Global Plant Based Beverages Market

Market Size in USD Billion

CAGR :

%

USD

22.36 Billion

USD

46.45 Billion

2024

2032

USD

22.36 Billion

USD

46.45 Billion

2024

2032

| 2025 –2032 | |

| USD 22.36 Billion | |

| USD 46.45 Billion | |

|

|

|

|

Plant-Based Beverages Market Size

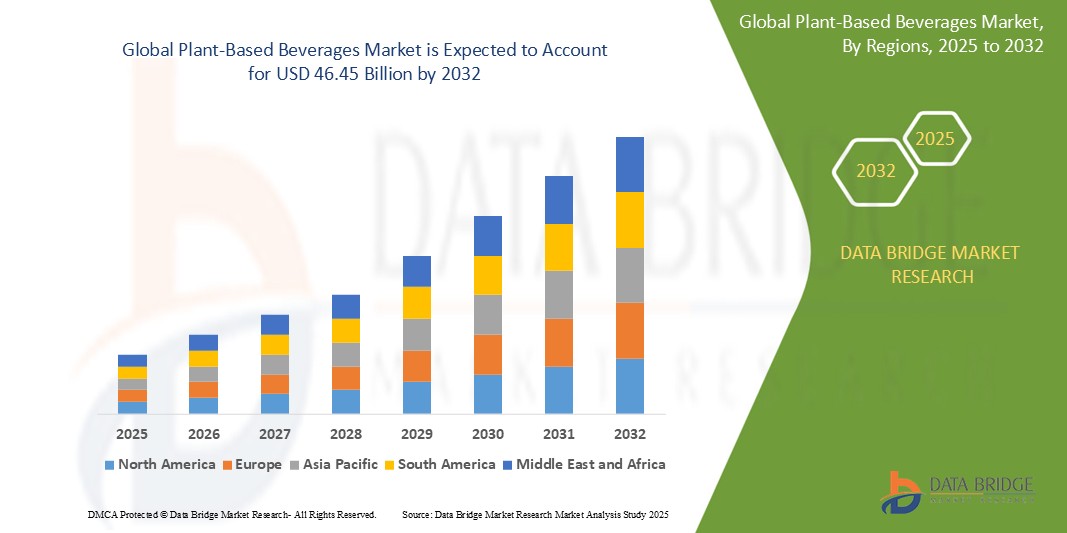

- The global plant-based beverages market size was valued at USD 22.36 billion in 2024 and is expected to reach USD 46.45 billion by 2032, at a CAGR of 9.57% during the forecast period

- The market growth is largely fuelled by the rising consumer demand for dairy alternatives, driven by increasing health consciousness, the prevalence of lactose intolerance, and a growing shift toward vegan and flexitarian lifestyles

- Moreover, sustainability concerns and the environmental impact of animal agriculture have encouraged both consumers and producers to embrace plant-based options. Innovations in taste, texture, and nutritional content have also contributed to the accelerated adoption of plant-based beverages globally

Plant-Based Beverages Market Analysis

- The plant-based beverages market is experiencing robust growth, driven by consumer demand for healthier and more sustainable alternatives to traditional dairy products. This shift is reflected in the increasing popularity of plant-based drinks such as oat milk, which has become the most preferred plant-based milk in many markets

- Innovations in product development, such as the introduction of new flavours and fortified varieties with added vitamins and minerals, are enhancing consumer appeal and expanding the market. In addition, partnerships between beverage companies and food service providers are broadening the availability of plant-based options in cafes, restaurants, and supermarkets worldwide

- Asia-Pacific plant-based beverages market accounted for the largest market revenue share of 67.2% in 2024. This dominance is primarily driven by rapid urbanization, rising disposable incomes, and increasing health and dietary awareness across key countries such as China, Japan, and India. The region's large population base and growing preference for dairy alternatives also contribute significantly.

- North America is expected to witness the fastest growth rate in 2024, simultaneously holding a significant market share of 29.9% in the plant-based beverage market. This rapid expansion is fuelled by a well-established health and wellness trend, high consumer adoption of plant-based lifestyles, and continuous product innovation from leading brands in the region

- The soy beverage segment dominates the plant-based beverages market with the largest revenue share of 38.9% in 2024, driven by its similar advantages to dairy milk, including being a good source of protein, vitamin A, vitamin B-12, potassium, and isoflavones. The widespread consumption of soy milk globally contributes to its market leadership

Report Scope and Plant-Based Beverages Market Segmentation

|

Attributes |

Plant-Based Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plant-Based Beverages Market Trends

