Global Photoacoustic Tomography Market

Market Size in USD Billion

CAGR :

%

USD

109.80 Billion

USD

405.78 Billion

2024

2032

USD

109.80 Billion

USD

405.78 Billion

2024

2032

| 2025 –2032 | |

| USD 109.80 Billion | |

| USD 405.78 Billion | |

|

|

|

|

Photoacoustic Tomography Market Size

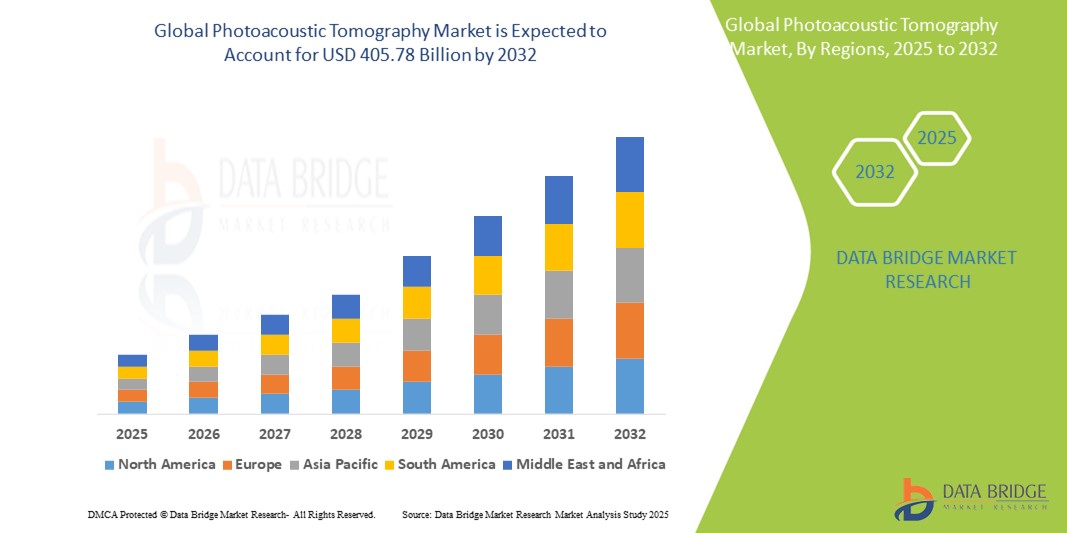

- The global photoacoustic tomography market size was valued at USD 109.80 billion in 2024 and is expected to reach USD 405.78 billion by 2032, at a CAGR of 17.75% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within biomedical imaging and non-invasive diagnostic technologies, leading to increased digitalization and precision in both clinical and research settings

- Furthermore, rising demand for high-resolution, real-time imaging solutions that offer deep tissue penetration without harmful radiation is establishing photoacoustic tomography as a preferred modality in oncology, cardiology, and neurology. These converging factors are accelerating the uptake of photoacoustic tomography solutions, thereby significantly boosting the industry's growth

Photoacoustic Tomography Market Analysis

- Photoacoustic tomography, a hybrid imaging technique combining optical and ultrasound technologies, is increasingly vital in modern biomedical diagnostics and research due to its ability to provide high-resolution, deep tissue imaging without ionizing radiation

- The escalating demand for photoacoustic tomography is primarily fuelled by the rising prevalence of chronic diseases such as cancer and cardiovascular disorders, increasing need for early and accurate diagnosis, and growing adoption of non-invasive imaging technologies in both clinical and preclinical applications

- North America dominates the photoacoustic tomography market with the largest revenue share of 38.7% in 2024, characterized by strong R&D infrastructure, robust funding for medical imaging innovations, and a high concentration of key industry players

- Asia-Pacific is expected to be the fastest growing region in the photoacoustic tomography market during the forecast period, with a CAGR of 9.7%, due to rapid healthcare infrastructure development, rising investments in advanced diagnostic technologies, and increased awareness of early disease detection

