Global Photogrammetry Software Market

Market Size in USD Billion

CAGR :

%

USD

1.53 Billion

USD

4.26 Billion

2024

2032

USD

1.53 Billion

USD

4.26 Billion

2024

2032

| 2025 –2032 | |

| USD 1.53 Billion | |

| USD 4.26 Billion | |

|

|

|

|

Photogrammetry Software Market Analysis

The photogrammetry software market is witnessing significant growth driven by advancements in technology, particularly with the rise of AI and machine learning integration. These technologies are enhancing the automation of image processing, increasing the accuracy and efficiency of data collection. For instance, AI algorithms can now automatically detect features and objects in images, reducing the need for manual input and speeding up analysis.

Additionally, the adoption of cloud-based solutions is expanding the market. Cloud platforms enable remote access, collaboration, and scalable storage for large datasets, offering flexibility and cost efficiency. Companies such as Pix4D and Agisoft are leading this trend, providing solutions that cater to industries ranging from construction and agriculture to archaeology and mining.

The integration of drones in photogrammetry is also boosting market growth. Drones equipped with high-resolution cameras are providing real-time aerial data, which is processed through photogrammetry software to create 3D models and maps. This has proven essential for surveying, urban planning, and disaster management applications.

The increasing demand for high-quality geospatial data, combined with technological innovations, is expected to propel the photogrammetry software market further, making it an essential tool across multiple sectors.

Photogrammetry Software Market Size

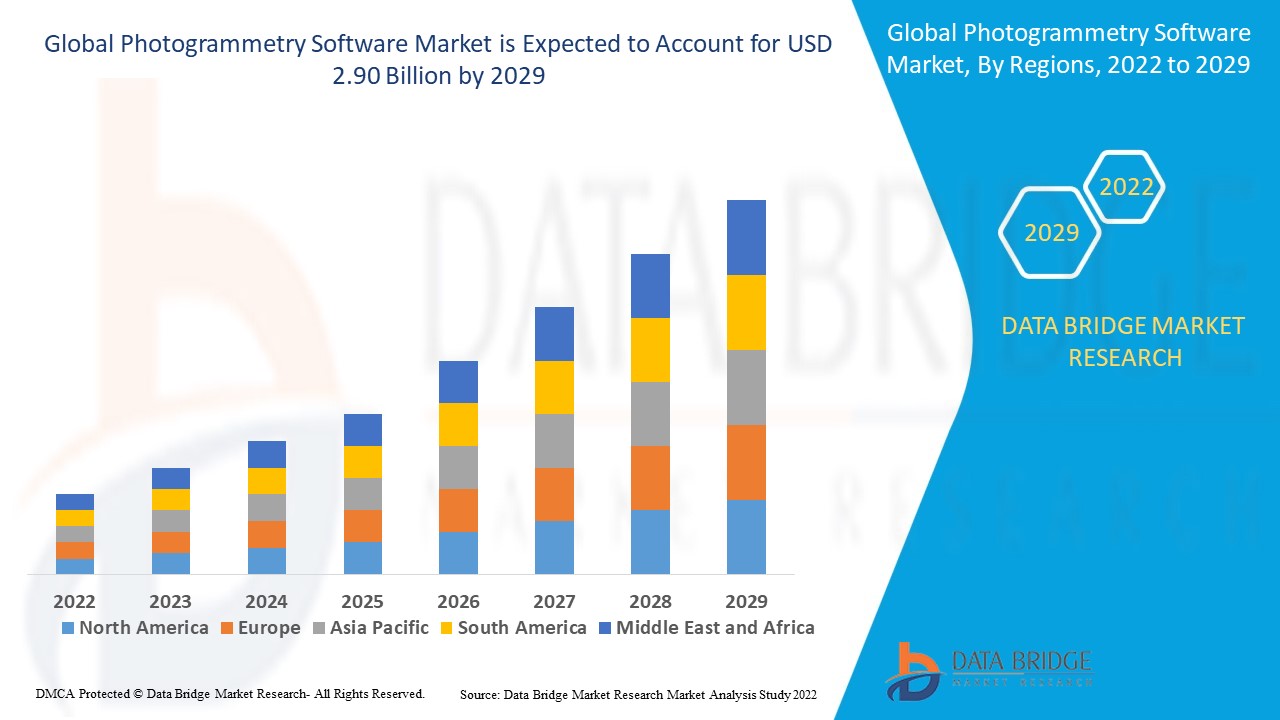

The global photogrammetry software market size was valued at USD 1.53 billion in 2024 and is projected to reach USD 4.26 billion by 2032, with a CAGR of 13.66% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Photogrammetry Software Market Trends

“Increasing Adoption of AI and Machine Learning in Photogrammetry Software”

A key trend in the photogrammetry software market is the integration of AI and machine learning (ML) technologies. These advancements enhance image processing and analysis, enabling software to automatically detect and classify objects, improving accuracy and efficiency. For instance, companies such as Pix4D and Agisoft have incorporated AI to automate feature extraction and improve point cloud generation, which speeds up the mapping process. These technologies also optimize workflows, reduce human error, and provide more detailed and accurate results. The adoption of AI and ML is transforming photogrammetry, making it more accessible and efficient for industries such as construction, agriculture, and mining.