“Rise of Functional Plant-Based Beverages”

- Functional plant-based beverages are gaining popularity as consumers seek drinks that offer additional health benefits beyond basic nutrition

- For instance, almond and oat milk are now available with added calcium and vitamin D to support bone health

- Brands are innovating by incorporating unique ingredients such as adaptogens and superfoods to enhance the functional appeal of their products

- For instance, beverages infused with turmeric are marketed for anti-inflammatory benefits, while matcha-based drinks are promoted for their antioxidant properties

- The demand for functional beverages is also driven by lifestyle trends focusing on wellness and preventive health care

- The convenience of ready-to-drink formats makes functional plant-based beverages an attractive option for busy individuals

- As the market evolves, companies are expected to continue exploring innovative formulations to meet the growing consumer interest in health-enhancing beverages

Plant-Based Beverages Market Dynamics

Driver

“Growing Health Consciousness and Dietary Shifts”

- Increasing health consciousness among consumers is driving a major shift from animal-based products to plant-based beverages

- For instance, many people are switching to almond or oat milk to avoid cholesterol and reduce risks linked to cardiovascular diseases

- Plant-based beverages are perceived as healthier, offering essential nutrients such as fiber, vitamins, and antioxidants with fewer calories and fats

- For instance, soy milk is often chosen for its high protein content while being lower in saturated fat compared to cow's milk

- The rise of vegan, vegetarian, and flexitarian lifestyles is contributing to the popularity of plant-based drinks

- The widespread availability of plant-based options in supermarkets, cafes, and restaurants makes it easier for consumers to make health-focused choices

- Social media and influencer marketing are playing a key role in spreading awareness and normalizing plant-based choices, especially among younger generations

Restraint/Challenge

“High Cost and Limited Accessibility”

- One of the major challenges in the plant-based beverages market is the high cost of production and retail pricing compared to traditional dairy

- For instance, almond and oat milk are often priced significantly higher than regular cow’s milk due to specialized processing and premium ingredients

- The need for advanced techniques and quality raw materials increases manufacturing costs, which are passed on to consumers

- For instance, producing smooth and shelf-stable plant-based milk requires equipment and additives not used in basic dairy production

- Limited accessibility in rural and underdeveloped areas restricts market growth, as distribution networks and awareness remain low

- Cultural preferences and scepticism around taste and nutrition present further barriers to adoption in regions with strong dairy traditions

- Inconsistent labelling and lack of standard product definitions can confuse consumers and reduce trust in plant-based beverage health claims

Plant-Based Beverages Market Scope

The Global plant-based beverages market is segmented on the basis of type, function, product, packaging, and sales channel.

- By Type

On the basis of type, the plant-based beverages market is segmented into soy, coconut, almond, oat, and others. The soy beverage segment dominates the plant-based beverages market with the largest revenue share of 38.9% in 2024, driven by its similar advantages to dairy milk, including being a good source of protein, vitamin A, vitamin B-12, potassium, and isoflavones. The widespread consumption of soy milk globally contributes to its market leadership.

The almond milk segment is expected to witness the fastest growth rate in the plant-based beverage market, appealing to a broad audience, including those with lactose intolerance, dairy allergies, and vegans, due to its accessibility and versatility. The Coconut milk market is also experiencing significant growth. The Oat segment is growing at a high rate.

- By Function

On the basis of function, the plant-based beverages market is segmented into cardiovascular health, cancer prevention, bone health, lactose free alternative, and others. The lactose-free alternative segment held the largest share in 2024 and is expected to witness the fastest growth rate from 2025 to 2032. This is driven by the increasing global prevalence of lactose intolerance and consumers seeking suitable dairy alternatives.

The Cardiovascular Health segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer awareness of heart health. This growth is further propelled by scientific studies highlighting the benefits of plant-based diets in reducing cholesterol and blood pressure. Consumers are actively seeking beverages that naturally support heart health, often enriched with ingredients such as oats or nuts that are known for their cardiovascular benefits, making these products a key part of preventative health strategies.

- By Product

On the basis of product, the plant-based beverages market is segmented into plain and flavored. The plain beverages segment dominates the plant-based beverages market with the largest revenue share of 70.8% in 2024, driven by consumers who prefer simplicity and fundamental plant-based milk features, making it a versatile option for culinary uses and as a dairy milk substitute. Its neutral taste profile allows it to blend seamlessly into coffee, tea, cereals, and a wide array of recipes without altering the core flavor of the dish. This adaptability makes plain plant-based milks a staple for health-conscious consumers and those integrating plant-based options into their daily cooking and baking.

