Global Plastic Films Market

Market Size in USD Billion

CAGR :

%

USD

101.92 Billion

USD

158.63 Billion

2024

2032

USD

101.92 Billion

USD

158.63 Billion

2024

2032

| 2025 –2032 | |

| USD 101.92 Billion | |

| USD 158.63 Billion | |

|

|

|

|

Plastic Films Market Size

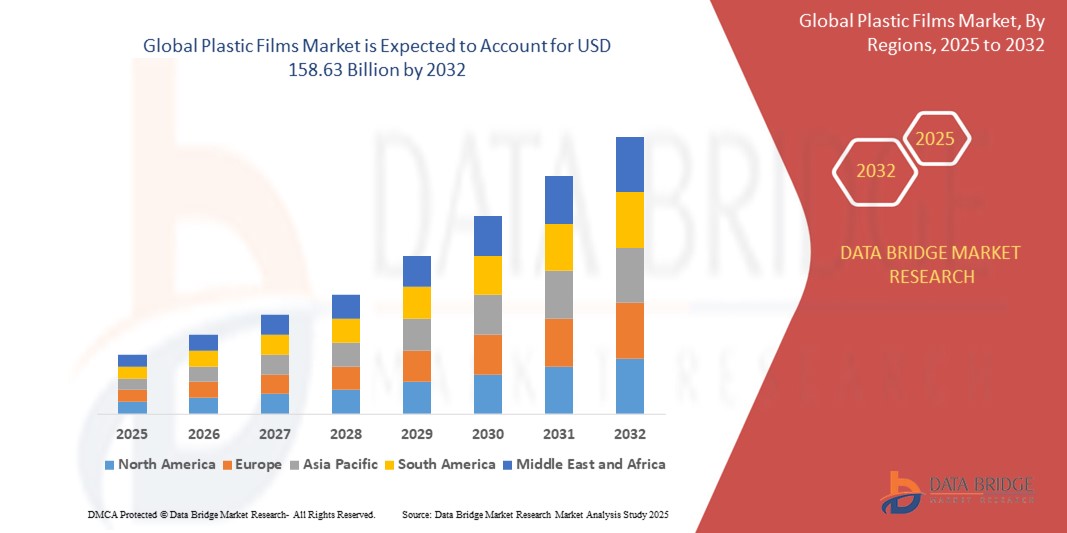

- The global plastic films market size was valued at USD 101.92 billion in 2024 and is expected to reach USD 158.63 billion by 2032, at a CAGR of 5.68% during the forecast period

- The market growth is largely fueled by increasing demand for flexible, lightweight, and sustainable packaging solutions across diverse industries such as food, pharmaceuticals, and consumer goods, which is driving widespread adoption of advanced plastic films

- Furthermore, growing environmental concerns and stringent regulations promoting biodegradable and recyclable materials are encouraging manufacturers to innovate and invest in eco-friendly film technologies, accelerating market expansion and supporting the shift toward sustainable packaging solutions

Plastic Films Market Analysis

- Plastic films, known for their versatility and lightweight properties, are increasingly essential materials across packaging, agriculture, construction, and pharmaceutical industries due to their ability to enhance product protection, shelf life, and sustainability

- The growing demand for plastic films is primarily driven by expanding end-use sectors, rising consumer preference for flexible and eco-friendly packaging, and stringent regulations encouraging the adoption of biodegradable and recyclable film technologies

- Asia-Pacific dominated the plastic films market with a share of 41% in 2024 due to expanding food packaging needs, population growth, and increasing demand for flexible packaging across FMCG, agricultural, and pharmaceutical sectors

- North America is expected to be the fastest growing region in the plastic films market during the forecast period due to increasing demand for flexible, sustainable, and high-barrier packaging across food, healthcare, and industrial sectors

- Packaging segment dominated the market with a market share of 83.3% in 2024 due to surging demand from food, beverage, and e-commerce sectors. Plastic films provide lightweight, flexible, and cost-efficient solutions with barrier properties essential for perishable goods

Report Scope and Plastic Films Market Segmentation

|

Attributes |

Plastic Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plastic Films Market Trends

“Rising Need for Convenient and Sustainable Packaging Options”

- A significant and accelerating trend in the global plastic films market is the growing emphasis on packaging solutions that offer both consumer convenience and environmental sustainability. This dual focus is reshaping material selection, design innovation, and end-use applications across industries such as food, pharmaceuticals, and personal care

- For instance, brands such as Nestlé and Unilever are increasingly using biodegradable and recyclable plastic films in their product packaging to align with environmental goals and consumer demand for sustainable choices. Water-soluble films are also gaining traction in single-use applications such as detergent pods and hygiene products

- The integration of biodegradable polymers and barrier films enables packaging that not only protects contents but also minimizes ecological impact. For example, BASF’s ecovio film-grade materials combine compostability with high-performance sealing and barrier properties, allowing manufacturers to maintain product safety without compromising sustainability

- Smart packaging innovations are enhancing convenience by incorporating resealable features, easy-tear functionality, and intelligent layers that respond to external stimuli such as temperature or humidity. These features are particularly valued in food and pharmaceutical sectors where freshness and usability are critical

