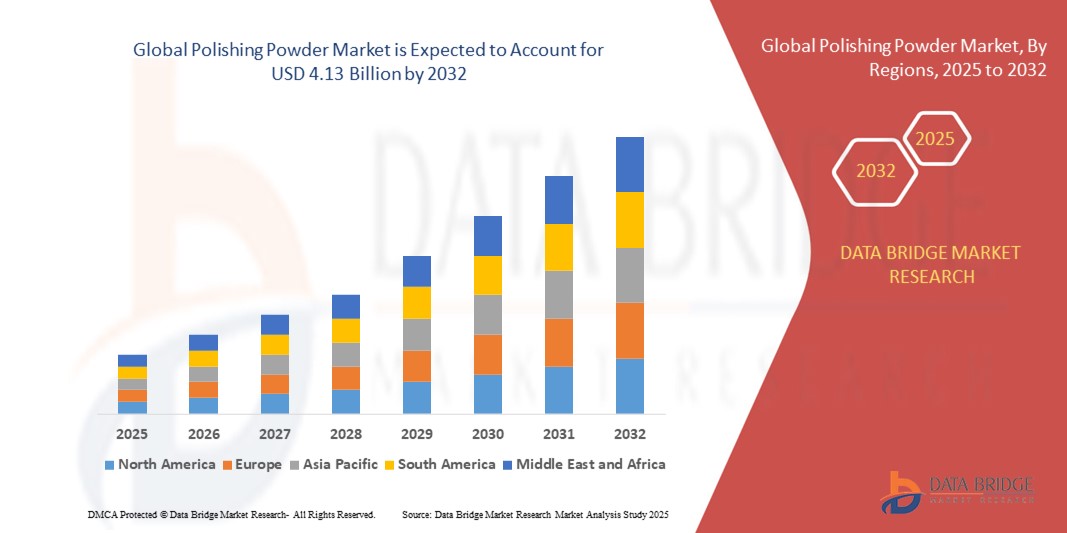

- The global polishing powder market size was valued at USD 2.84 billion in 2024 and is expected to reach USD 4.13 billion by 2032, at a CAGR of 4.8% during the forecast period

- The market growth is largely fueled by the increasing demand from the semiconductor, optics, and metal finishing industries, where precision surface finishing and defect-free polishing are critical. Technological advancements in abrasive materials, such as diamond and aluminum oxide polishing powders, are enhancing efficiency and quality, supporting adoption across high-performance manufacturing sectors

- Furthermore, rising investment in electronics manufacturing, coupled with the growing need for ultra-fine surface finishing in automotive and aerospace components, is boosting the market. The expansion of industrial automation and precision engineering is further accelerating demand for high-grade polishing powders, thereby strengthening the market’s growth trajectory

Polishing Powder Market Analysis

- Polishing powders are fine abrasive materials used to achieve smooth, defect-free surfaces in applications such as semiconductor wafers, optical components, and metal products. These powders, available in various material types and grain sizes, enable precision finishing while meeting strict quality requirements in advanced manufacturing

- The escalating demand for polishing powders is primarily fueled by the proliferation of high-performance electronics, increasing adoption in automotive and aerospace surface finishing, and the need for enhanced productivity and quality in industrial processes

- North America dominated the polishing powder market with a share of 39% in 2024, due to strong industrial activity and significant demand from semiconductor manufacturing, optics, and metal finishing sectors

- Asia-Pacific is expected to be the fastest growing region in the polishing powder market during the forecast period due to rapid industrialization, urbanization, and rising investments in semiconductor manufacturing, optics, and metal finishing industries across China, Japan, India, and South Korea

- Fine polishing powder segment dominated the market with a market share of 53.6% in 2024, due to its widespread use in applications requiring high precision and smooth surface finishes, such as semiconductor wafers, optical lenses, and jewelry polishing. Fine powders enable gradual and controlled material removal, which is essential for avoiding surface defects and maintaining dimensional accuracy. The demand for finer powders is growing as end-use industries prioritize surface quality and product reliability. Improvements in particle size distribution and powder uniformity have further enhanced the performance of fine polishing powders, driving their continued market leadership

Report Scope and Polishing Powder Market Segmentation

|

Attributes |

Polishing Powder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polishing Powder Market Trends

Growing Use of Eco-Friendly Polishing Powders

- The market is experiencing robust growth driven by rising demand for eco-friendly polishing powders, as stricter global regulations and heightened environmental awareness encourage manufacturers to innovate with biodegradable, low-toxicity, and nonhazardous formulations that minimize impact on air and water quality

