Global Point Of Care Hba1c Testing Market

Market Size in USD Million

CAGR :

%

USD

670.17 Million

USD

1,035.54 Million

2024

2032

USD

670.17 Million

USD

1,035.54 Million

2024

2032

| 2025 –2032 | |

| USD 670.17 Million | |

| USD 1,035.54 Million | |

|

|

|

|

Point-of-Care Hba1c Testing Market Analysis

The point-of-care HbA1c testing market is rapidly growing due to advancements in diabetes management and the increasing demand for quick, accurate testing methods. HbA1c testing is crucial for monitoring long-term blood sugar levels in diabetic patients, and its ability to provide immediate results is transforming the way healthcare providers manage diabetes. Recent technological innovations, such as the development of portable, easy-to-use devices and the integration of digital platforms for data analysis, have made these tests more accessible and efficient. Notable advancements include systems that deliver faster results with minimal sample requirements, such as those offered by companies such as Roche and Siemens Healthineers. In addition, collaborations between major players, such as HemoCue's partnership with Novo Nordisk, are expanding access to point-of-care testing in low- and middle-income countries, improving global healthcare outcomes. The market's growth is also fueled by the rising prevalence of diabetes, particularly in regions such as North America and Asia-Pacific, where healthcare access and awareness are improving. With increased investments in R&D and a growing focus on patient-centric care, the point-of-care HbA1c testing market is expected to continue expanding, contributing to better diabetes management worldwide.

Point-of-Care Hba1c Testing Market Size

The global Point-of-Care Hba1c Testing market size was valued at USD 670.17 million in 2024 and is projected to reach USD 1035.54 million by 2032, with a CAGR of 5.59% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Point-of-Care Hba1c Testing Market Trends

“Rising Adoption of Portable and User-Friendly Devices”

A key trend in the point-of-care HbA1c testing market is the rising adoption of portable and user-friendly devices, which offer rapid, accurate results for diabetes management. These devices are particularly beneficial in remote areas and low-resource settings, where access to traditional laboratories may be limited. Companies such as Roche and Siemens Healthineers are leading the charge with their innovative systems, which require minimal blood samples and provide results within minutes, making them ideal for both clinical and home-use applications. For instance, Roche’s Cobas b101 System is a compact, easy-to-use device that delivers HbA1c results with high precision, aiding in faster decision-making for healthcare providers. In addition, collaborations such as the one between HemoCue and Novo Nordisk are expanding the availability of point-of-care testing, especially in underserved regions. As the prevalence of diabetes continues to rise globally, this trend towards accessible, efficient testing is expected to drive significant growth in the market, making diabetes management more effective and timely.

Report Scope and Point-of-Care Hba1c Testing Market Segmentation

|

Attributes |

Point-of-Care Hba1c Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Bio-Rad Laboratories, Inc. (U.S.), ARKRAY, Inc. (Japan), The Menarini Group (Italy), F. Hoffmann-La Roche Ltd (Switzerland), Siemens Healthineers AG (Germany), HemoCue AB (Sweden), Trinity Biotech (Ireland), PTS Diagnostics (U.S.), Abbott (U.S.), Danaher (U.S.), SUGENTECH, Inc. (South Korea), Getein Biotech, Inc. (China), BIOMÉRIEUX (France), and EKF Diagnostics (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Point-of-Care Hba1c Testing Market Definition

Point-of-care HbA1c testing refers to diagnostic tests conducted at or near the site of patient care to measure the hemoglobin A1c (HbA1c) level, a key indicator of long-term blood glucose control in individuals with diabetes. These tests offer rapid, reliable results, allowing healthcare providers to make immediate decisions regarding the management and treatment of diabetes.