- This trend is driving the development of multi-functional films that balance protective performance, sustainability, and user-friendly design. As a result, companies such as Amcor, Mondi, and Sealed Air are investing in R&D to develop new film technologies that meet evolving packaging needs while reducing environmental footprint

- The demand for plastic films that deliver on both convenience and ecological responsibility is growing rapidly across global markets as consumers, governments, and brands converge on circular economy goals and plastic reduction targets

Plastic Films Market Dynamics

Driver

“Increasing Consumer Awareness about Product Safety”

- The rising global emphasis on product integrity and contamination prevention, especially in the food, pharmaceutical, and healthcare sectors, is a significant driver for the growing demand for high-performance plastic films

- For instance, in March 2024, Berry Global partnered with a leading pharmaceutical firm to supply ultra-clean barrier films for medical packaging that ensure sterility and extend shelf life. Such initiatives highlight how safety-focused innovations in plastic films are gaining prominence across regulated industries

- As consumers become increasingly cautious about hygiene, tamper evidence, and contamination risks, manufacturers are turning to multi-layered plastic films that provide effective barriers against oxygen, moisture, UV light, and microbes—critical for safeguarding product quality

- Moreover, plastic films with anti-microbial coatings and improved sealing properties are enhancing consumer trust by offering visible indicators of tampering or spoilage. These features are particularly relevant in perishable food items and medical device packaging

- The growing demand for packaging materials that prioritize health and safety is accelerating innovation and investment in plastic films, particularly in sectors where cleanliness, shelf stability, and product authenticity are paramount

Restraint/Challenge

“Rising Environmental Concerns over Plastic Waste”

- Rising global scrutiny over the environmental footprint of single-use plastics, including films, poses a significant challenge to the broader growth of the plastic films market. Growing awareness about plastic pollution in oceans, landfills, and ecosystems is prompting consumers, regulators, and industries to reassess their reliance on conventional plastic films

- For instance, the European Union’s directive on single-use plastics and extended producer responsibility laws in countries such as Canada and India have led to increased pressure on manufacturers to reduce plastic usage or switch to alternatives

- Addressing these environmental concerns requires a transition toward recyclable, compostable, or biodegradable film options. However, these alternatives often come with higher production costs, lower performance under certain conditions, and limited industrial composting infrastructure, making large-scale adoption difficult

- Furthermore, confusion among consumers about what constitutes “recyclable” plastic, along with inconsistent recycling systems across regions, undermines efforts to manage plastic film waste effectively. Inadequate waste segregation often leads to contamination, making recycling efforts less efficient

- Overcoming this challenge will require strong collaboration among stakeholders, including packaging manufacturers, governments, recyclers, and consumers, to create sustainable end-of-life solutions, enforce eco-friendly regulations, and educate the public about responsible plastic film disposal

Plastic Films Market Scope

The market is segmented on the basis of technology, polymer type, and end-use industry.

• By Technology

On the basis of technology, the plastic films market is segmented into nanocomposites, water-soluble films, biodegradable films, and barrier polymer films. The barrier polymer films segment accounted for the largest market revenue share in 2024, owing to their superior performance in moisture and gas barrier protection, which is critical in food, pharmaceutical, and industrial packaging. These films enhance shelf life and product safety, making them indispensable in high-performance packaging applications.

The biodegradable films segment is projected to witness the fastest CAGR from 2025 to 2032, driven by growing environmental concerns, regulatory pressures, and the rising demand for sustainable packaging. These films are increasingly adopted in agriculture, food packaging, and retail sectors as eco-friendly alternatives to conventional plastics, especially in regions with strict single-use plastic bans.

• By Polymer Type

On the basis of polymer type, the plastic films market is segmented into polyethylene films, polypropylene films, polyvinyl chloride films, polyester or polyethylene terephthalate, barrier polymers, and biodegradable polymers. The polyethylene films segment held the largest market share in 2024, attributed to their widespread use in packaging, agriculture, and construction due to flexibility, durability, and cost-effectiveness. LDPE and HDPE variants dominate consumer and industrial packaging applications globally.

Biodegradable polymers are anticipated to witness the fastest CAGR from 2025 to 2032, spurred by increased consumer demand for sustainable materials and supportive legislation. These polymers, derived from renewable sources such as starch and PLA, are gaining traction in compostable packaging, medical products, and agricultural mulch films.

• By End Use Industry

On the basis of end use industry, the plastic films market is segmented into packaging, consumer goods, construction, pharmaceutical, electrical, and others. The packaging segment accounted for the largest market revenue share of 83.3% in 2024, driven by surging demand from food, beverage, and e-commerce sectors. Plastic films provide lightweight, flexible, and cost-efficient solutions with barrier properties essential for perishable goods.

The pharmaceutical industry is expected to witness the fastest CAGR from 2025 to 2032, owing to stringent quality standards, rising global health awareness, and the demand for high-barrier and tamper-evident packaging. Films used in blister packs, sachets, and sterile wrapping are crucial for preserving drug efficacy and safety.