The flavored segment is expected to witness the fastest growth rate in 2024, driven by increasing consumer demand for diversified taste experiences, the continuous introduction of new and exciting flavors by manufacturers, and the appeal of masking the inherent taste of some plant bases. This growth is also fuelled by their popularity in ready-to-drink formats and as ingredients in smoothies and shakes, appealing to a broader consumer base seeking indulgence alongside plant-based benefits.

- By Packaging

On the basis of packaging, the plant-based beverages market is segmented into glass bottles, plastic bottles and pouches, carton, and cans. While specific market share data for plant-based beverage packaging types are limited, the overall beverage packaging market indicates that the plastic segment holds the largest share due to its versatility, cost-effectiveness, and lightweight properties.

The carton segment is expected to witness the fastest growth rate, driven by its excellent barrier properties that extend shelf life and its eco-friendly perception among consumers, often being made from renewable resources. Furthermore, glass packaging is emerging as a fast-growing category due to its premium appeal and recyclability, attracting environmentally conscious consumers and brands aiming for a more sustainable and high-end image for their products.

- By Sales Channel

On the basis of sales channel, the plant-based beverages market is segmented into hypermarkets/supermarkets, convenience stores, independent small groceries, specialty stores, and online retailers. Hypermarkets/Supermarkets are pivotal distribution channels, offering a wide range of brands and product varieties under one roof, providing convenience, accessibility, and competitive pricing for consumers.

The online retail segment is expected to witness the fastest growth rate, driven by the accelerated adoption of online platforms for purchases. This channel offers unparalleled convenience, allowing consumers to browse a wider selection of products, compare prices, and receive direct-to-door delivery, which has been particularly bolstered by shifting consumer habits towards e-commerce.

Plant-Based Beverages Market Regional Analysis

- The Asia-Pacific plant-based beverages market accounted for the largest market revenue share of 67.2% in 2024, driven by increasing urbanization, rising disposable incomes, and a growing awareness of health and dietary concerns in countries such as China, Japan, and India

- The region's high prevalence of lactose intolerance naturally predisposes a large population to dairy alternatives

- Furthermore, cultural shifts, aggressive marketing by international and local brands, and continuous product diversification are expanding the affordability and accessibility of plant-based beverages to a wider consumer base

Japan Plant-Based Beverages Market Insight

The Japan plant-based beverages market is expected to witness the fastest growth rate from 2025-2032 for plant-based milk, due to the country’s increasing health consciousness, high rates of urbanization, and demand for convenient and nutritious food options. The Japanese market places a significant emphasis on product quality and subtle flavors, and the adoption of plant-based beverages is driven by the growing number of health-conscious consumers and the diversification of dietary preferences. The integration of plant-based milks into traditional Japanese diets and cafes, alongside innovative product development, is fuelling growth.

China Plant-Based Beverages Market Insight

The China plant-based beverages market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and high rates of health and wellness awareness. China stands as one of the largest and fastest-growing markets for plant-based products, with plant-based beverages becoming increasingly popular due to concerns about lactose intolerance and a general shift towards healthier lifestyles. The strong presence of domestic manufacturers and a robust e-commerce landscape offering diverse and affordable plant-based options are key factors propelling the market in China.

North America Plant-Based Beverages Market Insight

North America is expected to witness the fastest growth rate in 2024, simultaneously holding a significant market share 29.9%, with its plant-based beverage market in 2024. This growth is driven by a well-established health and wellness trend, high consumer awareness of plant-based diets, and a strong preference for sustainable and ethical food choices. Consumers in the region are increasingly prioritizing plant-based options due to concerns about lactose intolerance, dairy allergies, and environmental impact. This widespread adoption is further supported by the diverse availability of plant-based beverage types, continuous product innovation, and effective marketing by major brands.

U.S. Plant-Based Beverages Market Insight

The U.S. plant-based beverages market captured a substantial revenue share within North America in 2024, fuelled by the accelerating shift in dietary preferences toward healthier and more sustainable alternatives. Consumers are increasingly embracing plant-based options for their perceived health benefits, such as lower cholesterol and fat content, as well as their alignment with vegan and flexitarian lifestyles. The robust growth of e-commerce platforms and the expanding availability of plant-based beverages in mainstream retail channels are further propelling market expansion across the nation.