Report Scope and Photogrammetry Software Market Segmentation

|

Attributes |

Photogrammetry Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Pix4D SA (Switzerland), 3Dflow SR (Italy), Agisoft (Russia), Capturing Reality s.r.o. (Slovakia), Vexcel Imaging GmbH (Austria), nFrames (Germany), REDcatch GmbH (Austria), NUBIGON Inc. (U.S.), Linearis3D GmbH & Co.KG (Germany), Menci software SRL (Italy), Photometrix Photogrammetry Software (Australia), Skyline Software Systems Inc. (U.S.), Racurs (Moscow), SimActive Inc. (Canada), ICAROS (Germany), Magnasoft. (India), DroneDeploy (US), PhotoModeler Technologies (Canada), Esri International LLC (U.S.), Autodesk, Inc. (U.S.), Trimble Inc. (U.S.), and Hexagon AB (Sweden) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Photogrammetry Software Market Definition

Photogrammetry software is a tool used to create 3D models or maps from photographs or other imagery. It works by analyzing multiple photos of an object or area taken from different angles and using algorithms to extract measurements and spatial information. This process creates accurate, high-resolution 3D models or maps. Photogrammetry is commonly used in fields such as surveying, architecture, archaeology, and geographic information systems (GIS). The software can handle both aerial and terrestrial imagery, making it useful for applications such as topographic mapping, terrain modeling, and virtual reality simulations, offering precise spatial data and visualization capabilities.

Photogrammetry Software Market Dynamics

Drivers

- Increasing Demand for 3D Modeling

The increasing demand for 3D modeling is a major driver of the photogrammetry software market. Industries such as construction, mining, and gaming rely on highly accurate 3D models for design, planning, and visualization. In construction, photogrammetry enables detailed site models, improving project planning and reducing errors. In mining, it's used to create digital models of mines for safer and more efficient resource extraction. The gaming industry leverages photogrammetry to create realistic environments and textures, enhancing user experience. For instance, AAA gaming titles such as Battlefield V use photogrammetry to replicate real-world landscapes, showcasing the software’s ability to produce highly detailed 3D models, further driving its market adoption across various sectors.

- Integration with GIS (Geographic Information Systems)

The seamless integration of photogrammetry software with Geographic Information Systems (GIS) plays a crucial role in enhancing spatial analysis and data visualization. This integration allows industries such as urban planning, environmental monitoring, and agriculture to make data-driven decisions based on accurate 3D models and geospatial data. For instance, in urban planning, cities such as New York utilize photogrammetry for detailed mapping, which is integrated with GIS to plan infrastructure development and monitor urban sprawl. Similarly, in agriculture, GIS-integrated photogrammetry helps in precision farming by providing insights into land topography and crop health, driving the growth of photogrammetry software as it supports a wide range of sectors with advanced data analysis capabilities.

Opportunities

- Advancements in Drone Technology

The rise of drones equipped with high-resolution cameras has significantly enhanced the capabilities of photogrammetry software, creating ample market opportunities. In agriculture, drones are used for crop monitoring and field mapping, enabling farmers to optimize irrigation and detect diseases early. For surveying, drones provide fast and cost-effective aerial imagery, reducing the need for manual data collection in remote or hazardous areas. Additionally, in infrastructure inspection, drones equipped with photogrammetry software allow detailed analysis of bridges, roads, and powerlines, minimizing downtime and increasing safety. For instance, companies such as senseFly and DJI are integrating advanced drones with photogrammetry tools, driving growth in industries ranging from agriculture to construction.

- Growing Adoption in Archaeology and Heritage Preservation

Photogrammetry software has become a critical tool in archaeology and heritage preservation. It enables the creation of highly detailed 3D models of ancient monuments, sculptures, and historical sites, preserving their structure for future generations. For instance, the 3D scanning of the ancient city of Pompeii and the restoration of the Notre-Dame Cathedral in Paris have demonstrated the value of photogrammetry in maintaining cultural heritage. The ability to digitally recreate and restore historical artifacts without physical interference opens up significant opportunities in the market, especially with governments, museums, and research institutions investing in these technologies for conservation and virtual tourism experiences.

Restraints/Challenges

- High Cost of Software

The high cost of advanced photogrammetry software significantly hinders market growth. The expensive pricing of these solutions creates a barrier for small businesses, independent professionals, and startups who may lack the financial resources to invest in high-end software. As a result, many potential users are forced to opt for lower-cost or free alternatives that offer limited features, which can be inadequate for professional use. This shift toward more affordable options reduces the overall adoption of cutting-edge software and restricts its use in industries where accuracy and precision are crucial. Consequently, the high price of photogrammetry software limits its widespread implementation and impedes market expansion.