Plastic Films Market Regional Analysis

- Asia-Pacific dominated the plastic films market with the largest revenue share of 41% in 2024, driven by expanding food packaging needs, population growth, and increasing demand for flexible packaging across FMCG, agricultural, and pharmaceutical sectors

- The region’s booming e-commerce industry, low-cost manufacturing base, and rising adoption of biodegradable and high-barrier films are key contributors to market expansion

- In addition, supportive government initiatives for sustainable materials, investment in modern extrusion technologies, and availability of raw materials are strengthening the market across key countries including China, India, and Southeast Asia.

Japan Plastic Films Market Insight

Japan’s plastic films market is growing steadily due to strong demand for high-performance packaging in electronics, food, and pharmaceuticals. The country's emphasis on product quality, hygiene, and precision drives innovation in multilayer and functional films. Local manufacturers are investing in eco-friendly materials and advanced recycling technologies to comply with national sustainability goals and circular economy policies.

China Plastic Films Market Insight

China held the largest share in the Asia-Pacific plastic films market in 2024, owing to its massive packaging, agriculture, and construction sectors. The government’s push toward green packaging, along with increasing exports of packaged food and electronics, is fueling demand. Major domestic players are scaling up production of biodegradable films and high-barrier materials to serve both domestic and international markets.

Europe Plastic Films Market Insight

Europe’s plastic films market is expected to grow at a steady pace, driven by stringent regulations promoting recyclable and compostable films, particularly in packaging applications. Growing consumer awareness, demand for low-carbon materials, and government mandates on single-use plastics are shaping the industry, especially in Western Europe. The region is at the forefront of innovation in multilayer barrier films and advanced recycling technologies, with strong demand from food, personal care, and pharmaceutical sectors.

U.K. Plastic Films Market Insight

U.K. market is showing notable growth, spurred by sustainability-driven packaging reforms and the rise of eco-conscious consumers. Government initiatives targeting plastic reduction and recycling are prompting companies to adopt biodegradable and recyclable film formats. Growth in private-label food and beverage brands and investment in circular supply chains are supporting long-term market demand.

Germany Plastic Films Market Insight

Germany’s plastic films market is expanding steadily, supported by a mature packaging industry, technological leadership, and robust recycling infrastructure. Increasing demand for high-barrier and antimicrobial films in food and pharma packaging is shaping product development. The country’s strong sustainability culture and shift toward green materials continue to drive innovation and adoption of biodegradable polymers.

North America Plastic Films Market Insight

North America’s plastic films market is projected to grow at the fastest CAGR from 2025 to 2032, fueled by increasing demand for flexible, sustainable, and high-barrier packaging across food, healthcare, and industrial sectors. Rising consumer preference for lightweight, portable packaging and the expansion of retail-ready packaging formats are boosting usage. The market also benefits from innovation in bio-based films, strong environmental regulations, and demand from the booming meal-kit and plant-based food industries.

U.S. Plastic Films Market Insight

U.S. accounted for the largest revenue share in North America in 2024, backed by strong adoption in food packaging, agriculture, and healthcare. Increasing focus on sustainability is encouraging the shift toward compostable and recyclable films. Major manufacturers are enhancing R&D efforts to meet evolving consumer and regulatory expectations around packaging performance and environmental impact.

Plastic Films Market Share

The plastic films industry is primarily led by well-established companies, including:

- Amcor PLC (Australia)

- Jindal Poly Films Limited (India)

- Mitsubishi Chemical Corporation (Japan)

- Novolex (U.S.)

- RKW Group (Germany)

- Sealed Air Corporation (U.S.)

- Dow Inc. (U.S.)

- Toray Industries, Inc. (Japan)

- Toyobo Co., Ltd. (Japan)

- UFlex Limited (India)

- DuPont (U.S.)

- Berry Global Inc. (U.S.)

- Innovia Films (U.K.)

- Klöckner Pentaplast (Germany)

- SINOPEC SHANGHAI PETROCHEMICAL COMPANY LIMITED (China)

- Treofan Group (Germany)

- Vibac S.p.A. (Italy)

- POLYPLEX (India)

- Inteplast Group (U.S.)

- Exxon Mobil Corporation (U.S.)

Latest Developments in Global Plastic Films Market

- In October 2022, Sukano and chemicals manufacturer Emery Oleochemicals collaborated to develop a transparent PET antifogging compound tailored for food contact PET packaging. This initiative aims to eliminate the need for additional antifogging coatings. The compound, designed for use in rigid and oriented Coex films, incorporates Sukano's co-polyester compound as one cap layer in a film extrusion line A/B structure, with PET serving as the core layer

- In June 2022, Innovia Films introduced RayoWrap CMS transparent BOPP film, specifically for shrink and wraparound label applications. Produced at its UK facility, CMS30 offers high shrinkage capabilities. The film's technical performance ensures suitability throughout the packaging value chain, from ease of printing and high-speed roll-fed wraparound labeling to effective end-of-life management and recycling processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastic Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastic Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastic Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.