Europe Plant Based Beverages Market Insight

The Europe plant-based beverages market is expected to witness the fastest growth rate in 2024, primarily driven by growing health consciousness, increasing concerns about environmental sustainability, and a rising number of consumers adopting flexitarian, vegetarian, and vegan diets. The region benefits from strong regulatory support for plant-based product labelling and a diverse culinary landscape that readily integrates plant-based alternatives. European consumers are actively seeking healthier, lactose-free options, contributing to significant growth across various product categories.

U.K. Plant-Based Beverages Market Insight

The U.K. plant-based beverages market is expected to witness the fastest growth rate from 2025-2032, driven by a rapid rise in veganism and a strong consumer demand for innovative and sustainable food products. Escalating health awareness and concerns over animal welfare are encouraging consumers to switch to dairy-free alternatives. The U.K.'s robust retail infrastructure, coupled with an increasing number of plant-based product launches and widespread availability in supermarkets, is expected to continue to stimulate market growth.

Germany Plant-Based Beverages Market Insight

The Germany plant-based beverages market is expected to expand at a considerable CAGR during the forecast period, fuelled by increasing consumer awareness of the health and environmental benefits of plant-based diets. Germany’s plant-based food market, the largest in Europe with Euro 2.2 billion in 2023 sales for plant-based foods, strongly supports the adoption of plant-based beverages. The integration of these beverages into daily consumption patterns, from breakfast to coffee, and the growing availability of diverse options, are key factors driving the market in Germany.

Plant-Based Beverages Market Share

The plant-based beverages industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- Abbott (U.S.)

- DSM (Netherlands)

- DuPont (U.S.)

- Amway (U.S.)

- The Nature's Bounty Co. (U.S.)

- GlaxoSmithKline plc. (U.K.)

- Nestlé SA (Switzerland)

- RiceBran Technologies (U.S.)

- Mead Johnson & Company, LLC. (U.S.)

- Medifast, Inc. (U.S.)

- Premier Nutrition Corporation (U.S.)

- TOOTSI IMPEX Inc. (Canada)

- U.S. Spice Mills, Inc. (U.S.)

- Health Food Manufacturers' Association (U.K.)

- NOW Foods (U.S.)

- Glanbia PLC (Ireland)

- Herbalife International of America, Inc. (U.S.)

- Bionova (India)

Latest Developments in Global Plant-Based Beverages Market

- In December 2022, Danone introduced a new Dairy & Plants Blend infant formula to cater to the rising demand for vegetarian, flexitarian, and plant-based feeding options. This innovation is designed to meet infants' nutritional needs while aligning with modern dietary preferences. The launch strengthens Danone’s position as a leader in offering inclusive, health-focused nutrition solutions and supports the growing shift toward plant-based diets in early childhood nutrition

- In September 2022, Vita Coco expanded its product portfolio by launching One Ready-To-Drink juice, reflecting a move toward convenience-driven, health-oriented beverages. This development caters to the needs of on-the-go consumers seeking nutritious and hydrating options. It reinforces Vita Coco’s standing in the health beverage space and supports the broader trend of functional and ready-to-consume plant-based drinks

- In June 2021, Plant Veda launched a vegan version of lassi made from cashews and real fruits, enriched with probiotics and free from cane sugar. This innovative dairy alternative appeals to health-conscious consumers looking for flavorful, gut-friendly beverages. The launch enhances Plant Veda’s presence in the plant-based market by offering culturally diverse and nutritious options

- In February 2021, Heartbest Foods rolled out its plant-based milk across Mexico, offering plain and quinoa flavors, including a sugar-free option. This product launch addresses consumer demand for healthier milk alternatives and introduces unique flavor profiles. It helps Heartbest capture attention in the growing plant-based beverage market and supports the shift toward more nutritious and diverse plant-based choices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PLANT-BASED BEVERAGES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PLANT-BASED BEVERAGES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PLANT-BASED BEVERAGES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 IMPORT-EXPORT SCENARIO

