Global Phthalic Anhydride Market

Market Size in USD Billion

CAGR :

%

USD

3.87 Billion

USD

6.17 Billion

2021

2029

USD

3.87 Billion

USD

6.17 Billion

2021

2029

| 2022 –2029 | |

| USD 3.87 Billion | |

| USD 6.17 Billion | |

|

|

|

|

Phthalic Anhydride Market Analysis and Size

Over the last few years, there has been increase usage of phthalic anhydride across the building and construction, automotive, paints and coatings, electrical and electronics, marine, and agricultural industries globally. Moreover, plasticizer manufacture frequently involves the use of phthalic anhydride. The manufacturers of PVC products employ plasticizers in about 90.0% of their production to alter the properties of their polyvinyl chloride products to meet customer demands.

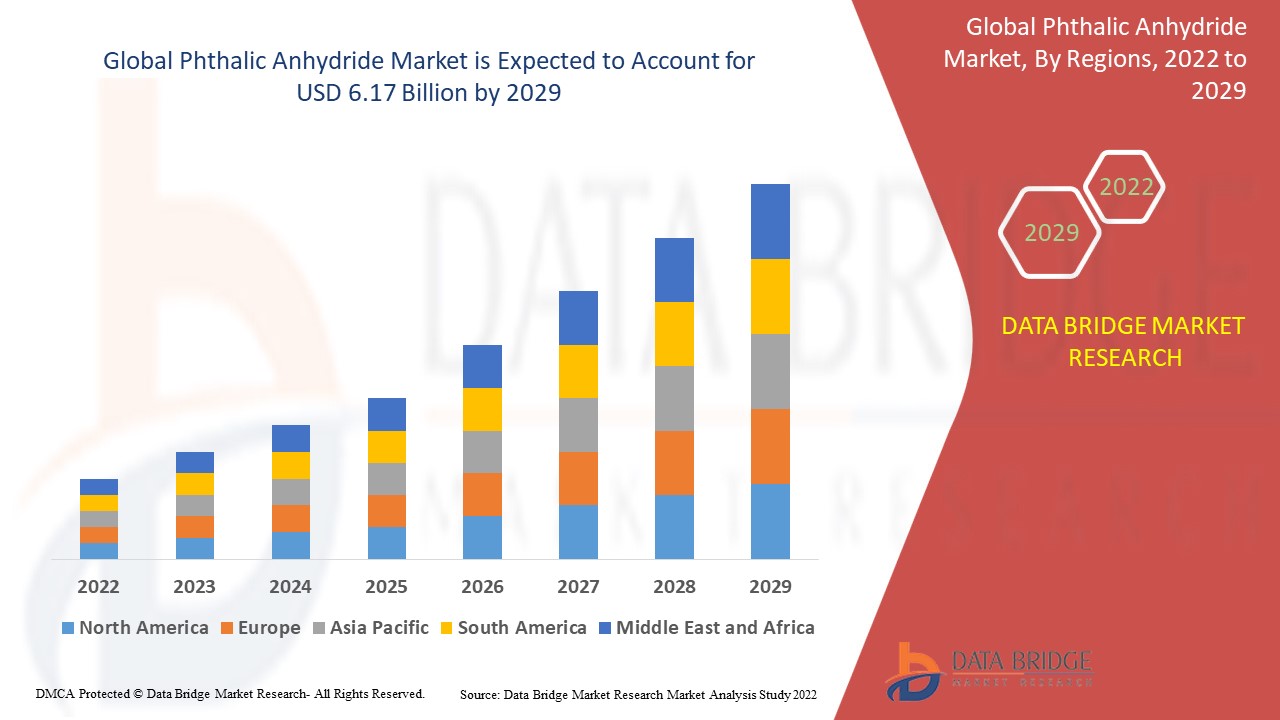

Global phthalic anhydride market was valued at USD 3.87 billion in 2021 and is expected to reach USD 6.17 billion by 2029, registering a CAGR of 4.70% during the forecast period of 2022-2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Phthalic Anhydride Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Process (O-Xylene Catalytic Oxidation, Naphthalene Catalytic Oxidation), Application (Plasticizers, Unsaturated Polyester Resins, Alkyd Resins, Flame Retardant, Dyes and Pigments), End User (Automotive, Electrical and Electronics, Construction, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