Point-of-Care Hba1c Testing Market Dynamics

Drivers

- Rising Prevalence of Diabetes

The rising prevalence of diabetes is a major driver for the point-of-care HbA1c testing market, especially in emerging markets where diabetes rates are increasing rapidly. According to the International Diabetes Federation (IDF), approximately 537 million adults were living with diabetes globally in 2021, a number expected to rise to 783 million by 2045. This growing prevalence, particularly in regions such as Asia-Pacific and Latin America, is driving the demand for accessible and efficient testing solutions. In these regions, where healthcare infrastructure may be limited, point-of-care HbA1c testing offers a vital solution, providing fast, reliable results outside of traditional clinical settings. The ability to monitor blood glucose levels in real time with minimal equipment, at lower costs, and with improved accessibility makes point-of-care testing essential for better diabetes management, especially as the global diabetes burden continues to escalate. As a result, the rising diabetes prevalence directly contributes to the market's expansion, as more individuals and healthcare providers seek out more convenient, cost-effective testing methods.

- Growing Focus on Preventive Healthcare

The growing focus on preventive healthcare is driving the point-of-care HbA1c testing market as individuals increasingly prioritize regular monitoring of their blood sugar levels to manage or prevent diabetes. With a rising awareness of the importance of early detection and proactive management, many people are now opting for more frequent testing to catch potential issues before they become serious health problems. For instance, in the U.S., programs such as the "National Diabetes Prevention Program" are promoting lifestyle changes and regular screenings to prevent the onset of type 2 diabetes. Point-of-care HbA1c testing facilitates this shift by providing immediate results, allowing individuals to track their glucose levels without the need for lab visits. This convenience is encouraging more people to monitor their health regularly, thus reducing the risk of diabetes-related complications. As a result, the increasing adoption of preventive healthcare strategies is directly boosting the demand for point-of-care testing devices, making it a key driver in the market's growth.

Opportunities

- Growing Government Initiatives and Awareness Campaigns

Government initiatives and awareness campaigns are playing a crucial role in expanding the point-of-care HbA1c testing market by promoting early diabetes diagnosis and encouraging individuals to monitor their health regularly. For instance, the "World Diabetes Day" campaign, led by the International Diabetes Federation (IDF), raises awareness about the importance of early detection and prevention of diabetes. In the U.S., programs such as "Healthy People 2030" aim to increase the number of people who are regularly screened for diabetes, which is driving demand for accessible and efficient testing methods such as point-of-care HbA1c tests. Similarly, governments in countries such as India and China are also focusing on diabetes awareness and prevention, often advocating for the use of point-of-care diagnostics to improve early detection in underserved areas. As a result, these initiatives are creating significant opportunities for market growth by encouraging broader adoption of point-of-care testing, enhancing accessibility, and supporting the prevention of diabetes-related complications.

- Increasing Technological Advancements

Technological advancements in point-of-care HbA1c testing devices are driving market growth by enhancing the accessibility, accuracy, and efficiency of diabetes monitoring. For instance, portable and user-friendly systems, such as the Abbott Afinion™ 2 and the Roche Cobas b101, offer rapid results with high accuracy, enabling healthcare providers and patients to conduct tests conveniently outside traditional clinical settings. These advancements allow for real-time monitoring, which is crucial for managing diabetes effectively and preventing complications. Moreover, innovations in miniaturization and connectivity, such as integration with mobile applications for tracking health data, are making it easier for patients to monitor their condition on a regular basis. This is particularly beneficial for those with diabetes in remote or underserved areas, where access to healthcare facilities may be limited. As technology continues to improve the usability and speed of results, it creates significant market opportunities by promoting the adoption of point-of-care HbA1c testing as a reliable tool for both diagnosis and ongoing management of diabetes.

