Global Phase Transfer Catalyst Market

Market Size in USD Billion

CAGR :

%

USD

1.39 Billion

USD

2.21 Billion

2024

2032

USD

1.39 Billion

USD

2.21 Billion

2024

2032

| 2025 –2032 | |

| USD 1.39 Billion | |

| USD 2.21 Billion | |

|

|

|

|

Global Phase Transfer Catalyst Market Size

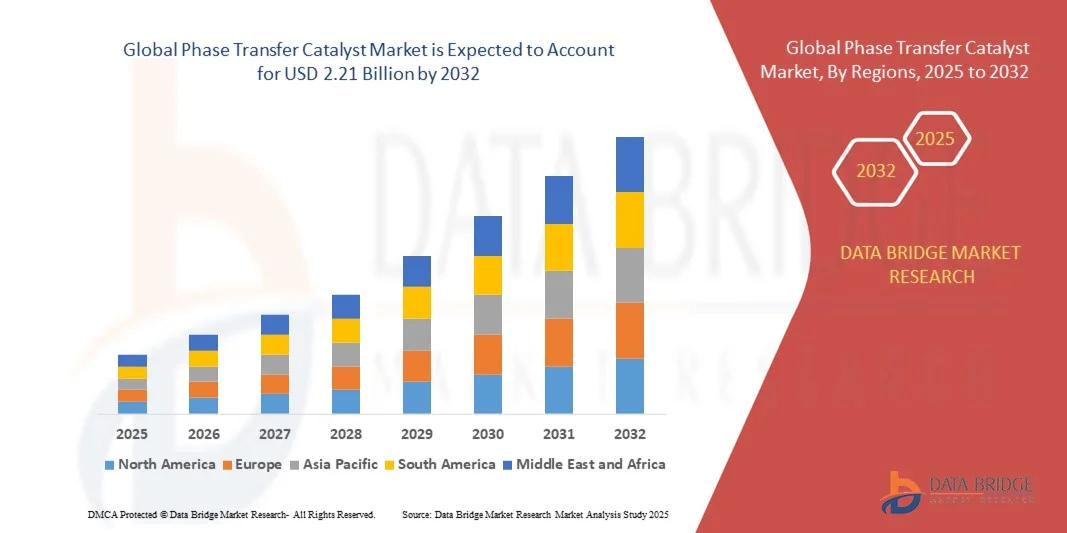

- The global Phase Transfer Catalyst Market size was valued at USD 1.39 billion in 2024 and is projected to reach USD 2.21 billion by 2032, growing at a CAGR of 6.00 % during the forecast period.

- Market expansion is primarily driven by increasing demand for green chemistry practices and sustainable synthesis methods in chemical manufacturing, pharmaceuticals, and agrochemicals.

- Additionally, the push for cost-effective, efficient, and environmentally friendly catalytic processes is propelling the use of phase transfer catalysts across diverse industries. These factors collectively support robust market growth through the forecast period.

Global Phase Transfer Catalyst Market Analysis

- Phase Transfer Catalysts (PTCs), which facilitate the migration of a reactant from one phase into another where reaction occurs, are essential components in enhancing reaction efficiency and selectivity in various chemical processes across industries such as pharmaceuticals, agrochemicals, and polymers.

- The growing demand for environmentally friendly and sustainable chemical synthesis methods, along with increasing industrial adoption of green chemistry principles, is the primary driver boosting the global phase transfer catalyst market.

- North America dominated the phase transfer catalyst market with the largest revenue share of 36.6% in 2024, driven by rapid industrialization, expanding pharmaceutical and chemical manufacturing sectors, and increased investments in research and development, particularly in China, India, and Japan.

- Asia-Pacific is expected to be one of the fastest-growing regions during the forecast period due to rising focus on sustainable manufacturing practices and strong regulatory support for eco-friendly catalysts.

- The ammonium salts segment dominated the market with the largest revenue share of approximately 45% in 2024. This dominance is driven by their extensive use as phase transfer catalysts and ion-exchange agents across various industries, supported by their cost-effectiveness and versatile chemical properties

Report Scope and Global Phase Transfer Catalyst Market Segmentation

|

Attributes |

Phase Transfer Catalyst Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to providing detailed insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by Data Bridge Market Research for the Global Phase Transfer Catalyst Market also encompass comprehensive expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material and consumables overview, vendor selection criteria, PESTLE analysis, Porter’s Five Forces analysis, and the regulatory framework. |

Global Phase Transfer Catalyst Market Trends

Enhanced Efficiency Through Advanced Catalytic Technologies

- A significant and accelerating trend in the global Phase Transfer Catalyst Market is the growing integration of advanced catalytic technologies with sustainable and green chemistry practices. This integration is driving enhanced reaction efficiency and environmental compliance across various chemical manufacturing processes.