LANXESS (Germany), Clariant (Switzerland), Avient Corporation (U.S.), The Lubrizol Corporation (U.S.), LG Chem (South Korea), BASF SE (Germany), 3M (U.S.), Dow (U.S.), DuPont (U.S.), LSB INDUSTRIES (U.S.), Sika AG (Switzerland), Innospec (U.S.), ADEKA CORPORATION (Japan), Dorf Ketal Chemicals (I) Pvt. Ltd. (U.S.), PMC Specialties Group (U.S.), Chemplast Sanmar Limited (India), Westlake Chemical Corporation (U.S.), Mitsubishi Chemical Corporation (Japan), SABIC (Saudi Arabia), Afton Chemical (U.S.), Mayzo, Inc. (U.S.), Solvay (Belgium), Akzo Nobel N.V. (Netherlands), Arkema (France) and Eastman Chemical Company (U.S.) |

|

Market Opportunities |

|

Market Definition

Phthalic anhydride is a white colored organic crystalline compound with the chemical formula C6H4 (CO) 2O generally formed due to catalytic oxidization of O-Xylene. Corrosion may be sped up by its exothermic reaction when in contact with water. Materials such as synthetic resins are produced using it. It is phthalic acid in its form as it is used commercially. Plastics made from vinyl chloride are often produced using phthalic anhydride as a chemical intermediary. Given its dual functionality and accessibility, it is referred to as a flexible intermediate in chemical reactions.

Phthalic Anhydride Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Various Applications of Phthalic Anhydride

Phthalic anhydride is frequently used as a monomer for synthetic resins like polyester, alkyd, and glyptic resins, which are utilized in applications for heat-resistant paints, maritime coatings, and insulation varnishes. Anthraquinone, phthalein, rhodamine, phthalocyanine, fluorescein, and xanthene dyes are also made from phthalic anhydride and are utilized in studies on medical diagnostics. Additionally, phenolphthalein, benzoic acid, phthalylsulfathiazole, and orthophthalic acid are produced from phthalic anhydrides as antibiotics for bowel operations and colon infections. Additionally, phthalic anhydride is a crucial chemical intermediary in the plastics industry from which many phthalate esters that serve as plasticizers in synthetic resins are generated. The market for phthalic anhydride is driven by the substance's wide range of useful characteristics and uses.

- Extensive Phthalic Anhydride Properties

The demand for phthalic anhydride is rising in the building, furniture, automotive, and aviation industries due to its advantages over other materials, including its low weight, resistance to chemical rot, high transparency, and resilience to weather, corrosion, abrasion, and impact. As they increase the polymers flexibility and elongation or ease of processing by lowering the cohesive intermolecular forces along the polymer chains, plasticizers are typically used in various end-use industries. The polyvinyl chloride plasticizers are also frequently utilized in the automotive and aviation industries because they allow for simple cutting, shaping, welding, and joining in a number of designs. During the projected period, the market for phthalic anhydrides will be driven by these wide features of phthalic anhydrides.

Furthermore, the increased use of polyester and polyvinyl chloride resins in end markets like building, electronics, machinery, marine, and automotive will further propel the growth rate of phthalic anhydride market. Additionally, the growth in trade by air transportation will also drive market value growth. The expansion of the automotive industry along with the increase in defense budgets are other market growth determinants which are projected to bolster the growth of the market.

Opportunities

- Market Strategies and Product Development

Furthermore, various market strategies adopted by the market players such as acquisition and collaborations further enhance product applications and extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, the product development and innovations will further expand the future growth of the phthalic anhydride market.

Restraints/Challenges

- Negative Impact

The development of a bio-based replacement to phthalic anhydride and the negative impacts of phthalates due to their toxicity are anticipated to restrain the growth of the phthalic anhydride market during the forecast period.

- Bio-Based Alternatives

Factors such as the development of bio-based alternatives for phthalic anhydride will challenge the growth rate of the phthalic anhydride market.