Restraints/Challenges

- Growing Competition from Alternative Diabetes Monitoring Technologies

The point-of-care (POC) HbA1c testing market is facing growing competition from alternative diabetes monitoring technologies, particularly continuous glucose monitoring (CGM) systems. Unlike POC HbA1c tests, which provide a snapshot of a patient's average blood sugar levels over the past two to three months, CGM systems offer real-time, continuous data on glucose fluctuations throughout the day. This capability makes CGM a more attractive option for both patients and healthcare providers, especially in the management of diabetes where daily glucose monitoring is essential. For instance, devices such as the Dexcom G6 or Abbott’s FreeStyle Libre have revolutionized diabetes care by offering seamless, ongoing tracking, reducing the reliance on intermittent HbA1c tests. As a result, POC HbA1c testing, which requires periodic testing and can only reflect long-term control rather than daily fluctuations, may seem less valuable in comparison, limiting its appeal in a market that increasingly prioritizes continuous, real-time data. This shift toward CGM technologies poses a significant challenge to the growth and adoption of POC HbA1c testing, as healthcare providers and patients increasingly gravitate toward systems that provide more detailed, actionable data for diabetes management.

- Difficult Adoption in Low-Resource Settings

Adoption in low-resource settings is a significant challenge in the Point-of-Care Hba1c Testing market, despite the clear benefits these technologies offer, such as enhanced visualization and improved ergonomics for surgeons. The high cost of equipment, combined with limited infrastructure and a shortage of trained personnel, hampers the widespread adoption of these devices in underserved regions. For instance, in many low-income countries, the upfront cost of Point-of-Care Hba1c Testing can exceed the budgets of public hospitals, where essential medical supplies and equipment already take priority. In addition, the lack of technical support, maintenance facilities, and training programs makes it difficult for healthcare providers in these areas to integrate advanced surgical technologies into their practice. This is particularly problematic in rural and remote areas, where healthcare professionals may not have access to specialized training or resources to operate complex devices. As a result, even in regions where these technologies could significantly improve surgical outcomes, their adoption is limited, exacerbating the disparity in access to quality healthcare. This barrier highlights a key market challenge, underscoring the need for affordable, scalable solutions and increased support for training and infrastructure in low-resource settings.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Point-of-Care Hba1c Testing Market Scope

The market is segmented on the basis of product, technology, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Instruments