- For instance, the adoption of novel quaternary ammonium salts and polymer-supported catalysts allows for improved phase transfer efficiency, reducing reaction times and waste generation. Similarly, developments in biodegradable and recyclable catalysts are gaining traction, offering eco-friendly alternatives to traditional catalysts.

- Advanced catalysts facilitate more selective reactions and higher yields, minimizing by-products and lowering energy consumption. For example, certain patented catalysts have been optimized for specific pharmaceutical syntheses, improving process safety and scalability while maintaining regulatory standards. Furthermore, these catalysts often enable simpler separation and recycling, enhancing cost-effectiveness in industrial applications.

- The seamless integration of phase transfer catalysts with continuous flow reactors and automated process control systems is facilitating more consistent product quality and operational efficiency. This convergence supports more sustainable manufacturing workflows and aligns with stringent environmental regulations globally.

- This trend towards more efficient, sustainable, and specialized catalytic solutions is fundamentally transforming the chemical and pharmaceutical industries’ approach to synthesis. Consequently, leading companies such as Tokyo Chemical Industry Co., Ltd. and SACHEM Inc. are investing in R&D to develop next-generation phase transfer catalysts tailored to specific industrial needs.

- The demand for advanced phase transfer catalysts that combine efficiency, sustainability, and process integration is rapidly increasing across pharmaceutical, agrochemical, and polymer sectors, driven by regulatory pressures and the global shift towards greener chemical manufacturing.

Global Phase Transfer Catalyst Market Dynamics

Driver

Growing Demand Driven by Increasing Focus on Sustainable and Efficient Chemical Processes

- The rising global emphasis on sustainable manufacturing practices and the need for more efficient chemical synthesis are significant drivers fueling demand for phase transfer catalysts. Industries such as pharmaceuticals, agrochemicals, and specialty chemicals increasingly require catalysts that improve reaction rates while minimizing environmental impact.

- For instance, in 2024, several leading global chemical manufacturers announced breakthroughs in environmentally friendly phase transfer catalysts that boost catalytic efficiency and reduce hazardous waste generation. Such innovations by key market players are anticipated to accelerate growth in the Global Phase Transfer Catalyst Market during the forecast period. As regulatory frameworks around the world become stricter regarding waste management and emissions, companies are adopting phase transfer catalysts that enable greener processes, helping them comply with environmental standards while reducing costs.

- Furthermore, the rising demand for complex chemical intermediates and active pharmaceutical ingredients (APIs) is driving the use of highly selective and versatile phase transfer catalysts that improve yield and purity, making them integral to modern chemical manufacturing workflows.

- The growing trend towards continuous flow processes and automated chemical production further supports the adoption of advanced phase transfer catalysts, enabling more scalable, cost-effective, and sustainable operations in both large-scale and specialty chemical sectors.

Restraint/Challenge

Challenges Related to Catalyst Stability and Cost-Effectiveness

- Despite the growing demand, concerns regarding catalyst stability, reusability, and overall cost-effectiveness remain key challenges limiting broader adoption in some applications. Phase transfer catalysts can degrade under harsh reaction conditions, reducing their lifespan and increasing operational costs.

- For Instance, some chemical manufacturers have reported decreased catalytic activity after multiple reaction cycles, leading to increased catalyst replacement costs and process downtime.

- Addressing these issues through the development of more robust, recyclable, and economically viable catalysts is critical to overcoming market barriers. Companies such as Tokyo Chemical Industry Co., Ltd. and SACHEM Inc. are investing heavily in R&D to enhance catalyst durability and performance.

- Additionally, the relatively higher initial investment required for specialty catalysts compared to conventional catalysts can be a deterrent, especially for small- and medium-sized enterprises (SMEs) operating under tight budget constraints.

- Although advances in catalyst design and manufacturing are gradually reducing costs, the perceived premium and concerns over long-term operational stability can still hinder faster adoption in certain regions and industries.

- Overcoming these challenges through innovation, cost optimization, and education on the long-term benefits of phase transfer catalysts will be essential for sustained growth in the market.

Global Phase Transfer Catalyst Market Scope

The market is segmented on the basis of type, end user.