- The photoacoustic tomography segment dominates the photoacoustic tomography market with a market share of 46.3% in 2024, driven by its widespread adoption in non-invasive imaging for deep tissue visualization, particularly in oncology, vascular imaging, and functional brain studies

Report Scope and Photoacoustic Tomography Market Segmentation

|

Attributes |

Photoacoustic Tomography Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Photoacoustic Tomography Market Trends

“Enhanced Precision Through AI and Multi-Modal Integration”

- A significant and accelerating trend in the global Photoacoustic Tomography (PAT) market is the increasing integration of artificial intelligence (AI) with multi-modal imaging platforms, enabling enhanced image reconstruction, noise reduction, and tissue characterization. This fusion of AI and PAT is significantly advancing diagnostic accuracy and workflow efficiency in clinical and research settings.

- For instance, AI algorithms are being incorporated into PAT systems to automate the identification of abnormal tissue structures, improving early disease detection, particularly in oncology and vascular imaging. Some advanced systems can now distinguish between malignant and benign tissues with greater confidence using real-time image processing powered by deep learning

- AI integration in photoacoustic tomography also supports dynamic image enhancement by learning from large datasets, thereby reducing operator dependency and variability. This allows researchers and clinicians to obtain consistent, high-quality images even in complex biological environments

- The seamless combination of PAT with other imaging modalities such as ultrasound, MRI, and CT—guided by AI—enables a comprehensive diagnostic view, merging anatomical, functional, and molecular information into a unified imaging solution. This convergence not only improves diagnostic precision but also facilitates advanced therapeutic planning

- This trend toward more intelligent, automated, and integrative imaging systems is fundamentally transforming expectations in biomedical imaging. Consequently, companies such as iThera Medical and FUJIFILM VisualSonics are developing AI-driven photoacoustic imaging platforms that offer enhanced performance, real-time analytics, and compatibility with broader imaging ecosystems

- The demand for photoacoustic tomography systems with AI-powered analytics and multi-modal capabilities is growing rapidly across academic, clinical, and pharmaceutical research sectors, as users increasingly seek faster, more accurate, and non-invasive diagnostic solutions

Photoacoustic Tomography Market Dynamics

Driver

“Increasing Demand for Advanced Non-Invasive Imaging and Early Disease Detection”

- The increasing prevalence of chronic and complex diseases such as cancer and cardiovascular conditions, coupled with the accelerating demand for high-resolution, non-invasive diagnostic tools, is a significant driver for the heightened demand for photoacoustic tomography

- For instance, in April 2024, leading research institutions announced breakthroughs in using photoacoustic tomography for improved early-stage tumor detection and characterization, demonstrating its potential to overcome limitations of traditional imaging methods. Such advancements in clinical and preclinical applications are expected to drive the photoacoustic tomography industry growth in the forecast period

- As medical professionals and researchers become more aware of the advantages of combining the high optical contrast of light with the deep tissue penetration of ultrasound, photoacoustic tomography offers advanced features such as superior visualization of vascular structures, oxygen saturation mapping, and molecular specificity, providing a compelling upgrade over standalone optical or ultrasonic imaging techniques

- Furthermore, the growing popularity of precision medicine and the desire for highly sensitive and quantitative imaging biomarkers are making photoacoustic tomography an integral component of these systems, offering seamless integration with molecular probes and targeted therapies

- The convenience of non-ionizing radiation, real-time imaging capabilities, and the ability to detect disease at early stages are key factors propelling the adoption of photoacoustic tomography in both research and emerging clinical sectors. The trend towards multimodal imaging platforms and the increasing availability of sophisticated photoacoustic tomography options further contributes to market growth

Restraint/Challenge

“Concerns Regarding High System Costs and Technical Complexity”