5.3 PRIVATE LABEL VS BRAND ANALYSIS

5.4 SHOPPING BEHAVIOUR AND DYNAMICS

5.4.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.4.2 RESEARCH

5.4.3 IMPULSIVE

5.4.4 ADVERTISEMENT

5.4.4.1. TELEVISION ADVERTISEMENT

5.4.4.2. ONLINE ADVERTISEMENT

5.4.4.3. IN-STORE ADVERTISEMENT

5.4.4.4. OUTDOOR ADVERTISEMENT

5.5 PROMOTIONAL ACTIVITIES

5.6 NEW PRODUCT LAUNCH STRATEGY

5.6.1 NUMBER OF NEW PRODUCT LAUNCH

5.6.1.1. LINE EXTENSTION

5.6.1.2. NEW PACKAGING

5.6.1.3. RE-LAUNCHED

5.6.1.4. NEW FORMULATION

5.6.2 DIFFERNTIAL PRODUCT OFFERING

5.6.3 MEETING CONSUMER REQUIREMENT

5.6.4 PACKAGE DESIGNING

5.6.5 PRICING ANALYSIS

5.6.6 PRODUCT POSITIONING

5.7 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

5.8 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 NEW PRODUCT LAUNCHES

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 SUPPLY CHAIN ANALYSIS

11.1 OVERVIEW

11.2 LOGISTIC COST SCENARIO

11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

12 CLIMATE CHANGE SCENARIO

12.1 ENVIRONMENTAL CONCERNS

12.2 INDUSTRY RESPONSE

12.3 GOVERNMENT’S ROLE

12.4 ANALYST RECOMMENDATIONS

13 GLOBAL PLANT-BASED BEVERAGES MARKET , BY TYPE , 2018-2032, (USD MILLION) (MARKET VOLUME)

(ASP, VALUE AND VOLUME WILL BE PROVIDED FOR ALL THE SEGMENTS)