- By Type

On the basis of type, the market is segmented into ammonium salts, phosphonium salts, crown ether, and cryptand. The ammonium salts segment dominated the market with the largest revenue share of approximately 45% in 2024. This dominance is driven by their extensive use as phase transfer catalysts and ion-exchange agents across various industries, supported by their cost-effectiveness and versatile chemical properties. Ammonium salts are favored for their strong ionic interactions and solubility, making them essential in large-scale chemical manufacturing processes.

The phosphonium salts segment is anticipated to witness the fastest growth rate of around 19.5% from 2025 to 2032. This growth is fueled by increasing applications in advanced organic synthesis, including their use in specialized catalysts and emerging fields such as materials science and pharmaceuticals, where their enhanced thermal stability and catalytic efficiency offer significant advantages over other types.

- By End-User

On the basis of end-user, the market is segmented into pharmaceuticals, agriculture, chemical, and others. The pharmaceuticals segment accounted for the largest market revenue share of 38.7% in 2024, driven by the critical role of salts and complexing agents in drug formulation, delivery systems, and biochemical synthesis. Growing demand for novel medicines and biopharmaceutical innovations are primary factors supporting this dominance.

The agriculture segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, propelled by increased usage of salts in fertilizers, pesticides, and soil conditioners that improve crop yield and resilience. Expanding global food demand and sustainable agricultural practices are key drivers for this rapid growth, along with technological advancements enabling more efficient nutrient delivery systems.

Global Phase Transfer Catalyst Market Regional Analysis

- North America dominated the global phase transfer catalyst market with the largest revenue share of 36.6% in 2024, driven by the strong presence of pharmaceutical, chemical, and agricultural industries that extensively utilize phase transfer catalysts in their manufacturing processes.

- Industry players and end-users in the region benefit from advanced technological infrastructure, stringent environmental regulations favoring greener synthesis methods, and increasing investments in research and development activities focusing on efficient catalyst systems.

- The market growth is further supported by high adoption rates of innovative catalysts like ammonium and phosphonium salts, along with a growing emphasis on sustainable and cost-effective production processes. These factors combined establish North America as a leading region in the phase transfer catalyst market for applications across pharmaceuticals, agriculture, and specialty chemicals.

U.S. Phase Transfer Catalyst Market Insight

The U.S. phase transfer catalyst market captured the largest revenue share of 42% in North America in 2024, driven by the country’s leading pharmaceutical, chemical, and agrochemical industries that heavily rely on phase transfer catalysts for efficient and sustainable synthesis. Increasing investments in green chemistry and process optimization are fueling market growth. The rising demand for eco-friendly and cost-effective catalysts in drug manufacturing, specialty chemicals, and crop protection further propels adoption. Additionally, the expanding focus on regulatory compliance and environmental safety supports the growing use of advanced catalyst systems across various sectors.

Europe Phase Transfer Catalyst Market Insight

The Europe phase transfer catalyst market is projected to grow at a robust CAGR over the forecast period, primarily driven by stringent environmental regulations and the shift towards sustainable manufacturing practices. The region’s pharmaceutical and specialty chemical industries are major end-users, benefiting from catalysts that enable greener synthesis routes. Rising urbanization and technological advancements are encouraging the adoption of phase transfer catalysts in agrochemicals and other industrial applications. Western and Central Europe, with strong research infrastructure and government incentives, are key contributors to market growth.

Germany Phase Transfer Catalyst Market Insight

The Germany phase transfer catalyst market is expected to witness significant growth during the forecast period, supported by the country’s advanced chemical manufacturing base and commitment to sustainable industrial practices. Germany’s stringent environmental standards and emphasis on innovation drive the adoption of phase transfer catalysts, especially in pharmaceutical and specialty chemical sectors. The demand for energy-efficient and eco-conscious catalytic processes aligns with local consumer and regulatory expectations, making Germany a critical market in Europe.

Asia-Pacific Phase Transfer Catalyst Market Insight

The Asia-Pacific phase transfer catalyst market is poised to grow at the fastest CAGR of around 23% from 2025 to 2032, propelled by rapid industrialization, expanding pharmaceutical production, and growing agrochemical demand. Countries like China, India, and Japan are at the forefront due to increasing manufacturing capabilities and government support for green chemistry initiatives. The region is also emerging as a major production hub for catalysts, enabling greater accessibility and competitive pricing. The rising focus on sustainable synthesis methods and chemical innovations in Asia-Pacific is a key market driver.