- Concerns surrounding the significant initial capital investment required for photoacoustic tomography systems, coupled with the technical complexity involved in their operation and data interpretation, pose a significant challenge to broader market penetration. As photoacoustic tomography relies on specialized laser sources, high-frequency ultrasound transducers, and advanced computational algorithms, these factors raise anxieties among potential adopters about the economic viability and operational demands

- For instance, high-profile reports on the substantial cost of establishing a dedicated photoacoustic tomography research lab or clinic have made some institutions hesitant to invest heavily in the technology, opting for more established and, in some cases, less expensive imaging modalities

- Addressing these high system costs through modular designs, more affordable component manufacturing, and enhanced user-friendliness of software is crucial for building broader adoption. Companies and research groups are actively working to reduce the complexity of photoacoustic tomography systems and improve their accessibility to reassure potential buyers. In addition, the relatively nascent stage of clinical translation for many photoacoustic tomography applications compared to mature imaging techniques can be a barrier to adoption for healthcare providers seeking proven, standardized diagnostic tools, particularly in developing regions or for budget-conscious hospitals. While basic systems are becoming more accessible, premium features such as advanced volumetric imaging or real-time functional mapping often come with a higher price tag

- While prices are gradually decreasing and technological advancements are simplifying operation, the perceived premium for this cutting-edge technology can still hinder widespread adoption, especially for those who do not see an immediate, critical need for its unique advantages over existing imaging modalities

Photoacoustic Tomography Market Scope

The photoacoustic tomography market is segmented into four notable segments based on type, application, geometry, and end user.

- By Type

On the basis of type, the photoacoustic tomography market is segmented into photoacoustic tomography, photoacoustic microscopy, and intravascular photoacoustic imaging. The photoacoustic tomography segment held the largest market revenue share of 46.3% in 2024. This is driven by its ability to provide deeper tissue penetration for macroscopic imaging compared to microscopy, making it highly valuable for various diagnostic applications in preclinical and emerging clinical settings.

The intravascular photoacoustic imaging segment is anticipated to witness the fastest growth rate, with a CAGR of 18.9% from 2025 to 2032. This rapid growth is fueled by its unique capability to provide high-resolution insights into vascular diseases directly within blood vessels, addressing a significant unmet clinical need.

- By Application

On the basis of application, the photoacoustic tomography market is segmented into cardiovascular disease (CVD), lymphatic, diagnosis and monitoring, clinical research, and others. The clinical research segment held the largest market revenue share in 2024. This is because photoacoustic tomography is still a rapidly evolving technology, with most of its current use being in academic and industrial research for exploring new diagnostic and therapeutic applications before widespread clinical adoption.

The diagnosis and monitoring segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the urgent need for non-invasive, highly sensitive tools for early cancer detection and monitoring treatment response.

- By Geometry

On the basis of geometry, the photoacoustic tomography market is segmented into planar, cylindrical, and spherical. The planar geometry segment held the largest market revenue share in 2024. This is driven by its simpler design, ease of implementation for superficial imaging, and versatility for a wide range of preclinical and dermatological applications.

The cylindrical geometry segment is anticipated to witness the fastest growth rate from 2025 to 2032. This is fueled by its suitability for whole-body small animal imaging and its potential for clinical applications requiring volumetric data acquisition, such as breast imaging.

- By End User

On the basis of end user, the photoacoustic tomography market is segmented into hospitals diagnostics, imaging centers, academic, and research institutes. The academic and research institutes segment held the largest market revenue share in 2024. This is because these institutions are at the forefront of developing and validating new photoacoustic tomography technologies and exploring their diverse applications in basic science and preclinical studies.

The hospitals diagnostics segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is projected as photoacoustic tomography systems gain more clinical approvals and demonstrate clear diagnostic benefits for specific medical conditions, leading to increased adoption in hospital settings for patient care.