13.1 OVERVIEW

13.2 PLANT-BASED MILK

13.2.1 ALMOND MILK

13.2.1.1. ALMOND MILK , BY TYPE

13.2.1.1.1. HOMEMADE

13.2.1.1.2. SHELF-STABLE

13.2.1.1.3. REFRIGERATED

13.2.1.2. ALMOND MILK, BY FORMULATION

13.2.1.2.1. SWEETENED

13.2.1.2.2. UNSWEETENED

13.2.2 COCONUT MILK

13.2.2.1. COCONUT MILK, BY TYPE

13.2.2.1.1. FULL FAT COCONUT MILK

13.2.2.1.2. LITE COCONUT MILK

13.2.2.1.3. REFRIGERATOR COCUNUT MILK

13.2.2.1.4. OTHERS

13.2.2.2. COCONUT MILK, BY FORMULATION

13.2.2.2.1. SWEETENED

13.2.2.2.2. UNSWEETENED

13.2.3 CASHEW MILK

13.2.3.1. CASHEW, BY TYPE

13.2.3.1.1. DESSERT WHOLES

13.2.3.1.2. SCORCHED WHOLES

13.2.3.1.3. WHITE WHOLES

13.2.3.1.4. OTHERS

13.2.3.2. CASHEW MILK, BY FORMULATION

13.2.3.2.1. SWEETENED

13.2.3.2.2. UNSWEETENED

13.2.4 WALNUT MILK

13.2.4.1. WALNUT, BY TYPE

13.2.4.1.1. BLACK WALNUT

13.2.4.1.2. BUTTERNUT

13.2.4.1.3. ENGLISH WALNUT

13.2.4.2. WALNUT MILK, BY FORMULATION

13.2.4.2.1. SWEETENED

13.2.4.2.2. UNSWEETENED

13.2.5 HAZELNUT MILK

13.2.5.1. HAZELNUT, BY TYPE

13.2.5.1.1. HYBRID HAZELNUT

13.2.5.1.2. BEAKED HAZELNUT

13.2.5.2. HAZELNUT MILK, BY FORMULATION

13.2.5.2.1. SWEETENED

13.2.5.2.2. UNSWEETENED

13.2.6 SOY MILK

13.2.6.1. SOY MILK, BY FORMULATION

13.2.6.1.1. SWEETENED

13.2.6.1.2. UNSWEETENED

13.2.7 OAT MILK

13.2.7.1. OAT MILK, BY FORMULATION

13.2.7.1.1. SWEETENED

13.2.7.1.2. UNSWEETENED

13.2.8 RICE MILK

13.2.8.1. RICE MILK, BY FORMULATION

13.2.8.1.1. SWEETENED

13.2.8.1.2. UNSWEETENED

13.2.9 FLAX MILK

13.2.9.1. FLAX MILK, BY FORMULATION

13.2.9.1.1. SWEETENED

13.2.9.1.2. UNSWEETENED

13.2.10 OTHERS

13.3 LEMONADE

13.3.1 LEMONADE, BY TYPES

13.3.1.1. PLAIN LEMONADE

13.3.1.2. MINTY LEMONADE

13.3.1.3. FRUITS LEMONADE

13.3.1.3.1. FRUITS LEMONADE, BY TYPES

13.3.1.3.2. MANFGO LEMONADE

13.3.1.3.3. PINEAPPLE LEMONADE

13.3.1.3.4. BLUE BERRY LEMONADE

13.3.1.3.5. BLACK BERRY LEMONADE

13.3.1.3.6. OTHERS

13.4 NECTOR DRINKS

13.4.1 NECTOR DRINKS, BY FLAVOUR

13.4.1.1.1. MANGO

13.4.1.1.2. LITCHI

13.4.1.1.3. APPLE

13.4.1.1.4. GUVAVA

13.4.1.1.5. MIX FRUIT

13.4.1.1.6. OTHERS

13.5 ENERGY /SPORTS DRINKS

13.5.1 ENERGY DRINKS,BY FLAVOUR

13.5.1.1. MANGO FLAVOR

13.5.1.2. SARSI FLAVOR

13.5.1.3. GRAPE FLAVOR

13.5.1.4. NONI FLAVOR

13.5.1.5. BASIL SEED FLAVOR

13.5.1.6. COCONUT FLAVOR

13.6 JUICES

13.6.1 JUICEA, BY TYPES

13.6.1.1. VEGETABLE JUICES

13.6.1.1.1. VEGETABLE JUICES ,BY TYPE

13.6.1.1.1.1 BEET JUICE

13.6.1.1.1.2 CABBAGE JUICE

13.6.1.1.1.3 CARROT JUICE

13.6.1.1.1.4 WATER MELON JUICE

13.6.1.1.1.5 OTHERS

13.6.1.2. FRUIT JUICES

13.6.1.2.1. FRUIT JUICES,BY TYPES