China Phase Transfer Catalyst Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by the country’s booming pharmaceutical, agrochemical, and specialty chemical industries. Rapid urbanization, expanding middle-class demand, and strong government backing for eco-friendly chemical processes accelerate market growth. The country’s domestic manufacturing capacity and cost-effective production of phase transfer catalysts enhance its competitive position. Additionally, China’s smart manufacturing initiatives and push towards sustainable industrialization are boosting the adoption of advanced catalyst technologies.

India Phase Transfer Catalyst Market Insight

India’s phase transfer catalyst market is witnessing rapid expansion, driven by increasing pharmaceutical manufacturing and rising agrochemical applications. Growing awareness of sustainable production methods and government incentives promoting green chemistry support this growth. The country’s expanding chemical industry infrastructure and rising demand for efficient catalysts in drug synthesis and crop protection contribute significantly. The adoption of phase transfer catalysts is expected to accelerate as manufacturers seek environmentally friendly and cost-effective catalytic solutions.

Japan Phase Transfer Catalyst Market Insight

Japan’s phase transfer catalyst market is growing steadily due to the country’s strong focus on high-tech chemical manufacturing and sustainable processes. The pharmaceutical and specialty chemical sectors are major users, benefiting from the catalytic efficiency and eco-friendly nature of phase transfer catalysts. Japan’s aging population also drives demand for advanced healthcare products, indirectly supporting catalyst usage in drug manufacturing. The country’s innovation-driven market and integration of catalysts into automated production systems contribute to steady growth.

Global Phase Transfer Catalyst Market Share

The Phase Transfer Catalyst industry is primarily led by well-established companies, including:

- SACHEM, INC. (U.S.)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- Nippon Chemical Industrial Co., Ltd. (Japan)

- Pat Impex (India)

- Tatva Chintan Pharma Chem Limited (India)

- Central Drug House (India)

- Volant-Chem Corp. (China)

- Pacific Organics Pvt Ltd (India)

- Otto Chemie Pvt. Ltd. (India)

- Dishman Group (India)

- GFS Chemicals, Inc. (U.S.)

- Dishman Group (India)

- PAT IMPEX (India)

What are the Recent Developments in Global Phase Transfer Catalyst Market?

- In April 2023, Catalyst Innovations Inc., a leading global chemical solutions provider, launched a strategic initiative in South Africa to expand the adoption of advanced phase transfer catalysts in pharmaceutical and agrochemical manufacturing. This initiative focuses on delivering sustainable and efficient catalytic solutions tailored to the specific needs of local industries. By leveraging its global R&D expertise and cutting-edge catalyst technologies, Catalyst Innovations is addressing regional manufacturing challenges while strengthening its position in the rapidly growing global phase transfer catalyst market.

- In March 2023, GreenChem Technologies, a U.S.-based specialty chemical company, introduced a new class of environmentally friendly phosphonium salt catalysts designed for high-efficiency organic synthesis in pharmaceutical applications. This innovation underscores GreenChem’s commitment to advancing green chemistry principles, providing safer and more sustainable catalytic processes that reduce environmental impact and improve reaction yields in commercial-scale production.

- In March 2023, BASF SE successfully implemented a large-scale phase transfer catalyst system in its manufacturing facility in Bengaluru, India, as part of its sustainable chemistry initiative. The project aims to enhance process efficiency and reduce waste generation in the production of fine chemicals, highlighting BASF’s dedication to innovative and eco-conscious manufacturing solutions. This deployment reinforces the growing importance of phase transfer catalysts in supporting greener industrial practices in emerging markets.

- In February 2023, SynTech Catalysts, a prominent supplier of catalytic systems for the agrochemical industry, announced a strategic partnership with the Asia-Pacific Agrochemical Association to promote the use of advanced ammonium and phosphonium salt catalysts across member countries. This collaboration seeks to improve crop protection formulations while ensuring environmentally responsible production methods, demonstrating SynTech’s commitment to driving innovation and sustainability in agriculture.

- In January 2023, Clariant AG, a global leader in specialty chemicals, unveiled its new line of crown ether-based phase transfer catalysts at the European Chemical Industry Conference (ECIC) 2023. These catalysts offer enhanced selectivity and efficiency for challenging chemical reactions, enabling pharmaceutical and chemical manufacturers to optimize production while reducing energy consumption. Clariant’s innovation highlights the company’s focus on integrating advanced catalyst technologies to support sustainable and cost-effective industrial processes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Phase Transfer Catalyst Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Phase Transfer Catalyst Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Phase Transfer Catalyst Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.