Photoacoustic Tomography Market Regional Analysis

- North America dominates the photoacoustic tomography market with the largest revenue share of 38.7% in 2024. This leadership is driven by significant investments in biomedical research and development, a robust healthcare infrastructure, and the early adoption of advanced medical imaging technologies within the region

- Researchers and clinicians in the region highly value the non-invasive nature, high spatial resolution, and functional contrast capabilities offered by photoacoustic tomography. This makes it an invaluable tool for applications such as early cancer detection, vascular mapping, and functional brain imaging, surpassing limitations of conventional imaging modalities for specific targets

- This widespread adoption is further supported by substantial government and private research funding, a large number of leading academic and research institutions, and a growing demand for innovative diagnostic and prognostic tools. These factors firmly establish photoacoustic tomography as a favored solution for both preclinical research and emerging clinical applications across North America

U.S. Photoacoustic Tomography Market Insight

The U.S. photoacoustic tomography market captured the largest revenue share of 71.7% in 2024 within North America. This is primarily fueled by a robust research and development ecosystem, high adoption rates of cutting-edge imaging technologies, and increasing clinical applications of photoacoustic tomography in oncology, neurology, and vascular imaging. The growing preference for non-invasive yet highly informative diagnostic tools, combined with strong federal funding for biomedical imaging research, further propels the photoacoustic tomography industry. Moreover, the increasing integration of advanced image processing algorithms and AI-driven solutions is significantly contributing to the market's expansion, enhancing diagnostic accuracy and efficiency.

Europe Photoacoustic Tomography Market Insight

The Europe photoacoustic tomography market is projected to expand at a substantial CAGR throughout the forecast period. This growth is primarily driven by increasing investments in medical imaging research, particularly in countries such as Germany and the UK, and the escalating need for enhanced diagnostic capabilities in chronic disease management. The focus on early disease detection, coupled with the demand for non-ionizing radiation imaging techniques, is fostering the adoption of photoacoustic tomography. European research institutions and hospitals are drawn to the technique's ability to provide high-resolution images with functional information. The region is experiencing significant growth across academic, preclinical, and emerging clinical applications, with photoacoustic tomography being incorporated into both research laboratories and specialized diagnostic centers.

U.K. Photoacoustic Tomography Market Insight

The U.K. photoacoustic tomography market is anticipated to grow at a noteworthy CAGR during the forecast period. This is driven by a strong emphasis on biomedical research and innovation, alongside increasing government and private funding for advanced medical technologies. In addition, the rising prevalence of chronic diseases such as cancer and cardiovascular conditions is encouraging healthcare providers and researchers to explore novel diagnostic solutions such as photoacoustic tomography. The UK’s robust academic-industrial collaborations, alongside its growing demand for non-invasive and high-resolution imaging, is expected to continue to stimulate market growth.

Germany Photoacoustic Tomography Market Insight

The Germany photoacoustic tomography market is expected to expand at a considerable CAGR during the forecast period. This growth is fueled by increasing awareness of advanced diagnostic capabilities and a strong demand for technologically sophisticated medical solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on precision medicine and advanced research, promotes the adoption of photoacoustic tomography, particularly in university hospitals and specialized imaging centers. The integration of photoacoustic tomography with other multimodal imaging systems is also becoming increasingly prevalent, with a strong preference for comprehensive, high-resolution diagnostic tools aligning with local clinical and research expectations.

Asia-Pacific Photoacoustic Tomography Market Insight

The Asia-Pacific photoacoustic tomography market is poised to grow at the fastest CAGR of 9.7% during the forecast period of 2025 to 2032. This rapid expansion is driven by increasing healthcare expenditure, rising prevalence of chronic diseases, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards advanced medical diagnostics, supported by government initiatives promoting indigenous R&D and healthcare infrastructure development, is driving the adoption of photoacoustic tomography. Furthermore, as APAC becomes a significant hub for medical device manufacturing and research, the affordability and accessibility of photoacoustic tomography systems are expanding to a wider clinical and research base.