13.6.1.2.1.1 ORANGE JUICE

13.6.1.2.1.2 APPLE JUICE

13.6.1.2.1.3 GRAPE JUICE

13.6.1.2.1.4 PINEAPPLE JUICE

13.6.1.2.1.5 OTHERS

13.7 OTHERS(SHAKES AND NOGS)

14 GLOBAL PLANT-BASED BEVERAGES MARKET, BY SOURCE, 2018-2032, (USD MILLION)

14.1 OVERVIEW

14.2 ALMOND

14.3 COCONUT

14.4 CASHEW

14.5 WALNUT

14.6 HAZELNUT

14.7 SOY

14.8 OAT

14.9 RICE

14.1 FLAX

14.11 OTHERS

15 GLOBAL PLANT-BASED BEVERAGES MARKET, BY CATEGORY, 2018-2032, (USD MILLION)

15.1 OVERVIEW

15.2 ORGANIC

15.3 CONVENTIONAL

16 GLOBAL PLANT-BASED BEVERAGES MARKET, BY FLAVOR , 2018-2032, (USD MILLION)

16.1 OVERVIEW

16.2 ORIGINAL/UNFLAVORED

16.3 FLAVORED

17 GLOBAL PLANT-BASED BEVERAGES MARKET, BY PRODUCT TYPE , 2018-2032, (USD MILLION)

17.1 OVERVIEW

17.2 REFRIGERATED

17.3 SHELF-STABLE

18 GLOBAL PLANT-BASED BEVERAGES MARKET, BY FORMULATION , 2018-2032, (USD MILLION)

18.1 OVERVIEW

18.2 SWEETENED

18.3 UNSWEETENED

19 GLOBAL PLANT-BASED BEVERAGES MARKET, BY FORTIFICATION , 2018-2032, (USD MILLION)

19.1 OVERVIEW

19.2 REGULAR

19.3 FORTIFIED

20 GLOBAL PLANT-BASED BEVERAGES MARKET, BY PRICE RANGE , 2018-2032, (USD MILLION)

20.1 OVERVIEW

20.2 MASS

20.3 PREMIUM

20.4 LUXURY

21 GLOBAL PLANT-BASED BEVERAGES MARKET, BY CLAIM , 2018-2032, (USD MILLION)

21.1 OVERVIEW

21.2 REGULAR

21.3 GLUTEN FREE

21.4 NUT FREE

21.5 SOY FREE

21.6 ARTIFICIAL PRESERAVTIVES & COLOR FREE

21.7 OTHERS

22 GLOBAL PLANT-BASED BEVERAGES MARKET, BY PACKAGING TYPE , 2018-2032, (USD MILLION)

22.1 OVERVIEW

22.2 BOTTLES

22.2.1 BOTTLES, BY TYPE

22.2.1.1. GLASS

22.2.1.2. PLASTICS

22.2.1.3. OTHERS

22.3 CAN

22.4 PACKETS

22.5 OTHERS

23 GLOBAL PLANT-BASED BEVERAGES MARKET, BY PACKAGING SIZE , 2018-2032, (USD MILLION)

23.1 OVERVIEW

23.2 LESS THAN 100 ML

23.3 100 TO 250 ML

23.4 250 TO 500 ML

23.5 500 TO 750 ML

23.6 750 TO 1000 ML

23.7 MORE THAN 1000 ML

24 GLOBAL PLANT-BASED BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032, (USD MILLION)

24.1 OVERVIEW

24.2 STORE-BASED RETAILERS

24.2.1 GROCERY RETAILERS

24.2.2 MODERN GROCERY RETAILERS

24.2.3 CONVENIENCE STORES

24.2.4 DISCOUNTERS STORES

24.2.5 FORECOURT RETAILERS

24.2.6 HYPERMARKETS/ SUPERMARKETS

24.2.7 TRADITIONAL GROCERY STORES

24.2.8 INDEPENDENT SMALL GROCERS STORES

24.2.9 OTHERS

24.3 NON-STORE RETAILERS

24.3.1 ONLINE

24.3.1.1. COMPANY OWNED WEBSITES

24.3.1.2. E-COMMERCE WEBSITES

24.3.2 VENDING MACHINE

25 GLOBAL PLANT-BASED BEVERAGES MARKET, BY REGION, 2018-2032 (USD MILLION) (MARKET VOLUME)

GLOBAL PLANT-BASED BEVERAGES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