- Consumables

Technology

- ION–Exchange HPCL

- Enzymatic Assay

- Affinity Binding Chromatography

- Turbidimetric Inhibition Immunoassay

End-Users

- Hospitals

- Clinics

- Ambulatory Surgery Centres

- Others

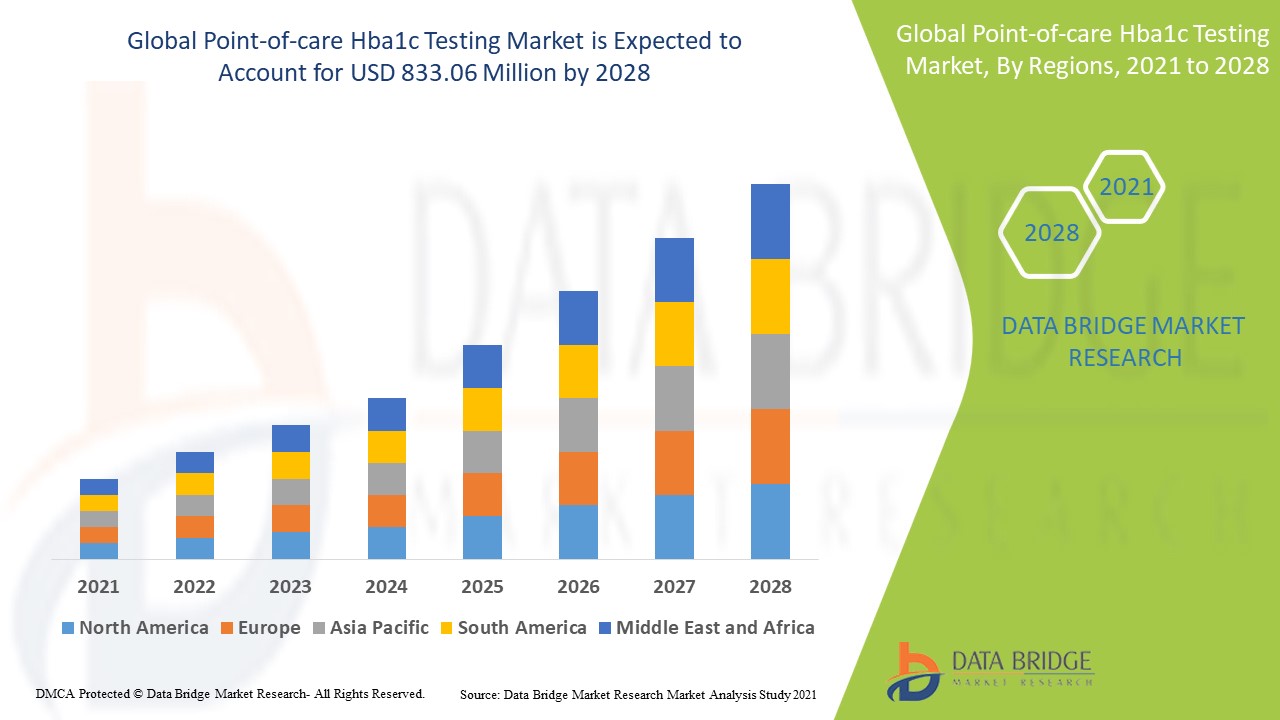

Point-of-Care Hba1c Testing Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, technology, and end-user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the point-of-care HbA1c testing market, both in terms of market share and revenue, and is expected to maintain its dominance throughout the forecast period. This growth is driven by the presence of key market players, substantial healthcare expenditure, and a growing adoption of advanced technological devices in hospitals and healthcare facilities across the region. The region’s healthcare infrastructure continues to improve, with more hospitals integrating point-of-care testing solutions for faster and more accurate results. In addition, the increasing prevalence of diabetes in North America further boosts the demand for efficient testing solutions, contributing to the market's expansion.

Asia-Pacific is anticipated to experience the highest growth rate in the point-of-care HbA1c testing market during the forecast period. This growth is attributed to the rising awareness about the importance of HbA1c testing in managing diabetes, coupled with the region’s rapidly changing lifestyles and dietary habits. The increasing prevalence of diabetes, combined with the expanding population in countries such as India and China, further accelerates the demand for more accessible and efficient testing methods. In addition, healthcare improvements and the rising adoption of advanced diagnostic technologies in emerging markets are expected to drive market expansion in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Point-of-Care Hba1c Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Point-of-Care Hba1c Testing Market Leaders Operating in the Market Are:

- Bio-Rad Laboratories, Inc. (U.S.)

- ARKRAY, Inc. (Japan)

- The Menarini Group (Italy)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- HemoCue AB (Sweden)

- Trinity Biotech (Ireland)

- PTS Diagnostics (U.S.)

- Abbott (U.S.)

- Danaher (U.S.)

- SUGENTECH, Inc. (South Korea)

- Getein Biotech, Inc. (China)

- BIOMÉRIEUX (France)

- EKF Diagnostics (U.K.)

Latest Developments in Point-of-Care Hba1c Testing Market

- In February 2024, HemoCue has partnered with Novo Nordisk to enhance point-of-care diagnostic testing for children with type 1 diabetes in low- and middle-income countries. The collaboration will deploy HemoCue HbA1c 501 Systems across 30 countries, aiming to improve diabetes management and reach 100,000 children by 2030

- In January 2024, Roche announced the acquisition of LumiraDx's point-of-care testing technology for USD 295 million, with an additional investment of up to USD 55 million to support Lumira's technology platform until the deal is finalized

- In April 2023, FIND partnered with Abbott, i-SENS Inc., and Siemens Healthineers to provide discounted point-of-care HbA1c test kits for low- and middle-income countries, focusing on improving diabetes diagnosis and management in underserved regions

- In November 2022, LumiraDx expanded the commercial reach of its HbA1c test, aiming to address diabetes management needs in various care settings. The test, run on the LumiraDx Platform, offers rapid results to support screening and monitoring, potentially improving patient outcomes

- In May 2022, Labcorp introduced an at-home collection kit for diabetes risk testing using a new device from Weavr Health. This initiative provides convenience and accessibility, enabling individuals to monitor their health status from home

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.