- For instance, leading brands are launching water-based and biodegradable polishing powder products in response to sustainability mandates and consumer preferences for green alternatives, with niche segments such as sustainable marble polishing powders gaining traction in residential and commercial construction markets

- Advances in material science, such as the use of nano-technology and non-toxic abrasive agents, are boosting product performance and meeting evolving environmental standards for industrial surface treatment and maintenance

- Expansion of online distribution channels supports the rapid introduction of eco-friendly polishing powders, enabling broader consumer and professional access to certified green products

- Investment in R&D for concentrated and multipurpose formulations is reducing packaging waste and improving product lifecycle sustainability

- Collaboration between key players and regulatory bodies helps ensure new launches meet international quality and safety standards, further accelerating the adoption of eco-friendly polishing powders globally

Polishing Powder Market Dynamics

Driver

Growth in Manufacturing Sector

- The steady growth of manufacturing activities across industries—including automotive, electronics, and construction—is the primary driver for polishing powder demand, fueling the need for high-performance surface finishing, cleaning, and restoration products

- For instance, the automotive sector accounts for significant consumption, using specific polishing powders for finishing headlights, panels, and body components, while expanding construction, luxury interiors, and renovation activities drive broader polishing powder use in marble, granite, and flooring applications across Asia-Pacific, North America, and Europe

- Rising demand for aesthetic and durable finished surfaces promotes both standard and specialized polishing powders tailored to diverse industrial and consumer requirements

- Increased investment in automation and advanced production technologies enables higher productivity and quality, further supporting market growth for premium and functional polishing powder grades

- Sectoral diversification, with healthcare, aerospace, and electronics industries adopting polishing powders for precision cleaning, supports ongoing expansion of the market's size and scope

Restraint/Challenge

Environmental Impact and Regulatory Compliance

- Environmental concerns arising from the use of chemicals and particulate emissions in traditional polishing powders create ongoing regulatory and operational challenges, requiring product reformulation and stricter compliance with global emission, waste disposal, and chemical usage standards

- For instance, regulations in regions such as the EU and North America are prompting manufacturers to pivot towards sustainable formulations, as consumers and industries increasingly opt for eco-conscious and certified products to address eco-toxicological risks

- Modifications to production processes and additional investments in cleaner technologies are often required to maintain compliance, increasing operational and development costs for manufacturers

- The need for comprehensive quality assurance and certification programs challenges both industry incumbents and new entrants with higher technical barriers to market entry

- Balancing effectiveness, application ease, and environmental compliance often necessitates ongoing innovation—and some performance trade-offs—impacting product positioning and market competitiveness

Polishing Powder Market Scope

The market is segmented on the basis of material type, abrasive type, application, and grain size.

- By Material Type

On the basis of material type, the polishing powder market is segmented into ceramic polishing powder, metal polishing powder, and stone polishing powder. The ceramic polishing powder segment dominated the largest market revenue share in 2024, largely due to its superior hardness, chemical stability, and versatility across diverse polishing applications. Ceramic powders are widely preferred in high-precision industries such as electronics and optics for their ability to achieve ultra-smooth finishes and maintain consistent performance. Furthermore, ceramic polishing powders are compatible with advanced polishing techniques, which has boosted their demand in both industrial and consumer sectors. Their cost-effectiveness and environmental friendliness also add to their appeal in various polishing processes. This dominance is reinforced by strong adoption in semiconductor wafer polishing and fine finishing applications.

The metal polishing powder segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing industrialization and the expanding metal finishing sector. Metal powders, especially those tailored for specific metals such as stainless steel or aluminum, are gaining traction for their efficiency in removing surface defects and enhancing the aesthetic and functional qualities of metal parts. Rising demand from automotive, aerospace, and heavy machinery industries, where metal components require high-quality surface treatment, is accelerating the adoption of metal polishing powders. In addition, innovations in powder formulations that improve polishing speed and reduce material consumption are expected to further fuel growth in this segment.

- By Abrasive Type

On the basis of abrasive type, the polishing powder market is segmented into diamond polishing powder, aluminum oxide polishing powder, and silicon carbide polishing powder. The diamond polishing powder segment held the largest market revenue share in 2024, attributed to diamond’s unmatched hardness and abrasive efficiency. Diamond powders are essential in high-precision polishing tasks in semiconductor manufacturing, optics, and jewelry industries, where extremely fine and controlled material removal is required. The durability and longevity of diamond abrasives reduce downtime and operating costs, making them a preferred choice for demanding applications. Their ability to polish a wide range of materials, from hard metals to ceramics, also supports their market dominance.