25.1 NORTH AMERICA

25.1.1 U.S.

25.1.2 CANADA

25.1.3 MEXICO

25.2 EUROPE

25.2.1 GERMANY

25.2.2 U.K.

25.2.3 ITALY

25.2.4 FRANCE

25.2.5 SPAIN

25.2.6 SWITZERLAND

25.2.7 NETHERLANDS

25.2.8 BELGIUM

25.2.9 RUSSIA

25.2.10 DENMARK

25.2.11 SWEDEN

25.2.12 POLAND

25.2.13 TURKEY

25.2.14 REST OF EUROPE

25.3 ASIA-PACIFIC

25.3.1 JAPAN

25.3.2 CHINA

25.3.3 SOUTH KOREA

25.3.4 INDIA

25.3.5 AUSTRALIA

25.3.6 SINGAPORE

25.3.7 THAILAND

25.3.8 INDONESIA

25.3.9 MALAYSIA

25.3.10 PHILIPPINES

25.3.11 NEW ZEALAND

25.3.12 VIETNAM

25.3.13 REST OF ASIA-PACIFIC

25.4 SOUTH AMERICA

25.4.1 BRAZIL

25.4.2 ARGENTINA

25.4.3 REST OF SOUTH AMERICA

25.5 MIDDLE EAST AND AFRICA

25.5.1 SOUTH AFRICA

25.5.2 UAE

25.5.3 SAUDI ARABIA

25.5.4 OMAN

25.5.5 QATAR

25.5.6 KUWAIT

25.5.7 REST OF MIDDLE EAST AND AFRICA

26 GLOBAL PLANT-BASED BEVERAGES MARKET, COMPANY LANDSCAPE

26.1 COMPANY SHARE ANALYSIS: GLOBAL

26.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

26.3 COMPANY SHARE ANALYSIS: EUROPE

26.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

26.5 MERGERS & ACQUISITIONS

26.6 NEW PRODUCT DEVELOPMENT & APPROVALS

26.7 EXPANSIONS & PARTNERSHIP

26.8 REGULATORY CHANGES

27 GLOBAL PLANT-BASED BEVERAGES MARKET, SWOT & DBMR ANALYSIS

28 GLOBAL PLANT-BASED BEVERAGES MARKET, COMPANY PROFILES

28.1 DANONE SA

28.1.1 COMPANY OVERVIEW

28.1.2 REVENUE ANALYSIS

28.1.3 PRODUCT PORTFOLIO

28.1.4 RECENT DEVELOPMENTS

28.2 OATLY, INC.

28.2.1 COMPANY OVERVIEW

28.2.2 REVENUE ANALYSIS

28.2.3 PRODUCT PORTFOLIO

28.2.4 RECENT DEVELOPMENTS

28.3 THE HAIN CELESTIAL GROUP, INC.

28.3.1 COMPANY OVERVIEW

28.3.2 REVENUE ANALYSIS

28.3.3 PRODUCT PORTFOLIO

28.3.4 RECENT DEVELOPMENTS

28.4 SANITARIUM HEALTH FOOD COMPANY

28.4.1 COMPANY OVERVIEW

28.4.2 REVENUE ANALYSIS

28.4.3 PRODUCT PORTFOLIO

28.4.4 RECENT DEVELOPMENTS

28.5 CALIFIA FARMS, LLC

28.5.1 COMPANY OVERVIEW

28.5.2 REVENUE ANALYSIS

28.5.3 PRODUCT PORTFOLIO

28.5.4 RECENT DEVELOPMENTS

28.6 THE HERSHEY COMPANY

28.6.1 COMPANY OVERVIEW

28.6.2 REVENUE ANALYSIS

28.6.3 PRODUCT PORTFOLIO

28.6.4 RECENT DEVELOPMENTS

28.7 SIMPLE FOODS

28.7.1 COMPANY OVERVIEW

28.7.2 REVENUE ANALYSIS

28.7.3 PRODUCT PORTFOLIO

28.7.4 RECENT DEVELOPMENTS

28.8 YEO HIAP SENG LTD.( FAR EAST ORGANIZATION)

28.8.1 COMPANY OVERVIEW

28.8.2 REVENUE ANALYSIS

28.8.3 PRODUCT PORTFOLIO

28.8.4 RECENT DEVELOPMENTS

28.9 PACIFIC FOODS (ACQUIRED BY CAMPBELL SOUP COMPANY)

28.9.1 COMPANY OVERVIEW

28.9.2 REVENUE ANALYSIS

28.9.3 PRODUCT PORTFOLIO

28.9.4 RECENT DEVELOPMENTS

28.1 ONLY EARTH

28.10.1 COMPANY OVERVIEW

28.10.2 REVENUE ANALYSIS

28.10.3 PRODUCT PORTFOLIO

28.10.4 RECENT DEVELOPMENTS

28.11 AXELUM RESOURCES CORP

28.11.1 COMPANY OVERVIEW

28.11.2 REVENUE ANALYSIS

28.11.3 PRODUCT PORTFOLIO

28.11.4 RECENT DEVELOPMENTS

28.12 MCCORMICK & COMPANY, INC

28.12.1 COMPANY OVERVIEW

28.12.2 REVENUE ANALYSIS

28.12.3 PRODUCT PORTFOLIO

28.12.4 RECENT DEVELOPMENTS

28.13 NESTLE SA

28.13.1 COMPANY OVERVIEW

28.13.2 REVENUE ANALYSIS

28.13.3 PRODUCT PORTFOLIO

28.13.4 RECENT DEVELOPMENTS

28.14 CHOBANI GLOBAL HOLDINGS LLC

28.14.1 COMPANY OVERVIEW

28.14.2 REVENUE ANALYSIS

28.14.3 PRODUCT PORTFOLIO

28.14.4 RECENT DEVELOPMENTS

28.15 SUNOPTA

28.15.1 COMPANY OVERVIEW

28.15.2 REVENUE ANALYSIS

28.15.3 PRODUCT PORTFOLIO

28.15.4 RECENT DEVELOPMENTS

28.16 MOOALA BRANDS, LLC.

28.16.1 COMPANY OVERVIEW

28.16.2 REVENUE ANALYSIS

28.16.3 PRODUCT PORTFOLIO

28.16.4 RECENT DEVELOPMENTS

28.17 ELMHURST

28.17.1 COMPANY OVERVIEW

28.17.2 REVENUE ANALYSIS

28.17.3 PRODUCT PORTFOLIO

28.17.4 RECENT DEVELOPMENTS

28.18 KIKKOMAN CORPORATION

28.18.1 COMPANY OVERVIEW

28.18.2 REVENUE ANALYSIS

28.18.3 PRODUCT PORTFOLIO

28.18.4 RECENT DEVELOPMENTS

28.19 RIPPLE FOODS

28.19.1 COMPANY OVERVIEW

28.19.2 REVENUE ANALYSIS

28.19.3 PRODUCT PORTFOLIO

28.19.4 RECENT DEVELOPMENTS

28.2 THE COCA COLA COMPANY

28.20.1 COMPANY OVERVIEW

28.20.2 REVENUE ANALYSIS

28.20.3 PRODUCT PORTFOLIO

28.20.4 RECENT DEVELOPMENTS

28.21 BORGES INTERNATIONAL GROUP

28.21.1 COMPANY OVERVIEW

28.21.2 REVENUE ANALYSIS

28.21.3 PRODUCT PORTFOLIO

28.21.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

29 RELATED REPORTS

30 CONCLUSION

31 QUESTIONNAIRE

32 ABOUT DATA BRIDGE MARKET RESEARCH

Global Plant Based Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plant Based Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plant Based Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.