This phthalic anhydride market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the phthalic anhydride market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Phthalic Anhydride Market

The recent outbreak of coronavirus had a negative impact on the phthalic anhydride market. Many nations are currently subject to stringent lockdowns, which have compelled several sectors to halt operations. As a result, phthalic anhydride output and demand have decreased and manufacture has been terminated. According to the United Nations Industrial Development Organization (UNIDO), the COVID-19 epidemic and the subsequent shutdown have had the harshest effects on the Micro, Small and Medium Enterprises (MSME) sector across developing economies, such as India. The demand for phthalic anhydride from various end-use industries, including building & construction, automotive, paints and coatings, is anticipated to fall as a result. It is anticipated that it will be difficult for the manufacturing sector to return to regular working conditions even with the lockdown's gradual lifting.

The lack of or reduced availability of labor is anticipated to directly impact the production operations of these industries, which will lead to a drop in the demand for phthalic anhydride. The market's growth is anticipated to slow as a result during the forecast period. The COVID-19 pandemic is to blame for the closure of paint and coating manufacturing facilities in a number of nations, which resulted in a global lockdown imposed by various governments. Because of this, there is now much less demand for the widely used phthalic anhydride-based alkyd resins that are used to make solvent-based coatings, which is predicted to slow the market's growth over the course of the forecast period. In the vehicle industry, phthalic anhydride is frequently used in the production of instrument panels, doors, and several other body elements, including the dashboard. Due to the disruption in the supply of automotive components, production activities in the automotive industry were shut down during the COVID-19 epidemic lockdown, which seriously impacted the sector. As a result, PVC demand has decreased dramatically, which has had an impact on phthalic anhydride demand. This trend is anticipated to continue as long as the global lockdown is in place.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In September 2021, Axalta announced that it has started working on a cutting-edge coatings factory in northern China in Jilin City, Jilin Province. The brand-new 46,000 square metre facility will manufacture mobility coatings for light trucks, commercial trucks, and automotive plastic parts.

- In May 2021, PPG has completed a US$13 million investment in its paint and coatings facility in Jiading, China. This investment included eight new powder coating production lines and an expanded Powder Coatings Technology Center. The addition will boost the plant's annual capacity by more than 8,000 metric tonnes.

Global Phthalic Anhydride Market Scope

The phthalic anhydride market is segmented on the basis of process, end user and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Process

- O-Xylene Catalytic Oxidation

- Naphthalene Catalytic Oxidation

Application

- Plasticizers

- Unsaturated Polyester Resins

- Alkyd Resins

- Flame Retardant

- Dyes and Pigments

End User

- Automotive

- Electrical and Electronics

- Construction

- Others

Phthalic Anhydride Market Regional Analysis/Insights

The phthalic anhydride market is analyzed and market size insights and trends are provided by country, process, end user and application as referenced above.

The countries covered in the phthalic anhydride market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. The market growth over this region is attributed to the increasing demand of Polyvinyl Chloride (PVC) based components from countries such as China and India.

North America on the other hand, is estimated to show lucrative growth over the forecast period of 2022-2029, due to the increasing usage across end use industries and surging research and development activities in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Phthalic Anhydride Market Share Analysis

The phthalic anhydride market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to phthalic anhydride market.

Some of the major players operating in the phthalic anhydride market are

- LANXESS (Germany)

- Clariant (Switzerland)

- Avient Corporation (U.S.)

- The Lubrizol Corporation (U.S.)

- LG Chem (South Korea)

- BASF SE (Germany)

- 3M (U.S.)

- Dow (U.S.)

- DuPont (U.S.)

- LSB INDUSTRIES (U.S.)

- Sika AG (Switzerland)

- Innospec (U.S.)

- ADEKA CORPORATION (Japan)

- Dorf Ketal Chemicals (I) Pvt. Ltd. (U.S.)

- PMC Specialties Group (U.S.)

- Chemplast Sanmar Limited (India)

- Westlake Chemical Corporation (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- SABIC (Saudi Arabia)

- Afton Chemical (U.S.)

- Mayzo, Inc. (U.S.)

- Solvay (Belgium)

- Akzo Nobel N.V. (Netherlands)

- Arkema (France)

- Eastman Chemical Company (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Phthalic Anhydride Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Phthalic Anhydride Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Phthalic Anhydride Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.