China Photoacoustic Tomography Market Insight

The China photoacoustic tomography market accounted for a substantial market revenue share in Asia Pacific in 2024, attributed to the country's rapidly expanding healthcare market, significant government investment in medical technology, and high rates of technological adoption. China stands as a key player in medical imaging research and manufacturing, and photoacoustic tomography is becoming increasingly popular in both preclinical research and emerging clinical applications. The push towards advanced healthcare infrastructure and the availability of increasingly sophisticated photoacoustic tomography options, alongside strong domestic research and development capabilities, are key factors propelling the market in China.

India Photoacoustic Tomography Market Insight

The India photoacoustic tomography market is anticipated to exhibit a robust CAGR of 19-21% during the forecast period. This strong growth is driven by the country's rapidly improving healthcare infrastructure, increasing prevalence of chronic diseases (especially cancer and cardiovascular conditions), and a rising demand for advanced, non-invasive diagnostic tools. Significant investments in medical research and development, particularly by government initiatives and emerging private players, are fueling the adoption of photoacoustic tomography. Furthermore, the growing awareness among clinicians and researchers about the unique capabilities of photoacoustic tomography, coupled with the increasing availability of specialized expertise, is contributing to the market's expansion across academic institutions and emerging diagnostic centers in India.

Photoacoustic Tomography Market Share

The photoacoustic tomography industry is primarily led by well-established companies, including:

- PerkinElmer (U.S.)

- Bruker (U.S.)

- FUJIFILM Corporation (Japan)

- Mediso Ltd (Hungary)

- MILabs B.V. (Netherlands)

- General Electric Company (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- MR Solutions (U.K.)

- Aspect Imaging Ltd. (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- OPOTEK LLC (U.S.)

- Hitachi High-Tech Corporation (Japan)

- LI-COR, Inc. (U.S.)

- Miltenyi Biotec (Germany)

- ENDRA Life Sciences Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- PreXion Inc. (U.S.)

- iThera Medical GmbH (Germany)

- kibero (Germany)

Latest Developments in Global Photoacoustic Tomography Market

- In April 2024, iThera Medical GmbH, a leading innovator in photoacoustic imaging, launched its next-generation inVision TRIO system. This preclinical imaging platform features improved image resolution and enhanced multispectral capabilities, enabling researchers to conduct more precise and efficient studies in oncology and inflammation. The upgrade reinforces iThera’s leadership in advancing translational imaging and expanding the applications of photoacoustic tomography in biomedical research

- In March 2024, FUJIFILM VisualSonics announced the integration of artificial intelligence into its Vevo LAZR-X photoacoustic imaging system. This development aims to enhance real-time image analysis and automate tissue characterization, significantly improving diagnostic accuracy in preclinical and clinical research. The AI-powered system enables researchers to quickly detect anomalies and streamline image interpretation, reflecting FUJIFILM’s ongoing commitment to innovation in non-invasive imaging

- In February 2024, ENDRA Life Sciences Inc. partnered with the University of Michigan to conduct a pilot clinical study evaluating its TAEUS® platform for liver disease detection using photoacoustic technology. The study marks a significant step in transitioning photoacoustic tomography from research to clinical settings, with the goal of offering a non-invasive, cost-effective alternative to traditional imaging modalities such as MRI and CT in detecting non-alcoholic fatty liver disease (NAFLD)

- In January 2024, Bruker Corporation expanded its photoacoustic product portfolio by acquiring a startup specializing in optical-acoustic sensor integration. The acquisition is expected to enhance Bruker’s capabilities in multimodal imaging systems by combining expertise in optical detection and acoustic signal processing, thereby strengthening its position in the biomedical imaging market

- In December 2023, kibero GmbH, a Germany-based provider of photoacoustic imaging solutions, introduced a portable, handheld photoacoustic tomography device aimed at point-of-care diagnostics. This device enables rapid assessment of superficial vascular and dermatological conditions in outpatient settings and emergency rooms. The launch supports kibero’s mission to make advanced imaging more accessible and practical for real-world clinical applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.