- Accuracy and Precision Limitations

Accuracy and precision limitations in photogrammetry software present a significant challenge to its adoption. In complex or obstructed environments, such as areas with poor lighting, dense vegetation, or intricate structures, the software may struggle to deliver precise results. This can lead to errors in crucial applications such as surveying, construction, and mapping, where high accuracy is essential. The resulting inaccuracies reduce the reliability of the software, diminishing user trust and hindering its widespread adoption. As these errors can impact the quality of projects and lead to costly mistakes, users may hesitate to rely on photogrammetry, ultimately limiting the market's growth and potential.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Photogrammetry Software Market Scope

The market is segmented on the basis of method, photogrammetry style, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Method

- Aerial Photogrammetry

- Terrestrial Photogrammetry

- Satellite Photogrammetry

- Macro Photogrammetry

Photogrammetry Style

- Point-and-Shoot Photogrammetry

- Multi-Camera Photogrammetry

- Video-to-Photogrammetry

Application

- Culture Heritage and Museum

- Films and Games

- Topographic Maps

- Traffic Management System

- 3D Printing

- Drones and Robots

- Others

End User

- Building and Construction

- Automotive

- Energy

- Oil and Gas

- Ship Building

- Others

Photogrammetry Software Market Regional Analysis

The market is analyzed and market size insights and trends are provided by method, photogrammetry style, application and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the photogrammetry software market due to the presence of major key players and increased investment to foster business growth in the region. Companies in the U.S. and Canada are focusing on enhancing their technological capabilities, leading to innovations in photogrammetry solutions. Additionally, the rising adoption of photogrammetry in industries such as construction, defense, and agriculture is driving market growth. The increasing demand for accurate 3D mapping and modeling solutions further strengthens North America's position as the leading market, with significant contributions from both private and public sectors.

Asia-Pacific is expected to witness significant growth in the photogrammetry software market during the forecast period due to the rise in construction activities and increased initiatives for infrastructural development in the region. Countries such as China and India are investing heavily in urban planning and large-scale infrastructure projects, boosting the demand for advanced software solutions. Additionally, the region's adoption of smart city technologies and the growing interest in geospatial data analytics further propel market growth. The expanding aerospace and defense sectors are also driving the demand for photogrammetry software, creating new opportunities for market players.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Photogrammetry Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Photogrammetry Software Market Leaders Operating in the Market Are:

- Pix4D SA (Switzerland)

- 3Dflow SR (Italy)

- Agisoft (Russia)

- Capturing Reality s.r.o. (Slovakia)

- Vexcel Imaging GmbH (Austria)

- nFrames (Germany)

- REDcatch GmbH (Austria)

- NUBIGON Inc. (U.S.)

- Linearis3D GmbH & Co.KG (Germany)

- Menci software SRL (Italy)

- Photometrix Photogrammetry Software (Australia)

- Skyline Software Systems Inc. (U.S.)

- Racurs (Moscow)

- SimActive Inc. (Canada)

- ICAROS (Germany)

- Magnasoft. (India)

- DroneDeploy (U.S.)

- PhotoModeler Technologies (Canada)

- Esri International LLC (U.S.)

- Autodesk, Inc. (U.S.)

- Trimble Inc. (U.S.)

- Hexagon AB (Sweden)

Latest Developments in Photogrammetry Software Market

- In March 2023, the release of Skycatch EdgePlus V2.4.0 introduced key updates that enhance the software’s capabilities for high-precision 3D drone photogrammetry, processing, and analysis. This version brings improvements to the platform, focusing on better integration and enhanced performance for industries such as mining and construction, allowing users to generate more accurate 3D models and geospatial data, making it an essential tool for advanced drone mapping applications

- In January 2023, Photometrix launched iWitnessPRO version 4.2, offering significant upgrades to its photogrammetry software. This version introduces automatic generation of fully textured high-resolution 3D models, digital surface models, and 3D object reconstructions. Leveraging advanced photogrammetry and dense image matching techniques, the software is now better suited for applications requiring precise 3D visualizations in industries such as surveying, engineering, and architecture, enhancing workflow efficiency and accuracy

- In December 2022, Pix4D rolled out new features and tools for its cloud platform, adding significant upgrades to improve the user experience. The update enables enhanced processing capabilities, including better handling of large datasets and faster model generation. These improvements cater to industries such as agriculture, construction, and mining, providing users with more robust and efficient photogrammetry solutions, streamlining data processing and analysis for better decision-making

- In 2021, Hexagon AB acquired PMS Photo Mess System AG, a notable player in the photogrammetry software market. This acquisition is expected to bolster Hexagon’s photogrammetry software offerings, expanding its portfolio with advanced solutions for industries requiring high-precision geospatial data. The strategic move enhances Hexagon’s position in providing innovative sensor, software, and autonomous technologies, facilitating the integration of cutting-edge photogrammetry tools into its broader technological ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Photogrammetry Software Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Photogrammetry Software Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Photogrammetry Software Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.