Silicon carbide polishing powder is expected to exhibit the fastest CAGR between 2025 and 2032, owing to its excellent hardness, chemical inertness, and cost-effectiveness compared to diamond abrasives. Silicon carbide powders are widely used in metal finishing, optics, and automotive industries for their versatility and efficiency in polishing both ferrous and non-ferrous metals. The growth in electronics manufacturing and increased demand for polished components in automotive sensors and optics are contributing to the rising adoption of silicon carbide powders. Advances in production technologies have also improved powder uniformity and particle size control, which enhance polishing outcomes and expand application possibilities.

- By Application

On the basis of application, the polishing powder market is segmented into semiconductor industry, optics, and metal finishing. The semiconductor industry segment dominated the largest market share in 2024 due to the critical need for ultra-fine polishing powders in wafer manufacturing and device fabrication. The semiconductor sector demands polishing powders that can achieve atomic-level surface smoothness without causing damage, and this stringent requirement drives high consumption of specialized powders, particularly diamond and ceramic types. Growth in semiconductor manufacturing worldwide, fueled by increasing electronics demand and technological advancements, further sustains this dominance. In addition, the rise of electric vehicles and 5G infrastructure intensifies the demand for advanced semiconductor polishing solutions.

The metal finishing application segment is projected to witness the fastest growth rate during the forecast period, propelled by the expanding automotive, aerospace, and construction industries. Metal finishing requires polishing powders that deliver both functional surface enhancements and aesthetic improvements, supporting corrosion resistance, wear reduction, and visual appeal. Increasing customization and quality standards in manufacturing have driven demand for sophisticated polishing powders tailored to different metals and alloys. Moreover, stricter regulations on product quality and surface finish are motivating industries to adopt advanced polishing technologies, boosting the growth of this segment.

- By Grain Size

On the basis of grain size, the polishing powder market is segmented into fine polishing powder and coarse polishing powder. The fine polishing powder segment held the largest market share of 53.6% in 2024, due to its widespread use in applications requiring high precision and smooth surface finishes, such as semiconductor wafers, optical lenses, and jewelry polishing. Fine powders enable gradual and controlled material removal, which is essential for avoiding surface defects and maintaining dimensional accuracy. The demand for finer powders is growing as end-use industries prioritize surface quality and product reliability. Improvements in particle size distribution and powder uniformity have further enhanced the performance of fine polishing powders, driving their continued market leadership.

Coarse polishing powders are anticipated to witness the fastest growth rate between 2025 and 2032, supported by rising demand in heavy-duty metal finishing and initial surface preparation processes. Coarser powders are favored for rapid material removal and rough polishing, especially in industries such as automotive manufacturing and construction where surface defects need to be efficiently eliminated before final finishing. The increasing focus on cost-efficient polishing cycles and process optimization has also led to a rise in the adoption of coarse powders. Growing infrastructure projects and metal fabrication activities globally are expected to sustain this rapid growth in coarse polishing powders.

Polishing Powder Market Regional Analysis

- North America dominated the polishing powder market with the largest revenue share of 39% in 2024, driven by strong industrial activity and significant demand from semiconductor manufacturing, optics, and metal finishing sectors

- The region’s advanced manufacturing infrastructure and focus on high-precision polishing applications contribute to widespread adoption

- In addition, stringent quality and surface finish standards in aerospace, automotive, and electronics industries support the demand for specialized polishing powders. The presence of leading polishing powder manufacturers and ongoing investments in R&D further enhance market growth in North America

U.S. Polishing Powder Market Insight

The U.S. polishing powder market captured the largest revenue share in 2024 within North America, fueled by the country’s leadership in semiconductor fabrication, optics production, and metal finishing industries. The rising need for ultra-fine surface finishes and high-efficiency polishing solutions is a key growth driver. Furthermore, the U.S. market benefits from rapid adoption of advanced manufacturing technologies and strong collaborations between industry and academia to innovate polishing materials and processes. The growing emphasis on precision engineering and product quality sustains the demand for premium polishing powders.

Europe Polishing Powder Market Insight

Europe holds a significant share of the polishing powder market, supported by strong industrial manufacturing, especially in Germany, the U.K., and France. The market is projected to expand steadily, driven by the region’s stringent environmental and quality regulations, which encourage the use of efficient and eco-friendly polishing powders. Demand from automotive, aerospace, and optics sectors is robust, with manufacturers focusing on sustainable polishing processes. The integration of polishing powders into advanced surface finishing applications in electronics and precision instruments is also supporting growth. The presence of established polishing powder producers and growing investments in high-tech manufacturing contribute to Europe’s market strength.

Germany Polishing Powder Market Insight

The Germany polishing powder market is a key contributor in Europe, propelled by the country’s advanced manufacturing capabilities and focus on innovation. Germany’s strong automotive and aerospace industries require high-performance polishing powders to meet demanding surface finish and durability standards. In addition, the country’s environmental policies encourage the adoption of sustainable polishing materials, further boosting market demand.

U.K. Polishing Powder Market Insight

The U.K. polishing powder market is witnessing growth due to rising demand from electronics manufacturing, optics, and metal finishing industries. Increasing focus on quality surface finishes and regulatory standards drives the adoption of technologically advanced polishing powders in the region.

Asia-Pacific Polishing Powder Market Insight

The Asia-Pacific polishing powder market is expected to grow at the fastest CAGR during the forecast period from 2025 to 2032, driven by rapid industrialization, urbanization, and rising investments in semiconductor manufacturing, optics, and metal finishing industries across China, Japan, India, and South Korea. The growing electronics and automotive manufacturing sectors in the region demand high-quality polishing powders to meet precision and quality requirements. Government initiatives promoting technological innovation and digital manufacturing also accelerate market growth. Furthermore, the region is a major manufacturing hub for polishing powders and components, enhancing affordability and accessibility across emerging economies.

China Polishing Powder Market Insight

China leads the Asia-Pacific market with the largest revenue share in 2024, supported by its expanding semiconductor industry, rising urban infrastructure projects, and growth in electronics manufacturing. The country’s increasing adoption of advanced surface finishing technologies and strong presence of domestic polishing powder manufacturers propel market expansion. Government programs aimed at upgrading manufacturing quality and promoting “Made in China 2025” further boost demand.

Japan Polishing Powder Market Insight

Japan’s polishing powder market growth is fueled by its high-tech manufacturing sector, especially in optics, electronics, and semiconductor industries. The market benefits from technological innovation and the increasing need for precision polishing in advanced manufacturing.

Polishing Powder Market Share

The polishing powder industry is primarily led by well-established companies, including:

- Cabot Microelectronics Corporation (U.S.)

- Asahi Diamond Industrial Co., Ltd. (Japan)

- Saint-Gobain Abrasives (France)

- 3M Company (U.S.)

- Fuji Machine Mfg. Co., Ltd. (Japan)

- Kemet International Ltd. (U.S.)

- Engis Corporation (U.S.)

- Abrasivos Aguila S.A. (Spain)

- Sintez Electromet Pvt. Ltd. (India)

- NanoMech, Inc. (U.S.)

Latest Developments in Global Polishing Powder Market

- In 2024, Northern Rare Earth Group achieved sustainability certification for 30% of its cerium output, aligning with the increasing emphasis on responsible sourcing and environmental compliance. This move is significant as it meets tightening regulatory requirements and also attracts customers in sectors actively seeking to reduce their environmental footprint, such as consumer electronics and green building materials

- In 2023, Solvay launched an ultra-fine nanoparticle High-Ce (cerium) polishing grade engineered to deliver approximately 10% smoother surface finishes compared to conventional products. This advancement caters to the rising demand for extreme precision in industries such as optics, semiconductors, and high-end glass manufacturing. The reduced surface roughness enhances product performance and aesthetics, positioning Solvay as a competitive leader in premium polishing solutions

- In 2023, Showa Chemical introduced a dispersion-stabilized High-Ce polishing powder designed to minimize micro-scratches by around 15% during polishing operations. This technology ensures more consistent surface quality, reducing defect rates and post-polishing rework, which can lower operational costs for end-users. Its adoption is expected to grow particularly in the production of smartphone displays and optical components, where flawless finishes are critical

- In 2023, AMG expanded its production capacity for cerium-based polishing powders by 25% to meet the growing global demand from electronics, precision glass, and automotive industries. This capacity boost supports large-scale contracts, ensures a more stable supply chain, and allows AMG to strengthen its position in key Asian and North American markets where demand growth is accelerating

- In December 2022, the innovative multifunctional polymer additive TEGO Powder Aid D01 was launched by Evonik. It makes powder coating compositions simpler to extrude by encouraging pigment wetting and significantly lowering melt viscosity. The new additive improves DOI (Distinctness of Image) on the coated surface and maximizes gloss development. In addition, TEGO Powder Aid D01 is highly adaptable since it can be used in formulations with both organic and Inorganic Pigments, including Carbon Black, and inorganic fillers and pigments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polishing Powder Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polishing Powder Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polishing Powder Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.